The blank apparel market was USD 7.8 billion in 2025 and is expected to rise at a CAGR of 8.4% from the period between 2025 to 2035. The industry size of the industry is expected to be USD 17.4 billion in 2035. One of the most influential drivers fueling this growth is the rapid development of e-commerce and print-on-demand websites that are revolutionizing the apparel personalization business. As consumer palates move towards individuality and small orders, blank apparel provides an adaptable canvas for personal style, business promotion, and event-related advertising

Underpinning this industry is the development of digital printing capabilities, lowering turn-around times and print quality. With advances in printing technologies and accessibility, additional small shops and artists are entering the marketplace, which demands high-quality, multi-purpose blanks. This has resulted in greater competition between providers to supply better-quality fabric, uniform sizing, and compatibility with printing equipment.

Furthermore, sustainability trends are influencing material sourcing and production in the industry. Both businesses and consumers are demanding greener materials, such as organic cotton and recycled products, prompting producers to go back to the supply chain and invest in responsibly sourced materials. That shift to green is positioning the marketplace to catch up with broader environmental and corporate social responsibility goals.

Brand minimalism and blankness are also other trends moving in the direction of blank apparel. Plain clothing popularity is responding to minimalist fashion trends and enabling the possibility of personalized or layered styling. The trend is not only evident within the fashion-conscious youth industry but is also breaking into the work wear and active wear spaces.

Europe and North America remain the industry leaders with robust digital infrastructure and a matured fashion-tech ecosystem. Asia-Pacific, though, is experiencing rapid growth, fueled by increasing garment manufacturing centers and rising interest in e-commerce entrepreneurship. This geographical diversity reflects the industry's global nature and highlights its potential for continued growth through 2035.

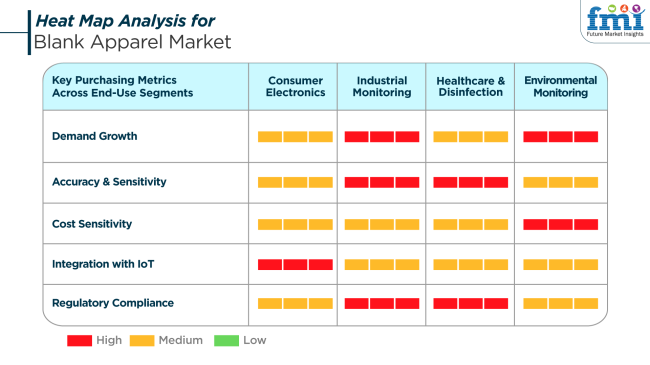

Key Purchasing Metrics Across End-Use Segments

In the business, purchasing behavior varies significantly among businesses that need to place their own branded clothing, labels, or resale. Consumer electronics companies, for example, prefer using branded apparel for promotion, with a high emphasis on IoT compatibility and looks while maintaining moderate cost sensitivity. Techno branding and customer engagement drive demand in this space.

In industrial monitoring use, the requirements are even more stringent, with high expectations of safety and wear resistance compliance. Companies in this sector seek clothing with improved sensor integration capabilities or branding materials for industrial wearables and tools, with a strong focus on regulation compliance and stress performance.

Healthcare and environmental sectors are increasingly applying blank apparel for hygienic labeling, employee identification, or event use. These sectors focus on comfort, regulatory compliance, and legibility in printing and have their purchases balanced against costs. With environmental sustainability being more of a focus in procurement, ecological monitoring applications particularly focus on the importance of eco-friendly material.

The industry, while expanding, remains susceptible to several systemic risks that may impede its long-term growth potential. One of the primary concerns pertains to the volatility of raw materials, particularly cotton and artificial fibers. Price volatility due to geopolitical tensions, climatic factors impacting crops, or protectionist trade measures can disrupt production costs and reduce manufacturers' and suppliers' profit margins.

Another critical risk is the mounting regulatory pressure on sustainability and labor conduct. As governments tighten compliance in textile sourcing and ethical manufacturing, those companies operating in low-compliance areas risk reputational loss or import/export restrictions. This would decrease the number of accessible industries for non-compliant players and thus affect supply chain resilience.

Besides, the high reliance on digital commerce platforms introduces cyber risk and industry saturation challenges. Small brands can get bogged down with visibility, digital marketing costs, and margin squeeze in highly competitive industries. Besides, with rapidly evolving consumer needs, brands need to constantly change fabric technology and customization options to remain fashionable, which introduces complexity to the operations and product development strategy.

The period between 2020 and 2024 witnessed consistent growth for the industry as growing demand for custom clothing and development of direct-to-consumer (DTC) brands picked up pace. Unbranded apparel like t-shirts, hoodies, and sweatshirts witnessed a heightened preference as people and companies hunted for multi-functional use options that can be easily personalized. The expansion of e-commerce platforms further facilitated industry growth by providing easy access to a wide variety of blank apparel products.

Further ahead, in 2025 to 2035, the industry will advance significantly with the development of smart blank apparel that will have various integration features of sensors and connectivity for enhanced functionality. Sustainability will essentially become the common thread that manufacturers are making investments in the use of eco-friendly materials and production processes. In addition, the integration of apparel into full-solution fashion will make it more attractive. It will be used as a fundamental element in modern wards.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Personalization-focused blank clothing products. | Technological Integration: Introduces connected and sensor-laden smart clothes. |

| Distribution Channels: Online platforms opened up for expanded reach. | Integrated Fashion Solutions: Integrated fashion packages including blank apparel. |

| Consumer Demographics: Primarily individuals and small business owners seeking custom options. | Expanded Demographics: Large consumer base of tech-embracing consumers and fashion-conscious consumers. |

| Sustainability Initiatives: Leading innovations towards sustainable packaging and sustainable materials. | Sustainable Innovations: Creation of sustainable manufacturing processes and biodegradable materials. |

| Industry Drivers: Tailored clothing demand and building DTC brands. | Advanced Fashion Solutions: Integration of blank apparel in smart wardrobes and personalized fashion experiences. |

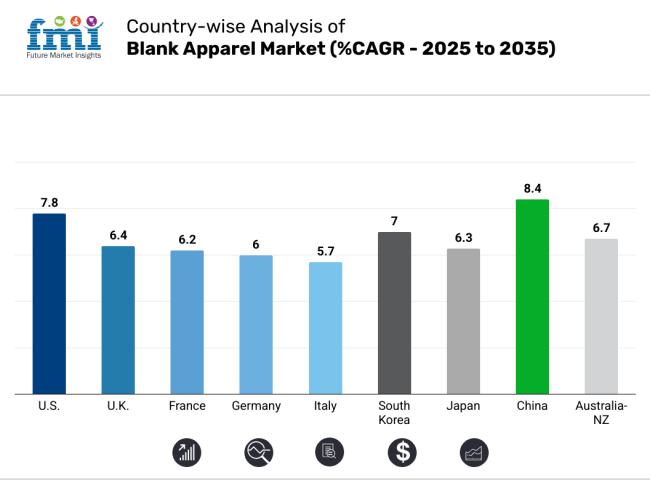

The USA industry is anticipated to witness 7.8% CAGR growth throughout the study. The USA remains a world hub for the business due to the growing popularity of custom fashion, personalized merchandise, and on-demand print services. The nation's strong e-commerce platform and growth in independent fashion labels created a heightened need for solid, adaptable clothing that can be customized as a base.

Blank T-shirts, hoodies, and sportswear items are used extensively for business identification, promotional products, and individual customization. The industry is also aided by the emergent gig economy, where small businesspeople and creatives are using print-on-demand services to enter the niche apparel industry.

Sustainability trends are also driving purchasing behavior as customers look for organic cotton and recycled fabric opportunities within blank apparel. In addition, the location of large wholesalers and fulfillment partners supports industry accessibility, lowering lead times and scaling up. With innovative logistics and an individual-oriented culture, the USA is likely to keep strong momentum within the industry in the next ten years.

The UK industry will grow at a 6.4% CAGR over the study period. The UK industry is growing steadily, driven by increasing interest in customized apparel and eco-friendly fashion. Enterprises, designers, and promotional organizations are increasingly adopting blank garments as a substrate for screen printing, embroidery, and digital printing. Demand is very high in metropolitan areas where customization is not only a trend but a mainstream fashion statement.

E-commerce remains at the forefront of industry growth, providing consumers with an extensive range of blank styles, materials, and fits. Product development and customer loyalty are both driven by the focus on sustainable fabrics and supply chain transparency. Small to medium-sized businesses are leveraging flexible sourcing models and local fulfillment centers to provide custom apparel with reduced inventory risk. With a favorable business climate and increasing consumer demand for innovative clothing solutions, the UK industry is also expected to register steady growth till 2035.

The French industry is expected to register a growth of 6.2% CAGR over the forecast period. France, with its fashion-conscious culture, is witnessing increasing demand utilized in customized and minimalist fashion brands. The emergence of boutique labels and lifestyle products has created more sourcing of plain, high-quality apparel items that can be tailored to suit particular aesthetics.

Consumers look for fine fabrics, clean cuts, and sustainability, and this has encouraged manufacturers to emphasize organic materials and ethical production methods. Print-on-demand business is picking up in France, primarily among young business owners and design collectives trying to put together one-of-a-kind fashion lines without initial inventory outlay.

Blank apparel is also extensively used in business-to-business and event marketing, sustaining promotion requirements from multiple industries. With the move towards digitalization and customer-oriented brand-building, France's industry will be able to maintain moderate but steady growth throughout the forecast period.

The industry in Germany is anticipated to increase at 6% CAGR throughout the study period. The German industry is marked by robust demand within the promotional space, as well as growing interest from independent fashion brands. Germany's industrial infrastructure enables effective textile logistics, with high standards for quality impacting business and retail consumer purchasing habits alike. Blank garments have a diverse set of uses, ranging from corporate identification to event giveaways and customized fashion products.

German consumers lean toward responsibly made and long-lasting products, a reflection of trends around organic cotton and recycled fiber use. Rising popularity in minimal fashion also translates into increased demand for unbranded, clean clothes. There is a choice of simple apparel from B2B suppliers and online platforms, whether for small orders or mass purchases. With stable industrial bases and a strong environmental consciousness, Germany should be a good solid growth industry for the industry up to 2035.

The Italian industry is anticipated to register a growth of 5.7% CAGR throughout the study. Italy's industry is gaining momentum, especially among the creative and artisanal industries that place high value on customizable, high-quality clothing. The cultural admiration for aesthetics and craftsmanship of materials is influencing demand for high-end blank clothing items that can be customized into unique fashion statements. Blank apparel use in local events, corporate branding, and new streetwear lines is also increasing.

While conventional fashion continues to hold sway in Italy, there is an increasing trend in small fashion firms using digital media to industry customized designs, particularly among the young. Environmental consciousness is making a difference in procurement decisions, as both manufacturers and consumers are inclining toward environmentally friendly textiles. Though the size of the industry is smaller in magnitude than that of Northern Europe, Italy's fashion and design reputation creates a rich soil for consistent growth in the industry.

The South Korean industry is anticipated to register a growth of 7% CAGR over the study period. South Korea is becoming a solid industry, supported by fashion-oriented youth and growing independent clothing labels. The influence of the country's K-fashion is internationalizing local tastes, with DIY-designed and custom-printed clothing becoming popular not just domestically but even in export industries.

Blank clothing is the pillar of this innovative movement, providing a platform for individual and business expression. Technology-aware consumers and high levels of internet penetration have contributed to the general use of online platforms for procuring blank clothing. Social media trends and influencer culture continue to influence demand, promoting rapid product turnover and short-run production models. Moreover, focusing on soft, breathable materials and eco-friendly options enables product differentiation. With high urban demand and a robust startup ecosystem in fashion and e-commerce, South Korea's industry is poised for significant growth in the decade ahead.

The Japanese industry will grow at a 6.3% CAGR over the study period. Japan's industry derives an advantage from Japan's culture of precision manufacturing, as well as changing consumer behavior that is oriented towards quality, simplicity, and sustainability. Small fashion brands, art collectives, and business clients are some of the leading sources of demand in the industry for custom clothing for branding, uniforms, and merchandising. Japanese customers value simplicity, giving blank clothing a robust basis for personal customization.

Domestic manufacturers are investing in eco-friendly production methods and high-tech textile innovations to fulfill increasing environmental requirements. Efficient logistics and aesthetic detail-focused culture underpin the need for quality base garments. Traditional retailing continues to have a presence, but online purchases and print-on-demand services are accelerating rapidly. As technology and tradition continue to blend in Japan's fashion arena, the industry will likely see steady, long-term growth.

The Chinese industry will grow at 8.4% CAGR during the period of this study. China will be the fastest-growing industry, driven by a huge manufacturing hub, increasing domestic consumption, and a boom in e-commerce-driven fashion brands. The nation has a high concentration of manufacturers that export to international industries. Still, local demand is growing quickly as local entrepreneurs and brands use customizable fashion as a growth driver. Online platforms facilitate direct-to-consumer sales, and the growth of social commerce is generating new models of distribution.

Urban consumers are looking for affordable, fashionable essentials that can be styled or customized based on trends. Sustainability is increasingly a focus, with industry leaders now providing organic cotton and recycled fabric offerings. China's adoption of technology in textile production and retail supply chain provides the country with both volume and competitive advantage in innovation. With healthy macroeconomic factors and a large youth market, China's industry will see the greatest growth during the forecast period.

Australia-New Zealand industry is forecasted to rise by 6.7% CAGR throughout the study. The Australia-New Zealand industry exhibits good demand, driven by increased interest in custom attire for occasions, small business identities, and lifestyle items. Outdoor brands and homegrown artists in Australia are adapting blank apparel into their lines, frequently using sustainable material. New Zealand follows a parallel path, emphasizing sustainability and ethical production.

E-commerce and local print-on-demand operations are facilitating easier access to blank apparel in small orders for consumers and creators. Tourist, sports, and promotional industries add further momentum to sales of T-shirts, polos, and casual wear that are being used as blank canvases for printing. Consumers are becoming more sensitive to clothes that are of equal quality and eco-friendly, presenting opportunities for players to provide organic and recycled materials. With a secure retailing environment and deep digital penetration, the Australia-New Zealand industry is set for steady growth up to 2035.

The artificial flower industry is expected to witness a commercial sector share of 62.1%, while residential sector applications will qualify for 37.9% in 2025.

The substantial share of the application segment is owed to commercial applications of artificial flowers for businesses, hotels, offices, restaurants, and the like. Artificial flowers are attractive to companies since they are inexpensive and require very little maintenance compared to natural flowers, which can be rather costly and need constant care.

This frees seasons for a pleasant arrangement that would be decoratively appealing, with no regard to seasonal availability. A floral and Silk Flowers Factory, for instance, sells many products aimed specifically at large commercial clients, offering bulk buying opportunities, customized designs, and economical alternatives for corporate spaces.

Residentials, even though they account for a much smaller share of the total market, still constitute a decent chunk of it. Homeowners not only appreciate artificial flowers for their affordability and ease of maintenance but also as objects of decoration. They find use in living rooms, dining rooms, and bedrooms as a way to introduce color and style into the interiors with zero maintenance. The growing trend of home decor and DIY projects fuels the use of artificial flowers in the residential market.

Commercial applications retain most of the industry share due to the scale and the longevity of artificial flowers in business settings; however, the residential segment continues to be a dynamic area of growth, spurred by evolving consumer preferences leaning towards carefree, affordable, yet good-looking home landscaping accessories.

T-shirts and tanks will continue to run the industry in 2025, with a projection of 45.1% industry share, followed by hoodies/sweatshirts with an estimated contribution of 28.4%.

From the start of time, t-shirts and tanks have been the elixirs of popularity, being casual, easy-to-wear clothes that are widely customized. Both are preferred for screen printing, embroidery, and any type of personal or business branding by the consumer and the industry. The popular American brands in this category, including Gildan and Bella+Canvas, offer a wide variety of colors, sizes, and styles for easy customization.

Fashion and lifestyle trends such as casual wear and athleisure are increasing popular demand for these items. They are considered by many to be the basic wardrobe items. T-shirts and tanks fall in in-between when compared to other items and have lower production costs. This factor makes them an item of choice for most bulk purchases from retailers and custom apparel brands.

Hoodies and sweatshirts come second, with a 28.4% contribution to the industry share. The trends in streetwear, athleisure, and casual are proliferating rapidly, and that is where the increased interest in these garments has emerged. They are the comfort- and style-proof layers that one can make for cooler months.

Champion, Hanes, and American Apparel sell a wide variety of high-quality options for personalization by individuals or businesses to benefit from this trend. These items are attractive in the industry due to their significant role in promotional products, team apparel, or even collegiate wear, thus simultaneously increasing their demand in the market.

T-shirts & tanks lead the market; however, hoodies and sweats continue benefiting from the ever-evolving trends in the fashion industry and consumer demand for stylish, comfortable, and customizable apparel.

The industry has transformed into a really vibrant one, marked by agile and sustainable sources for aligned brand customization capabilities. Gildan continues to tower as a vertically integrated giant, using scale, low-cost operations, and distribution power in North America and even the rest of the world.

BELLA+CANVAS remained on the premium side of the industry with a sustainability-focused narrative backed up by investments in eco-dyeing technology and a strong DTC and B2B e-commerce pipeline. Next Level Apparel has put itself in a good place to compete by using both style versatility and quality consistency in high-volume wholesale channels.

AS Colour and Stanley/Stella are now catching on internationally as they picked up the sustainability-first cause by offering traceability in their supply chains, including the use of organic fibers to meet the ever-increasing demand brought on by eco-conscious brands. Startups like Los Angeles Apparel and LANE SEVEN are occupying the niches they have with USA-made goods.

These shapes are around-the-clock silhouettes with futures cast in that they target fashion-forward microbrands. Strategic partnerships with print-on-demand platforms and customized branding services have become key differentiators for companies such as Independent Trading Company, which relies on deep catalogs in fleece and outerwear for customization industries.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Gildan | 28-32% |

| BELLA+CANVAS | 14-18% |

| Next Level Apparel | 10-13% |

| AS Colour | 6-9% |

| Stanley/Stella | 5-7% |

| Other Players | 24-30% |

Key Company Insights

Gildan is perhaps the most dominant brand in the industry, with a share valued at 28-32% and well beyond. Full vertical integration-from yarn spinning to distribution-allows this company to realize global scale, thus offering competitive price leadership for mass retail and wholesale channels. Gildan also continues to invest in Central American production hubs, which contributes to bolstering supply chain resilience.

BELLA+CANVAS is responsible for approximately 14-18% of the industry through its offerings of fashion basics with a sustainable edge and premium cotton. Its California presence promises eco-conscious manufacturing, catering lifestyle brands, and eco-minded startups.

Next Level Apparel holds in that range of 10-13% among industry shares because of producing consistent quality across styles and cheap wholesale scalability partnerships. With its nationwide networks and international distributors, it has become a really good and trustworthy partner for both volume business and individual boutique clients. AS Colour, with a 6-9% industry share, is well known for its ethical production and durable construction of garments. It has gained popularity among high-end independent brands as well as fashion labels with an accent on transparency.

Stanley/Stella forms the last of the top five with a 5-7% mark, based more on European leadership than on certified factories of organic basics cotton. Its strength rests on co-branding with ethical fashion collectives and slow fashion retailers.

The industry is segmented into T-shirts & tanks, hoodies/sweatshirts, bottoms, shirts, and others.

The industry is divided into B2B and B2C. The B2C segment is further categorized into online and offline distribution channels.

The industry is analyzed across several regions, including North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 7.8 billion in 2025.

The industry is projected to grow to USD 17.4 billion by 2035.

The industry is expected to grow at a CAGR of 8.4% during the forecast period.

The commercial sector is a significant part of the industry.

Key players include BELLA+CANVAS, SpectraUSA, Gildan, Soffe Apparel, Inc., Los Angeles Apparel Inc., LANE SEVEN APPAREL, AS Colour, Independent Trading Company, Stanley/Stella, and Next Level Apparel.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blanket Market Size and Share Forecast Outlook 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Gym Apparel Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Plush Blanket Market Growth - Trends & Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Decorated Apparel Market segmented by Product, End-user and Distribution Channel through 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Equestrian Apparel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA