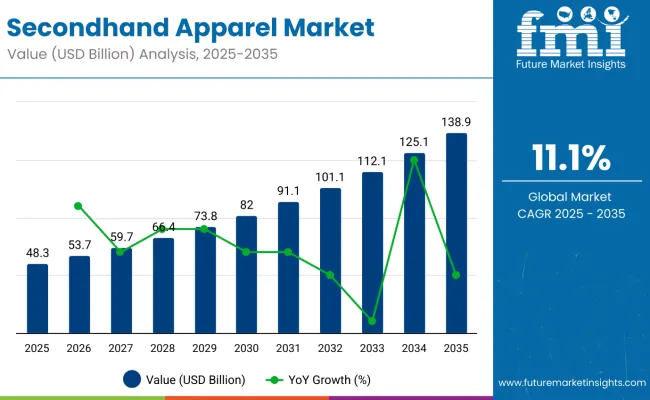

The global secondhand apparel market is projected to expand from USD 48.32 billion in 2025 to nearly USD 138.90 billion by 2035, reflecting a CAGR of 11.1% over the forecast period. In 2024, the market was valued at USD 43.49 billion. This growth has been driven by increased consumer interest in sustainable and affordable fashion alternatives.

Environmental concerns and awareness of textile waste reduction have been cited as key factors behind the shift toward secondhand purchases. A conscious lifestyle has been adopted by Gen Z and millennial consumers, further reinforcing this trend.

Strong growth has been observed in online resale platforms. Digital marketplaces such as thredUP, Poshmark, and The RealReal have been scaled to attract a global base of sellers and buyers. In 2025, platform innovations such as mobile-first interfaces, live shopping features, and AI personalization tools have been deployed to increase consumer engagement. Partnerships between traditional fashion brands and resale platforms have also been established. These initiatives have been designed to align with rising demand for sustainable consumption and to reduce overproduction-related inventory costs.

Circular economy practices have been incorporated more aggressively across the secondhand fashion ecosystem. By 2025, initiatives supporting product traceability and lifecycle transparency have been introduced by multiple brands. Digital product passports and sustainability certifications have been piloted to enhance consumer trust. Regulatory support-especially in Europe and North America has encouraged recycling and the reuse of textiles. Cross-border resale has been facilitated by improved logistics and payment integration, benefiting luxury and vintage segments in particular.

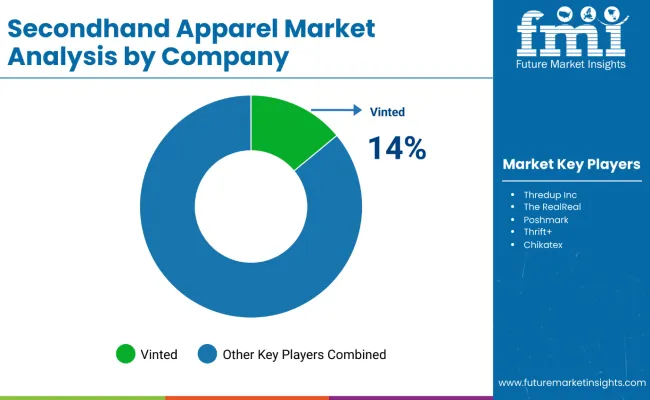

Key market players include thredUP, Poshmark, The RealReal, Vestiaire Collective, eBay, and Depop. ThredUP’s resale-as-a-service model has been extended to additional B2B partners. Vestiaire Collective’s B Corp certification has been viewed as a benchmark in sustainability.

Poshmark has advanced social commerce by introducing live shopping experiences. Several fast fashion brands have launched resale pilots to address growing scrutiny from regulators and consumers alike. With expectations for transparency and environmental responsibility intensifying, the secondhand apparel market is forecasted to grow steadily through 2035, supported by innovation, policy shifts, and evolving consumer values.

| Attributes | Details |

|---|---|

| Secondhand Apparel Market Value for 2025 | USD 48.32 billion |

| Projected Market Value for 2035 | USD 138.90 billion |

| CAGR (2025 to 2035) | 11.1% |

Adoption of circular economy practices varies across regions, reflecting differences in policy frameworks, economic priorities, infrastructure readiness, and environmental awareness. While some regions have advanced, integrated systems, others are in the early stages of transition toward circularity.

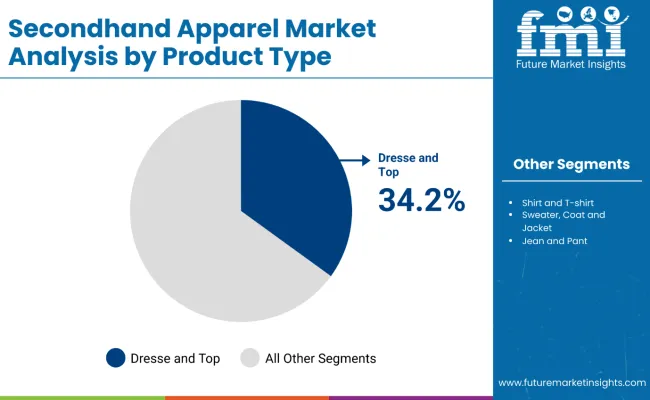

In 2025, a 34.2% share of the global secondhand apparel market is expected to be held by dresses and tops, making them the leading product category. Increased demand for these items has been driven by greater consumer acceptance of sustainable fashion choices. Secondhand dresses and tops are being favored due to their affordability, widespread availability, and reduced environmental impact.

Resale platforms such as ThredUp, Depop, and Poshmark are being used to offer curated collections of gently used garments. The preference for pre-owned apparel is being reinforced by the rising awareness of circular fashion, where garment reuse is promoted to reduce textile waste. The environmental burden of new clothing production is being offset through resale participation.

This product category is being supported by both consumers and brands, with second-use initiatives and take-back programs increasingly being implemented. As sustainability becomes a core shopping criterion, demand for secondhand dresses and tops is being strengthened by both economic and ethical motivations.

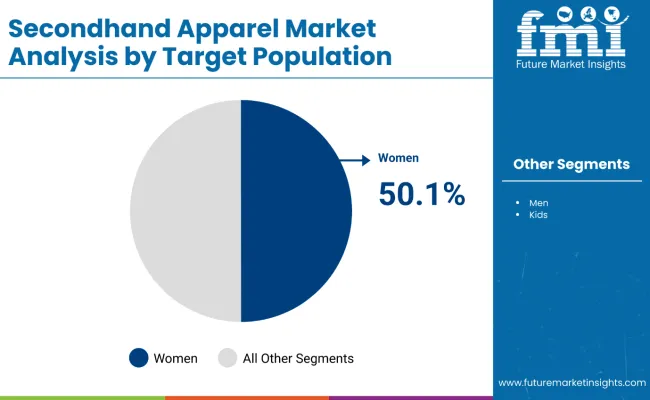

A 50.1% share of the global secondhand apparel market is projected to be held by women in 2025, establishing them as the largest consumer group. The popularity of secondhand clothing among women is being attributed to shifting preferences toward cost-effective and environmentally conscious fashion. Online resale platforms such as The RealReal, Vinted, and Vestiaire Collective are being used by women to access premium apparel at lower costs.

Ethical shopping habits are being reinforced by increased awareness of fast fashion’s ecological impact. Participation in resale is being encouraged by the social appeal of thrift hauls and influencer-led fashion content. Secondhand clothing is being incorporated into daily wardrobe choices as a result of its affordability and sustainability.

Wardrobe rotation, reduced landfill waste, and fashion diversity are being prioritized by women. Consequently, women are being recognized as the most influential and investable demographic in the global secondhand fashion industry. Their behavior is being shaped by both economic factors and a growing commitment to eco-friendly fashion consumption.

This section provides a detailed analysis of the industry during the last five years, focusing on expected developments in the used clothing market. The market grew at a 8.9% CAGR during the historical period. The market is anticipated to grow at a CAGR of 11.1% through 2035.

| Historical CAGR | 8.9% |

|---|

The market is expanding because of several causes, including the rising acceptance of eco-fashion, the expansion of internet usage and eCommerce, and the affordability of secondhand apparel.

Fundamental aspects are anticipated to influence the demand for secondhand apparel through 2035.

Market players are going to desire to be slick and flexible over the anticipated period since these difficult attributes position the industry for success in the near future.

Gen-Z Vibes on Millennial Fashion

The secondhand apparel industry is experiencing significant growth, primarily driven by younger shoppers, particularly Generation Z and Millennials. These demographics increasingly choose to buy pre-owned clothing due to its cost-effectiveness and environmental consciousness. The Gen-Z shoppers value sustainability and the circular fashion economy, as it aligns with their values of reducing waste and carbon footprint.

Affordability is also a key factor in the popularity of secondhand clothing, as it makes high-quality items, including luxury brands, more accessible. The trend of derivative apparel reflects the emphasis on value and sustainability in place of ownership and status symbols. The emergence of the secondhand apparel sector represents a societal movement toward more conscientious buying habits, a divergence from the old linear model of fashion consumption.

Vintage Clothing Never Goes Out of Style

The market is undergoing a significant transformation due to the growing trend of embracing vintage and retro styles, especially among younger consumers. A desire for individuality, appreciation of craftsmanship, and nostalgia drives the trend of vintage and retro fashion. These styles provide a unique way to express oneself, contrasting with mass-produced garments. They often showcase quality craftsmanship and intricate details, showcasing the artistry of bygone eras.

The fusion of old and new cultural influences also sparks creativity and adds depth to personal-style narratives. Secondhand shopping is now seen as a mainstream and socially responsible choice, driven by growing environmental awareness. By opting for pre-owned clothing, individuals can extend the lifespan of garments, reduce textile waste, and contribute to a more sustainable fashion industry.

Resale Platforms Stimulate the Demand for Secondhand Apparel

The rise of resale platforms and marketplaces is a significant shift in the fashion industry, driven by changing consumer preferences and technological advancements. These platforms remove the obstacles associated with conventional thrift shopping by giving customers an easy and accessible option to purchase and sell secondhand apparel.

Fashion brands also collaborate with resale platforms to tap into new markets and customer segments, leveraging their expertise and infrastructure to capitalize on secondhand shopping and sustainability. Partnerships between clothing brands and resale platforms also serve as a vehicle for innovation and creative expression, allowing brands to experiment with new business models and expand their product range.

The symbiotic relationship fosters mutual growth and a more sustainable fashion ecosystem. The emergence of resale markets and platforms signifies a change toward a more sustainable and circular future, democratizing access to pre-owned apparel and opening the door for a more moral, open, and robust fashion industry.

The markets for secondhand apparel in some of the most significant nations in the global arena, including the United States, China, India, Japan, and the United Kingdom, are scheduled to be looked at in this section. Examine the many factors impacting these countries' acceptance and demand for recycled clothes through in-depth study.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| United Kingdom | 9.3% |

| China | 4.8% |

| Japan | 7.6% |

| India | 14.0% |

The United States fashion industry seeks secondhand clothing due to the quick fashion rise. The United States' demand for secondhand apparel is expected to grow at a CAGR of 2.6% through 2035. The demand for secondhand apparel is being driven by the following factors, which are anticipated to be very important for the industry's growth:

China is a pioneer of quick fashion manufacturing, developing a high demand for sustainable secondhand clothing. The secondhand apparel demand in China is growing at a 4.8% CAGR. The following are some of the main trends:

The United Kingdom's secondhand apparel industry is expected to witness a CAGR of 9.3% from 2025 to 2035. The fashion industry of the United Kingdom is in considerable demand for vintage clothing options for the shoppers. Among the main fashions are:

The demand for anime-inspired clothing in Japan is rising, and the secondhand apparel demand is expected to increase at a CAGR of 7.6% through 2035; among the primary motivators are:

India's secondhand apparel market is predicted to rise at an impressive CAGR of 14.0% through 2035, propelled by the demand for vintage and ethnically inspired clothing. Growth of such kind is anticipated to maintain the leading position of the Indian market globally. Among the principal trends are the following ones:

Secondhand apparel market players shape the industry through innovative business models, technological advancements, and strategic partnerships. The clothing companies are meeting the growing demand for sustainable fashion alternatives and driving significant changes in consumer behavior and industry practices.

Secondhand apparel brands are leveraging technology to improve the online shopping experience and streamline operations. Advanced algorithms and machine learning techniques enhance product recommendations, personalize user experiences, and optimize inventory management, making secondhand shopping more convenient and accessible to a wider consumer base.

Clothing manufacturers are introducing new business models that promote circularity and sustainability in the fashion industry. These include subscription-based rental services, which allow customers to lease clothing items for a limited period, and initiatives like clothing resale and upcycling programs, which encourage consumers to extend garment lifecycles.

Secondhand apparel enterprises are forming strategic partnerships with fashion brands, retailers, and influencers to expand their reach and penetrate new markets. These collaborations enable the resale of pre-owned designer clothing, attracting luxury consumers seeking value and sustainability. Social media influencers and celebrities also raise awareness and drive secondhand shopping adoption among diverse demographics.

The global secondhand apparel market is transforming consumer preferences and industry norms through innovation, technology, and collaboration, promoting sustainability, circularity, and inclusivity, paving the way for a more ethical, transparent, and resilient future.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 48.32 billion |

| Projected Market Size (2035) | USD 138.90 billion |

| CAGR (2025 to 2035) | 11.1% |

| Base Year for Estimation | 2023 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2024 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Dresses and Tops, Shirts and T-shirts, Sweaters, Coats and Jackets, Jeans and Pants, Others |

| Sectors Analyzed (Segment 2) | Resale, Traditional Thrift Stores & Donations |

| Target Populations Analyzed (Segment 3) | Men, Women, Kids |

| Sales Channels Analyzed (Segment 4) | Wholesalers or Distributors, Hypermarkets or Supermarkets, Multi-brand Stores, Independent Small Stores, Departmental Stores, Online Retailers, Other Sales Channels |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Thredup Inc., The RealReal, Poshmark, Vinted, Micolet, Percentil.ma, Thrift+, Chikatex, HunTex Recycling Kft, EBay Inc., British Used Clothing Company, A&E Used Clothing Wholesale, Mobacotex, Tradesy, StockX |

| Additional Attributes | Surge in eco-conscious consumerism, Rise of recommerce platforms, Fast fashion backlash fueling resale trends |

| Customization and Pricing | Customization and Pricing Available on Request |

The secondhand apparel market is expected to be USD 48.32 billion in 2025.

Dresses and tops are estimated to hold 33.0% share in the global market.

The demand for secondhand apparel grew at an 8.9% CAGR from 2020 to 2024.

The market is anticipated to surpass a valuation of USD 138.90 billion by 2035.

The secondhand apparel industry is anticipated to grow at a CAGR of 11.1% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Sector, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Sector, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Target Population, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by Target Population, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Sector, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Sector, 2024 to 2034

Figure 28: Global Market Attractiveness by Target Population, 2024 to 2034

Figure 29: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Sector, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Sector, 2024 to 2034

Figure 58: North America Market Attractiveness by Target Population, 2024 to 2034

Figure 59: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Sector, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Sector, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Target Population, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Sector, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Sector, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by Target Population, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Sector, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Sector, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by Target Population, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Sector, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Sector, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by Target Population, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Sector, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Sector, 2024 to 2034

Figure 208: East Asia Market Attractiveness by Target Population, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Sector, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by Target Population, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Sector, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Sector, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Sector, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sector, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Target Population, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Target Population, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Target Population, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Target Population, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Sector, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Target Population, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Secondhand Apparel Market Share

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Secondhand Goods Industry Analysis in Europe - Size, Share, and Forecast Outlook 2025 to 2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Gym Apparel Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Decorated Apparel Market segmented by Product, End-user and Distribution Channel through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA