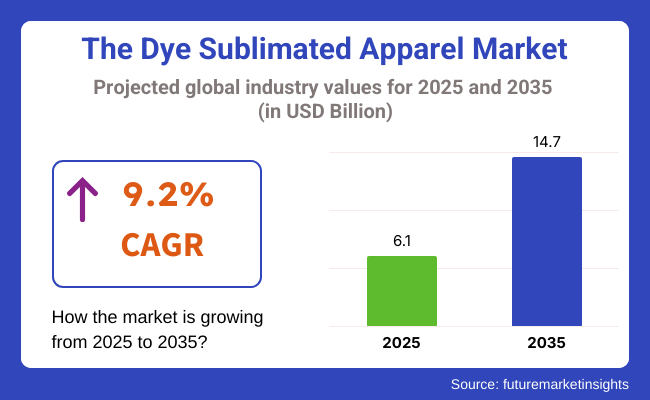

The dye sublimated apparel market size was USD 6.1 billion in 2025 and is expected to grow at a 9.2% CAGR in the period from 2025 to 2035. The valuation of the dye sublimated apparel industry is expected to reach USD 14.7 billion in 2035.

The most significant driver of growth is the increasing consumer demand for enduring, vibrant, and personalized clothing in both performance sports apparel and fashion segments.The sublimation dyeing process, which enjoys superior colorfastness and high design accuracy, has gained strong momentum in performance sportswear, team sports kits, and corporate uniforms.

In the USA and other developed economies, customers move towards apparel that signifies personal identity and team allegiance, and thus, personalized sublimated designs have become more popular in the mainstream. Advances in heat transfer and digital printing technology have made entry costs affordable, enabling small firms and startups to enter.

Increasing interest in sporting and recreational sports involvement, combined with the continued popularity of esports and merchandise branding, is driving demand for sublimated t-shirts, hoodies, and jerseys.

These are not only aesthetically pleasing but also feature practicality in the form of breathability, moisture-wicking ability, and stretch, which aligns with shifting consumer attitudes toward multifunctional apparel.The sector is underpinned by growth in web-to-print and direct-to-consumer business models.

Customers are enabled to design products themselves through online configurators, with rapid turnaround enabled through on-demand production. The trend is reshaping supply chains and compelling manufacturers towards lean, agile manufacturing with localized clusters of fabrication in a bid to provide fast delivery.

Environmental concerns are also shaping product innovation. With sustainability as a competitive imperative, manufacturers are turning to green polyester alternatives, water-based inks, and low-energy dyeing.

Sourcing transparency and a circular product life cycle now shape both B2B and B2C purchasing decisions, pointing to a shift of the value proposition of dye-sublimated clothing from looks alone to performance with purpose.

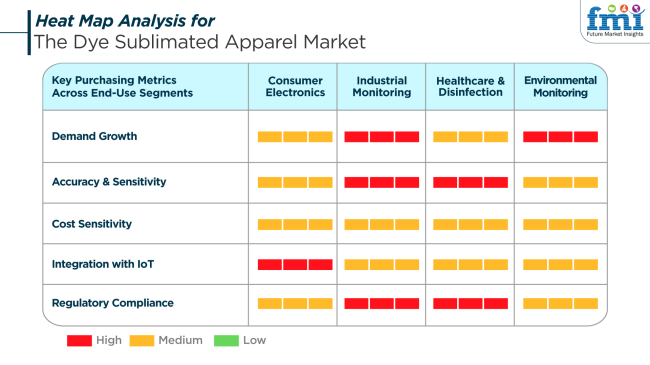

Though not technological equipment, dye-sublimated clothing shares concurrent patterns of demand in customized consumer goods. Demand growth is strong in end-use markets where high-performance and personal solutions are needed. Purchasers in the sports, fashion, and promotion industries are looking for clothing with aesthetic appeal rather than functional performance.

Cost sensitivityis moderate. Small batch producers are frequently able to command premium prices for highly custom orders, but bulk customers seek economies of scale. The growth in digital design software and automated production workflows is helping to drive down costs, which is making personalization affordable without cutting margins.

Compliance with regulations, particularly for dye usage, chemical safety, and sustainability certification, is increasingly important. Ethically conscious consumers and institutional purchasers are increasingly seeking products that are certified to OEKO-TEX, GRS, or similar standards. These certifications contribute to the legitimacy of a brand and drive purchasing decisions where visual quality must now meet ethical production standards.

<

The dye-sublimated clothing industry is exposed to several key risks that can hinder its projected growth. At the top of these is the volatility of raw materials pricing, particularly with polyester material and specialty ink. As the industry adopts more and more eco-friendly materials, any supply disruption or rise in the cost of eco-solutions will affect the scalability of production and pricing actions.

Technological obsolescence is also an emerging problem. With newer digital printing technologies and hybrid dye technologies emerging, older machines may soon become obsolete. Small- and medium-sized manufacturers risk being left behind if they fail to invest regularly in R&D and refresh cycles, which tend to be capital-intensive.

The commoditization and saturation of basic sublimated products are challenges. As printing hardware and design software are easily accessible, competition is intensified, with new entrants finding it difficult to differentiate themselves. Established players need to focus on providing high-quality customization experiences, fast shipping, and environmentally sustainable sourcing to foster and sustain customer loyalty.

Between 2020 and 2024, the dye sublimation apparelindustry registered steady growth owing to increasing interest in colored, customized apparel across sportswear, fashion, and promotional merchandise industries. The trend toward athleisure and customized brand sportswear, especially during the COVID-19 pandemic period, contributed to growing popularity.

Micro-enterprises and web-based entrepreneurs embraced print-on-demand concepts, allowing low-inventory, high-flexibility manufacturing through sublimation processes. Environmentally friendly consumers also positively reacted to sublimation printing because of its waterless dyeing process and low fabric waste.

Between 2025 and 2035, there will be AI-driven design automation, intelligent textile integration, and eco-friendly ink developments. Brands will use sublimation for hyper-personalized small-batch apparel according to fast-custom fashion. Sustainability will become increasingly important with innovation in bio-based inks and recycled polyester blends.

Retailers will use AR/VR to enable consumers to visualize custom designs in real time before purchase. Growing smart, moisture-wicking, and UV-protective clothing will also drive the adoption of dye sublimation across performance wear and smart lifestyle clothing. Internationalization of on-demand, small-scale fashion across e-commerce channels will also extend democratization to access to clothing production of sublimated goods.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth of athleisure, print-on-demand business models, and personalized team sportswear. | AI-driven personalization, smart fashion trends, and bio-sustainable print technologies for textiles. |

| Small sports teams, fashion labels, print-on-demand entrepreneurs, and sportswear shoppers. | Gen Z consumers, green shoppers, performance apparel users, and fashion consumers with integration technology. |

| Expansion of digital printing of textiles and increased polyester compatibility. | AI/AR design software, bio-integrated smart fabric, and bio-based sublimation ink. |

| Much reduced waste generation and waterless dyeing are used as conventional techniques. | Biodegradable inks, recyclable fibers, and closed-loop factories for manufacturing. |

| Preponderantly, it is sportswear, team wear, and promotional wear. | Smart casuals, interactive wear, green fast fashion, and healthcare-monitoring wearables. |

| Print-on-demand and small-batch runs for fast fashion and personalization. | On-demand, hyper-localized, AI-based micro-factories linked with e-commerce platforms. |

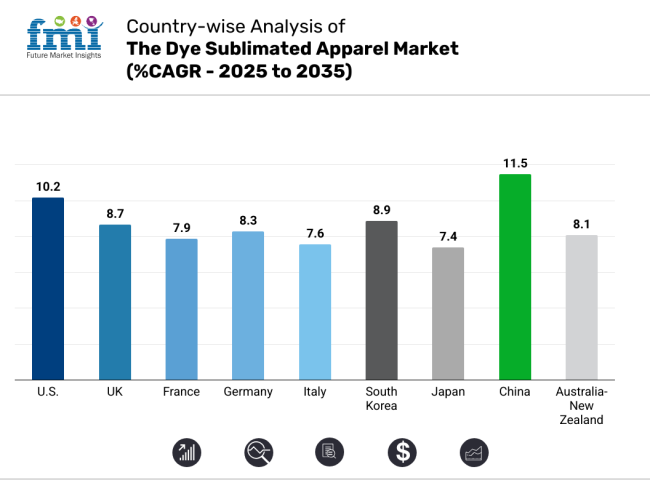

The USA will grow at 10.2% CAGR over the study period. Increased demand for customized clothing and increased adoption of digital textile printing techniques have played a major role in the growth of dye-sublimated clothing. The USA has a highly developed sports and fitness culture, which fuels the demand for customized sportswear produced through dye sublimation.

In addition, the popularity of web-based apparel customization websites has provided a conducive climate for on-demand printing, a fundamental strength of dye sublimation technology. Schools and companies regularly place orders for customized uniforms, generating repeat demand. Moreover, the development of sublimation printers and the availability of environmentally friendly dye-based inks have enhanced quality and sustainability, further driving adoption.

The USA also enjoys the presence of large apparel brands and promotional product suppliers investing in quick-turnaround printing capabilities. The growth of small-scale custom apparel businesses, facilitated by e-commerce platforms, continues to gain traction. With high consumer expenditure and a strong desire for personalized experiences, dye sublimation is emerging as a go-to method in the USA fashion landscape.

The UK is predicted to grow at 8.7% CAGR over the research period. Increasing demand for custom fashion and the expansion of independent clothing brands are fueling demand for dye sublimation technology.

UK SMEs operating in the clothing industry are embracing dye sublimation more and more due to its affordability for small runs and fast turnaround time. Urban fashion trends and fast fashion cycles have increased the need for agile production methods, making dye sublimation a viable solution.

The UK also features a mature online shopping industry with strong growth in digital custom clothing platforms. Further, increased uptake in wellness and fitness activities is creating demand for personalized fitness attire.

Fashion-conscious consumers and social influencers are further nudging the industry toward customization, and colorful full-color prints are optimally facilitated through sublimation methods. Sustainability has also taken center stage, with waterless printing techniques such as dye sublimation increasing in favor compared to conventional ones.

France is likely to grow at 7.9% CAGR over the study period. The French clothing industry, renowned for its design-oriented and fashion-forward consumers, is gradually embracing dye sublimation printing. The process's ability to print high-resolution, detailed designs complements the design requirements of boutique fashion labels. Eco-friendly fashion growth also comes into play since dye sublimation is regarded as more eco-friendly because it consumes less water and generates less waste.

France, too, has experienced a growing demand for event-based and promotional customized apparel. Substantial numbers of smaller to mid-scale brands are running limited editions on sublimation in order to lower inventory risk and provide design freedom. Local artists and designers are also making use of sublimation printing to produce high-end wearable art.

As France continues to incorporate digital technologies in fashion manufacturing, dye sublimation will most likely have an increasingly pivotal role in facilitating creative expression with lower environmental costs.

Germany is anticipated to expand at 8.3% CAGR over the study period. Being one of Europe's top industrial economies, Germany has adopted digital transformation in many sectors, including textile production.

The nation's strong demand for high-performance, customized sports apparel in professional and recreational sports is driving the application of dye sublimation processes. Moreover, the technical textile sector is transforming, with dye sublimation being used to produce innovative and multifunctional clothing.

Germany's focus on quality and sustainability is a perfect fit for the key attributes of dye-sublimated garments. Germany also has a high concentration of equipment suppliers, which benefits local manufacturing and reduces supply chains. In business-to-business, the demand for branded and staff clothing is another driving force for growth.

Italy will grow at 7.6% CAGR throughout the study period. Renowned for its historical fashion heritage, Italy is utilizing dye sublimation to combine craftsmanship with advanced production methods. Increasing demand among Italian consumers and designers for small-batch, customized apparel is driving dye sublimation technologies forward. Print-on-demand services and artisanal brands are discovering dye sublimation as a perfect solution to provide rich designs without heavy inventory requirements.

Italy's fashion capitals like Milan and Florence have witnessed an increase in bespoke fashion stores providing online and offline customization options. In addition, the tourism industry contributes to the need for souvenir and event wear, which tends to use dye sublimation for its speed and accuracy. As Italian fashion becomes more sustainable, the environmentally friendly nature of sublimation is likely to aid its uptake further.

South Korea will grow at 8.9% CAGR through the study period. The dynamic fashion culture of South Korea and its speedy digitalization are important drivers for dye-sublimated clothing growth. South Korea has an active consumer segment that prefers one-of-a-kind styles that suit the customizable ability of sublimation printing. K-fashion and influencer trends require high-definition prints and rapid design turnaround, rendering dye sublimation a strategic technology.

South Korean fashion tech startups and tech-enabled fashion firms are embracing high-end printing technology to create small collections and trial garments, a trend supported by a robust local e-commerce platform.

In addition, the rising popularity of national and global sporting events continues to fuel demand for sublimated team jerseys and fan gear. As consumers place importance on both style and technological integration, South Korea's dye sublimated apparel industry will continue to experience steady growth.

Japan will grow at a 7.4% CAGR during the period of study. Japan is defined by the harmonization of traditional values with contemporary tastes, presenting distinctive opportunities for dye sublimation. The availability of sophisticated designs to print on fabrics with high accuracy appeals to Japanese designers who are detail-oriented and desire quality. Sublimation finds application in the production of visually appealing garments in streetwear, pop culture, and cosplay segments.

Online fashion businesses and domestic brands increasingly prefer on-demand manufacturing, which complements Japan's small retail formats and focuses on sustainability. Japan's aging populace also promotes customized wellness clothing. With more affordable digital fashion tools, Japan is set to witness greater adoption of sublimation printing in fashionable and traditional textile industries.

China is forecast to expand at 11.5% CAGR throughout the study. Being the world's biggest textile production hub, China offers immense opportunities for the development of dye sublimation. There is a shift from mass production to flexible, on-demand production. There is a growing domestic demand for customized fashion and an emerging middle class looking for uniqueness in clothing.

China is also making significant investments in digital printing equipment and green technologies. Local brands are emphasizing customization, e-commerce, and fashion for youth. Sublimation is being taken up across a range of product categories, from sportswear and fashion to workwear and promotional products. With increasing digital literacy and design software becoming commonplace, China's dye sublimated apparel industry will drive innovation.

The Australia-New Zealand region is likely to grow at 8.1% CAGR throughout the study period. Growing consumer demand for personalized and sustainable apparel is driving the growth of sublimation in both nations.

Australia and New Zealand have thriving sports cultures and active lifestyle subcultures, driving demand for sublimation-printed performance apparel. Local brands and startups are adopting digital personalization to serve niche communities with exclusive tastes.

Internet channels have enabled direct-to-consumer platforms where custom designs and small-batch collections are highly sought after. Dye sublimation's quick turnaround and capacity to produce photorealistic images make it a favored option for this application. Both countries are tapping sublimation technology as a scalable and eco-friendly printing solution.

In the dye sublimation apparel market for the year 2025, bottom wear will lead with 38.5%, while T-shirts may account for 26.0% of the total industry value.Bottom wear, which corresponds to leggings, joggers, pants, and shorts, thrives due to the demand for personalized designs and performance activewear.

Athletic lifestyles have long associated bottom wear with workouts and casual wear. Dye sublimation is indeed a great technique to put long-lasting and colorful designs onto fabrics for consumers with sports activities or fashion in mind.

Brands such as Nike, Adidas, and Under Armour use dye sublimation very much in custom team uniforms, activewear, and athleisure lines, whereas Lululemon and Fabletics, also among the top brands in the athleisure field, use this technology to deliver individualized but bright designs for leggings and performance apparel. Thus, they satisfy the high-quality, functional, and personalization expectations of the customers, which make an impression on the bottom wear.

T-shirts are estimated to hold a share of 26% by 2025. Custom T-shirts have seen buoyant growth over online platforms such as Teespring, Redbubble, and Zazzle, especially among trend-savvy Millennials and Gen Z fashionistas.

Custom Ink, Vistaprint, and Printful are some of the companies keeping the custom T-shirt frenzy alive thanks to their easy-to-use platforms. Individuals and small businesses can create and sell custom T-shirts through these platforms. It is because of dye sublimation that T-shirts can get all-over vibrant designs that appeal to an audience and help them find unique or one-of-a-kind pieces.

In 2025, the 3D vacuum heat pressis likely to lead with 28% of the share, while calendar heat press will obtain 27% of the share. Printing techniques determine the qualitative and versatile nature of the designs to be laid out on fabrics.

The 3D vacuum heat press is becoming popular for printing on three-dimensional surfaces, hence applying bright designs on products like caps, bags, and other accessories, apart from wearing apparel. It provides tough and long-lasting high-definition all-over prints with fine detailing and bright applications of color.

Customizing sportswear and fashion accessories is extremely popular for a 3D vacuum press, wherein unique and detailed designs become the key demand. M&R Printing Equipment and Stahls are top players in this segment, producing 3D heat press machines for quality and volume-driven businesses.

These machines are a good fit for companies looking to expand into custom apparel and accessories.The calendar heat presses also fit this effect in that they are quite often utilized for the transfer of images from paper substrates onto fabrics using heat and pressure. Calendar heat press machines work best for large designs on flat surfaces like apparel, t-shirts, bottoms, and home textiles and are highly efficient for high production volumes.

The top producers of calendar heat presses for business use are Sublimation101 and Hotronix. It is an invaluable tool in a mass-production setup for any company that makes custom appraisals with heavy sports and promotional segment requirements.

The industry is characterized by a surge of innovative brands that focus on bright, high-quality designs for personalized clothing. Major players, including Dad's Printing and Inkwell Printing, have established themselves by providing high-quality sublimation printing services to individual customers as well as large corporations.

They both offer a wide variety of products, ranging from custom hoodies and t-shirts to sports teams, taking advantage of the versatility of dye sublimation to produce full-color, all-over prints that target a wide base of customers. Royal Apparel and TEXmarket both specialize in supplying high-performance, customizable apparel made of green and sustainable materials while offering premium quality sublimation services.

Printful, Inc., which is one of the leading players in the global print-on-demand business, has extended its reach further by providing a wide range of sublimated apparel products for online stores and individuals.

New players such as ALE CLOTHING and Berunwear have also established themselves by focusing on fashion-forward designs along with the potential of the dye sublimation process, addressing the athleisure and the custom fashion industries. Emirates Apparel and ASPECT specialize in offering high-quality, tailored solutions for corporate and sportswear uses.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Dad’s Printing | 15-18% |

| Inkwell Printing | 12-15% |

| Royal Apparel | 10-13% |

| TEXmarket | 8-10% |

| Printful, Inc. | 7-9% |

| Other Players | 32-40% |

Key Company Insights

Dad's Printing is a key leader in dye sublimated apparel production with an estimated 15-18% share based on its aggressive emphasis on customized, high-quality garments and fast turnaround capabilities. The firm has become one of the leading picks for small firms as well as big businesses searching for personalized items.Inkwell Printing closely trails with a 12-15% share, offering high-quality design and growing its client base in custom apparel, servicing large orders as well as individual consumers. Royal Apparel enjoys a 10-13% share and is in demand for its green initiatives and environmentally friendly textiles, providing personal sublimation prints for clothing and sports fashion.

TEXmarket enjoys an 8-10% share in providing quality customized apparel for small businesses as well as corporate clients. Printful, Inc. controls 7-9% of the industry and is greatly respected for its print-on-demand business model, providing a huge collection of sublimated clothing for retailers and entrepreneurs worldwide. Other players like ALE CLOTHING, Emirates Apparel, FUSH, and Berunwear bring diversity with fashion, sportswear, and promotional apparel offerings.

The segmentation is into bottomwear, hoodies, and T-shirts (including golf, cricket, cycling, and other T-shirts).

The segmentation is into Small Format Heat Press, Calendar Heat Press, Flatbed Heat Press, and 3D Vacuum Heat Press.

The segmentation is into Online and Offline channels.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to reach USD 6.1 billion in 2025.

The valuation is expected to grow to USD 14.7 billion by 2035.

The market is anticipated to grow at a CAGR of 11.5% during the forecast period.

Bottom wear is a key segment within the dye sublimated apparel market.

Key players include Dad’s Printing, Inkwell Printing, Royal Apparel, TEXmarket, Printful, Inc., ALE CLOTHING, Emirates Apparel, FUSH, and Berunwear.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Printing Techniques, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Printing Techniques, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Printing Techniques, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Printing Techniques, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Printing Techniques, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Printing Techniques, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Printing Techniques, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Printing Techniques, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Dye-Sublimation Printing Machines Market

Dyes and Pigments Market

Gym Apparel Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leather Dyes Manufacturers

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

FD and C Dyes Market Size, Growth, and Forecast for 2025 to 2035

Synthetic Dye Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA