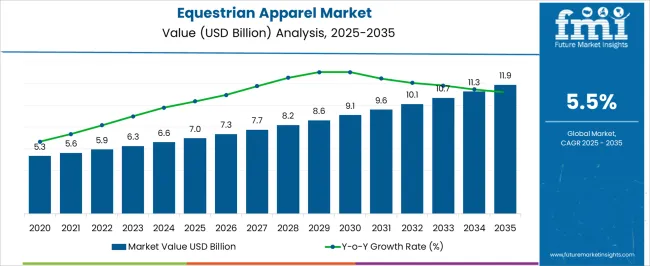

The equestrian apparel market is projected at 7.0 USD billion in 2025 and is anticipated to reach 11.9 USD billion by 2035, registering a CAGR of 5.5%. Growth is fueled by rising participation in equestrian sports, increased horse ownership, and expanding interest in competitive riding events globally. The market is experiencing gradual saturation in developed regions such as North America and Western Europe, where high awareness, established retail networks, and premium brand presence have already captured a significant share of consumer demand.

Emerging markets in Asia-Pacific and Latin America offer incremental growth opportunities due to increasing disposable incomes, equestrian training facilities, and rising awareness of safety and performance apparel. Product diversification, including riding boots, jackets, gloves, breeches, and helmets, caters to both professional riders and leisure enthusiasts. Branding, quality certifications, and material innovations, such as moisture-wicking fabrics and protective gear, influence purchasing decisions. Dollar sales, share, and consumer loyalty are higher for established premium brands, whereas niche and mid-tier offerings are gaining traction through online channels and specialized equestrian stores. Market dynamics also reflect a shift toward lifestyle-oriented equestrian apparel, blending performance with fashion, further extending adoption beyond competitive riding. Overall, growth is steady, but gradual saturation in mature markets necessitates strategic expansion and product differentiation to capture remaining potential.

| Metric | Value |

|---|---|

| Equestrian Apparel Market Estimated Value in (2025 E) | USD 7.0 billion |

| Equestrian Apparel Market Forecast Value in (2035 F) | USD 11.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The equestrian apparel market is influenced by several interconnected parent markets, each contributing distinctly to overall demand and growth. The competitive equestrian sports segment holds the largest share at 35%, as professional riders and competitive events drive demand for high-performance riding jackets, breeches, boots, gloves, and helmets that ensure safety, comfort, and style. The recreational and leisure riding market contributes 25%, with hobbyists and casual riders seeking durable, fashionable, and functional apparel for training, trail riding, and club events. The equestrian lifestyle and fashion segment accounts for 20%, emphasizing stylish and premium-quality riding wear that appeals to enthusiasts who integrate equestrian culture into everyday fashion.

The equestrian education and training market holds 12%, where riding schools, academies, and youth programs require standardized apparel for safety, uniformity, and skill-based training purposes. Finally, the online and specialty retail segment represents 8%, providing global access to niche brands, custom-fit products, and innovative materials that enhance performance and aesthetics. Collectively, competitive sports, recreational riding, and lifestyle segments account for 80% of overall demand, highlighting that performance, comfort, and fashion remain the primary growth drivers, while training programs and specialized retail channels offer additional opportunities for market expansion globally.

The equestrian apparel market is experiencing steady growth, supported by the rising participation in equestrian sports and the increasing emphasis on performance-oriented and stylish riding gear. The demand is being influenced by both professional and recreational riders seeking comfort, durability, and improved functionality in their apparel. Innovations in fabric technology, such as moisture-wicking, stretchability, and enhanced breathability, are driving product adoption across regions.

The market is also benefiting from growing consumer interest in sustainable materials and ethically produced garments, aligning with broader lifestyle and environmental trends. Expanding equestrian events and competitions, alongside growing equestrian tourism, are further contributing to market expansion.

With increasing investment from apparel manufacturers in customization, fit optimization, and design aesthetics, the market outlook remains positive The combination of performance enhancement and fashion appeal is expected to sustain demand, making the sector attractive for both established brands and new entrants.

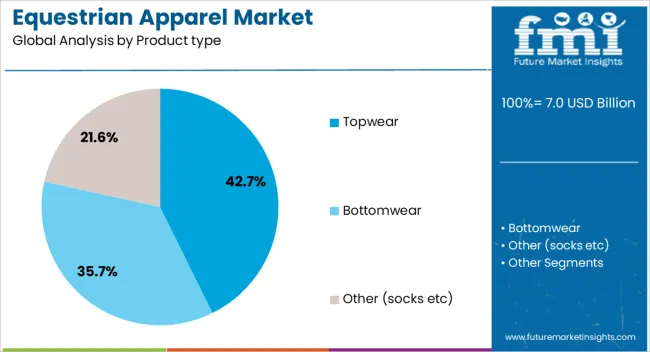

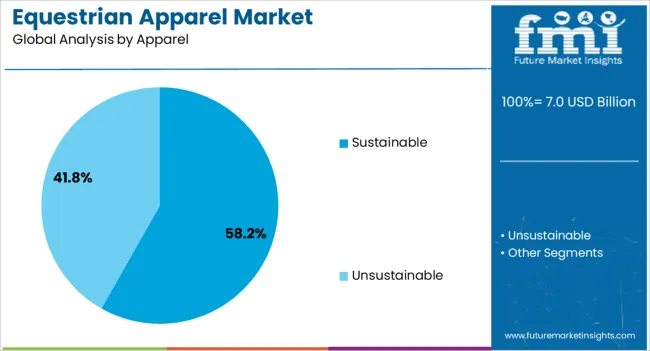

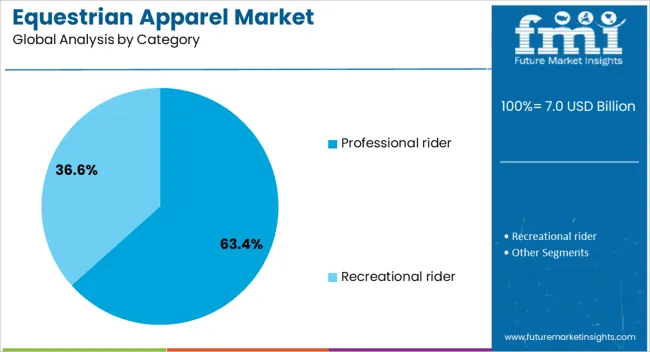

The equestrian apparel market is segmented by product type, apparel, category, consumer group, price range, distribution channel, and geographic regions. By product type, equestrian apparel market is divided into Topwear, Bottomwear, and Other (socks etc). In terms of apparel, equestrian apparel market is classified into Sustainable and Unsustainable. Based on category, equestrian apparel market is segmented into Professional rider and Recreational rider.

By consumer group, equestrian apparel market is segmented into Female, Male, and Children. By price range, equestrian apparel market is segmented into Mid, Low, and High. By distribution channel, equestrian apparel market is segmented into Offline and Online. Regionally, the equestrian apparel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Topwear segment is projected to hold 42.7% of the overall equestrian apparel market revenue in 2025, making it the leading product type. This leadership position is being supported by the high frequency of use of riding shirts, jackets, and competition tops, which are essential for both training and competitive events.

The growth of this segment has been driven by increasing demand for performance fabrics that offer comfort, flexibility, and durability under varied weather conditions. The appeal of stylish and functional topwear, coupled with availability in a range of fits and designs, has encouraged frequent purchases among riders. Advancements in breathable, moisture-control fabrics and ergonomic tailoring have enhanced rider comfort, further strengthening market share The recurring need for topwear replacement due to wear and exposure in outdoor riding activities is also contributing to its sustained dominance in the product type category.

The Sustainable apparel segment is expected to account for 58.2% of the equestrian apparel market revenue in 2025, making it the leading apparel type. This dominance is being driven by growing consumer awareness of environmental impact and a shift towards ethically produced riding gear.

The increasing availability of apparel made from organic, recycled, and low-impact materials has aligned with evolving consumer preferences for responsible purchasing. Brands are adopting eco-conscious manufacturing processes, including reduced water usage and non-toxic dyeing techniques, which resonate strongly with the target audience.

The durability and comfort offered by sustainable fabrics, combined with their positive environmental attributes, have supported higher adoption rates The segment’s growth is also being reinforced by marketing strategies highlighting traceability and ethical sourcing, which enhance consumer trust and brand loyalty.

The Professional Rider category is anticipated to hold 63.4% of the equestrian apparel market revenue in 2025, positioning it as the dominant category. This prominence is being attributed to the high-performance requirements of professional riders, who demand apparel that supports precision, safety, and comfort during competitive events.

The use of advanced technical fabrics that enhance movement, regulate body temperature, and provide protection has contributed to the segment’s leadership. Professional riders also tend to invest in multiple apparel sets for training, competitions, and seasonal variations, resulting in higher spending per individual compared to recreational riders.

Sponsorships, endorsements, and partnerships between apparel brands and professional athletes have further strengthened market presence The continuous introduction of premium product lines tailored for professional use has reinforced the segment’s dominance and is expected to support sustained growth in the coming years.

Competitive sports and recreational riding remain primary growth drivers, while lifestyle, fashion, and training programs provide complementary opportunities. Premium and mid-tier apparel dominate dollar sales, share globally.

The equestrian apparel market is significantly influenced by the growth of competitive equestrian sports, including show jumping, dressage, and eventing. Riders demand high-quality, functional, and durable apparel such as jackets, breeches, gloves, boots, and helmets to ensure safety, performance, and comfort during competitions. Professional clubs, tournaments, and federations increasingly emphasize standardized gear, driving adoption of certified, performance-tested products. Dollar sales, share indicate that premium and specialized riding apparel dominate revenue, while mid-tier products serve amateur competitors. Training academies and sports associations promote branded uniforms and equipment. Growing sponsorship, media coverage, and international competitions raise visibility, encouraging aspirants and enthusiasts to invest in performance-oriented apparel, further reinforcing market expansion and premium segment growth globally.

Recreational and leisure riding contributes significantly to equestrian apparel demand, as hobbyists engage in trail riding, horse training, and local club activities. Riders prioritize comfort, durability, and style, selecting apparel that supports extended riding hours while protecting against weather conditions. Dollar sales, share suggest mid-range apparel holds substantial market share, with casual and multifunctional designs appealing to non-professional riders. Riding schools and regional clubs influence adoption patterns, providing guidance on appropriate gear and promoting safety equipment. The rise of weekend riders and equestrian tourism boosts sales of practical apparel like gloves, jackets, and boots. Specialty retail stores, e-commerce platforms, and seasonal promotions further enhance accessibility, supporting steady growth across leisure riding segments globally.

Equestrian lifestyle and fashion trends increasingly shape apparel preferences, with riders seeking stylish, high-quality garments suitable for competitions, social events, and casual wear. Premium and designer riding apparel, including tailored jackets, leather boots, and branded accessories, dominate high-value segments, reflecting dollar sales, share concentration. Lifestyle-oriented consumers often integrate equestrian-inspired clothing into everyday fashion, driving crossover appeal. Social media, influencer endorsements, and fashion collaborations amplify awareness and desirability of niche brands. Limited-edition collections and customization options cater to affluent riders and collectors. Retailers focus on curated product lines and visual merchandising to highlight quality and aesthetic appeal. This trend boosts demand for sophisticated fabrics, craftsmanship, and exclusive designs, enhancing revenue potential in the premium equestrian apparel segment globally.

Equestrian education, training programs, and retail infrastructure drive apparel adoption and market reach. Riding schools, academies, and youth programs require standardized and certified apparel to ensure safety, uniformity, and skill-based learning. Dollar sales and share indicate these segments hold consistent demand, particularly in beginner and intermediate markets. Retail distribution, including specialty stores, online platforms, and equestrian clubs, expands accessibility to functional and premium apparel across regions.

Marketing campaigns, seasonal promotions, and product demonstrations educate consumers about fit, material, and safety features. Partnerships between schools, sports federations, and retailers encourage consistent purchasing behavior. Strong logistics and supply chain networks ensure product availability, quality maintenance, and timely delivery, supporting overall market growth globally.

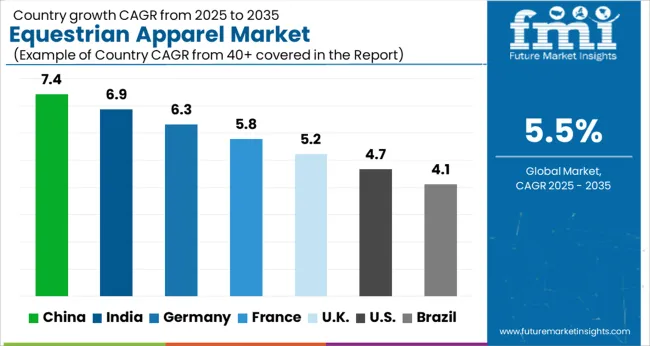

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

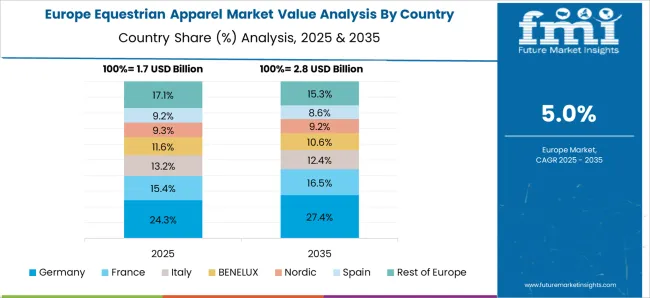

The global equestrian apparel market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads at 7.4%, followed by India at 6.9%, France at 5.8%, the UK at 5.2%, and the USA at 4.7%. Growth is driven by increasing participation in competitive equestrian sports, recreational riding, and rising interest in equestrian lifestyle and fashion. Asia, particularly China and India, exhibits rapid expansion due to growing middle-class spending, organized riding clubs, and leisure activity adoption, while Europe emphasizes premium apparel, designer brands, and standardized safety-certified gear. North America focuses on professional riding, equestrian schools, and recreational enthusiasts seeking functional and stylish riding apparel. Distribution through retail, specialty stores, and e-commerce platforms enhances accessibility and adoption. Dollar sales, share indicate that premium, performance-oriented apparel dominates revenue, while mid-tier and casual products drive incremental growth. The analysis covers over 40+ countries, with the leading markets detailed below.

The equestrian apparel market in China is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by rising interest in equestrian sports, leisure riding, and premium lifestyle adoption. The expansion of riding clubs, polo tournaments, and competitive equestrian events is fueling demand for riding jackets, breeches, boots, helmets, and safety-certified gear. Rising disposable income among the urban and semi-urban population encourages investment in branded and performance-oriented apparel. Domestic manufacturers are expanding production while international brands enter through partnerships and retail channels. E-commerce platforms, social media marketing, and sponsorship of equestrian events enhance visibility and accessibility. Dollar sales, share indicate that premium and performance-focused products dominate revenue, while mid-range and casual riding wear contribute to market penetration. Government-backed sports initiatives and equestrian training academies further strengthen adoption.

The equestrian apparel market in India is expected to expand at a CAGR of 6.9% from 2025 to 2035, supported by increasing interest in competitive riding, polo, and recreational equestrian activities. Rising disposable income among affluent urban households, combined with the establishment of riding schools and sports clubs, is driving adoption of helmets, jackets, boots, gloves, and protective gear. Local brands are introducing cost-effective, functional apparel, while international players focus on high-end, performance-oriented collections. Event sponsorships, equestrian tournaments, and awareness campaigns promote visibility and brand recognition. Dollar sales, share indicate that premium riding gear and safety-certified apparel contribute significantly to revenue, whereas casual and mid-tier apparel boost overall market penetration. Growth is further aided by government-supported sports programs and equestrian federations organizing competitions and training programs.

The equestrian apparel market in France is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by the country’s long-standing equestrian tradition and strong participation in competitive sports like dressage, show jumping, and eventing. High demand for premium riding jackets, breeches, boots, gloves, and protective helmets is observed among professional riders and hobbyists. European consumers prioritize quality, durability, and designer labels, leading manufacturers to focus on high-end, performance-enhancing fabrics and safety-certified apparel. Specialty retailers, equestrian boutiques, and online platforms facilitate distribution. Dollar sales, share show that luxury and functional riding apparel dominate revenue, while mid-range products contribute to market expansion. Equestrian clubs, federations, and training centers promote brand engagement, sponsorships, and event-based marketing to drive adoption.

The equestrian apparel market in the UK is expected to expand at a CAGR of 5.2% from 2025 to 2035, supported by widespread equestrian sports participation, leisure riding, and professional competitions. Helmets, jackets, boots, breeches, gloves, and safety gear see strong demand from both competitive and recreational riders. British consumers emphasize durability, comfort, and safety compliance, prompting manufacturers to produce high-performance, certified apparel. Retail chains, specialized boutiques, and online marketplaces facilitate accessibility. Dollar sales, share indicate premium and functional riding apparel dominate revenue, while casual wear and mid-tier options broaden market penetration. Sponsorship of tournaments, riding schools, and equestrian federations’ initiatives promote awareness and engagement, fostering adoption across various demographic segments and riding disciplines.

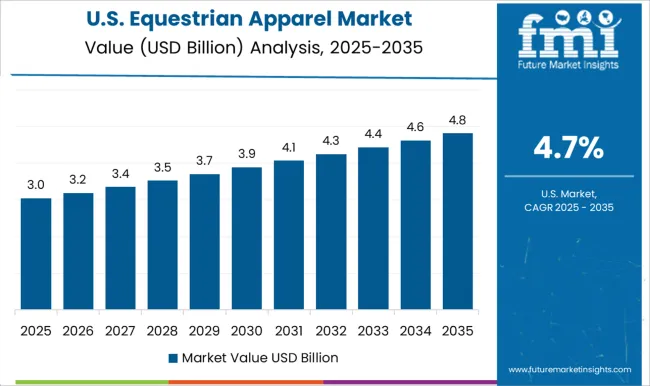

The equestrian apparel market in the USA is projected to grow at a CAGR of 4.7% from 2025 to 2035, driven by recreational riding, competitive equestrian sports, and lifestyle adoption. Riders increasingly seek helmets, boots, jackets, gloves, and breeches combining performance, comfort, and style. Domestic brands emphasize functional designs, while international premium brands cater to affluent consumers. Retail stores, equestrian specialty shops, and e-commerce platforms improve accessibility and visibility. Dollar sales, share indicate premium and performance-oriented apparel dominate revenue, whereas casual and mid-range riding wear contribute to market reach. Participation in polo, dressage, and show jumping events, coupled with equestrian clubs, schools, and federations, supports adoption and brand loyalty. Event sponsorships and marketing initiatives further strengthen consumer engagement.

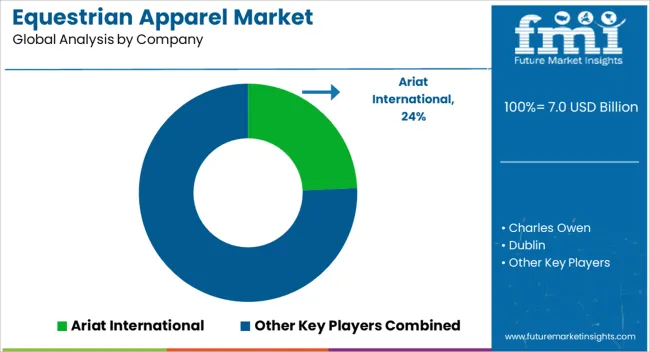

Competition in the equestrian apparel market is defined by product quality, performance, comfort, and brand recognition. Ariat International leads with a wide portfolio of riding boots, jackets, breeches, and gloves that combine durability, ergonomic design, and safety certification for both professional and recreational riders. Charles Owen differentiates through high-standard helmets, emphasizing safety compliance, lightweight construction, and stylish designs. Dublin and Equi-Star focus on mid-range riding apparel and protective gear, offering functional, cost-effective options for hobbyists and entry-level riders. Eskadron, Goode Rider, and Helite compete through premium and technologically advanced apparel, including airbag vests, breathable jackets, and performance-enhancing fabrics. Regional and niche players such as Horze, Kentucky Horsewear, Kingsland Equestrian, Pikeur, Riders International, Samshield, and Tredstep Ireland leverage specialized product lines for dressage, show jumping, and leisure riding. Strategies emphasize brand loyalty, product innovation, durability, and ergonomic fit.

Partnerships with equestrian clubs, event sponsorships, and riding schools strengthen market penetration, while e-commerce and retail channels expand accessibility across diverse consumer segments. Dollar sales and share indicate that premium and performance-oriented products dominate revenue, whereas mid-tier and casual riding apparel contribute to a broader market reach. Product offerings are showcased in detailed catalogs, highlighting material quality, safety certifications, moisture-wicking properties, stretchability, and impact protection. Apparel is designed for various disciplines, including competitive, leisure, and recreational riding. Packaging, sizing guidance, and care instructions are provided to ensure optimal performance and durability. Complementary services such as customer support, fitting assistance, and customization options are included. Marketing efforts emphasize lifestyle, heritage, and equestrian sport participation to attract professional and amateur riders. The market remains highly competitive, with a focus on performance, comfort, and brand differentiation across global and regional equestrian communities.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Product type | Topwear, Bottomwear, and Other (socks etc) |

| Apparel | Sustainable and Unsustainable |

| Category | Professional rider and Recreational rider |

| Consumer group | Female, Male, and Children |

| Price range | Mid, Low, and High |

| Distribution channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ariat International, Charles Owen, Dublin, Equi-Star, Eskadron, Goode Rider, Helite, Horze, Kentucky Horsewear, Kingsland Equestrian, Pikeur, Riders International, Samshield, and Tredstep Ireland |

| Additional Attributes | Dollar sales, share, regional demand, competitive landscape, consumer preferences for comfort, safety, and style, distribution channels, and emerging riding disciplines. |

The global equestrian apparel market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the equestrian apparel market is projected to reach USD 11.9 billion by 2035.

The equestrian apparel market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in equestrian apparel market are topwear, bottomwear and other (socks etc).

In terms of apparel, sustainable segment to command 58.2% share in the equestrian apparel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Gym Apparel Market Analysis – Growth & Forecast 2024-2034

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Decorated Apparel Market segmented by Product, End-user and Distribution Channel through 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Secondhand Apparel Market Share

Second-hand Apparel Market in Europe Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Dye Sublimated Apparel Market is segmented by product, printing technique, distribution and region through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA