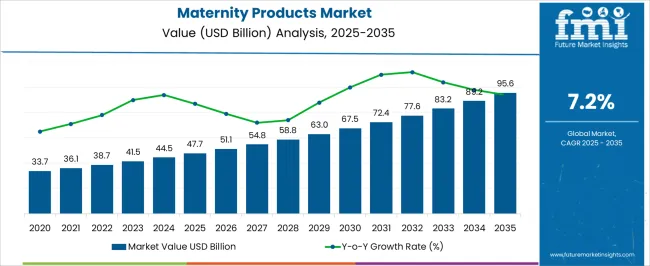

The maternity products market is estimated to be valued at USD 47.7 billion in 2025 and is projected to reach USD 95.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. The growth curve of the maternity products market is expected to follow a steady and sustained upward trajectory, with market value projected to rise from USD 47.7 billion in 2025 to USD 95.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.2%.

Year-on-year analysis indicates gradual growth, with values increasing from USD 47.7 billion in 2025 to USD 51.1 billion in 2026 and reaching USD 58.8 billion by 2028. This progression reflects the growing reliance on specialized products for maternal care, including nutrition, healthcare, personal care, and apparel, where safety, quality, and functional design are critical factors influencing consumer preference and purchasing decisions.

By 2035, the maternity products market is projected to reach USD 95.6 billion, highlighting the increasing adoption of reliable and tailored solutions to meet the needs of expecting mothers. The consistent growth pattern suggests that manufacturers and suppliers focusing on high-quality, comfortable, and functional maternity products are likely to benefit from expanding demand. Products that combine performance, usability, and consumer trust are expected to drive market expansion, while continuous emphasis on quality assurance and product innovation strengthens competitive positioning.

The maternity products market is a specialized segment within the broader maternal and infant care market, where it currently holds approximately 5-6% share, driven by the increasing focus on maternal health, comfort, and safety during pregnancy. Within the personal care and hygiene market, maternity products account for around a 3-4% share, encompassing items such as maternity pads, skincare solutions, and personal hygiene products designed specifically for expectant mothers.

In the baby products market, maternity products represent roughly a 2-3% share, as they complement infant care by providing support to mothers before and after childbirth, including breastfeeding aids and maternity clothing. Within the healthcare and wellness market, maternity products capture about a 4-5% share, reflecting their importance in ensuring the health, well-being, and convenience of pregnant women through nutritional supplements, exercise aids, and ergonomic products.

In the apparel and clothing market, maternity-focused garments hold approximately 3-4% share, catering to the growing demand for comfortable, stylish, and functional clothing for expectant mothers. Collectively, these parent markets underscore the essential role of maternity products in enhancing maternal comfort, safety, and overall pregnancy experience. With rising awareness about maternal health, increasing disposable income, and the expansion of retail and e-commerce channels, the maternity products market is expected to grow steadily, strengthening its share and adoption across these parent sectors over the coming decade.

| Metric | Value |

|---|---|

| Maternity Products Market Estimated Value in (2025 E) | USD 47.7 billion |

| Maternity Products Market Forecast Value in (2035 F) | USD 95.6 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The maternity products market is growing steadily due to rising maternal health awareness, increased spending on comfort-oriented lifestyle products, and the growing representation of working women in the global workforce. Shifting cultural norms around body positivity during pregnancy and improved retail availability of specialized maternity items are further supporting this expansion.

Technological innovations in fabric and design, especially in maternal apparel, have enhanced both functionality and fashion appeal. Moreover, rising healthcare accessibility in emerging economies and a surge in e-commerce penetration are bringing maternity goods to underserved geographies, thereby expanding the market’s footprint.

Continued focus on holistic pregnancy well-being from prenatal to postpartum stages is expected to sustain demand across product categories.

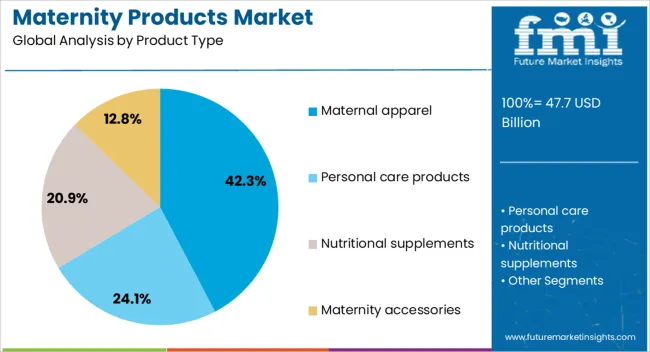

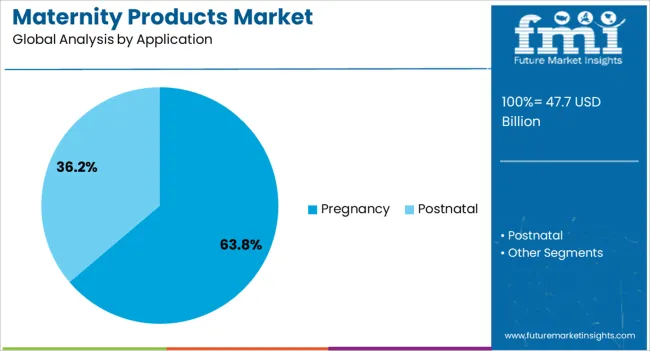

The maternity products market is segmented by product type, application, pricing, distribution channel, and geographic regions. By product type, maternity products market is divided into Maternal apparel, Personal care products, Nutritional supplements, and Maternity accessories. In terms of application, maternity products market is classified into Pregnancy and Postnatal.

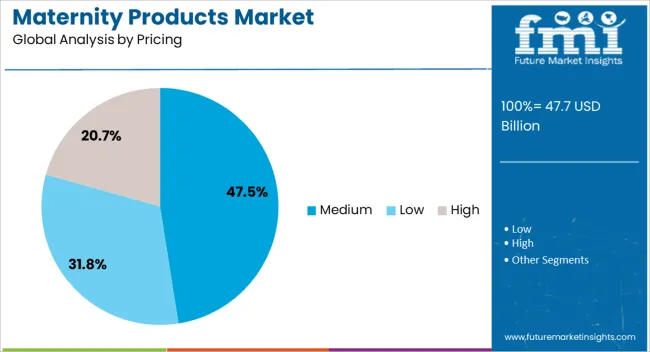

Based on pricing, maternity products market is segmented into Medium, Low, and High. By distribution channel, maternity products market is segmented into Online and Offline. Regionally, the maternity products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Maternal apparel leads the product category with a projected 42.30% share in 2025, driven by consumer emphasis on comfort, fit, and adaptability during pregnancy. This segment’s growth is supported by design innovations that blend style with practicality, appealing to women balancing work, travel, and social life while expecting.

Market players are integrating breathable materials, expandable waistbands, and dual-use post-pregnancy features to enhance usability. Retailers are also offering size-inclusive collections and collaborating with influencers to boost visibility.

As maternity fashion becomes mainstream, both premium and affordable brands are contributing to the rising popularity of maternal apparel.

The pregnancy phase is anticipated to account for 63.80% of market demand in 2025, reflecting its dominance across product application. This phase demands a range of supportive items from body care and apparel to nutritional supplements and ergonomic accessories.

Heightened focus on fetal and maternal safety during pregnancy has prompted greater investment in wellness-focused products. Healthcare professionals increasingly recommend specialized goods that reduce discomfort and risk during this phase.

As women adopt more proactive pregnancy planning, the consumption of curated maternity kits and clinically-approved goods is rising, further consolidating demand in this segment.

Medium-priced products are projected to lead the pricing tier with 47.50% share in 2025. This dominance stems from the balance between affordability and perceived quality that appeals to middle-income consumers.

Shoppers in this segment are typically urban, brand-conscious, and value-oriented, seeking durable yet aesthetically appealing maternity solutions. Retailers are optimizing this category with multi-use features, bundling options, and loyalty benefits.

The segment also benefits from offline and online distribution synergies, offering wide access without compromising pricing strategies. As inflation-conscious buyers look for high returns on maternity investments, the medium price tier remains the market’s most resilient.

The maternity products market is expanding due to growing awareness of maternal health and rising consumer demand. Opportunities lie in innovative, multifunctional, and wellness-focused offerings, while trends highlight eco-friendly and hypoallergenic products. Challenges include high costs and market fragmentation. Overall, market growth is supported by consumer preference for safe, comfortable, and functional maternity products, combined with increasing adoption across healthcare, retail, and e-commerce channels worldwide.

The maternity products market is being driven by increasing awareness of maternal health and well-being. Expectant mothers are prioritizing comfort, safety, and hygiene, boosting demand for maternity wear, support belts, nursing accessories, and personal care products. Hospitals, clinics, and retail channels are expanding offerings to cater to diverse consumer needs. Rising urbanization, disposable income growth, and the focus on prenatal care contribute to consistent adoption. Healthcare providers and retailers are emphasizing quality, comfort, and functional designs to meet evolving consumer expectations globally.

Significant opportunities exist in developing innovative maternity products that enhance comfort and convenience. Products such as adjustable maternity wear, ergonomic support belts, nursing pads, and wearable health monitors are gaining popularity. Brands introducing multifunctional, lightweight, and breathable designs are capturing consumer interest. E-commerce platforms and subscription-based delivery services also present avenues for wider reach. Growing emphasis on pre- and postnatal care, along with personalized and wellness-focused products, further expands the market potential for manufacturers offering differentiated, high-quality maternity solutions.

A key trend is the adoption of eco-friendly, hypoallergenic, and skin-friendly maternity products. Consumers are increasingly seeking organic fabrics, chemical-free lotions, and biodegradable accessories that ensure safety for both mother and baby. Retailers are highlighting product certifications and sustainable packaging to appeal to conscious buyers. This shift toward health-oriented and environmentally considerate options reflects broader consumer preferences for safe, natural, and premium maternity products. Brands integrating these trends are gaining competitive advantage and enhancing brand loyalty.

The maternity products market faces challenges due to high production costs for premium materials and specialized designs. Price-sensitive consumers in emerging markets may limit adoption of high-end offerings. Market fragmentation across regional preferences, varying quality standards, and distribution complexities can hinder scaling. Additionally, ensuring product safety, regulatory compliance, and consistent supply chains remains critical. Manufacturers need to optimize cost structures, invest in quality assurance, and offer localized solutions to overcome these barriers and maintain market competitiveness.

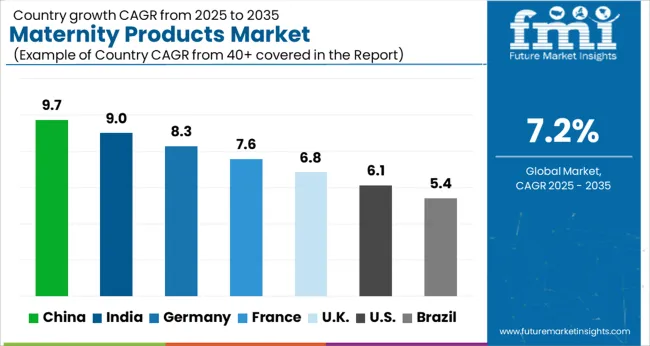

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global maternity products market is projected to grow at a CAGR of 7.2% from 2025 to 2035. China leads with a growth rate of 9.7%, followed by India at 9% and France at 7.6%. The United Kingdom records a growth rate of 6.8%, while the United States shows the slowest growth at 6.1%. Expansion is supported by rising awareness of maternal health, increasing disposable income, and growing demand for innovative and convenient maternity products. Emerging markets like China and India benefit from expanding healthcare infrastructure and a growing population of expecting mothers, while developed countries such as the USA, UK, and France focus on premium product offerings, specialized care, and e-commerce distribution channels. This report includes insights on 40+ countries; the top markets are shown here for reference.

The maternity products market in China is growing at 9.7% CAGR, the highest among leading nations. Growth is driven by rising awareness of maternal health, expanding healthcare infrastructure, and increasing adoption of innovative maternity products. Manufacturers are introducing comfortable, safe, and technologically advanced maternity wear, prenatal care products, and baby accessories. Urbanization, rising disposable income, and government programs supporting maternal care further accelerate market adoption.

The maternity products market in India is advancing at 9% CAGR, fueled by increasing healthcare awareness, rising disposable income, and growing urban population. Adoption of maternity care products including prenatal supplements, maternity apparel, and baby care essentials is increasing across hospitals, retail outlets, and e-commerce channels. Manufacturers focus on affordable, high-quality, and convenient solutions to meet the needs of expecting mothers. Rapidly expanding retail and online platforms further support market growth.

The maternity products market in France is growing at 7.6% CAGR, supported by premium product adoption, advanced healthcare services, and focus on maternal wellness. Consumers increasingly prefer high-quality maternity wear, prenatal supplements, and baby care products. Manufacturers emphasize safety, comfort, and ergonomic designs. E-commerce platforms and specialized retail outlets facilitate access to a wide range of maternity products, further accelerating market growth.

The maternity products market in the United Kingdom is expanding at 6.8% CAGR, influenced by growing maternal health awareness and adoption of innovative care products. Consumers increasingly prefer specialized maternity apparel, prenatal supplements, and baby care accessories. Retailers and online platforms provide easy access to a wide range of maternity solutions. Manufacturers focus on product differentiation, convenience, and high quality to meet consumer expectations. Government programs promoting maternal care further support market expansion.

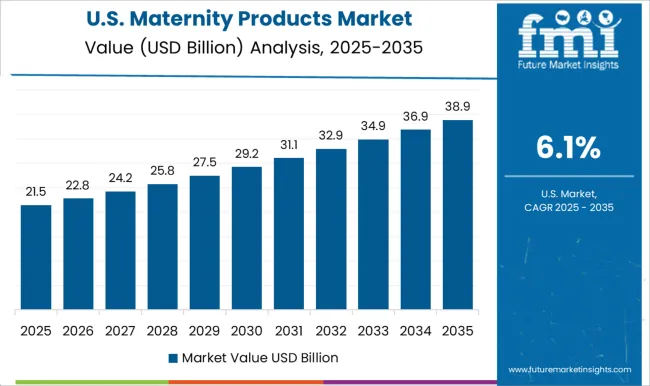

The maternity products market in the United States is growing at 6.1% CAGR, the slowest among leading nations. Growth is supported by rising disposable income, preference for premium and technologically advanced maternity products, and increasing awareness of maternal and infant care. Adoption of maternity wear, prenatal supplements, and baby care essentials is rising across retail and online channels. Manufacturers focus on innovative designs, convenience, and safety features to meet consumer demand. Government initiatives supporting maternal and child health also contribute to market expansion.

Leading companies in the maternity products market, such as H&M, A Pea in the Pod, and ASOS, are competing by offering comfortable, stylish, and functional clothing for expectant mothers. H&M Mama emphasizes versatile designs that adapt throughout pregnancy, with brochures highlighting soft fabrics, adjustable fits, and affordability. A Pea in the Pod focuses on premium, fashion-forward collections, promoting quality, trend-conscious pieces that appeal to luxury buyers. ASOS targets digital-first shoppers, showcasing a wide variety of maternity wear and accessories designed for comfort, style, and convenience.

Other key players, including Cake, HATCH, and JoJo Maman Bébé, differentiate through specialized products such as maternity lingerie, nursing wear, and versatile layering pieces. PinkBlush and Seraphine emphasize seasonal collections and trend-driven designs, while Gap, Old Navy, and Motherhood focus on accessible everyday wear. Destination, Isabella Oliver, and The Moms Co. highlight eco-friendly materials and health-conscious product lines in their brochures.

Marketing materials consistently frame maternity products as a blend of comfort, style, and practicality. Competition is driven by design innovation, fabric quality, and adaptability, with companies positioning themselves as trusted partners supporting mothers through pregnancy and early motherhood.

| Item | Value |

|---|---|

| Quantitative Units | USD 47.7 Billion |

| Product Type | Maternal apparel, Personal care products, Nutritional supplements, and Maternity accessories |

| Application | Pregnancy and Postnatal |

| Pricing | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | H&M Mama, A Pea in the Pod, ASOS, Cake, Destination, Frida, Gap, HATCH, Isabella Oliver, JoJo Maman Bébé, Motherhood, Old Navy, PinkBlush, Seraphine, and The Moms Co. |

| Additional Attributes | Dollar sales by product type (nursing, maternity wear, personal care, baby gear) and distribution channel (online, offline, specialty stores) are key metrics. Trends include rising demand for comfort-focused and eco-friendly products, increasing awareness of maternal health, and growth in e-commerce adoption. Regional preferences, technological innovations, and lifestyle changes are driving market growth. |

The global maternity products market is estimated to be valued at USD 47.7 billion in 2025.

The market size for the maternity products market is projected to reach USD 95.6 billion by 2035.

The maternity products market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in maternity products market are maternal apparel, tops, bottoms, outerwear, intimates, sleepwear, personal care products, nutritional supplements and maternity accessories.

In terms of application, pregnancy segment to command 63.8% share in the maternity products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

Maternity Innerwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Competitive Overview of Maternity Activewear Market Share

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA