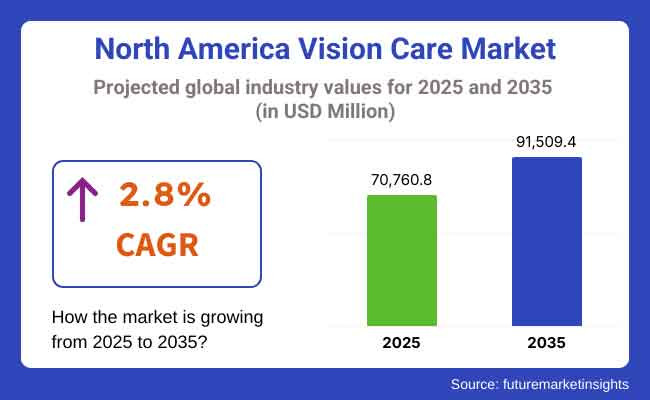

The North American vision care market is expected to reach USD 70,760.8 million by 2025 and is projected to grow steadily at a CAGR of 2.8% to reach USD 91,509.4 million by 2035. In 2024, cluster headache syndrome generated roughly USD 69,115.2 million in revenues.

North American sales within the Vision Care sector, which includes referenced eye care through contact lenses, eyeglasses, ophthalmic lenses, and other eye care products. Vision care sales are increasing, in part due to an aging population, greater exposure to digital screens, and a higher incidence of vision-related disorders.

The increasing prevalence of refractive errors, including myopia, hyperopia, and astigmatism, is the major growth factor. Eye strain and vision deterioration have become increasingly common as screen time from digital devices has become a daily requirement, creating a higher demand for corrective lenses and specialty eyewear.

The preeminent technological advancements in lens materials, designs, and smart eyewear solutions further fueled the market. Companies are developing new solutions, such as enhanced contact lenses that retain moisture, protect against UV rays, and enable wearers to go longer between lens replacements.

Moreover, growing knowledge of eye health and preventive care has resulted in more frequent eye exams and an earlier start of vision correction products.The other reason is the growth of e-commerce and direct-to-consumer (DTC) models. With the rise of e-commerce, consumers have access to a wide variety of eyewear that is both more affordable and convenient. Revenue growth is also being aided by the increasing propensity for premium and customized eyewear solutions.

North America vision care industry overview 2020 to 2024, North America's Vision Care category continued to be an area of significant transformation as consumer needs evolved (refer chapter Vision Care growth from 2020 to 2024, 2020 to 2024 international across industry and segments). Players in the Vision Care Market responded with new business strategies, from product innovation to e-commerce tactics to platform launches.

The first half of this interval was characterized by unsettling impacts of the pandemic, which initially resulted in a decline in routine eye care visits and elective procedures. However, when restrictions were relaxed, demand surged as people focused on their eye health and corrective solutions.

The growing prevalence of vision-related problems is owing to changing lifestyles. The increased use of remote work, online learning and prolonged screen time played a role in the higher rates of digital eye strain and the progression of myopia. This increased the demand for prescription eyewear, contact lenses, and blue-light-filtering lenses.

North America is a significant region for the Vision Care Market with North America holding the largest market share, attributed to well-established healthcare infrastructure, increased consumer awareness about eye care, and innovative product strategies. A growing incidence of refractive errors, driven by prolonged screen time and an aging population, has spurred demand for corrective lenses, including glasses and contact lenses. The region has a high adoption of advanced optical technologies, including blue-light filtering lenses, multifocal contact lenses, and customized vision correction solutions.

The growth of e-commerce has also increased sales capacity. Consumers have been rapidly adopting online shopping as it is both convenient and cost-effective. Contact lenses subscription services are on the rise, guaranteeing stable demand. Additionally, the growing awareness of preventive eye care has contributed to an increase in the frequency of optometric visits, enabling early diagnosis and treatment of vision disorders. The growing influence of lifestyle preferences has also driven demand for high-end, fashion-forward eyewear options.

Challenges

Counterfeit and Substandard Products Have Emerged as a Concern in the North American Vision Care Market

The growth of online retail has fundamentally transformed the competitive landscape; however, counterfeit and substandard products have emerged as a significant challenge. The substance of consumer trust and the risk to eye health is brought into question with the availability of low-cost, unregulated eyewear. However, established brands must continually reassure their customers of quality and authenticity to maintain their credibility.

A major challenge towards adoption is the expensive nature of advanced vision correction options. On the other hand, premium glasses, advanced lenses, and surgical procedures come at a price point that many customers simply cannot afford. Lack of insurance coverage for corrective eyewear [other than the discount offered by social security] makes it less accessible for many people, causing people to wait until they need vision care.

This restricts industry growth by limiting the adoption rates of innovative products. Regulatory constraints also present challenges, with lengthy approval processes for new lens materials, lens coatings and other medical devices delaying introduction.

This regional diversity of safety standards presents an operational complexity barrier to entry, requiring significant research and development costs, as well as extended certification timelines, for companies. One more challenge is the less awareness and accessibility to some demographic. Regular eye care services are often difficult for rural and underserved communities to access, which limits early detection of vision issues. Industry growth in both regimes is hindered without broad awareness programs and better distribution networks.

Opportunities

Increasing Need for Personalized Vision Solutions Creating Opportunity for the Market

One growing area of opportunity is the increasing need for personalized vision solutions. There is also a growing trend among consumers to seek eyewear tailored to their individual needs, such as customized lens prescriptions, advanced coatings for digital screen protection, and innovative contact lenses for extended wear comfort. As a result, there is a strong demand for precision manufacturing and digital fitting technologies that enable companies to provide highly personalized products.

Another important opportunity is that smart eyewear can be integrated with digital connectivity. As wearable technology becomes increasingly popular, the demand for eyeglasses with augmented reality (AR) functionality, health monitoring sensors, and lenses that adapt to various lighting conditions is growing. These innovations elevate Vision Care products above and beyond corrective options by further integrating them into everyday life.

This is expanding opportunities driven by myopia control advancements. Recent years have seen a troubling rise in myopia, especially among young people, leading to increased demand for therapeutic lenses and target-optimized optical designs that can help slow progression. Such advancements have contributed to the development of new lens technologies focused on long-term eye health. In recent times, however, another route, focused on sustainability, is catching fire.

Consumers are increasingly going green, and they want biodegradable contact lenses, recyclable eyewear frames and sustainable packaging. Businesses that take steps towards sustainable materials and ethical manufacturing are becoming competitive in this new environment of change.

The Vision Care market experienced significant changes from 2020 to 2024 due to evolving healthcare dynamics, shifting consumer behavior, and external economic factors. That period originally presented some challenges, with lower rates of routine eye care visits and supply chain issues affecting product access. However, with increasing accessibility to healthcare, especially for primary and preventive vision solutions, demand returned.

Increased awareness of long-term eye health among consumers drove the adoption of daily disposable contact lenses and specialty eyewear.Advances in material science helped make lenses more comfortable and durable, further building consumer confidence in high-tech eyewear.

From 2025 to 2035, a transformational era of scientific advancement, demographic shifts, and evolving consumer expectations will drive the Vision Care market to grow as the opportunity level increases. An older population will drive demand for presbyopia correction and age-related eye health solutions, and new genetic and biomarker-based diagnostics will enable more personalized approaches to vision care. Artificial intelligence and automation will also continue to improve vision testing, making eye evaluations increasingly accurate and convenient.

Hybrid retail models are expected to rise, merging digital prescriptions with augmented reality try-on experiences to elevate the way consumers select eyewear. Similarly, future innovations in material sustainability and auto-calibrating lenses will transform the way we perceive glasses.

As more people around the world start paying greater attention to their vision care, proactive leadership strategies will certainly be used to take a more preventive approach to protecting vision health and helping keep the industry progressing in response to both medical and lifestyle-driven needs.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA streamlined approval processes for digital vision devices and tele-optometry. |

| Technological Advancements | Rise of blue light blocking lenses, tele-optometry, and AR try-on tools. |

| Consumer Demand | High demand for daily disposables, fashion eyewear, and screen-protective lenses. |

| Market Growth Drivers | Increased screen time, aging population, and myopia in younger age groups. |

| Sustainability | Push for recyclable packaging and sustainable contact lens materials began. |

| Supply Chain Dynamics | COVID-19 disrupted global supply chains; there is an increased focus on local sourcing. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased regulation is expected for AI-based diagnostics and smart contact lenses. |

| Technological Advancements | Growth of AI diagnostics, smart eyewear, and personalized lens tech. |

| Consumer Demand | Shift towards vision wellness, hybrid lenses, and wearable-integrated vision solutions. |

| Market Growth Drivers | Innovation in eye health monitoring and integration with digital health ecosystems. |

| Sustainability | Strong demand for circular economy models and biodegradable vision care products. |

| Supply Chain Dynamics | AI-driven inventory management and regional manufacturing to improve agility. |

Market Outlook

USA Vision Care Market is growing at a significant rate due to the incorporation of advanced technology and higher consumer awareness pertaining to ocular health. The use of digital devices has surged significantly, leading to a growing need for protective eyewear, such as blue-light blocking lenses and prescription eyeglasses, to alleviate eye strain. Sales are also being driven by consumers' new preference for daily disposable contact lenses owing to their convenience and hygiene benefits.

Tele-optometry services have enhanced access to eye care, allowing individuals to obtain prescriptions without in-person visits and purchase eyewear through digital means. Moreover, style-conscious customers are increasingly recognizing eyewear as a fashion accessory, thereby increasing demand for premium and designer frames. Moreover, vision insurance coverage in the USA has supported purchases by forcing people to undergo regular eye exams and thus buy new glasses to reflect their prescription.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2 .2% |

Market Outlook

Due to an aging population and the increasing incidence of age-related eye diseases, the Vision Care segment in Canada is tracking a growing market. As the population ages and the number of presbyopes and patients with other types of refractive error increases, interest in progressive lenses and multifocal contact lenses has continued to increase. The nation’s focus on preventive medicine has promoted regular eye check-ups, resulting in timely diagnosis and treatment of visual problems.

Ophthalmic retail chains and independent optometry clinics have also expanded their reach by providing in-depth consultation services, thereby increasing consumer confidence. The seasonality of Canada and harsh weather conditions create the need for special high-performance eyewear such as anti-glare lenses, etc., and prescription glasses for hot and cold visibility. Sustainability trends are also influencing shopping habits, as consumers seek eco-friendly frames made from recycled materials.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 4.1% |

Market Outlook

Growing awareness of eye health and access to affordable eyewear solutions is driving the growth of the Mexican Vision Care industry. The increasing number of optical retail stores and mobile eye care clinics in rural and urban areas is enabling people to access vision correction products. The country’s high exposure to sunlight has increased demand for UV-protective lenses, particularly among outdoor workers and residents in coastal areas. Additionally, the growing middle-class population, characterized by higher per capita disposable income, is leading to increased consumption of luxury eyewear products, including polarized sunglasses and prescription sports eyewear. Fashion trends are also influencing purchasing behavior, with younger consumers increasingly gravitating toward fashionable contact lenses and frame designs. In addition, the implementation of digital eye screening technologies in public healthcare initiatives is positively impacting the early diagnosis of vision-related problems, which in turn is boosting the demand for corrective lenses and ophthalmic treatment on a regular basis.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Mexico | 8.3% |

Rx-Lenses Leading Due to Personalized Vision Correction Solutions

Prescription lenses continue to hold the largest share of this growing market, as they offer customized vision correction for people with conditions such as myopia, hyperopia, and astigmatism. Specialist lens technologies (for example high-index materials and progressive multifocal options) meet individual visual requirements, making for greater comfort and clarity.

Consumers demand customized coatings such as anti-glare and anti-UV, which improve visual performance and protect eye health. The sales growth of progressive lenses has been further propelled by an aging population suffering from presbyopia. As mentioned before, optical professionals understand the value of finding the right prescription to ensure you have the best lenses as opposed to just any lens, which reiterates the argument that the best prescription is not the generic lens.

However, the growing concern about digital eye strain has also fueled demand for blue-light filtering lenses, particularly among individuals who spend long hours in front of screens. While seeing clearly is essential, prescription lenses have a significant presence in the optical world, and innovation is focused on how these products can push the limits of function and long-term performance.

Frames Gaining Prominence with Style and Durability

The frames serve a purpose, but oftentimes they can be a fashion statement. Consumers are flying blind when it comes to the aesthetics, comfort, and durability of the frames they choose, and this is leading to the higher sale of premium materials like titanium, acetate, and lightweight alloys. By leveraging current trends, the emergence of designer eyewear brands has bolstered the popularity of fashionable frames, particularly among younger consumers seeking styles with a distinctive edge.

Additional customization options, like nose pads that can be adjusted for fit and flexible hinges, also add to your comfort, making a set of well-crafted frames a very nice choice. Furthermore, consumers who wear prescription eyewear typically own several pairs of frames, allowing them to have different styles for different outfits or occasions, which further drives repeat purchases.

The rise of sustainable frame options using recycled material has also been popular with eco-minded shoppers. Where eyewear was once an exclusively medical requirement, frames have now carved themselves out a place as a sartorial statement, and as such continue to drive the industry’s sales.

Retail Stores Leading with Personalized Fitting and Instant Availability

Retail stores make up the majority of the eyewear market- they inspect you face to face, place your order, and take home the product directly. Opticians offer expertise in helping consumers, ensuring that lenses and frames are matched to one's vision needs and face shape. Being able to preview various styles and materials prior to buying boosts customer confidence and minimizes return rates.

Most retail outlets offer on-site eye examinations so customers can also get prescriptions updated for free and you can even choose your purchases as per the results in one visit. Exclusive in-store promotions, bundled discounts, and financing options are also available only at retail locations, making them more appealing to many buyers.

Independent stores and optical chains compete based on their brand image and the quality of service they offer, ensuring customer loyalty. Retail stores are still the main players in the eyewear market ever since walk-ins allow for immediate gratification, not to mention the direct contact allows for a sense of trust building.

E-Commerce Expanding with Convenience and Digital Integration

Convenience, accessibility, and a wide variety of products have increased the adoption of e-commerce in the eyewear industry. Opening with the ease of shopping for prescription lenses, frames, and contact lenses from home rather than heading to a store, online platforms allow consumers to view a range of products. Shoppers can make accurate selections with advanced digital tools like virtual try-on features and AI-powered prescription verification that facilitate a smooth shopping experience.

Lower prices, regular discounts, and flexible return policies appear to entice consumers to buy online, making e-commerce an attractive alternative for price-sensitive consumers. Contact lenses and blue-light filtering glasses have also been offered as subscription services, creating recurring sales with automatic deliveries.

Moreover, the introduction of tele-optometry services enables consumers to get their prescriptions updated online, making the purchase process more efficient. As tech innovation enhances the convenience and accessibility of e-commerce, the channel is steadily capturing a larger share of the eyewear market.

A mix of established players and new entrants influences innovation and the battle for market share in the eyewear industry. Brands are differentiating themselves by investing in innovative lens technology, fashionable frame aesthetics, and tailor-made vision solutions.

It was retail that still dominated, while e-commerce was growing through digital tools and virtual try-on options. The rising demand for sustainable and technology-driven eyewear is also encouraging firms to invest in research and development, which in turn contributes to increased competition throughout the sector.

Market Share Analysis by Company

| Company Name | Johnson & Johnson Vision Care Inc. |

|---|---|

| Year | 2025 |

| Key Company Offerings and Activities | Johnson & Johnson Vision Care Inc. works on technologies to create a more breathable lens using silicone hydrogel materials. They spend millions on research for their various eye health products that address ocular surface, ocular diagnostics, lens and visual products, surgical and vaccination solutions to offer alternative optometry options to consumers. |

| Company Name | The Cooper Companies Inc. ( CooperVision ) |

|---|---|

| Year | 2024 |

| Key Company Offerings and Activities | This includes The Cooper Companies ( CooperVision ), a private label producer specializing in custom and specialty contact lenses for patients with astigmatism, presbyopia and irregular cornea. It focuses on increasing product availability via worldwide distribution networks and collaborations with eye care specialists. |

| Company Name | EssilorLuxottica |

|---|---|

| Year | 2024 |

| Key Company Offerings and Activities | EssilorLuxottica combines performance, vision, and fashion, creating a seamless experience from prescriptions to high-end eyewear. It employs omnichannel methods, including its digital retail platform and in-store gestures, to reinforce customer engagement. |

| Company Name | Alcon (formerly part of Novartis AG) |

|---|---|

| Year | 2024 |

| Key Company Offerings and Activities | Alcon, which was spun off from Novartis AG, offers surgical and vision care products, mainly in intraocular lenses as well as in surgical products for advanced eye surgery. The way it specializes in ophthalmic innovation supports accuracy in vision correction methods, fostering patient outcomes and professional implementation. |

Key Company Insights

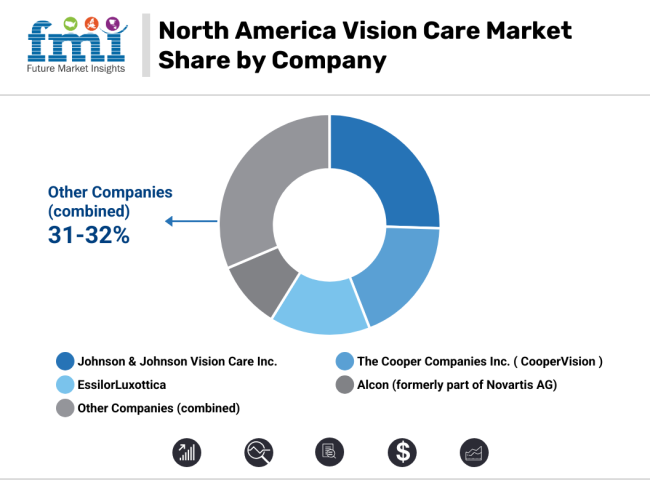

Johnson & Johnson Vision Care Inc.(25-26%)

Another company is constantly at work, enhancing its product mix through innovative research or strategic acquisition, with the goal of dealing with unmet eye health needs and improving patient outcomes.

The Cooper Companies Inc. (CooperVision)(18-19%)

Having specialized in geographic expansion and emerging markets penetration as well as investments in research and development to drive high-tech contact lens technologies.

EssilorLuxottica(14-15%)

Its vertically integrated business helps the company reduce complexity and strengthen its market reach through digitalization and e-commerce, enabling it to adapt to changing consumer needs.

Alcon (formerly part of Novartis AG)(9-10%)

Alcon focuses on developing new eye care solutions through research and development efforts to cater to a wide range of vision requirements and strengthen its global market position.

Other Key Players (31-32% Combined)

A number of other companies are major contributors to the North America vision care market through innovative technologies and increased distribution networks. They include:

With the demand for veterinary auto-immune therapeutics procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Rx-Lenses, Frames, Contact Lenses, Non Rx Sunglasses, Reading Glasses,Contact Lens Solutions

Retail Stores, E-Commerce, Clinics,Hospitals

North America

The overall market size for North America vision care market was USD 70,760.8 million in 2025.

The North America vision care market is expected to reach USD 91,509.4 million in 2035.

The increasing need for personalized lens prescriptions, specialized coatings for digital screen protection, and advanced contact lenses designed for prolonged comfort.

The top key players that drives the development of North America vision care market are Johnson & Johnson Vision Care Inc., The Cooper Companies Inc. (CooperVision), EssilorLuxottica, Alcon (formerly part of Novartis AG) and Bausch & Lomb (formerly Valeant).

Rx-Lenses is by product type leading segment in North America vision care market is expected to command significant share over the assessment period.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: USA Vision Care Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: USA Vision Care Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 9: USA Vision Care Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: USA Vision Care Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: USA Vision Care Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: USA Vision Care Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 13: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Canada Vision Care Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Canada Vision Care Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Canada Vision Care Industry Analysis and Outlook Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: USA Vision Care Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: USA Vision Care Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: USA Vision Care Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 22: USA Vision Care Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: USA Vision Care Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: USA Vision Care Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: USA Vision Care Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: USA Vision Care Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: USA Vision Care Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: USA Vision Care Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: USA Vision Care Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: USA Vision Care Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: USA Vision Care Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 32: USA Vision Care Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: USA Vision Care Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: USA Vision Care Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 35: USA Vision Care Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: USA Vision Care Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 37: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 40: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Canada Vision Care Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Canada Vision Care Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Canada Vision Care Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Canada Vision Care Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Canada Vision Care Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Canada Vision Care Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Canada Vision Care Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Canada Vision Care Industry Analysis and Outlook Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Canada Vision Care Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Canada Vision Care Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Canada Vision Care Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 53: Canada Vision Care Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Canada Vision Care Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA