The North America Chitosan Market is estimated to be valued at USD 14.7 billion in 2025 and is projected to reach USD 54.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

| Metric | Value |

|---|---|

| North America Chitosan Market Estimated Value in (2025 E) | USD 14.7 billion |

| North America Chitosan Market Forecast Value in (2035 F) | USD 54.3 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The North America chitosan market is expanding steadily, driven by the rising utilization of biopolymers in water treatment, pharmaceuticals, and food applications. Growing concerns regarding wastewater management and the need for eco friendly solutions are promoting the use of chitosan as a natural coagulant and flocculant.

The pharmaceutical and nutraceutical industries are increasingly incorporating chitosan in drug delivery systems, wound healing materials, and dietary supplements due to its biocompatibility and biodegradability. In the food sector, demand is supported by its role as a natural preservative and fat binding agent.

Regulatory encouragement for sustainable alternatives and ongoing research into advanced biomedical uses further reinforce the growth trajectory. With rising consumer awareness and industry adoption, the market outlook remains positive, offering scope for innovations in high purity grades and specialized formulations.

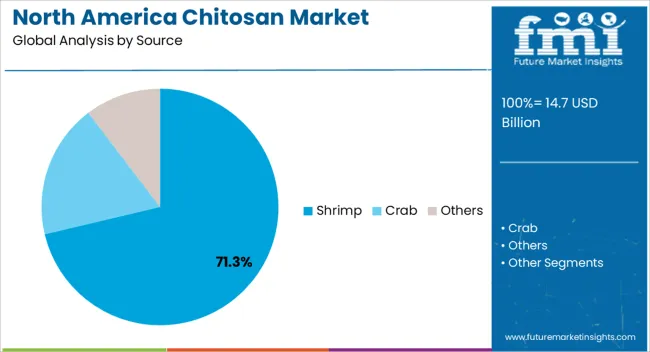

The shrimp segment is anticipated to represent 71.30% of total revenue by 2025 under the source category, making it the dominant segment. Its leading position is driven by abundant shrimp shell availability in North America and cost effective extraction processes.

Shrimp derived chitosan exhibits favorable properties such as high purity and strong biocompatibility, which have enhanced its adoption across industrial and biomedical applications. The established seafood processing industry in the region ensures a consistent raw material supply, further supporting growth.

These factors have reinforced the shrimp source segment as the primary contributor to market expansion.

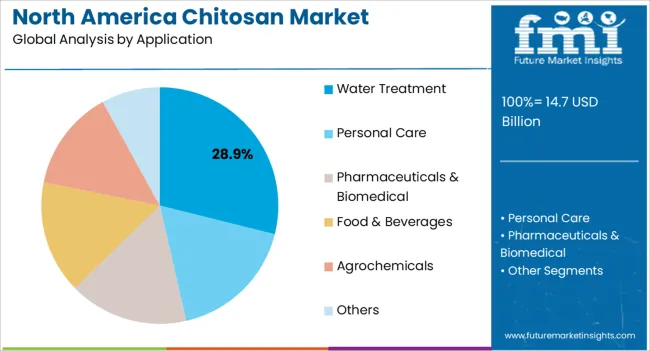

The water treatment application segment is projected to account for 28.90% of overall market revenue by 2025, positioning it as a key application area. Rising demand for safe drinking water, coupled with stringent regulations on wastewater discharge, is driving adoption of chitosan as an effective natural treatment agent.

Its efficiency in heavy metal removal, turbidity reduction, and organic pollutant capture has made it a preferred alternative to synthetic chemicals. Growing municipal and industrial focus on sustainable and biodegradable treatment solutions is further accelerating uptake.

This combination of environmental benefits and regulatory compliance has established water treatment as a significant application segment within the North America chitosan market.

The North American chitosan market was worth USD 7.7 billion in 2020. It accumulated a market value of USD 14.7 billion in 2025 while growing at a CAGR of 11.2% from 2020 to 2025.

chitosan market is expected to grow with a significant growth rate in the United States during the assessment period. The consumption of Chitosan is further estimated to grow by approximately 3.8 times over the forecast period in North America.

The growth of the North American chitosan market has been contributed by the growing demand for biodegradable and biocompatible substances in various end use industries including, pharmaceuticals and biomedical, personal care and cosmetics, water and waste water treatment, food and beverages, and others. This is due to manufacturers’ preference for the use of products with low carbon footprint along with the products which are associated with low waste generation which will decrease the cost of waste disposal and treatment to increase the profit margin.

On the basis of sources used for the production of chitosan, shrimp is anticipated to remain most preferred. Other sources includes lobsters, crabs, and fungi. Furthermore, there are several trends which are shaping the market of Chitosan in North America, which includes growing competition between the market participants, sustainable development, increasing investment in research for the development of the innovative and advance products and many others.

According to FMI’s analysis, chitosan market is expected to grow at 14.6% CAGR between 2025 and 2035. Chitosan is used in various end-use industries such as, pharmaceuticals and biomedical, water treatment, in personal care and cosmetics, agrochemicals, surgery and many others for several applications. Significantly growing end use segments is expected to benefit the market of chitosan. Moreover the growing demand for biodegradable and biocompatible materials in these end use industries is anticipated to boost the market of chitosan. Due to biocompatible nature, chitosan can be used in tissue engineering, for drug delivery, further the compound is used as coagulating and flocculating agent for water treatment, chitosan is further used as preservatives and as an ingredient if food and beverages and in nutraceuticals.

With the initiatives taken by the government to recover the economic growth and revive the performance of the industrial as well as commercial sector, chitosan market is expected to get the desirable growth from 2025.

Investment in research and development (R&D) for the development of advance and innovative products to meet the growing demand and challenges faced by the end-use industries plays a crucial role for the market growth of a product.

Some of the key participants are investing in R&D to introduce advance and innovative chitosan product to cater the growing demand from the end-use application sectors. Their efforts also are intended to increasing their market footprint. Further, the investment is being done for process development to manufacture chitosan by consuming less energy and emitting minimum Greenhouse gas.

A significant amount is also been invested in nanotechnology, to utilize chitosan nanoparticles for drug delivery system to treat cancer and also to utilize chitosan in tissue engineering.

Extracting chitin from various living organisms and transforming it into chitosan and other chitosan-based products is an energy-intensive and expensive process. The process further generates a huge amount of waste and to neutralize this waste, a large amount of energy and cost are consumed. Chitosan and its derivatives are generally imported from Asia Pacific, including China, Japan, India, and other Southeast Asian countries owing to low cost and the limited production capacity of the manufacturers of North America.

Several chitosan manufacturers of North America produce chitosan by Good Manufacturing Practices (GMP) process. GMP is a system that ensures the product being produced is consistent and controlled as per the quality standards set for that particular product. This type of practice is being done in the field of pharmaceuticals, dietary supplements, cosmetics, food and beverages and others. All these factors contribute to the high cost of chitosan. High cost of chitosan affects the growth of chitosan for its bulk usage in several end use applications.

In North America, the United States holds for a prominent share in the market, accounting for about fourth fifth of the chitosan consumption in the region. The region is expected to grow with a CAGR of 14.8% until 2035. Owing to the strong industrialization and rapidly growing end-use application sectors the demand of chitosan has increased in the country.

Tthanks to strong trade relationship with the Asian players, import of chitosan based products from various Asian countries like China, India, Japan and others remain easy for the country, as Asian players provides chitosan at a low cost. Further, the growing research for the use of biopolymers in various end use industries is expected to benefit the market of chitosan in the country.

In the North America Chitosan market Canada holds about one fifth of the market share and the market is estimated to witness a significant growth rate over the forecast period. The market in this region is expected to grow with a CAGR of 14.4% during the forecast period.

Pharmaceuticals and biomedical and personal care application segments are expected to remain the prominent end users of for chitosan in Canada. Moreover, the growing demand of biopolymers in various end use industries is estimated to boost the market of Chitosan in the coming years in the country.

By application, water treatment segment is expected to dominate the market by exhibiting a CAGR of 15.1% during the forecast period. Chitosan is used as coagulating and flocculating agent for the treatment of water and wastewater. It is because the compound helps to remove metal ions, bacteria, fungi and other microbes, dust particles, and other impurities from water and reduces odor from water.

The water treatment application segment accounts for about 15% of the overall chitosan consumption in North America. Moreover, the growing demand for water and wastewater treatment in the region is expected to boost the market of Chitosan in the coming years.

The shrimp segment is expected to dominate the North American chitosan market with a CAGR of 15.3% during the forecast period. A number of sources are used for the extraction of chitin for the production chitosan such as, lobsters, fungi, crabs, shrimps and many others.

Of all the sources, shrimp is anticipated to remain the prominent source utilized for the manufacturing chitosan in the region owing to the easy processing. The source is further anticipated to grow with a substantial growth rate during the assessment period.

It is being anticipated that nanotechnology will gradually make inroads in several sectors including medical, surgery, electronics, defense, water treatment, and others. Functional groups present in chitosan (hydroxyl and amino group) make chitosan an excellent adsorbing substance. Chitosan zinc oxide nanoparticles are efficient in removing 99% of colors from the effluent stream of the textile industry.

Chitosan nanoparticles can further be used as antibacterial and antimicrobial agents and gene delivery agents. These nanoparticles can also be used in antimicrobial textiles for the production of clothes for doctors, surgeons and other healthcare professionals.

Chitosan nanoparticles can further be utilized for skin regeneration. This type of nanoparticles can further be used for drug delivery systems, to treat cancer cells. Since chitosan is positively charged, it can attract negatively charged mucus and act as an excellent carrier for mucoadhesive drugs.

Start-ups are crucial in identifying growth opportunities, including the North America chitosan market. They effectively translate inputs to outputs and adapt to market uncertainties, contributing to the industry's expansion. Some start-ups are expected to drive growth in the North America chitosan market.

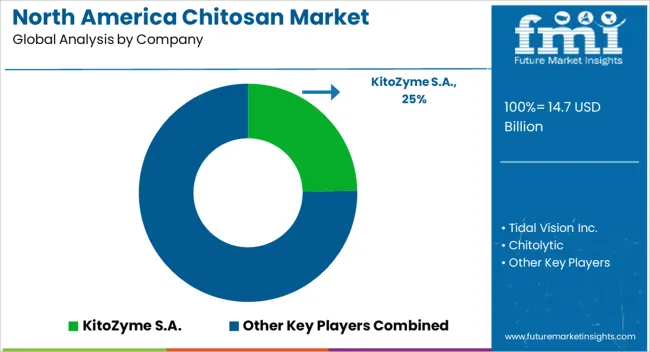

The market for North America chitosan is highly competitive, with numerous prominent industry players making substantial investments in their production.

The key industry players are KitoZyme S.A., Tidal Vision Inc., Chitolytic, CarboMer, Inc., Spectrum Chemical MFG Corp., Foodchem International Corporation, Meron Group, Mycodev Group, Toronto research Chemicals, MP Biomedicals.

Key market players are employing organic growth strategies such as acquisitions, mergers, partnerships, and collaborations to bolster their product portfolios. This concentrated effort is anticipated to drive the growth of the North America chitosan market.

| Attribute | Details |

|---|---|

| Market Value in 2025 | USD 14.7 billion |

| Market Value in 2035 | USD 54.3 billion |

| Growth Rate | CAGR of 14.0% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Source, Application, Country |

| Key Countries Profiled | United States, Canada |

| Key Companies Profiled | KitoZyme S.A.; Tidal Vision Inc.; Chitolytic; CarboMer Inc.; Spectrum Chemical MFG Corp.; Foodchem International Corporation; Meron Group; Mycodev Group; Toronto Research Chemicals; MP Biomedicals |

| Customization & Pricing | Available Upon Request |

The global North America chitosan market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the North America chitosan market is projected to reach USD 54.3 billion by 2035.

The North America chitosan market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in North America chitosan market are shrimp, crab and others.

In terms of application, water treatment segment to command 28.9% share in the North America chitosan market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Electrical Testing Services Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA