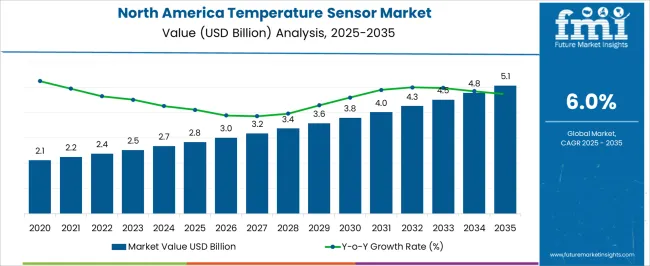

The North America Temperature Sensor Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| North America Temperature Sensor Market Estimated Value in (2025 E) | USD 2.8 billion |

| North America Temperature Sensor Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The North America temperature sensor market is positioned for steady growth, supported by rising demand for accurate and reliable sensing technologies across industrial, automotive, healthcare, and consumer electronics applications. The increasing integration of sensors into connected devices, driven by advancements in IoT and Industry 4.0 initiatives, is shaping market expansion. Regulatory requirements for monitoring and safety standards across energy, automotive, and food processing sectors are reinforcing adoption.

Continuous technological advancements in sensor design, such as miniaturization, improved response times, and higher durability, are making them indispensable in critical systems. Growth is further supported by the rising adoption of electric vehicles and battery management systems, where precise temperature monitoring ensures performance and safety. The healthcare sector is also creating opportunities, with demand for sensors in medical devices and patient monitoring equipment.

As regional industries focus on improving operational efficiency and energy management, temperature sensors are expected to remain a vital component With increasing investments in innovation and strong demand from end-user industries, the market is forecast to experience sustained growth across North America.

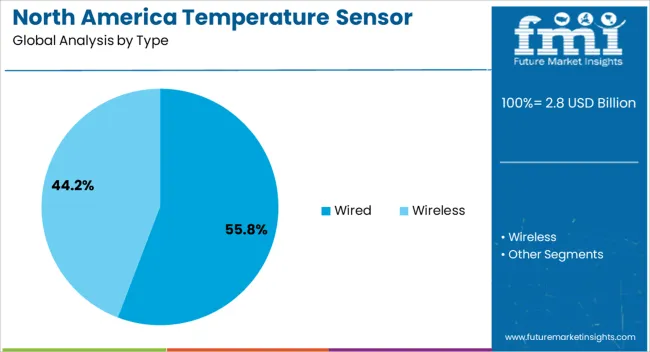

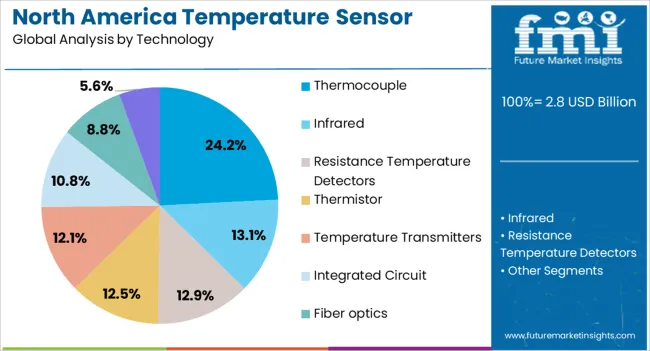

The north america temperature sensor market is segmented by type, technology, end-user industry, and geographic regions. By type, north america temperature sensor market is divided into Wired and Wireless. In terms of technology, north america temperature sensor market is classified into Thermocouple, Infrared, Resistance Temperature Detectors, Thermistor, Temperature Transmitters, Integrated Circuit, Fiber optics, and Others.

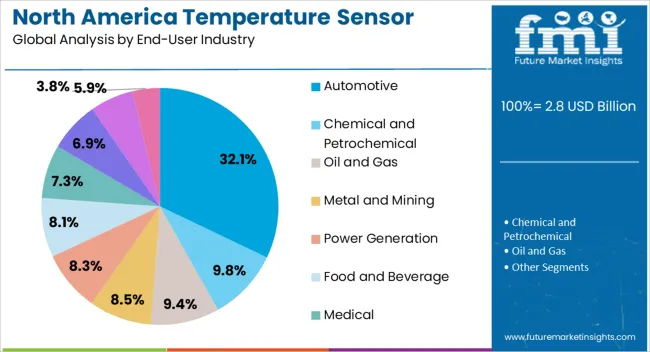

Based on end-user industry, north america temperature sensor market is segmented into Automotive, Chemical and Petrochemical, Oil and Gas, Metal and Mining, Power Generation, Food and Beverage, Medical, Consumer Electronics, Aerospace and Military, and Others. Regionally, the north america temperature sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wired type segment is projected to account for 55.8% of the North America temperature sensor market revenue share in 2025, establishing itself as the leading category. Its dominance is being reinforced by reliability, accuracy, and stable performance in mission-critical applications across industrial and automotive sectors. Wired sensors provide consistent data transmission without concerns of interference or connectivity loss, which is essential in harsh operating conditions.

Their robust design allows for long-term use in environments with high temperatures, vibrations, or electromagnetic disturbances, where wireless alternatives often face limitations. The cost-effectiveness of wired solutions compared to advanced wireless systems has also contributed to their widespread adoption across manufacturing facilities and energy operations.

Furthermore, wired sensors are preferred in safety-critical systems, such as automotive engine management and industrial process control, where uninterrupted communication is a priority The segment’s continued leadership is being supported by advancements in sensor accuracy and integration capabilities with modern control systems, reinforcing its importance across North American industries.

The thermocouple segment is anticipated to hold 24.2% of the North America temperature sensor market revenue share in 2025, making it the leading technology category. This dominance is being driven by the wide operating temperature range and durability offered by thermocouples, which make them suitable for a variety of demanding applications. Their ability to provide accurate measurements in extreme conditions, including high temperatures and corrosive environments, has reinforced their position in industrial, aerospace, and automotive systems.

The relatively low cost and simple design of thermocouples have further supported their adoption in large-scale industrial applications where multiple sensors are required. Increasing demand from energy production facilities and process industries has also played a significant role in supporting growth.

As North American manufacturers place emphasis on operational efficiency and process optimization, thermocouples are being increasingly integrated into monitoring and control systems Continuous improvements in materials and manufacturing techniques are further enhancing their accuracy and stability, ensuring their continued dominance in the regional temperature sensor market.

The automotive end-user industry segment is expected to capture 32.1% of the North America temperature sensor market revenue share in 2025, positioning it as the leading industry vertical. This leadership is being driven by the rising adoption of electric vehicles, hybrid vehicles, and advanced internal combustion systems that require precise temperature monitoring for safety and efficiency. Sensors are essential in monitoring battery packs, exhaust systems, engine components, and cabin climate control, ensuring compliance with performance and emission standards.

Growth in the automotive sector is also supported by increasing regulatory emphasis on fuel efficiency and safety, prompting manufacturers to integrate advanced temperature sensing solutions across vehicle platforms. The demand for real-time monitoring to optimize performance and prevent overheating in powertrain and electronic systems is further reinforcing adoption.

Additionally, the expansion of connected car technologies and predictive maintenance applications is creating new opportunities for sensor integration As North America continues to strengthen its position in automotive innovation, the segment is expected to remain the largest contributor to market revenue.

Some of the major factors boosting the market share are:

The quick technological improvements have significantly influenced the growth of wireless temperature sensors during the past few years in temperature monitoring. Large-scale manufacturers have been putting a lot of effort into incorporating cutting-edge ideas like IR sensors and heat sensors. Furthermore, it is anticipated that the use of cutting-edge concepts would create a sizable window of opportunity for market expansion in the years to come.

In essence, sensor networks have been observing physical environmental features and converting those values into electrical impulses. The sensor networks mainly record data on parameters like temperature, among others. In several situations, the network has been built to act on the physical environment based on observed data in addition to simply sensing the environment.

Applications for IR temperature sensors can be found in a variety of defense settings, including optical target sighting and measurements of fluctuating emissivity that are frequently useful for tracking operations. However, due to rising military spending around the world, all of these applications are quite sophisticated and in constant demand.

Even the most popular snack manufacturers, like Frito-Lay North America, Inc., a well-known Pepsi Co. division, have launched a new line of goods recently that are baked rather than fried. These developments, along with the strict international laws governing food safety, are anticipated to soon open up a sizable market for IR temperature sensors.

For such technology, Forward-Looking Infrared (FLIR) has been a well-known supplier. To detect increased body temperatures, FLIR technology has been employed in ports, borders, airports, and other locations. These orders have significantly increased for the company during the past month.

The number of nations utilizing FLIR equipment for temperature screening keeps expanding. China, Thailand, Taiwan, the Philippines, Singapore, Malaysia, South Korea, Italy, and the United States are now part of it. The business claimed that the demand is still being met by its supply network.

One of the market's functional applications for infrared (IR) temperature sensors is predictive maintenance; businesses are putting more and more emphasis on automation, IoT, and predictive maintenance.

Temperature detection and measurement is a very important activity and has a variety of applications ranging from simple household to industrial. A temperature sensor is a device that collects the concerning temperature data and displays in a human-understandable format. Temperature sensing is the most controlled and measurable factor behind any critical application.

The temperature sensing market shows continuous growth due to its need in research & development, semiconductor and chemical industries. Temperature sensing is gaining a lot of attention due to increasing adoption of HVAC (heating, ventilating, and air conditioning) for domestic as well as industrial use.

Temperature sensors are primarily of two types, contact temperature sensors and non-contact temperature sensors. The contact temperature sensors are thermocouples, filled system thermometers, resistance temperature detectors and bimetallic thermometers.

Contact temperature sensors are currently dominating the market. Non-contact temperature sensors like infrared devices have extensive opportunities in the defence sector due to their ability to detect thermal radiation power of optical and infrared rays emitted from liquids and gases.

The quality of a temperature sensor is measured in terms of standard characteristics such as response time, accuracy, repeatability and stability of output senility towards change in other physical environmental factors.

Life of the sensor, termination style, probe type and range of measurement are a few other important specifications to be taken into account while considering commercial use.

There is an increasing demand for temperature sensing in the North American market due to its applicability in defence, aerospace, chemical processing and automotive vehicular production sectors. The key driving force behind the increasing market share of North America in temperature sensing include increasing end-user and industrial applications, rising security concerns towards security & surveillance and increasing macroeconomic government interventions.

On the other hand, there is a continuous reduction in prices of temperature sensors due to the introduction of more competitive technologies and higher associated costs that act as restraints for market development.

The North American temperature sensor market is segmented on the basis of product type, application and geography. On the basis of product type, the market is divided into fibre-optic temperature sensors, bimetallic temperature sensors, integrated circuit temperature sensors, infrared temperature sensors, thermistors, resistance temperature detectors (RTD), silicon-based temperature sensors and thermocouples.

On the basis of application, the market is categorized into transportation, healthcare, aerospace & defence, petrochemicals, energy & power generation and HVAC & refrigeration. On the basis of geography, North American market is divided into Canada, the United States and Mexico.

There is a need for continuous development in temperature sensing to enhance its usability in different verticals and segments.

Remote temperature sensing, switch gear temperature monitoring, MRI temperature sensing, fibre-optic temperature sensing, microwave induction heating control, smart temperature sensing, distributed temperature sensing and geothermal sensing are some of the advancements in the temperature sensing market. Use of nanotechnology and microtechnology is also offering contactless accurate measurement at low cost.

Silicon-based temperature sensors are used in coolants and are gaining popularity because they do not need any calibration and are inherently stable.

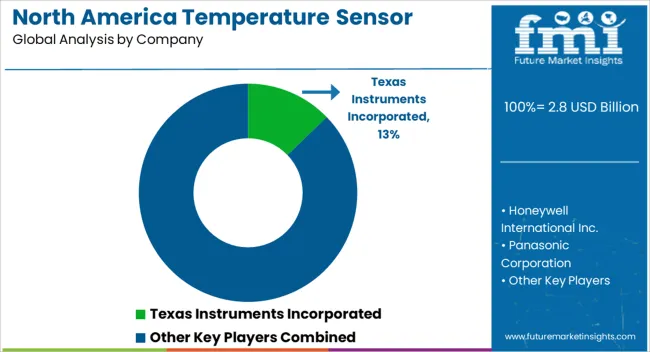

The key players in North America market are Texas Instruments Inc. (USA), Sensata Technologies (USA), Maxim Integrated Products Inc. (USA), Microchip Technology Inc. (USA), Analog Devices Inc. (USA) and Honeywell International Inc. (USA). The market in the US is more developed as compared to RoW (Rest of the World).

The market in Mexico is in its development stage and need some more time to mature. Development of new technologies and up gradation of existing temperature sensing technologies in automobiles, equipment and machineries is showing continuous growth. The future temperature sensor market is characterized by advanced technology at an affordable cost.

The research report presents a comprehensive assessment of North America’s temperature sensor market and contains thoughtful insights, facts, historical data, and statistically supported and industry validated market data and projections with suitable set of assumptions and methodology.

It provides analysis and information by categories such as market geographies, product types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

It provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

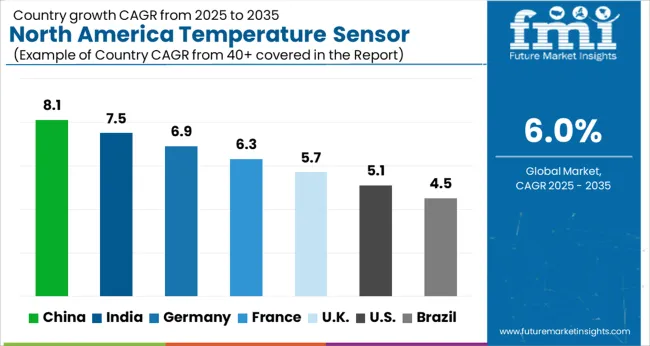

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

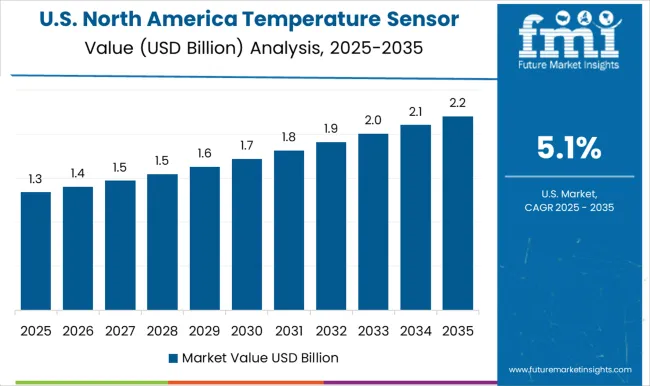

| USA | 5.1% |

| Brazil | 4.5% |

The North America Temperature Sensor Market is expected to register a CAGR of 6.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.1%, followed by India at 7.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global North America Temperature Sensor Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.9%. The USA North America Temperature Sensor Market is estimated to be valued at USD 1.0 billion in 2025 and is anticipated to reach a valuation of USD 1.7 billion by 2035. Sales are projected to rise at a CAGR of 5.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 137.3 million and USD 72.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Type | Wired and Wireless |

| Technology | Thermocouple, Infrared, Resistance Temperature Detectors, Thermistor, Temperature Transmitters, Integrated Circuit, Fiber optics, and Others |

| End-User Industry | Automotive, Chemical and Petrochemical, Oil and Gas, Metal and Mining, Power Generation, Food and Beverage, Medical, Consumer Electronics, Aerospace and Military, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Texas Instruments Incorporated, Honeywell International Inc., Panasonic Corporation, Siemens AG, STMicroelectronics N.V., NXP Semiconductors N.V., Analog Devices, Inc., Infineon Technologies AG, Maxim Integrated Products, Inc., TE Connectivity Ltd., ON Semiconductor Corporation, Microchip Technology Inc., Sensirion AG, Amphenol Corporation, and Emerson Electric Co. |

The global north america temperature sensor market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the north america temperature sensor market is projected to reach USD 5.1 billion by 2035.

The north america temperature sensor market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in north america temperature sensor market are wired and wireless.

In terms of technology, thermocouple segment to command 24.2% share in the north america temperature sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Electrical Testing Services Market - Growth & Demand 2025 to 2035

North America In-building Wireless Market Growth - Demand & Forecast 2025 to 2035

North America Access Control Market - Security & IoT Integration 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA