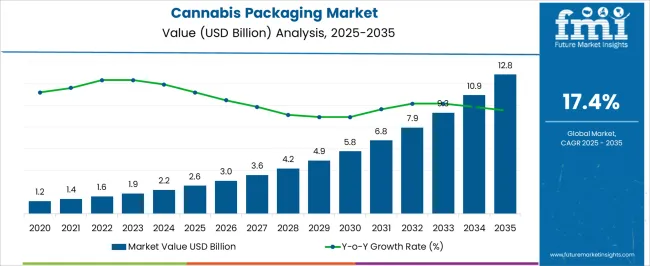

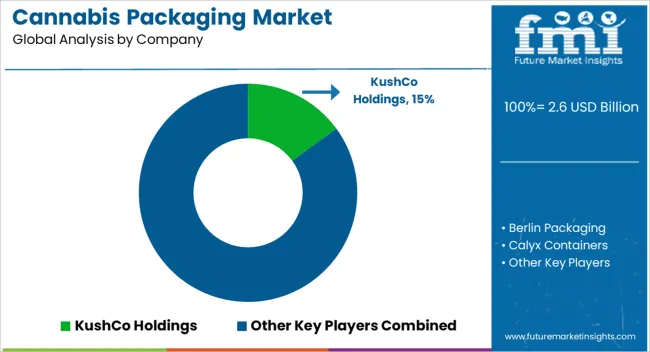

The Cannabis Packaging Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 2.6 billion to USD 5.8 billion, driven by increasing legalization and demand for innovative, compliant, and sustainable packaging solutions for cannabis products. Year-on-year analysis shows rapid expansion, with values reaching USD 3.0 billion in 2026 and USD 3.6 billion in 2027, supported by a rising number of licensed producers and evolving packaging regulations.

By 2028, the market is forecasted to reach USD 4.2 billion, advancing to USD 4.9 billion in 2029 and USD 5.8 billion by 2030. Growth will be further fueled by the increasing focus on tamper-proof, child-resistant, and eco-friendly packaging options, alongside a rise in premium cannabis products. These dynamics position the cannabis packaging market as a rapidly growing segment within the larger cannabis industry, offering significant opportunities for innovation in packaging materials, designs, and functionality.

| Metric | Value |

|---|---|

| Cannabis Packaging Market Estimated Value in (2025 E) | USD 2.6 billion |

| Cannabis Packaging Market Forecast Value in (2035 F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

The Cannabis Packaging Market is undergoing rapid expansion, supported by increasing legalization, evolving regulatory frameworks, and rising consumer demand for both medical and recreational cannabis products. Growth in this market is being driven by the need for compliant, secure, and brand-differentiated packaging solutions. Industry developments, including government mandates for child-resistant, tamper-evident, and sustainable packaging, have created strong demand for innovation across packaging types and materials.

Statements from cannabis companies and packaging solution providers have highlighted the importance of ensuring freshness, safety, and branding consistency, which has significantly influenced packaging choices. As more regions transition to legal frameworks, manufacturers are focusing on scalable packaging systems that address both cost efficiency and regulatory compliance.

Moreover, sustainability commitments are encouraging adoption of recyclable and biodegradable materials, while premiumization trends in cannabis consumption are pushing for high-quality, retail-ready formats With investments flowing into automation and smart packaging technologies, the market is positioned for sustained momentum across developed and emerging markets.

The cannabis packaging market is segmented by type, material, product, application, and geographic regions. By type, the cannabis packaging market is divided into Rigid and Flexible. In terms of material, the cannabis packaging market is classified into Plastic, Metal, Glass, Paper & paperboard, and Others. Based on product, the cannabis packaging market is segmented into Bottles & jars, Tubes, Tins, Pouches, Blisters & clamshells, and Others. By application, the cannabis packaging market is segmented into Recreational use and Medical use. Regionally, the cannabis packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

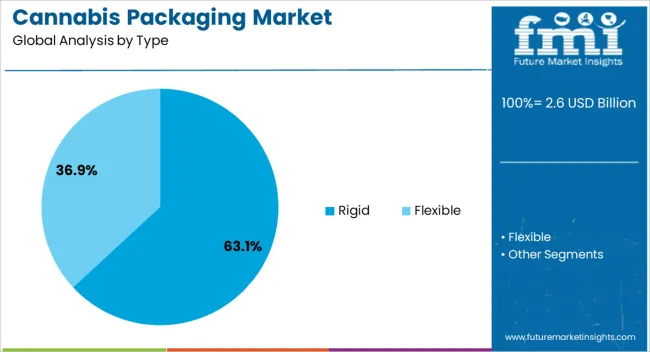

The rigid type segment is projected to contribute 63.1% of the Cannabis Packaging Market revenue share in 2025, maintaining its position as the dominant packaging format. This leadership is being driven by the segment’s superior protection, structural strength, and regulatory compliance features. It has been noted in industry publications and company statements that rigid packaging is preferred for its durability, tamper-resistance, and extended shelf-life protection for sensitive cannabis products.

The segment’s widespread use in storing flowers, concentrates, and edibles is also contributing to its share, particularly in jurisdictions where product safety and labeling requirements are stringent. Moreover, rigid containers are being adopted for their ability to support advanced branding techniques such as embossing and UV printing, which are increasingly important in retail differentiation.

Ease of stacking, storage, and transportation further supports its logistical advantages These combined attributes have positioned rigid packaging as the go-to choice for both producers and retailers aiming for consistency, security, and consumer appeal in cannabis packaging.

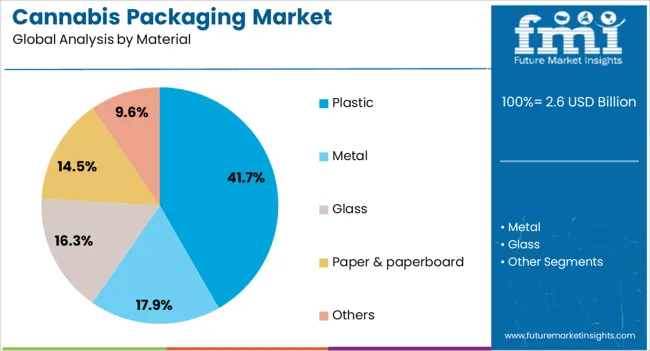

The plastic material segment is expected to hold 41.7% of the Cannabis Packaging Market revenue share in 2025, leading the material category. This dominance is being influenced by the material’s cost-effectiveness, flexibility in design, and adaptability to diverse packaging formats. Plastic has been widely adopted due to its lightweight nature, ability to form airtight seals, and suitability for child-resistant mechanisms required by cannabis packaging laws.

The segment’s growth is being reinforced by the scalability it offers to manufacturers aiming to meet rising product volumes while maintaining regulatory compliance. Companies have reported that plastic solutions offer a balance between performance, shelf presentation, and customization potential, particularly in rigid formats such as jars, vials, and containers.

Advances in recyclable and biodegradable plastic formulations are also addressing environmental concerns, further sustaining its relevance These functional, regulatory, and sustainability-driven advantages have contributed to plastic’s leading role in cannabis packaging material choices.

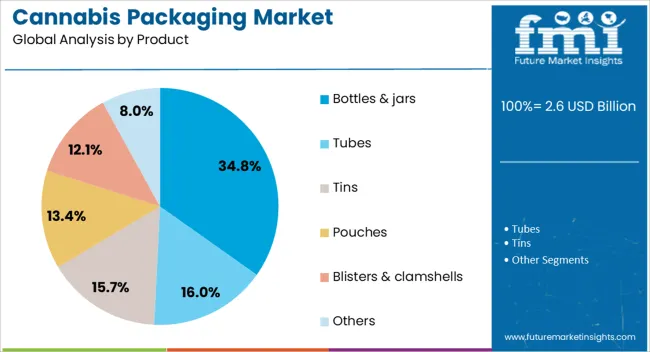

The bottles and jars segment is anticipated to contribute 34.8% of the Cannabis Packaging Market revenue share in 2025, emerging as the most preferred product type. This segment’s dominance is being driven by its compatibility with multiple cannabis formats including flower, concentrates, tinctures, and edibles. Bottles and jars have been favored for their ability to preserve aroma, potency, and freshness while meeting labeling and safety standards imposed by cannabis regulatory agencies.

The packaging’s rigid structure and reusability offer a premium feel that aligns with branding strategies in both medical and recreational markets. It has also been observed that these formats provide a larger surface area for branding and regulatory information, making them attractive to both producers and marketers.

Enhanced product visibility, tamper-evident designs, and child-resistant closures have further supported their adoption These attributes have led to sustained demand, positioning bottles and jars as a core component of product packaging strategies in the cannabis industry.

The cannabis packaging market is driven by the growing demand for secure, compliant packaging solutions as cannabis legalization expands. Opportunities in expanding retail channels and trends toward eco-friendly, customizable packaging are reshaping the market. However, high packaging costs and regulatory compliance challenges remain significant barriers. By 2025, overcoming these obstacles through cost-efficient, sustainable solutions will be essential for market growth.

The cannabis packaging market is growing due to the rising demand for cannabis products and the increasing need for secure, compliant packaging solutions. As the cannabis industry expands, the demand for packaging that ensures product quality, safety, and adherence to regulatory requirements is becoming more pronounced. By 2025, this growth will continue, particularly in regions where cannabis legalization is expanding, creating a significant need for specialized, child-resistant, and tamper-evident packaging solutions.

Opportunities in the cannabis packaging market are increasing with the growing legalization of cannabis and expansion of retail channels. As more countries and states legalize cannabis, the need for specialized packaging that meets legal and safety standards will surge. Additionally, the rise of cannabis retail outlets and online dispensaries will drive demand for high-quality, branded packaging solutions. By 2025, these opportunities will create substantial growth for packaging manufacturers in the expanding cannabis market.

Emerging trends in the cannabis packaging market include the growing demand for eco-friendly and customizable packaging solutions. As consumers become more environmentally conscious, demand for biodegradable and recyclable packaging materials is rising. Furthermore, cannabis brands are increasingly seeking customizable packaging that reflects their unique brand identity and appeals to their target audience. By 2025, these trends will be central to the market as brands strive to meet both sustainability goals and consumer preferences.

Despite growth, challenges related to high packaging costs and regulatory compliance remain in the cannabis packaging market. Specialized packaging, such as child-resistant and tamper-evident solutions, can be costly, especially when considering small production runs. Furthermore, strict regulations around cannabis packaging vary across regions, making compliance a complex and costly process. By 2025, addressing these challenges through cost-effective packaging solutions and streamlined compliance strategies will be critical for the market’s continued growth.

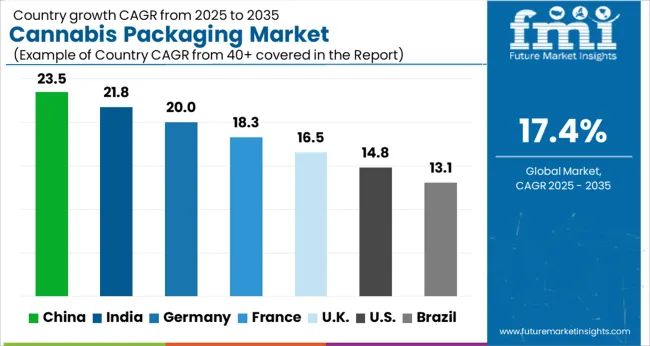

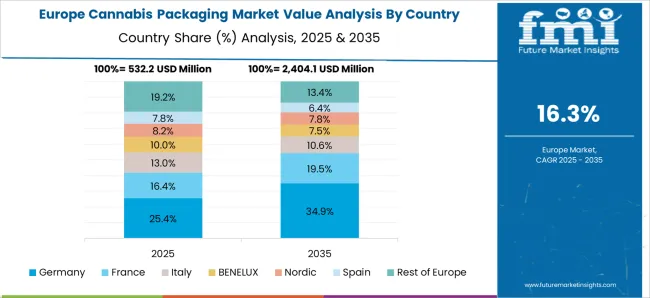

The global cannabis packaging market is projected to grow at a 17.4% CAGR from 2025 to 2035. China leads with a growth rate of 23.5%, followed by India at 21.8%, and Germany at 20%. The United Kingdom records a growth rate of 16.5%, while the United States shows the slowest growth at 14.8%. These varying growth rates are driven by factors such as the increasing legalization of cannabis, growing consumer demand for cannabis products, and the need for compliant, sustainable, and secure packaging solutions. Emerging markets like China and India are experiencing higher growth due to the evolving regulatory landscapes and expanding cannabis industries, while more mature markets like the USA and the UK see steady growth driven by stricter packaging regulations, sustainability initiatives, and the ongoing development of the legal cannabis market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cannabis packaging market in China is growing rapidly, with a projected CAGR of 23.5%. As China gradually adapts to the evolving global cannabis industry and shifts its stance on cannabis regulation, the demand for secure and compliant packaging solutions is increasing. The growing focus on product safety, tamper-evident packaging, and sustainability drives the adoption of advanced packaging technologies. Additionally, China’s expanding consumer market and rising interest in cannabis-derived wellness products further accelerate the demand for innovative packaging solutions that meet the needs of both consumers and regulatory authorities.

The cannabis packaging market in India is projected to grow at a CAGR of 21.8%. India’s evolving stance on cannabis and its expanding medical cannabis industry are key drivers of demand for packaging solutions. The increasing awareness of cannabis-based wellness products, along with the growing legalization of cannabis in various states, is contributing to the need for secure, compliant packaging solutions. Additionally, India’s focus on sustainability and environmentally friendly packaging materials further accelerates the adoption of advanced cannabis packaging solutions, particularly in the medical and wellness sectors.

The cannabis packaging market in Germany is projected to grow at a CAGR of 20%. Germany’s leadership in the European cannabis market, driven by increasing medical cannabis usage and regulatory frameworks for safe and compliant packaging, is contributing to steady market growth. The growing demand for cannabis products in both recreational and medical sectors, coupled with the country’s focus on eco-friendly packaging solutions, is accelerating the adoption of sustainable cannabis packaging. Furthermore, Germany’s stringent regulations on packaging standards and product safety continue to drive demand for high-quality, compliant packaging materials.

The cannabis packaging market in the United Kingdom is projected to grow at a CAGR of 16.5%. The UK’s demand for cannabis packaging solutions is driven by the expanding medical cannabis market and increasing interest in cannabis-based wellness products. The country’s focus on sustainable and compliant packaging materials, along with the rising demand for tamper-evident, child-proof packaging solutions, is further accelerating market growth. Additionally, the UK government’s regulatory focus on ensuring safe and secure cannabis packaging to prevent misuse contributes to the steady expansion of the market.

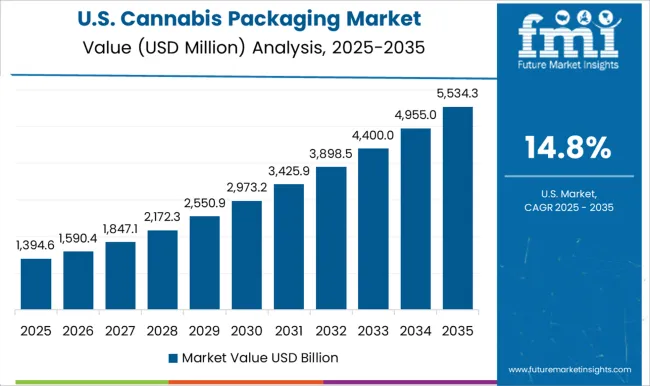

The cannabis packaging market in the United States is expected to grow at a CAGR of 14.8%. The USA market remains strong, driven by the increasing legalization of cannabis across states and the growing demand for recreational and medical cannabis products. The focus on compliance with state and federal packaging regulations, including child-proof, tamper-evident, and eco-friendly packaging solutions, is driving steady demand for innovative cannabis packaging. Additionally, the rising consumer preference for sustainable and recyclable packaging materials is further fueling market growth in the USA

The cannabis packaging market is dominated by KushCo Holdings, which leads with its innovative, compliant packaging solutions specifically designed for cannabis products. KushCo’s dominance is supported by its broad portfolio, strong partnerships with cannabis producers, and commitment to providing eco-friendly, secure, and functional packaging that meets regulatory standards. Key players such as Berlin Packaging, Calyx Containers, and Diamond Packaging maintain significant market shares by offering a wide range of customizable packaging options, including glass jars, child-resistant packaging, and innovative labeling systems for cannabis flower, edibles, and concentrates. These companies focus on ensuring packaging safety, durability, and sustainability while aligning with cannabis industry regulations. Emerging players like Dymapak, Elevate Packaging, and Sana Packaging are expanding their market presence by offering specialized cannabis packaging solutions that emphasize environmentally friendly materials, innovative designs, and compliance with the rapidly evolving legal landscape. Their strategies include reducing plastic usage, offering biodegradable packaging options, and enhancing product branding with customizable designs. Market growth is driven by increasing legalization of cannabis, rising demand for premium packaging, and the growing need for child-resistant, tamper-evident, and eco-conscious solutions. Innovations in sustainable packaging, smart packaging technologies, and new material development are expected to continue shaping competitive dynamics and fuel further growth in the global cannabis packaging market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Type | Rigid and Flexible |

| Material | Plastic, Metal, Glass, Paper & paperboard, and Others |

| Product | Bottles & jars, Tubes, Tins, Pouches, Blisters & clamshells, and Others |

| Application | Recreational use and Medical use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | KushCo Holdings, Berlin Packaging, Calyx Containers, Cannaline Cannabis Packaging Solutions, Diamond Packaging, Dymapak, Elevate Packaging, eBottles Cannabis, Green Rush Packaging, Kacepack, Kaya Packaging, Max Bright Packaging, MMC Depot, N2 Packaging Systems, Packaging Bee, Pollen Gear, Sana Packaging, and Tin Canna |

| Additional Attributes | Dollar sales by packaging type and application, demand dynamics across recreational and medical cannabis sectors, regional trends in cannabis packaging adoption, innovation in child-resistant and eco-friendly materials, impact of regulatory standards on safety and compliance, and emerging use cases in branded packaging and sustainable packaging solutions. |

The global cannabis packaging market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the cannabis packaging market is projected to reach USD 12.8 billion by 2035.

The cannabis packaging market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in cannabis packaging market are rigid and flexible.

In terms of material, plastic segment to command 41.7% share in the cannabis packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cannabis Packaging Equipment Market Growth - Forecast 2025 to 2035

Cannabis Beverages Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Concentrate Market Analysis - Size, Share, and Forecast 2025 to 2035

Cannabis Use Disorder Treatment Market – Trends & Innovations 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA