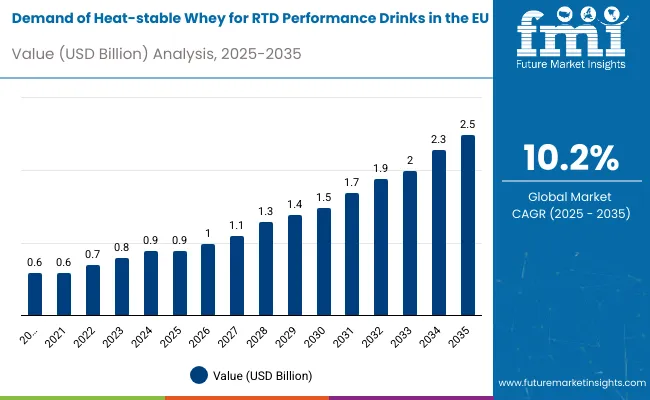

Sales of heat-stable whey for RTD performance drinks in the European Union are estimated at USD 0.94 billion in 2025, with projections indicating a rise to USD 2.47 billion by 2035, reflecting a CAGR of approximately 10.2% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 0.94 billion |

| Industry Value (2035F) | USD 2.47 billion |

| CAGR (2025 to 2035) | 10.2% |

This growth reflects both a broadening consumer base and increased per capita consumption in key urban centres. The rise in demand is linked to shifting dietary preferences, growing awareness of sports nutrition, and evolving convenience trends. By 2025, per capita consumption in leading EU countries such as Germany, France, and the Netherlands averages between 0.8 to 1.2 kilograms, with projections reaching 1.6 kilograms by 2035. Berlin leads among metropolitan areas, expected to generate USD 197 million in heat-stable whey RTD sales by 2035, followed by Paris (USD 150 million), Amsterdam (USD 103 million), Madrid (USD 80 million), and Milan (USD 66 million).

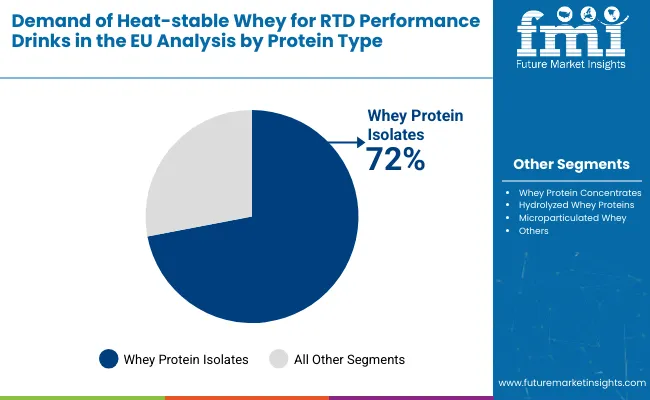

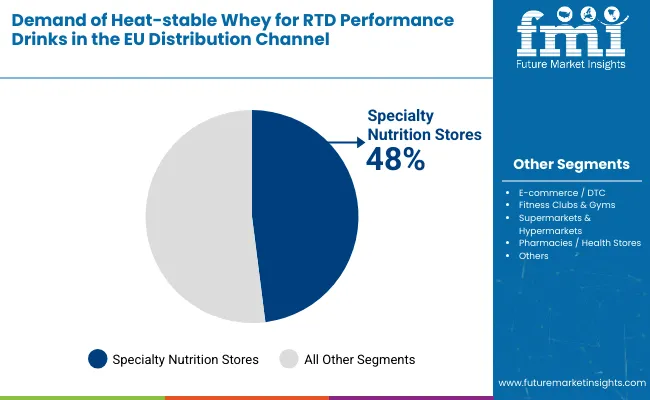

The largest contribution to demand continues to come from whey protein isolate formulations, which are expected to account for 72% of total sales in 2025, owing to superior heat stability, clean taste profile, and extended shelf life properties. By distribution channel, specialty nutrition stores represent the dominant retail format, responsible for 48% of all sales, while e-commerce platforms and fitness clubs are expanding rapidly.

Consumer adoption is particularly concentrated among fitness enthusiasts and active professionals, with age groups 25-45 emerging as significant drivers of demand. While price remains a limiting factor, the average price premium over conventional RTD protein drinks has declined from 34% in 2020 to 19% in 2025. Continued improvements in manufacturing scale and direct-to-consumer offerings are expected to accelerate affordability and access across mid-income households. Regional disparities persist, but per capita demand in emerging Eastern European nations is narrowing the gap with traditionally strong Western European hubs.

The heat-stable whey for RTD performance drinks space in the EU is classified across several segments. By protein type, the key categories include whey protein isolates, whey protein concentrates, hydrolyzed whey proteins, and microparticulated whey formulations. By distribution channel, the segment spans specialty nutrition stores, e-commerce platforms, fitness clubs and gyms, supermarkets and hypermarkets, and pharmaceutical retailers.

By application focus, formulations include post-workout recovery drinks, pre-exercise energy beverages, meal replacement shakes, clinical nutrition products, and general wellness beverages. By consumer profile, the segment covers fitness enthusiasts, professional athletes, active aging population, health-conscious millennials, and individuals with specific dietary requirements. By region, countries such as Germany, France, Netherlands, Spain, and Italy are included, along with coverage across all 27 EU member states. By city, key metro areas analyzed include Berlin, Paris, Amsterdam, Madrid, and Milan.

Whey protein isolates are projected to dominate sales in 2025, supported by superior heat stability, neutral taste, and high protein content. Other formats such as concentrates, hydrolyzed proteins, and microparticulated formulations are growing steadily, each serving distinct performance needs.

Heat-stable whey RTD performance drinks in the EU are distributed through a mix of specialized retail and mainstream sales channels. Specialty nutrition stores are expected to remain the primary point of sale in 2025, followed by e-commerce platforms and fitness facilities. Distribution strategies are evolving to match consumer shopping behavior, with growth coming from both physical and digital formats.

Heat-stable whey RTD performance drinks in the EU utilize various application focuses, selected for efficacy, consumer need, and consumption timing. Post-workout recovery remains the most widely targeted application, though pre-exercise and meal replacement categories are gaining momentum. Product developers are increasingly exploring specialized formulations to meet evolving athletic and wellness demands.

The heat-stable whey RTD performance drinks category appeals to a diverse consumer base across age groups, activity levels, and health objectives. While motivations vary from performance enhancement to convenience to clinical needs, demand is concentrated among five key demographic clusters. Each group brings distinct purchase behaviors, channel preferences, and product expectations.

| Cities | CAGR (2025 to 2035) |

| Madrid | 3.12% |

| Milan | 3.12% |

| Amsterdam | 2.87% |

| Paris | 2.87% |

| Berlin | 2.64% |

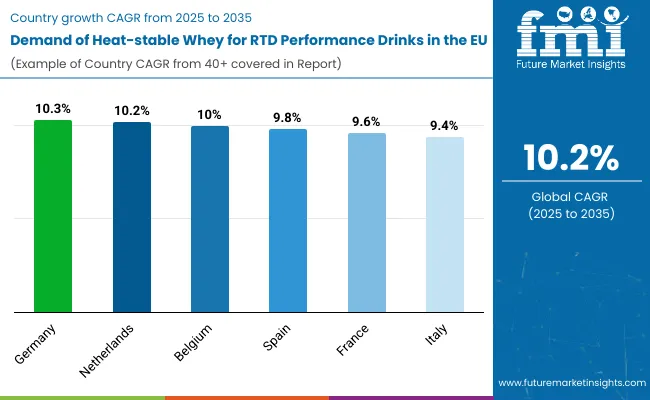

Heat-stable whey RTD performance drink sales will not grow uniformly across every metropolitan area. Rising health consciousness and faster adoption rates in Southern European cities give Madrid and Milan a measurable edge, while mature Northern European hubs such as Berlin expand more steadily from a higher base. The table below shows the compound annual growth rate (CAGR) each of the five largest cities is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for heat-stable whey RTD performance drinks is projected to expand across all major EU metropolitan areas, but the pace of growth will vary based on demographic shifts, retail penetration, and baseline consumption levels. Among the top five cities analyzed, Madrid and Milan are expected to register the fastest compound annual growth rate (CAGR) of 3.12%, outpacing more mature Northern European hubs.

This acceleration is underpinned by a combination of factors: growing fitness culture, increasing disposable income, and expanding availability of premium sports nutrition products across specialized retail and modern trade channels. In both cities, per capita consumption is projected to rise from 0.9 kg in 2025 to 1.3 kg by 2035, closing the gap with higher-consumption cities such as Berlin and Amsterdam. Retail assortment is also expanding faster in these regions, with new heat-stable whey RTD formats gaining traction in fitness clubs, specialty nutrition stores, and premium convenience outlets.

Amsterdam and Paris are each forecast to grow at a CAGR of 2.87% over the same period. Both cities already maintain established sports nutrition ecosystems, with widespread access to heat-stable whey RTD products across specialty stores, fitness facilities, and online platforms. In Amsterdam, growth is supported by a strong cycling and fitness culture, brand experimentation, and increasing uptake of direct-to-consumer subscription models.

Paris reflects similar dynamics, particularly among professional athletes and health-conscious urban professionals seeking convenient protein solutions. In both cities, per capita consumption is projected to increase from 1.1 kg in 2025 to 1.5 kg by 2035, reflecting mainstreaming of performance nutrition convenience options.

Berlin, while maintaining the highest overall sales in absolute terms, is expected to grow at a CAGR of 2.64%, slightly below its Southern European counterparts. The city already exhibits higher-than-average per capita intake (1.2 kg in 2025), extensive product saturation, and a dense fitness retail network. Growth will likely come from product premiumization, specialized clinical applications, and format innovation rather than first-time trial.

Collectively, these five metropolitan areas represent the core of urban demand for heat-stable whey RTD performance drinks in the EU, but their individual growth paths highlight the importance of regional tailoring in pricing, format development, and channel strategy.

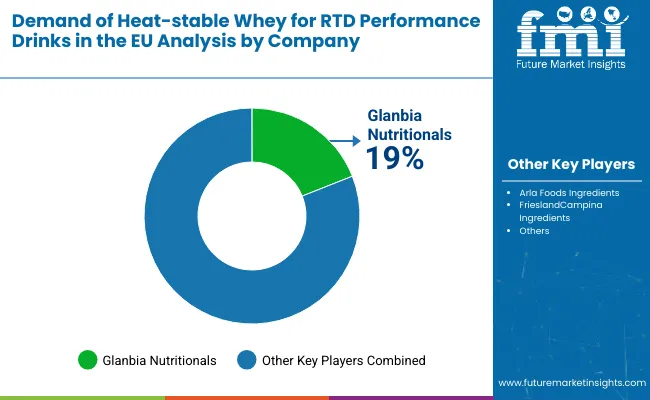

The competitive environment is characterized by a mix of established dairy ingredient suppliers and specialized sports nutrition manufacturers. Ingredient technology and distribution breadth rather than product count remains the decisive success factor: the five largest suppliers collectively reach more than 25,000 retail outlets across the EU and account for a majority of heat-stable whey RTD shelf facings in the category.

Glanbia Nutritionals is the most mature participant in the EU heat-stable whey ingredient space. The Irish company offers specialized heat-stable whey protein solutions including Optisol 1007 for neutral pH RTD beverages and clear protein isolates. Its core ingredient portfolio gives it deep penetration in sports nutrition manufacturing while maintaining full continental coverage through major beverage co-packers and private label partnerships.

Arla Foods Ingredients, owned by the Danish cooperative Arla Foods, leverages its advanced dairy processing capabilities to supply microparticulated whey proteins and heat-stable isolates to RTD manufacturers across Europe. Post-acquisition integration of specialized filtration technologies has allowed Arla to introduce ultra-clear whey solutions that maintain low viscosity and neutral taste in shelf-stable applications.

FrieslandCampina Ingredients, based in the Netherlands, benefits from scale synergies within a USD 11.6 billion dairy portfolio and from co-development partnerships with major European beverage brands. Recent launches under the Nutri Whey brand extend FrieslandCampina beyond ingredient supply into turnkey RTD beverage concepts specifically targeting performance nutrition manufacturers.

The next tier comprises regional specialists and emerging technology companies. Kerry Group focuses on functional protein blends and flavor-masked heat-stable formulations, with Q2-2025 financial reports showing steady growth in European sports nutrition ingredients. Fonterra, despite its New Zealand base, maintains significant European operations through specialized heat-stable whey concentrate offerings designed for extended shelf-life RTD applications.

Contract manufacturing partnerships with companies like Refresco and private label programs at retailers like Decathlon (Aptonia brand) and Lidl are expanding heat-stable whey RTD availability at price points 20-25% below branded equivalents, creating competitive pressure while supporting consumer trial. Consolidation is therefore likely to continue as ingredient innovation and omnichannel distribution become critical for maintaining market access and promotional frequency in this technology-driven category.

| Attribute | Details |

|---|---|

| Study Coverage | EU sales and consumption of heat-stable whey for RTD performance drinks from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025-2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All 27 EU member states; country-level and city-level granularity |

| Top Countries Analyzed | Germany, France, Netherlands, Spain, Italy, Poland, Belgium |

| Top Cities Analyzed | Berlin, Paris, Amsterdam, Madrid, Milan, Warsaw, Brussels |

| By Protein Type | Whey protein isolates, Whey protein concentrates, Hydrolyzed whey, Microparticulated whey |

| By Distribution Channel | Specialty nutrition stores, E-commerce/DTC, Fitness clubs, Supermarkets, Pharmacies |

| By Application Focus | Post-workout recovery, Pre-exercise energy, Meal replacement, Clinical nutrition, General wellness |

| By Consumer Profile | Fitness enthusiasts, Professional athletes, Active aging, Health-conscious millennials, Dietary restricted |

| Metrics Provided | Sales (EUR), Volume (MT), Per capita consumption (kg), CAGR (2025-2035), Share by segment |

| Price Analysis | Average unit prices by protein type and region |

| Competitive Landscape | Company profiles, ingredient innovation strategies, manufacturing partnerships |

| Forecast Drivers | Per capita demand trends, channel expansion, price convergence, fitness culture growth |

By 2035, total EU sales of heat-stable whey for RTD performance drinks are projected to reach EUR 2.34 billion, up from EUR 0.89 billion in 2025, reflecting a CAGR of approximately 10.2%.

Whey protein isolates hold the leading share, accounting for approximately 72% of total sales in 2025, followed by whey protein concentrates and hydrolyzed whey formulations.

Madrid and Milan lead in projected growth, each registering a CAGR of 3.12% between 2025 and 2035, due to expanding fitness culture and increasing health consciousness.

Specialty nutrition stores are the dominant sales channel (48% share in 2025), but e-commerce platforms and fitness clubs are growing at double-digit CAGR, especially in urban regions.

Major players include Glanbia Nutritionals, Arla Foods Ingredients, FrieslandCampina Ingredients, Kerry Group, and Fonterra, with growing competition from private label brands and specialized co-packers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mineral Enrichment Ingredients in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in UK Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Online Clothing Rental in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA