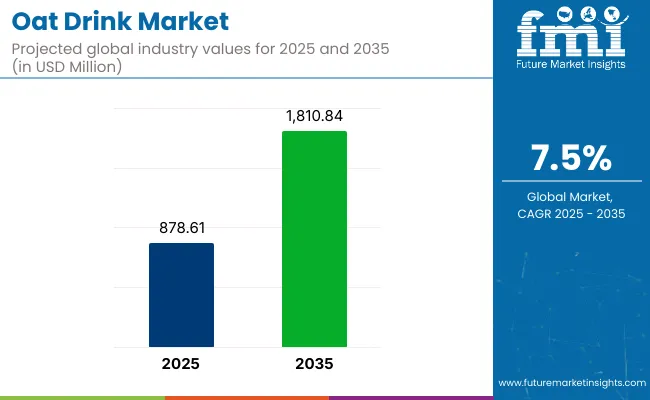

The global oat drink market is projected to grow from USD 878.61 million in 2025 to USD 1,810.84 million by 2035, which shows a CAGR of 7.5% over the forecast period. This growth is being fueled by the rising consumer preference for plant-based, lactose-free, and allergen-friendly dairy alternatives.

Oat drinks, known for their creamy texture, mild taste, and nutritional benefits, are increasingly used in coffee, smoothies, cereals, and cooking applications. As dietary trends shift toward sustainability, digestive health, and vegan lifestyles, oat-based beverages are gaining momentum in both developed and emerging markets.

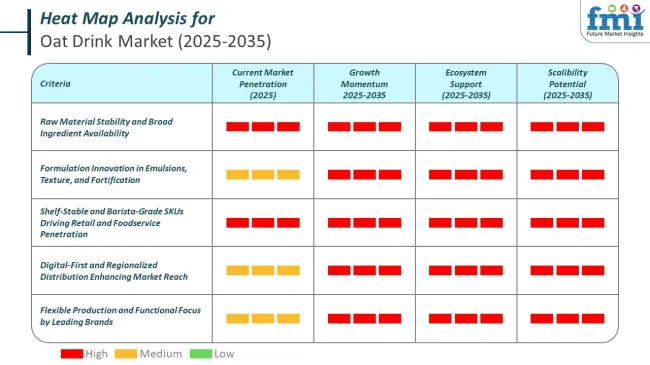

Product innovation and retail expansion are playing key roles in boosting oat drink sales. Manufacturers are launching fortified versions with added calcium, vitamins, and fiber to appeal to health-conscious consumers. Flavored oat drinks, barista-specific formulations, and on-the-go packaging formats are also expanding the category’s reach.

The proliferation of oat drinks across mainstream supermarkets, health food stores, and e-commerce platforms is improving accessibility and consumer trial. Leading food and beverage brands are also forming partnerships with cafes and restaurants to increase oat milk usage as a dairy substitute, especially in coffee-based beverages.

Brands are enhancing nutritional profiles by fortifying products with vitamins and minerals like calcium, vitamin D, and B12. Flavor innovation is also a key trend, with offerings expanding beyond traditional vanilla and chocolate to include options like matcha, chai, and seasonal flavors such as pumpkin spice.

Supportive regulatory trends and environmental awareness are reinforcing the market’s upward trajectory. Compared to dairy, oat drink production requires significantly less water and results in lower greenhouse gas emissions, aligning well with global sustainability goals.

Governments and nutrition organizations in North America, Europe, and Asia are encouraging plant-based consumption through educational campaigns and dietary guidelines. As consumers become more informed about environmental impact, dietary sensitivities, and gut health, the oat drink market is expected to continue its strong performance, supported by innovation, brand diversification, and the ongoing transformation of global food consumption patterns.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 878.61 million |

| Industry Value (2035F) | USD 1,810.84 million |

| CAGR (2025 to 2035) | 7.5% |

Per-person consumption of oat-based beverages varies across regions. In 2025, Sweden records over 9 liters per capita, followed by Denmark and Finland. These markets operate with vertically integrated processors and foodservice networks that include chilled oat beverages among standard dairy-alternative offerings.

Imports arriving at Nhava Sheva support packaging and distribution via modern trade networks. Japanese and South Korean cities maintain consistent product rotation in vending formats and QSR outlets.

Canada maintained oat concentrate shipments to China and Japan across the first two quarters of 2025. Terminals in Rotterdam and Hamburg handled more than 30,000 metric tons of oat base between January and May. French processors operated with cold storage infrastructure showing recorded uptime above 90 percent.

The market is segmented based on product type, flavor, end use application, nature, format, and region. By product type, the market is categorized into regular/full fat and reduced fat variants. By flavor, it includes natural/unflavored, flavored, vanilla, chocolate, coffee, mocha, mint, fruit-flavored, and others (including caramel, cinnamon, turmeric, matcha, and hazelnut).

In terms of end use application, the market is segmented into food services, cafes, quick-service restaurants, full-service restaurants, retail sales, hypermarkets/supermarkets, convenience stores, mass grocery retailers, food & drink specialty stores, and online retailing.

By nature, the market includes organic and conventional oat drinks. Based on format, the market is divided into shelf-stable and refrigerated variants. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

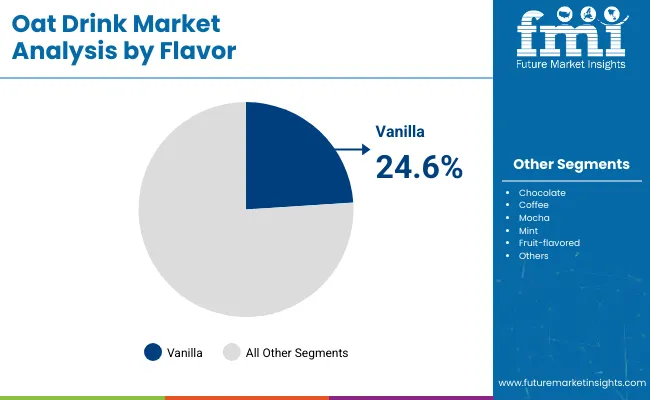

The vanilla segment is projected to dominate the oat drink market by flavor, accounting for 24.6% of the market share in 2025. As a classic and universally accepted taste, vanilla-flavored oat drinks continue to attract both new and loyal consumers. The segment is especially popular among consumers transitioning from dairy milk to plant-based alternatives, as vanilla offers a familiar and palatable taste experience.

Vanilla oat drinks are widely used in coffee preparation, smoothies, breakfast cereals, and baked goods, which has helped expand their visibility across foodservice and retail channels. Leading brands such as Oatly, Califia Farms, and Alpro have diversified their vanilla-flavored oat drink lines to include low-sugar, fortified, and organic options to cater to various dietary needs.

The flavor's versatility supports its use in both chilled and shelf-stable formats. Furthermore, vanilla pairs well with both sweet and savory recipes, making it a staple flavor in households and cafés alike. While fruit-flavored and chocolate oat drinks are also rising in popularity, vanilla continues to appeal to a broad demographic, including children, athletes, and health-conscious adults. Its mild sweetness and adaptability ensure that vanilla maintains its leading position in the flavored oat drink category.

| Flavor Segment | Market Share (2025) |

|---|---|

| Vanilla | 24.6% |

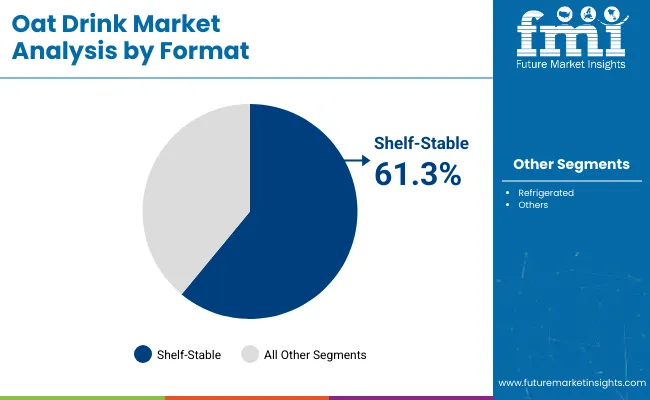

The shelf-stable segment is expected to hold a 61.3% market share in 2025, emerging as the leading format in the oat drink market. Shelf-stable oat drinks offer extended shelf life, ambient storage, and lower distribution costs, making them ideal for large-scale retail, e-commerce, and foodservice operations.

This format is highly favored in regions where cold chain logistics are either underdeveloped or cost-prohibitive. It allows manufacturers to reach rural, remote, and emerging markets more efficiently, contributing to expanded brand presence. Global brands such as Oatly, Planet Oat, and Silk have significantly invested in aseptic processing technologies and Tetra Pak packaging to improve product stability without compromising on taste or nutrition. This has enabled better placement on supermarket shelves and convenience stores.

The shelf-stable segment is also experiencing growth in online retail, where consumers prefer bulk purchasing and pantry stocking of non-perishable items. While refrigerated oat drinks are gaining popularity for their freshness and perceived premium quality, shelf-stable variants dominate volume sales due to affordability and convenience. As oat drink consumption grows globally, shelf-stable options are expected to remain a cornerstone of product strategy for both legacy players and emerging startups.

| Format Segment | Market Share (2025) |

|---|---|

| Shelf-Stable | 61.3% |

The food services segment is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by increasing demand for plant-based beverages in cafés, restaurants, and commercial kitchens. Oat drinks are now widely used as dairy milk alternatives in lattes, smoothies, sauces, and desserts, owing to their creamy texture and neutral taste.

As consumer interest in lactose-free, vegan, and sustainable diets intensifies, foodservice providers are rapidly expanding their oat-based menu offerings. Major coffee chains like Starbucks and Dunkin’ have integrated oat drinks into their permanent menus, which has boosted visibility and trial among consumers. Quick-service restaurants and independent cafés are also capitalizing on the trend, often charging a premium for oat-based milk substitutes.

The segment's growth is further supported by barista-specific formulations that are optimized for frothing and heat stability. Manufacturers are partnering directly with foodservice distributors to offer bulk and customized solutions that enhance efficiency for high-volume outlets. As oat drinks become a core component of modern beverage programs, the food services segment will continue to capture investment interest across North America, Europe, and Asia.

| End Use Application Segment | CAGR (2025 to 2035) |

|---|---|

| Food Services | 7.4% |

The regular/full fat segment of the oat drink market is anticipated to expand at a CAGR of 6.5% from 2025 to 2035, driven by rising demand for plant-based dairy alternatives. The regular/full fat segment is gaining preference due to its rich texture, creamy mouthfeel, and versatile usage across beverages and culinary applications.

Consumers replacing dairy milk are increasingly favoring these full-fat options for their taste and satiety benefits. Leading brands such as Oatly, Alpro, and Califia Farms continue to strengthen this segment by offering barista-specific editions that enhance froth and flavor, appealing especially to cafés and home baristas alike.

Additionally, regular oat drinks are resonating with health-conscious consumers seeking energy-rich, naturally fatty plant-based drinks. Conversely, reduced-fat oat drinks are carving out space among calorie-conscious buyers and those focused on dietary control. Product innovation in this sub-segment is leading to improved texture and taste profiles without relying on sugar or artificial stabilizers. Despite this progress, reduced-fat oat drinks still lag in terms of volume consumption, primarily due to the stronger taste and versatility offered by regular variants.

| By Product Type | CAGR (2025 to 2035) |

|---|---|

| Regular/Full Fat | 6.5% |

The conventional segment of the oat drink market is forecast to grow at a CAGR of 6.7% from 2025 to 2035, supported by evolving consumer preferences and expanding plant-based portfolios. The conventional segment remains the dominant choice, driven by its affordability, consistent quality, and widespread availability across retail chains, cafés, and online channels.

Brands such as Danone, Oatly, and Chobani are actively expanding their conventional product lines to cater to mainstream consumer needs through flavored and fortified options. A well-established supply chain further supports large-scale production and distribution, making conventional oat drinks a dependable and scalable option globally.

The organic segment, though smaller, is gradually gaining attention from eco-conscious and health-focused buyers. These products are manufactured without synthetic chemicals or GMOs, aligning with the growing clean-label movement and sustainability-driven choices. Companies such as Pacific Foods and Minor Figures are positioning their organic oat drinks with ethical branding and minimalist formulations. However, higher price points remain a barrier to widespread adoption.

| By Nature | CAGR (2025 to 2035) |

|---|---|

| Conventional | 6.7% |

The booming e-commerce industry has made oat drinks more accessible to several consumers in different parts of the globe. Adoption of innovative marketing strategies by companies producing and distributing oat-based drinks is contributing to organic oat milk market growth.

Healthy eating is specifically trending in the Middle East, leading to massive growth of the market in the region. While crowd favorites such as almond, soy, and coconut have been around on the market for several years, oat drinks have gone mainstream only recently.

Oat-based drinks currently hold a tiny percentage of the overall plant-based drink market. However, its penetration is increasing rapidly. This is due to several factors, such as creative marketing tactics pursued by companies such as Oatly AB.

Key companies are directly targeting cafés as part of their product launch strategy. The unique texture and thickness of drinks containing oats also make them a tasty and healthy alternative to animal-based drinks such as regular milk.

Europe is currently the most prominent market and will continue to be lucrative, exhibiting high demand. With rising trend among the youth and athletes turning toward veganism, demand for plant-based drinks is rising considerably.

Using oats in coffee-based drinks is particularly popular and accounts for the majority of the flavored drink segment. Also, people suffering from animal dairy allergies are a target segment for plant-based drinks.

The global oat drink market displayed robust growth from 2020 to 2024. Several factors influenced this growth. Reputed drink-based product manufacturers entered the market during this period.

Rising demand for drinks that are healthy and nutritious helped push market growth. Emergence of label-based products such as non-GMO and allergen-free also augmented sales. Consumer shift toward organic beverages contributed to growth of the overnight oats drink market.

Oat-based drinks are likely to continue to expand in terms of popularity among millennial consumers. Increased investment in research and development to improve the taste and texture of the drinks is predicted to propel sales of oat-based protein shakes. Introduction of new and attractive beverage flavors is another crucial factor augmenting demand.

The boom of oat beverages is unprecedented. One of the most significant factors propelling the market is the rising shift toward sustainable products. Modern consumers are looking at themselves as social and environmental guardians.

They are constantly seeking deeper connections with the environment. Hence, they are expecting the same characteristics in brands manufacturing the products they purchase on a regular basis. The high sustainability factor of oats is pushing consumers toward overnight oat drinks.

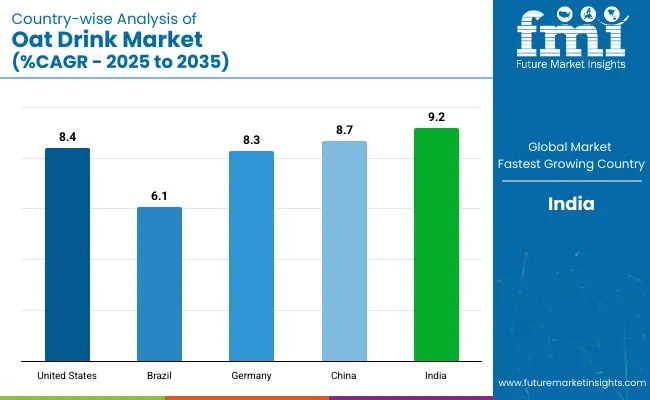

The table below showcases the CAGRs of several countries present in the oat drink market. India, China, and the United States are estimated to exhibit CAGRs of 9.2%, 8.7%, and 8.4%, respectively.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 8.4% |

| Brazil | 6.1% |

| Germany | 8.3% |

| China | 8.7% |

| India | 9.2% |

The United States will likely expand at a CAGR of 8.4% from 2025 to 2035 and reach USD 321.9 million in the same year. The country is set to hold a prominent share of 23.9% by 2035.

Increasing focus on innovation is pushing the priorities of oatmeal drink vendors operating in the United States. Constant innovations are likely to help the country in maintaining its top position. Mastery over several supply chain issues that come with a market prone to variable production has also been a key factor in the success of leading players in the United States.

China’s massive middle-class population with a considerable disposable income will make it a crucial consumer in the market, with a share of 7.3% by 2035. Rising awareness of the delightful taste and texture of whole oat milk is set to push sales. This awareness of plant-based drinks among the masses might lead to a robust CAGR of 8.7% till 2035, helping China reach a market valuation of USD 114.1 million by 2035.

Germany is estimated to overtake the United Kingdom as a key country in Europe’s oat drink market by holding a share of 5.8% by 2035. With a considerable CAGR of 8.3% in the forecast period, Germany will reach an oat powder drink market valuation of USD 79.1 million by 2035.

A massive shift of the population in Germany toward vegetarianism and veganism is likely to propel demand. Increased preference for organic products has also led to strong growth in Germany.

Competition is fierce as key oat-based drink companies are looking to increase their footing in the market by offering innovative drinks. Manufacturers and suppliers focus on meeting consumer needs for taste as well as affordable pricing. Mergers, acquisitions, and partnerships are common strategies in the landscape.

For instance

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 878.61 million |

| Projected Market Size (2035) | USD 1,810.84 million |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value and million metric tons for volume |

| By Product Type | Regular/Full Fat, Reduced Fat |

| By Flavor | Natural/Unflavored, Flavored, Vanilla, Chocolate, Coffee, Mocha, Mint, Fruit-Flavored, Others (Caramel, Cinnamon, Turmeric, Matcha, Hazelnut) |

| By End Use Application | Food Services, Cafes, Quick-service Restaurants, Full-service Restaurants, Retail Sales, Hypermarkets/Supermarkets, Convenience Stores, Mass Grocery Retailers, Food & Drink Specialty Stores, Online Retailing |

| By Nature | Organic, Conventional |

| By Format | Shelf-Stable, Refrigerated |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Brazil, Germany, China, India |

| Key Players | Cereal Base Ceba AB, Pacific Foods of Oregon LLC, Elmhurst Milked Direct LLC, Danone S.A., Lima Food SRL, Oatworks, The Hain Celestial Inc., Abafoods s.r.l., Kaslink Foods Oy, Rude Health, Valsoia S.p.A., Earth’s Own Food Company |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global oat drink market is projected to reach USD 1,810.84 million by 2035, growing from USD 878.61 million in 2024, at a CAGR of 7.5% during the forecast period.

The vanilla segment is expected to dominate the flavor category, holding a 24.6% share in 2025, driven by its versatile taste, wide culinary application, and consumer preference across both retail and foodservice formats.

The shelf-stable segment will maintain leadership with a projected 61.3% market share in 2025, owing to its ambient storage advantage, extended shelf life, and popularity across e-commerce and mainstream retail channels.

The food services segment is projected to expand at a CAGR of 7.4% from 2025 to 2035, driven by growing usage in cafés, quick-service restaurants, and specialty coffee chains promoting plant-based alternatives.

Leading companies include Oatly, Danone S.A., Califia Farms, Pacific Foods, Earth’s Own Food Company, and Elmhurst Milked, all investing in barista editions, fortified oat drinks, and international market expansion.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 7: Global Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 9: Global Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 10: Global Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 11: Global Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 12: Global Market Volume (MT) Forecast by Format, 2019 to 2034

Table 13: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 15: North America Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 17: North America Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 18: North America Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 19: North America Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 20: North America Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 21: North America Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 22: North America Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 23: North America Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 24: North America Market Volume (MT) Forecast by Format, 2019 to 2034

Table 25: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 26: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: Latin America Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 28: Latin America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 29: Latin America Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 30: Latin America Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 31: Latin America Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 32: Latin America Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 33: Latin America Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 34: Latin America Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 35: Latin America Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 36: Latin America Market Volume (MT) Forecast by Format, 2019 to 2034

Table 37: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 38: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 39: Europe Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 40: Europe Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 41: Europe Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 42: Europe Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 43: Europe Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 44: Europe Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 45: Europe Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 46: Europe Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 47: Europe Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 48: Europe Market Volume (MT) Forecast by Format, 2019 to 2034

Table 49: East Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 52: East Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 53: East Asia Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 54: East Asia Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 55: East Asia Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 56: East Asia Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 57: East Asia Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 58: East Asia Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 59: East Asia Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 60: East Asia Market Volume (MT) Forecast by Format, 2019 to 2034

Table 61: South Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 62: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 63: South Asia Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 64: South Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 65: South Asia Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 66: South Asia Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 67: South Asia Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 68: South Asia Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 69: South Asia Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 70: South Asia Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 71: South Asia Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 72: South Asia Market Volume (MT) Forecast by Format, 2019 to 2034

Table 73: Oceania Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 74: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 75: Oceania Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 76: Oceania Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 77: Oceania Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 78: Oceania Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 79: Oceania Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 80: Oceania Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 81: Oceania Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 82: Oceania Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 83: Oceania Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 84: Oceania Market Volume (MT) Forecast by Format, 2019 to 2034

Table 85: Middle East & Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 86: Middle East & Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 87: Middle East & Africa Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 88: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 89: Middle East & Africa Market Value (US$ million) Forecast by Flavor, 2019 to 2034

Table 90: Middle East & Africa Market Volume (MT) Forecast by Flavor, 2019 to 2034

Table 91: Middle East & Africa Market Value (US$ million) Forecast by End Use Application, 2019 to 2034

Table 92: Middle East & Africa Market Volume (MT) Forecast by End Use Application, 2019 to 2034

Table 93: Middle East & Africa Market Value (US$ million) Forecast by Nature, 2019 to 2034

Table 94: Middle East & Africa Market Volume (MT) Forecast by Nature, 2019 to 2034

Table 95: Middle East & Africa Market Value (US$ million) Forecast by Format, 2019 to 2034

Table 96: Middle East & Africa Market Volume (MT) Forecast by Format, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Flavor, 2024 to 2034

Figure 3: Global Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 4: Global Market Value (US$ million) by Nature, 2024 to 2034

Figure 5: Global Market Value (US$ million) by Format, 2024 to 2034

Figure 6: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 7: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 8: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 15: Global Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 16: Global Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 17: Global Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 19: Global Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 20: Global Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 21: Global Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 23: Global Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 24: Global Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 25: Global Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 26: Global Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 27: Global Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 28: Global Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 29: Global Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 30: Global Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 31: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 32: Global Market Attractiveness by Flavor, 2024 to 2034

Figure 33: Global Market Attractiveness by End Use Application, 2024 to 2034

Figure 34: Global Market Attractiveness by Nature, 2024 to 2034

Figure 35: Global Market Attractiveness by Format, 2024 to 2034

Figure 36: Global Market Attractiveness by Region, 2024 to 2034

Figure 37: North America Market Value (US$ million) by Product Type, 2024 to 2034

Figure 38: North America Market Value (US$ million) by Flavor, 2024 to 2034

Figure 39: North America Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 40: North America Market Value (US$ million) by Nature, 2024 to 2034

Figure 41: North America Market Value (US$ million) by Format, 2024 to 2034

Figure 42: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 43: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 44: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 47: North America Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 48: North America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 51: North America Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 52: North America Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 55: North America Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 56: North America Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 57: North America Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 58: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 59: North America Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 60: North America Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 61: North America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 62: North America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 63: North America Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 64: North America Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 65: North America Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 66: North America Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 67: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 68: North America Market Attractiveness by Flavor, 2024 to 2034

Figure 69: North America Market Attractiveness by End Use Application, 2024 to 2034

Figure 70: North America Market Attractiveness by Nature, 2024 to 2034

Figure 71: North America Market Attractiveness by Format, 2024 to 2034

Figure 72: North America Market Attractiveness by Country, 2024 to 2034

Figure 73: Latin America Market Value (US$ million) by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ million) by Flavor, 2024 to 2034

Figure 75: Latin America Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 76: Latin America Market Value (US$ million) by Nature, 2024 to 2034

Figure 77: Latin America Market Value (US$ million) by Format, 2024 to 2034

Figure 78: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 79: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 83: Latin America Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 84: Latin America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: Latin America Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 88: Latin America Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 91: Latin America Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 92: Latin America Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 93: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 95: Latin America Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 96: Latin America Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 99: Latin America Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 100: Latin America Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 103: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 104: Latin America Market Attractiveness by Flavor, 2024 to 2034

Figure 105: Latin America Market Attractiveness by End Use Application, 2024 to 2034

Figure 106: Latin America Market Attractiveness by Nature, 2024 to 2034

Figure 107: Latin America Market Attractiveness by Format, 2024 to 2034

Figure 108: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 109: Europe Market Value (US$ million) by Product Type, 2024 to 2034

Figure 110: Europe Market Value (US$ million) by Flavor, 2024 to 2034

Figure 111: Europe Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 112: Europe Market Value (US$ million) by Nature, 2024 to 2034

Figure 113: Europe Market Value (US$ million) by Format, 2024 to 2034

Figure 114: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 115: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 116: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 119: Europe Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 120: Europe Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 123: Europe Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 124: Europe Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 125: Europe Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 127: Europe Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 128: Europe Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 129: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 130: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 131: Europe Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 132: Europe Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 133: Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 135: Europe Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 136: Europe Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 137: Europe Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 139: Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 140: Europe Market Attractiveness by Flavor, 2024 to 2034

Figure 141: Europe Market Attractiveness by End Use Application, 2024 to 2034

Figure 142: Europe Market Attractiveness by Nature, 2024 to 2034

Figure 143: Europe Market Attractiveness by Format, 2024 to 2034

Figure 144: Europe Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ million) by Product Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ million) by Flavor, 2024 to 2034

Figure 147: East Asia Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 148: East Asia Market Value (US$ million) by Nature, 2024 to 2034

Figure 149: East Asia Market Value (US$ million) by Format, 2024 to 2034

Figure 150: East Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 152: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 155: East Asia Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 156: East Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 159: East Asia Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 160: East Asia Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 163: East Asia Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 164: East Asia Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 165: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 167: East Asia Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 168: East Asia Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 171: East Asia Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 172: East Asia Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 176: East Asia Market Attractiveness by Flavor, 2024 to 2034

Figure 177: East Asia Market Attractiveness by End Use Application, 2024 to 2034

Figure 178: East Asia Market Attractiveness by Nature, 2024 to 2034

Figure 179: East Asia Market Attractiveness by Format, 2024 to 2034

Figure 180: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 181: South Asia Market Value (US$ million) by Product Type, 2024 to 2034

Figure 182: South Asia Market Value (US$ million) by Flavor, 2024 to 2034

Figure 183: South Asia Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 184: South Asia Market Value (US$ million) by Nature, 2024 to 2034

Figure 185: South Asia Market Value (US$ million) by Format, 2024 to 2034

Figure 186: South Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 187: South Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 188: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 189: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 190: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 191: South Asia Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 192: South Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 193: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 194: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 195: South Asia Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 196: South Asia Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 197: South Asia Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 198: South Asia Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 199: South Asia Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 200: South Asia Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 201: South Asia Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 202: South Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 203: South Asia Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 204: South Asia Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 205: South Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 206: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 207: South Asia Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 208: South Asia Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 209: South Asia Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 210: South Asia Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 211: South Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 212: South Asia Market Attractiveness by Flavor, 2024 to 2034

Figure 213: South Asia Market Attractiveness by End Use Application, 2024 to 2034

Figure 214: South Asia Market Attractiveness by Nature, 2024 to 2034

Figure 215: South Asia Market Attractiveness by Format, 2024 to 2034

Figure 216: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 217: Oceania Market Value (US$ million) by Product Type, 2024 to 2034

Figure 218: Oceania Market Value (US$ million) by Flavor, 2024 to 2034

Figure 219: Oceania Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 220: Oceania Market Value (US$ million) by Nature, 2024 to 2034

Figure 221: Oceania Market Value (US$ million) by Format, 2024 to 2034

Figure 222: Oceania Market Value (US$ million) by Country, 2024 to 2034

Figure 223: Oceania Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 224: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 227: Oceania Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 228: Oceania Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 229: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 230: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 231: Oceania Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 232: Oceania Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 233: Oceania Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 234: Oceania Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 235: Oceania Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 236: Oceania Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 237: Oceania Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 239: Oceania Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 240: Oceania Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 241: Oceania Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 242: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 243: Oceania Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 244: Oceania Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 245: Oceania Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 246: Oceania Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 247: Oceania Market Attractiveness by Product Type, 2024 to 2034

Figure 248: Oceania Market Attractiveness by Flavor, 2024 to 2034

Figure 249: Oceania Market Attractiveness by End Use Application, 2024 to 2034

Figure 250: Oceania Market Attractiveness by Nature, 2024 to 2034

Figure 251: Oceania Market Attractiveness by Format, 2024 to 2034

Figure 252: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 253: Middle East & Africa Market Value (US$ million) by Product Type, 2024 to 2034

Figure 254: Middle East & Africa Market Value (US$ million) by Flavor, 2024 to 2034

Figure 255: Middle East & Africa Market Value (US$ million) by End Use Application, 2024 to 2034

Figure 256: Middle East & Africa Market Value (US$ million) by Nature, 2024 to 2034

Figure 257: Middle East & Africa Market Value (US$ million) by Format, 2024 to 2034

Figure 258: Middle East & Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 259: Middle East & Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 260: Middle East & Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 261: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 262: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 263: Middle East & Africa Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 264: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 265: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 266: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 267: Middle East & Africa Market Value (US$ million) Analysis by Flavor, 2019 to 2034

Figure 268: Middle East & Africa Market Volume (MT) Analysis by Flavor, 2019 to 2034

Figure 269: Middle East & Africa Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 270: Middle East & Africa Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 271: Middle East & Africa Market Value (US$ million) Analysis by End Use Application, 2019 to 2034

Figure 272: Middle East & Africa Market Volume (MT) Analysis by End Use Application, 2019 to 2034

Figure 273: Middle East & Africa Market Value Share (%) and BPS Analysis by End Use Application, 2024 to 2034

Figure 274: Middle East & Africa Market Y-o-Y Growth (%) Projections by End Use Application, 2024 to 2034

Figure 275: Middle East & Africa Market Value (US$ million) Analysis by Nature, 2019 to 2034

Figure 276: Middle East & Africa Market Volume (MT) Analysis by Nature, 2019 to 2034

Figure 277: Middle East & Africa Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 278: Middle East & Africa Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 279: Middle East & Africa Market Value (US$ million) Analysis by Format, 2019 to 2034

Figure 280: Middle East & Africa Market Volume (MT) Analysis by Format, 2019 to 2034

Figure 281: Middle East & Africa Market Value Share (%) and BPS Analysis by Format, 2024 to 2034

Figure 282: Middle East & Africa Market Y-o-Y Growth (%) Projections by Format, 2024 to 2034

Figure 283: Middle East & Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 284: Middle East & Africa Market Attractiveness by Flavor, 2024 to 2034

Figure 285: Middle East & Africa Market Attractiveness by End Use Application, 2024 to 2034

Figure 286: Middle East & Africa Market Attractiveness by Nature, 2024 to 2034

Figure 287: Middle East & Africa Market Attractiveness by Format, 2024 to 2034

Figure 288: Middle East & Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat Proteins Market Size and Share Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Oats Market Analysis - Size, Share, and Forecast 2025 to 2035

Oat Beta-Glucan Market Analysis - Size, Share, and Forecast 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Drink Carrier Poly Bags Market Size and Share Forecast Outlook 2025 to 2035

Oat Milk Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Leading Providers & Market Share in Drink Carrier Poly Bags

Oat Protein Market Trends - Plant-Based Nutrition & Industry Demand 2024 to 2034

Drinkware Accessories Market

Goat Milk Replacer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA