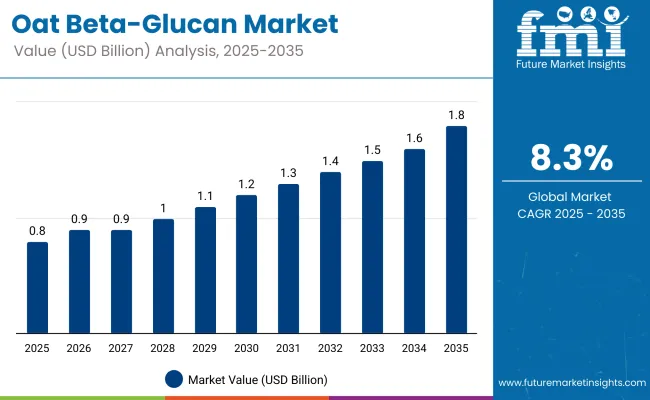

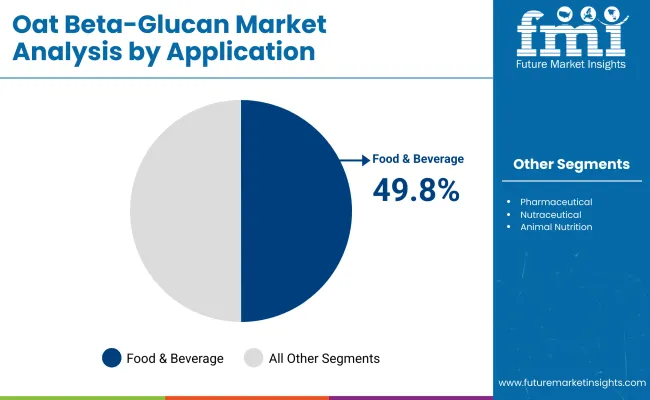

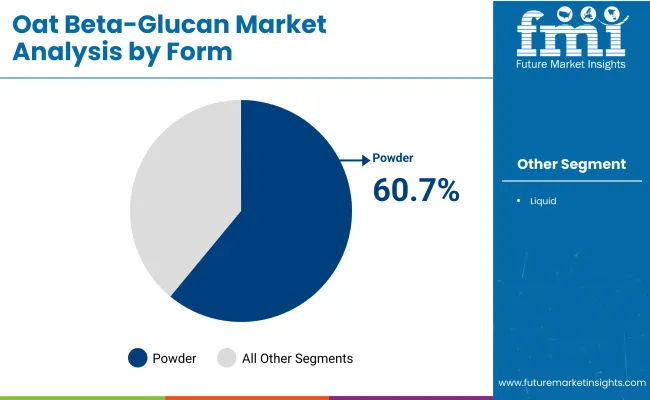

The oat beta-glucan market is estimated to grow from USD 0.8 billion in 2025 to USD 1.8 billion by 2035, registering a CAGR of 8.3% over the forecast period. Food and beverage applications will account for the largest market share at 49.8% in 2025, while the powder form segment will dominate with a 60.7% share.

Oat beta-glucan, a soluble dietary fiber, is renowned for its positive effects on heart health, cholesterol reduction, and immune system support. These health-promoting properties have led to its widespread inclusion in dietary supplements, fortified foods, and beverages. The growing prevalence of lifestyle-related diseases such as cardiovascular conditions and diabetes has intensified consumer interest in ingredients like beta-glucan that offer preventive health benefits.

The food and beverage industry is the primary end-user of oat beta-glucan, utilizing it in products such as bakery items, cereals, dairy alternatives, and nutritional bars. Its ability to improve texture, stability, and fiber content makes it a valuable functional ingredient. Additionally, the pharmaceutical and cosmetic sectors are exploring beta-glucan’s immunomodulatory and skin health properties, broadening application scopes.

Market growth is bolstered by increased consumer preference for natural and plant-based ingredients amid rising health consciousness. The shift towards clean-label products and organic formulations further propels demand. Moreover, regulatory approvals and health claims supporting beta-glucan’s efficacy enhance its acceptance among manufacturers and consumers.

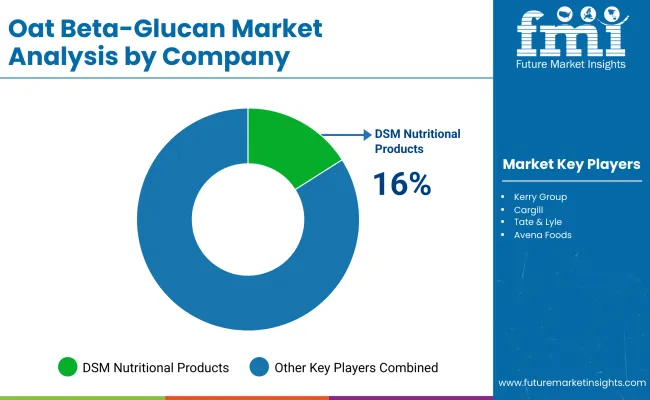

In March 2025, DSM Nutritional Products launched OatWell™ Pro, an oat beta-glucan ingredient designed to support heart health and blood sugar management. This product is part of DSM's commitment to providing clean-label, plant-based nutritional solutions. OatWell™ Pro is derived from high-quality oats and offers a neutral taste, making it suitable for incorporation into a variety of food and beverage applications. The launch reflects the growing demand for functional ingredients that contribute to overall wellness.

Sustainability and clean sourcing are important trends, with manufacturers emphasizing responsible oat cultivation and environmentally friendly extraction methods. This aligns with consumer demand for ethically produced and sustainable ingredients. Challenges such as supply chain variability, product standardization, and regulatory differences across regions may pose constraints. Nonetheless, ongoing innovation and increasing investment in research and development are expected to strengthen market prospects.

| Attributes | Description |

|---|---|

| Estimated Global Oat Beta-Glucan Industry Size (2025E) | USD 0.8 billion |

| Projected Global Oat Beta-Glucan Industry Value (2035F) | USD 1.8 billion |

| Value-based CAGR (2025 to 2035) | 8.3% |

Per capita consumption of oat beta-glucan varies widely across countries, reflecting differences in dietary patterns and staple foods. Finland stands out as one of the highest consumers, where daily intake levels approach 0.7 g per person, supported by a strong cultural presence of oat-based foods such as porridge and breads.

In contrast, the United States shows minimal penetration, with average intake levels closer to 0.05–0.10 g per person per day. Oatmeal consumption remains a niche habit, and oat-derived beta-glucan intake sits far below thresholds required for recognized health benefits.

Regulatory authorities, such as the European Food Safety Authority, highlight that at least 3 g of oat beta-glucan per day is needed to deliver clinically proven cholesterol-lowering effects. When set against this benchmark, most markets remain underpenetrated, suggesting a substantial growth opportunity for functional foods and fortified products that close the gap between everyday diets and clinically relevant doses.

The broader implication is that countries with oat-centric cuisines naturally capture higher intakes, while regions dominated by wheat or rice staples lag behind. As consumer awareness of gut and heart health accelerates, the market potential for oat-based functional foods lies in bridging this consumption disparity.

The food and beverage segment is projected to hold a significant 49.8% market share in 2025, leading the oat beta-glucan market due to increasing consumer focus on health and nutrition. Manufacturers are actively developing oat beta-glucan-infused products such as oat-based drinks, smoothies, and functional beverages that offer convenient sources of dietary fiber and cholesterol-lowering benefits.

These products appeal to health-conscious consumers seeking easy-to-consume options that support heart health. In addition to beverages, snack foods like bars and cereals fortified with oat beta-glucan have gained popularity for their combined health benefits and taste appeal. This trend aligns with the growing demand for “better-for-you” foods and allows manufacturers to capitalize on expanding health food markets.

The incorporation of oat beta-glucan enhances the nutritional profile of food products, positioning it as a key ingredient in modern diets. As consumer awareness rises and regulatory support for health claims increases, the food and beverage segment is expected to sustain strong growth and remain a primary driver for oat beta-glucan sales through 2035.

The powder form segment is anticipated to secure a dominant 60.7% market share in 2025, reflecting its pivotal role in the oat beta-glucan market. Powdered oat beta-glucan offers manufacturers unmatched versatility, allowing seamless incorporation into various products including smoothies, baked goods, and snacks without adversely affecting taste or texture.

This form is highly concentrated, meaning smaller quantities achieve desired health benefits, enabling cost-efficient production and formulation flexibility. Such advantages facilitate precise labeling and marketing claims related to cholesterol reduction and heart health, meeting the growing consumer demand for scientifically backed nutritional products.

The powder’s ease of use in formulation streamlines product development and expands its application across food and beverage categories. As consumers increasingly seek convenient, nutritious options with minimal preparation, powder-based oat beta-glucan is well-positioned to drive innovation and growth in the market. Ongoing advancements in processing and formulation technologies will further enhance its appeal, supporting sustained dominance in this segment over the forecast period.

A growing awareness of the benefits of health and nutraceutical food has greatly helped drive the market for functional food, including oat beta glucan food. Thus, people turn to natural components with the needed health values added oat beta-glucan is known to reduce cholesterol and be beneficial for the heart.

Not only does this trend tend to lead manufacturers to include oat beta-glucan in more foods together with cereal, snacks, and drinks, but it also promotes the reformulation of foods with improved flavor and texture.

Further, the increasing focus on fibers and their benefits in digestive health puts oat beta-glucan as a key ingredient in the natural/functional food-products portfolio. This transition towards a high consumption of functional food is predicted to further fuel the market growth because it presents manufacturers with numerous opportunities to develop new products for the health-conscious population.

It also reveals that for oat beta-glucan manufacturers who want to improve their product portfolio investing in the R/D is vital. The approach to R&D allows companies to look for additional functions of oat beta-glucan and its use in other products, including gluten-free foods and nutrition supplements. It not only expands the range of products for these ingredients but also meets a new trend in consumers’ preferences toward healthy foods.

Moreover, R&D initiatives sometimes produce enhanced extraction and purging methodologies which substantially enhance the purity of oat beta-glucan besides improving its functional characteristics.

This is because manufacturers, who invest more in their research, can create product formulations that are distinct in their health benefits, and therefore take up a lion’s share of the market. With consumers’ preferences changing from time to time, the only way to level the competition in products under the health foods and functional ingredients category will be to continue investing in R&D.

This is why regulatory support for the oat beta-glucan market is an important factor, including statements from regulatory bodies such as the FDA that provide health claims for the substance. Such endorsements confirm the benefits of oat beta-glucan, including a well-proven ability to lower cholesterol.

The above regulatory support not only affirmations marketing communications information but also motivates manufacturers to patent their products through research and development. Since numerous researches draw attention to the impact of oat beta-glucan on health, the regulating authorities, in turn, extend the approved messages concerning its benefits, which will stimulate market potential.

This environment of increased credibility helps manufacturers to place products more appropriately and be appealing to health-conscious individuals. Therefore, with the scientific proof and support from the regulation, the oat beta-glucan should increase the food and supplement industries’ sales and improve its status.

Global sales increased at a CAGR of 8.0% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 8.3% CAGR.

Between 2020 and 2024, the oat beta-glucan market across the world also experienced sales growth because of the increasing consumer knowledge related to the product. Companies stayed tight on product differentiation, fortifying oat beta-glucan in gluten-free and other functional foods, catering to newly emerging consumers’ tastes.

Sustainability efforts also emerged, and firms began to discuss their environmentally friendly procurement and manufacturing procedures, which consumers with extensive environmental awareness would find favor with. North America led in sales, and a new growth area was the Asia-Pacific region, which demonstrated different types of markets related to regional consumers. In balance, the situation on the market was quite stable and showed the ability to stimulate and adapt.

From the year 2025 to 2035, the current consumption trends for oat beta-glucan are allied with the rising health consciousness and the need for functional food products for heart and gastrointestinal health. The trend here is that manufacturers are busy with product differentiation where oat beta-glucan is being used in most of the product segments such as snacks and beverages.

Pricing for Sustainable is also a factor, as customer’s desire to know the origin of products they need is growing day by day. Future perspectives are connected with the development in the sphere of individual diet with the use of oat beta-glucan in processing technologies for the improvement of the product and the development of its new characteristics, all these factors will contribute to the further growth of demand in the market.

The major producer of oat beta-glucan is tier 1 manufacturers who have dominant controls of market share and vast distributive channels. Select listed industries and manufacturers spend a lot of capital on research and development, and thus accommodate market demands for new products and services.

Owing to their brand loyalty and dominant marketing strategies, they encourage the congregation of a significant percentage of the market. Companies within this tier include Oatwell, DSM, and Kerry Group, they deploy their skills to tap into expanding healthwise ingredients demand.

Tier 2 are companies that are not global but have a strong position in certain segments of the automotive market. Most of these firms are regionally orientated which makes it easier for them to be in a position to meet market needs and demands of that area.

They do not rank globally as Tier 1 players but they are well capable of competing within their regions or as local players. The middle or Tier 2 manufacturers include GrainsCanada, Avena Foods, and MGP Ingredients, who position their products as healthy and sustainable.

Tier 3 represents small producers offering products for specific markets or outsourcing producers introducing oat beta-glucan enriched products on the market. These companies will normally cover certain niches like organic food or gluten-free products and therefore will have relatively small but strong customer bases.

This makes them well suited to adapt to micro trends and the needs of the consumer in the marketplace. For instance, dominated by other smaller brands such, as NutraBlast, Oatsome, and Finnish Oat Fiber stress product differentiation and local procurement hence diversifying the oat beta-glucan market.

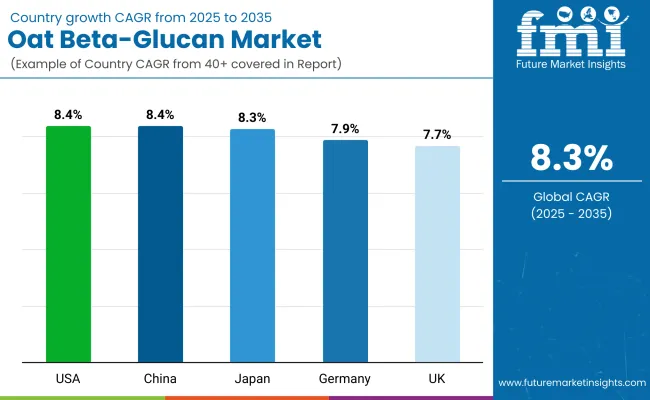

The following table shows the estimated growth rates of the top three territories. The USA and China are set to exhibit high consumption, recording CAGRs of 8.4% and 8.4%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The USA | 8.4% |

| Japan | 8.3% |

| China | 8.4% |

Currently, more and more customers in Japan’s market pay great attention to their health, resulting in more demand for functional foods. Of all the elevated ingredients, oat beta-glucan has become one of the most appreciated due to its health benefits including the control of cholesterol and; thus, the heart.

This trend has led the manufacturers to embark upon functional foods and diversification with applications for oat beta-glucan in functional foods including snacks, functional drinks, and dietary supplements. Kerry Group, Oatwell, and MGP Ingredients for example are supporting this trend by creating products that cater to the increasing demand by consumers for health-conscious ingredients.

Also, the permission given to dietary health claims concerning oat beta-glucan improves the market prospects of the product. Dietary trends have shown that the Japanese consumer looks for natural and functional ingredients when choosing foods, which is expected to gradually extend the functionality of oat beta-glucan in the functional foods business.

Market prospects of beta-glucan have never seen any threat in the USA market and the manufacturers will experience a high deal of growth in the further years. Increasing consumer knowledge of the reputational values of beta-glucan especially that it decreases cholesterol and is beneficial to the health of the heart according to current research studies.

Since people today are more concerned with their health they look for functional foods and dietary supplements and therefore, manufacturers have taken the step to add this beta-glucan in a broad variety of products such as cereals, snack foods, and beverages.

Companies are using the endorsement of various regulatory authorities including the FDA to promote the health benefits surrounding fiber and more specifically beta-glucan. Players like Kerry Group, Oatwell, and MGP Ingredients are leading the innovation charge, broadening More than just being derived from grains, the product portfolios of key players like Kerry Group, Oatwell, and MGP Ingredients are continuing to grow in response to demand.

According to various research, the market is growing at an estimated CAGR of 6-8% in the USA and the demand of this health-focused segment offers great potential for the manufacturers to make their position in this market.

Oat manufacturers in China are also improving their product development strategies by emphasizing the need to diversify products to meet the changing market trend. Meanwhile, there is an increase in awareness of healthy food, and therefore, oats and snacks, oat-based beverages, and gluten-free products are entering the market. All these innovations seek to cater to the need for healthy and easy-to-prepare foods.

Traditional oat snacks like oat bars and oat cookies are useful for the busy consumer while oat drinks provide the functionality of dairy in a non-dairy product ideal for the plant-based consumer. Moreover, gluten-free oats specialty products are finding entrée with clients with special dietary needs, thereby broadening the market universe.

The change is indicative of the general efforts in the Chinese food market to better address the improved dietary concerns of consumers. These companies are not only offering new and better oat products but they are also providing their consumers with a lot more options as well as helping the growth of the nutritious food industry within this region.

The competition structure of the oat beta-glucan market is shifting slowly but step by step towards a higher level of competitiveness due to the consumers’ increasing concern about their health. They are incumbent food makers, specialty enzymes and specialty chemicals companies, and new-age companies that specialize in functional foods.

Some of the large manufacturers use sophisticated processing techniques to increase the solubility and effectiveness of oat beta-glucan in their product line, claiming a premium position in markets that are highly sensitized to health benefits.

Moreover, the industrial relationships between the oat ingredients’ suppliers and food producers are strengthening, thus enabling the launching of new oat-containing foods. Local contenders are also emerging in the market and they are coming up with more specific solutions that they understand will be well received in the region.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 0.8 billion |

| Projected Market Size (2035) | USD 1.8 billion |

| CAGR (2025 to 2035) | 8.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and tons for volume |

| Forms Analyzed (Segment 1) | Powder, Liquid |

| Applications Analyzed (Segment 2) | Food and Beverage (Bakery Products, Dairy Products, Functional Foods, Beverages), Pharmaceutical, Nutraceutical, Animal Nutrition, Personal Care & Cosmetics |

| Distribution Channels Analyzed (Segment 3) | Offline (Modern Trade, Health Foods Stores, Pharmacies or Drug Stores, Other Offline Retails), Online |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Oat Beta-Glucan Market | Oatwell, DSM Nutritional Products, Kerry Group, Cargill, Tate & Lyle, Granotec, BASF, Hawkins Watts, Oatside, Nutraceutical International Corporation, Avena Foods, Others |

| Additional Attributes | Dollar sales by form (powder vs liquid), Dollar sales by application (functional foods, nutraceuticals, pharma), Role of beta-glucan in cholesterol and gut health, Consumer preference for clean-label oat-derived ingredients, Growth in e-commerce and pharmacy sales of oat-based supplements |

| Customization and Pricing | Customization and Pricing Available on Request |

As per Form, the industry has been categorized into Powder and Liquid.

As per Application, the industry is categorized into Food and Beverage (Bakery Products, Dairy Products, Functional Foods, and Beverages), Pharmaceutical, Nutraceutical, Animal Nutrition, and Personal Care & Cosmetics.

As per distribution channel, the industry has been categorized into Offline (Modern Trade, Health Foods Stores, Pharmacies or Drug Stores, and Other Offline Retails), and Online.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global industry is estimated at USD 0.8 billion in 2025.

Sales increased at a CAGR of 8.0% between 2020 and 2024.

Key players include Oatwell, DSM Nutritional Products, Kerry Group, Cargill, Tate & Lyle, Granotec, BASF, Hawkins Watts, Oatside, Nutraceutical International Corporation, and Avena Foods.

North America is projected to hold a revenue share of 25.3% over the forecast period.

The industry is projected to grow at a CAGR of 8.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat Proteins Market Size and Share Forecast Outlook 2025 to 2035

Oats Market Analysis - Size, Share, and Forecast 2025 to 2035

Oat Drink Market Analysis - Size, Share & Forecast 2025 to 2035

Oat Milk Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Oat Protein Market Trends - Plant-Based Nutrition & Industry Demand 2024 to 2034

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Boat Wiring Harness Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Goat Milk Products Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA