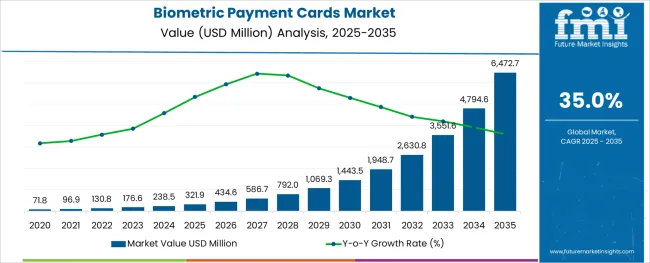

The Biometric Payment Cards Market is estimated to be valued at USD 321.9 million in 2025 and is projected to reach USD 6472.7 million by 2035, registering a compound annual growth rate (CAGR) of 35.0% over the forecast period.

The biometric payment cards market is expanding rapidly as the demand for secure and convenient payment methods grows worldwide. Consumers and financial institutions alike are prioritizing enhanced security features to reduce fraud and improve transaction safety. Technological advancements have enabled the integration of fingerprint sensors and biometric authentication directly onto payment cards, providing a seamless and user-friendly experience.

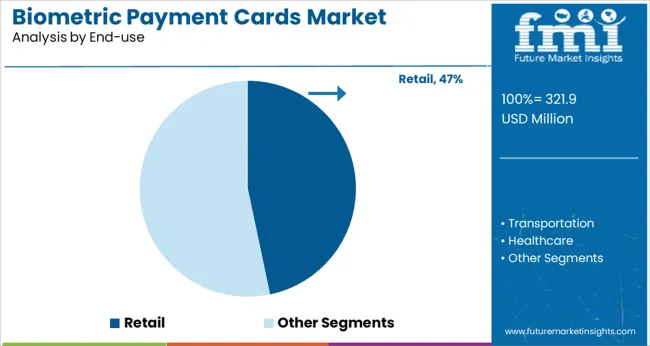

The retail sector has emerged as a key driver, with merchants adopting biometric cards to streamline checkout processes and offer customers increased confidence in payment security. Growing e-commerce activity and contactless payment trends have further accelerated market adoption.

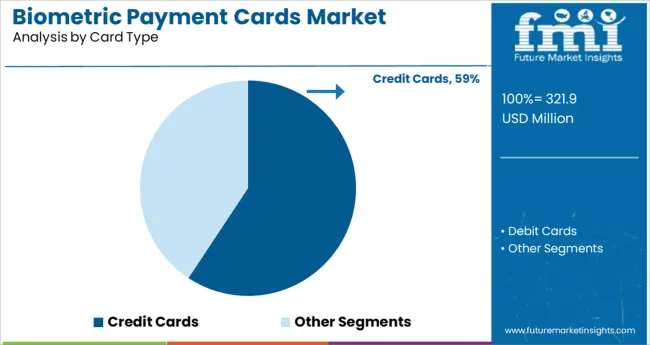

Future growth is expected to be supported by rising consumer awareness, expanding digital infrastructure, and increased regulatory focus on secure payment systems. Segmental leadership is expected from the Credit Cards type due to their widespread usage and the Retail sector as the primary end-use, reflecting consumer and merchant demand for secure and efficient payment solutions.

The market is segmented by Card Type and End-use and region. By Card Type, the market is divided into Credit Cards and Debit Cards. In terms of End-use, the market is classified into Retail, Transportation, Healthcare, Hospitality, Government, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Credit Cards segment is projected to hold 59.3% of the biometric payment cards market revenue in 2025, maintaining its leading position. Credit cards continue to dominate consumer payment preferences due to their convenience and credit facilities. The integration of biometric authentication has enhanced the security of credit card transactions, addressing concerns related to card theft and unauthorized use.

Consumers and banks have favored biometric credit cards for the reduced reliance on PIN codes and passwords, making payments quicker and safer. This segment benefits from strong issuer support and extensive merchant acceptance networks.

The ongoing push toward secure digital payments is expected to keep the Credit Cards segment at the forefront of biometric card adoption.

The Retail segment is anticipated to contribute 46.7% of the biometric payment cards market revenue in 2025, positioning it as the dominant end-use sector. Retailers are increasingly adopting biometric payment cards to enhance customer experience through faster checkout and reduced fraud.

The sector benefits from high transaction volumes and frequent consumer interactions, making secure payment methods a priority. Retail environments, including supermarkets, department stores, and specialty shops, have invested in biometric-compatible point-of-sale systems to support seamless transactions.

Additionally, the rise in contactless payments and omnichannel retail strategies has reinforced the demand for biometric authentication. As retail competition intensifies, merchants view biometric cards as a way to increase consumer trust and loyalty. The Retail segment is expected to continue driving growth in biometric payment card usage.

Another significant factor driving the biometric payment cards market growth is the growing demand for biometric payment cards on a global scale. The biometric payment cards market players are heavily invested in the introduction of biometric payment cards. As a result, the introduction of more biometric payment cards has increased the adoption of these smart cards by customers and businesses.

For instance, 81.0% of all global consumers preferred the use of fingerprint biometrics over PIN codes in 2024, according to IDEMIA, a security company.

Debit and credit cards were equipped with the same biometric technology found in mobile phones to ensure maximum security when processing contactless payments, which led to the acceptance and widespread demand for biometric payment cards.

Furthermore, the primary driver of the expansion of biometric payment cards market future trends was the widespread adoption of biometric payment cards. The aforementioned elements thus contribute to the biometric payment cards market’s continued expansion.

Although demand for biometric payment cards is growing, their higher cost poses a challenge and may limit the biometric payment cards market growth during the anticipated period.

Another problem with the biometric payment cards market is that the majority of businesses are still engaged in pilot projects, which raises doubts about the technology's eventual commercialization.

As the biometric payment cards market participants are working together to cut costs, it is anticipated that the fees for the biometric payment card will decrease.

For example, Zwipe and IDEMIA, who have partnered, are on track to deliver significant unit cost reductions for biometric payment cards by presenting a single silicon solution.

Although the biometric payment cards market is expanding, the higher cost of these cards can be a problem and may limit the biometric payment cards market opportunities during the anticipated period.

Another problem with the biometric payment cards market is that the majority of businesses are still running pilot programmes, which begs the question of whether the technology will actually be commercialized.

With a revenue share of more than 29%, the retail sector dominated the biometric payment cards market share. With a noteworthy CAGR of 63.3% over the course of the forecast period, the retail segment is also anticipated to grow the fastest for the biometric payment cards market.

NFC, QR codes, and voice payment methods have already been adopted by the retail sector, opening up biometric payment cards market opportunities for segment growth. Additionally, retailers are largely implementing the contactless digital payment method.

The biometric payment cards market players have also partnered with companies to use their retail networks in an effort to spread adoption of biometric payment cards.

Throughout the forecast period, it is anticipated that the hospitality segment will experience significant biometric payment cards market growth. In order to allow customers to pay directly using fingerprint scanners, restaurants and hotels have installed biometric digital payment systems.

For instance, Hitachi has developed a fingertip payment system that allows users to make purchases simply by having their fingers scanned at the device. Therefore, it is anticipated that the hospitality sector's adoption of biometric payment cards systems will accelerate the uptake adoption of biometric payment cards.

With a revenue share of more than 64.0%, the debit cards' biometric payment cards market segment is anticipated to be the biometric payment cards market leader.

Debit cards with fingerprint sensors are currently being tested by companies in the biometric payment cards market. The majority of the biometric payment cards market players have also successfully finished the pilot program for debit cards.

During the forecast period, the credit card segment is anticipated to grow at the fastest rate, with a CAGR of 62.7%. The segment growth is anticipated to be fueled by people using credit cards more frequently, surging the biometric payment cards market size. The adoption of biometric payment cards is the result of a variety of factors, including, among others, using the bank's leverage, receiving cash back, and receiving discounts.

Additionally, banks are starting to test out biometric credit cards, which is increasing the adoption of biometric payment cards.

North America held a commanding biometric payment cards market share of more than 35.0%. The existence of a sizable number of businesses operating in the biometric payment cards market can be blamed for the expansion of the regional biometric payment cards market.

According to Visa, contactless payments will be possible on more than 70% of Visa cards in New York as of April 2024.

Such acceptance is being sparked by the New York MTA's introduction of contactless on all subways and buses. Therefore, it is anticipated that the increased use of contactless cards as a form of payment in North America will open up biometric payment cards market opportunities and hence biometric payment cards market growth for the local biometric payment cards market.

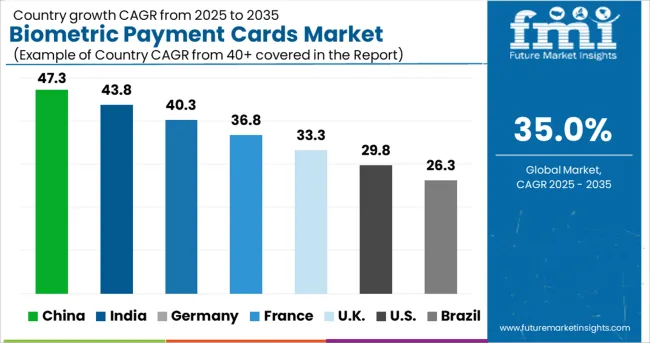

With a CAGR of 63.6%, Asia Pacific is anticipated to grow the fastest during the forecast period. Some of the major biometric payment cards market players, including Goldpac Fintech, are based in Asia Pacific. Additionally, biometric payment cards market participants plan to introduce biometric payment cards in nations throughout the Asia Pacific.

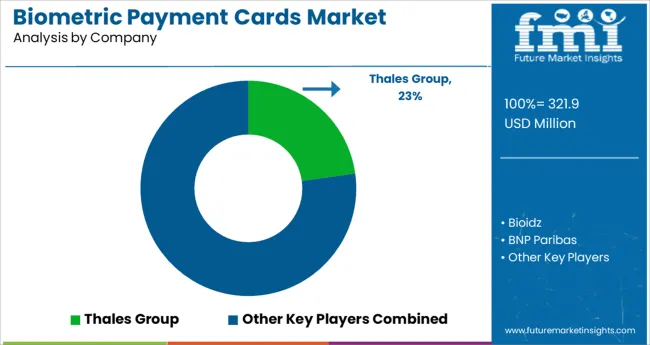

The biometric payment cards market can be characterised as being slightly fragmented. In an effort to strengthen their position in the biometric payment cards market, leading biometric payment cards market players are pursuing a variety of strategies, including strategic partnerships, product innovations and launches, mergers and acquisitions, and geographic expansion.

While some biometric payment cards market players are concentrating on piloting the biometric credit and debit cards to quickly introduce the commercialization of these smart cards, others are concentrating on launching the biometric payment cards to offer customers a secured contactless payment processing experience.

Businesses are implementing a variety of strategies to increase biometric payment cards market share as a result of biometric payment cards market competition. The most widely used tactic is strategic partnerships. The businesses are collaborating to introduce biometric payment cards.

Recent Development:

The global biometric payment cards market is estimated to be valued at USD 321.9 million in 2025.

It is projected to reach USD 6,472.7 million by 2035.

The market is expected to grow at a 35.0% CAGR between 2025 and 2035.

The key product types are credit cards and debit cards.

retail segment is expected to dominate with a 46.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Payment Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Payment Bank Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biometric Vehicle Access Market Size and Share Forecast Outlook 2025 to 2035

Payment Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biometric PoS Terminals Market by Technology, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Biometric Driver Identification System Market Growth - Trends & Forecast 2025 to 2035

Biometric Sensors Market Trends – Growth & Forecast 2025 to 2035

Biometric-as-a-Service Market Forecast 2025 to 2035

Biometric Lockers Market

ePayment System Market Analysis by Component, Deployment, Enterprise Size, Industry, and Region through 2025 to 2035

B2B Payments Platform Market

Mobile Payment Transaction Market Analysis – Growth, Applications & Outlook 2025 to 2035

Crypto Payment Gateways Market Insights - Trends & Growth 2025 to 2035

Mobile Payment Data Protection Market Trends – Growth & Demand 2024-2034

Mobile Payment Security Market Insights – Growth & Demand 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Mobile Payment Technologies Market

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Instant Payments Market Size and Share Forecast Outlook 2025 to 2035

Virtual Cards Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA