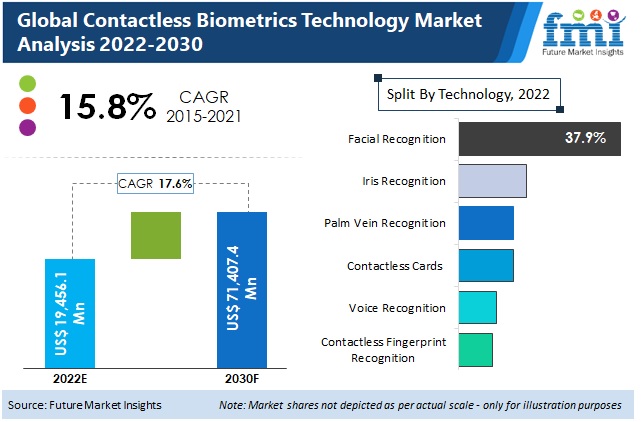

The global Contactless Biometric Technology market is projected to grow significantly, from USD 25,208.2 Million in 2025 to USD 119,265.5 Million by 2035 an it is reflecting a strong CAGR of 12.8%. Contactless Biometric Technology refers to the advanced technology that enables users to authenticate themselves without making physical contact using biometric identifiers.

From BFSI to healthcare to IT, various verticals are adopting biometric solutions globally for improved security, fraud detection, and seamless identification processes. Convenience in user experience is compelling enterprises to embrace the trend of contactless authentication, now and especially in the post-pandemic world. Regulatory standards like GDPR (in Europe) and CCPA (California) are driving organizations toward strict security implementation.

Regulations demand data privacy, secure authentication, and fraud prevention - contactless biometric solutions are vital due to the nature of these requirements. These technologies are being adopted by organizations to ensure compliance with changing regulatory standards and boosting security infrastructure.

Businesses during transformation are adopting the contactless biometric technologies for the identity verification, payments, and access control. With the rise of cloud services, IT outsourcing, and remote work, there is a growing need for advanced biometric authentication systems to secure sensitive information and improve operational efficiency.

Increasing cyber threats have amplified the demand for biometric security solutions. Identity theft, data breaches, and unauthorized access pose significant threats to organizations; therefore, real-time authentication and compliance monitoring are essential.

Biometric technologies that do not require contact, including facial recognition, fingerprint scanning, and iris recognition, provide strong security measures to mitigate the risks of cyber threats. North America accounts for the highest market share due to the stringent regulatory requirements as well as high emphasis on cyber security and prominent biometric solution providers.

Adoption is also accelerating due to the increasing digital economy and more regulatory scrutiny. In Comparison, nations such as India and Australia face increasing demand as companies of all sizes grow and invest in more advanced security solutions to guard their growing digital ecosystems.

| Company | NEC Corporation |

|---|---|

| Contract/Development Details | Awarded a contract by Vienna Airport to deploy contactless biometric solutions for seamless passenger boarding, enhancing security and efficiency in airport operations. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 15 |

| Renewal Period | 5 years |

| Company | Fingerprint Cards AB |

|---|---|

| Contract/Development Details | Partnered with Seshaasai to introduce contactless biometric payment cards in the Indian market, aiming to enhance secure and convenient transactions for consumers. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 10 |

| Renewal Period | 3 years |

Growing reliance on digital payments and identity verification

It fuels the need for contactless biometric as more and more people are hopping on the bandwagon of digital payments. With financial institutions and e-commerce platforms ramping up their digital payment infrastructure, biometric authentication methods (such as facial recognition, fingerprint scanning and voice recognition) are increasingly being incorporated into fraud prevention.

These solutions are favored amongst consumers given their ease of use and added security compared to older PINs or passwords. Even governments are pressing for secure digital transactions. As an example, one national financial authority recently revealed that more than 80% of digital transactions last year used biometric authentication to prevent fraud and unauthorized access.

It indicates a decisive move away from traditional account verification and towards the use of biometrics, particularly in the digital banking and e-commerce sectors. Furthermore, many countries are taking steps to ensure compliance with anti-money laundering regulations by implementing biometric-based Know Your Customer (KYC) verification for financial services.

As the number of cyber-attacks and data leaks increased, businesses and various governmental authorities have been shifting focus towards advanced authentication solutions, which has made contactless biometrics the go-to enabler in terms of secure digital financial ecosystems.

Biometric Authentication in Banking, Retail, and Other Financial Services The increasing shift towards digital payments, supported by regulatory authorities and technological advancements, is boosting the adoption of biometric authentication in banking, retail, and other financial services.

Increasing smartphone penetration with built-in biometric capabilities

Biometric authentication has evolved to become a central pillar of smartphones, as manufacturers integrated fingerprint scanners, face unlocks, and iris scanning for security. The rapid popularity of mobile payment systems and digital wallets is accelerating the demand for smartphones with biometrics capabilities.

Governments are capitalizing on this trend tomake citizen authentication for public services more secure. A recent government digital initiative highlighted that mobile-based authentication integration has allowed over 90 million citizens to secure ongoing access to digital identity systems and financial services as they submitted their biometric data.

Especially in developing economies, rapid growth of smartphone penetration is a driver for the adoption of biometric authentication in everyday transactions. Furthermore, mobile manufacturers keep introducing more innovative techniques to enhance the accuracy and secure nature of biometric authentication, thus making contactless authentication more secure as ever.

Those services expanded into companies being able to onboard and verify user identities remotely with biometric-enabled smartphones, as well as enabling seamless and secure experiences to their customers. Biometric security will become a critical aspect of how we transact, communicate, and engage online, driving increased reliance on mobile-based authentication and further solidifying biometric technologies.

Increasing use of cloud-based biometric solutions for scalability

Cloud biometric solutions are becoming popular as companies consider scalable and efficient authentication systems. These solutions provide businesses with the ability to store and process biometric data securely while enabling real-time cross-platform authentication. Cloud-based biometric databases are being used by governments as well to speed up the verification process.

The government announcement claimed that 150 Million+ biometric records have been stored securely on a national cloud infrastructure to enable e-governance services, border security, and digital identity verification. The Biometric Cloud Authentication enables the enterprises and huge organizations to perform the biometric authentication quickly without investing a fortune in either devices or infrastructure.

With wide-ranging expansion of digital capabilities across the businesses domain, scalable authentication solutions have become increasingly in demand, especially in the fields of banking, healthcare and corporate security. Cloud-based biometric systems allow for constant monitoring and fraud detection, making cybersecurity more robust.

AI & Machine Learning is another emerging technique for cloud biometrics which increases their accuracy and adaptability, thus making it the popular choice for organizations in search of an authentication solution that is future-ready. With governments and enterprises undergoing digital transformations, cloud-based biometric security will continue to flourish as an apt alternative for a scalable identity verification system.

High implementation costs for advanced biometric infrastructure

The high implementation cost of contactless biometric technology is a major restraint for several organizations. Futuristic biometric systems might need the deployment of high-end hardware, including specialized cameras, sensors, and AI-driven processing units. Moreover, businesses also require sturdy IT support for real-time authentication and data storage, which adds greatly to the cost.

Furthermore, enterprises need to integrate their biometric authentication with existing security architectures, which may involve expensive software upgrades and system adjustments for vast deployments. Such costs can be prohibitive for SMEs and slow down large-scale adoption, however.

The organizations are investing in trained professionals, operating, and maintaining biometric systems. High-end computing power and secure cloud storage are also required for advanced biometric solutions; which will automatically increase operational expenditure over time.

This price component poses a great barrier to market penetration for low-service sectors, such as small businesses and public institutions, which have limited budgets. Moreover, as a live feature, biometric authentication must continuously evolve and update itself, which adds to long-term maintenance costs as well. Because of high financial overhead costs involved in deploying and maintaining biometric authentication solutions, it is accessible only to well-funded enterprises and government organizations.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced data privacy laws governing biometric data collection. |

| Touchless Technology Adoption | Widespread adoption of facial recognition and iris scanning for authentication. |

| Enterprise Security Integration | Contactless biometrics became standard in corporate security systems. |

| Healthcare & Public Safety Use | Hospitals and public transport integrated contactless biometric solutions. |

| Market Growth Drivers | Demand for hygienic authentication methods post-pandemic. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven biometric encryption ensures secure and compliant identity verification. |

| Touchless Technology Adoption | AI-powered multimodal biometrics integrate voice, facial, and behavioral recognition. |

| Enterprise Security Integration | AI-driven adaptive access control dynamically adjusts security levels based on real-time risk assessment. |

| Healthcare & Public Safety Use | AI-driven health diagnostics utilize biometric data for predictive healthcare insights. |

| Market Growth Drivers | Widespread adoption of decentralized identity verification in smart cities. |

The section highlights the CAGRs of countries experiencing growth in the Contactless Biometric Technology market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.9% |

| China | 14.7% |

| Germany | 10.3% |

| Japan | 12.9% |

| United States | 11.5% |

Biometric Payment Adoption in China with a growing trend, the number of biometric payment systems has reached high levels in China, especially in terms of retail and e-commerce. A more digitized consumer, greater use of mobile payment methods - the reliance on both facial recognition and fingerprint authentication has become essential and second nature for seamless transactions.

The direct meaning of "biometrics" in Mandarin is "biological measurement," and top platforms such as Alipay and WeChat Pay have added support for biometrics verification, enabling users to make contactless payments by scanning their faces.

The Chinese state has actively encouraged payment based on biometric data to improve both the safety and ease of payment at the expense of cash and credit cards. This action is consistent with China’s aspirations to be a cashless economy.

As part of the push for better policies, the People's Bank of China has urged banks and payment service providers to deploy biometric security as part of an effort to prevent fraud. According to the report, more than 80% of people using mobile payments in China use biometric authentication.

Moreover, in large cities like Shanghai and Beijing,170057 retailers have also deployed facial recognition kiosks for smooth checkouts,17462 where transaction time is lowered by 30%17358 than traditional checkouts.

Biometric payments have also been adapted by public transport systems, and metro users can now use facial scans to enter the metro services. That mass deployment highlights the increasing dependence on biometric authentication to enable both secure and frictionless transactions in China’s fast-growing digital economy.

Demand for biometric Know Your Customer (KYC) verification in India has surged due to a government mandate and the rise of fintech. For example, Aadhaar-enabled e-KYC allows financial institutions to remotely verify customers' identities in real time through biometric authentication which significantly expedites account openings and digital transactions.

With regulators such as the Reserve Bank of India (RBI) enforcing stringent compliance requirements, banks and fintech firms have adopted the biometric KYC solution to counter identity fraud and boost financial inclusion. This makes a big difference in rural areas, where document-based verification is often not possible.

More than 1.3 billion Aadhaar-enabled biometric authentication have been performed in the banking and financial services domain that has guaranteed half the onboarding time for opening bank accounts. In addition, biometric KYC: adoption has been even more accelerated by the Indian Government’s Digital India initiative, accelerating authentication of mobile wallets, microfinance and digital lending platforms.

According to the State Bank of India (SBI), in 2023, over 80% of accounts were opened using biometric KYC. Biometric authentication also mitigates the assumptions of identity fraud that traditional paper-based processes carry through, protecting against this sort of fraud. With the growing prevalence of digital transactions, biometric KYC will continue to serve as an indispensable measure in fortifying India’s financial ecosystem while also achieving regulatory compliance.

Corporate offices and critical infrastructure facilities in the United States are adopting biometric access control on a national scale. With the rise of cybersecurity threats and workplace security issues, organizations are replacing conventional keycards and passwords with facial recognition, iris scanning and fingerprint identification authentication.

Biometric access control has also been implemented by government agencies in high-risk areas including airports, defense facilities and data centers to strengthen the security measures. Through biometric security, the Department of Homeland Security (DHS) has implemented facial recognition systems in federal buildings to control access.

In October 2023, a government directive was issued that every federal agency building must utilize biometric verification by 2025, allowing employees and contractors secure access. USA companies such as Google and Apple have also responsive implemented biometric access systems on their premises, mitigating chances of unauthorized entry by 60%.

Biometrics technology will also help critical infrastructure facilities like power plants and research laboratories to prevent cyber threats and unauthorized breaches. At airports, the Transportation Security Administration (TSA) has also ramped up its biometric screening program, facilitating more than 3 million travelers with facial recognition.

The section contains information about the leading segments in the industry. By Technology, the Facial Recognition segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Application, Identity Verification segment hold dominant share in 2025.

| Technology | CAGR (2025 to 2035) |

|---|---|

| Facial Recognition | 14.4% |

In terms of industry, facial recognition technology is booming in security, payments, health care, and retail. Elevating demand for inducing a smooth and contact-less authentication, has resulted in a substantial usage in smartphones, banking, public surveillance, and transportation.

Facial recognition is widely used by governments for security related purposes such as identity verification, border control and law enforcement. AI-powered facial recognition systems have been used in airports in countries such as China and the USA, enabling 40% reductions in passenger boarding times.

By 2025, the USA Department of Homeland Security plans to deploy its facial recognition program at 97% of international passengers in the USA And similarly, China has rolled out facial recognition surveillance in major cities to prevent crime and ensure public safety, with an estimated 600 million cameras in use.

The Indian state has also deployed the world’s largest biometric systems, where the government would match individual faces for Aadhaar-based verification of public services. With the increasing concern to stay protected, governments follow strict policies that ensure that ethical usage is scaled by compliant data privacy laws. The increasing convenience and enhanced accuracy of facial recognition technology for access control contribute to its fast expansion into contactless biometric systems in numerous industry sectors.

| Application | Value Share (2025) |

|---|---|

| Identity Verification | 45.3% |

This segment is the largest segment of the contactless biometric technology market, owing to the wide-ranging applications of contactless biometric technologies in financial services, government and digital security. With the growing threat of fraud and cybercrime, organizations are focused on secure authentication mechanisms to keep sensitive information secure.

Across several sectors, including banking, border control, and healthcare, contactless biometric solutions (e.g., facial recognition, fingerprint, and iris) are prevalent. In the fight against identity fraud, governments are stepping up with stringent identity verification measures to help ensure safe online transactions.

In the USA, biometric verification via government portals has been implemented at the Social Security Administration, reducing the number of online fraud cases by 30% over the past two years. The Aadhaar biometric database created and maintained by the government of India, which covers more than 1.3 billion Indian citizens, remains the de facto standard for identity verification in banking, welfare schemes and mobile SIM registration.

New digital identity regulations have also been implemented in the European Union, requiring people to complete biometric verification before executing digital financial transactions. Furthermore, banks reported a 50% reduction in verification time with the adoption of biometric-based KYC (Know Your Customer) processes in fintech. The robust government support and rising security concerns are expected to keep identity verification as the largest segment in the contactless biometric market.

The demand for contactless biometric technology is on the rise, with its ability to provide a high level of security and convenience in identity verification. Applied in government, banking, healthcare and consumer electronics, companies are investing heavily in AI powered facial recognition, iris scanning, and palm vein technology. Top players leverage advanced algorithms, high-accuracy authentication, and integration with cloud-based security solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thales Group | 22-27% |

| NEC Corporation | 15-20% |

| IDEMIA | 12-18% |

| Cognitec Systems | 8-12% |

| Aware, Inc. | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thales Group | Specializes in AI-driven facial recognition, fingerprint, and iris scanning for border security, banking, and national identity programs. Focuses on privacy-enhancing technologies. |

| NEC Corporation | Develops high-accuracy facial recognition and behavioral biometrics for public safety, airport security, and corporate authentication. Strengthens deep learning algorithms. |

| IDEMIA | Offers biometric authentication for secure payments, travel security, and government ID solutions. Expands biometric access control and fraud detection capabilities. |

| Cognitec Systems | Provides scalable facial recognition for border control, retail analytics, and enterprise security. Focuses on AI-powered real-time verification. |

| Aware, Inc. | Specializes in multimodal biometric authentication, cloud-based identity verification, and contactless onboarding solutions for enterprises and governments. |

Strategic Outlook

Thales Group (22-27%)

Thales Group biometric authentication market leaders provide innovative solutions specifically in the fields of AI facial recognition, fingerprint scanning, and iris recognition. The company offers secure digital identity authentication for government, banking, and border security uses.

Thales invests in privacy-by-design technologies and anti-spoofing solutions to enhance authentication accuracyThales invests in privacy-by-design technologies and anti-spoofing solutions to enhance authentication accuracy.

NEC Corporation (15-20%)

NEC Corporation is a leader in accurate facial recognition and behavioral biometrics. The company serves public safety, corporate security, and smart city initiatives, embedding AI-driven facial recognition in surveillance and authentication systems. NEC technology for deep learning enhances fraud detection and biometric verification in high-security environment.

IDEMIA (12-18%)

IDEMIA provides secure biometric authentication solutions for border control, financial services, and mobile identity verification. Integrate biometrics in digital payments, which helps to enhance fraud prevention in financial transactions, that leverage will help to get its strengthened position. IMDEDIAMIA is building its portfolio of multimodal biometric systems that integrate facial, iris, and palm vein identification with combined facial and iris modalities.

Cognitec Systems (8-12%)

Cognitec Systems specializes in facial recognition for border control, retail analytics, and access control. They actively enhance AI-powered authentication for faster real-time identification. Cognitec focuses on compliance-driven biometric solutions, guaranteeing adoption in highly-regulated industries such as law enforcement and government services.

Aware, Inc. (6-10%)

Aware, Inc. is recognized as the advanced cloud-native biometric authentication provider for enterprises and governments. The firm is focused on multimodal biometrics, providing facial, voice and finger recognition for contactless identity verification. Aware's AI-based identity proofing and fraud detection technologies make it a significant force in secure digital onboarding and remote authentication.

Other Key Players (25-35% Combined)

Companies such as HID Global, Fujitsu Limited, Suprema Inc., BioID GmbH, and Fingerprint Cards AB add to the growth of the market. Such companies are targeting niche biometrics - for example, palm vein authentication, multimodal biometrics and embedded biometrics for smartphones and access control. They are driving greater adoption in financial services, healthcare and consumer electronics.

In terms of System, the segment is segregated into Contactless Fingerprint Technology, Facial Recognition, Iris Recognition, Palm Vein Recognition, Voice Recognition and Contactless Cards.

In terms of Component, the segment is segregated into Hardware, Software and Services.

In terms of Application, it is distributed into Identity Verification, Payments & Transactions and Access Control.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Contactless Biometric Technology industry is projected to witness CAGR of 12.8% between 2025 and 2035.

The Global Contactless Biometric Technology industry stood at USD 25,208.2 million in 2025.

The Global Contactless Biometric Technology industry is anticipated to reach USD 119,265.5 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.5% in the assessment period.

The key players operating in the Global Contactless Biometric Technology Industry Thales Group, NEC Corporation, IDEMIA, Cognitec Systems, Aware, Inc., HID Global, Fujitsu Limited, Suprema Inc., BioID GmbH, Fingerprint Cards AB.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Component, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Component, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Component, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Component, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 26: Global Market Attractiveness by Technology, 2023 to 2033

Figure 27: Global Market Attractiveness by Component, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Industry, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 56: North America Market Attractiveness by Technology, 2023 to 2033

Figure 57: North America Market Attractiveness by Component, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Industry, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contactless Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Contactless Ticketing ICs Market

Contactless Smart Card Market

Contactless Payment Market

Contactless Payment Terminals Market

Biometric Vehicle Access Market Size and Share Forecast Outlook 2025 to 2035

Biometric Payment Cards Market Size and Share Forecast Outlook 2025 to 2035

Biometric PoS Terminals Market by Technology, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Biometric Driver Identification System Market Growth - Trends & Forecast 2025 to 2035

Biometric Sensors Market Trends – Growth & Forecast 2025 to 2035

Biometric-as-a-Service Market Forecast 2025 to 2035

Biometric Lockers Market

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Behavioral Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Biometrics Market Trends - Growth, Demand & Forecast 2025 to 2035

AI-enabled Biometrics Market

Multi-Modal Biometric Cabin Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fingerprint Biometrics Market by Authentication Type, Mobility, Industry & Region Forecast till 2035

Hand Geometry Biometrics Market Insights - Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA