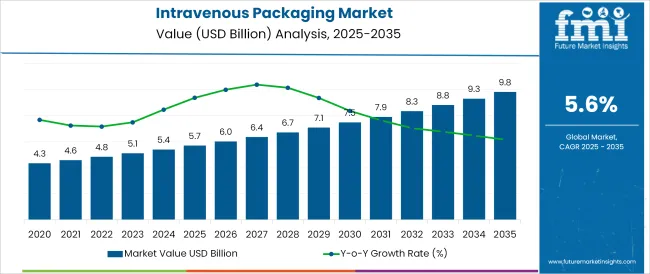

The Intravenous Packaging Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The intravenous (IV) packaging market is witnessing steady expansion, largely driven by increasing demand for sterile, durable, and tamper-evident packaging solutions in clinical settings. The rising incidence of chronic illnesses, coupled with an aging global population, has intensified the need for IV therapies, thereby amplifying demand for reliable packaging formats that ensure sterility and patient safety.

Regulatory scrutiny around drug administration safety and the growing emphasis on single-use, contamination-resistant medical packaging are further supporting the market’s evolution. Innovation in materials such as multilayer films and high-barrier polymers has enabled longer shelf life and product integrity across complex supply chains.

Moreover, the expansion of healthcare infrastructure, especially in emerging economies, is enhancing procurement volumes for IV delivery systems, thus reinforcing packaging demand. As sustainability and waste reduction continue to be addressed across the healthcare sector, manufacturers are also exploring recyclable and low-waste alternatives that comply with strict medical standards—creating opportunities for further growth.

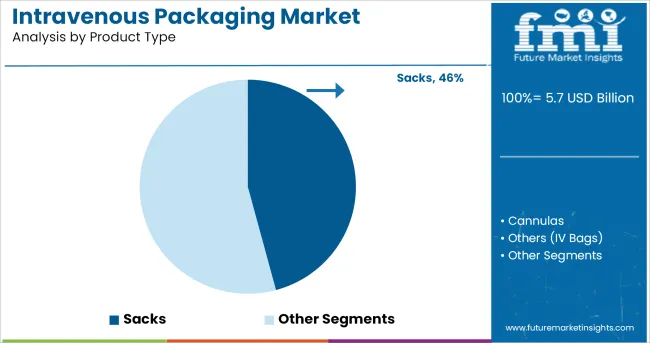

The sacks segment is expected to account for 45.80% of total market revenue by 2025, establishing itself as the leading product type. This prominence can be attributed to its superior containment capacity, cost efficiency, and compatibility with a variety of IV solutions. Sacks have demonstrated a high level of adaptability across different storage environments and are favoured for their flexibility and ease of transportation within hospital logistics systems.

Additionally, they are often manufactured using multi-layer co-extruded films that maintain sterility and barrier performance, meeting critical regulatory standards. Their ability to support high-volume intravenous formulations while minimizing the risk of leakage or contamination has further bolstered their dominance.

As hospitals and medical centers prioritize operational efficiency and patient safety, sacks continue to be the most preferred packaging option in the IV delivery ecosystem.

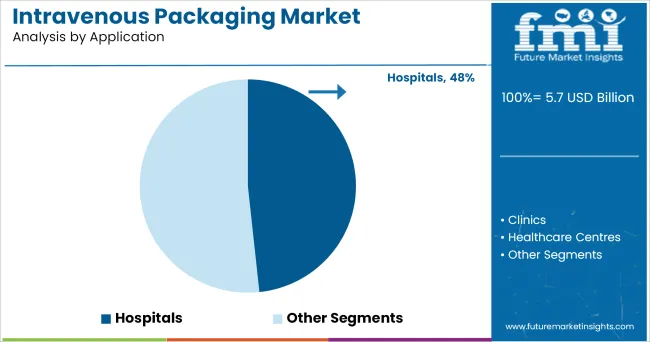

Hospitals are projected to contribute 48.30% of total market revenue within the application segment by 2025, reinforcing their position as the dominant end-use environment. This leadership stems from the consistently high volume of IV therapies administered in acute and long-term care settings.

Hospitals require packaging solutions that align with stringent infection control protocols, reduce handling time, and ensure ease of administration for healthcare professionals. The segment’s dominance has been further supported by increased surgical procedures, emergency care demand, and long-duration infusion therapies.

In addition, hospital procurement strategies favour packaging formats that support inventory efficiency, rapid deployment, and compliance with pharmacovigilance standards. The need for traceable, sterile, and durable IV packaging has made hospitals the focal point of demand, solidifying their position as the primary driver of growth in the intravenous packaging market.

The growth of the geriatric population and the rise in chronic illnesses due to lifestyle changes are driving the intravenous packaging industry. In contrast, the medical and healthcare industry is expected to drive intravenous packing market growth because it is utilized for blood transfusions and to rectify electrolyte imbalances in patients.

Intravenous packing goods use the intravenous route of administration, which allows medicine and fluids to be delivered quickly. As a result of the expanding number of diseases, demand for intravenous packing, which is mostly utilized in the medical field, is predicted to rise.

Intravenous packing developments are being driven by complex formulations, individualized medicines, COVID-19 treatments, and environmental goals. During the forecast period, it is anticipated that the pharmaceutical packaging market would rise. This expansion is accompanied by changes in technological needs and market demands, both of which are creating innovative potential.

The growing need for patient-administered medicines, as well as the developing biological therapeutic path, are pushing innovation in injectable packaging and delivery. Continued innovation in primary packaging solutions that are registered will also aid in supply chain transparency and fake prevention.

As a result, the packaging for vaccines has to be designed with the specific needs in mind in order to maintain the medicinal product's safety and efficacy. Advanced packaging methods for sensitive biologics including nucleic acid and protein vaccines are lowering development costs and speeding up the time to market. Thus, manufacturers are concentrating their efforts on creating more inventive intravenous packing.

The growing number of hospitals in the United States, as well as rising hospitalization rates, are predicted to fuel the country's economy. In the coming years, the intravenous packaging market will grow in the country.

According to the American Hospital Association, there is 6,090 hospitals in the United States in 2024 to address the needs of the patient population. In fact, total hospital admissions in 2024 were around 36,241,815, which increased due to the rising pandemic. As a result, it is projected that the sale of intravenous packaging will increase in the region.

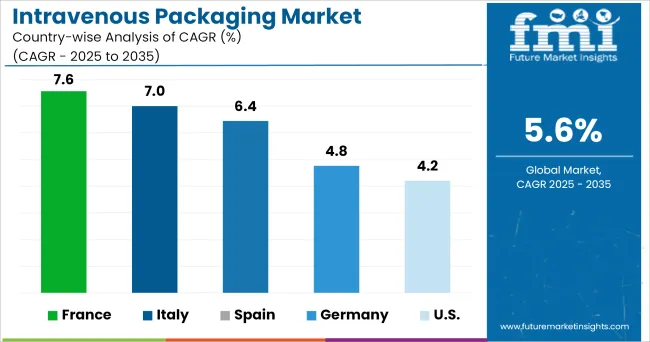

The intravenous packaging industry in Europe is currently growing at a moderate rate. It is mostly influenced by the presence of well-known merchants. Furthermore, intravenous packing products have well-established distribution networks, which boosts their availability. Aside from that, increased spending power and significant healthcare spending are also key contributors.

Furthermore, the continuous introduction of innovative packaging to treat a number of disorders has boosted intravenous packing sales across the region, indicating a promising future for the industry.

Some of the leading manufacturers and suppliers of intravenous packing include

In order to continue to transform and increase access to care for patients around the world, Baxter Company is investing in new collaborations and partnering with world-renowned institutions. These collaborative strategies will help the company to expand its business globally.

Eurolife Healthcare announced the acquisition of Teva Pharmaceutical Industries' intravenous (IV) infusion business in Hungary in 2020. Teva Pharmaceuticals IV infusion joins Eurolife Healthcare, giving the company the opportunity to expand its global presence in Europe and the United States, as well as a competitive advantage over competitors, as Eurolife becomes one of the few Indian pharmaceutical companies in the IV infusion business to have its own facility in the European Union.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

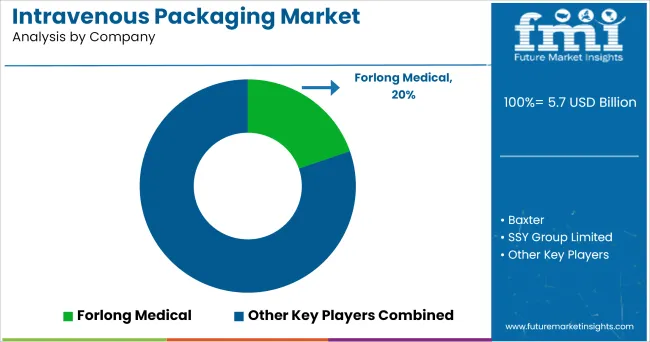

The global intravenous packaging market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the intravenous packaging market is projected to reach USD 9.8 billion by 2035.

The intravenous packaging market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in intravenous packaging market are sacks, cannulas and others (iv bags).

In terms of application, hospitals segment to command 48.3% share in the intravenous packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Leading Intravenous Packaging Providers

Intravenous Hydration Therapy Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Line Connectors Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Iron Drugs Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Pegloticase Market Insights - Growth, Demand & Forecast 2025 to 2035

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA