The Gel Stent Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

| Metric | Value |

|---|---|

| Gel Stent Market Estimated Value in (2025 E) | USD 1.7 billion |

| Gel Stent Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The Gel Stent market is experiencing significant growth, driven by the increasing prevalence of glaucoma and other ocular conditions that require minimally invasive surgical interventions. Rising demand for effective intraocular pressure management and patient-preferred treatments is supporting market expansion. Technological advancements in stent design and biocompatible gel materials are enhancing clinical performance and safety, resulting in improved post-operative outcomes.

Integration of controlled fluid dynamics, reduced risk of complications, and simplified implantation procedures are further strengthening adoption in ophthalmology practices. Increasing awareness among healthcare providers and patients regarding innovative glaucoma management options is expanding the market. Investments in clinical research and regulatory approvals are accelerating the availability of new gel stent devices across regions.

Growing adoption in developed and emerging markets, combined with ongoing improvements in device longevity, safety, and efficacy, is fueling market momentum As healthcare infrastructure advances and the focus on minimally invasive therapies intensifies, the Gel Stent market is positioned for sustained growth over the coming decade, offering opportunities for both established and emerging players in the ophthalmic device space.

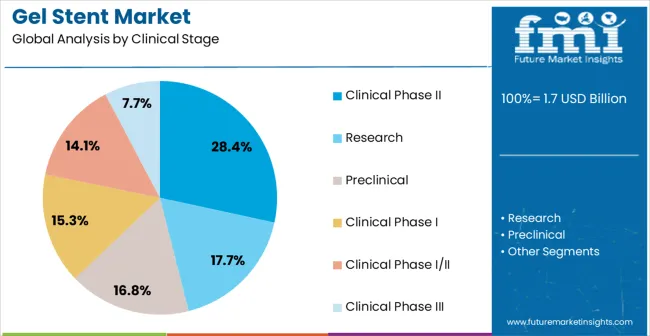

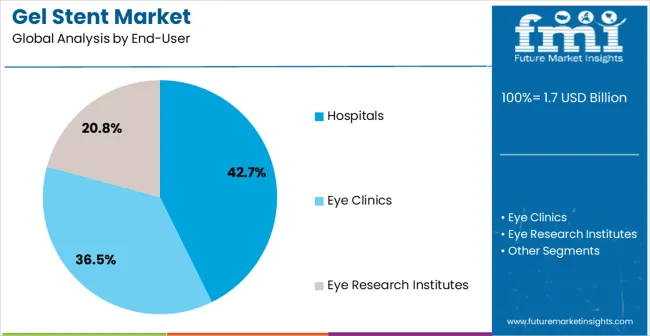

The gel stent market is segmented by clinical stage, end-user, and geographic regions. By clinical stage, gel stent market is divided into Clinical Phase II, Research, Preclinical, Clinical Phase I, Clinical Phase I/II, and Clinical Phase III. In terms of end-user, gel stent market is classified into Hospitals, Eye Clinics, and Eye Research Institutes. Regionally, the gel stent industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clinical phase II stage segment is projected to hold 28.4% of the market revenue in 2025, establishing it as the leading clinical stage category. Growth in this segment is being driven by the increasing number of gel stent candidates progressing through mid-stage clinical trials to evaluate safety and efficacy profiles. Phase II studies provide critical insights into device performance, patient tolerability, and optimal procedural techniques, which inform regulatory approvals and commercialization strategies.

Strong collaboration between medical device companies and research institutions is supporting trial enrollment and data collection. Advanced trial designs and patient monitoring technologies are enabling more accurate and faster assessment of outcomes, reducing development timelines.

Positive Phase II results increase clinician confidence, accelerate adoption, and facilitate transitions into Phase III and market launch As interest in minimally invasive glaucoma surgery continues to grow, the clinical phase II segment is expected to remain a key driver of innovation and investment, supporting the long-term expansion of the Gel Stent market

The hospitals end-user segment is anticipated to account for 42.7% of the market revenue in 2025, making it the leading end-use category. Growth is being driven by the increasing deployment of gel stents in hospital-based ophthalmology departments and surgical centers where specialized procedures are performed. Hospitals provide access to advanced surgical infrastructure, trained ophthalmologists, and post-operative monitoring, enabling higher adoption of minimally invasive treatments.

The ability to handle complex cases, offer comprehensive patient care, and integrate gel stent procedures with broader glaucoma management programs reinforces hospital demand. Additionally, hospitals are increasingly investing in innovative devices to improve surgical outcomes, reduce complications, and enhance patient satisfaction.

The segment benefits from higher procedure volumes, insurance coverage, and reimbursement support, which makes hospitals the preferred setting for gel stent interventions As awareness and clinical acceptance of minimally invasive glaucoma surgeries increase, the hospital segment is expected to continue leading revenue contribution in the Gel Stent market, supporting sustained adoption and market growth.

Astent is a small tube that is expandable and is used for treatment of the narrowed arteries. Stents can also be placed in weak arteries to improve the blood flow and prevent arteries from bursting. The most common surgical treatment for glaucoma is trabeculectomy or trabeculoplasty which are highly effective yet invasive.

The gel stent is made up of soft collagen derived gelatin. On injection, the stent gets hydrated and swells which create a soft and flexible channel that adheres to ocular tissue and cannot move. The procedure is minimally invasive, it reduces the intraocular pressure (IOP) significantly by drainage of fluid to subconjunctival passage, and the material minimizes the complication as compared to other synthetic materials.

| Country | CAGR |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| Brazil | 12.6% |

| USA | 11.4% |

| U.K. | 10.2% |

| Japan | 9.0% |

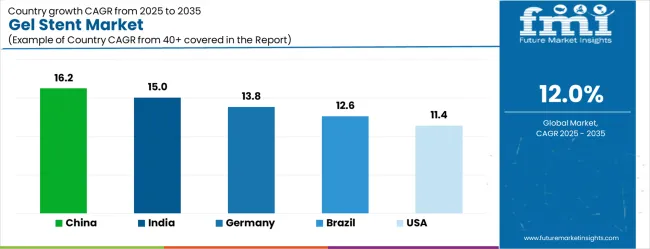

The Gel Stent Market is expected to register a CAGR of 12.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.2%, followed by India at 15.0%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Japan posts the lowest CAGR at 9.0%, yet still underscores a broadly positive trajectory for the global Gel Stent Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.8%. The U.S. Gel Stent Market is estimated to be valued at USD 647.0 million in 2025 and is anticipated to reach a valuation of USD 647.0 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 88.1 million and USD 59.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Clinical Stage | Clinical Phase II, Research, Preclinical, Clinical Phase I, Clinical Phase I/II, and Clinical Phase III |

| End-User | Hospitals, Eye Clinics, and Eye Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

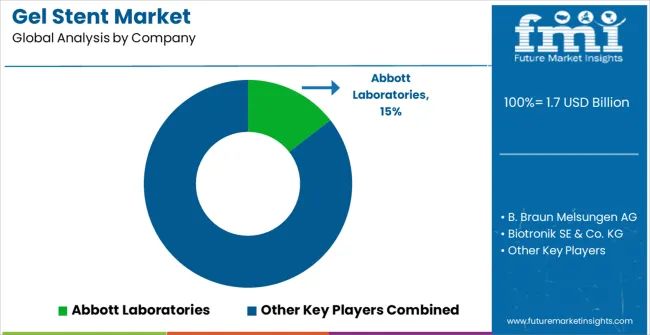

| Key Companies Profiled | Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & Co. KG, Biosensors International Group, Ltd., Boston Scientific Corporation, Elixir Medical Corporation, Medtronic Plc, Meril Life Science, MicroPort Scientific Corporation, Stryker, Terumo Corporation, and W.L Gore & Associates |

The global gel stent market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the gel stent market is projected to reach USD 5.4 billion by 2035.

The gel stent market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in gel stent market are clinical phase ii, research, preclinical, clinical phase i, clinical phase i/ii and clinical phase iii.

In terms of end-user, hospitals segment to command 42.7% share in the gel stent market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gelatin Filters Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Gel Dryer Market Size and Share Forecast Outlook 2025 to 2035

Gel Warmers Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Gellan Gum Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Gel Packs Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Gelatin Market Trends - Food, Pharma & Nutritional Growth 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Stent Graft Balloon Catheter Market Insights - Growth & Forecast 2025 to 2035

Gelling Agent Market Insights – Texture & Food Innovation 2025 to 2035

Gelatin Hydrolysates Market

Gel Column Agglutination Test System Market

Existent Gum Steam Generator Market

Sol-Gel Based Skin Treatments Market Size and Share Forecast Outlook 2025 to 2035

Pyrogel Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA