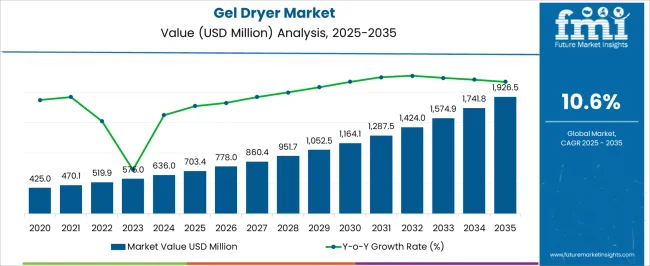

The Gel Dryer Market is estimated to be valued at USD 703.4 million in 2025 and is projected to reach USD 1926.5 million by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

| Metric | Value |

|---|---|

| Gel Dryer Market Estimated Value in (2025 E) | USD 703.4 million |

| Gel Dryer Market Forecast Value in (2035 F) | USD 1926.5 million |

| Forecast CAGR (2025 to 2035) | 10.6% |

The Gel Dryer market is experiencing steady growth driven by increasing demand for efficient and precise laboratory equipment in research, pharmaceutical, and industrial applications. In 2025, the market is characterized by a strong adoption of systems that combine advanced drying technology with user-friendly operation and process automation. The need for consistent sample preparation, reduction of operational time, and minimization of product loss has been shaping the market.

The trend toward laboratory modernization and high-throughput experimentation has further reinforced the adoption of gel drying solutions. Increasing investment in research and development across pharmaceuticals, biotechnology, and materials science sectors has created a favorable environment for advanced gel dryer technologies.

The future outlook is expected to be influenced by rising automation, integration with laboratory information management systems, and the development of energy-efficient systems These factors are likely to create new opportunities for manufacturers, particularly those offering modular, software-compatible, and environmentally optimized gel drying solutions.

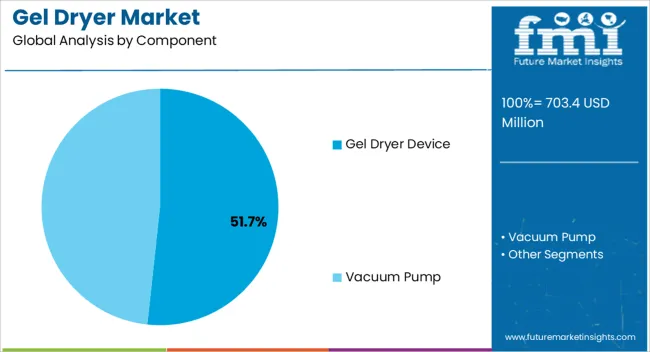

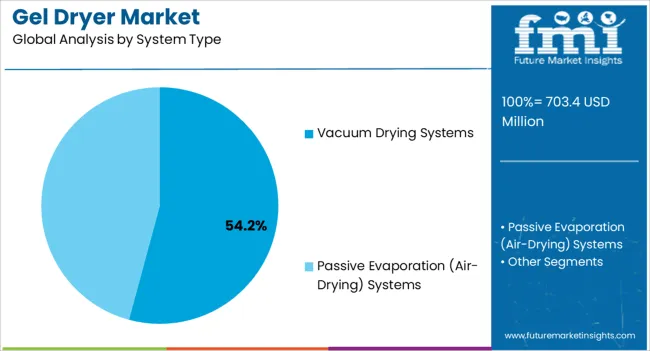

The gel dryer market is segmented by component, system type, and geographic regions. By component, gel dryer market is divided into Gel Dryer Device and Vacuum Pump. In terms of system type, gel dryer market is classified into Vacuum Drying Systems and Passive Evaporation (Air-Drying) Systems. Regionally, the gel dryer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Gel Dryer Device component segment is projected to hold 51.70% of the total market revenue in 2025, making it the leading component type. This dominance is being attributed to its critical role in ensuring uniform drying, reproducibility, and reliability in laboratory workflows. The growth of this segment has been driven by the increasing demand for devices that support precise temperature and pressure control, enabling reproducible results in protein and nucleic acid analysis.

Laboratories are increasingly favoring devices that can reduce sample handling and prevent cross-contamination, further boosting adoption. The ease of integration with existing laboratory setups, alongside enhanced safety features and ergonomic designs, has also contributed to its prominence.

Additionally, the segment benefits from the growing trend toward automation and high-throughput workflows, where standalone gel dryer devices offer flexibility and consistent performance The ability to handle a wide range of gel types and sizes without compromising quality continues to make this segment the most sought after component in the market.

The Vacuum Drying Systems type is expected to account for 54.20% of the Gel Dryer market revenue in 2025, establishing it as the leading system type. The growth of this segment has been driven by the need for efficient moisture removal under controlled low-pressure environments, which helps in preserving the structural integrity and chemical composition of gels. Laboratories and research facilities are increasingly adopting vacuum drying systems due to their energy efficiency, reduced drying times, and compatibility with sensitive biological and chemical samples.

The segment has benefitted from technological advancements that allow precise vacuum and temperature control, minimizing degradation and ensuring reproducibility. Additionally, vacuum drying systems support higher throughput operations, aligning with the demand for productivity and scalability in modern laboratories.

Their application across pharmaceutical development, diagnostic testing, and industrial research has reinforced their market leadership As institutions continue to prioritize efficiency, accuracy, and automation, vacuum drying systems are anticipated to remain the preferred choice, driving growth in the Gel Dryer market.

Academic research laboratories involve an extensive practice of routine protein and nucleotide analysis that includes the use of agarose or polyacrylamide gels. Time plays a crucial role in daily research tasks wherein drying of gels consumes a significant amount of time.

While a majority of researchers practice time management by allowing the gels to dry naturally, structured labs with greater funding opt for gel dryers to save time and maintain reproducibility of their research analysis.

Gel dryers find significant application in academic and clinical laboratories where protein and nucleotide analysis are extensive. The gel dryer market has availability of a number of machine variants that deliver different size specifications, heat timers and other versatile operations. Flexible operations allow researchers to use gel dryers for drying of different gels and subsequent processing such as autoradiography.

Declining investments in the field of research and development are likely to hit the gel dryer market revenues as the instrument does not fall under the category of essential laboratory instruments. In addition, biotechnology manufacturers have introduced gel drying kits that provide economical and convenient alternative to gel dryers that are usually costly as well as require maintenance.

Research approaches are becoming more streamlined with greater emphasis on critical thinking over time spent in physical operations - this can sustain a steady outlook of the gel dryer market in the future.

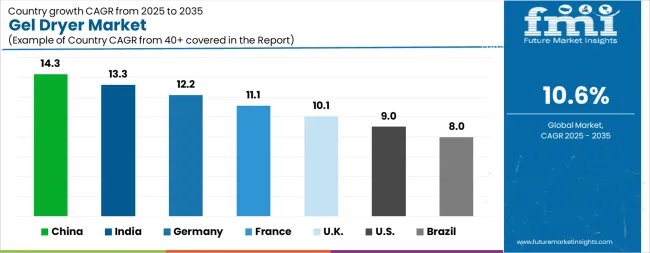

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

The Gel Dryer Market is expected to register a CAGR of 10.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 14.3%, followed by India at 13.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.0%, yet still underscores a broadly positive trajectory for the global Gel Dryer Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.2%. The USA Gel Dryer Market is estimated to be valued at USD 248.2 million in 2025 and is anticipated to reach a valuation of USD 588.2 million by 2035. Sales are projected to rise at a CAGR of 9.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 35.7 million and USD 19.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 703.4 Million |

| Component | Gel Dryer Device and Vacuum Pump |

| System Type | Vacuum Drying Systems and Passive Evaporation (Air-Drying) Systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

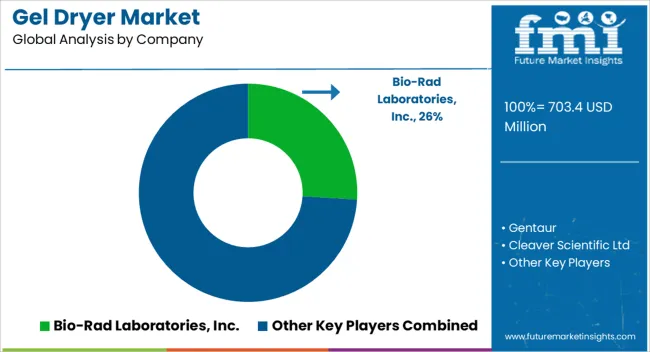

| Key Companies Profiled | Bio-Rad Laboratories, Inc., Gentaur, Cleaver Scientific Ltd, Labconco, Hoefer Inc., Major Science, Consort bvba, and BIOTEK ENGINEERS |

The global gel dryer market is estimated to be valued at USD 703.4 million in 2025.

The market size for the gel dryer market is projected to reach USD 1,926.5 million by 2035.

The gel dryer market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in gel dryer market are gel dryer device and vacuum pump.

In terms of system type, vacuum drying systems segment to command 54.2% share in the gel dryer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gelatin Filters Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Gel Stent Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Gel Warmers Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Gellan Gum Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gel Packs Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Gelatin Market Trends - Food, Pharma & Nutritional Growth 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Gelling Agent Market Insights – Texture & Food Innovation 2025 to 2035

Gelatin Hydrolysates Market

Gel Column Agglutination Test System Market

Sol-Gel Based Skin Treatments Market Size and Share Forecast Outlook 2025 to 2035

Pyrogel Insulation Market Size and Share Forecast Outlook 2025 to 2035

Aerogel Insulation Market Size and Share Forecast Outlook 2025 to 2035

Air Dryer Cartridge Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA