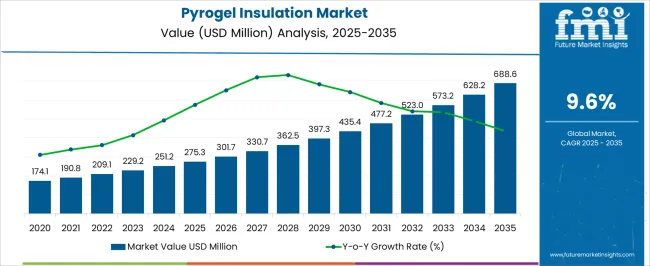

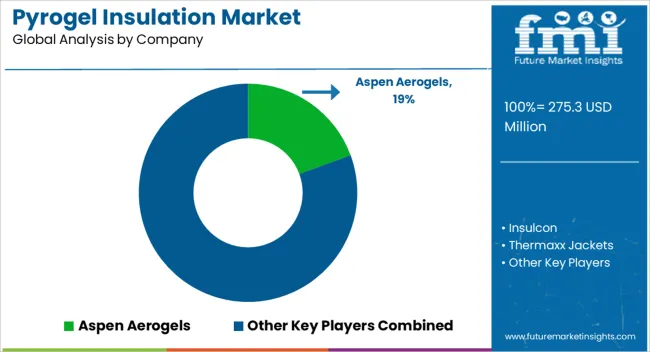

The Pyrogel Insulation Market is estimated to be valued at USD 275.3 million in 2025 and is projected to reach USD 688.6 million by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period.

The pyrogel insulation market follows a consistent acceleration pattern with steady deceleration in its growth trajectory. Beginning at USD 275.3 million in 2025, the market sees initial steady growth, advancing from USD 174.1 million in 2020 to USD 275.3 million in 2025, which reflects a moderate increase over the first five years. This early growth is driven by the growing need for high-performance insulation materials across sectors such as oil & gas, petrochemicals, and construction, where thermal efficiency and energy conservation are critical.

The steady rise during these years marks the foundational adoption phase, where industries begin integrating advanced insulation solutions like pyrogel into their operations.From 2026 to 2030, the market accelerates significantly, growing from USD 301.7 million to USD 397.3 million, marking a notable shift towards faster expansion. This acceleration is attributed to increasing demand for energy-efficient materials, especially in high-temperature insulation applications, and the widespread adoption of pyrogel insulation in industrial applications, where it provides superior thermal performance. The rise of sustainability initiatives and regulatory pressure further contribute to this rapid growth. From 2031 to 2035, the market continues to expand but at a decelerated pace, reaching USD 688.6 million in 2035. While growth continues, the pace slows down as the market matures, with saturation in key industries and a focus on efficiency rather than rapid expansion.

| Metric | Value |

|---|---|

| Pyrogel Insulation Market Estimated Value in (2025 E) | USD 275.3 million |

| Pyrogel Insulation Market Forecast Value in (2035 F) | USD 688.6 million |

| Forecast CAGR (2025 to 2035) | 9.6% |

The pyrogel insulation market is witnessing sustained growth due to its exceptional thermal performance, low thermal conductivity, and ability to deliver superior energy efficiency in a range of industrial applications. Demand is being supported by increasing requirements for lightweight and durable insulation materials that can operate under extreme temperature and environmental conditions.

The market is benefiting from rising adoption in oil and gas, petrochemical, power generation, and industrial processing sectors, where insulation reliability directly impacts operational efficiency and safety. Stringent regulatory frameworks aimed at improving energy efficiency and reducing carbon emissions are driving the integration of advanced aerogel-based materials like pyrogel into both new and retrofit projects.

Technological advancements in manufacturing processes are improving product flexibility, moisture resistance, and long-term durability, making pyrogel an attractive choice for cost-effective thermal management As industries continue to prioritize operational optimization, safety, and sustainability, the pyrogel insulation market is positioned for strong growth, with manufacturers focusing on capacity expansion, new grade development, and application diversification.

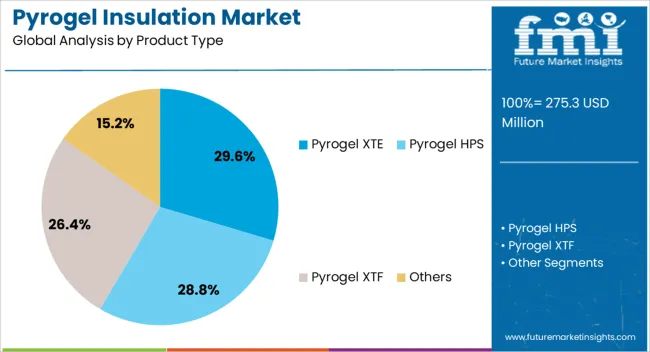

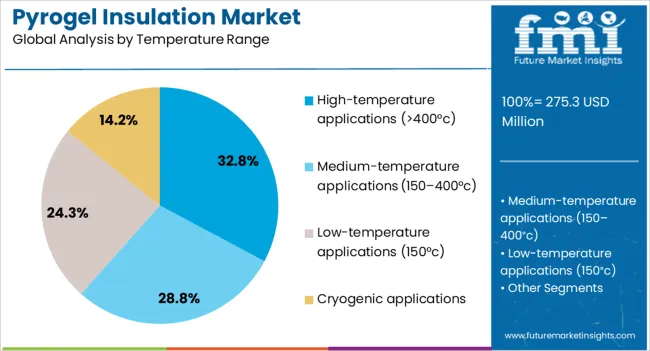

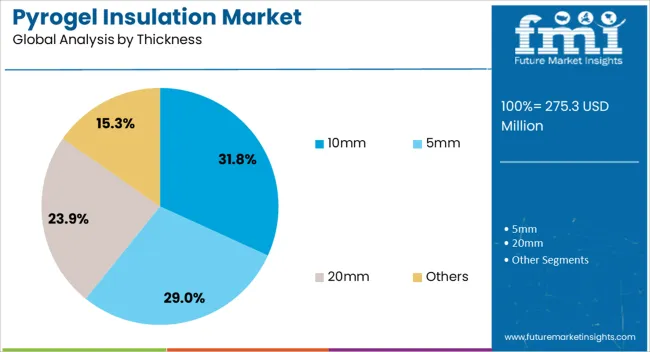

The pyrogel insulation market is segmented by product type, temperature range, thickness, form, application, end use industry, installation type, and geographic regions. By product type, pyrogel insulation market is divided into Pyrogel XTE, Pyrogel HPS, Pyrogel XTF, and Others. In terms of temperature range, pyrogel insulation market is classified into High-temperature applications (>400°c), Medium-temperature applications (150–400°c), Low-temperature applications (150°c), and Cryogenic applications. Based on thickness, pyrogel insulation market is segmented into 10mm, 5mm, 20mm, and Others. By form, pyrogel insulation market is segmented into Blankets, Sheets, Custom-cut pieces, and Others. By application, pyrogel insulation market is segmented into Pipe insulation, Process piping, Steam piping, Cryogenic piping, Others, Equipment insulation, Fire protection, Acoustic insulation, Subsea insulation, and Others. By end use industry, pyrogel insulation market is segmented into Oil & gas, Refining & petrochemical, Chemical processing, Power generation, Industrial processing, Marine & shipbuilding, Aerospace & defense, Building & construction, and Other end use industries. By installation type, pyrogel insulation market is segmented into New installation, Retrofit & replacement, and Maintenance & repair. Regionally, the pyrogel insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Pyrogel XTE segment is expected to account for 29.6% of the pyrogel insulation market revenue share in 2025, positioning it as the leading product type. This dominance is being driven by its superior resistance to high temperatures, excellent water repellency, and high compressive strength, which enhance operational performance across demanding industrial applications.

Pyrogel XTE offers low thermal conductivity while maintaining a thin profile, enabling space savings without compromising insulation efficiency. Its hydrophobic nature protects against corrosion under insulation, extending the lifespan of critical assets in sectors such as oil and gas, power generation, and processing industries.

The ability to perform reliably in both new construction and maintenance projects, combined with reduced installation time and labor costs, is further strengthening its adoption Additionally, Pyrogel XTE’s compliance with stringent safety and performance standards has solidified its position as a preferred choice for industrial insulation where durability, thermal efficiency, and moisture control are critical operational factors.

The high-temperature applications segment, covering ranges above 400°C, is projected to hold 32.8% of the pyrogel insulation market revenue share in 2025, making it the largest temperature range category. Its leadership is being driven by the material’s ability to maintain thermal performance, structural stability, and safety under extreme operating conditions. In high-temperature environments such as refineries, chemical plants, and power facilities, effective insulation reduces heat loss, improves process efficiency, and enhances worker safety.

Pyrogel’s aerogel-based composition ensures minimal thermal conductivity even at elevated temperatures, contributing to significant energy savings and extended equipment life. The segment’s growth is further supported by increasing industrial investments in upgrading insulation systems to meet stricter energy efficiency regulations and safety standards.

Pyrogel’s resilience against thermal cycling and its ability to resist degradation in harsh chemical or environmental exposures reinforce its suitability for critical operations As industries continue to operate at higher process temperatures, demand for insulation solutions that can deliver long-term reliability and performance is expected to remain strong.

The 10mm thickness segment is forecasted to capture 31.8% of the pyrogel insulation market revenue share in 2025, establishing itself as the leading thickness category. Its dominance is being reinforced by the balance it offers between insulation efficiency, material cost, and installation flexibility. At this thickness, pyrogel provides excellent thermal resistance while maintaining a compact profile, allowing it to be applied in confined spaces or areas where bulkier insulation would be impractical.

This dimension is widely preferred for both maintenance and new installation projects due to its ease of handling, reduced installation labor, and compatibility with existing cladding systems. The segment’s popularity is also supported by its ability to meet rigorous safety and energy performance standards without requiring significant structural modifications.

Its versatility enables use across a range of industries, including petrochemicals, oil and gas, and power generation, where reliable thermal protection and space optimization are equally important The cost-effectiveness and adaptability of the 10mm format are expected to sustain its leading position in the market over the forecast period.

The pyrogel insulation market is witnessing robust growth, driven by the increasing demand for high-performance thermal solutions in industries such as oil and gas, power generation, marine, and construction. Pyrogel, a type of aerogel insulation, offers exceptional thermal resistance, lightweight properties, and a thin form factor, making it ideal for applications where space and energy efficiency are critical. The rise in global industrial development, coupled with environmental regulations pushing for more energy-efficient solutions, is contributing to market expansion. As technologies continue to advance, the adoption of pyrogel in various sectors is expected to grow, especially in regions with stringent energy efficiency mandates.

One major barrier is the high cost associated with the material and its installation, which is significantly higher compared to traditional insulation materials. This cost discrepancy can deter small and medium-sized enterprises from adopting pyrogel solutions, limiting its widespread use. Another challenge is the complexity of integrating pyrogel insulation into existing infrastructure, particularly in older systems that may require specialized expertise and modifications for installation. The limited availability of pyrogel in some regions also restricts its global adoption, as distribution networks are not fully developed. Competition from emerging alternative insulation materials such as spray foam and fiberglass poses a threat to pyrogel's market share, as these materials often offer lower upfront costs. To overcome these barriers, the industry needs continued innovation to reduce costs, improve manufacturing processes, and expand global distribution channels, making it more accessible to a broader range of industries.

Pyrogel's superior thermal performance, along with its lightweight and space-saving nature, makes it ideal for applications in the oil and gas industry, where insulation is crucial for protecting pipelines and subsea systems. Additionally, its moisture and fire resistance make it highly valuable in the power generation and chemical processing sectors. The growing awareness of the need for lightweight, fire-resistant materials is positioning pyrogel as a preferred choice over conventional insulation materials. In the construction industry, as buildings are required to meet more stringent energy efficiency standards, pyrogel's ability to provide effective thermal resistance in a compact form factor further boosts its adoption. These factors, coupled with the ongoing advancements in pyrogel technology that enhance its performance and lower costs, are accelerating market growth across various sectors, ensuring continued demand.

The pyrogel insulation market presents numerous opportunities for growth and expansion. As environmental concerns continue to rise, the development of sustainable pyrogel formulations is gaining momentum, with manufacturers focusing on creating more eco-friendly solutions. Increased demand for lightweight, high-performance materials in industries such as automotive, aerospace, and construction is driving the need for advanced insulation materials like pyrogel. Pyrogel’s integration with other advanced materials, such as composite structures, is expanding its applications, making it suitable for a wider range of industries. The growing trend of energy-efficient buildings and retrofitting existing structures to meet modern energy standards is also fueling the market's expansion. Furthermore, the automotive sector’s increased focus on fuel efficiency and the reduction of vehicle weight is spurring the adoption of pyrogel in automotive insulation. By investing in R&D and forming strategic partnerships, companies can unlock new markets and applications for pyrogel insulation, establishing themselves as leaders in the evolving industry.

One major trend is the continuous improvement in aerogel production techniques, which are enhancing the performance and cost-efficiency of pyrogel, making it more accessible to a wider range of industries. The integration of digital technologies, such as sensors and the Internet of Things (IoT), into insulation systems is allowing for real-time monitoring and better performance tracking, particularly in energy-intensive sectors like oil and gas, construction, and power generation. Industries like automotive and aerospace, where high-performance, lightweight materials are critical, are increasingly turning to pyrogel for its thermal resistance and low weight. The miniaturization of pyrogel materials is expanding its use in compact applications, including electronics and portable devices. These trends suggest that pyrogel insulation technology will continue evolving, meeting the increasing demand for innovative and energy-efficient materials across various sectors.

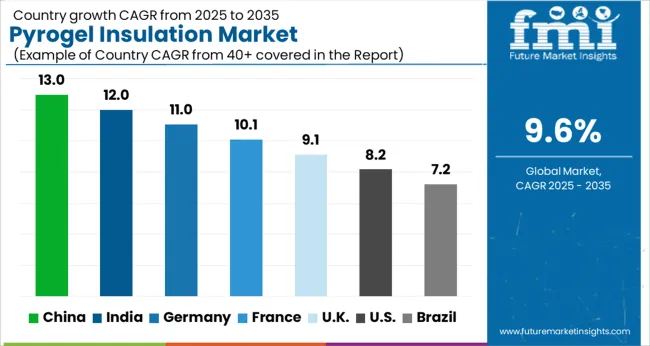

The global Pyrogel insulation market is projected to grow at a CAGR of 9.6% from 2025 to 2035. Among the key markets, China leads with a growth rate of 13.0%, followed by India at 12.0%, and France at 10.1%. The United Kingdom and the United States show more moderate growth rates of 9.1% and 8.2%, respectively. The growth is driven by increasing demand for high-performance insulation solutions in construction and industrial sectors, as well as the rising focus on energy efficiency, sustainability, and reducing operational costs across industries. The analysis includes over 40+ countries, with the leading markets detailed below.

The global Pyrogel insulation market is projected to grow at a CAGR of 9.6% from 2025 to 2035. Among the key markets, China leads with a growth rate of 13.0%, followed by India at 12.0%, and France at 10.1%. The United Kingdom and the United States show more moderate growth rates of 9.1% and 8.2%, respectively. The growth is driven by increasing demand for high-performance insulation solutions in construction and industrial sectors, as well as the rising focus on energy efficiency, sustainability, and reducing operational costs across industries. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global Pyrogel insulation market, growing at a projected CAGR of 13.0% from 2025 to 2035. The country’s increasing focus on energy-efficient solutions and high-performance insulation systems is driving the market. China’s strong manufacturing base, particularly in industries like construction, oil and gas, and chemical processing, is fueling the demand for advanced insulation materials like Pyrogel. As China’s industrial sector continues to grow, along with its expanding focus on reducing energy consumption, the adoption of Pyrogel insulation is rising. China’s push for sustainable infrastructure and green building initiatives is further contributing to the market’s growth.

The Pyrogel insulation market inn India is projected to grow at a CAGR of 12.0% from 2025 to 2035. The rapid expansion of the country’s industrial and construction sectors is driving the demand for advanced insulation materials. As India focuses on improving energy efficiency across industries, the need for high-performance insulation systems like Pyrogel is growing. The increasing emphasis on environmental sustainability and energy conservation in residential and commercial buildings is expected to further fuel market growth. The rise in infrastructure development, especially in energy-intensive industries such as oil, gas, and manufacturing, is contributing significantly to the adoption of Pyrogel insulation in India

The Pyrogel insulation market in France is expected to grow at a projected CAGR of 10.1% from 2025 to 2035. The country’s demand for energy-efficient building materials and insulation systems, particularly in the construction and industrial sectors, is fueling market growth. France’s commitment to sustainability and reducing carbon emissions is driving the adoption of advanced insulation materials like Pyrogel in both new constructions and retrofitting projects. The demand for Pyrogel insulation is also growing in energy-intensive industries, such as oil and gas and chemical processing, where high-performance insulation is needed to improve operational efficiency and reduce energy loss

The Pyrogel insulation market in the United Kingdom is projected to grow at a CAGR of 9.1% from 2025 to 2035. The demand for Pyrogel insulation is being driven by the country’s growing focus on energy efficiency, particularly in the industrial and construction sectors. As the UK continues to focus on sustainable building practices and reducing energy consumption, the demand for advanced insulation materials like Pyrogel is expected to rise. The UK’s increasing focus on upgrading infrastructure, particularly in energy-intensive sectors such as oil, gas, and manufacturing, is further boosting the adoption of Pyrogel insulation systems.

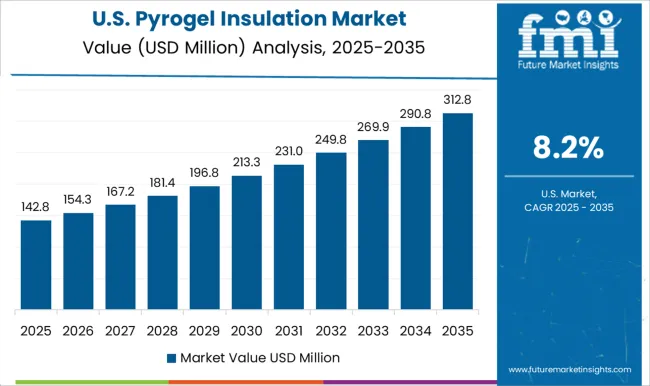

The USA Pyrogel insulation market is projected to grow at a CAGR of 8.2% from 2025 to 2035. The demand for Pyrogel insulation is driven by the increasing focus on energy efficiency, especially in the industrial, commercial, and residential sectors. The USA market for Pyrogel insulation is seeing rapid adoption in industries like oil, gas, and chemical processing, where high-performance insulation is required for reducing energy consumption and improving operational efficiency. The growing trend of energy-efficient building practices and government incentives for sustainable construction are contributing to the market’s growth.

The pyrogel insulation market is expanding rapidly, fueled by the growing demand for energy-efficient solutions across industries such as oil and gas, construction, and manufacturing. Key players in this market include Aspen Aerogels, Insulcon, Thermaxx Jackets, Brock Group, Pacor, KLAY EnerSol, Magnaflux, Stadur-Süd Dämmstoff-Produktions GmbH, and AKTARUS GROUP.

Aspen Aerogels is a dominant player, known for its Pyrogel® products, which offer superior thermal insulation and durability. The company’s innovative solutions cater to a variety of industries, including energy, industrial, and commercial applications. Insulcon offers a range of high-performance insulation materials, including pyrogel-based solutions, designed for applications that require advanced thermal protection in extreme conditions. Thermaxx Jackets specializes in the design and production of custom thermal insulation jackets, including those made with pyrogel materials, for industries such as petrochemical, manufacturing, and utilities.

Brock Group provides a broad portfolio of insulation and industrial services, leveraging pyrogel products for energy efficiency in industrial applications. Pacor delivers thermal insulation products and services with a strong focus on innovative, energy-saving solutions. KLAY EnerSol, Magnaflux, Stadur-Süd Dämmstoff-Produktions GmbH, and AKTARUS GROUP further expand the competitive landscape by offering customized pyrogel insulation solutions for a wide range of industrial applications. These companies differentiate themselves through their technological advancements, product innovation, and extensive industry-specific expertise, driving the adoption of pyrogel insulation across various sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 275.3 Million |

| Product Type | Pyrogel XTE, Pyrogel HPS, Pyrogel XTF, and Others |

| Temperature Range | High-temperature applications (>400°c), Medium-temperature applications (150–400°c), Low-temperature applications (150°c), and Cryogenic applications |

| Thickness | 10mm, 5mm, 20mm, and Others |

| Form | Blankets, Sheets, Custom-cut pieces, and Others |

| Application | Pipe insulation, Process piping, Steam piping, Cryogenic piping, Others, Equipment insulation, Fire protection, Acoustic insulation, Subsea insulation, and Others |

| End Use Industry | Oil & gas, Refining & petrochemical, Chemical processing, Power generation, Industrial processing, Marine & shipbuilding, Aerospace & defense, Building & construction, and Other end use industries |

| Installation Type | New installation, Retrofit & replacement, and Maintenance & repair |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aspen Aerogels, Insulcon, Thermaxx Jackets, Brock Group, Pacor, KLAY EnerSol, Magnaflux, Stadur-Süd Dämmstoff-Produktions GmbH, and AKTARUS GROUP |

| Additional Attributes | Dollar sales by application (oil and gas, industrial, commercial, construction) and form (blanket, sheet, roll). Demand is driven by the increasing focus on energy efficiency, temperature control, and environmental sustainability. Regional trends show strong adoption in North America, Europe, and Asia-Pacific, driven by stringent energy regulations, industrial expansion, and the increasing need for high-performance insulation solutions. |

The global pyrogel insulation market is estimated to be valued at USD 275.3 million in 2025.

The market size for the pyrogel insulation market is projected to reach USD 688.6 million by 2035.

The pyrogel insulation market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in pyrogel insulation market are pyrogel xte, pyrogel hps, pyrogel xtf and others.

In terms of temperature range, high-temperature applications (>400°c) segment to command 32.8% share in the pyrogel insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Tank Insulation Market Growth – Trends & Forecast 2024-2034

Foam Insulation Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA