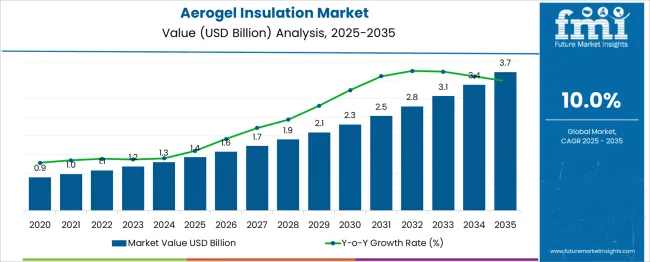

The Aerogel Insulation Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. The market growth curve shape analysis shows an initial steady increase followed by a more pronounced acceleration. Between 2025 and 2030, the market grows from USD 1.4 billion to USD 2.3 billion, contributing USD 0.9 billion in growth, reflecting a CAGR of 11.4%. This early phase shows stronger growth driven by the rising demand for high-performance, lightweight insulation materials in industries such as construction, automotive, and aerospace. Aerogel's unique thermal and acoustic properties position it as a sought-after solution for applications requiring extreme temperature insulation.

From 2030 to 2035, the market continues its upward trajectory, moving from USD 2.3 billion to USD 3.7 billion, adding USD 1.4 billion in growth, with a slightly slower CAGR of 9.6%. This phase indicates a deceleration in growth as the market matures, but the demand for aerogel insulation continues to rise due to its increasing adoption in specialized applications and advanced industries. The overall growth curve reflects a strong upward trend, with initial high growth followed by continued, albeit slower, expansion as aerogel insulation technology becomes increasingly integrated into diverse sectors. The market is set for sustained growth driven by ongoing innovation and broader industry applications.

| Metric | Value |

|---|---|

| Aerogel Insulation Market Estimated Value in (2025 E) | USD 1.4 billion |

| Aerogel Insulation Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The aerogel insulation market is witnessing accelerated growth due to its exceptional thermal resistance, low density, and ability to significantly reduce energy losses across a wide range of applications. With industrial and commercial sectors increasingly adopting sustainable and high-performance materials, aerogels are gaining traction as next-generation insulators in oil and gas pipelines, power generation units, and building envelopes.

The growing shift towards carbon neutrality and stricter regulatory mandates on energy conservation have reinforced the demand for insulation materials with high R-value and low environmental impact. Aerogel’s non-combustibility, flexibility across temperature ranges, and resistance to moisture have enabled its deployment in environments requiring both thermal and fire safety standards.

Furthermore, ongoing advancements in aerogel manufacturing, including reduced production costs and enhanced scalability, are expected to support wider adoption across new geographies. Collaborations among material science innovators, energy operators, and infrastructure developers are paving the way for aerogel insulation to become a preferred choice for sustainable and high-efficiency thermal management.

The aerogel insulation market is segmented by product type, form, temperature range, end usedistribution channel, and geographic regions. By product type of the aerogel insulation market is divided into Silica aerogel, Polymer aerogel, Carbon aerogel, Composite aerogelOthers. In terms of form of the aerogel insulation market is classified into Blankets, Panels, Granules, CoatingsOthers (foam, etc.). Based on temperature range of the aerogel insulation market is segmented into Medium temperature insulation (100°C - 500°C), High temperature insulation (>500°C)Low temperature insulation (100°C). By end use of the aerogel insulation market is segmented into Building & construction, Oil & gas, Aerospace, Automotive, Industrial insulation, ElectronicsOthers. By distribution channel of the aerogel insulation market is segmented into DirectIndirect. Regionally, the aerogel insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

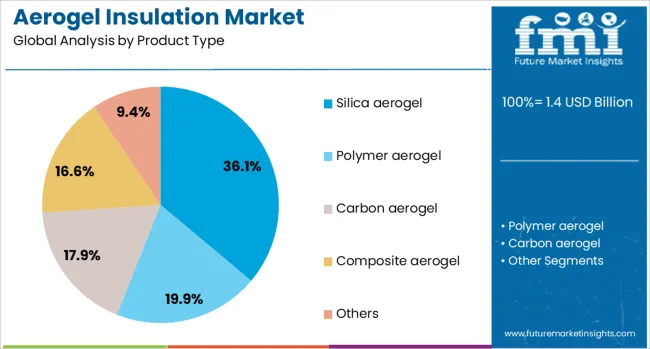

Silica aerogel is anticipated to account for 36.1% of the total revenue share in the aerogel insulation market in 2025, reflecting its dominance in performance-driven thermal insulation applications. Its ultra-low thermal conductivity, superior flame resistance, and lightweight characteristics have positioned it as the preferred material in high-value sectors such as aerospace, oil and gas, and construction.

The widespread adoption of silica-based aerogels has been facilitated by their compatibility with various forms including blankets, panels, and particles, enabling integration across diverse insulation systems. Enhanced hydrophobicity and flexibility allow their use in complex geometries and moisture-prone environments.

Continuous innovation in production techniques, including ambient pressure drying and supercritical drying processes, has contributed to lower costs and increased commercial viability of silica aerogels. Additionally, the inert chemical nature and recyclability of silica aerogels support regulatory compliance and sustainability goals, making them increasingly favorable in energy-conscious and safety-critical projects.

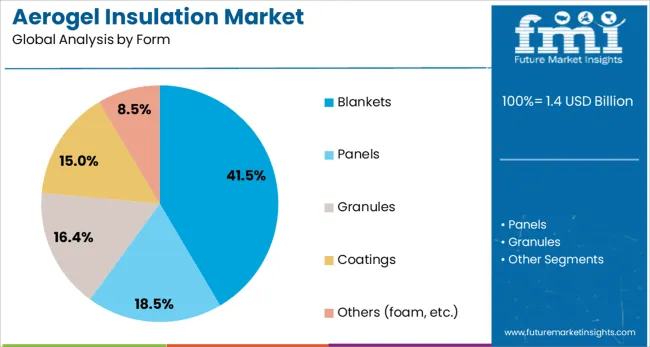

Blankets are projected to represent 41.5% of the aerogel insulation market’s revenue share in 2025, driven by their versatility, ease of installation, and compatibility with industrial insulation applications. Their flexible structure and low-profile thickness have made them suitable for use in narrow spaces and irregular surfaces, such as pipelines, storage tanks, and reactors.

The lightweight nature of aerogel blankets reduces the structural load, which is critical in offshore platforms, aerospace modules, and retrofit building envelopes. Enhanced mechanical resilience and resistance to thermal shock have allowed these materials to maintain performance under cyclic temperature conditions.

The ability to pre-fabricate and custom-cut blankets according to project requirements has also lowered labor costs and installation time. Furthermore, the integration of aerogel blankets with reinforced fiber composites has improved their durability, fire rating, and service life, making them the insulation format of choice across demanding industrial environments and large-scale infrastructure projects.

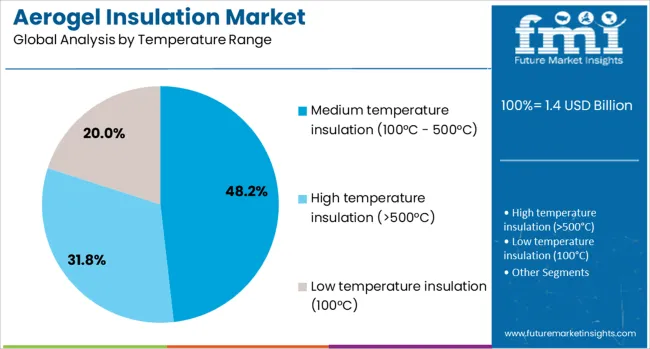

Medium temperature insulation in the 100°C to 500°C range is forecast to hold 48.2% of the revenue share in the aerogel insulation market by 2025, reflecting its widespread applicability in energy-intensive operations. This temperature range encompasses the operational conditions of numerous systems in the oil and gas, petrochemical, and power generation sectors where energy loss and surface temperature control are critical.

Aerogels used within this range offer optimized thermal resistance while maintaining structural integrity, even under prolonged exposure to thermal cycling and harsh industrial atmospheres. Their performance under medium temperatures has contributed to operational cost savings by reducing heat loss, enhancing worker safety, and minimizing corrosion under insulation.

Demand for mid-range thermal solutions has been amplified by stricter efficiency standards and sustainability mandates, encouraging plant operators and facility managers to replace conventional insulation materials with high-performance aerogel systems. The scalable manufacturing and longer service lifespan of aerogel insulation further support its continued dominance in this temperature bracket.

The aerogel insulation market is growing due to its superior thermal resistance, lightweight properties, and increasing demand for energy-efficient insulation materials in various industries. Aerogels are being adopted in high-performance applications such as aerospace, construction, and oil and gas, where traditional insulation materials fall short in terms of efficiency and space optimization. The push for sustainable and energy-efficient building materials, along with advancements in aerogel manufacturing, is contributing to the market’s expansion. Despite challenges such as high production costs and scalability, opportunities exist in emerging applications and demand from high-tech industries.

The aerogel insulation market is driven by the growing demand for energy-efficient insulation solutions that can offer superior performance while minimizing space and weight. Aerogel materials have one of the lowest thermal conductivities among solid materials, making them ideal for industries that require high-performance insulation, such as aerospace, oil and gas, and construction. With rising energy costs and an increased focus on sustainability, industries are turning to aerogel insulation for its ability to reduce heat loss in buildings, improve energy efficiency, and provide better protection in extreme environments. As regulatory standards around energy efficiency become more stringent, the demand for aerogel-based insulation is expected to continue growing.

One of the significant challenges in the aerogel insulation market is the high production costs associated with manufacturing aerogels. The production process for aerogels is complex, requiring advanced techniques and specialized equipment, which increases the overall cost compared to traditional insulation materials. These costs can be a barrier to widespread adoption, particularly in price-sensitive markets. The scaling up production while maintaining product quality and performance remains a challenge. Although advancements are being made in manufacturing processes, including the development of more cost-effective methods, the high cost of raw materials and the need for specialized manufacturing facilities still pose challenges for large-scale production and market penetration.

The aerogel insulation market offers substantial opportunities, especially in high-performance sectors like aerospace, construction, and oil and gas. In the aerospace industry, aerogels are used for thermal insulation in spacecraft, satellite components, and rocket propulsion systems due to their light weight and exceptional thermal resistance. The construction industry is increasingly adopting aerogel insulation in green buildings and energy-efficient homes, where space-saving, high-performance insulation materials are in high demand. In the oil and gas sector, aerogels are used to insulate pipelines and storage tanks in extreme temperature environments. The growth of these industries, along with the increasing demand for energy-efficient building materials, presents significant growth opportunities for aerogel insulation in the coming years.

A key trend in the aerogel insulation market is the continuous advancement in material science, which is driving the development of more efficient and cost-effective aerogel products. Research is focused on improving the thermal performance of aerogels, increasing their mechanical strength, and reducing production costs. Manufacturers are also developing eco-friendly aerogels using renewable and sustainable raw materials to cater to the growing demand for green building materials and sustainable industrial applications. Additionally, the integration of aerogels into multi-functional insulation solutions is gaining traction, where aerogels are combined with other materials to enhance their insulating properties and meet specific application requirements. These trends are shaping the future of the aerogel insulation market, making it more competitive and versatile in various industries.

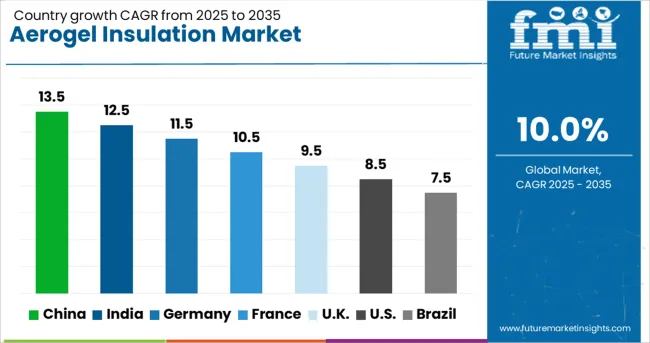

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

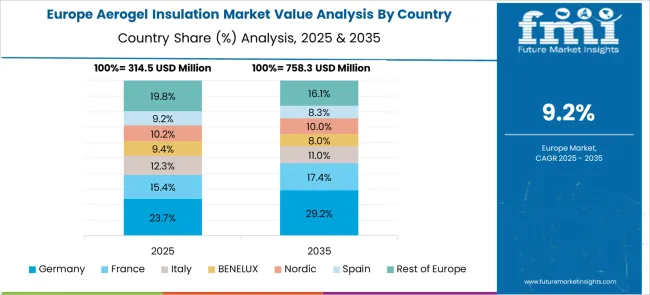

The aerogel insulation market is projected to grow at a global CAGR of 10% from 2025 to 2035. China leads the market at 13.5%, followed by India at 12.5%, and France at 10.5%. The United Kingdom is expected to grow at 9.5%, while the United States is projected to grow at 8.5%. China and India are driving this growth due to rapid industrialization, the push for energy-efficient building solutions, and the rise in demand for lightweight, effective insulation materials. In OECD nations like France, the UK, and the USA, growth is steady, supported by the increasing focus on sustainability, building efficiency standards, and infrastructure development. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 13.5% through 2035, leading the aerogel insulation market due to its rapid industrialization, urbanization, and the government’s emphasis on energy-efficient buildings. The country is adopting innovative construction materials like aerogel insulation to meet stringent energy-saving goals. As China becomes more focused on sustainability and reducing carbon emissions, the demand for high-performance materials that improve building efficiency is increasing. The market is also supported by the country’s booming construction industry, which is increasingly adopting aerogel insulation for both residential and commercial buildings.

India is projected to grow at a CAGR of 12.5% through 2035, driven by the rapid growth in industrialization, urbanization, and residential and commercial construction. The demand for aerogel insulation is increasing as the country focuses on improving energy efficiency and meeting new building regulations. India’s expanding industrial base and growing focus on energy conservation are fueling the need for advanced, lightweight, and high-performance insulation materials. As the construction sector continues to grow, driven by both government initiatives and private investments, the adoption of aerogel insulation for energy-efficient buildings is set to rise significantly.

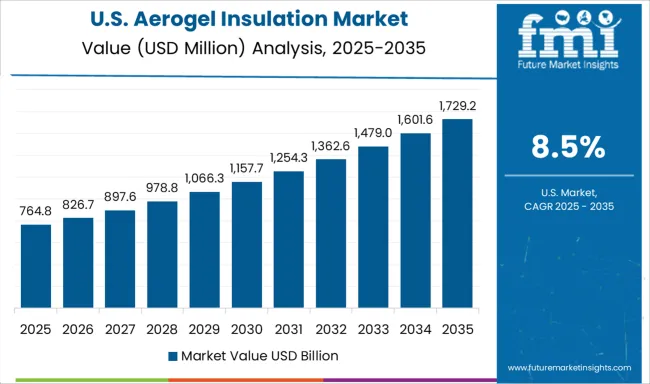

The United States is projected to grow at a CAGR of 8.5% through 2035, with demand for aerogel insulation driven by increasing building regulations, energy-efficiency standards, and a growing focus on sustainability. As the USA moves toward more energy-efficient buildings and the adoption of green construction materials, the demand for high-performance, lightweight insulation solutions like aerogel is expected to rise. The expansion of the construction sector, alongside the growing focus on sustainable energy, is pushing manufacturers and builders to adopt aerogel insulation for its superior thermal properties and low weight, making it ideal for modern infrastructure projects.

Germany is projected to grow at a CAGR of 10.5% through 2035, supported by the country’s focus on green construction and energy-efficient buildings. The demand for aerogel insulation in Germany is growing as the country invests heavily in reducing carbon emissions and improving energy efficiency in buildings. With government incentives and stricter building codes promoting the use of energy-efficient materials, the adoption of aerogel insulation in both residential and commercial buildings is increasing. As Germany continues to lead Europe in sustainability initiatives and environmental awareness, the demand for advanced insulation materials like aerogel will continue to rise.

The United Kingdom is projected to grow at a CAGR of 9.5% through 2035, with demand for aerogel insulation driven by increasing government regulations on energy efficiency and carbon emissions. The rise in demand for high-performance insulation materials is largely due to the growing construction of energy-efficient buildings and the increasing adoption of green technologies. The UK government’s push towards achieving net-zero emissions by 2050 continues to drive the market, alongside growing demand for energy-efficient materials. As the country increasingly focuses on sustainability and energy-efficient solutions, the demand for aerogel insulation in the residential and commercial sectors continues to grow.

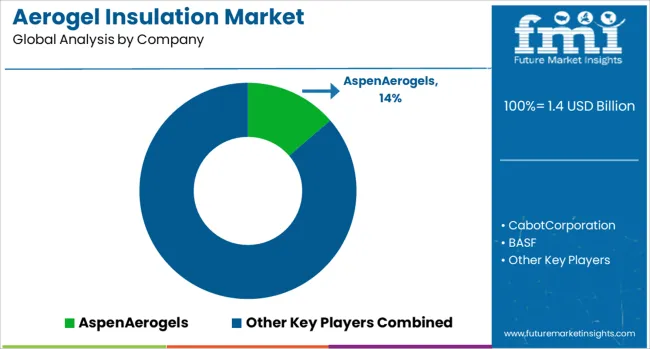

The aerogel insulation market is driven by leading companies offering advanced, lightweight, and highly efficient thermal insulation solutions for industries such as construction, oil and gas, automotive, and aerospace. Aspen Aerogels is a key player in the market, providing high-performance aerogel-based insulation materials used in energy-efficient buildings and industrial applications. Cabot Corporation and BASF are also significant players, specializing in the development of aerogel insulation materials with superior thermal resistance and energy-saving properties. Saint-Gobain and Armacell offer innovative aerogel insulation solutions for both industrial and residential applications, focusing on reducing energy loss and improving fire protection.

Dow and Aerogel Technologies are known for providing aerogel-based materials that cater to the growing demand for lightweight, high-performance insulation, especially in extreme temperature environments like aerospace and oil and gas. Johns Manville and Solvay provide a wide range of aerogel insulation solutions designed for high-performance thermal and sound insulation. KCC Corporation and Aerogel Systems focus on producing cost-effective and scalable aerogel insulation solutions, catering to commercial and industrial markets. Jios Aerogel and Guangdong Alison offer affordable aerogel insulation products with a focus on the construction and manufacturing sectors, expanding the reach of aerogel-based solutions in emerging markets. Thermo Dyne Systems and Nanoveu specialize in innovative aerogel materials with specific applications in medical, industrial, and consumer products. Competitive differentiation in this market is driven by thermal efficiency, material flexibility, product performance, and the ability to meet regulatory standards. Barriers to entry include high R&D costs, technological complexity, and the need for continuous innovation in aerogel manufacturing processes. Strategic priorities include improving aerogel efficiency, expanding production capabilities, and focusing on sustainable manufacturing practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product Type | Silica aerogel, Polymer aerogel, Carbon aerogel, Composite aerogel, and Others |

| Form | Blankets, Panels, Granules, Coatings, and Others (foam, etc.) |

| Temperature Range | Medium temperature insulation (100°C - 500°C), High temperature insulation (>500°C), and Low temperature insulation (100°C) |

| End Use | Building & construction, Oil & gas, Aerospace, Automotive, Industrial insulation, Electronics, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AspenAerogels, CabotCorporation, BASF, Saint-Gobain, Armacell, Dow, AerogelTechnologies, JohnsManville, Solvay, KCCCorporation, AerogelSystems, JiosAerogel, GuangdongAlison, ThermoDyneSystems, and Nanoveu |

| Additional Attributes | Dollar sales by insulation type (aerogel blankets, panels, granules) and end-use segments (construction, oil & gas, automotive, aerospace). Demand dynamics are driven by the increasing need for energy-efficient buildings, advancements in high-performance thermal insulation materials, and rising industrial applications in extreme temperature environments. Regional trends show strong growth in North America and Europe, with rapid adoption in Asia-Pacific due to rising industrialization and energy efficiency regulations. |

The global aerogel insulation market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the aerogel insulation market is projected to reach USD 3.7 billion by 2035.

The aerogel insulation market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in aerogel insulation market are silica aerogel, polymer aerogel, carbon aerogel, composite aerogel and others.

In terms of form, blankets segment to command 41.5% share in the aerogel insulation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

Aerogel Market Size, Growth, and Forecast for 2025 to 2035

Aerogel Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Aerogel Market Insights – Growth, Demand & Forecast 2025-2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

USA Aerogel Market Analysis – Demand, Trends & Innovations 2025-2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA