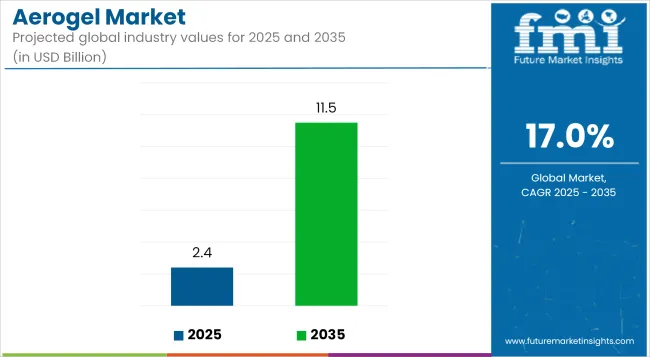

The global aerogel market is projected to grow from USD 2.4 billion in 2025 to USD 11.5 billion by 2035, reflecting a CAGR of 17.0% during the forecast period. Market expansion is being driven by stringent energy-efficiency regulations in construction, increased deployment of thermal management materials in electric vehicles, and widespread adoption in oil and gas insulation systems.

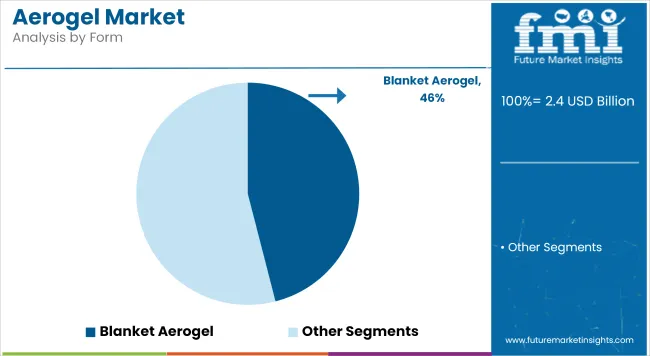

Silica-based aerogels are being preferred due to their ultra-low thermal conductivity and inert chemical profile. Blanket-form aerogels, which enable easy handling and conformability on irregular surfaces, are expected to account for nearly 43% of global sales in 2025. The construction sector is being identified as the dominant end-use industry, where aerogel-based insulation materials are being used for retrofitting building envelopes, green roofs, and passive wall systems.

In energy infrastructure, aerogels are being adopted for subsea pipeline wraps and LNG insulation jackets. Performance benefits such as reduced heat loss and prevention of hydrate formation are driving usage across upstream and midstream installations. These attributes are being valued in high-value assets such as deepwater pipelines and cryogenic storage units.

In electric vehicles, thin-layer aerogel spacers are being integrated into battery modules to minimize thermal propagation risk while supporting compact pack architectures. Aerospace projects are continuing to validate aerogels in fuel tank linings, reentry systems, and debris protection, reinforcing their relevance in extreme temperature and vacuum conditions.

Manufacturers are moving toward ambient-pressure drying and automated roll-to-roll manufacturing to achieve cost reductions and scale-up. Leading producers such as Aspen Aerogels, Cabot Corporation, and Armacell are undertaking capacity expansion and process debottlenecking initiatives to reduce unit production costs by as much as 25% within five years.

Rapid capacity addition in China is being enabled by vertically integrated supply chains and favorable energy pricing, while European manufacturers are focusing on low-carbon alternatives through the use of bio-based feedstocks. Demand visibility is expected to be reinforced through long-term offtake agreements with EV manufacturers, EPC contractors, and government-backed infrastructure programs.

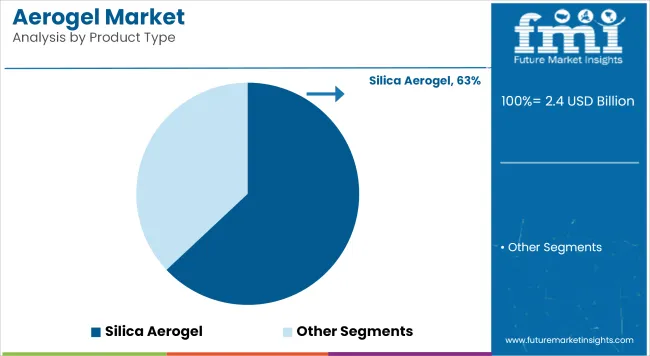

Silica aerogels are estimated to account for approximately 63% of the global aerogel market share in 2025 and are projected to grow at a CAGR of 17.2% through 2035. These aerogels offer extremely low thermal conductivity, high porosity, and minimal density, making them highly effective in insulation applications across construction, oil and gas pipelines, and aerospace systems.

Silica-based materials are also preferred for their non-combustibility and compatibility with coatings and laminates. The market is experiencing a surge in demand for flexible silica aerogel blankets and panels as alternatives to traditional insulation, particularly in energy efficiency retrofits and high-performance building envelopes.

Blanket aerogels are projected to hold approximately 46% of the global aerogel market share in 2025 and are expected to grow at a CAGR of 17.3% through 2035. These flexible, fiber-reinforced mats are widely used in industrial insulation for pipes, vessels, and equipment exposed to extreme temperatures.

Their ultra-thin profile allows for reduced insulation thickness without compromising thermal performance, a critical factor in space-constrained applications such as aircraft, automotive components, and offshore oil platforms. Major manufacturers are also developing hydrophobic variants to improve moisture resistance and durability. As industries prioritize energy conservation and lightweight material integration, blanket-form aerogels are expected to remain central to market expansion across both infrastructure and transportation sectors.

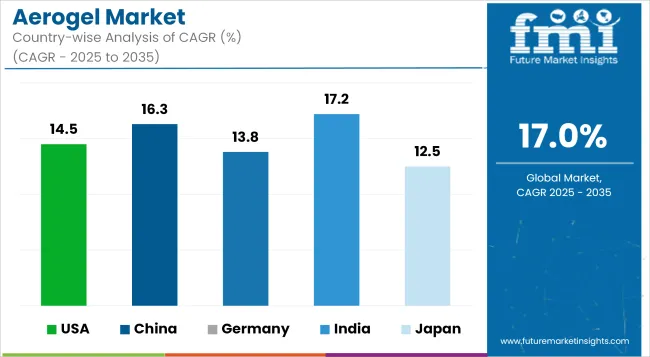

In the United States aerogel market demand is projected to climb at about a 14.5% CAGR through 2035, as federal tax incentives and stricter state-level energy codes accelerate deep-retrofit activity in offices, hospitals, and data centers. National laboratories are likely to validate aerogel-vacuum panels in next-generation heat pump trials, thereby broadening specification confidence.

Aerospace programmes-NASA’s Artemis cargo modules and commercial launch vehicles- are expected to keep procuring cryogenic tanks and ablative shields, anchoring a high-margin niche. Refinery and LNG operators are poised to adopt aerogel wraps that cut pipe heat loss by up to 40%, extending maintenance cycles and supporting steady aftermarket revenues.

China is projected to post roughly 16.3% CAGR, buoyed by the government’s dual-carbon roadmap, which tightens insulation norms in megacity high-rises and industrial parks. Provincial subsidies for ultra-low-energy buildings are likely to spur blanket and panel uptake in the Yangtze River Delta retrofit districts.

Domestic EV makers are expected to embed thin aerogel spacers in high-nickel battery packs to mitigate the risk of thermal runaway, creating a sizable demand for silica grades. Concurrently, the rapid build-out of coastal LNG terminals and long-distance cryogenic pipelines is set to sustain demand for ambient-pressure-dried rolls, which simplify on-site installation.

Germany's aerogel industry is forecast to advance at a rate of approximately 13.8% CAGR as automotive OEMs pursue lightweighting and battery safety ahead of the Euro 7 emissions rules. Aerogel fire-protection mats are likely to be specified for pouch-cell modules, while hydrogen fuel-cell buses may adopt carbon-aerogel insulation around cryo-compressed tanks.

Building-renovation grants under the BEG programme are expected to favour slender aerogel plasters for heritage façades where bulky mineral wool is impractical. Chemical-cluster operators along the Rhine are set to line super-heated steam pipes with composite blankets, trimming energy loss and helping plants meet Scope 1 decarbonisation targets.

India is projected to register the fastest national CAGR, around 17.2%, as Smart-City missions and new energy-conservation codes mandate higher R-values in residential towers and metro-station envelopes. Flagship green-hydrogen hubs and LNG import terminals on the western coast are likely to specify aerogel pipe wraps and tank-base pads, driving large industrial orders.

Domestic two-wheeler makers are expected to roll out battery-electric scooters with aerogel liners that meet the new AIS 156 thermal safety norms, thereby widening mobility penetration. Production-linked incentive schemes for advanced materials could further lower unit costs, boosting local manufacturing scale-up by mid-decade.

Japan’s aerogel demand is expected to rise at about 12.5% CAGR through 2035 as an ageing building stock undergoes energy-retrofit cycles under the ZEH+ initiative and municipal resilience plans. Railway operators are likely to install aerogel-insulated carriages to improve passenger comfort while trimming HVAC electricity draw on long-distance routes.

JAXA’s upcoming launch systems and lunar landers are projected to require ultra-light cryogenic insulation, sustaining a specialised aerospace stream. Electronics manufacturers are poised to test polymer-aerogel substrates in high-speed 6G base-station modules, signaling how thermal-management advances could ripple through Japan’s telecom supply chain.

Competition Outlook

The aerogel materials market is witnessing significant developments as companies increasingly focus on meeting the growing demand for high-performance thermal insulation and fire protection solutions across various industries.

Producers are investing in expanding regional production capacities, such as new manufacturing plants in emerging markets, to address the rising need for energy-efficient materials in sectors like oil and gas, LNG infrastructure, and industrial piping. As electric vehicle (EV) adoption accelerates, the market is also seeing a surge in demand for specialized aerogels, such as those used for battery fire protection in EVs.

Recent Devemopments

Future Market Insights’ chemicals research applies a rigorous, bottom-up framework that tracks both supply and demand to derive precise market estimates: it begins with comprehensive market profiling defining product scope, formulations, applications and end-use industries then builds a detailed data-capture list covering historical demand, installed production capacity, utilization rates, HS-code trade flows, application- and grade-wise consumption patterns and market fragmentation metrics.

Data is sourced via secondary research (industry journals, HS-trade databases, SEC filings, pricing quotes) and filled through primary interviews with manufacturers, distributors and KOLs; these inputs feed FMI’s proprietary year-over-year projection model, which weights macro-economic factors (raw-material availability, regulatory compliance, economic outlook) and micro drivers (capacity additions, company expansions) to generate scenario-based forecasts.

Throughout, iterative triangulation across supply records, consumption forecasts and trade analytics ensures auditable TAM calculations, while tiered competition mapping analyzes producer portfolios, capacities, market shares and strategic developments, rounds out a fully validated, data-driven outlook for the chemicals sector. Get the full research methodology and sample.

| Attribute | Description |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data | 2020 to 2024 |

| Base year for estimates | 2024 |

| Units of measure | USD billion (value) |

| Segments covered | Product type (silica, polymer, carbon, others); form (blanket, panel, monolith, article); end-use industry (construction, oil & gas, automotive & transport, aerospace & defence, others); region/country |

| Report coverage | Market size and growth, CAGR analysis, drivers and restraints, regional and country outlooks, competitive landscape, and emerging opportunities |

| Regions/countries analysed | United States, China, Germany, India, Japan, plus the wider markets of North America, Latin America, Western & Eastern Europe, South Asia, East Asia, and the Middle East & Africa |

| Key players profiled | Aspen Aerogels; Cabot Corporation; Armacell International; Nano Tech; Zhejiang UGOO; Guangdong Alison; Beerenberg; Aerogel Technologies; Enersens; IBIH Advanced Materials |

| Industry classification | Chemicals & Materials - General & Advanced Materials |

| Customisation scope | Country-specific break-outs, additional segment splits, competitive-mapping add-ons |

On the basis of product type, the market is categorized into Silica Aerogel, Polymer Aerogel, Carbon Aerogel, and Others

On the basis of form, the market is categorized into Monolith Aerogel, Blanket Aerogel, Article Aerogel, and Panel Form Aerogel

On the basis of end use industry, the market is categorized into Oil and Gas, Marine and Aerospace, Performance Coating, Construction, Automotive, and Others

Key regions considered for the study include North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and Middle East and Africa

The market is projected to reach about USD 2.4 billion in 2025.

Global sales are forecast to rise to roughly USD 11.5 billion by 2035.

Revenue is expected to advance at an approximately 17% CAGR over the forecast period.

Tighter building-energy codes, wider use of lightweight thermal barriers in electric-vehicle batteries, and insulation upgrades in LNG infrastructure are likely to underpin growth.

Silica aerogel is projected to account for about 71% of global revenue in 2025 owing to its ultra-low thermal conductivity and broad industrial acceptance.

India is expected to post the highest national CAGR around 17% supported by smart-city energy codes, LNG terminal expansions, and new e-scooter battery safety norms.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerogel Insulation Market Size and Share Forecast Outlook 2025 to 2035

Aerogel Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Aerogel Market Insights – Growth, Demand & Forecast 2025-2035

USA Aerogel Market Analysis – Demand, Trends & Innovations 2025-2035

ASEAN Aerogel Market Insights – Trends, Demand & Growth 2025-2035

Japan Aerogel Market Analysis – Size, Share & Industry Outlook 2025-2035

Germany Aerogel Market Outlook – Share, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA