In 2025, the aerogel film market is valued at USD 1.3 billion, and it is projected to reach USD 2.5 billion by 2035, growing at a CAGR of 6.8%.The market is set to experience substantial growth, driven by the rising demand for lightweight, high-performance materials in industries such as aerospace, automotive, and construction.

| Attributes | Details |

|---|---|

| Market Value (2025) | USD 1.3 billion |

| Forecast Value (2035) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.8% |

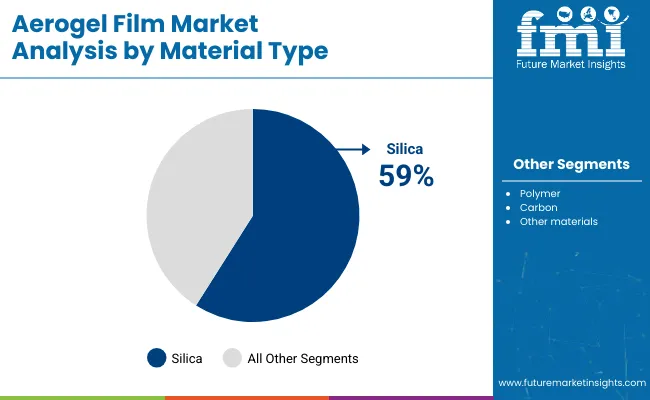

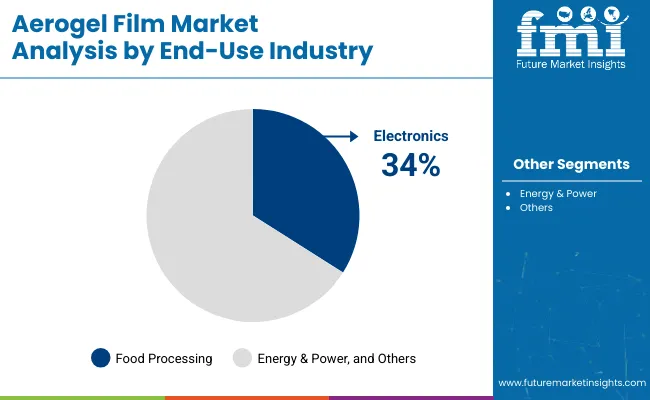

Silica aerogel films are projected to dominate the material segment, holding 59% of the market share in 2025. The electronics industry will continue to be the leading end-use sector, with growing adoption of aerogel sheets in electronic devices, insulation, and energy-efficient applications. Additionally, increasing demand for lightweight, durable materials in the aerospace and automotive sectors will further fuel market expansion.

The growth of the industry will also be propelled by increasing demand for advanced insulation materials in the construction sector, along with continued advancements in energy and power applications. Innovations in aerogel sheets manufacturing are improving the material’s thermal insulation, mechanical strengths.

Key market players are investing heavily in R&D to enhance properties, making them more efficient and environmentally friendly. As industries such as construction, energy, and electronics increasingly seek high-performance materials, the demand is expected to rise, driving further market development.

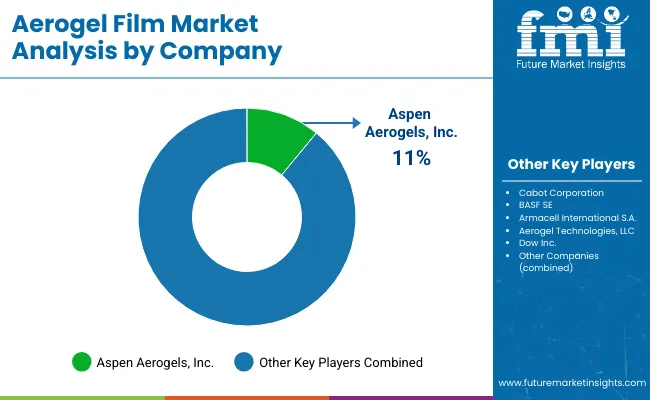

Aspen Aerogels, a leading player in the aerogel market, is focusing on expanding its thermal barrier and energy industrial activities. The company aims to optimize its supply chain and cost structure while broadening its market reach. As Don Young, President and CEO of Aspen Aerogels, stated, “We continue to drive the key elements of our strategy by broadening our Thermal Barrier and Energy Industrial commercial activities, fortifying our supply chain, and optimizing our cost structure.” In Q1 2025, Aspen Aerogels reported USD 78.7 million in revenue and secured a contract for its PyroThin® thermal barrier technology in electric vehicle platforms.

The market is segmented by material type (silica, polymer, carbon aerogel films), form factor (blanket/sheet, tiles/panels, powder/granules), and end-use industry (aerospace, automotive, construction, electronics, energy). Silica-based aerogel films dominate due to superior insulation properties, while blanket/sheet formats are favored for easy application across industries.

Silica aerogel films are poised to hold 59% of the material segment in 2025. These films are prized for their exceptional thermal insulation, low density, and high strength-to-weight ratio. They are widely adopted in aerospace, automotive, and construction for applications requiring lightweight yet durable insulation.

The electronics sector is set to capture 34% of market demand in 2025.These films are being deployed in battery thermal management, semiconductor packaging, and consumer electronics insulation to prevent overheating and extend device lifespans.

Blanket and sheet aerogel films will represent 42.9% of the form factor segment in 2025. Their flexibility, ease of installation, and superior thermal resistance make them ideal for building insulation, industrial piping, and protective garments.

The industry growth is underpinned by demand for superior insulation and lightweight solutions across construction, aerospace, and electronics. Yet, high production costs and complex manufacturing processes are major hurdles. Continuous R&D and process innovation will be essential to scale up production, reduce costs, and unlock the full potential of aerogel sheets through 2035.

Surging demand for high-performance insulation materials

Demand is being propelled by stringent energy-efficiency regulations and ecofriendly initiatives across industries. In construction, blanket/sheet aerogel is replacing traditional insulation to meet green-building standards. In automotive and aerospace, lightweight aerogel components reduce fuel consumption and emissions.

Electronics manufacturers are integrating films for next-generation thermal management in batteries and semiconductors. R&D investments by Aspen Aerogels and Cabot Corporation are accelerating the development of composite films with enhanced mechanical strength and moisture resistance.

High production costs and manufacturing complexity

Despite strong demand, the market faces significant barriers due to the high cost of raw materials and complex manufacturing processes. Conventional sol-gel methods require prolonged drying and supercritical processes, limiting throughput. Advanced techniques like ambient pressure drying are being explored, but yield and quality challenges remain.

Small and mid-tier producers struggle to achieve economies of scale, while capital expenditure for specialized equipment restricts new entrants. Regulatory approvals for novel aerogel composites add further delays. Overcoming cost and complexity will be critical for market players to expand production capacity and meet growing global demand.

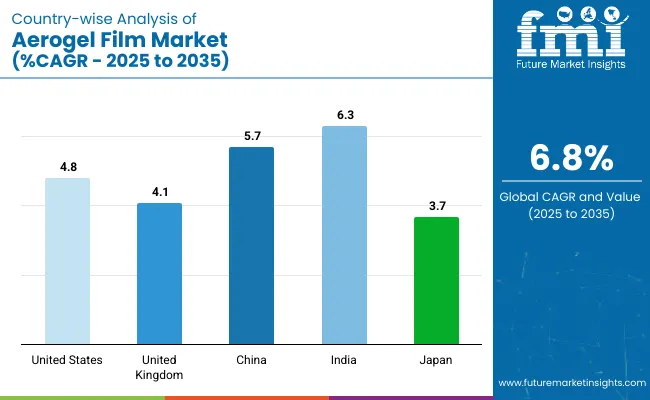

The market is led by the United States and the United Kingdom in innovation and pilot-scale production, while China and India accelerate adoption through government mandates and infrastructure needs. Japan focuses on high-end electronics and automotive applications. Strong public-private partnerships, green policies, and R&D investments underpin growth across these key markets.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

| United Kingdom | 4.1% |

| China | 5.7% |

| India | 6.3% |

| Japan | 3.7% |

The United States aerogel-based film industry is leading with innovation in high-performance insulation and lightweight materials at a CAGR of 4.8% through 2035.

Companies such as Aspen Aerogels and Cabot Corporation have expanded pilot production facilities in Texas and Massachusetts to supply silica and polymer based aerogel sheets to aerospace, automotive, and construction sectors. Battery and semiconductor manufacturers are integrating aerogel sheet for thermal management, reducing device overheating and extending component lifespan.

In the United Kingdom, the aerogel films are being deployed in heritage building retrofits, electronics, and specialty automotive applications and growth is estimated at a CAGR of 4.1%. Cabot’s Cambridge facility producing moisture-resistant blanket aerogel has partnered with architectural firms to insulate Grade II listed structures without altering exteriors. The National Physical Laboratory’s performance validations ensure long-term durability under United Kingdom weather conditions.

The market in China is expanding rapidly at a CAGR of 5.7% through 2035, underpinned by massive infrastructure investments and stringent energy-efficiency regulations. Domestic manufacturers, including Guangdong Alison Hi-Tech and LG Chem’s Shanghai plant, have doubled capacity for silica and carbon aerogel-based films. The “Green Building Action Plan” mandates improved thermal insulation in new residential and commercial construction, driving aerogel adoption.

Demand in India is estimated at a CAGR of 6.3% during the forecast period, fueled by infrastructure development, renewable energy, and urbanization. Armacell International and Active Aerogels have launched pilot lines in Gujarat and Tamil Nadu, targeting the construction and power sectors. The Smart Cities Mission incorporates aerogel-insulated buildings to improve energy performance in public facilities.

The market in Japan is likely to record a CAGR of 3.7% through 2035. The market benefits from a mature R&D ecosystem and advanced manufacturing capabilities. Companies such as JIOS Aerogel and Thermablok Aerogels have commercialized specialty films for semiconductor fab insulation and electric vehicle thermal management. Collaborative projects with METI’s energy-efficiency programs are piloting aerogel-blanket insulation in earthquake-resilient structures.

The global aerogel film market is highly competitive, with key players such as KONLIDA, Stanford Advanced Materials, and Aerogel Technologies leading the charge. These industry leaders focus on innovation and extensive R&D to deliver high-performance aerogels used across aerospace, construction, and energy sectors.

Their ability to develop lightweight, insulating, and eco-friendly film gives them a distinct market advantage. The market’s competitive dynamics are shaped by the increasing demand for advanced materials with superior properties like thermal insulation, strength, and eco-friendliness.

High entry barriers, including substantial capital investment and technical expertise in aerogel production, limit the number of new entrants, consolidating market control in the hands of established firms. Despite this, the market remains fragmented, with growth opportunities for consolidation. As the demand for energy-efficient solutions and advanced materials rises, leading aerogel manufacturers are expected to strengthen their positions and expand their technological capabilities, driving further market evolution.

Recent Aerogel Film Industry News

Aspen Aerogels opened its Advanced Thermal Barrier Center in Marlborough, MA, to accelerate prototype development of next-generation for aerospace and energy applications. Cabot Corporation’s silica aerogel was selected to insulate UNESCO-listed Mathildenhöhe buildings in Germany, demonstrating its performance in heritage retrofits. Recent peer-reviewed research has advanced ambient-pressure drying processes, aiming to preserve aerogel mechanical and thermal properties while reducing cost. These developments highlight a focus on scalable manufacturing, application-specific R&D, and Green process innovations.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand square meters for volume |

| Material Types Analyzed | Silica, Polymer, Carbon, Other Materials |

| Form Factor Segmentation | Blanket/Sheet, Tiles/Panels, Powder/Granules |

| End-Use Industry Segmentation | Aerospace & Defense, Automotive, Construction, Electronics, Energy & Power, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | KONLIDA, Stanford Advanced Materials, Aerogel Technologies, LLC, Sheen Electronical Technology Co., FSPG HI-TECH CO., LTD., Huatao Group, and Aerchs Adhesive Solution Co., Ltd. |

| Additional Attributes | Dollar sales by material type, form factor, and end-use industry, rising demand for thermal insulation and energy-efficient solutions, growing adoption in aerospace and construction industries, technological advancements in aerogel production processes, regional trends in environmental regulations. |

The market is segmented into silica, polymer, carbon, and other materials.

The market is segmented into blanket/sheet, tiles/panels, and powder/granules.

The market is segmented into aerospace & defense, automotive, construction, electronics, energy & power, and others.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Middle East & Africa.

The global Industry is projected to reach USD 2.5 billion by 2035.

In 2025, the market was valued at USD 1.3 billion.

The market is expected to grow at a CAGR of 6.8% over the forecast period.

Silica films are expected to dominate, capturing 59% of the material segment in 2025.

The electronics sector will lead with 34% market share, driven by thermal management applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerogel Insulation Market Size and Share Forecast Outlook 2025 to 2035

Aerogel Market Size, Growth, and Forecast for 2025 to 2035

UK Aerogel Market Insights – Growth, Demand & Forecast 2025-2035

USA Aerogel Market Analysis – Demand, Trends & Innovations 2025-2035

ASEAN Aerogel Market Insights – Trends, Demand & Growth 2025-2035

Japan Aerogel Market Analysis – Size, Share & Industry Outlook 2025-2035

Germany Aerogel Market Outlook – Share, Growth & Forecast 2025-2035

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA