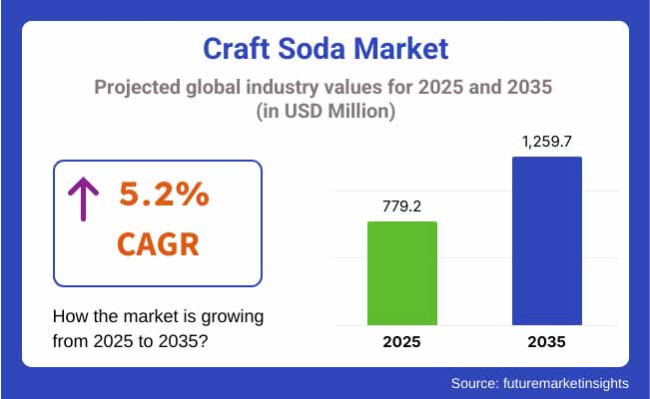

The craft soda market is estimated to clock a revenue of USD 779.2 million in 2025. Craft soda producers and distributors can expect a modest CAGR of 5.2% through 2035, with a forecast valuation of USD 1,259.7 million by 2035.

Craft soda is a low-production, small-batch soft drink by various industries using natural ingredients and fine flavors. Not containing any artificial components, this drink presents a premium quality soda product, often containing sweetened with organic components, real fruit extracts, botanical infusions, etc.

The craft soda market is about artisanal soft drinks. Small-batch, made-from-nature soft drinks have been driven by health-conscious consumers and demands for specific flavor profiles. Gains are also social media, e-commerce, and eco-friendly. Applications of this market involve standalone drinks, gourmet pairings, and cocktail mixers and premium beverage seekers.

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Healthy and conscious consumers with demand for natural ingredients lead to steady growth. | Rapid expansion due to innovation, sustainability, and global market penetration. |

| Organic, natural flavors, and less sugar are emphasized. | Functional sodas with probiotics, adaptogens, and personalized nutrition gain popularity. |

| E-commerce and direct-to-consumer sales are increasing. | Online platforms, subscription models, and AI-driven personalization dominate. |

| The trend is moving toward ecological packaging and ethical sourcing. | Any biodegradable material in use today suggests carbon neutrality in production and local sourcing. |

| Unique botanical infusions and artisanal blends. | AI-driven flavor development, exotic ingredient integration, and hyper-localized options. |

| Emerging brands challenging mainstream soda giants. | Consolidation of craft soda brands and acquisitions by larger beverage companies. |

| Smart packaging (QR codes, AR experiences) is gaining traction. | Advanced AI-powered personalization, blockchain-based transparency, and interactive marketing strategies. |

Consumers are looking for craft sodas aligned with their health-conscious lifestyles, which puts pressure on brands to innovate through natural ingredients, reduced sugar, and functional benefits such as probiotics and botanical extracts.

Meanwhile, eco-conscious customers restore priority to sustainability by buying products from brands embracing recyclable packaging, carbon-neutral production methods, and sustainable use in sourcing processes. The premiumization trend has turned the market toward small-batch artisanal sodas that provide bold complex flavors and heightened consumer sensorial experience.

Nostalgia is driving a renewed of interest in craft sodas, as brands reintroduce old flavors with a modern twist to recreate a sense of comfort and authenticity. Such an emotional connection fosters consumer loyalty and boosts brand engagement. At the same time, the speed of the digital transformation has changed the consumer experience for craft sodas.

The conveniences of direct selling to consumers, subscription services, and online platforms are enhancing access. Personalized marketing, AI-based recommendations, and brand storytelling led by social media all heighten consumer engagement. Craft soda brands are poised for long-term growth in a digital-first marketplace.

| Attributes | Details |

|---|---|

| Top Flavor | Cola |

| Market Share in 2025 | 39.2% |

The cola flavor category is likely to capture 39.2% in 2025. The young generation and millennials are targeted by the infusion of cola flavor in craft sodas. The authentic, unique, and unorthodox taste of cola flavor continues to be attractive for Gen Z. The brands innovate in healthier formulations incorporating nutritive or organic sweeteners, in cognizance of recent consumer trends.

In the last few years, brands have revisited their handcrafted heritage, often introducing new innovative flavor combinations. For example, while Coca-Cola may experiment with artisanal flavors in an effort to build on the craft soda movement, going ahead, market players are expected to develop exquisite experiences for their beverages in line with the changing consumer preferences.

| Attributes | Details |

|---|---|

| Top Distribution Channel | B2C |

| Market Share in 2025 | 73.1% |

The B2C segment is likely to lead the global market. B2C will be the 73.1% share according to the most recent estimates for 2025. DTC sales, online ordering, and in-store pickup are also boosting the growth of the segment. The most important benefit of the B2C model is to have control over product pricing and branding. This way, the brands can easily define their identity and maximize profit.

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 5% |

| Germany | 4.5% |

| USA | 4.2% |

| India | 5.1% |

| China | 4.7% |

According to projections, the sector is expected to grow with a CAGR of 5% from 2025 to 2035. Growing consumption of organic ingredients for premium carbonated beverages drive the UK market. In contrast, companies opt for alternatives to plastic for packaging purposes, while flavours continue to stay innovative as the reason for appeal to consumers.

Germany is expected to grow at about 4.5% per annum over the forecast period as energy-boosting and packaging trends favor the category. An increase in screen time and more working hours call for more high-energy drinks, which craft soda has capitalized on by being innovative in offering user-friendly packs and functional product formulations to fill the needs of busy consumers on the go.

The USA is expected to grow at about 4.2% CAGR between 2025 and 2035. Companies are quickly investing in the area of packaging innovation as well as wellness-centric products. In fact, introducing cool novel flavors with refreshing energies to stimulate a healthy and mindful drinking behavior will fuel growth for the market.

India is expected to grow at a CAGR of 5.1% over the next decade. The growth in premium carbonated beverages is the primary driver of this growth. There is a consumption trend towards high-quality brands, and higher digital engagement is further enhancing the brand, and companies can strengthen their market presence by reaching health-conscious consumers.

China expects to witness a CAGR of 4.7% until 2035. International and regional brands are launching craft soda offerings in metropolis cities with large populations. Businesses optimize user-generated content and social commerce strategies with the main goal of enhancing customer engagement, virtual shopping experiences, and sales in this comparatively competitive market.

Craft sodas are emerging as the quality alternative to mass-produced carbonated beverages, not only favouring natural ingredients but also unique flavors. Small and mid-sized brands support these operations, producing craft sodas that resonate with the healthy-conscious as much as with those wanting adventure in taste. This change mirrors the populace's general preference for authenticity, quality, and transparency over artificial constituents and standardized tastes.

Despite such growth, craft soda remains very fragmented, and independent producers have to compete against the large beverage corporations. In terms of innovation, niche brands dominate, whereas major players are expanding their portfolios to include craft-style sodas. This development has increased the competition, and well-established companies are using the vast distribution network to introduce the artisanal beverage that challenges small producers.

Tier 1 beverage companies are aware of this demand and, through acquisitions as well as new product development inside their own firms, have attempted to capture part of the segment.

Through this acquisitions, the companies establish an immediate foothold in that environment by leveraging existing customer loyalty and brand equity. Simultaneously, their craft lines give consumers a premium alternative, though under a recognizable corporate umbrella-a further consolidation strategy.

Industry concentration is influenced considerably by distribution since the larger firms command the principal retail and hospitality channels. Whereas independent brands can only sell through direct-to-consumer sales, specialty retailers, and a limited number of partners, Tier 1 companies guarantee shelf space at supermarkets, convenience stores, and food service venues. This makes it easier for large players to grow their operations, while the smaller producers fight the logistical complexities and lack of resources.

Although the craft soda sector thrives on innovation and consumer loyalty, the growing presence of Tier 1 companies alters competitive dynamics. Independent brands continue to define the segment through creativity and authenticity, but corporate-backed craft sodas benefit from superior reach and scalability. With ongoing consolidation trends, producers find themselves in a tough balance between craft integrity and industrial expansion.

The distribution of share is very fragmented. Many different players exist due to the considerable size of the bulk. Major companies that contribute to the industry include Jones Soda Co., Appalachian Brewing Co., Reed's Inc., PepsiCo, Inc., The Original Craft Soda Company, The Coca-Cola Company, Crooked Beverage Co., SIPP eco Beverage Co. Inc., Boylan Bottling Co., and Wild Poppy Company.

There are a variety of suppliers that offer different products for various consumer tastes. This includes Jones Soda Co. with their innovative flavors and labels with photos submitted by consumers; Reed's Inc., a firm that specializes in natural, ginger-based beverages; and Boylan Bottling Co., an offering made with all-natural ingredients classic sodas made with pure cane sugar.

Recently released products include the introduction of a limited-edition Raspberry Blood Orange flavor by Sunkist at Casey's convenience stores. OLIPOP rapidly became a darling in the market, outperforming Coke and Pepsi in many USA retail outlets soon after it launched a new single-serve soda.

In summary, stabilized growth of the market was being promoted with objectives like demand for diverse flavors and natural ingredients. The traditional players are innovating in the product and forming strategic alliances to create greater market positions. The progressive offering of flavors and healthful brands such as OLIPOP are indicative of the industry dynamics.

| Company | Key Strategy & Market Approach |

|---|---|

| Jones Soda Co. | Promotes unique flavors and consumer engagement with personalized labeling on its bottles. In June 2023, they unveiled a limited-edition craft soda flavor in partnership with Mary Jones. |

| Reed’s Inc. | Gingersnap nutrient-based all-natural refreshments, intended for health cognizant consumers hoping to advance past customary soft drinks. |

| Appalachian Brewing Co. | This company maintains a line of craft sodas that focus on old-school brewing principles and natural ingredients. This will resonate with seekers of the authentic. |

| PepsiCo, Inc. | PepsiCo, Inc. started product lines that consist of natural ingredients and distinctive flavor profiles to target the growing trend of premium-based beverage products. |

| The Coca-Cola Company | Company Has expanded into the craft soda segment, offering drinks that emphasize artisanal characteristics and attract consumers' changing palates. |

The craft soda market is projected to reach USD 779.2 million in 2025 and grow to USD 1,259.7 million by 2035, with a CAGR of 5.2%.

Craft soda product sales are expected to expand steadily, driven by innovation, sustainability, health-conscious trends, and digital advancements.

Major craft soda manufacturers include Jones Soda Co., Appalachian Brewing Co., Reed’s Inc., PepsiCo, Inc., The Coca-Cola Company, and Boylan Bottling Co.

The UK, India, and China are likely to create lucrative opportunities, with India leading at a CAGR of 5.1% due to premium branding and digital marketing.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Litres) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 4: Global Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 6: Global Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 12: North America Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 14: North America Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 20: Latin America Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 22: Latin America Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 28: Western Europe Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 30: Western Europe Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 36: Eastern Europe Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 38: Eastern Europe Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 52: East Asia Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 54: East Asia Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Litres) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Flavor, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Litres) Forecast by Flavor, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Litres) Forecast by Packaging, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Litres) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Litres) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 10: Global Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 14: Global Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Flavor, 2024 to 2034

Figure 22: Global Market Attractiveness by Packaging, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 34: North America Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 38: North America Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Flavor, 2024 to 2034

Figure 46: North America Market Attractiveness by Packaging, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 58: Latin America Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 62: Latin America Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Flavor, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Packaging, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 82: Western Europe Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 86: Western Europe Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Flavor, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Packaging, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Flavor, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Packaging, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Flavor, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Packaging, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 154: East Asia Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 158: East Asia Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Flavor, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Packaging, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Flavor, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Packaging, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Litres) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Flavor, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Litres) Analysis by Flavor, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavor, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavor, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Litres) Analysis by Packaging, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Litres) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Flavor, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Packaging, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Craft Beer Saccharification Equipment Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Craft Plastic Films Market

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA