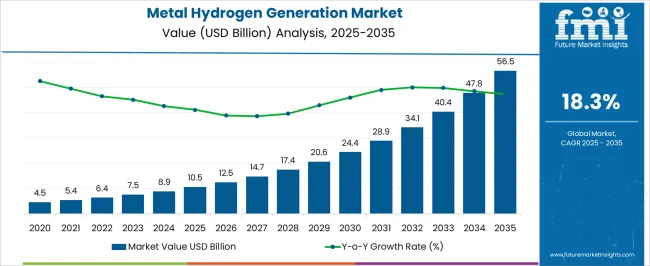

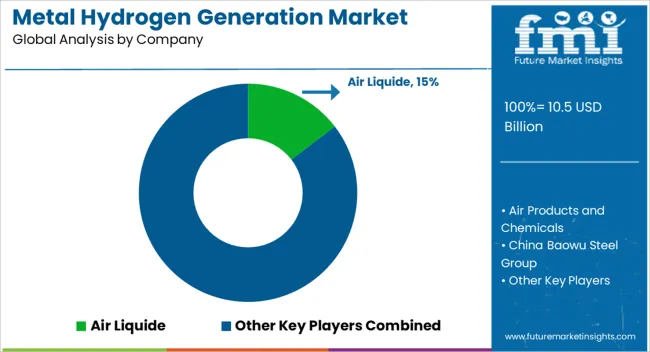

The metal hydrogen generation market is estimated to be valued at USD 10.5 billion in 2025 and is projected to reach USD 56.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.3% over the forecast period. This impressive expansion highlights the growing importance of metal-based hydrogen generation technologies as countries and industries accelerate the shift toward clean energy. Rising global energy demand, coupled with the urgent need to decarbonize industrial, automotive, and power generation sectors, is driving strong interest in hydrogen as a sustainable alternative to fossil fuels. Governments are actively promoting hydrogen adoption through regulatory incentives, funding programs, and national hydrogen strategies, making metal hydrogen generation a key area of investment. The market’s growth is also underpinned by technological advancements in metal hydrides, aluminum-based generation, and other metal-water reaction processes, which are helping reduce costs and improve efficiency.

The ability of metal-based hydrogen generation systems to provide on-demand and portable hydrogen solutions is expanding their application in aerospace, defense, and backup power systems. Another critical growth driver is the increasing focus on renewable integration, where hydrogen acts as an energy carrier and storage medium to balance intermittent wind and solar power. Strategic partnerships between energy firms, metal producers, and technology developers are also shaping the competitive landscape, accelerating commercialization.

The metal hydrogen generation market is strongly influenced by four interrelated parent technologies that collectively drive production efficiency, cost competitiveness, and adoption across industrial, mobility, and energy applications. The natural gas–based hydrogen market currently holds the largest share at 48%, as steam methane reforming remains the most economical and widely deployed pathway despite carbon concerns. The electrolysis-based hydrogen market contributes 32%, driven by renewable integration and green hydrogen mandates, with growing investment in proton exchange membrane (PEM) and alkaline electrolyzers.

The coal gasification and other conventional pathways represent around 15%, primarily concentrated in regions with abundant coal reserves, though facing regulatory challenges and declining investment. Finally, metal-based hydrogen generation, including metal hydrides, sodium borohydride, aluminum, and magnesium-based reactions, accounts for 5% of the overall market share, offering compact storage, on-demand hydrogen release, and safer handling benefits.

Although currently niche due to high costs and limited large-scale infrastructure, metal-based hydrogen generation is gaining traction in defense, aerospace, and portable fuel cell applications where safety, energy density, and mobility are critical. Together, natural gas and electrolysis contribute 80% of demand, while metal hydrogen generation remains an emerging yet strategically significant segment, shaping the long-term innovation pipeline of the hydrogen economy.

| Metric | Value |

|---|---|

| Metal Hydrogen Generation Market Estimated Value in (2025 E) | USD 10.5 billion |

| Metal Hydrogen Generation Market Forecast Value in (2035 F) | USD 56.5 billion |

| Forecast CAGR (2025 to 2035) | 18.3% |

The metal hydrogen generation market is witnessing steady expansion, supported by increasing industrial hydrogen demand, advancements in production technologies, and growing emphasis on energy security. Market growth is being driven by strategic integration of hydrogen generation systems into on-site industrial processes, minimizing dependence on external supply chains and enhancing operational efficiency.

Rising adoption in sectors such as chemicals, metals, and energy storage has reinforced market momentum, while environmental regulations are accelerating the shift toward cleaner production methods. Cost optimization through technological innovation, along with supportive government policies and incentives, is fostering investment in large-scale and decentralized hydrogen generation infrastructure.

Competitive dynamics are shaped by the push for improved efficiency, reduced carbon emissions, and long-term energy sustainability Over the forecast period, a combination of stable industrial demand, technological scalability, and global transition toward low-carbon energy systems is expected to sustain market growth, with regional diversification further strengthening supply resilience and profitability.

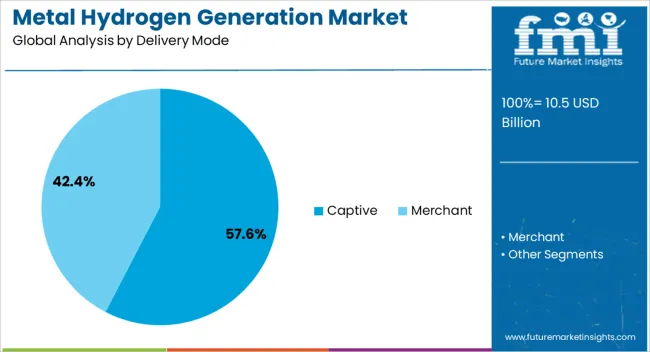

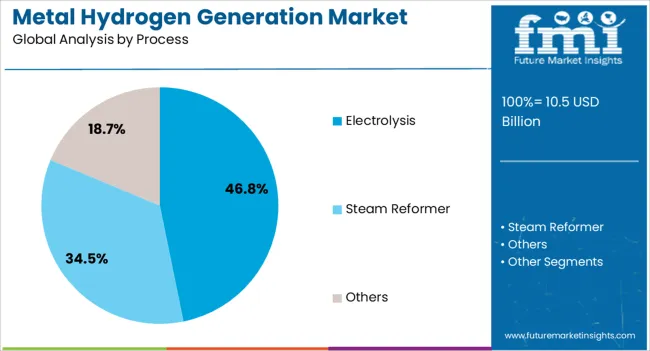

The metal hydrogen generation market is segmented by delivery mode, process, and geographic regions. By delivery mode, metal hydrogen generation market is divided into captive and merchant. In terms of process, metal hydrogen generation market is classified into electrolysis, steam reformer, and others. Regionally, the metal hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The captive delivery mode segment, holding 57.60% of the market, has maintained dominance due to its ability to ensure consistent hydrogen supply for industrial applications without reliance on external distribution networks. This approach reduces logistical costs, minimizes supply chain vulnerabilities, and allows for tailored production aligned with specific process requirements.

Industries adopting captive hydrogen generation benefit from enhanced operational autonomy, improved process efficiency, and greater control over production costs. The segment’s growth has been supported by the integration of advanced monitoring and control systems, which optimize output and improve safety standards.

Furthermore, the captive model aligns well with sustainability objectives by enabling the direct use of renewable power sources for hydrogen production, reducing greenhouse gas emissions As industries move toward decarbonization and energy independence, the captive delivery mode is expected to retain its leadership position, driven by both economic and environmental benefits.

The electrolysis process, accounting for 46.80% of the market, has emerged as a leading hydrogen production method due to its compatibility with renewable energy integration and potential for zero-carbon output. This process utilizes electricity to split water into hydrogen and oxygen, enabling a clean and adaptable production route for industries seeking to reduce carbon intensity.

Market adoption has been reinforced by declining renewable electricity costs, advancements in electrolyzer efficiency, and supportive policy frameworks promoting green hydrogen. Electrolysis offers high-purity hydrogen suitable for a range of applications, from chemical synthesis to fuel cell technology, enhancing its appeal across multiple end-use sectors.

While capital costs remain higher than conventional methods, ongoing technological innovation and economies of scale are expected to lower production expenses over time Strategic investments in large-scale electrolysis facilities and hybrid energy systems are positioning this process for long-term growth, making it a critical enabler in the transition to sustainable hydrogen generation.

Metal hydrogen generation is evolving as a strategic enabler in defense, aerospace, and portable energy systems. Despite cost barriers, regulatory support and niche applications are driving its long-term market relevance.

The demand for metal-based hydrogen generation is rising significantly in defense and aerospace sectors due to its compactness, safety, and efficiency in high-pressure or mobile environments. Military operations and aerospace missions require lightweight, high-density energy storage systems that can release hydrogen on demand, making technologies like sodium borohydride and metal hydrides attractive. Unlike conventional gas or liquid hydrogen storage, these systems reduce risks of leakage, flammability, and heavy infrastructure dependency. This ensures enhanced operational flexibility in remote or strategic locations. Governments are increasingly funding projects that explore on-board hydrogen release systems for unmanned aerial vehicles (UAVs), spacecraft, and portable military equipment, creating a strong niche opportunity for metal hydrogen generation technologies.

Although metal hydrogen generation is currently viewed as cost-intensive compared to conventional electrolysis or natural gas–based production, its long-term potential lies in improved scalability and declining material costs. Research into recycling of metals like aluminum and magnesium, alongside breakthroughs in catalysis, is driving lower operational expenses. Additionally, partnerships between industry and research institutes are exploring modular designs for distributed hydrogen supply, supporting cost-efficient deployment in localized applications. This trajectory indicates that metal-based hydrogen could become a competitive alternative in specialized energy ecosystems. Over time, as raw material cycles stabilize and economies of scale emerge, the technology is likely to strengthen its commercial adoption beyond niche defense and aerospace markets.

The growth of metal-based hydrogen generation is increasingly linked to favorable regulatory frameworks and national hydrogen roadmaps. Governments across regions such as North America, Europe, and parts of Asia-Pacific are offering incentives, tax credits, and funding programs for pilot projects involving safe and portable hydrogen storage solutions. These initiatives not only support R&D but also encourage collaboration between private companies and defense agencies. Safety regulations are another critical driver, as stricter hydrogen handling norms make metal-based storage more attractive. Policies that prioritize local energy security and decentralized hydrogen production further enhance the role of metals as a viable hydrogen carrier, accelerating both investments and demonstration projects worldwide.

Metal hydrogen generation is showing growing potential in portable fuel cell markets, medical devices, emergency backup systems, and field applications where reliability and compact energy storage are essential. Unlike large-scale hydrogen production facilities, these use cases require consistent, on-demand hydrogen generation with minimal infrastructure. Metal hydrides and borohydrides deliver this advantage by enabling lightweight and controllable hydrogen release, reducing dependence on heavy cylinders or complex storage. Start-ups and specialized manufacturers are increasingly targeting niche segments such as mobile energy packs and transportable power systems for both civilian and defense applications. As consumer and industrial demand for portable hydrogen solutions grows, this segment is expected to witness accelerated commercialization.

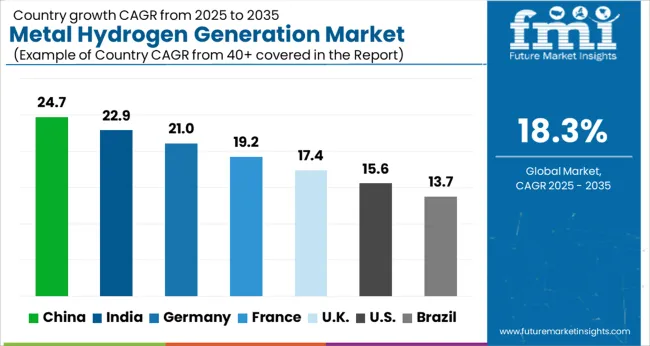

| Country | CAGR |

|---|---|

| China | 24.7% |

| India | 22.9% |

| Germany | 21.0% |

| France | 19.2% |

| UK | 17.4% |

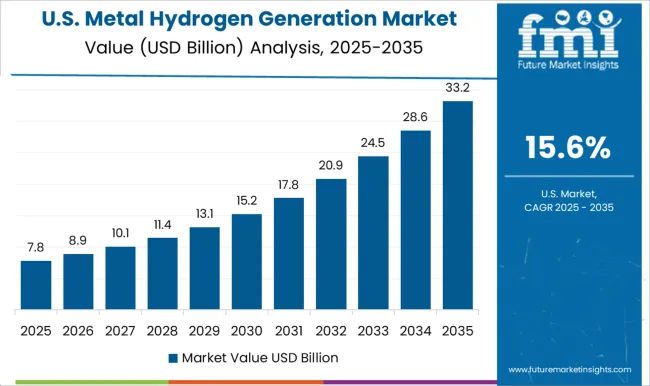

| USA | 15.6% |

| Brazil | 13.7% |

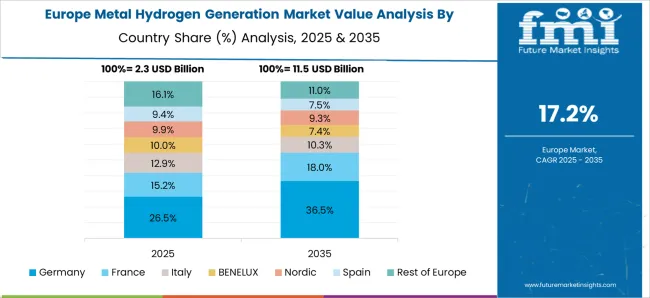

The global metal hydrogen generation market is projected to expand at a CAGR of 18.3% between 2025 and 2035. China and India, both part of BRICS, are leading this transformation with rapid adoption of metal hydrides and borohydrides for defense, aerospace, and distributed energy systems. Their focus on scaling localized hydrogen ecosystems, supported by strong government funding and industrial investments, drives their market strength. Germany, France, and the UK, as OECD members, are emphasizing regulatory frameworks, clean energy targets, and industrial integration to expand hydrogen adoption across portable fuel cells, transport, and backup systems.

The USA leverages its strong R&D ecosystem and pilot deployments in aerospace and defense. Asia dominates production and commercialization, while Europe and North America emphasize regulatory alignment, niche industrial applications, and next-gen portable hydrogen innovations. The analysis spans over 40+ countries, with the leading markets detailed below.

The metal hydrogen generation market in China is projected to grow at a CAGR of 24.7% from 2025 to 2035, supported by large-scale investments in hydrogen storage and clean fuel programs. The country is prioritizing the deployment of metal hydrides for defense, aerospace, and distributed energy systems, benefitting from strong government incentives and state-owned enterprise participation. Domestic manufacturers are scaling mass production to lower costs, while integration into green hydrogen projects boosts long-term adoption. Strategic collaborations with EV and battery firms are also accelerating commercialization.

India’s metal hydrogen generation market is anticipated to expand at a CAGR of 22.9% between 2025 and 2035, driven by its push for renewable energy and localized hydrogen production hubs. Adoption of metal-based hydrogen solutions is expanding across transportation, industrial backup, and grid applications. The “National Hydrogen Mission” supports R&D, subsidies, and pilot deployments, creating a strong policy framework. Growing demand for clean fuels in mobility and industrial sectors accelerates market penetration.

Germany’s metal hydrogen generation market is projected to grow at a CAGR of 21.0% from 2025 to 2035, supported by its ambitious clean energy transition and hydrogen integration plans. Metal hydrides are gaining traction for energy storage, mobility, and industrial hydrogen use. Germany’s strong industrial base, combined with partnerships between automotive giants and hydrogen startups, is accelerating practical deployment. Regulatory support under EU hydrogen strategies ensures funding and compliance alignment.

The UK market for metal hydrogen generation is forecasted to expand at a CAGR of 17.4% during 2025-2035, driven by its renewable energy initiatives and hydrogen-ready infrastructure. The government’s hydrogen roadmap includes pilot projects for stationary storage and industrial decarbonization. Partnerships between research institutes and energy companies are focusing on advanced hydrogen carriers, including metal hydrides.

The USA metal hydrogen generation market is expected to grow at a CAGR of 15.6% from 2025 to 2035, fueled by defense, aerospace, and renewable integration projects. Federal funding through clean hydrogen initiatives is stimulating early-stage adoption, while private firms explore hydrogen storage for mobility and energy backup systems. The presence of strong R&D institutions and collaborations with aerospace and automotive players enhance technological scaling.

Competition in the metal hydrogen generation market is shaped by large-scale hydrogen production, storage technologies, and integration with industrial applications. Air Liquide leads with extensive global hydrogen infrastructure and investments in clean hydrogen hubs. Air Products and Chemicals focuses on large-scale hydrogen projects and advanced hydrogen liquefaction systems, targeting mobility and industrial sectors. China Baowu Steel Group and JSW Group leverage their steelmaking operations to integrate hydrogen-based reduction methods, cutting emissions while scaling hydrogen demand in heavy industries.

Linde remains a key player with advanced hydrogen storage, distribution networks, and fuel cell integration projects, particularly in Europe and North America. Messer Group supports regional industrial hydrogen supply with emphasis on cost-effective delivery systems. Nel Hydrogen drives innovation through electrolyzers and hydrogen fueling infrastructure, collaborating with global governments and energy firms for scalable deployments. Reliance Industries enters aggressively with clean energy investments and vertical integration into hydrogen production across refining, petrochemicals, and renewables. Shell Global is investing heavily in hydrogen hubs and partnerships across transportation, energy, and heavy industry to accelerate adoption.

SSAB differentiates through hydrogen-based green steel initiatives, setting benchmarks for industrial decarbonization and long-term hydrogen integration. Strategies emphasize scaling hydrogen hubs, developing reliable storage carriers, and reducing cost per kilogram of hydrogen. Partnerships with automotive, aerospace, and steel sectors accelerate commercialization. Focus areas include safety, scalability, and compliance with government-led clean energy roadmaps. Companies highlight efficiency metrics, project capacity, and integration into energy transition strategies in their product and solution portfolios.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.5 billion |

| Delivery Mode | Captive and Merchant |

| Process | Electrolysis, Steam Reformer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, China Baowu Steel Group, JSW Group, Linde, Messer Group, Nel Hydrogen, Reliance Industries, Shell Global, and SSAB |

| Additional Attributes | Dollar sales, share, growth rate, demand outlook, supply chain gaps, raw material trends, regional opportunities, competitor moves, pricing strategies, and policy impacts. |

The global metal hydrogen generation market is estimated to be valued at USD 10.5 billion in 2025.

The market size for the metal hydrogen generation market is projected to reach USD 56.5 billion by 2035.

The metal hydrogen generation market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in metal hydrogen generation market are captive and merchant.

In terms of process, electrolysis segment to command 46.8% share in the metal hydrogen generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA