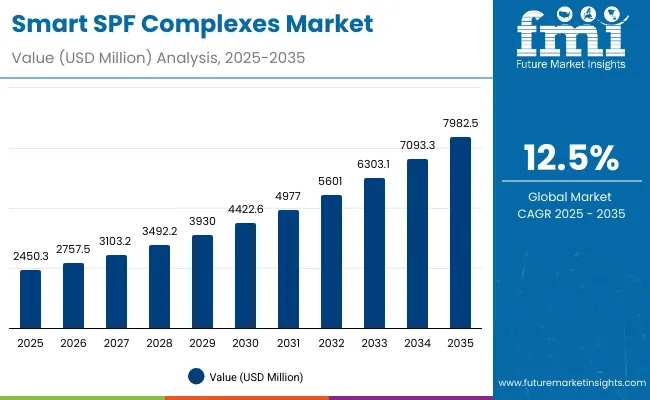

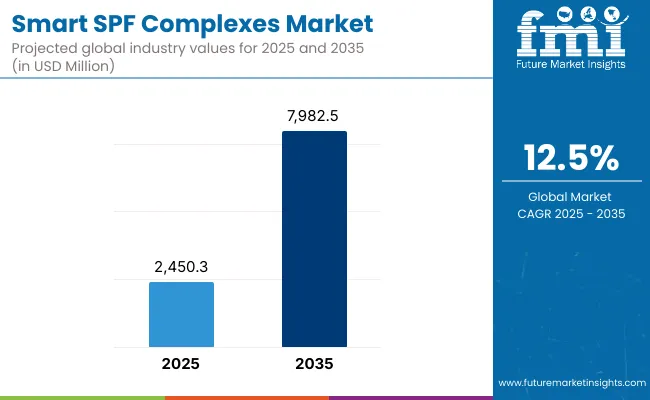

The global Smart SPF Complexes Market is expected to record a valuation of USD 2,450.3 million in 2025 and USD 7,982.5 million in 2035, with an increase of USD 5,532.2 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.5% and a 2X increase in market size.

Global Smart SPF Complexes Market Key Takeaways

| Metric | Value |

|---|---|

| Global Smart SPF Complexes Market Estimated Value in (2025E) | USD 2,450.3 million |

| Global Smart SPF Complexes Market Forecast Value in (2035F) | USD 7,982.5 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,450.3 million to USD 4,422.6 million, adding USD 1,972.3 million, which accounts for 36% of the total decade growth. This phase records steady adoption in advanced sun protection products, multi-functional skin formulations, and premium beauty innovations, driven by the rising consumer preference for daily-use UV shields. UV protection dominates this period as it caters to over 57% of market demand, reflecting strong consumer awareness of photoaging and skin cancer risks.

The second half from 2030 to 2035 contributes USD 3,559.9 million, equal to 64% of total growth, as the market jumps from USD 4,422.6 million to USD 7,982.5 million. This acceleration is powered by widespread deployment of smart skincare hybrids combining SPF with anti-aging peptides, brightening actives, and pollution defense complexes.

Serums and sprays/mists gain traction, while creams/lotions retain a significant baseline due to mass consumer familiarity. Digital-first distribution, including e-commerce platforms and subscription-based models, propels rapid expansion. The claim segment shifts toward dermatologist-tested and vegan products, with dermatologist-tested formulations alone accounting for USD 1,286.9 million in 2025.

From 2020 to 2024, the global Smart SPF Complexes Market grew steadily from niche multifunctional sun care to a broader mainstream adoption, reaching close to USD 2.2 billion in value. During this period, the competitive landscape was dominated by clinical-grade skincare brands and dermatology-backed labels, controlling nearly 70% of revenue, with leaders such as Supergoop!, La Roche-Posay, and Shiseido focusing on combining superior sun protection with added skin health benefits. Competitive differentiation relied on scientific validation, skin compatibility, and lightweight formulations, while digital channels became an essential driver of consumer reach. Service-based offerings such as personalized SPF routines had minimal traction, contributing less than 8% of the total market value.

Demand for Smart SPF Complexes will expand to USD 2,450.3 million in 2025, and the revenue mix will shift as multifunctional claims (anti-aging, brightening, and pollution defense) grow to over 42% share. Traditional SPF leaders face rising competition from indie clean-label players offering vegan, dermatologist-tested, and natural/organic certifications.

Major global vendors are pivoting to hybrid positioning, integrating antioxidant complexes, DNA repair enzymes, and AI-driven skin testing kits to retain consumer relevance. Emerging entrants specializing in e-commerce-first models, subscription services, and K-beauty-inspired SPF textures are gaining share. The competitive advantage is moving away from SPF strength alone to brand trust, dermatological endorsement, and holistic skin wellness integration.

Advances in dermatological research and skincare formulations have improved efficacy and safety, allowing for multifunctional SPF products that go beyond basic sun protection. UV protection remains the leading driver as rising skin cancer cases and photoaging concerns push consumers toward high-SPF, broad-spectrum complexes.

The addition of anti-aging peptides, niacinamide-based brightening, and pollution defense antioxidants has turned Smart SPF into an everyday skincare essential. Consumers, particularly in urban and high-pollution areas, are increasingly demanding products that protect against UVA, UVB, blue light, and environmental toxins simultaneously.

Expansion of dermatologist-tested, vegan, and clean-label formulations has fueled consumer trust and adoption. Innovations in lightweight serums, sprays, and stick formats have made SPF reapplication easier, addressing one of the biggest compliance challenges in sun care.

Segment growth is expected to be led by UV protection under function, creams/lotions under product type, and dermatologist-tested under claims due to their proven safety and efficacy. E-commerce platforms, beauty specialty stores, and pharmacy chains are expected to open new application and distribution areas, boosting both accessibility and premium positioning.

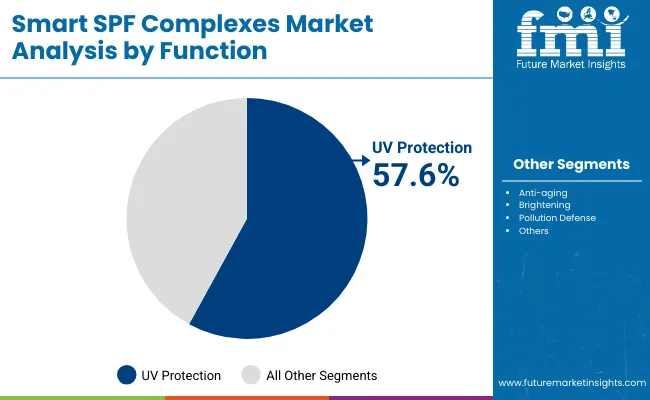

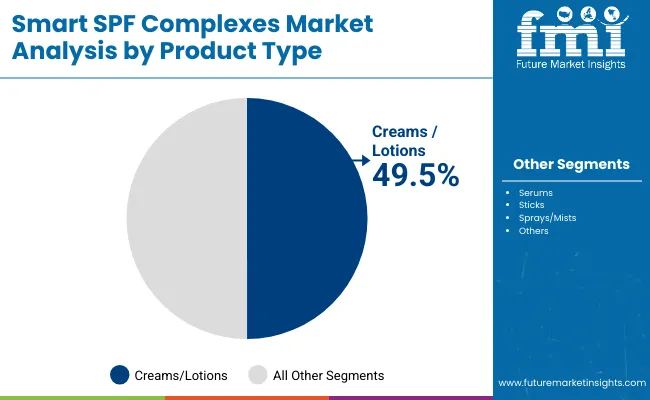

The market is segmented by function, product type, channel, claim, and region. Functions include UV protection, anti-aging, brightening, and pollution defense, highlighting the core elements driving adoption. Product type classification covers creams/lotions, serums, sticks, and sprays/mists to cater to different consumer usage patterns.

Based on channel, the segmentation includes pharmacies, e-commerce, mass retail, and specialty beauty stores. In terms of claims, categories encompass dermatologist-tested, vegan, clean-label, and natural/organic certifications. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| UV protection | 57.6% |

| Others | 42.4% |

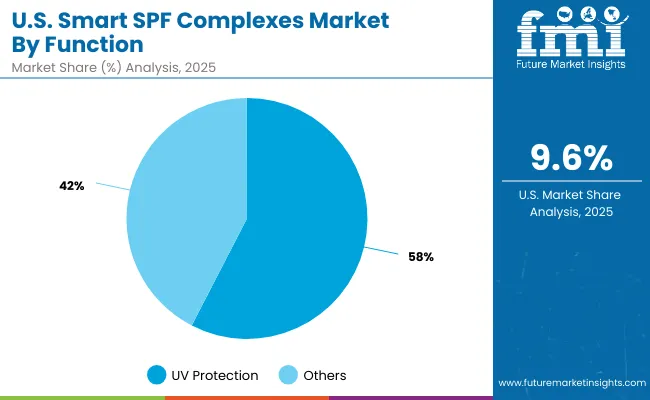

The UV protection segment is projected to contribute 57.6% of the global Smart SPF Complexes Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by ongoing demand for broad-spectrum sun protection that shields against UVA and UVB radiation, addressing both health and cosmetic skin concerns. UV protection remains the entry point for most consumers, but the rise of anti-aging and brightening actives as add-ons shows the evolving consumer preference for multi-dimensional skincare solutions.

The segment’s growth is also supported by increased consumer education on SPF compliance and global campaigns highlighting the risks of unprotected exposure. With innovations such as hybrid sunscreen-serums, breathable textures, and antioxidant-boosted UV shields, UV protection is expected to retain its position as the backbone of smart SPF innovation.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 49.5% |

| Others | 50.5% |

The creams/lotions segment is forecasted to hold 49.5% of the market share in 2025, led by its widespread consumer familiarity and role as the most trusted format for sun care. Creams and lotions offer versatility across age groups and skin types, making them the preferred choice for both dermatology prescriptions and over-the-counter retail.

Their ease of formulation allows brands to integrate multiple actives, such as retinol for anti-aging, niacinamide for brightening, and antioxidants for pollution defense. As lightweight and quick-absorbing textures continue to evolve, creams and lotions remain highly adaptable for daily routines, while serums and sprays are emerging as strong complements for specific use cases such as layering and reapplication.

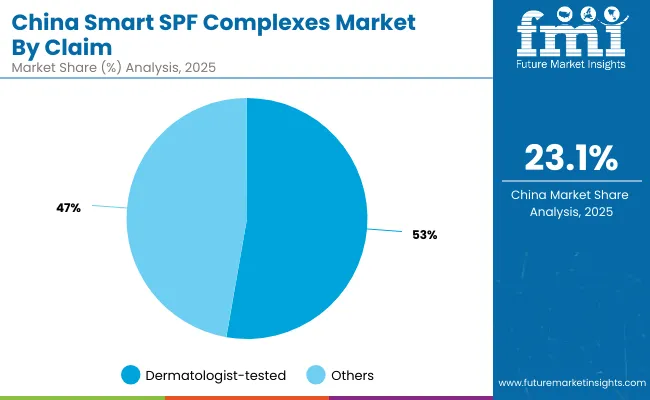

| Claim Segment | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 52.5 % |

| Others | 47.5 % |

The global Smart SPF Complexes Market in 2025 is strongly anchored by dermatologist-tested formulations, which account for 52.5% of total value, equal to USD 1,286.9 million. This dominance reflects a global shift toward clinical validation and consumer trust in products that guarantee safety, efficacy, and skin tolerance.

Dermatologist endorsements serve as a credibility anchor, especially in developed markets like the USA, Germany, and the UK, where medical associations and pharmacy-led distribution heavily influence purchase decisions. The segment’s strength is also tied to consumer concerns over SPF label controversies and efficacy transparency, making clinically backed SPF complexes the most preferred choice worldwide.

The “Others” category, comprising vegan, clean-label, and natural/organic claims, represents 47.5% (USD 1,163.27 million) in 2025 and is expanding rapidly across Asia-Pacific and emerging markets. Clean-label claims resonate with eco-conscious consumers, while vegan and natural/organic options appeal to millennials and Gen Z seeking ethical skincare.

Although smaller than dermatologist-tested, this segment is driving innovation in lightweight, plant-derived SPF hybrids and refillable packaging solutions. Over the next decade, convergence between dermatologist-tested rigor and clean-label positioning is expected to define brand success, as consumers increasingly demand both clinical validation and ingredient transparency from their SPF choices.

Rising Demand for Hybrid Skincare Products Integrating SPF with Anti-Aging and Brightening Complexes

One of the strongest growth drivers in the global Smart SPF Complexes Market is the consumer preference for hybrid skincare formats that combine sun protection with active benefits like anti-aging peptides, antioxidants, and brightening actives. Traditionally, SPF products were perceived as functional and often left behind in the skincare hierarchy. However, the global demand is shifting towards "value-stacked" products where SPF is seamlessly embedded into daily-use creams, serums, and even color cosmetics.

This transition is particularly evident in premium and mass segments in Asia-Pacific and the USA, where dermatologist-tested and vegan SPF complexes with claims such as anti-pollution or skin barrier repair are gaining rapid adoption. Brands like Supergoop! and La Roche-Posay are leading this narrative by innovating with SPF serums and lightweight lotions that not only prevent photoaging but also deliver long-term skin health benefits.

Expansion of E-commerce and Subscription-Based Distribution Models for Daily SPF Products

E-commerce is becoming a dominant distribution channel for SPF complexes, accounting for a rising share of global sales. Unlike traditional sun care, Smart SPF Complexes benefit heavily from digital-first positioning, influencer-driven campaigns, and targeted skincare education online. Subscription models, pioneered by niche indie players and increasingly adopted by leading brands, are fueling recurring sales by embedding SPF use into daily routines.

This is particularly important because one of the historic challenges of sun care was low reapplication compliance but subscription boxes with auto-renewals and bundled skincare kits are improving penetration rates. In markets like China and India, where CAGR is projected above 20%, e-commerce-first SPF launches are not only expanding brand reach but also shaping new consumer habits around regular and multi-step sun protection.

Formulation Complexity and High R&D Costs in Smart SPF Integration

Unlike traditional sunscreens, Smart SPF Complexes must integrate photostable filters with additional active ingredients such as antioxidants, peptides, and brightening agents all while maintaining compatibility, stability, and skin tolerance. This significantly raises formulation challenges and R&D investment requirements for brands. Stability issues such as oxidation of vitamin C in SPF serums or the interaction of retinoids with UV filters can compromise product safety and efficacy.

These scientific complexities slow down product pipelines and make scaling difficult, particularly for mid-tier or indie players. For multinational brands, this means higher production costs and longer launch cycles, limiting their ability to compete with fast-moving K-beauty or clean-label brands that thrive on speed-to-market.

Consumer Distrust Stemming from SPF Efficacy and Labeling Controversies

The market continues to face restraint due to skepticism over SPF label accuracy, especially after regulatory recalls and lawsuits questioning the actual UV protection delivered compared to advertised claims. In markets like the USA and Europe, some SPF products have come under scrutiny for containing benzene impurities or providing lower-than-claimed SPF ratings under real-use conditions.

This has eroded trust and made consumers more selective, favoring dermatologist-tested or clinically validated SPF complexes. While this creates opportunities for medically endorsed brands like La Roche-Posay or EltaMD, it restrains overall growth by making adoption slower in emerging markets where consumers are wary of premium price tags without clear regulatory assurances.

Surge of Dermatologist-Tested and Clinical-Grade SPF Complexes as a Consumer Trust Anchor

With dermatologist-tested products already capturing 52.5% of global market share in 2025 (USD 1,286.9 million), clinical-grade validation is becoming the cornerstone of competitive positioning. Consumers increasingly look for evidence-backed claims, driving major players like ISDIN and Bioderma to emphasize dermatological testing and medical endorsements.

This trend is particularly pronounced in China, where dermatologist-tested SPF complexes dominate the claim segment. In parallel, clinical aesthetics and dermatology clinics are integrating SPF complexes as part of prescribed post-treatment skincare, further embedding them into everyday routines. This blurs the line between medical-grade skincare and consumer beauty, positioning dermatologist-tested Smart SPF Complexes as the default choice for risk-averse consumers.

Regional Innovation Driven by Asia-Pacific: K-Beauty and J-Beauty Leading Global SPF Textures

Asia-Pacific, with China (CAGR 23.1%) and Japan (CAGR 18.0%), is setting the innovation tone for global Smart SPF Complexes. K-beauty and J-beauty brands are pioneering formats like SPF mists, sticks, and essence-like serums that integrate seamlessly into multi-step skincare routines. These innovations are influencing Western brands to adapt lightweight, reapplication-friendly textures that move beyond heavy creams.

For example, sprays and sticks are becoming more popular in the USA as consumers seek convenience for on-the-go application. The cross-pollination of formats and textures between Asia and Western markets is establishing a trend where "SPF reapplication made easy" is central to innovation. This trend also extends into packaging, with eco-friendly, refillable SPF applicators gaining traction under the clean-label and sustainable beauty movement.

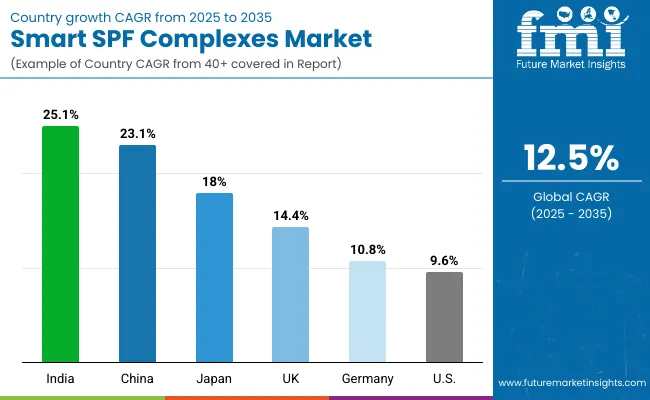

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 23.1% |

| USA | 9.6% |

| India | 25.1% |

| UK | 14.4% |

| Germany | 10.8% |

| Japan | 18.0% |

The country-wise outlook for the global Smart SPF Complexes Market highlights significant regional variations in growth trajectories, reflecting differences in consumer behavior, dermatological awareness, and retail infrastructure. India is expected to lead with the highest CAGR of 25.1% between 2025 and 2035, driven by a young demographic, increasing disposable incomes, and rapid urbanization that amplifies pollution and UV exposure concerns.

China follows closely at 23.1%, benefitting from its strong e-commerce ecosystem, influencer-led beauty marketing, and rising preference for dermatologist-tested and multi-functional SPF complexes. Japan, with an 18.0% CAGR, demonstrates its established culture of daily SPF usage, where beauty and prevention are deeply embedded in skincare routines. These Asian markets are shaping innovation in SPF formats from lightweight serums and mists to convenient sticks and are driving global adoption trends.

In contrast, mature Western markets such as the USA, UK, and Germany show more moderate yet steady growth, reflecting their already established consumer bases. The USA is projected to expand at a 9.6% CAGR, underpinned by dermatologist-recommended products, strong pharmacy distribution, and premiumization trends in daily SPF.

The UK, at 14.4%, reflects a growing consumer shift toward clean-label and vegan claims, while Germany’s 10.8% CAGR is supported by a strong dermocosmetic market and regulatory confidence in clinically validated products. Together, these markets will continue to provide stability, but the sharper growth curve is clearly in Asia-Pacific, positioning it as the engine of innovation and expansion for global Smart SPF Complexes over the forecast period.

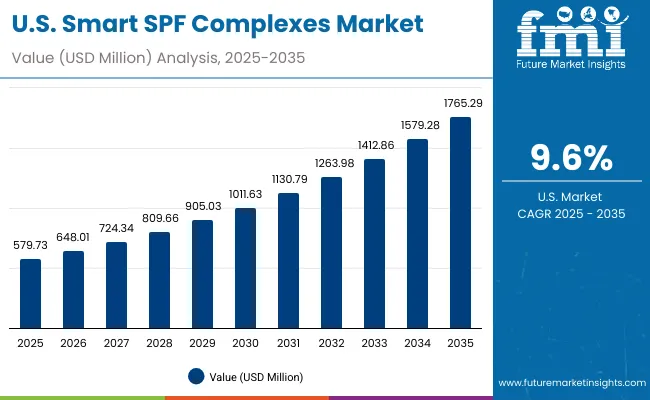

| Year | USA Smart SPF Complexes Market (USD Million) |

|---|---|

| 2025 | 579.7 |

| 2026 | 648.0 |

| 2027 | 724.3 |

| 2028 | 809.7 |

| 2029 | 905.0 |

| 2030 | 1011.6 |

| 2031 | 1130.8 |

| 2032 | 1264.0 |

| 2033 | 1412.9 |

| 2034 | 1579.3 |

| 2035 | 1765.3 |

The Smart SPF Complexes Market in the United States is projected to grow at a CAGR of 9.6%, led by rising demand for dermatologist-tested and daily-use multifunctional SPF products. Dermatology clinics and pharmacies are central to consumer adoption, with UV protection-based creams and lotions dominating sales. Growth is further supported by heightened awareness of photoaging and skin cancer prevention, reinforced by strong medical endorsements.

Digital-first consumer engagement, including social media influencers and DTC subscription models, is reshaping retail. Premium players like Supergoop! and La Roche-Posay are expanding beyond UV-only claims by integrating anti-aging and pollution-defense complexes.

The Smart SPF Complexes Market in the United Kingdom is expected to grow at a CAGR of 14.4%, supported by consumer preferences for vegan, clean-label, and natural/organic SPF claims. The UK market is shaped by strong consumer movements toward transparency and sustainability in beauty, with SPF products increasingly marketed as part of eco-conscious routines.

Retailers and specialty beauty stores are expanding premium shelf space for SPF serums, sprays, and mists. Heritage skincare brands are also adopting digital marketing to emphasize dermatologist-tested benefits. Growth is further reinforced by governmental skin cancer awareness campaigns and rising adoption of multifunctional daily-use products across men’s grooming and unisex skincare.

India is witnessing rapid growth in the Smart SPF Complexes Market, which is forecast to expand at a CAGR of 25.1% through 2035, the highest globally. Rising disposable incomes, growing pollution levels in urban centers, and increasing awareness of UV damage are accelerating adoption. Tier-2 and Tier-3 cities are emerging growth hubs, where affordable dermatologist-tested SPF lotions and creams are entering pharmacies and retail chains.

Premium brands are capturing metros with brightening and anti-aging SPF complexes, while e-commerce platforms are extending reach to younger consumers. Education on daily SPF use is being driven by dermatologists, social media influencers, and regional KOLs.

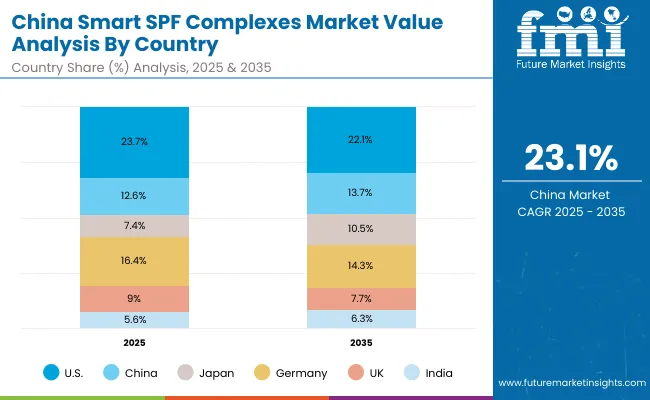

The Smart SPF Complexes Market in China is expected to grow at a CAGR of 23.1%, one of the fastest among global markets. This momentum is driven by the country’s advanced e-commerce infrastructure, rapid premiumization in skincare, and consumer preference for dermatologist-tested formulations. Urban consumers are shifting toward hybrid SPF products with multifunctional claims, particularly brightening and pollution defense.

Local brands are increasingly competitive, offering affordable but clinically validated products that cater to Gen Z and millennials. Influencer-led marketing, combined with K-beauty and J-beauty inspired formats such as mists, sticks, and essence-SPFs, is shaping demand.

| Country | 2025 Share (%) |

|---|---|

| USA | 23.7% |

| China | 12.6% |

| Japan | 7.4% |

| Germany | 16.4% |

| UK | 9.0% |

| India | 5.6% |

| Country | 2035 Share (%) |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 10.5% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.3% |

| Function Segment | Market Value Share, 2025 |

|---|---|

| UV protection | 54.6% |

| Others | 45.4% |

The Smart SPF Complexes Market in the United States is valued at USD 579.73 million in 2025, with UV protection leading at 54.6%, reflecting deep dermatology-led awareness and daily-wear habits. UV-first routines are anchored in pharmacy and clinic channels where dermatologist-tested claims drive trust, compliance, and repeat purchase.

Lightweight creams and lotions remain the baseline for broad-spectrum coverage, while premium lines layer anti-aging peptides and brightening actives to convert sunscreen from a seasonal item to a 365-day skincare essential. The opportunity is strongest at the intersection of medical endorsement and consumer convenience, where stick and spray formats support on-the-go reapplication without sacrificing photostability or skin feel. Digital-native brands are also leveraging subscriptions to fix reapplication behavior, translating medical guidance into predictable basket sizes.

This advantage positions UV-led Smart SPF complexes as the primary entry point into higher-value hybrid regimens in the United States. E-commerce and omnichannel pharmacy chains amplify this effect through targeted education and sampling, while tinted SPF, mineral-forward options, and sensitive-skin variants expand reach across diverse skin tones and conditions.

As retailers elevate dermocosmetic assortments, the upside shifts toward serums that stack SPF with antioxidants and pollution defense for urban lifestyles. Brands that can validate claims with clinical data and transparent filter systems will outpace peers as consumers scrutinize efficacy and ingredient integrity.

| Claim Segment | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 52.5% |

| Others | 47.5% |

The Smart SPF Complexes Market in China is valued at approximately USD 308.74 million in 2025, with dermatologist-tested leading at 52.5%. China’s opportunity profile is defined by rapid premiumization in skincare, live commerce that educates at scale, and a consumer pivot toward clinically verified, sensitive-skin-safe formulas. Dermatologist-tested is not only a reassurance signal but also a conversion lever for first-time buyers of hybrid SPF formats.

Brightening and pollution defense co-claims resonate strongly in Tier 1 and Tier 2 cities where air quality and hyperpigmentation concerns push multi-active SPF serums and essence textures into everyday routines. Local champions are competitive on speed-to-market and price, while international brands compete on clinical depth and texture innovation inspired by K-beauty and J-beauty.

This advantage positions dermatologist-tested lines as the de facto standard for growth in China, especially where proof of efficacy and filter transparency are front and center in livestreams and social reviews. Value packs, refillable packaging, and travel minis accelerate trial and reapplication, while mists and sticks unlock incremental occasions throughout the workday. As cross-border and domestic e-commerce platforms refine discovery and sampling mechanics, the segment’s ceiling lifts further for brands that pair lightweight aesthetics with lab-backed outcomes across brightening and barrier repair.

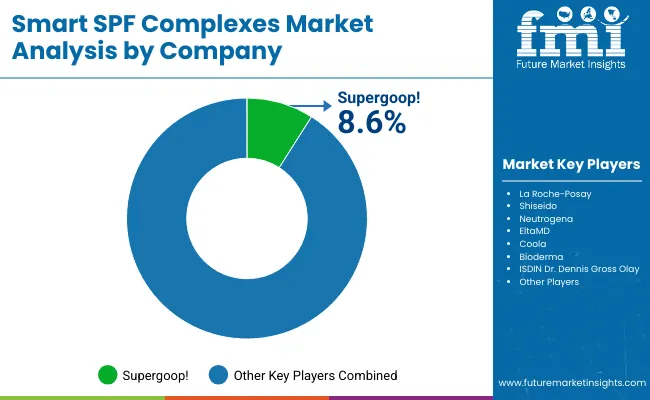

| Companies | Global Value Share 2025 |

|---|---|

| Supergoop ! | 8.6% |

| Others | 91.4% |

The global Smart SPF Complexes Market is moderately fragmented, with dermatologist-backed leaders, performance-driven premium brands, and agile clean-label specialists competing across claims, textures, and channels. Supergoop! sets the pace on product architecture and format breadth, translating daily SPF education into stickiness through textures like cloud-light lotions, primer-style SPF, and mini formats that simplify reapplication.

La Roche-Posay, EltaMD, and Bioderma leverage clinical equities and pharmacy distribution to scale dermatologist-tested franchises, anchoring trust for sensitive-skin and post-procedure use. Shiseido and ISDIN differentiate on high-performance filters and elegant wear that suit humid and urban conditions, while Neutrogena and Olay use mass retail and DTC to democratize hybrid SPF with anti-aging and brightening co-claims.

Competitive strategies are shifting from isolated SPF strength to integrated ecosystems where claims validation, texture engineering, and channel design compound advantage. Leaders are investing in clinical substantiation that travels well in physician offices and live-commerce demos, while packaging innovation supports on-the-go top-ups without residue.

Clean-label and vegan positioning create additional lanes for Coola and indie players that win with ingredient transparency and reef-conscious narratives. As specialty beauty stores and pharmacies expand dermocosmetic bays, bundled routines that pair SPF with antioxidant serums and barrier-repair moisturizers unlock higher lifetime value. The next leg of differentiation will come from measurable outcomes, clearer filter disclosures, and frictionless replenishment models that align with how consumers actually use SPF every day.

Key Developments in Global Smart SPF Complexes Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,450.3 million |

| Function | UV protection, Anti-aging, Brightening, and Pollution defense |

| Product Type | Creams/lotions, Serums, Sticks, and Sprays/mists |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Dermatologist-tested, Vegan, Clean-label, and Natural/organic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Supergoop !, La Roche- Posay , Shiseido, Neutrogena, EltaMD , Coola, Bioderma , ISDIN, Dr. Dennis Gross, and Olay |

| Additional Attributes | Dollar sales by function, product type, and channel; adoption trends in UV protection and anti-aging SPF skincare; rising demand for dermatologist-tested and vegan claims; segment-specific growth in creams/lotions and e-commerce; integration of antioxidants such as vitamin C and peptides into SPF complexes; regional trends influenced by K-beauty, J-beauty, and clean-label movements; and innovations in hybrid SPF formats like serums, mists, and sticks designed for daily reapplication. . |

The Global Smart SPF Complexes Market is estimated to be valued at USD 2,450.3 million in 2025.

The market size for the Global Smart SPF Complexes Market is projected to reach USD 7,982.5 million by 2035.

The Global Smart SPF Complexes Market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in the Global Smart SPF Complexes Market are creams/lotions, serums, sticks, and sprays/mists.

In terms of function, the UV protection segment is projected to command 57.6% share in the Global Smart SPF Complexes Market in 2025, valued at USD 1,411.1 million.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA