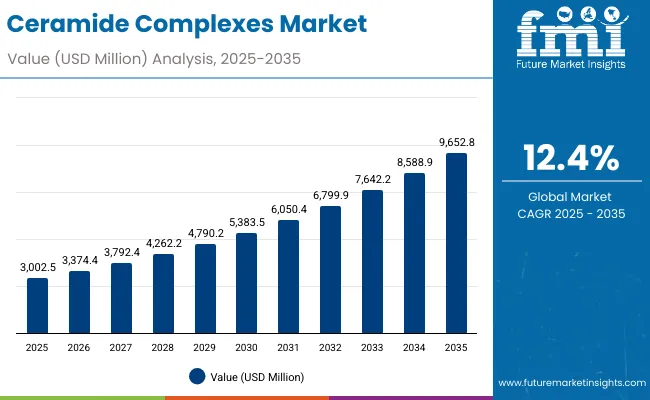

The valuation of the ceramide complexes market is projected to reach USD 3,002.5 million in 2025 and rise to USD 9,652.8 million by 2035, reflecting an addition of over USD 6,650.3 million across the decade. This expansion represents a 12.4% CAGR, indicating a robust upward trajectory and a more than threefold increase in market scale within ten years.

Ceramide Complexes Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 3,002.5 million |

| Market Forecast Value in (2035F) | USD 9,652.8 million |

| Forecast CAGR (2025 to 2035) | 12.40% |

The first half of the forecast period, spanning 2025 to 2030, is anticipated to witness steady growth, with revenues rising from USD 3,002.5 million to USD 5,383.5 million, capturing nearly 36% of the overall decade growth. During this phase, market momentum will be driven by increasing adoption of ceramide-based formulations within mass-market skincare and heightened awareness of barrier repair as a preventative measure against aging and environmental stress.

The second half of the period, from 2030 to 2035, is forecast to accelerate sharply, adding over USD 4,269.3 million in value as the market advances from USD 5,383.5 million to USD 9,652.8 million. This phase is expected to be characterized by widespread integration of ceramide complexes into diversified skincare portfolios, supported by scientific validation, e-commerce penetration, and rising premiumization in Asia-Pacific markets. Segmental dominance is anticipated from cream formulations, which will account for the largest share in 2025, while barrier repair remains the leading function. Global expansion will be reinforced by double-digit growth in China and India, positioning the market as a cornerstone of advanced dermocosmetic care.

Between 2020 and 2024, the Ceramide Complexes Market grew steadily as consumer awareness of barrier repair and hydration benefits gained traction. Expansion during this period was led by multinational players, with L’Oréal, Beiersdorf, and Johnson & Johnson consolidating strong shares through pharmacy-based distribution and digital-first campaigns.

By 2025, market value is estimated at USD 3,002.5 million, with revenues forecast to rise to USD 9,652.8 million by 2035. This threefold increase reflects accelerated adoption of masstige skincare, premium innovation, and sustainable formulations. Differentiation is expected to shift from general moisturizing benefits to clinically validated barrier restoration and eco-friendly ceramide solutions. New entrants are leveraging e-commerce, dermatologist collaborations, and digital engagement, while established leaders are enhancing portfolios with bioengineered ceramides and sustainable packaging. Competitive advantage is moving from pure scale toward trust, sustainability, and integration into holistic skin health ecosystems.

Growth in the ceramide complexes market is being fueled by rising consumer awareness of skin barrier health and the increasing prevalence of dermatological concerns linked to pollution, stress, and aging. Strong clinical validation has reinforced the role of ceramides in repairing barrier function, reducing sensitivity, and improving hydration, which has encouraged adoption across mass and premium skincare ranges. Demand is also being supported by the expansion of masstige offerings, where affordable yet scientifically backed formulations are bringing advanced skincare to wider consumer bases.

E-commerce penetration has accelerated discovery and accessibility, enabling dermatologist-recommended products to reach global audiences. Growth in emerging economies such as China and India is being powered by rising disposable incomes, preventive health consciousness, and expanding retail channels. Premiumization trends in Asia-Pacific are further strengthening market value creation. The long-term outlook is expected to be shaped by ongoing innovations in formulation science, sustainability initiatives in ingredient sourcing, and greater integration of ceramide complexes into holistic skin wellness routines.

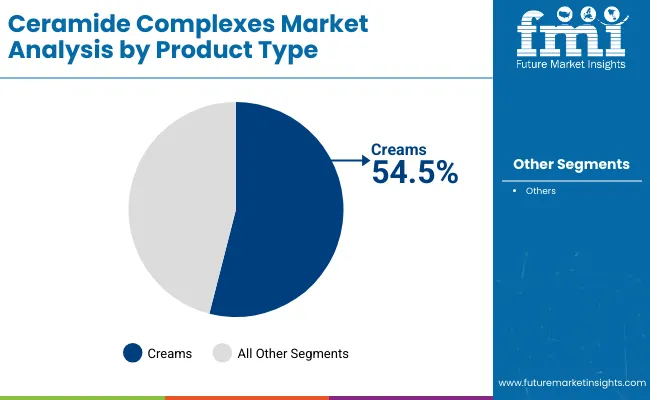

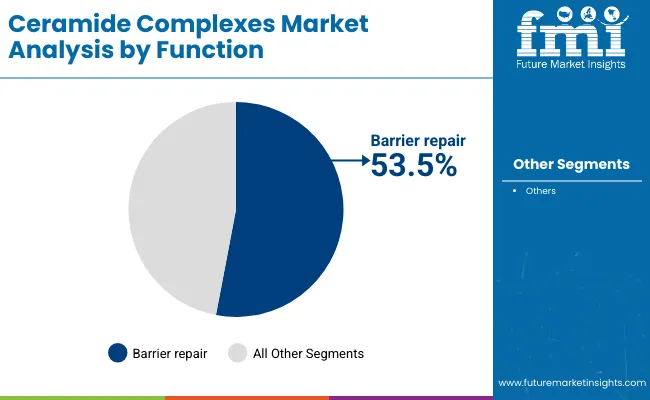

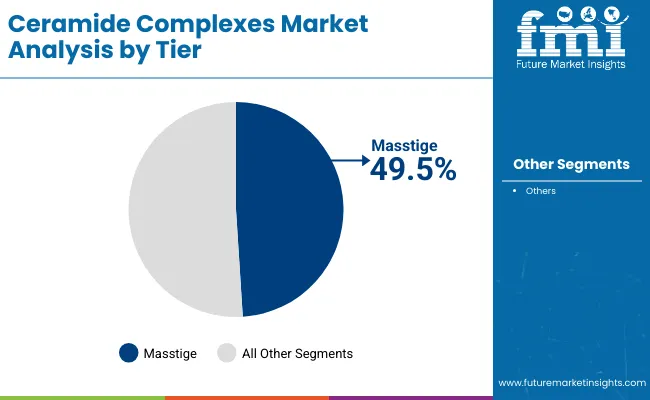

The ceramide complexes market has been segmented across product type, function, and tier, each highlighting distinct demand drivers shaping adoption. Cream formulations are positioned as the dominant category due to their proven delivery efficacy and consumer familiarity, while barrier repair functions continue to hold the strongest scientific and clinical validation. Tier-wise, the masstige category has emerged as a key growth lever, reflecting rising demand for dermatologist-endorsed skincare made accessible to a broader audience.

Across these segments, growth has been reinforced by consumer awareness, affordability, and scientific credibility. The analysis suggests that while premium categories are evolving, mass and masstige adoption will underpin long-term value creation, enabling ceramides to become foundational within both everyday and specialized skincare routines.

| Segment | Market Value Share, 2025 |

|---|---|

| Creams | 54.5% |

| Others | 45.5% |

Cream formulations are expected to lead the ceramide complexes market in 2025, accounting for 54.5% share. Their dominance is being supported by superior efficacy in delivering active concentrations and the trust built through dermatologist recommendations. Consumer familiarity with creams, coupled with their versatility across daily routines, is expected to sustain growth momentum. While alternative product types such as lotions, gels, and balms are expanding, their uptake remains complementary. Creams are projected to remain the core driver of volume adoption as they balance accessibility with proven results, ensuring they maintain a central role in both mass and masstige categories throughout the forecast horizon.

| Segment | Market Value Share, 2025 |

|---|---|

| Barrier repair | 53.5% |

| Others | 46.5% |

Barrier repair has been identified as the largest function within ceramide complexes, with a projected 53.5% share. Growth in this segment is being driven by consumer awareness of the role of ceramides in strengthening skin resilience, reducing transepidermal water loss, and addressing sensitivity. Dermatologist endorsements and clinical research have further reinforced trust in barrier repair claims, making them a cornerstone of marketing strategies. While hydration and anti-aging benefits remain important, they are typically framed as secondary advantages to barrier efficacy. The functional dominance of barrier repair is expected to persist, as its credibility is rooted in long-term skin health outcomes, establishing it as a sustainable growth engine.

| Segment | Market Value Share, 2025 |

|---|---|

| Masstige | 49.5% |

| Others | 50.5% |

The masstige segment is projected to account for 49.5% of global revenues in 2025, valued at USD 1,484.8 million. Expansion in this tier is being propelled by the accessibility of dermatologist-approved ceramide products at affordable price points, bridging the gap between mass-market affordability and premium credibility. This democratization of advanced skincare is expected to deepen penetration across emerging and developed economies. Masstige growth is further supported by strong retail and e-commerce distribution, ensuring wider consumer reach. While premium offerings are likely to gain traction through innovation and luxury positioning, masstige products will continue to capture the largest consumer base, reinforcing their role as a critical pillar of volume and value growth across the global ceramide complexes market.

The ceramide complexes market is being shaped by evolving consumer expectations, clinical validation, and technological advancement, while challenges related to cost efficiency, formulation complexity, and claim substantiation continue to define the balance between accelerated adoption and structural limitations across global skincare portfolios.

Clinical Validation and Dermatological Endorsement

Clinical validation and strong dermatological endorsement have been identified as a primary accelerator for ceramide complexes adoption. Unlike generic moisturizers, ceramide formulations are supported by reproducible clinical outcomes linked to barrier strengthening and hydration retention. This medical alignment has reinforced trust among consumers and practitioners, ensuring long-term inclusion within preventative and corrective skincare routines.

The forward-looking potential lies in deeper integration with tele-dermatology platforms, where digital consultations are expected to amplify product credibility and expand reach. As global healthcare systems increasingly recognize skin health as part of holistic wellness, ceramide complexes are positioned to become medical-grade actives accessible to both mass and premium audiences, thereby strengthening their market penetration.

Ingredient Sourcing Complexity and Cost Pressure

A significant restraint in the ceramide complexes market is associated with sourcing complexity and raw material cost volatility. High-quality ceramides often require specialized bioengineering or lipid extraction processes, which elevate production costs and limit scalability for smaller players. These challenges have restricted price competitiveness in markets dominated by mass skincare, where affordability dictates consumer choice.

In the forward-looking scenario, this restraint is expected to shape consolidation, as larger multinational firms with integrated supply chains and R&D capabilities are better positioned to absorb cost fluctuations. Sustainability concerns around sourcing methods could further elevate pressure, compelling manufacturers to invest in synthetic biology or green chemistry solutions. Such transitions are anticipated to transform cost structures but will require significant upfront investment, creating uneven adoption patterns across geographies.

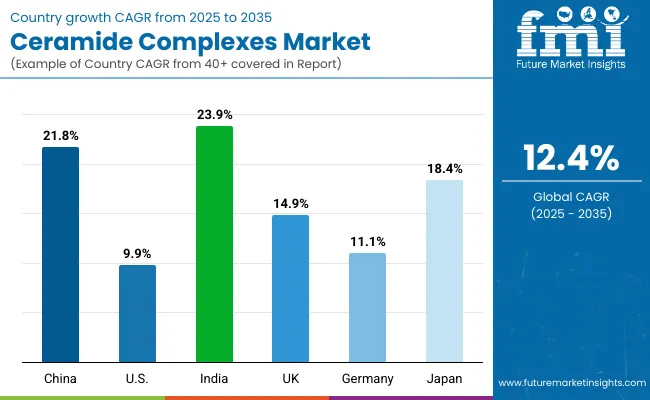

| Countries | CAGR |

|---|---|

| China | 21.8% |

| USA | 9.9% |

| India | 23.9% |

| UK | 14.9% |

| Germany | 11.1% |

| Japan | 18.4% |

The global ceramide complexes market is expected to display marked variation in adoption and growth when assessed by country-level dynamics, shaped by consumer awareness, healthcare integration, and retail modernization. Emerging Asia is projected to outperform due to strong demand drivers and favorable growth conditions. India is forecast to deliver the fastest expansion, with a 23.9% CAGR, underpinned by growing middle-class incomes, masstige positioning, and rapid e-commerce penetration. China is expected to follow closely at 21.8% CAGR, supported by dermatology-driven endorsements and a rising focus on preventive skincare within urban populations. Japan’s growth at 18.4% CAGR reflects both premium positioning and strong consumer affinity for clinically validated formulations.

Europe is expected to maintain steady progress, with the UK and Germany advancing at 14.9% and 11.1% CAGR respectively, driven by regulatory alignment, strong pharmacy channels, and increasing investment in dermatological research. Adoption in these countries will be reinforced by premium and masstige strategies that combine efficacy with clinical validation.

The USA, while expanding at a more moderate 9.9% CAGR, is expected to remain a critical revenue contributor due to scale, established brands, and consumer trust in dermatologist-endorsed skincare. Overall, high-growth Asian markets are expected to reshape global share distribution, while Europe and North America maintain strong but steadier contributions.

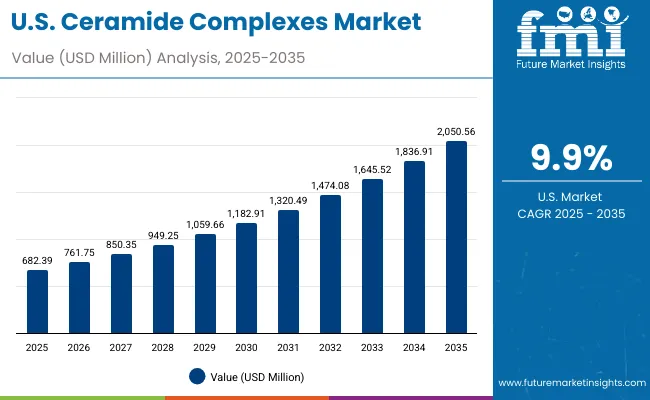

| Year | USA Ceramide Complexes Market (USD Million) |

|---|---|

| 2025 | 682.39 |

| 2026 | 761.75 |

| 2027 | 850.35 |

| 2028 | 949.25 |

| 2029 | 1,059.66 |

| 2030 | 1,182.91 |

| 2031 | 1,320.49 |

| 2032 | 1,474.08 |

| 2033 | 1,645.52 |

| 2034 | 1,836.91 |

| 2035 | 2,050.56 |

The ceramide complexes market in the United States is projected to grow at a CAGR of 9.9% between 2025 and 2035. The market is estimated at USD 682.39 million in 2025 and is forecast to reach USD 2,050.56 million by 2035, with steady growth recorded across the decade. In 2026, the value is expected at USD 761.75 million, followed by USD 850.35 million in 2027 and USD 949.25 million in 2028. By 2029, the market is anticipated to reach USD 1,059.66 million and climb further to USD 1,182.91 million in 2030. The upward trajectory continues in 2031 with USD 1,320.49 million, USD 1,474.08 million in 2032, USD 1,645.52 million in 2033, USD 1,836.91 million in 2034, and USD 2,050.56 million in 2035.

The decade-long progression highlights sustained momentum, supported by consumer reliance on dermatologist-endorsed skincare, expansion of masstige products, and strong visibility across pharmacy and online channels. Early growth will be shaped by increased trust in ceramide-led barrier repair solutions, while the latter years are expected to accelerate through innovations in bioengineered ceramides and sustainability-driven sourcing. The USA is projected to remain a leading revenue generator globally, despite faster relative growth rates in emerging Asian markets.

The ceramide complexes market in the United Kingdom is projected to grow at a CAGR of 14.9% between 2025 and 2035. This growth will be underpinned by increasing consumer focus on skin barrier health, expansion of dermocosmetic retail channels, and heightened awareness of clinically validated formulations. Pharmacies and online platforms are expected to act as the mainstay of market expansion, with masstige offerings bridging affordability and efficacy. By the latter half of the decade, the market will likely be accelerated by rising premiumization trends, sustainability-focused branding, and enhanced integration of ceramide complexes into multi-functional anti-aging skincare lines. Regulatory standards for product claims and labeling are expected to maintain credibility while fostering consumer trust.

The ceramide complexes market in India is projected to grow at a CAGR of 23.9% between 2025 and 2035. This makes the country the fastest-growing market globally, driven by rising disposable incomes, urbanization, and a shift toward preventative skincare practices. Increasing adoption of ceramide formulations is expected to be amplified by digital-first beauty platforms, e-commerce penetration, and the masstige category that balances affordability with dermatologist-backed credibility. In the early years, market expansion will be supported by strong pharmacy sales and heightened visibility in modern retail. Toward the latter half of the decade, premium adoption will be shaped by the aspirational consumer segment and rising demand for sustainable formulations. India’s trajectory is expected to reshape the regional balance of revenues in Asia-Pacific by 2035.

The ceramide complexes market in China is projected to grow at a CAGR of 21.8% between 2025 and 2035. Growth will be supported by heightened awareness of barrier repair skincare, urban lifestyle stressors driving dermatology adoption, and endorsement of ceramide formulations by medical professionals. Early market expansion will be driven by mass and masstige categories, reflecting strong demand for affordable, clinically proven skincare. In the latter half of the forecast period, premium lines and sustainable, bioengineered ceramides are expected to elevate market momentum. Digital platforms and social commerce are projected to act as critical accelerators, shaping consumer education and driving trial-to-purchase conversions. China’s role as a hub for dermocosmetic innovation will reinforce its position as a leading Asian market.

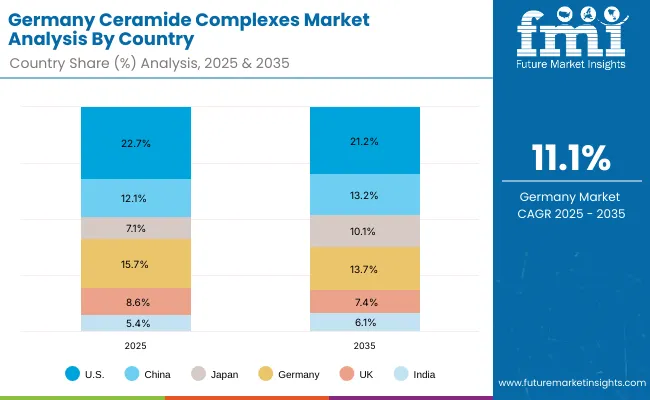

| Countries | 2025 |

|---|---|

| USA | 22.7% |

| China | 12.1% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Countries | 2035 |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

The ceramide complexes market in Germany is projected to grow at a CAGR of 11.1% between 2025 and 2035. Growth will be driven by the country’s established dermocosmetic culture, strong pharmacy networks, and stringent regulatory standards that reinforce product credibility. In the early phase, adoption will be centered on functional skincare anchored in barrier repair claims and dermatologist endorsements.

By the later years, innovation in sustainable ceramide sourcing, premium anti-aging formulations, and hybrid masstige offerings are expected to accelerate demand. Germany is also projected to remain an influential market in shaping EU-wide compliance benchmarks for claims, thereby elevating trust in ceramide-based products. While its growth rate is moderate compared to Asia, Germany’s high-value consumer base and medical credibility will sustain steady expansion.

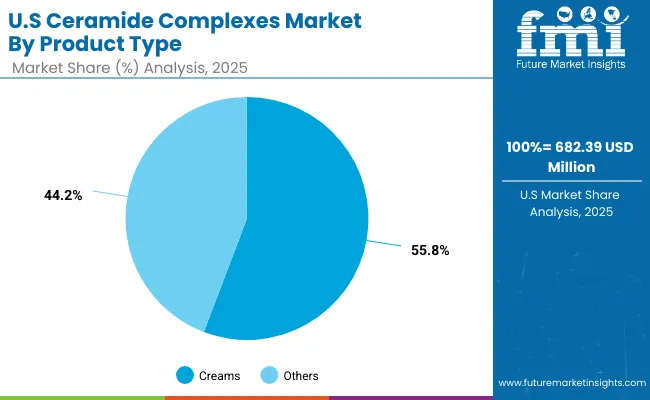

| Segment | Market Value Share, 2025 |

|---|---|

| Creams | 55.8% |

| Others | 44.2% |

The ceramide complexes market in the United States is projected at USD 682.39 million in 2025. Cream formulations contribute 55.8%, equivalent to USD 380 million, while other product types account for 44.2%, valued at USD 301.92 million. The dominance of creams reflects their superior efficacy in delivering active ceramides, ensuring deeper penetration and higher stability compared to lighter formats such as gels or lotions. This preference is reinforced by dermatologist endorsements and consumer familiarity with cream-based regimens as the foundation of barrier-repair and hydration solutions.

Over the forecast period, growth in creams is expected to be supported by strong visibility across pharmacy chains and e-commerce platforms. Other formats are anticipated to remain complementary, catering to consumer demand for texture variety and situational use, but creams will continue to anchor the USA market due to proven outcomes and consistent user trust.

| Segment | Market Value Share, 2025 |

|---|---|

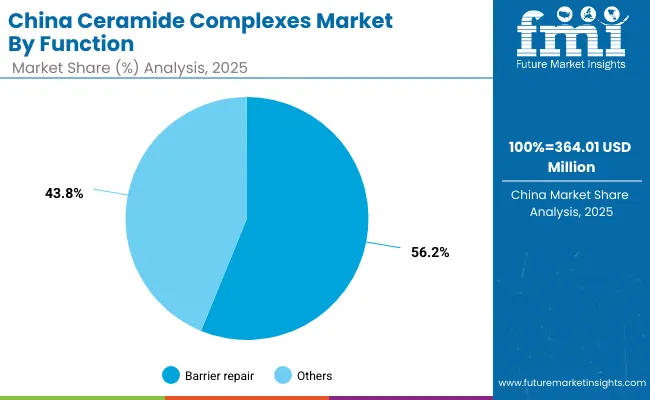

| Barrier repair | 56.2% |

| Others | 43.8% |

The ceramide complexes market in China is projected at USD 364.01 million in 2025. Barrier repair contributes 56.2%, equivalent to USD 205 million, while other functions represent 43.8%, valued at USD 159.31 million. The clear leadership of barrier repair reflects the growing recognition of ceramides as essential in strengthening the skin’s defense against pollution, stress, and environmental aggressors common in urban areas.

Clinical validation and dermatologist endorsement have elevated consumer trust, making barrier repair the anchor benefit across skincare routines. Unlike secondary functions such as hydration or soothing, barrier repair provides measurable outcomes, which resonate strongly with Chinese consumers seeking visible efficacy. Over the forecast period, digital-first beauty ecosystems, social commerce, and masstige affordability are expected to broaden access, while premium innovation in sustainable ceramides is anticipated to reinforce long-term market expansion.

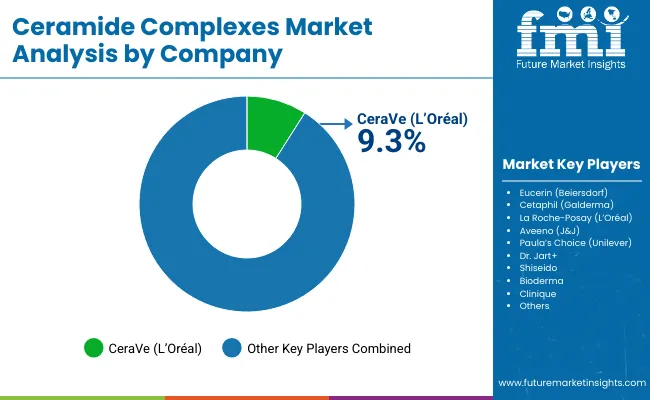

The ceramide complexes market is moderately fragmented, with global leaders, multinational personal care companies, and niche dermocosmetic specialists competing for share. Global leaders such as L’Oréal, Beiersdorf, Johnson & Johnson, Unilever, Galderma, and Shiseido have been recognized as key participants, leveraging strong dermatological credibility and widespread retail distribution. Among them, CeraVe (L’Oréal) is the dominant brand, holding a 9.3% global value share in 2025 and slightly lower at 9.1% in 2024, making it the largest single contributor to global revenues.

Established mid-sized players, including Bioderma, Paula’s Choice, and Dr. Jart+, focus on dermatology-driven formulations with a balance of accessibility and clinical positioning. These companies are accelerating adoption by engaging through pharmacies, e-commerce platforms, and masstige pricing strategies that blend affordability with dermatologist endorsement.

Niche-focused providers, such as Aveeno and Clinique, have been expanding their role in barrier-focused skincare but remain regionally stronger rather than globally dominant. Their strategies emphasize specific consumer needs, such as sensitive-skin relief or premium anti-aging regimens, while maintaining loyal customer bases.

Competitive differentiation is shifting from product type alone toward integrated strategies that combine clinical validation, digital education, and sustainable sourcing. Long-term success will likely be determined by the ability of companies to merge affordability, dermatologist credibility, and eco-friendly innovations, ensuring wider penetration across both developed and emerging markets.

Key Developments in Ceramide Complexes Market

| Item | Value |

|---|---|

| Market size (2025) | USD 3,002.5 million |

| Market size (2035) | USD 9,652.8 million |

| Growth rate (CAGR, 2025-2035) | 12.4% CAGR |

| Forecast window | 2025-2035 |

| Product type segmentation | Creams; Others |

| Function segmentation | Barrier repair; Others |

| Tier segmentation | Masstige; Others |

| Distribution channels covered | Pharmacies; E-commerce; Mass retail; Dermatology clinics |

| Regions covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries covered | United States; China; India; Japan; Germany; United Kingdom |

| Key companies profiled | CeraVe (L’Oréal); Eucerin (Beiersdorf); Cetaphil (Galderma); La Roche-Posay (L’Oréal); Aveeno (J&J); Paula’s Choice (Unilever); Dr. Jart+; Shiseido; Bioderma; Clinique |

| Competitive baseline (2025) | CeraVe global value share 9.3%; Others 90.7% |

| Additional quantitative attributes | Creams share 54.5% (USD 1,636.4 million); Barrier repair share 53.5% (USD 1,606.1 million); Masstige share 49.5% (USD 1,484.8 million); United States 2025 size USD 682.39 million |

The global Ceramide Complexes Market is estimated to be valued at USD 3,002.5 million in 2025.

The market size for the Ceramide Complexes Market is projected to reach USD 9,652.8 million by 2035.

The Ceramide Complexes Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in the Ceramide Complexes Market are creams and other skincare formulations such as lotions, gels, and balms.

In terms of function, the barrier repair segment is expected to command 53.5% share in the Ceramide Complexes Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

Ceramide-Infused Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ceramide Sunscreen Market Growth – Size, Trends & Forecast 2024-2034

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart SPF Complexes Market Size and Share Forecast Outlook 2025 to 2035

Energizing ATP Complexes Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Caviar-Like Peptide Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Boron Trifluoride and Complexes Market 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA