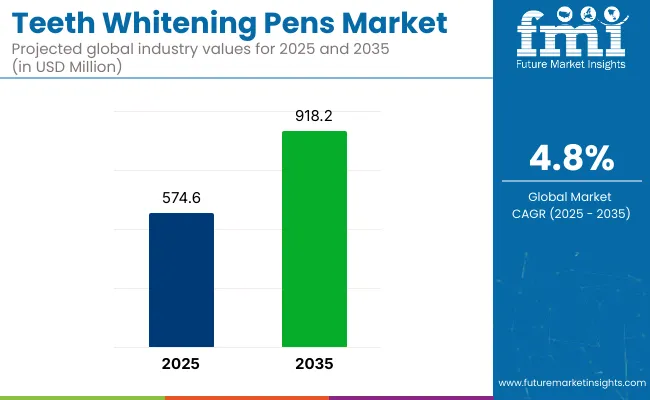

The global Teeth Whitening Pens Market is estimated to be valued at USD 574.6 million in 2025 and is projected to reach USD 918.2 million by 2035, registering a compound annual growth rate of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 574.6 million |

| Industry Value (2035F) | USD 918.2 million |

| CAGR (2025 to 2035) | 4.8% |

The teeth whitening pens market is gaining traction due to rising consumer interest in personal grooming and accessible cosmetic dental care. The demand is driven by convenience, portability, and the desire for non-invasive, fast-acting whitening solutions. Increasing awareness around dental aesthetics, coupled with digital marketing and influencer-led product promotions, is enhancing brand visibility and customer engagement.

Technological innovations like peroxide-free formulations and LED-enhanced pens are widening the consumer base, particularly among sensitivity-prone users. E-commerce expansion and direct-to-consumer strategies further support market growth. With ongoing advancements and a shift toward at-home oral care routines, the market is expected to see sustained innovation and competitive activity, creating ample opportunities for both emerging and established brands

Carbamide Peroxide-Based Pens is expected to hold 60.5% revenue share in the global teeth whitening pens market in 2025. This dominance has been attributed to its safer chemical profile, as it breaks down more slowly than hydrogen peroxide, releasing a lower and gentler concentration of whitening agents.

This slow release reduces irritation and enamel damage, making it suitable for users with sensitive teeth. Preference for carbamide peroxide formulations has been further supported by professional endorsements and its inclusion in over-the-counter and dentist-recommended products.

Longer shelf stability and compatibility with various applicator designs have also contributed to its widespread use. As consumers increasingly seek non-invasive and sustained whitening solutions, this segment is anticipated to retain its lead in the foreseeable future.

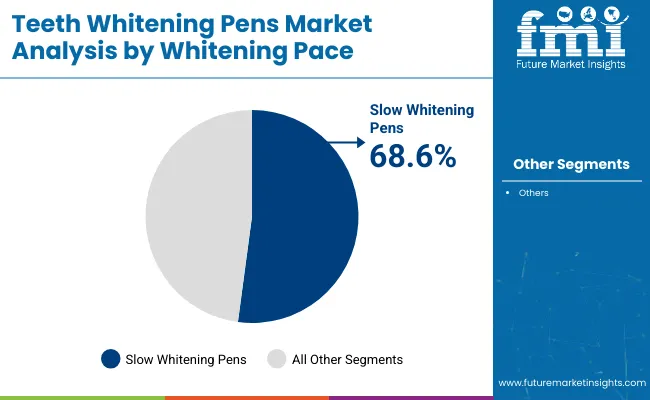

Slow whitening pens are projected to account for 68.6% revenue share of the overall market in 2025. Their dominance has been driven by a growing preference for gentle, low-concentration whitening solutions that minimize side effects such as tooth sensitivity and gum irritation.

These products have been favored by dental professionals and users alike for their compatibility with regular oral care routines. As long-term usage becomes more common, consumers are seeking less aggressive alternatives that deliver consistent results without compromising dental health.

Recommendations from oral care specialists and increasing consumer education on enamel safety have further reinforced the appeal of this segment. As a result, slow whitening continues to be viewed as a dependable and user-friendly whitening approach.

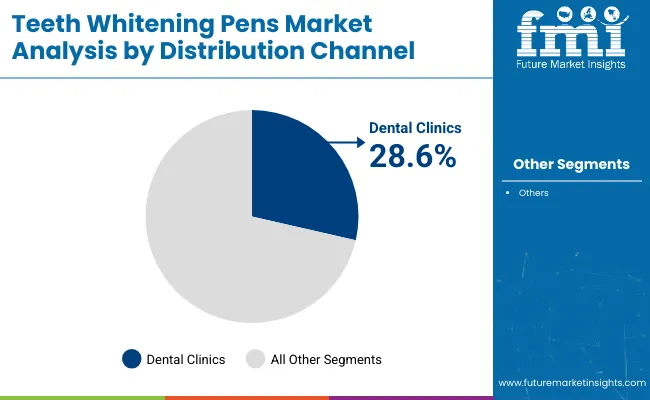

Dental clinics are anticipated to capture 28.6% revenue share in the global teeth whitening pens market in 2025. This prominence is largely driven by the trust and credibility associated with professional dental guidance. Teeth whitening pens distributed through clinics are often seen as safer and more effective, given their alignment with personalized treatment plans and regulated formulations.

Patients are more likely to comply with product usage when recommendations are issued by licensed professionals. Clinics also benefit from brand tie-ups and exclusive distribution rights, enhancing their role as a controlled and reliable channel. This segment continues to thrive as consumers seek assurance on product efficacy and safety, especially in clinical or post-procedural contexts.

The Teeth Whitening Pens Industry is on a steady upward trajectory, driven by growing consumer demand for convenient, affordable, and non-invasive cosmetic dental solutions. Rising awareness of dental aesthetics, especially among younger demographics, is pushing both innovation and competition. Brands offering safe, easy-to-use, and fast-acting products stand to gain, while traditional, clinic-based whitening treatments may see reduced demand.

Innovate with Sensitivity-Safe and Fast-Acting Formulas

Invest in R&D to develop peroxide-free, enamel-safe whitening pens that deliver quick results, addressing a key consumer pain pointteeth sensitivitywhile differentiating the product in a crowded industry.

Leverage Digital-First Marketing and Personalization

Align with shifting consumer behaviours by prioritizing influencer-led campaigns, social commerce strategies, and personalized product recommendations through AI-driven platforms to enhance engagement and conversion.

Expand E-Commerce and Strategic Retail Partnerships

Strengthen distribution through partnerships with leading online marketplaces, beauty retailers, and subscription services, while exploring M&A opportunities to acquire niche players with strong D2C models or innovative technology.

| Risk | Probability - Impact |

|---|---|

| Regulatory scrutiny on ingredient safety | Medium - High |

| Consumer skepticism due to exaggerated product claims | High - Medium |

| Supply chain disruptions affecting raw materials | Medium - Medium |

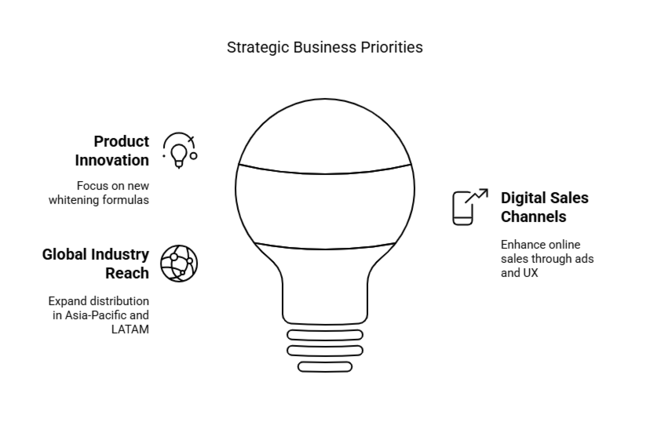

| Priority | Immediate Action |

|---|---|

| Expand Product Innovation | Conduct consumer testing on new peroxide-free whitening formulas |

| Strengthen Digital Sales Channels | Launch targeted ad campaigns and optimize D2C website UX |

| Broaden Global Industry Reach | Identify regional distributors in Asia-Pacific and LATAM |

To stay ahead, companies must double down on innovation that prioritizes safety, speed, and ease of usekey drivers in the teeth whitening pens industry. This intelligence underscores the shift toward at-home, tech-enabled oral care, signaling a need to reallocate resources toward R&D, influencer-led digital advertising, and strategic e-commerce expansion.

Forward-looking brands should explore peroxide alternatives, LED-enhanced pens, and AI-based personalization to differentiate in a crowded space. Additionally, securing agile supply chains and forming regional retail alliancesespecially in high-growth industries like Asia-Pacificwill be critical to sustaining momentum and capturing long-term industry share.

(Surveyed Q4 2024, n=450 stakeholder participants across manufacturers, retailers, dentists, and consumers in North America, Western Europe, Japan, and South Korea)

Regional Variance

Adoption of Smart and Clean Technologies

Converging View

Regional Differences

Manufacturers

Retailers

End Users (Consumers)

Consensus

Regional Trends

Variance vs. Consensus

Key Variances

Strategic Insight

| Countries | Regulations and Certifications |

|---|---|

| USA | Whitening products are regulated by the FDA. Most products are considered cosmetics and do not require approval unless they are classified as drugs. |

| UK | Up to 0.1% hydrogen peroxide is allowed for consumer use, while products containing between 0.1% and 6% hydrogen peroxide may only be used by dentists. |

| France | Follows EU regulations. Products with less than 0.1% hydrogen peroxide are allowed for consumer use, while those containing 0.1% to 6% hydrogen peroxide can only be used by dentists. |

| Germany | Follows EU regulations, similar to France. Products with less than 0.1% hydrogen peroxide are allowed for consumer use, while higher concentrations can only be used by dentists. |

| Italy | Follows EU regulations. The same rules apply as in France and Germany. |

| South Korea | Regulated by the Ministry of Food and Drug Safety (MFDS). Whitening products may require approval depending on the ingredients used, including hydrogen peroxide. |

| Japan | Whitening products are often classified as quasi-drugs and require approval from the Ministry of Health, Labour and Welfare (MHLW) if they contain hydrogen peroxide. |

| China | If hydrogen peroxide is used in whitening products, they are classified as "special cosmetics" and require pre-approval from the National Medical Products Administration (NMPA). |

| Australia and New Zealand | The Therapeutic Goods Administration (TGA) regulates whitening products. Products containing over 6% hydrogen peroxide require a dentist’s supervision, while lower concentrations are allowed for consumer use with safety labeling. In New Zealand, Products with high peroxide content are restricted. The regulations follow Medsafe and the Medicines Act for approval, ensuring consumer safety and appropriate use. |

The teeth whitening pens market is becoming increasingly competitive, driven by innovation, brand repositioning, and digital-first strategies. Companies are actively developing peroxide-free and sensitivity-safe formulations to appeal to a wider audience, especially consumers seeking gentle and safe whitening solutions.

Direct-to-consumer (DTC) channels, influencer marketing, and social media campaigns are being used extensively to drive engagement and boost product visibility. Subscription models and product bundling are also gaining traction to enhance customer retention.

At the same time, newer entrants are disrupting the space with affordable, clean-label alternatives and sustainable packaging. Established players are reinforcing brand trust through dental professional endorsements and integration of advanced features like LED activation. Overall, the market is shaped by rapid innovation, strong digital presence, and evolving consumer preferences.

Key Development

In 2024, BURST Oral Care launched its Precision Whitening Pen. This pocket-sized pen, developed over five years with input from dental professionals, features a 9% hydrogen peroxide formula and a precision applicator for targeted whitening. It is designed to be gentle on teeth and gums, containing soothing ingredients like coconut oil, aloe vera, and xylitol. The pen aims to provide up to 5 shades whiter teeth after 7 days of use, offering a convenient, effective, and portable solution for a brighter smile.

In 2024, Colgate® Optic White® partnered with McBride Sisters Collection to launch a Limited Edition Set. This unique pairing includes the McBride Sisters Collection Red Blend wine and two Colgate Optic White Overnight Whitening Pens, allowing consumers to enjoy red wine while ensuring a brighter smile.

The industry is valued at USD 574.6 million in 2025.

The industry is expected to grow at a CAGR of 4.8% between 2025 and 2035.

E-commerce is emerging as the preferred channel due to convenience and personalized offerings.

Consumers increasingly prefer peroxide-free, sensitivity-safe, and fast-acting formulations.

North America and Asia-Pacific are key growth regions driven by innovation and affordability.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Teeth Desensitizer Market Analysis by Product Type, Form, Distribution Channels and Region 2025 to 2035

Teeth Whitening Market Overview – Growth & Trends 2024-2034

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Bone and Teeth Supplements Market Size and Share Forecast Outlook 2025 to 2035

Whitening Gold Peptide Complex Market Size and Share Forecast Outlook 2025 to 2035

The Dental Whitening Lamps Market is segmented by Product, Light Source and End User from 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Expense Tracker Apps Market Growth – Trends & Forecast 2025 to 2035

Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Suspension Bump Stopper Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Robots Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Guns Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Trays Market Size, Share & Forecast 2025 to 2035

Dispensing Carboy Market Size and Share Forecast Outlook 2025 to 2035

Dispensing Caps Market Growth - Demand & Forecast 2025 to 2035

Key Players & Market Share in the Dispensing Spout Industry

Market Share Breakdown of Dispensing Carboy Providers

Dispensing Spout Market by Cap & Pump Type from 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA