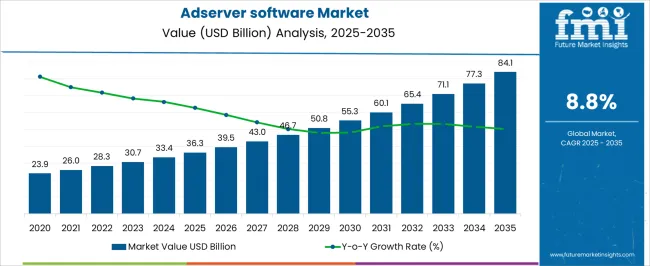

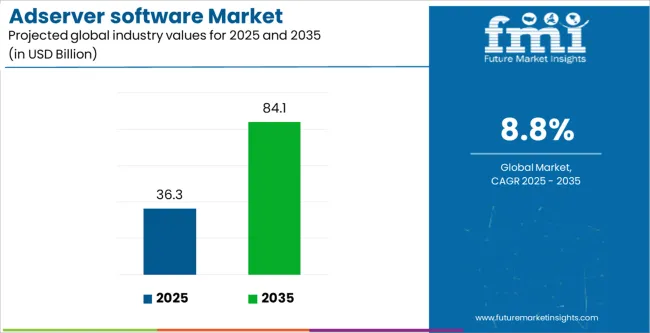

The Adserver software Market is estimated to be valued at USD 36.3 billion in 2025 and is projected to reach USD 84.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Adserver software Market Estimated Value in (2025 E) | USD 36.3 billion |

| Adserver software Market Forecast Value in (2035 F) | USD 84.1 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The Adserver Software market is experiencing steady growth driven by the increasing demand for automated, data-driven advertising solutions that enhance targeting, campaign management, and performance analytics. The market landscape is being shaped by the rising adoption of programmatic advertising, growing digital marketing budgets, and the increasing need for transparency and efficiency in ad delivery.

Cloud-based platforms, integration with customer relationship management systems, and advanced analytics capabilities are enabling organizations to optimize ad spend and measure campaign effectiveness in real time. In addition, the shift toward omnichannel marketing strategies and the rise of mobile and social media advertising are supporting the broader adoption of adserver software across industries.

The market is also benefiting from investments in AI and machine learning, which provide predictive analytics, fraud detection, and audience segmentation capabilities As brands seek scalable, cost-effective, and flexible solutions to manage complex advertising operations, the adoption of adserver software is expected to continue expanding across enterprise and commercial environments.

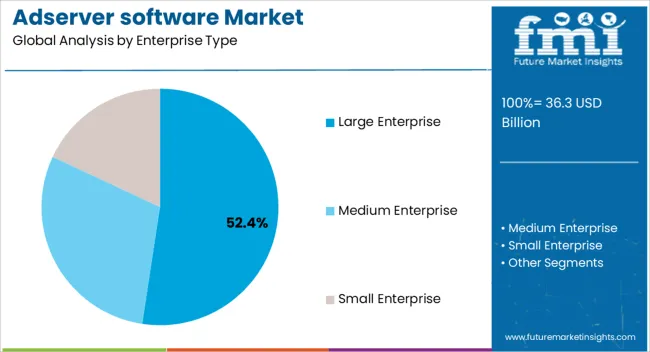

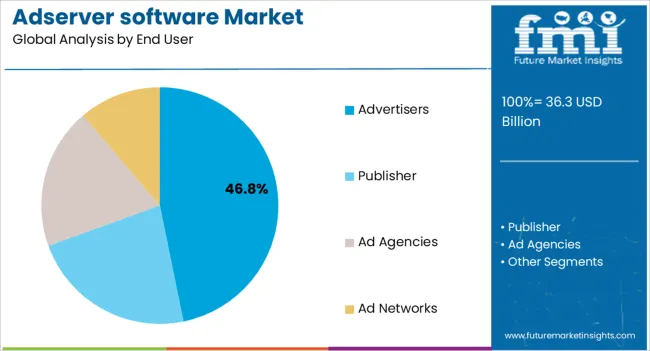

The adserver software market is segmented by enterprise type, end user, deployment, and geographic regions. By enterprise type, adserver software market is divided into Large Enterprise, Medium Enterprise, and Small Enterprise. In terms of end user, adserver software market is classified into Advertisers, Publisher, Ad Agencies, and Ad Networks. Based on deployment, adserver software market is segmented into Cloud and On-Premise. Regionally, the adserver software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The large enterprise segment is projected to hold 52.40% of the Adserver Software market revenue in 2025, making it the leading enterprise type. This dominance is being driven by the substantial advertising budgets, sophisticated marketing operations, and complex campaign management requirements that characterize large organizations. Large enterprises are increasingly leveraging adserver software to consolidate ad inventory management, optimize targeting, and enhance reporting and analytics.

The scalability of these platforms allows enterprises to manage high-volume campaigns efficiently while maintaining compliance with data privacy and security regulations. Adoption has also been accelerated by the need for multi-channel campaign orchestration, integration with CRM and analytics systems, and the ability to implement AI-driven optimization strategies.

The combination of operational complexity, demand for automation, and requirement for measurable ROI has reinforced the leading position of large enterprises in the market Future growth is expected to be driven by digital transformation initiatives and the continuous expansion of global marketing operations.

The advertisers end-user segment is expected to account for 46.80% of the market revenue in 2025, establishing it as the dominant application area. This growth has been driven by the increasing need to optimize advertising spend, achieve precise audience targeting, and measure campaign performance across digital channels.

Advertisers are leveraging adserver software to streamline the management of creative assets, monitor ad placements in real time, and improve overall campaign efficiency. The adoption of programmatic advertising models and the growing importance of data-driven decision-making have further accelerated uptake.

Advertisers benefit from features such as predictive analytics, dynamic creative optimization, and advanced reporting tools, which allow campaigns to be continuously refined for maximum impact As digital marketing becomes more sophisticated and competitive, advertisers continue to rely on software solutions that provide flexibility, scalability, and transparency, making this segment a key driver of the Adserver Software market.

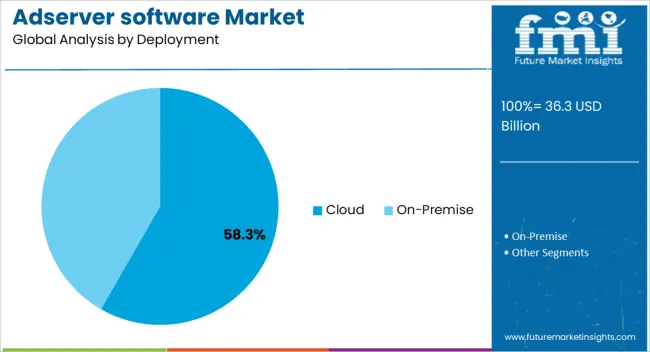

The cloud deployment segment is anticipated to hold 58.30% of the Adserver Software market revenue in 2025, making it the preferred deployment model. This predominance is being attributed to the flexibility, scalability, and cost-effectiveness offered by cloud-based platforms. Cloud deployment allows organizations to access adserver capabilities without significant upfront infrastructure investment, while enabling seamless updates, high availability, and remote management.

The ability to integrate with various digital channels, analytics systems, and third-party applications is enhanced in a cloud environment, providing real-time insights and operational agility. Additionally, cloud-based adservers support rapid scaling to handle high traffic volumes during peak campaign periods, which is particularly advantageous for enterprises and advertisers with fluctuating workloads.

The reduced need for in-house IT maintenance and the enhanced disaster recovery capabilities further reinforce adoption As organizations prioritize digital transformation and seek to optimize advertising operations globally, cloud deployment is expected to remain the leading choice in the market.

The evolution in the advertisement industry by introduction of online marketing and consumer analytics based advertisement is resulting in the adoption of software for managing all advertisement process, and adserver software is one of these software. The server-based advertisement is in demand nowadays as it reduces complexity and time required for advertisement.

The advertisers, publishers, are demanding the adserver software for carrying out the advertisement campaign and online advertisement. In addition to this, serving target audience based on analytical results available using the adserver software is resulting in increasing demand for the adserver software.

Industries are investing a huge amount in the marketing segment for improving sales of their products and services which is ultimately resulting in increasing demand for adserver software.

An adserver is a computer server, specifically a web server. The adserver store advertisements which are used while performing online marketing and also delivers them to website visitors or users and the adserver software is used for managing the total advertisement process of adserver.

| Country | CAGR |

|---|---|

| China | 11.8% |

| India | 10.9% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.3% |

| USA | 7.4% |

| Brazil | 6.6% |

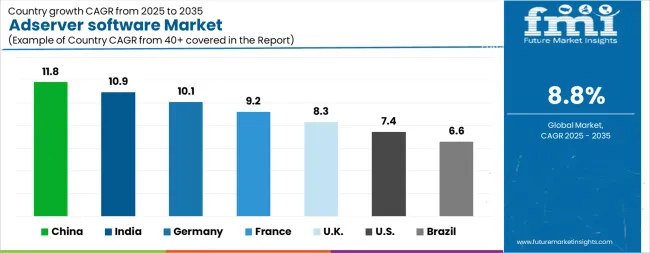

The Adserver software Market is expected to register a CAGR of 8.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.8%, followed by India at 10.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.6%, yet still underscores a broadly positive trajectory for the global Adserver software Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.1%. The USA Adserver software Market is estimated to be valued at USD 12.9 billion in 2025 and is anticipated to reach a valuation of USD 26.4 billion by 2035. Sales are projected to rise at a CAGR of 7.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.8 billion and USD 1.2 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.3 Billion |

| Enterprise Type | Large Enterprise, Medium Enterprise, and Small Enterprise |

| End User | Advertisers, Publisher, Ad Agencies, and Ad Networks |

| Deployment | Cloud and On-Premise |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

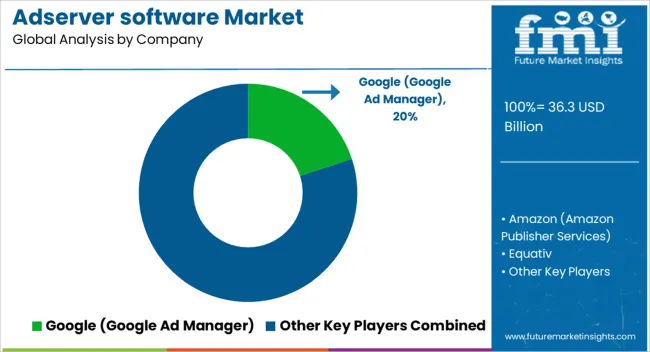

| Key Companies Profiled | Google (Google Ad Manager), Amazon (Amazon Publisher Services), Equativ, Xandr (formerly AppNexus), The Trade Desk, Media.net, PubMatic, and OpenX |

The global adserver software market is estimated to be valued at USD 36.3 billion in 2025.

The market size for the adserver software market is projected to reach USD 84.1 billion by 2035.

The adserver software market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in adserver software market are large enterprise, medium enterprise and small enterprise.

In terms of end user, advertisers segment to command 46.8% share in the adserver software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

MES Software For Discrete Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA