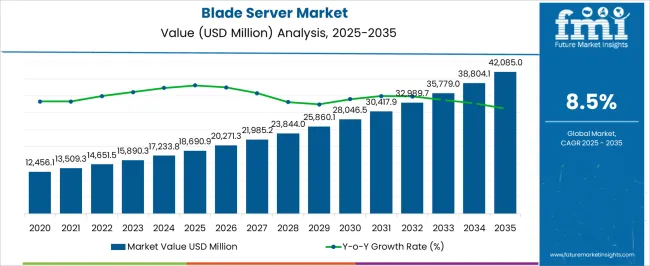

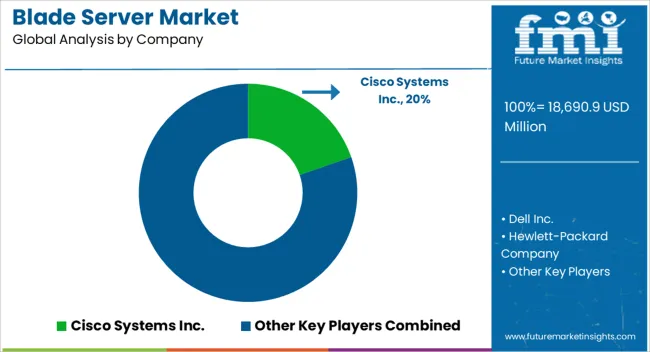

The Blade Server Market is estimated to be valued at USD 18690.9 million in 2025 and is projected to reach USD 42085.0 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Blade Server Market Estimated Value in (2025 E) | USD 18690.9 million |

| Blade Server Market Forecast Value in (2035 F) | USD 42085.0 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The blade server market is experiencing accelerated growth due to the rising adoption of virtualization, cloud computing, and high performance applications across enterprises and service providers. Demand is being reinforced by the need for optimized data center infrastructure that ensures higher processing density, reduced power consumption, and simplified management.

Enterprises are increasingly investing in modular architectures to improve scalability while reducing operational costs. Additionally, the shift toward edge computing, AI driven workloads, and hyperscale cloud deployments is further intensifying demand for efficient and compact server designs.

Regulatory focus on energy efficiency and carbon footprint reduction is pushing organizations to adopt blade servers as a preferred infrastructure solution. The outlook remains positive as organizations prioritize agility, automation, and sustainable operations to support the growing digital economy.

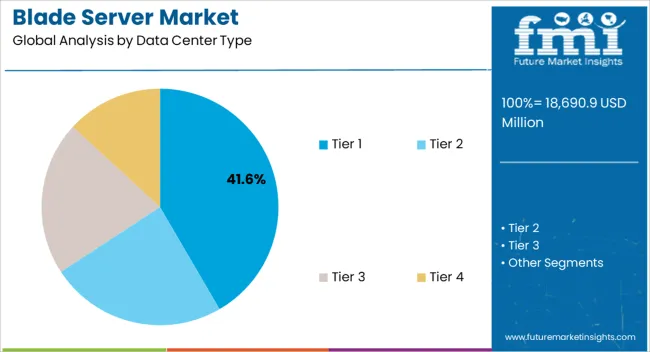

The tier 1 data center type segment is expected to account for 41.60% of market revenue by 2025, making it a leading contributor within the data center type category. Growth is being driven by expanding digital services in emerging economies and cost conscious enterprises seeking efficient but reliable server infrastructure.

Tier 1 facilities provide essential support for businesses with moderate workloads, making them suitable for organizations in early stages of digital transformation.

The affordability and operational simplicity of tier 1 centers have reinforced their widespread adoption, establishing this category as a key driver of blade server market expansion.

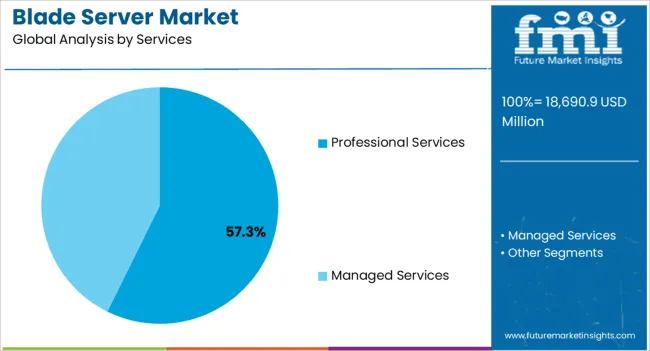

The professional services segment is projected to hold 57.30% of overall revenue by 2025 within the services category, making it the dominant segment. This leadership is attributed to the reliance of enterprises on expert deployment, consulting, and integration support when adopting blade server infrastructure.

Professional services ensure that systems are optimized for workload requirements, scalability, and energy efficiency, which are critical in complex IT environments. The ability to streamline implementation and reduce downtime has further strengthened demand.

Consequently, professional services have become a cornerstone for organizations aiming to achieve faster returns on investment from their blade server deployments.

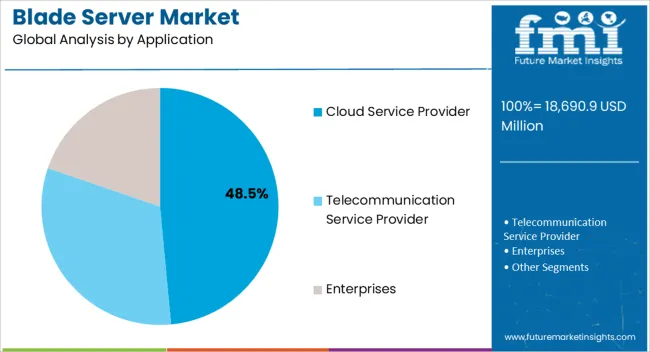

The cloud service provider segment is projected to represent 48.50% of the overall market by 2025 within the application category, positioning it as the most significant segment. Demand is being driven by the exponential growth of cloud based platforms, digital content consumption, and enterprise migration to cloud environments.

Blade servers are favored for their scalability, high density computing, and energy efficiency, all of which align with the requirements of hyperscale cloud operators. The need to support AI, big data analytics, and storage intensive applications has further reinforced their adoption.

As cloud providers continue to expand global data center capacity, blade servers remain central to their infrastructure strategies, consolidating this segment’s market leadership.

By allowing more processing power in fewer places, businesses may lower their primary costs. Demand for blade servers is high as they can be used to accomplish this due to their highly compact design, which uses less energy and physical space.

Secondary expenses, such as hardware cabling costs, facilities charges, as well as the personnel hours needed to configure and manage systems, also need reduction. The implementation of blade servers can curb these expenses, making the processes work smoothly.

Blade servers are increasingly being deployed, as it resolves a lot of challenges faced by various enterprises. These challenges include improving service availability, reducing operation costs, and increasing consistency and predictability.

The blade server market share is likely to experience notable growth, as consumers seek reduced operational costs and energy while expanding their IT infrastructure. Additionally, traditional rack and tower servers occupy a large surface area and huge power, and are hence, being replaced by blade servers.

Incorporating expensive technology, as well as vendor lock-in, requires high capital investment. This is expected to be a major drawback that obstructs the blade server market share.

Although one blade server does not create a heat problem - the installment of several blade servers is known to generate excessive heat. This is likely to curb the demand for these servers, as this issue can decrease their functionality.

However, the blade server adoption offers better advantages over the setup, provisioning, and upkeep of large server farms. This is anticipated to open up possibilities for its development and promote the market's growth.

| Category | Data Center Type |

|---|---|

| Leading Segment | Tier 4 |

| Market Share | 32.3% |

| Category | Application |

|---|---|

| Leading Segment | Cloud Service Provider |

| Market Share | 43.3% |

North America accounts for the highest share of the blade server market, with a significant revenue of 37.6% in 2025. This is attributed to the presence of several data-driven enterprises.

The USA government aimed to deliver better services to the public while increasing return-on-investment to taxpayers. This was done by launching the Data Center Optimization Initiative (DCOI) and consolidating many data centers around the country.

This region is experiencing a shift from individual device and system storage to the core cloud and edge of networks. Furthermore, the need for immediate processing of the vast amount of data being acquired on a real-time basis is likely to increase as a result of the extensive investments in AI infrastructure by the companies in this region.

Partnerships and acquisitions, as well as new product launches, have been the key strategies of the market players. The growing demand for blade servers is expected to strengthen their product portfolios and expand their geographic presence.

The combination of streamlined tens to hundreds of server management, lower prices, better efficiency, and more effective usage of costly data center capacity are all the pivotal factors that have rendered blade servers tempting.

Start-up companies are contributing to the growing demand with their own manufacturing strategies.

The presence of significant players in the market creates fierce competition. This surges numerous research and development activities, along with mergers and acquisitions, which eventually promote the growth of the global blade server market size.

Key players like Cisco Systems Inc, Hewlett-Packard Company, and Hewlett-Packard Company offer high-technology services and products that support computers and related products.

Moreover, companies are focusing on providing a wide variety of hardware components, as well as software and related services, to consumers, small and medium-sized businesses (SMBs), and large enterprises, including customers in the government, health, and education sectors.

Some Of The Recent Developments In The Blade Server Market Are:

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 8.5% from 2025 to 2035 |

| The base year for estimation | 2025 |

| Historical data | 2020 to 2025 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Data Center Type, Services, Application, End Users, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Afric;, ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates, Iran, South Africa |

| Key companies profiled | Cisco Systems Inc.; Dell Inc.; Hewlett-Packard Company; Lenovo Group Limited; Fujitsu Limited; Hitachi Limited; NEC Corporation; Silicon Graphics International Corporation; Huawei Technologies Co. Ltd.; Lenovo Group Limited |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global blade server market is estimated to be valued at USD 18,690.9 million in 2025.

The market size for the blade server market is projected to reach USD 42,085.0 million by 2035.

The blade server market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in blade server market are tier 1, tier 2, tier 3 and tier 4.

In terms of services, professional services segment to command 57.3% share in the blade server market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blade-type Belt Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Air Blade Dryer Market Size, Share, and Forecast 2025 to 2035

Wiper Blade Market Size and Share Forecast Outlook 2025 to 2035

Grader Blades Market Size and Share Forecast Outlook 2025 to 2035

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Turbine Blade Material Market Size and Share Forecast Outlook 2025 to 2035

Razor and Blade Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Razor and Blade Providers

APAC Wiper Blade Industry Size and Share Forecast Outlook 2025 to 2035

Helicopter Blades Market Size and Share Forecast Outlook 2025 to 2035

Skin Graft Blades Market

Circular Saw Blade Market Forecast and Outlook 2025 to 2035

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Blade Repair Material Market Growth – Trends & Forecast 2024-2034

Aircraft Engine Blade Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wiper Blade Market Growth – Trends & Forecast 2024 to 2034

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA