The hacksaw blades market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. The hacksaw blades market shows a steady upward trend from 2020 to 2024, moving from USD 0.9 billion to 1.0 billion. Year-on-year growth during this early period remains modest, averaging around USD 0.03–0.04 billion annually. This reflects consistent demand in construction, manufacturing, and metalworking applications, with buyers gradually increasing purchases to meet operational needs.

By 2025, the market will reach USD 1.1 billion, marking the start of a more defined growth phase. Incremental increases between 2025 and 2030 range between USD 0.05–0.07 billion per year, indicating stable expansion as the market captures wider commercial and industrial usage. From 2030 to 2035, the market growth continues at a slightly higher pace, moving from USD 1.3 billion to 1.6 billion. Year-on-year increments average around USD 0.08–0.10 billion, signaling stronger adoption and broader penetration in regional and global markets. The growth during this period reflects increasing replacement cycles and higher production demand in industries relying on precision cutting. By 2035, the market will achieve a mature level with predictable growth patterns, allowing manufacturers to focus on operational efficiency, inventory management, and meeting the steady demand across diverse industrial sectors.

| Metric | Value |

|---|---|

| Hacksaw Blades Market Estimated Value in (2025 E) | USD 1.1 billion |

| Hacksaw Blades Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

Growth is being influenced by increasing usage across developing economies, where manual cutting tools remain widely used due to affordability and simplicity. The shift toward precision cutting in metalworking and fabrication has also reinforced the relevance of durable and high-performance hacksaw blades. Investments in infrastructure development, DIY activities, and the ongoing modernization of small-scale workshops are contributing to a broader customer base.

Manufacturers are focusing on material enhancements and blade longevity, which is creating future opportunities for innovation. As the balance between manual and mechanized cutting solutions evolves, the market is expected to witness gradual transitions while retaining strong demand for essential, versatile, and cost-effective hacksaw blades across commercial and industrial end-users.

The hacksaw blades market is segmented by mechanism, blade type, blade material, blade length, teeth per inch (TPI), price, application, and geographic regions. By mechanism, the hacksaw blades market is divided into Manual and Electric. In terms of blade type, the hacksaw blades market is classified into Regular Hacksaw Blade, Raker Hacksaw Blade, and Wavy Hacksaw Blade. Based on blade material, the hacksaw blades market is segmented into High Speed Steel, Bimetal, Tungsten Steel, Alloy Steel, and Others. By blade length, the hacksaw blades market is segmented into Medium (6 - 12”), Small (6”), and High (Over 12”).

By teeth per inch (TPI), the hacksaw blades market is segmented into 24 TPI, 14 TPI, 18 TPI, and 32 TPI. By price, the hacksaw blades market is segmented into Medium, Low, and High. By application, the hacksaw blades market is segmented into Industrial, Residential, and Commercial. Regionally, the hacksaw blades industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual mechanism segment is projected to account for 64.70% of the overall Hacksaw Blades market revenue in 2025, making it the leading segment by mechanism. This dominance is being attributed to the simplicity, affordability, and ease of use associated with manual hacksaws.

In regions where cost-sensitive applications are prevalent, manual blades are preferred due to minimal setup requirements and compatibility with a wide range of materials. The absence of reliance on power sources makes manual hacksaw blades suitable for on-site, remote, and mobile use, particularly in construction and maintenance settings.

Growth in small and mid-scale manufacturing units and the continuation of traditional metal cutting methods in several industries have further supported the segment's expansion. The strong presence of manual cutting tools in household toolkits and vocational training environments is also contributing to its high share, reinforcing the segment’s relevance in both professional and personal use cases.

The regular hacksaw blade segment is expected to contribute 41.30% to the total Hacksaw Blades market revenue in 2025, making it the most prominent blade type. This position is being supported by its broad applicability, consistent performance, and availability across a variety of sizes and tooth configurations.

Regular hacksaw blades are widely chosen for general-purpose cutting tasks involving metals, plastics, and light construction materials. Their established presence in the market, coupled with continued preference for simple and reliable tools, has enabled sustained adoption across multiple user segments.

The ability to handle basic fabrication, plumbing, and repair work without specialized setup has strengthened their position in retail and industrial distribution channels. Additionally, manufacturers have maintained focus on improving the strength and longevity of regular blade formats, which has encouraged ongoing use even as specialty blade types evolve.

The high speed steel blade material segment is projected to account for 36.90% of the overall Hacksaw Blades market revenue in 2025, positioning it as the leading material type. This prominence is being attributed to the superior durability, heat resistance, and cutting efficiency of high speed steel compared to standard carbon steel variants.

These properties allow blades to maintain edge sharpness over extended use, especially in metal cutting applications where precision and strength are critical. The growing requirement for blades that perform under high-stress and high-friction conditions in industrial workshops and fabrication units has reinforced demand for this material.

Moreover, the extended lifespan of high-speed steel blades helps reduce replacement frequency and downtime, delivering long-term cost advantages for end users. As performance expectations in manual and semi-mechanized operations increase, high-speed steel is expected to remain the preferred material choice in both commercial and professional use environments.

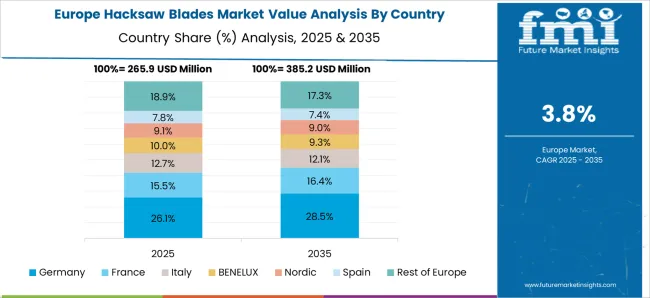

The hacksaw blades market is witnessing steady growth driven by increasing demand in metalworking, construction, automotive, and fabrication industries. Versatile and durable, these blades are essential for cutting metals, plastics, and composites with precision. Market expansion is fueled by rising industrialization, infrastructural development, and DIY trends. North America and Europe lead due to mature manufacturing and construction sectors, while Asia-Pacific shows rapid adoption owing to growing industrial output. Companies differentiate through advanced steel grades, coated blades for longevity, and specialized teeth designs for high-precision cutting.

Consistency in blade quality remains a key challenge. Differences in steel grade, tooth design, heat treatment, and coating can affect cutting efficiency, durability, and corrosion resistance. Lack of standardized testing protocols across manufacturers may result in performance variability. Industrial clients demand high reliability and adherence to cutting specifications for metals, plastics, or composites. Until harmonized quality standards are widely implemented, manufacturers may face difficulties in maintaining performance, meeting client expectations, and achieving regulatory compliance.

Technological advancements are enhancing hacksaw blade performance. Innovations include high-speed steel, bi-metal compositions, carbide-tipped teeth, anti-corrosion coatings, and variable pitch designs for smoother cuts. Ergonomic blade-handle integration and precision-engineered tooth geometries improve usability and efficiency. Companies leveraging computer-aided design and advanced metallurgical processes optimize cutting performance, longevity, and energy efficiency. These innovations support industrial, construction, and DIY applications, driving adoption among professional and hobbyist users.

Hacksaw blades must comply with safety and industrial tool standards to prevent workplace accidents and ensure performance reliability. Regulations focus on material safety, dimensional accuracy, and manufacturing quality. Industrial users require compliance with occupational safety norms, particularly in manufacturing and construction environments. Certification under recognized quality and safety standards enhances market credibility and trust. Until global safety and manufacturing standards are fully harmonized, manufacturers must navigate diverse regulatory requirements across regions to ensure market access and reduce liability risks.

The market is highly competitive, with numerous global and regional manufacturers competing on quality, price, and innovation. Supply chain constraints, such as steel availability, precision manufacturing capacity, and coating materials, can impact production timelines and costs. Companies investing in vertical integration, strategic sourcing, and automated production gain reliability and cost advantages. Competitive differentiation focuses on blade durability, specialized designs, and brand reputation. Until supply chain stability and standardization improve, rivalry and production challenges will continue to influence market growth and adoption in industrial, construction, and DIY segments.

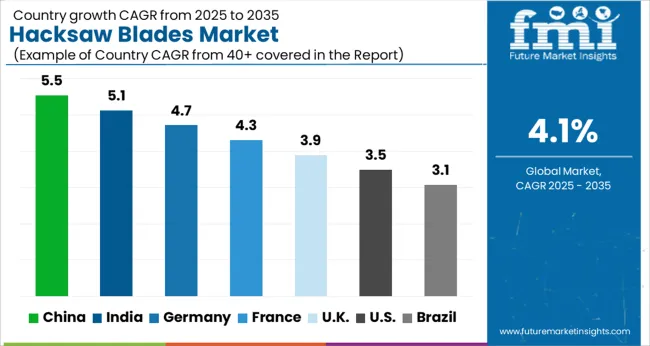

The global market is projected to grow at a CAGR of 4.1% through 2035, supported by increasing demand across construction, metalworking, and industrial applications. Among BRICS nations, China has been recorded with 5.5% growth, driven by large-scale production and deployment in industrial and construction sectors, while India has been observed at 5.1%, supported by growing utilization in manufacturing and metal fabrication. In the OECD region, Germany has been measured at 4.7%, where production and adoption for industrial and construction applications have been steadily maintained. The United Kingdom has been noted at 3.9%, reflecting consistent use in industrial and metalworking operations, while the USA has been recorded at 3.5%, with production and utilization in manufacturing, construction, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The hacksaw blades market in China is growing at a CAGR of 5.5%, driven by rising industrial manufacturing, construction, and metalworking activities. As the country continues to expand its infrastructure and industrial base, demand for high-quality cutting tools, including hacksaw blades, is increasing. Technological advancements, such as improved blade materials, longer durability, and precision cutting capabilities, enhance productivity and efficiency in manufacturing and construction processes. The market is also benefiting from investments in automated and semi-automated metal cutting equipment, where specialized hacksaw blades are required. Rising safety and quality standards in workshops and industrial facilities further support market expansion. China’s focus on industrial modernization and export-oriented metal products ensures sustained demand for innovative and reliable hacksaw blades across multiple sectors.

The hacksaw blades market in India is expanding at a CAGR of 5.1%, fueled by growing industrialization, construction projects, and manufacturing activities. The rising metalworking and fabrication industries require reliable cutting tools with precision and longevity. Advanced hacksaw blades with durable materials, ergonomic designs, and specialized cutting features are increasingly adopted to enhance productivity. Government initiatives supporting industrial growth, “Make in India” programs, and expansion of manufacturing hubs contribute to market growth. Training programs for workers and strict adherence to workplace safety standards encourage the use of quality cutting tools. As India invests in infrastructure and industrial projects, the demand for high-performance hacksaw blades is expected to remain steady, with manufacturers focusing on innovation, durability, and cost-effectiveness to meet industry requirements.

The hacksaw blades market in Germany is growing at a CAGR of 4.7%, supported by strong industrial and engineering sectors. Demand comes primarily from metalworking, automotive, and manufacturing industries where precision and reliability are crucial. Technological innovations in blade materials, tooth design, and cutting efficiency improve productivity while reducing operational costs. Strict quality control and safety standards ensure adoption of high-performance blades in industrial applications. Germany’s focus on advanced manufacturing, automation, and engineering excellence sustains steady demand for high-quality hacksaw blades. Additionally, the country’s strong export-oriented metal fabrication industry creates continuous requirements for efficient cutting tools, ensuring that the hacksaw blades market remains competitive and innovation-driven.

The hacksaw blades market in the United Kingdom is expanding at a CAGR of 3.9%, mainly driven by manufacturing, construction, and metal fabrication industries. Demand for precision cutting tools is increasing due to modern engineering requirements and adherence to safety standards. Advanced hacksaw blades with durable materials, improved cutting efficiency, and ergonomic designs are increasingly used in industrial workshops and construction sites. Government initiatives promoting industrial safety, manufacturing modernization, and infrastructure projects support market growth. Adoption in small and medium enterprises, along with industrial maintenance operations, ensures steady demand. With a focus on quality, productivity, and compliance with European safety standards, the UK hacksaw blades market is expected to grow moderately but consistently.

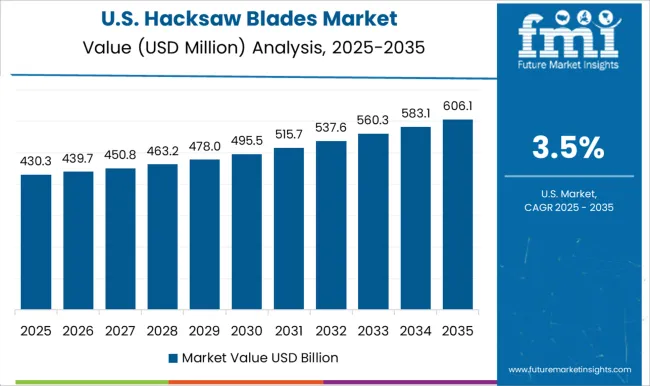

The hacksaw blades market in the United States is growing at a CAGR of 3.5%, driven by industrial manufacturing, metalworking, and construction activities. Demand is fueled by the need for precision cutting, durable tools, and enhanced productivity in workshops and industrial operations. Advanced blades with improved material strength, ergonomic designs, and specialized cutting capabilities are increasingly adopted. Industrial safety standards and workforce training programs encourage the use of high-quality cutting tools. The USA market also benefits from investments in manufacturing modernization, automation, and industrial maintenance operations. Continuous focus on innovation, reliability, and compliance with safety regulations ensures steady growth in the hacksaw blades market across various industrial applications.

The hacksaw blades market serves industrial, construction, and DIY sectors, offering tools for cutting metal, plastic, and wood with precision and durability. Key suppliers and manufacturers drive innovations in blade materials, tooth design, and ergonomics to meet varying cutting requirements. Stanley is a prominent manufacturer known for durable hand tools and hacksaw blades suitable for professional and home use. Apex Tool Group LLC produces high-performance cutting tools, emphasizing strength and long-lasting sharpness.

Bipico Industries Pvt. Ltd. specializes in precision blades for industrial applications, catering to diverse material requirements. Black Hawk Industries provides robust hacksaw blades designed for both heavy-duty and general-purpose use. CooperTools manufactures reliable cutting solutions with a focus on ergonomics and user safety, while Dewalt offers professional-grade blades renowned for toughness and efficiency. Disston delivers high-quality steel blades engineered for accuracy and longevity. Fein is recognized for precision and innovative blade designs in metal and specialty cutting applications. Klein Tools produces durable, user-friendly hacksaw blades for both professional trades and DIY enthusiasts.

Lenox focuses on high-performance materials and innovative tooth geometry for faster, cleaner cuts. Robert Bosch GmbH combines German engineering with advanced blade technology for industrial and professional use. Snap-on Tools Company LLC offers premium blades designed for precision and durability. Starrett produces specialized blades for industrial and high-precision applications, while Techtronic Industries Co., Ltd. and TTI Group deliver a wide range of innovative cutting tools emphasizing efficiency and versatility. These leading suppliers continue to shape the global hacksaw blades market through advanced design, material innovation, and customer-focused solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Mechanism | Manual and Electric |

| Blade Type | Regular Hacksaw Blade, Raker Hacksaw Blade, and Wavy Hacksaw Blade |

| Blade Material | High Speed Steel, Bimetal, Tungsten Steel, Alloy Steel, and Others |

| Blade Length | Medium (6 - 12”), Small (6”), and High (Over 12”) |

| Teeth per Inch (TPI) | 24 TPI, 14 TPI, 18 TPI, and 32 TPI |

| Price | Medium, Low, and High |

| Application | Industrial, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley, Apex Tool Group LLC, Bipico Industries Pvt. Ltd., Black Hawk Industries, CooperTools, Dewalt, Disston, Fein, Klein Tools, Lenox, Robert Bosch GmbH, Snap-on Tools Company LLC, Starret, Techtronic Industries Co., Ltd., and TTI Group |

| Additional Attributes | Dollar sales by type including high-speed steel, bi-metal, and carbon steel blades, application across metalworking, construction, and woodworking industries, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising industrial manufacturing, increasing demand for precision cutting tools, and expansion of the construction and fabrication sectors. |

The global hacksaw blades market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the hacksaw blades market is projected to reach USD 1.6 billion by 2035.

The hacksaw blades market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in hacksaw blades market are manual and electric.

In terms of blade type, regular hacksaw blade segment to command 41.3% share in the hacksaw blades market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Grader Blades Market Size and Share Forecast Outlook 2025 to 2035

Helicopter Blades Market Size and Share Forecast Outlook 2025 to 2035

Skin Graft Blades Market

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA