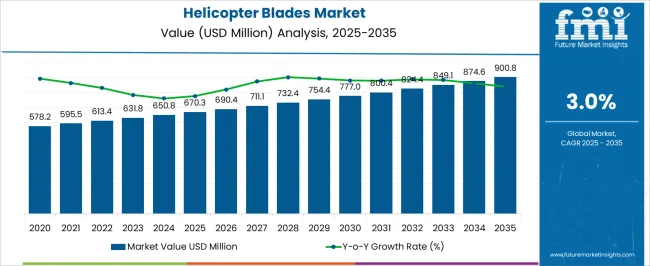

The helicopter blades market is projected to expand from USD 670.3 million in 2025 to USD 777 million by 2030, showing consistent growth in the first five-year block. This period marks an increase of more than USD 100 million, reflecting steady demand for rotor blades in both civil and defense applications. The upward curve is shaped by fleet modernization programs, growing demand for lightweight yet durable blade materials, and replacement requirements for aging helicopters.

From USD 690.4 million in 2026 to USD 732.4 million in 2028, the year-on-year rise demonstrates predictable market stability. Manufacturers are focusing on composites and advanced aerodynamics to improve efficiency and reduce long-term maintenance costs, which is driving early growth momentum. Between 2025 and 2030, the helicopter blades market demonstrates a consistent upward slope, reaching USD 777 million by the end of the block. This trajectory highlights the importance of rotor blades in supporting diverse helicopter missions across commercial, medical, and military operations. Increased investments in defense budgets and the rising use of helicopters for emergency services are expected to fuel growth.

The market’s reliance on precision engineering, improved vibration control, and longer service intervals is creating opportunities for both OEM suppliers and aftermarket providers. This first block of expansion signals a stable and reliable growth path, with opportunities concentrated in innovation, aftermarket upgrades, and regional fleet expansions. The steady trajectory suggests that stakeholders can expect gradual yet dependable market returns through this period.

| Metric | Value |

|---|---|

| Helicopter Blades Market Estimated Value in (2025 E) | USD 670.3 million |

| Helicopter Blades Market Forecast Value in (2035 F) | USD 900.8 million |

| Forecast CAGR (2025 to 2035) | 3.0% |

The helicopter blades market holds an important yet specialized position across several parent markets, with its share defined by the critical role blades play in rotorcraft performance and safety. Within the aerospace components market, helicopter blades contribute around 6%, reflecting their share among a wide range of structural and propulsion parts. In the rotorcraft systems market, their share is significantly higher at about 25%, since rotor blades are central to lift, maneuverability, and overall aircraft capability. Within the aviation parts and spares market, helicopter blades represent nearly 7%, as demand is tied to both new production and frequent replacement cycles due to wear and fatigue. In the military and defense aviation equipment market, their contribution stands close to 8%, highlighting the importance of advanced blade materials and designs in enhancing mission readiness and durability. Finally, within the commercial aviation equipment market, helicopter blades account for about 4%, since this broader segment is dominated by fixed-wing aircraft components but still requires steady investment in rotorcraft.

Collectively, these percentages show that helicopter blades are a relatively niche element in larger aerospace and aviation markets but dominate within rotorcraft-specific segments. Their strong share in rotorcraft systems underscores their indispensability, while their moderate contributions in military and commercial aviation reflect a balance between specialized importance and competition with broader categories of aircraft equipment.

The helicopter blades market is gaining strong momentum due to increasing defense investments, demand for rotorcraft modernization, and expansion of vertical lift operations in both military and civil sectors. Enhanced rotor performance requirements, focus on noise and vibration reduction, and integration of composite materials have redefined product innovation in the market.

Additionally, OEMs are collaborating with armed forces and aviation agencies to deliver customized blade configurations suited to high-speed maneuverability, thermal endurance, and aerodynamic efficiency.

Government-backed R&D funding and the shift toward electric and hybrid helicopters are expected to further drive technological advancement and adoption of advanced rotor systems.

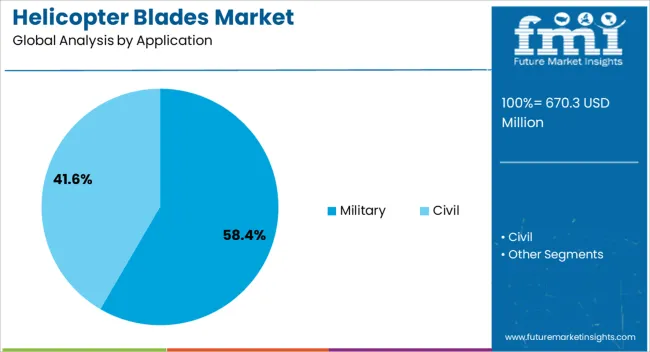

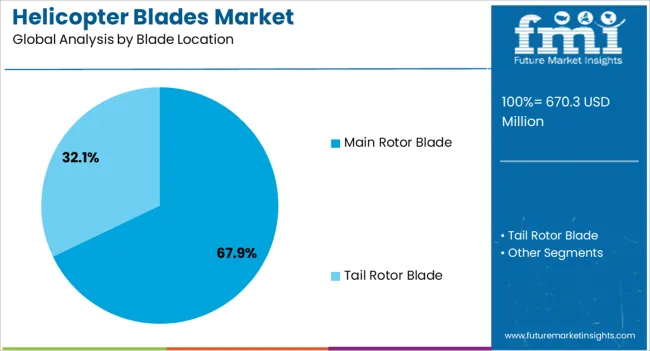

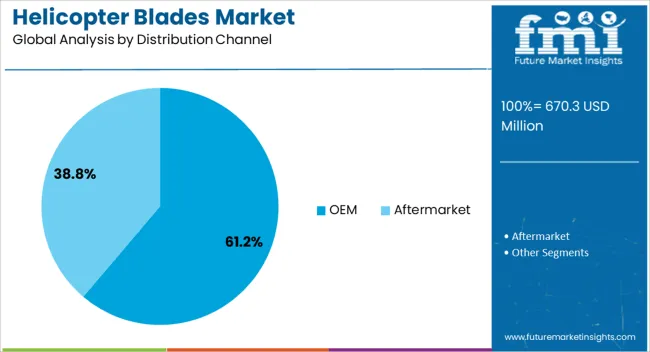

The helicopter blades market is segmented by application, blade location, distribution channel, and geographic regions. By application, helicopter blades market is divided into Military and Civil. In terms of blade location, helicopter blades market is classified into Main Rotor Blade and Tail Rotor Blade. Based on distribution channel, helicopter blades market is segmented into OEM and Aftermarket. Regionally, the helicopter blades industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The military segment is projected to account for 58.40% of the helicopter blades market by 2025, making it the dominant application category. This growth is being driven by heightened defense spending, replacement of aging helicopter fleets, and increasing use of rotorcraft in tactical and logistic missions.

Advanced blade technologies, including radar-absorbing coatings and extended-life composite materials, are being adopted to improve mission readiness and reduce maintenance cycles. Military modernization programs in the USA, India, and NATO countries are reinforcing demand for upgraded rotor systems across both combat and utility helicopters.

The focus on stealth, agility, and payload efficiency further consolidates the military segment’s leadership.

Main rotor blades are expected to represent 67.90% of total market share in 2025, positioning this as the leading blade location category. The centrality of main rotors in generating lift and enabling directional control makes them a critical focus for innovation.

Key advancements include shape optimization, active blade control systems, and lightweight composite structures designed to enhance durability and responsiveness. The high replacement rate and frequent wear due to aerodynamic loads further contribute to consistent aftermarket and OEM demand.

Investments in rotorcraft with increased vertical takeoff capabilities and enhanced hover performance are keeping main rotor blades at the forefront of product development.

The OEM distribution channel is anticipated to dominate with a 61.20% share in 2025, emerging as the preferred mode of blade supply. OEMs benefit from direct integration into helicopter manufacturing and are often the first to adopt proprietary or customized blade technologies.

Early-stage design collaboration between blade manufacturers and helicopter OEMs ensures optimal fit, load-bearing capacity, and aerodynamic performance. The growing prevalence of long-term maintenance and support agreements between defense agencies and OEMs is reinforcing this distribution pathway.

Additionally, OEM channels offer superior quality assurance, traceability, and compatibility, making them highly preferred for new aircraft procurement programs.

The helicopter blades market is advancing as military, civil, and commercial operators expand fleets and replace aging rotor systems. Opportunities are strengthening in composite materials and lightweight designs, while trends emphasize aftermarket services, modular designs, and lifecycle management. Challenges persist in high costs, regulatory hurdles, and material supply chain risks. In my opinion, the most competitive players will be those who balance innovation with cost efficiency, offering reliable, compliant, and service-focused solutions to meet evolving aviation demands across global defense and civilian sectors.

Demand for helicopter blades has been reinforced by the growing use of helicopters in defense, emergency medical services, tourism, and offshore operations. Military fleets require durable and high-performance blades for combat and surveillance, while civilian operators focus on reliability and lower maintenance costs. Replacement cycles of aging fleets also contribute significantly to demand. In my opinion, this demand will continue to rise as governments and private operators expand fleets to meet diverse operational needs, making rotor blades a crucial component in the aviation supply chain.

Opportunities have been created by advancements in composite and lightweight materials used in helicopter blades. Manufacturers are focusing on carbon fiber and advanced alloys to reduce weight while improving aerodynamic performance and durability. Civil aviation, defense modernization programs, and commercial operators are increasingly opting for these upgraded blades. I believe companies investing in research and partnerships with aerospace OEMs will capture significant opportunities, particularly as operators demand blades that enhance efficiency, reduce fuel costs, and extend service life across both civil and defense applications.

Trends indicate a rising emphasis on aftermarket services, including blade repairs, refurbishments, and replacement programs. Operators prefer service packages that minimize downtime and extend blade longevity. Another trend is the adoption of modular blade designs that simplify installation and maintenance, enhancing operational efficiency. In my opinion, this focus on services reflects a shift from purely product-driven sales to lifecycle management, where the ability to provide long-term reliability and performance assurance determines competitiveness in the helicopter blades market globally.

Challenges in the helicopter blades market stem from high manufacturing costs and stringent aviation safety regulations. The use of advanced materials raises production expenses, making blades more costly for operators. Certification processes and strict compliance with aviation standards add further complexities, slowing market entry for new players. Supply chain disruptions for specialized materials also create risks. In my assessment, only manufacturers with strong financial capacity, regulatory expertise, and integrated supply networks will overcome these barriers, while others may struggle to remain competitive in the aerospace industry.

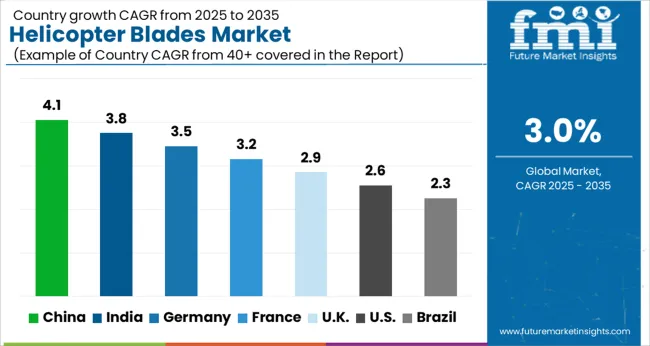

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The global helicopter blades market is projected to grow at a CAGR of 3% from 2025 to 2035. China leads with a growth rate of 4.1%, followed by India at 3.8%, and France at 3.2%. The United Kingdom records a growth rate of 2.9%, while the United States shows the slowest growth at 2.6%. Growth is supported by rising investments in defense aviation, expanding civil helicopter fleets, and growing demand for rotorcraft in offshore, medical, and surveillance operations. Emerging economies like China and India are experiencing faster growth due to defense procurement and fleet modernization, while mature markets such as the USA, UK, and France focus on maintenance, composite blade innovations, and integration of advanced materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

The helicopter blades market in China is projected to grow at a CAGR of 4.1%. Rising defense spending and demand for advanced rotorcraft in surveillance and combat missions are driving adoption. Civil aviation growth is also supporting higher usage in medical transport, emergency services, and offshore operations. Chinese manufacturers are increasingly focusing on composite blade production, enhancing durability and reducing weight. Government-backed R&D initiatives and collaborations with international aerospace firms are strengthening China’s manufacturing capacity and global competitiveness.

The helicopter blades market in India is expected to grow at a CAGR of 3.8%. Increasing demand from defense forces for utility and attack helicopters is fueling adoption. Civil applications are expanding, particularly in medical evacuations, disaster relief, and transport services across remote areas. The “Make in India” initiative is encouraging domestic manufacturing of helicopter components, including blades, to reduce reliance on imports. Collaborations with global aerospace companies are strengthening technology transfer and boosting local production capacity. This is positioning India as a growing hub for rotorcraft component manufacturing in Asia.

The helicopter blades market in France is projected to grow at a CAGR of 3.2%. France’s strong aerospace sector, led by manufacturers such as Airbus Helicopters, is a key driver of adoption. Demand is supported by defense requirements, as well as civil and emergency services. Innovations in composite blades are improving flight efficiency, noise reduction, and overall rotorcraft performance. France is also investing in R&D to develop advanced materials for next-generation rotor systems. Strong export demand for helicopters further enhances the outlook for blade manufacturing in France.

The helicopter blades market in the UK is projected to grow at a CAGR of 2.9%. Demand is driven by military rotorcraft programs, with emphasis on upgrading fleets and integrating composite blades. Civil uses in emergency medical services and offshore operations also support market expansion. The UK aerospace industry is focusing on partnerships and research collaborations to enhance blade technology, with particular interest in lightweight and damage-tolerant materials. Although growth is modest compared to Asia, the UK maintains steady demand due to its defense and civil aviation requirements.

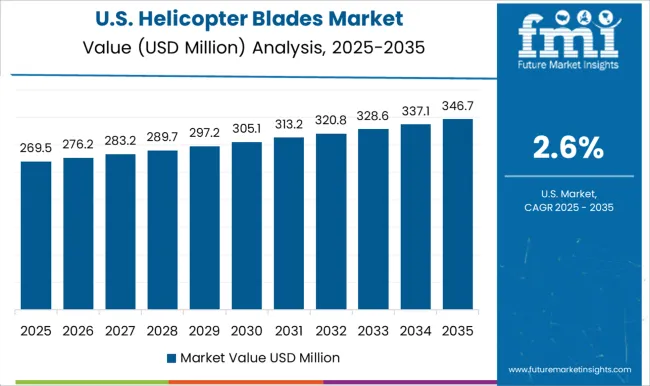

The helicopter blades market in the USA is projected to grow at a CAGR of 2.6%. The USA remains a leading hub for rotorcraft development, with significant demand from defense aviation and homeland security. Civil applications, particularly in medical evacuations, firefighting, and law enforcement, further contribute to market growth. Manufacturers are focusing on innovations in composite and hybrid blades to improve durability, efficiency, and noise control. The aftermarket for replacement blades also plays a significant role, as the USA operates one of the largest helicopter fleets worldwide.

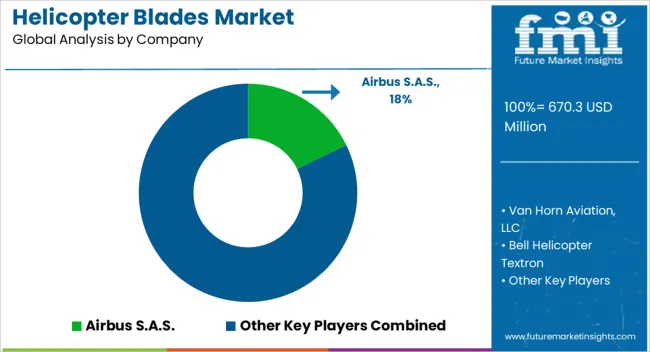

Competition in the helicopter blades space is shaped by aerospace giants and specialized rotorcraft component makers. Airbus S.A.S. and Bell Helicopter Textron push advanced composite blade programs for both civilian and defense fleets, while Boeing and Lockheed Martin integrate rotor solutions within broader helicopter platforms. Hindustan Aeronautics Limited builds localized rotorcraft blades to serve India’s defense procurement, and Van Horn Aviation, LLC concentrates on aftermarket upgrades, carbon composite blades, and STC-certified replacements for existing fleets. This blend of OEM-backed integration and niche specialization defines the competitive balance. Strategies revolve around material science, weight reduction, and noise suppression. Airbus and Boeing highlight composite designs for higher lift and longer service intervals. Bell emphasizes aftermarket kits and retrofit options for extending fleet life. Lockheed Martin uses defense contracts to scale rotor design in multi-mission helicopters. Hindustan Aeronautics Limited leverages state programs to secure procurement contracts, while Van Horn Aviation differentiates through aftermarket performance enhancements and FAA certifications. Across the board, partnerships with defense agencies, fleet operators, and aviation authorities strengthen market footholds. Product brochures place visual focus on cross-sections of carbon fiber and titanium edge assemblies, with emphasis on fatigue resistance, aerodynamic shaping, and vibration dampening. Performance data tables showcase lift-to-weight ratios, service life hours, and acoustic signatures compared to older blade formats. Marketing materials often stress operational cost savings, mission readiness, and safety assurance. By highlighting both innovation in composite manufacturing and adaptability to diverse helicopter platforms, brochures act as decision tools for operators seeking reliability, compliance, and performance advantages.

| Item | Value |

|---|---|

| Quantitative Units | USD 670.3 Million |

| Application | Military and Civil |

| Blade Location | Main Rotor Blade and Tail Rotor Blade |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus S.A.S., Van Horn Aviation, LLC, Bell Helicopter Textron, Boeing, Lockheed Martin Corporation, and Hindustan Aeronautics Limited |

| Additional Attributes | Dollar sales by product type (main rotor blades vs tail rotor blades), Dollar sales by material (composite vs metal), Trends in lightweight aerostructures and vibration reduction, Use in military, commercial, and emergency service helicopters, Growth of replacement demand in aging fleets, Regional manufacturing and adoption across North America, Europe, and Asia-Pacific. |

The global helicopter blades market is estimated to be valued at USD 670.3 million in 2025.

The market size for the helicopter blades market is projected to reach USD 900.8 million by 2035.

The helicopter blades market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in helicopter blades market are military and civil.

In terms of blade location, main rotor blade segment to command 67.9% share in the helicopter blades market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Helicopter Market Size and Share Forecast Outlook 2025 to 2035

Helicopter Wheels Market

Civil Helicopter MRO Market Insights – Growth & Forecast 2025 to 2035

Commercial Helicopter Market

Airplane And Helicopter Hangar Doors Market Size and Share Forecast Outlook 2025 to 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Grader Blades Market Size and Share Forecast Outlook 2025 to 2035

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Skin Graft Blades Market

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA