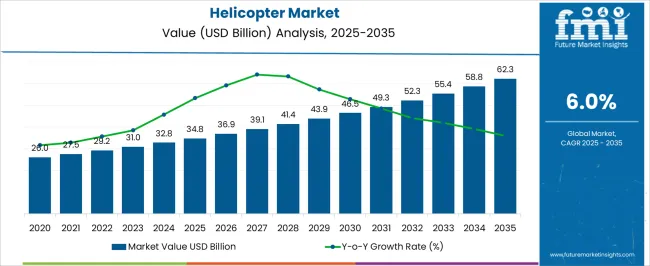

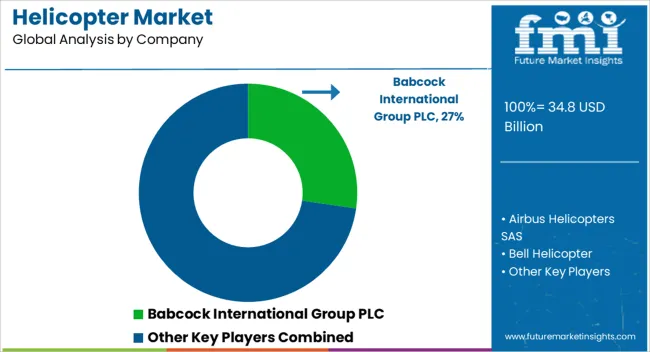

The helicopter market is estimated to be valued at USD 34.8 billion in 2025 and is projected to reach USD 62.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The helicopter market is valued at USD 34.8 billion in 2025 and is expected to grow to USD 62.3 billion by 2035, with a CAGR of 6.0%. Between 2021 and 2025, the market grows steadily from USD 26.0 billion to USD 34.8 billion, progressing through USD 27.5 billion, 29.2 billion, 31.0 billion, and 32.8 billion. The growth in this early phase is closely linked to the demand from industries like defense, emergency medical services, oil and gas, and tourism. Economic factors, such as defense budgets and oil prices, influence helicopter sales, with a direct correlation to fluctuations in global economic conditions.

From 2026 to 2030, the market expands further from USD 34.8 billion to USD 49.3 billion, with values reaching USD 36.9 billion, 39.1 billion, 41.4 billion, and 43.9 billion. The increase in air travel, as well as the adoption of helicopters for commercial and urban air mobility, boosts the market. Economic recovery and rising disposable incomes during this period play a key role in fueling demand for private and commercial helicopter services.

Between 2031 and 2035, the market reaches USD 62.3 billion, with values progressing through USD 52.3 billion, 55.4 billion, 58.8 billion, and 62.3 billion. The elasticity of growth in this phase shows strong dependency on macroeconomic indicators such as GDP growth, oil prices, and defense spending, which drive demand for helicopter purchases, especially in emerging markets.

| Metric | Value |

|---|---|

| Helicopter Market Estimated Value in (2025 E) | USD 34.8 billion |

| Helicopter Market Forecast Value in (2035 F) | USD 62.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The aerospace and defense market is the largest contributor, accounting for approximately 40-45%, as helicopters are essential in military operations for tasks such as surveillance, reconnaissance, search and rescue, and combat support. The commercial aviation market plays a significant role, contributing about 25-30%, with helicopters being widely used for passenger transport, tourism, air ambulance services, and corporate travel, particularly in regions where traditional aircraft cannot operate. The oil and gas market contributes around 15-20%, as helicopters are crucial for offshore oil and gas operations, providing transportation for workers and equipment to remote drilling sites.

The emergency services market is another key driver, accounting for approximately 10-12%, as helicopters are used for air ambulance services, firefighting, search-and-rescue missions, and disaster response, offering critical support during emergencies. Finally, the tourism and leisure market contributes around 8-10%, driven by the growing demand for helicopter tours in scenic locations and private leisure flights, catering to luxury travel experiences. These parent markets collectively highlight the diverse applications of helicopters, from defense and emergency services to commercial aviation, oil and gas, and tourism, illustrating the broad demand for helicopters across multiple industries.

The helicopter market is witnessing consistent growth, supported by expanding demand across civil, defense, emergency services, and commercial transportation sectors. The market outlook remains positive as helicopters continue to play a critical role in offshore operations, border surveillance, search and rescue missions, and medical evacuation. Increasing investments in fleet modernization and the adoption of advanced avionics and composite materials are improving the performance, safety, and operational efficiency of helicopters.

Defense procurement programs and rising demand for versatile rotary-wing aircraft in both developed and emerging economies are further fueling market expansion. The need for vertical lift platforms capable of accessing remote or confined locations is reinforcing the value of helicopters in urban air mobility and defense logistics.

Additionally, manufacturers are focusing on enhancing fuel efficiency and reducing noise and emissions, aligning product development with sustainability goals As global security requirements evolve and commercial applications expand, the helicopter market is positioned for sustained growth driven by technological advancement and operational versatility.

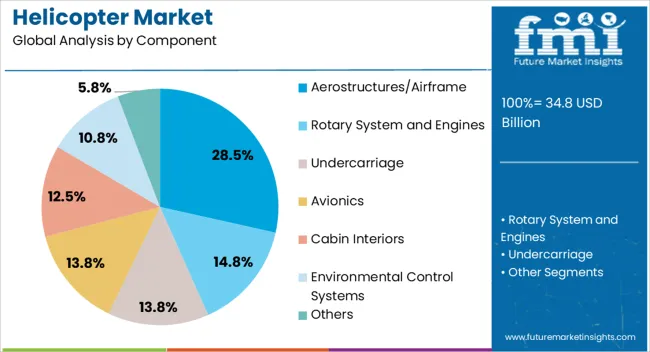

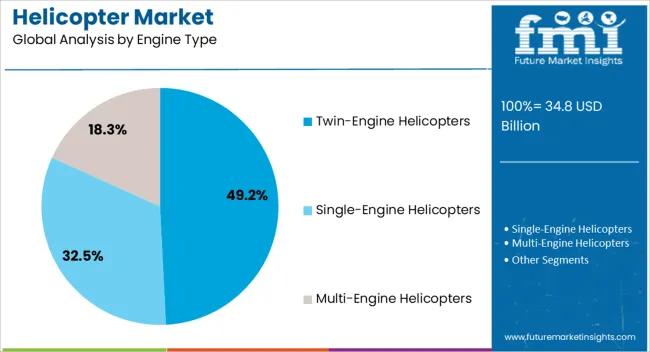

The helicopter market is segmented by component, sales channel, engine type, rotor type, end use, and geographic regions. By component, helicopter market is divided into aerostructures/airframes, rotary systems and engines, undercarriages, avionics, cabin interiors, environmental control systems, and others. In terms of sales channel, helicopter market is classified into OEM and maintenance, repair and overhaul (MRO). Based on engine type, helicopter market is segmented into twin-engine helicopters, single-engine helicopters, and multi-engine helicopters. By rotor type, helicopter market is segmented into single-rotor helicopters, twin-rotor helicopters, and tiltrotor helicopters. By end use, helicopter market is segmented into military, commercial, transport, medical services/search & rescue, offshore sector, reconnaissance, maritime surveillance, and others. Regionally, the helicopter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aerostructures or airframe segment is projected to account for 28.5% of the helicopter market revenue share in 2025, making it the leading component category. This dominance is being attributed to the central role that airframe structures play in ensuring aircraft integrity, safety, and aerodynamic performance. Continuous advancements in composite materials and precision manufacturing techniques are enhancing structural strength while reducing weight, resulting in improved fuel efficiency and payload capacity.

The demand for lightweight, corrosion-resistant materials is also influencing design innovations in airframe construction. The segment is benefiting from increased helicopter production and fleet upgrades globally, especially in military and civil aviation sectors where operational efficiency and survivability are critical.

Integration of advanced materials such as carbon fiber and titanium alloys is further supporting structural optimization As regulatory standards for crashworthiness and airworthiness become more stringent, investments in advanced airframe technologies are expected to rise, reinforcing the segment’s leadership in the helicopter market.

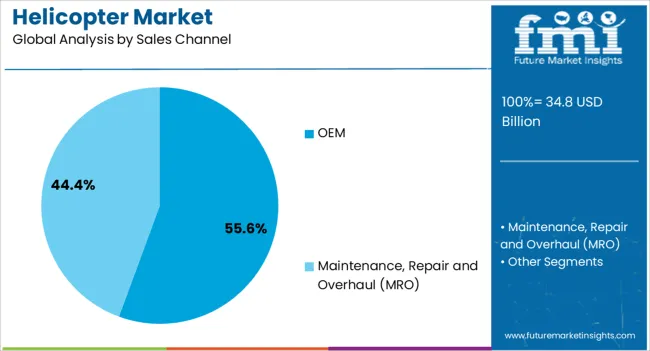

The OEM segment is expected to capture 55.6% of the helicopter market revenue share in 2025, emerging as the dominant sales channel. This segment’s leadership is being driven by increasing procurement of new helicopters across civil, paramilitary, and defense sectors to meet evolving mission requirements and regulatory standards.

Original equipment manufacturers are offering integrated systems with the latest avionics, structural enhancements, and propulsion technologies, appealing to operators seeking long-term value and lower lifecycle costs. The OEM channel is also benefiting from large-scale fleet renewal initiatives and government-led modernization programs across several countries.

Demand for mission-specific configurations such as medical evacuation, search and rescue, and VIP transport is reinforcing the preference for OEM-supplied helicopters tailored to operational needs As manufacturers focus on digital production methods, modular assemblies, and faster turnaround times, the OEM segment is poised to retain its leadership, supported by strong backlogs and robust order pipelines across both commercial and military markets.

The twin-engine helicopters segment is anticipated to represent 49.2% of the helicopter market revenue share in 2025, securing its position as the leading engine type. This dominance is being supported by operational advantages such as improved safety, greater lift capacity, and the ability to perform missions in challenging environments. Twin-engine configurations are widely preferred in applications requiring redundancy and reliability, including offshore transport, defense operations, firefighting, and emergency medical services.

Enhanced performance in adverse weather conditions and high-altitude terrains further contributes to their widespread adoption. Regulatory mandates in certain regions, which require twin-engine platforms for specific mission profiles, are also reinforcing demand. Continuous improvements in engine design, fuel efficiency, and noise reduction are making twin-engine helicopters more cost-effective and environmentally sustainable.

Manufacturers are increasingly focusing on developing lightweight and digitally managed twin-engine platforms, enabling enhanced maneuverability and mission flexibility With expanding utility in both public and private sectors, this engine type is expected to maintain its leadership in the global helicopter market.

Helicopters play a crucial role in sectors such as air transport, search and rescue, law enforcement, oil and gas exploration, and military defense. The market is driven by technological advancements, such as enhanced avionics, improved fuel efficiency, and multi-mission capabilities that make helicopters more versatile. The growing use of helicopters for urban air mobility (UAM) and the expansion of air ambulance services are propelling market growth.

Challenges in the market include high operating costs, stringent regulatory standards, and the complexity of maintenance. Opportunities lie in the development of electric and hybrid helicopters, which offer lower emissions and operating costs, as well as the growing demand for unmanned aerial systems (UAS) in defense and commercial applications. Trends indicate a shift toward more advanced rotorcraft, autonomous flight technologies, and increased investment in advanced materials and fuel-efficient designs.

The helicopter market is experiencing significant growth driven by the increasing demand for helicopters in emergency services, defense, and urban air mobility (UAM). In emergency services, helicopters are crucial for airlifting patients, providing quick access to remote areas, and performing search-and-rescue operations. In the defense sector, helicopters continue to be essential for troop transport, surveillance, and reconnaissance missions.

Urban air mobility is gaining momentum, with the development of electric and autonomous helicopters aimed at reducing traffic congestion and improving urban transportation. These applications highlight the versatility of helicopters, with continued innovation in electric and hybrid systems making them more efficient and cost-effective, thereby expanding their market potential across both urban and rural areas.

Helicopters are expensive to purchase, operate, and maintain, which can limit their accessibility, especially for smaller operators or emerging markets. Regulatory standards, particularly those related to airspace management, safety, and environmental emissions, add complexity to the market and require manufacturers and operators to meet stringent requirements.

Additionally, helicopters require specialized parts and maintenance, which can lead to longer downtimes and high service costs. Technical constraints, such as limitations in battery life for electric helicopters and the complexity of autonomous flight systems, continue to hinder the broader adoption of certain advanced technologies in the market. These challenges necessitate continuous innovation and investment in more affordable, efficient, and reliable solutions to drive future growth.

Opportunities in the helicopter market are emerging with the development of electric and hybrid helicopter technologies, as well as the growing demand for unmanned aerial systems (UAS) in both commercial and defense applications. Electric and hybrid helicopters offer the promise of reducing operating costs and minimizing emissions, making them an attractive option for the environmentally conscious market. These technologies are still in the early stages but are expected to play a significant role in the future of aviation, especially for short-range urban transportation.

Furthermore, the increasing use of UAS for surveillance, reconnaissance, and logistical operations is creating new avenues for growth in both defense and commercial sectors. As battery technology advances and the demand for drone-based services increases, manufacturers are exploring the potential of integrating UAS capabilities with traditional helicopter platforms, further expanding market opportunities.

The helicopter market is witnessing several key trends, including the development of autonomous flight capabilities, advanced materials, and fuel-efficient designs. Autonomous flight technologies, driven by advancements in artificial intelligence and sensor systems, are set to revolutionize the helicopter market, particularly in defense, emergency services, and urban air mobility. These technologies aim to reduce human error, enhance safety, and enable more cost-effective operations.

Additionally, the use of advanced composite materials and lightweight structures is improving helicopter performance by reducing weight and increasing fuel efficiency. These innovations are making helicopters more efficient, durable, and capable of carrying out complex missions in a variety of environments. As fuel costs continue to rise, the market is also seeing a shift towards more fuel-efficient helicopters that offer lower operating costs and longer flight times, further boosting their appeal.

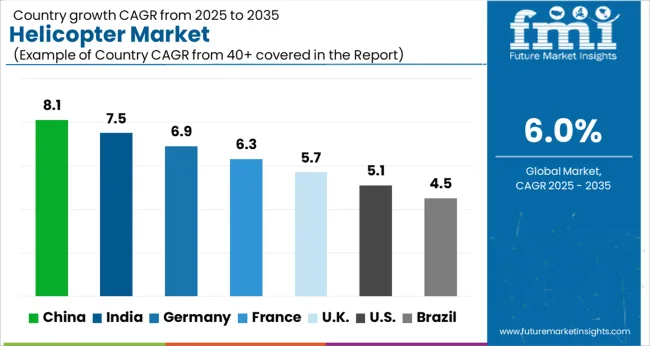

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global helicopter market is expected to grow at a CAGR of 6.0% from 2025 to 2035. China leads the market with the highest growth rate of 8.1%, followed by India at 7.5% and Germany at 6.9%. The UK and the USA show moderate growth at 5.7% and 5.1%, respectively. The market is driven by the increasing use of helicopters in defense, emergency medical services, and transport logistics, along with rising demand for private air mobility services and tourism. As the global helicopter market continues to evolve, new technological advancements and government support will further enhance growth opportunities. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to experience significant growth in the helicopter market, with a CAGR of 8.1% from 2025 to 2035. The country’s growing demand for helicopters is driven by increasing applications across various industries, including defense, emergency medical services (EMS), oil and gas, and infrastructure development. China’s investment in modernizing its aviation fleet, combined with a rising demand for private and commercial helicopter services, is expected to further boost the market.

The Chinese government’s focus on enhancing defense and emergency response capabilities, along with its large-scale infrastructure projects, is also contributing to the market’s growth. The rise of urban air mobility and helicopter tourism in China presents new opportunities for growth in the sector.

The helicopter market in India is projected to grow at a CAGR of 7.5% from 2025 to 2035. The demand for helicopters in India is primarily driven by the need for air transport solutions in remote areas, disaster management, and the growing oil and gas sector. The increasing adoption of helicopters in the defense and security sectors, particularly for surveillance and rescue operations, is also a major contributor to market growth.

The Indian government’s emphasis on improving connectivity in rural and remote areas through helicopter services is expected to further fuel market demand. Private sector investments in helicopter tourism and air mobility services are driving the growth of the market in India.

The helicopter market in Germany is set to grow at a CAGR of 6.9% from 2025 to 2035. The country’s strong aerospace and defense industry, combined with rising demand for helicopters in emergency medical services (EMS), defense, and transport logistics, is driving the market growth. Germany has been a leader in the development and manufacturing of helicopter technologies, particularly for military and rescue operations.

As the need for urban air mobility solutions increases, helicopters are expected to play a crucial role in enhancing transportation services across the country. Germany’s strategic investments in infrastructure and aviation technology will continue to support the growth of the helicopter market in the coming years.

The UK helicopter market is projected to expand at a CAGR of 5.7% from 2025 to 2035. The UK has a well-established helicopter market with significant demand across multiple sectors, including defense, law enforcement, air ambulance services, and offshore oil and gas operations. The UK government’s focus on improving air ambulance capabilities and expanding defense helicopter fleets is driving demand.

Additionally, the rise of helicopter tourism and private sector ventures in urban air mobility is creating new market opportunities. As the need for faster and more efficient air transportation solutions increases, helicopters will continue to play an important role in the UK’s aviation industry.

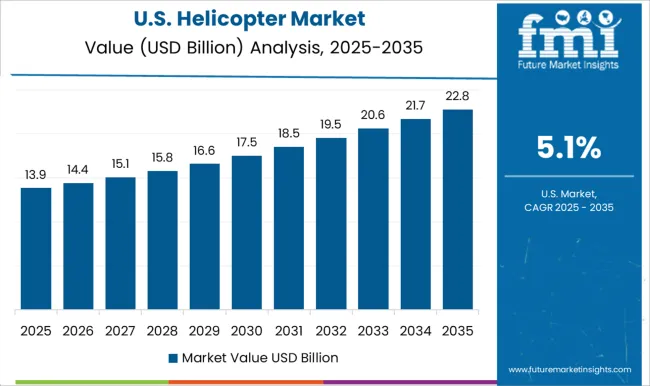

The USA helicopter market is forecasted to expand at a CAGR of 5.1% from 2025 to 2035. The USA remains a global leader in helicopter manufacturing, with a strong demand for helicopters across defense, emergency medical services, commercial transport, and search-and-rescue operations. The USA government’s continued investment in military and law enforcement helicopters plays a key role in the market’s growth.

Increasing private sector interest in air mobility services and helicopter tourism is contributing to market expansion. With advancements in helicopter technologies and rising concerns over environmental impact, the USA helicopter market is expected to continue evolving to meet new demands.

The global helicopter market is evolving with strong competition from companies offering a variety of helicopters designed for commercial, defense, and emergency applications. Babcock International Group PLC focuses on defense and emergency response sectors, providing integrated fleet management, operational support, and maintenance solutions. Their strategy revolves around securing long-term government contracts and offering high levels of safety, reliability, and cost-efficiency, catering to both military and civil sectors.

Airbus Helicopters SAS, a leading market player, competes by offering innovative solutions like the H125 and H145, known for their advanced avionics, fuel efficiency, and multi-role capabilities. Their helicopters are widely used in oil and gas, law enforcement, and emergency medical services. Airbus emphasizes cutting-edge technology and extensive after-sales support, ensuring customer satisfaction and operational excellence. Bell Helicopter, part of Textron Inc., offers a diverse range of helicopters such as the Bell 206 and Bell 407.

Bell's strategy focuses on performance, technology integration, and strong service networks. Their helicopters cater to commercial, military, and law enforcement sectors, with a focus on autonomous flight capabilities and enhanced safety features. By combining innovation with customization, Bell is a preferred choice for both corporate clients and defense organizations. Robinson Helicopter Company specializes in affordable and reliable helicopters like the R22 and R44, targeting the training, survey, and private transport sectors. Robinson’s cost-effective solutions ensure broad accessibility while maintaining high safety standards, which appeals to small businesses and flight schools.

Kawasaki Heavy Industries competes in the military helicopter sector, offering models like the BK117 and KV-107, designed for search and rescue and troop transport. Their focus on performance and ruggedness allows them to meet stringent military requirements. Competitive strategies in this market are centered around offering specialized, versatile helicopters tailored to different operational needs. Product brochures from these companies highlight key attributes like safety, efficiency, reliability, and long-term performance, demonstrating their commitment to meeting the growing demand for rotorcraft solutions across sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 34.8 billion |

| Component | Aerostructures/Airframe, Rotary System and Engines, Undercarriage, Avionics, Cabin Interiors, Environmental Control Systems, and Others |

| Sales Channel | OEM and Maintenance, Repair and Overhaul (MRO) |

| Engine Type | Twin-Engine Helicopters, Single-Engine Helicopters, and Multi-Engine Helicopters |

| Rotor Type | Single-Rotor Helicopters, Twin-Rotor Helicopters, and Tiltrotor Helicopters |

| End Use | Military, Commercial, Transport, Medical Services/Search & Rescue, Offshore Sector, Others, Reconnaissance, and Maritime Surveillance |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Babcock International Group PLC, Airbus Helicopters SAS, Bell Helicopter, Robinson Helicopter Company, and Kawasaki Heavy Industries |

| Additional Attributes | Dollar sales by helicopter type, application, and technology are rising, driven by air mobility needs, military upgrades, and remote transport. North America, Europe, and Asia-Pacific show strong demand and investment growth |

The global helicopter market is estimated to be valued at USD 34.8 billion in 2025.

The market size for the helicopter market is projected to reach USD 62.3 billion by 2035.

The helicopter market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in helicopter market are aerostructures/airframe, rotary system and engines, undercarriage, avionics, cabin interiors, environmental control systems and others.

In terms of sales channel, oem segment to command 55.6% share in the helicopter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Helicopter Blades Market Size and Share Forecast Outlook 2025 to 2035

Helicopter Wheels Market

Civil Helicopter MRO Market Insights – Growth & Forecast 2025 to 2035

Commercial Helicopter Market

Airplane And Helicopter Hangar Doors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA