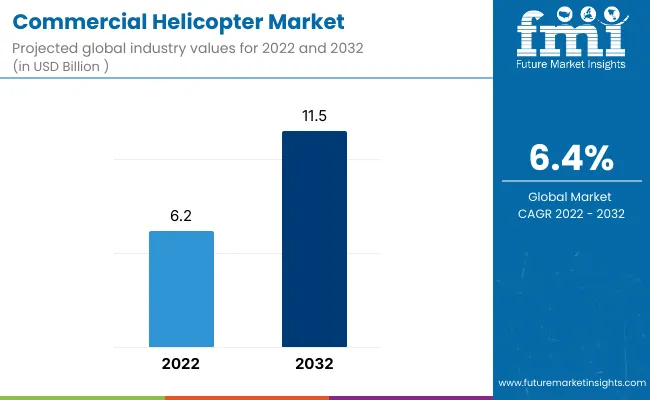

[250 Pages Report] In 2021, the Global Commercial Helicopter market was estimated to be worth around US$ 5.9 Billion. The industry is expected to reach a worth of about US$ 11.5 Billion by the end of 2032, based on a projected CAGR of 6.4% over the next ten years. The Global Commercial Helicopter Market has already witnessed rapid growth over the years with a CAGR of 5.4% from 2017 to 2021.

|

Attributes |

Details |

|

Global Commercial Helicopter Market Size (2021F) |

USD 5.9 Billion |

|

Global Commercial Helicopter Market Size (2022E) |

USD 6.2 Billion |

|

Projected Market Value (2032F) |

USD 11.5 Billion |

|

Global Market Growth Rate (2022 to 2032) |

6.4% CAGR |

|

Share of Top 5 Countries |

59% |

|

North America Market Share (2021) |

41.4% |

|

United States Growth Rate (2022 to 2032) |

5.5% CAGR |

|

Key Companies Covered |

|

The growing demand for commercial helicopters for usage in Emergency services, military and defense purposes, VIP transport, oil and gas rigs, and replacement of older fleets, are driving factors for the market. The use of electric power is enhancing safety, cost, and noise components. The light type of helicopters generated the maximum revenue for the Commercial Helicopter Market. Law Enforcement and public safety is the leading application, having witnessed a CAGR of 5% from 2017 to 2022 and a forecasted CAGR of 5.5% from 2022 to 2032. The global market for commercial helicopters witnessed a CAGR of 5.4% from the year 2017 to 2021 and is expected to witness a CAGR of 6.4% in the next ten years.

New technologies to reduce noise to help overcome a significant barrier to growth

According to studies, the sound a helicopter makes flying at 500 feet is around 87dB. At double the distance, 1000 feet, the sound level is significantly lower, 79 Db. These sound levels and the concern for noise pollution created due to them are key issues for the industry and a barrier to growth and mainstream usage. Manufacturers trying to combat this are looking at several options. One emerging solution amongst communities thus is to increase the height these helicopters fly at, and fly on less populated routes so as to reduce the harm to people. Apart from this, manufacturers have attempted to innovate their hardware in several ways.

Airbus introduced the Blue Edge rotor blades, which reduce BVI-generated noise through a swept-back tip. There have also been several innovations on the tail end of the aircraft. Fenestron by Airbus covers the tail rotors, which serve the dual purpose of noise reduction and improving safety.

The increased safety, environmental noise, and reduced cost of electric power can provide gives a boost to the market

Fully electric helicopters still face issues with range, weight, and distance. Traditional helicopters have an edge over the existing models of purely electric aircraft since they can handle extreme conditions- such as the ones rescue operations are often carried out in, can fly longer distances, and fare better against unexpected weather issues.

Hybridized helicopters, which harness the benefits of electric power in combination with the advantages of traditional aircraft show promise in boosting market demand. There are several reasons why manufacturers are looking to switch over to electricity in some form. For one, the environmental benefits the improved fuel economy and emission reduction complete hybrids can provide, owing to the electric motor-traditional combustion engine setup.

Hybrid power can also reduce noise and cost-related concerns. For example, Bell introduced their version of an electrically distributed anti-torque system or EDAT which replaces the tail motor with electric fans. This system can lead to significantly lower operating costs and enhanced noise control. There are also safety benefits; for instance, Airbus and the French CAA tested out a hybrid helicopter with an electric engine as a backup, in the form of a battery and an electric motor. They found that this system provided around 30 seconds' worth of power, which is a crucial amount of tie in the event of engine failure as it provides the pilot precious seconds to trigger emergency mechanisms. The development of more powerful engines, which can allow for a few minutes of power shows significant potential in boosting demand by enhancing safety.

Helicopters gaining traction as a way to increase connectivity and boost the liveability of cities

Urban Air Mobility or the usage of small aircraft in urban areas at low altitudes is an emerging trend in the wider picture of making urban spaces more connected and boosting their liveability. One example of this is air taxis. As early as the 1950s, air taxi UAM services were being offered in the USA, mainly connecting people from cities to airports. Several cities even encourage this as a way to reduce congestion on prominent routes.

Use in police operations, emergency medical services and search-rescue operations contribute to the demand growth

Public Safety and Law Enforcement is the leading application of commercial helicopters, having witnessed a CAGR of 5.0%, with the forecasted CAGR growing at 5.5%.

Helicopters can carry large weights and transport equipment and people to and from areas where road vehicles cannot reach. They can carry water to douse forest fires, log trees, people, or supplies from difficult terrain and carry camera equipment to cover police operations or large pallets of cargo. These helicopters are often being used for law enforcement, such as for traffic control, pollution control, night patrols, and surveillance.

The EMS or emergency medical services, such as air ambulance or emergency cargo transportation are a key component. In remote situations or in situations where the immediate transport of a patient, or transfer to other hospitals is necessary, air ambulances, which as helicopters equipped with a limited number of medical equipment, are often used.

Search and rescue operations are also harnessing the benefits of using helicopters. Smaller helicopters can be used to collect intelligence while larger aircraft can be used to physically remove people or drop supplies or emergency helpers in case of rescue or natural disaster relief.

Light commercial helicopters are the leading component of commercial helicopters, having witnessed a CAGR of 5.2% in the 2017 to 2021 time period which is expected to continue, with the predicted CAGR growing at 6% during the forecast period. Light types of helicopters are often used in situations where heavy lifting is not necessary, such as in police operations, surveillance, aerial inspections, and archaeological or geographical surveys. The benefit of lower costs and the ability to take off, land, and be parked in comparatively narrow areas mean light commercial helicopters will continue to lead demand. They can also be used to gather information in case of a natural disaster.

Europe is an emerging market for commercial helicopters, having witnessed a CAGR of 2% from 2017 to 2021 and a forecasted CAGR of 6% in the forecast period of 2022 to 2032. The estimated market value at the end of the forecast period, 2032 is US$ 2.8 Billion, with the estimated contribution to revenue in 2021 being a quarter of the global market at 25.1%

The increase in defense spending and spending on emergency service-use helicopters, political tensions in the market, the need for replacement of the aging fleet, Heli-tourism, and technological developments as driving demand. The European Geostationary Navigation and Overlay Service, or EGNOS is a collaboration between the European Space Agency, Eurocontrol, and the European Commission, and provides a navigation system to improve the GPS accuracy in Europe significantly, by between from 2m to as much as 20m more accurate.

The USA has the largest market for Commercial Helicopters and will continue to do so in 2032, with a market value of US$ 3.9 Billion. The US has the largest fleet of both civil and military helicopters at over 9,700, as well as the largest number of heliports, over 5600 in the world. From 2017 to 2021, the US witnessed a CAGR of 5.1%, and from 2022 to 2032, it is predicted to have a CAGR of 5.5%.

Commercial helicopter manufacturers are focusing on further enhancing their existing models, improving safety, and harnessing new technologies such as electric power. There are a large number of researchers working on developing technologies for the automation of certain parts of the flying process to reduce loads on pilots. Airbus S.A.S., Bell Helicopter Textron Inc., Enstrom Helicopter Corp., Hindustan Aeronautics Limited, Korea Aerospace Industries, Lockheed Martin Sikorsky Aircraft, and Robinson Helicopter Company are among the key companies.

Some of the recent developments by the key players in the Commercial Helicopter Industry are as follows:

The global Commercial Helicopters market was valued at US$ 5.9 Billion in 2021.

The Commercial Helicopters industry is set to witness a growth rate of 6.4% over the forecast period and be valued at US$ 11.5 Billion by 2032.

The Commercial Helicopters market expanded at 5.4% from 2017 through 2021.

Airbus S.A.S., Bell Helicopter Textron Inc., Enstrom Helicopter Corp., Hindustan Aeronautics Limited, Korea Aerospace Industries, Lockheed Martin Sikorsky Aircraft and Robinson Helicopter Company are some of the key players.

The light Commercial Helicopters is driving significant market demand.

Law enforcement and Public Safety, which witnessed a CAGR of 5.0 from 2017 to 2022 and has a forecasted CAGR of 5.5% for the test 10 years, is the key component of demand.

The USA, UK, China, Japan, and South Korea are expected to be the key drivers of sales.

The market in the USA accounts for more than 37% of the global market.

1. Executive Summary | Commercial Helicopter Market

1.1. Global Market Outlook

1.2. Demand-side Trends

1.3. Supply-side Trends

1.4. Technology Roadmap Analysis

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Market Background

3.1. Market Dynamics

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunity

3.1.4. Trends

3.2. Scenario Forecast

3.2.1. Demand in Optimistic Scenario

3.2.2. Demand in Likely Scenario

3.2.3. Demand in Conservative Scenario

3.3. Opportunity Map Analysis

3.4. Investment Feasibility Matrix

3.5. PESTLE and Porter’s Analysis

3.6. Regulatory Landscape

3.6.1. By Key Regions

3.6.2. By Key Countries

3.7. Regional Parent Market Outlook

4. Global Market Analysis 2017 to 2021 and Forecast, 2022 to 2032

4.1. Historical Market Size Value (US$ Billion) Analysis, 2017 to 2021

4.2. Current and Future Market Size Value (US$ Billion) Projections, 2022 to 2032

4.2.1. Y-o-Y Growth Trend Analysis

4.2.2. Absolute $ Opportunity Analysis

5. Global Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Type

5.1. Introduction / Key Findings

5.2. Historical Market Size Value (US$ Billion) Analysis By Type, 2017 to 2021

5.3. Current and Future Market Size Value (US$ Billion) Analysis and Forecast By Type, 2022 to 2032

5.3.1. Light

5.3.2. Medium

5.3.3. Heavy

5.3.4. Very Large

5.4. Y-o-Y Growth Trend Analysis By Type, 2017 to 2021

5.5. Absolute $ Opportunity Analysis By Type, 2022 to 2032

6. Global Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Application

6.1. Introduction / Key Findings

6.2. Historical Market Size Value (US$ Billion) Analysis By Application, 2017 to 2021

6.3. Current and Future Market Size Value (US$ Billion) Analysis and Forecast By Application, 2022 to 2032

6.3.1. Oil & Gas

6.3.2. Medical Services

6.3.3. Transport

6.3.4. Law Enforcement & Public Safety

6.3.5. Other Applications

6.4. Y-o-Y Growth Trend Analysis By Application, 2017 to 2021

6.5. Absolute $ Opportunity Analysis By Application, 2022 to 2032

7. Global Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Region

7.1. Introduction

7.2. Historical Market Size Value (US$ Billion) Analysis By Region, 2017 to 2021

7.3. Current Market Size Value (US$ Billion) Analysis and Forecast By Region, 2022 to 2032

7.3.1. North America

7.3.2. Latin America

7.3.3. Europe

7.3.4. Asia Pacific

7.3.5. Middle East and Africa (MEA)

7.4. Market Attractiveness Analysis By Region

8. North America Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Country

8.1. Historical Market Size Value (US$ Billion) Trend Analysis By Market Taxonomy, 2017 to 2021

8.2. Market Size Value (US$ Billion) Forecast By Market Taxonomy, 2022 to 2032

8.2.1. By Country

8.2.1.1.United States of America

8.2.1.2. Canada

8.2.2. By Type

8.2.3. By Application

8.3. Market Attractiveness Analysis

8.3.1. By Country

8.3.2. By Type

8.3.3. By Application

8.4. Key Takeaways

9. Latin America Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Country

9.1. Historical Market Size Value (US$ Billion) Trend Analysis By Market Taxonomy, 2017 to 2021

9.2. Market Size Value (US$ Billion) Forecast By Market Taxonomy, 2022 to 2032

9.2.1. By Country

9.2.1.1. Brazil

9.2.1.2. Mexico

9.2.1.3. Rest of Latin America

9.2.2. By Type

9.2.3. By Application

9.3. Market Attractiveness Analysis

9.3.1. By Country

9.3.2. By Type

9.3.3. By Application

9.4. Key Takeaways

10. Europe Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Country

10.1. Historical Market Size Value (US$ Billion) Trend Analysis By Market Taxonomy, 2017 to 2021

10.2. Market Size Value (US$ Billion) Forecast By Market Taxonomy, 2022 to 2032

10.2.1. By Country

10.2.1.1. Germany

10.2.1.2. United Kingdom

10.2.1.3. France

10.2.1.4. Spain

10.2.1.5. Italy

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Application

10.3. Market Attractiveness Analysis

10.3.1. By Country

10.3.2. By Type

10.3.3. By Application

10.4. Key Takeaways

11. Asia Pacific Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Country

11.1. Historical Market Size Value (US$ Billion) Trend Analysis By Market Taxonomy, 2017 to 2021

11.2. Market Size Value (US$ Billion) Forecast By Market Taxonomy, 2022 to 2032

11.2.1. By Country

11.2.1.1. Japan

11.2.1.2. China

11.2.1.3. India

11.2.1.4. Malaysia

11.2.1.5. Singapore

11.2.1.6. Australia

11.2.1.7. Rest of Asia Pacific

11.2.2. By Type

11.2.3. By Application

11.3. Market Attractiveness Analysis

11.3.1. By Country

11.3.2. By Type

11.3.3. By Application

11.4. Key Takeaways

12. MEA Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Country

12.1. Historical Market Size Value (US$ Billion) Trend Analysis By Market Taxonomy, 2017 to 2021

12.2. Market Size Value (US$ Billion) Forecast By Market Taxonomy, 2022 to 2032

12.2.1. By Country

12.2.1.1. GCC Countries

12.2.1.2. South Africa

12.2.1.3. Israel

12.2.1.4. Rest of MEA

12.2.2. By Type

12.2.3. By Application

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Type

12.3.3. By Application

12.4. Key Takeaways

13. Key Countries Market Analysis

13.1. United States of America

13.1.1. Pricing Analysis

13.1.2. Market Share Analysis, 2021

13.1.2.1. By Type

13.1.2.2. By Application

13.2. Canada

13.2.1. Pricing Analysis

13.2.2. Market Share Analysis, 2021

13.2.2.1. By Type

13.2.2.2. By Application

13.3. Brazil

13.3.1. Pricing Analysis

13.3.2. Market Share Analysis, 2021

13.3.2.1. By Type

13.3.2.2. By Application

13.4. Mexico

13.4.1. Pricing Analysis

13.4.2. Market Share Analysis, 2021

13.4.2.1. By Type

13.4.2.2. By Application

13.5. Rest of Latin America

13.5.1. Pricing Analysis

13.5.2. Market Share Analysis, 2021

13.5.2.1. By Type

13.5.2.2. By Application

13.6. Germany

13.6.1. Pricing Analysis

13.6.2. Market Share Analysis, 2021

13.6.2.1. By Type

13.6.2.2. By Application

13.7. United Kingdom

13.7.1. Pricing Analysis

13.7.2. Market Share Analysis, 2021

13.7.2.1. By Type

13.7.2.2. By Application

13.8. France

13.8.1. Pricing Analysis

13.8.2. Market Share Analysis, 2021

13.8.2.1. By Type

13.8.2.2. By Application

13.9. Spain

13.9.1. Pricing Analysis

13.9.2. Market Share Analysis, 2021

13.9.2.1. By Type

13.9.2.2. By Application

13.10. Italy

13.10.1. Pricing Analysis

13.10.2. Market Share Analysis, 2021

13.10.2.1. By Type

13.10.2.2. By Application

13.11. Rest of Europe

13.11.1. Pricing Analysis

13.11.2. Market Share Analysis, 2021

13.11.2.1. By Type

13.11.2.2. By Application

13.12. Japan

13.12.1. Pricing Analysis

13.12.2. Market Share Analysis, 2021

13.12.2.1. By Type

13.12.2.2. By Application

13.13. China

13.13.1. Pricing Analysis

13.13.2. Market Share Analysis, 2021

13.13.2.1. By Type

13.13.2.2. By Application

13.14. India

13.14.1. Pricing Analysis

13.14.2. Market Share Analysis, 2021

13.14.2.1. By Type

13.14.2.2. By Application

13.15. Malaysia

13.15.1. Pricing Analysis

13.15.2. Market Share Analysis, 2021

13.15.2.1. By Type

13.15.2.2. By Application

13.16. Singapore

13.16.1. Pricing Analysis

13.16.2. Market Share Analysis, 2021

13.16.2.1. By Type

13.16.2.2. By Application

13.17. Australia

13.17.1. Pricing Analysis

13.17.2. Market Share Analysis, 2021

13.17.2.1. By Type

13.17.2.2. By Application

13.18. Rest of Asia Pacific

13.18.1. Pricing Analysis

13.18.2. Market Share Analysis, 2021

13.18.2.1. By Type

13.18.2.2. By Application

13.19. GCC Countries

13.19.1. Pricing Analysis

13.19.2. Market Share Analysis, 2021

13.19.2.1. By Type

13.19.2.2. By Application

13.20. South Africa

13.20.1. Pricing Analysis

13.20.2. Market Share Analysis, 2021

13.20.2.1. By Type

13.20.2.2. By Application

13.21. Israel

13.21.1. Pricing Analysis

13.21.2. Market Share Analysis, 2021

13.21.2.1. By Type

13.21.2.2. By Application

13.22. Rest of MEA

13.22.1. Pricing Analysis

13.22.2. Market Share Analysis, 2021

13.22.2.1. By Type

13.22.2.2. By Application

14. Market Structure Analysis

14.1. Competition Dashboard

14.2. Competition Benchmarking

14.3. Market Share Analysis of Top Players

14.3.1. By Regional

14.3.2. By Type

14.3.3. By Application

15. Competition Analysis

15.1. Competition Deep Dive

15.1.1. Airbus S.A.S.

15.1.1.1. Overview

15.1.1.2. Product Portfolio

15.1.1.3. Profitability by Market Segments

15.1.1.4. Sales Footprint

15.1.1.5. Strategy Overview

15.1.1.5.1. Marketing Strategy

15.1.2. Bell Helicopter Textron Inc.

15.1.2.1. Overview

15.1.2.2. Product Portfolio

15.1.2.3. Profitability by Market Segments

15.1.2.4. Sales Footprint

15.1.2.5. Strategy Overview

15.1.2.5.1. Marketing Strategy

15.1.3. Enstrom Helicopter Corp.

15.1.3.1. Overview

15.1.3.2. Product Portfolio

15.1.3.3. Profitability by Market Segments

15.1.3.4. Sales Footprint

15.1.3.5. Strategy Overview

15.1.3.5.1. Marketing Strategy

15.1.4. Hindustan Aeronautics Limited

15.1.4.1. Overview

15.1.4.2. Product Portfolio

15.1.4.3. Profitability by Market Segments

15.1.4.4. Sales Footprint

15.1.4.5. Strategy Overview

15.1.4.5.1. Marketing Strategy

15.1.5. Korea Aerospace Industries, Ltd.

15.1.5.1. Overview

15.1.5.2. Product Portfolio

15.1.5.3. Profitability by Market Segments

15.1.5.4. Sales Footprint

15.1.5.5. Strategy Overview

15.1.5.5.1. Marketing Strategy

15.1.6. Leonardo S.P.A.

15.1.6.1. Overview

15.1.6.2. Product Portfolio

15.1.6.3. Profitability by Market Segments

15.1.6.4. Sales Footprint

15.1.6.5. Strategy Overview

15.1.6.5.1. Marketing Strategy

15.1.7. Lockheed Martin Corporation

15.1.7.1. Overview

15.1.7.2. Product Portfolio

15.1.7.3. Profitability by Market Segments

15.1.7.4. Sales Footprint

15.1.7.5. Strategy Overview

15.1.7.5.1. Marketing Strategy

15.1.8. MD Helicopters, Inc.

15.1.8.1. Overview

15.1.8.2. Product Portfolio

15.1.8.3. Profitability by Market Segments

15.1.8.4. Sales Footprint

15.1.8.5. Strategy Overview

15.1.8.5.1. Marketing Strategy

15.1.9. Robinson Helicopter Company

15.1.9.1. Overview

15.1.9.2. Product Portfolio

15.1.9.3. Profitability by Market Segments

15.1.9.4. Sales Footprint

15.1.9.5. Strategy Overview

15.1.9.5.1. Marketing Strategy

15.1.10. Russian Нelicopters, JSC

15.1.10.1. Overview

15.1.10.2. Product Portfolio

15.1.10.3. Profitability by Market Segments

15.1.10.4. Sales Footprint

15.1.10.5. Strategy Overview

15.1.10.5.1. Marketing Strategy

16. Assumptions & Acronyms Used

17. Research Methodology

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ Billion) Forecast by Type, 2017 to 2032

Table 3: Global Market Value (US$ Billion) Forecast by Application, 2017 to 2032

Table 4: North America Market Value (US$ Billion) Forecast by Country, 2017 to 2032

Table 5: North America Market Value (US$ Billion) Forecast by Type, 2017 to 2032

Table 6: North America Market Value (US$ Billion) Forecast by Application, 2017 to 2032

Table 7: Latin America Market Value (US$ Billion) Forecast by Country, 2017 to 2032

Table 8: Latin America Market Value (US$ Billion) Forecast by Type, 2017 to 2032

Table 9: Latin America Market Value (US$ Billion) Forecast by Application, 2017 to 2032

Table 10: Europe Market Value (US$ Billion) Forecast by Country, 2017 to 2032

Table 11: Europe Market Value (US$ Billion) Forecast by Type, 2017 to 2032

Table 12: Europe Market Value (US$ Billion) Forecast by Application, 2017 to 2032

Table 13: Asia Pacific Market Value (US$ Billion) Forecast by Country, 2017 to 2032

Table 14: Asia Pacific Market Value (US$ Billion) Forecast by Type, 2017 to 2032

Table 15: Asia Pacific Market Value (US$ Billion) Forecast by Application, 2017 to 2032

Table 16: MEA Market Value (US$ Billion) Forecast by Country, 2017 to 2032

Table 17: MEA Market Value (US$ Billion) Forecast by Type, 2017 to 2032

Table 18: MEA Market Value (US$ Billion) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Billion) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ Billion) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Billion) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Billion) Analysis by Region, 2017 to 2032

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Billion) Analysis by Type, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 10: Global Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 13: Global Market Attractiveness by Type, 2022 to 2032

Figure 14: Global Market Attractiveness by Application, 2022 to 2032

Figure 15: Global Market Attractiveness by Region, 2022 to 2032

Figure 16: North America Market Value (US$ Billion) by Type, 2022 to 2032

Figure 17: North America Market Value (US$ Billion) by Application, 2022 to 2032

Figure 18: North America Market Value (US$ Billion) by Country, 2022 to 2032

Figure 19: North America Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Billion) Analysis by Type, 2017 to 2032

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 25: North America Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 28: North America Market Attractiveness by Type, 2022 to 2032

Figure 29: North America Market Attractiveness by Application, 2022 to 2032

Figure 30: North America Market Attractiveness by Country, 2022 to 2032

Figure 31: Latin America Market Value (US$ Billion) by Type, 2022 to 2032

Figure 32: Latin America Market Value (US$ Billion) by Application, 2022 to 2032

Figure 33: Latin America Market Value (US$ Billion) by Country, 2022 to 2032

Figure 34: Latin America Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Billion) Analysis by Type, 2017 to 2032

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 40: Latin America Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 43: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 44: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 45: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 46: Europe Market Value (US$ Billion) by Type, 2022 to 2032

Figure 47: Europe Market Value (US$ Billion) by Application, 2022 to 2032

Figure 48: Europe Market Value (US$ Billion) by Country, 2022 to 2032

Figure 49: Europe Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 52: Europe Market Value (US$ Billion) Analysis by Type, 2017 to 2032

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 55: Europe Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 58: Europe Market Attractiveness by Type, 2022 to 2032

Figure 59: Europe Market Attractiveness by Application, 2022 to 2032

Figure 60: Europe Market Attractiveness by Country, 2022 to 2032

Figure 61: Asia Pacific Market Value (US$ Billion) by Type, 2022 to 2032

Figure 62: Asia Pacific Market Value (US$ Billion) by Application, 2022 to 2032

Figure 63: Asia Pacific Market Value (US$ Billion) by Country, 2022 to 2032

Figure 64: Asia Pacific Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 67: Asia Pacific Market Value (US$ Billion) Analysis by Type, 2017 to 2032

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 70: Asia Pacific Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 73: Asia Pacific Market Attractiveness by Type, 2022 to 2032

Figure 74: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 75: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 76: MEA Market Value (US$ Billion) by Type, 2022 to 2032

Figure 77: MEA Market Value (US$ Billion) by Application, 2022 to 2032

Figure 78: MEA Market Value (US$ Billion) by Country, 2022 to 2032

Figure 79: MEA Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 80: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 81: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 82: MEA Market Value (US$ Billion) Analysis by Type, 2017 to 2032

Figure 83: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 84: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 85: MEA Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 86: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: MEA Market Attractiveness by Type, 2022 to 2032

Figure 89: MEA Market Attractiveness by Application, 2022 to 2032

Figure 90: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA