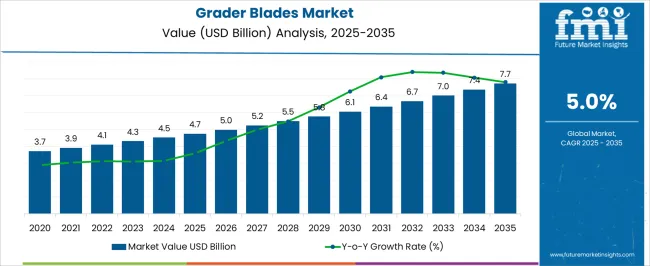

The grader blades market is projected to grow at a CAGR of 5.0% from 2025 to 2035, with an estimated market value of USD 4.7 billion in 2025, reaching USD 7.7 billion by 2035. This growth trajectory is driven by sustained demand in construction, road maintenance, and mining operations worldwide. Heavy machinery operators are increasingly investing in durable, high-performance grader blades to enhance operational efficiency, reduce downtime, and optimize material removal rates.

Infrastructure development projects in emerging economies are generating significant demand for advanced grader equipment, while replacement cycles in mature markets support steady aftermarket growth. Manufacturers are focusing on alloy enhancements, wear-resistant coatings, and precision engineering to improve blade lifespan and performance under varied terrain conditions. The integration of automated and GPS-guided grading systems also influences the selection of compatible blades, further stimulating market expansion.

Public and private investment in road rehabilitation, urban development, and industrial facility preparation contributes to consistent sales, while competitive pricing strategies and OEM partnerships enable manufacturers to capture broader market segments. The long-term accumulation of market value reflects both organic growth from new projects and replacement-driven demand across global construction and mining sectors.

| Metric | Value |

|---|---|

| Grader Blades Market Estimated Value in (2025 E) | USD 4.7 billion |

| Grader Blades Market Forecast Value in (2035 F) | USD 7.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The grader blades market is strongly influenced by five interconnected parent markets, each contributing distinctly to overall demand and expansion. The construction and road infrastructure sector holds the largest share at 35%, driven by government and private projects requiring durable grader blades for road grading, leveling, and maintenance across highways, urban streets, and rural pathways. The mining and quarrying segment contributes 25%, as operators utilize high-performance blades for material handling, site preparation, and surface leveling in large-scale open-pit and underground mining operations, where durability and wear resistance are critical.

The equipment OEM and machinery manufacturing market accounts for 15%, with blade manufacturers supplying specialized components compatible with motor graders, tractors, and multi-purpose heavy machinery, emphasizing precision, alloy quality, and lifecycle performance. The aftermarket and replacement parts segment holds a 15% share, catering to maintenance, refurbishment, and retrofitting needs of aging fleets to ensure operational continuity and cost-effectiveness.

The rental and contractor services market represents 10%, driven by construction contractors and equipment rental firms seeking standardized, reliable blades for temporary projects and seasonal work. Construction, mining, and OEM segments account for 75% of overall demand, highlighting that project scale, equipment compatibility, and material performance remain primary growth drivers, while aftermarket and rental services provide supplementary opportunities for global market expansion.

The grader blades market is experiencing steady expansion, supported by the increasing demand for high-performance earthmoving and road maintenance equipment. The market’s growth is being shaped by rising infrastructure development projects, greater investment in road rehabilitation, and advancements in material engineering that enhance blade durability and efficiency.

The adoption of grader blades with optimized designs for specific applications is enabling improved operational output and reduced downtime. Furthermore, the increasing mechanization of construction and agricultural sectors, combined with the focus on cost-effective equipment lifecycle management, is encouraging the use of blades that can be customized and replaced with ease.

The future outlook remains positive as governments and private contractors continue to prioritize infrastructure upgrades, creating sustained demand for robust and adaptable grader blade solutions that meet diverse operational needs.

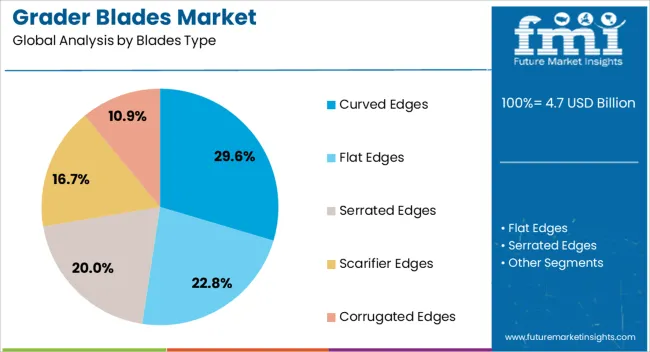

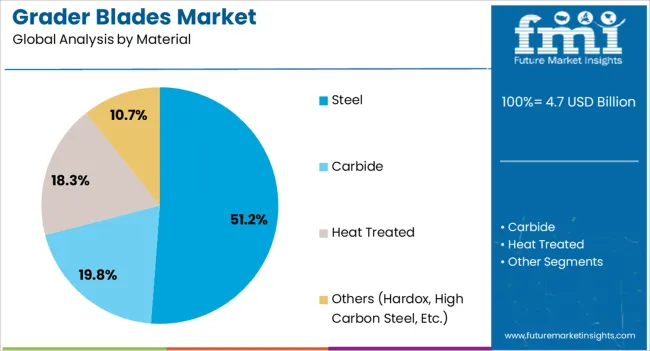

The grader blades market is segmented by blades type, material, blade length, application, and geographic regions. By blades type, grader blades market is divided into Curved Edges, Flat Edges, Serrated Edges, Scarifier Edges, and Corrugated Edges. In terms of material, the grader blades market is classified into Steel, Carbide, heat-treated, and Others (Hardox, High Carbon Steel, etc.).

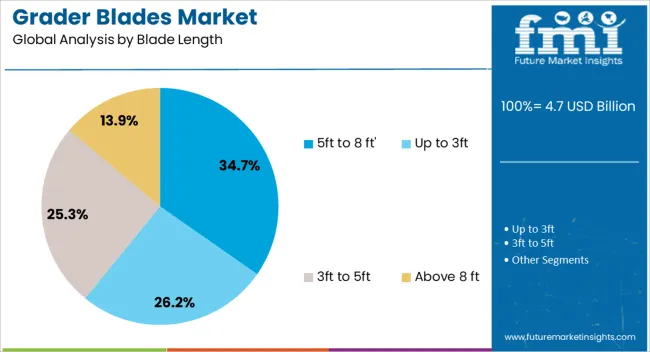

Based on blade length, the grader blades market is segmented into 5ft to 8 ft, up to 3ft, 3ft to 5ft, and above 8 ft.. By application, the grader blades market is segmented into Construction, Mining, Snow Removal, and Others (Agriculture, Road Maintenance, etc.). Regionally, the grader blades industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Curved Edges blade type is projected to hold 29.6% of the Grader Blades market revenue share in 2025, making it the leading segment in blade type classification. This leadership is being attributed to its superior performance in moving, spreading, and finishing materials with enhanced control and precision.

The curved design facilitates better rolling of materials, reducing resistance and enabling smoother grading operations. Demand for this blade type has been reinforced by its suitability across varied terrain conditions, contributing to efficiency in roadwork, land grading, and construction projects.

Its adaptability to different grader models and ability to handle both light and heavy-duty tasks have further strengthened its market position. Additionally, operators have favored curved edges for their extended wear life and the ease with which they can be maintained or replaced, ensuring consistent operational productivity.

The Steel material category is anticipated to account for 51.2% of the Grader Blades market revenue share in 2025, securing its position as the dominant material choice. This dominance is being driven by the material’s exceptional strength, wear resistance, and cost-effectiveness in high-friction applications.

Steel blades provide the durability required for heavy-duty grading tasks, making them a preferred choice for demanding environments such as mining, construction, and large-scale roadwork. The capacity to withstand abrasive materials while maintaining cutting efficiency has further enhanced their adoption.

Advances in heat treatment and alloy composition have improved the performance and lifespan of steel blades, enabling reduced maintenance costs over the operational period. The widespread availability of steel and its compatibility with standard and specialized grader equipment have also played a key role in the sustained demand for this segment.

The 5ft to 8ft blade length segment is expected to command 34.7% of the Grader Blades market revenue share in 2025, making it the leading size category. This leadership is being supported by its optimal balance between operational versatility and maneuverability, allowing effective use in both confined and open workspaces.

Blades in this length range are widely utilized for municipal road maintenance, small-to-medium scale construction projects, and agricultural land leveling, as they offer adequate coverage without compromising precision. Their compatibility with a broad range of grader machines has contributed to higher adoption rates across various industries.

Furthermore, the segment’s growth is being driven by the increasing need for equipment that can deliver consistent performance in mixed-use operations, combining the efficiency of larger blades with the adaptability of smaller ones. The ease of transportation and storage also makes this blade length range particularly appealing for contractors handling diverse project requirements.

Grader blades market growth is driven by road infrastructure, mining, and OEM demand, with aftermarket and rental services providing additional opportunities. Durability, compatibility, and performance remain the primary adoption factors globally.

The grader blades market is primarily driven by increasing investment in road construction, maintenance, and highway expansion projects globally. Governments and private developers are prioritizing durable, high-performance blades that can withstand rigorous grading, leveling, and surface preparation activities. Large-scale infrastructure projects, including expressways, rural roads, and urban streets, are fueling demand for heavy-duty blades that improve operational efficiency and reduce downtime. Contractors seek blades with high wear resistance, extended lifecycle, and compatibility with a variety of motor graders and tractors. Rising adoption of high-strength steel and alloy materials ensures longer blade service life, reducing replacement frequency and maintenance costs. Seasonal and climate-related operational demands also encourage suppliers to produce versatile, weather-resistant grader blades.

The mining and quarrying sector is another significant driver, contributing to high demand for grader blades used in surface leveling, site preparation, and material handling operations. Open-pit mining, extraction sites, and aggregate handling require blades capable of enduring abrasive conditions, heavy loads, and continuous operation. Manufacturers are developing customized blades optimized for different soil types, rock hardness, and operational conditions. Mining contractors prioritize blades that minimize wear, reduce downtime, and maintain grading accuracy. Market growth is further supported by increasing global mineral demand, expansion of quarrying activities, and modernization of mining fleets. OEMs and aftermarket suppliers collaborate with mining operators to ensure timely availability of replacement blades, fostering sustained adoption and operational reliability.

Original equipment manufacturers (OEMs) play a crucial role in shaping the grader blades market by supplying high-quality, compatible blades for new motor graders, tractors, and heavy machinery. Precision-engineered blades enhance equipment performance and longevity, making them attractive to construction and mining operators. The replacement and aftermarket segment is also growing, driven by fleet maintenance, refurbishment, and retrofitting needs. Contractors and operators prefer standardized, interchangeable blades to reduce operational downtime and repair costs. Regional aftermarket suppliers focus on ensuring timely availability, customization, and competitive pricing. Strategic collaborations between OEMs, blade manufacturers, and heavy machinery dealers further expand market penetration, improve supply chain efficiency, and support continuous adoption across diverse industrial sectors.

Equipment rental companies and contractors represent an emerging dynamic in the grader blades market, driven by short-term projects, seasonal work, and cost-conscious operations. Rental firms demand durable, versatile blades compatible with multiple grader models to maximize utilization across different construction sites. Contractors prioritize high-performance, easy-to-install blades to maintain project timelines and operational efficiency. The market also benefits from training and support services provided by suppliers to ensure proper usage, blade longevity, and safety compliance. Regional availability, rapid delivery, and aftermarket support are key differentiators for supplier selection. This segment fosters steady demand, enhances adoption in smaller or temporary projects, and complements larger infrastructure and mining applications, creating a balanced market ecosystem.

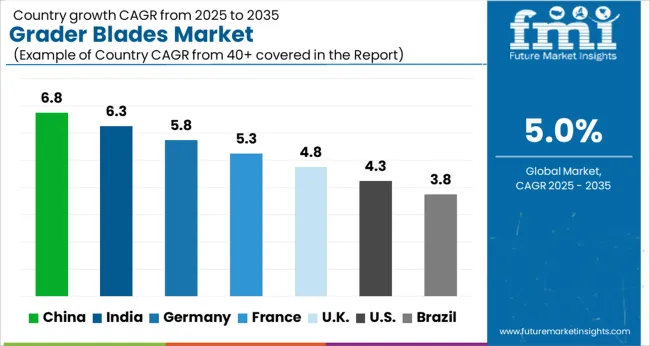

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global grader blades market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads at 6.8%, followed by India at 6.3%, Germany at 5.8%, the UK at 4.8%, and the USA at 4.3%. Growth is driven by increasing investments in road infrastructure, highway maintenance, mining operations, and industrial construction projects requiring high-performance, durable blades.

Asia Pacific, particularly China and India, exhibits rapid adoption due to expanding construction activities, fleet modernization, and mining sector growth. In contrast, Europe and North America focus on equipment replacement, aftermarket support, and performance-optimized blades that reduce downtime and maintenance costs. OEM collaborations, aftermarket services, and regional distribution networks further enhance dollar sales and market share. The analysis includes over 40+ countries, with the leading markets highlighted below.

The grader blades market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035, fueled by large-scale road construction, mining operations, and industrial infrastructure expansion. Demand is driven by construction companies, mining contractors, and municipal authorities seeking durable, high-performance blades for graders and earthmoving equipment. Domestic manufacturers are scaling production capacities and adopting advanced steel and alloy treatments to enhance wear resistance, strength, and operational life.

Aftermarket services, including replacement blades and maintenance support, are expanding accessibility. OEM collaborations and partnerships with international suppliers are introducing technologically optimized designs, improving efficiency and reducing downtime for end-users. Regional infrastructure development programs and government investments in highways and urban projects further accelerate adoption.

The grader blades market in India is expected to grow at a CAGR of 6.3% from 2025 to 2035, supported by highway modernization, urban road expansion, and mining sector growth. Construction firms, government road projects, and private contractors increasingly require heavy-duty blades with superior wear resistance and long operational life. Domestic manufacturers are enhancing capacities, employing advanced steel alloys, heat treatment, and precision engineering to improve performance and durability.

eCommerce and regional distribution networks facilitate accessibility for small contractors and fleet operators. Government investments in national highway corridors, rural road networks, and urban infrastructure projects are boosting blade replacement cycles. Strategic alliances with international suppliers introduce optimized designs and technology transfer for high-performance blades.

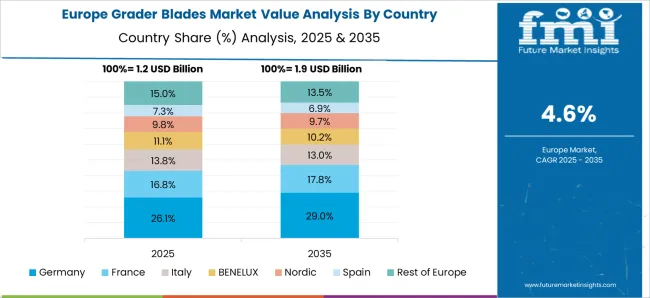

The grader blades market in Germany is projected to expand at a CAGR of 5.8% from 2025 to 2035, driven by road maintenance, highway upgrades, and industrial construction projects. Contractors and municipal authorities focus on high-quality, durable, and environmentally compliant blades suitable for frequent use in varying terrains.

Local manufacturers emphasize precision engineering, alloy optimization, and heat-treated steel for enhanced wear resistance and longer service life. OEM collaborations provide specialized blades compatible with European grader models. Retrofit and replacement demand in construction and mining fleets sustains steady market growth. Strategic partnerships with international suppliers allow the adoption of cutting-edge designs, reducing operational downtime while meeting stringent EU safety and quality standards.

The grader blades market in the UK is expected to grow at a CAGR of 4.8% from 2025 to 2035, fueled by road repair, urban development, and civil engineering projects. Contractors, public works departments, and mining operators seek reliable, high-strength blades to optimize grader performance. Manufacturers are focusing on wear-resistant alloys, heat treatment processes, and precision machining to extend operational life and reduce maintenance cycles. Retrofit and replacement blades for aging grader fleets contribute to incremental growth.

Collaborations with European OEMs facilitate compatibility and design improvements. Supply chain enhancements, distribution networks, and aftermarket services are increasing accessibility to small and medium-sized contractors across the country, ensuring consistent dollar sales and market share expansion.

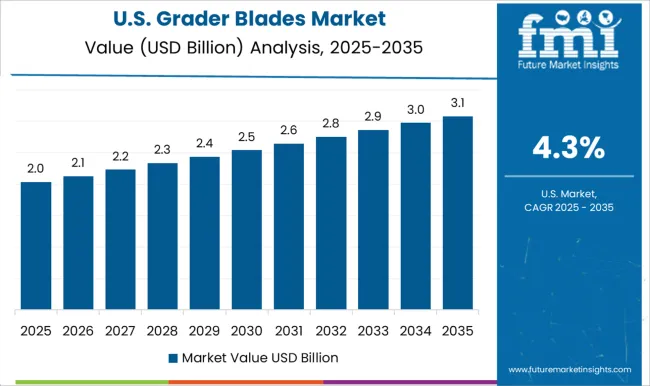

The grader blades market in the USA is projected to grow at a CAGR of 4.3% from 2025 to 2035, supported by federal and state-level infrastructure development, mining, and industrial construction projects. Contractors and municipalities demand high-performance blades with durability, corrosion resistance, and long service life.

Manufacturers are introducing advanced steel alloys, precision heat treatment, and engineering designs to enhance wear resistance and efficiency. Replacement cycles for aging fleets in highway maintenance, urban roads, and mining sites drive steady adoption. Partnerships with OEMs and international suppliers facilitate the supply of specialized blades compatible with diverse grader models. Aftermarket distribution networks ensure accessibility and operational continuity for end-users nationwide.

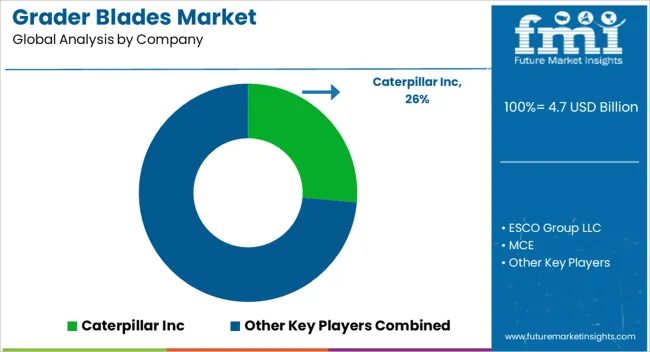

Competition in the grader blades market is defined by material durability, wear resistance, and compatibility with various grader models for construction, mining, and road maintenance applications. Caterpillar Inc. leads with high-performance steel blades designed for heavy-duty grading operations, emphasizing long service life, superior strength, and OEM compatibility across global construction and mining projects.

ESCO Group LLC competes through abrasion-resistant and precision-engineered blades, offering both aftermarket replacements and OEM-integrated solutions for earthmoving equipment. MCE and NMC CAT differentiate by providing customizable blade designs for varied terrains and operational conditions, focusing on maximizing efficiency and minimizing downtime. Fortus and Beri Udyog leverage cost-effective manufacturing and regional distribution networks to serve small- to medium-scale contractors. John Deere offers premium grader blades optimized for hydraulic graders and heavy machinery, highlighting durability, corrosion resistance, and OEM alignment. Kennametal Inc. focuses on engineered alloys and advanced heat treatment technologies to enhance blade wear life and performance under harsh conditions. CASE Construction Equipment provides integrated solutions, combining blade design with machinery optimization to improve productivity in road construction and mining operations.

Komatsu Ltd. emphasizes high-strength steel, precision machining, and OEM-approved compatibility for both domestic and international markets. Strategies across market players prioritize product longevity, reliability, aftermarket availability, and partnerships with construction firms, contractors, and equipment manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Blades Type | Curved Edges, Flat Edges, Serrated Edges, Scarifier Edges, and Corrugated Edges |

| Material | Steel, Carbide, Heat Treated, and Others (Hardox, High Carbon Steel, Etc.) |

| Blade Length | 5ft to 8 ft', Up to 3ft, 3ft to 5ft, and Above 8 ft |

| Application | Construction, Mining, Snow Removal, and Others (Agriculture, Road Maintenance, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc, ESCO Group LLC, MCE, NMC CAT, Fortus, Beri Udyog, John Deere, Kennametal Inc, CASE Construction Equipment, and Komatsu Ltd. |

| Additional Attributes | Dollar sales, share, regional demand, adoption by construction, mining, and road maintenance sectors, competitive landscape, OEM vs aftermarket preferences, material and size demand, and growth projections. |

The global grader blades market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the grader blades market is projected to reach USD 7.7 billion by 2035.

The grader blades market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in grader blades market are curved edges, flat edges, serrated edges, scarifier edges and corrugated edges.

In terms of material, steel segment to command 51.2% share in the grader blades market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Graders Market Size and Share Forecast Outlook 2025 to 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Helicopter Blades Market Size and Share Forecast Outlook 2025 to 2035

Skin Graft Blades Market

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA