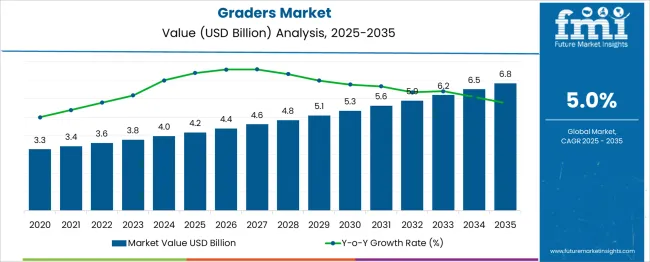

The Graders Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Examining the rolling CAGR over smaller periods within this decade reveals steady and consistent growth. From 2025 to 2030, the market expands from USD 4.2 billion to approximately USD 5.1 billion, reflecting a CAGR of around 4.0%.

This growth phase is primarily driven by ongoing demand for graders in infrastructure development projects and maintenance activities, where reliable and efficient equipment is essential for site preparation and road construction. Replacement of older machinery also contributes to steady market expansion during this period.

Between 2030 and 2035, the growth rate accelerates slightly, with the market growing from USD 5.1 billion to USD 6.8 billion, resulting in a CAGR of approximately 6.0%. This boost is supported by increased construction activity and road maintenance projects across various regions, requiring more graders to meet project timelines and quality standards.

Equipment replacement cycles for graders purchased in earlier years help maintain this growth momentum. Overall, the rolling CAGR analysis highlights a healthy and balanced growth trend, with the latter half of the decade showing stronger expansion. This steady growth pattern underscores the graders market’s importance in supporting construction and infrastructure development over the next ten years.

| Metric | Value |

|---|---|

| Graders Market Estimated Value in (2025 E) | USD 4.2 billion |

| Graders Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The graders market is experiencing notable expansion, primarily driven by rising investments in road construction, infrastructure modernization, and mining activities across both emerging and developed regions. A strong demand has been observed for machinery capable of handling precision grading and earthmoving tasks, particularly in areas undergoing rapid urbanization and rural connectivity projects. Government-backed initiatives focused on public infrastructure, such as smart cities and transportation corridors, have further boosted market momentum.

Technological advancements, including telematics integration and automation features, are enhancing operational efficiency and equipment lifecycle, encouraging greater adoption across construction and industrial sectors. In addition, manufacturers are increasingly prioritizing fuel efficiency and performance optimization, responding to evolving environmental regulations and end-user cost considerations.

As project complexity grows and terrain adaptability becomes critical, the market is being shaped by the need for customizable, durable, and high-output grader solutions. These trends are expected to continue reinforcing long-term demand and profitability within the graders industry..

The graders market is segmented by propulsion, frame, blade, application, and geographic regions. By propulsion, the graders market is divided into ICE and electric. In terms of the frame of the graders market, it is classified into Articulated Rigid. Based on the blade of the graders, the market is segmented into Medium motor graders, Large motor graders, and Small motor graders.

By application, the market is segmented into Construction, Mining, Agriculture, Snow removal, and others. Regionally, the graders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

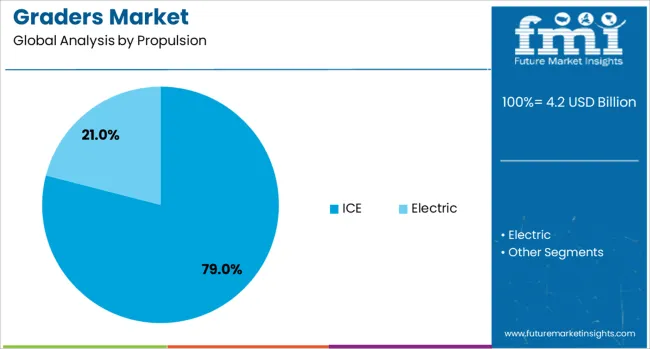

The internal combustion engine propulsion segment is estimated to contribute 79% of the graders market revenue share in 2025, making it the leading propulsion category. This dominance has been driven by the widespread availability of ICE-powered graders that offer high torque output, reliability in remote operations, and compatibility with existing fueling infrastructure.

In regions where electric charging infrastructure remains underdeveloped, ICE-powered machinery continues to be the preferred choice due to ease of refueling and extended operational range. The segment's growth has also been supported by advancements in fuel-efficient engine technologies that reduce emissions while maintaining performance standards.

Heavy-duty applications in road building, mining, and rural construction have further necessitated the use of high-horsepower graders, reinforcing the stronghold of ICE propulsion. Additionally, the global installed base of ICE grader fleets remains substantial, creating an ecosystem of serviceability and operator familiarity that continues to support the segment’s leadership position in the overall market..

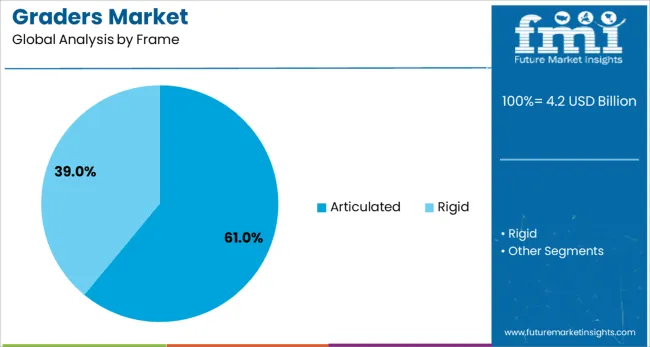

The articulated frame segment is expected to hold 61% of the graders market revenue share in 2025, positioning it as the dominant frame type. Articulated frame graders have gained preference due to their superior maneuverability and adaptability across challenging terrains and tight job sites. These machines have been widely utilized in infrastructure projects requiring high-precision grading on uneven or curved surfaces.

Enhanced by responsive steering and dynamic weight distribution, articulated frame models offer operational advantages that straight frame counterparts often cannot match. Their suitability for roadworks, mining, and construction tasks in varying environments has further driven widespread adoption. The frame’s articulation allows for greater control during complex grading tasks, resulting in improved productivity and lower operator fatigue.

Continued investment in smart control systems and operator-assist technologies has reinforced the appeal of articulated graders. As demand for efficient and agile equipment intensifies, the articulated frame configuration has maintained a strong leadership position in the global market..

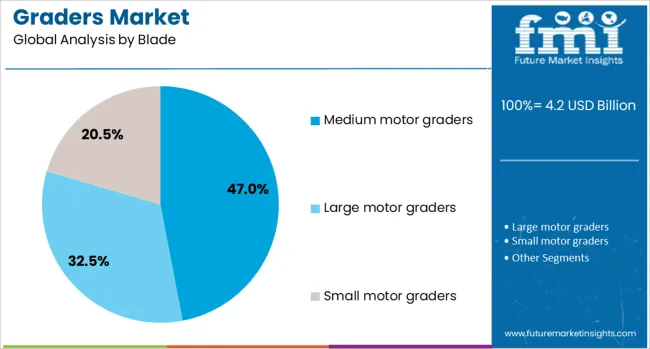

The medium motor graders blade segment is projected to represent 47% of the graders market revenue share in 2025, leading the blade category. This segment's strength has been attributed to the balance it offers between power, agility, and cost-efficiency, making it suitable for a wide range of applications. Medium motor graders have been widely adopted in municipal road maintenance, small to mid-scale construction, and general infrastructure development.

Their versatility in both urban and rural settings has enabled deployment across diverse geographies and work environments. Increased demand for mid-sized graders capable of precise grading and cost-effective operation has supported sustained growth in this segment.

The capability to integrate automation features, such as grade control and remote diagnostics, without significant upscaling of the machine footprint, has added to their attractiveness. Additionally, the moderate capital investment required for medium motor graders has aligned well with budget-conscious government agencies and contractors, securing the segment’s lead in the blade category..

The graders market is growing steadily as demand rises for efficient earthmoving and road construction equipment. Graders are essential for precise leveling, shaping, and finishing tasks in infrastructure development, mining, and agriculture. Increasing investments in road construction and maintenance globally boost demand. Challenges include high equipment costs and operational complexity. However, technological enhancements, such as improved fuel efficiency and operator comfort, combined with expanding infrastructure projects in developing countries, support market growth. Growing adoption of automated and GPS-enabled graders presents significant opportunities.

Infrastructure expansion in urban and rural areas is a major driver for the graders market. Governments worldwide are investing heavily in road construction, highway upgrades, and urban development projects requiring precise grading for durable and safe surfaces. Mining and agriculture sectors also rely on graders for site preparation and land leveling. The versatility of graders in performing multiple tasks makes them indispensable for construction companies. Growing focus on improving transportation networks in developing countries creates consistent demand for reliable, high-performance graders. As construction projects become more complex, the need for equipment that enhances productivity and quality further fuels the market.

Graders are capital-intensive machines with significant purchase and maintenance costs, which can deter smaller contractors and operators from investing. The complexity of operating graders requires skilled operators to maximize efficiency and safety, leading to additional training expenses. Fuel consumption and maintenance also contribute to overall operational costs. Harsh working conditions in construction and mining can cause wear and tear, increasing downtime and repair needs. Additionally, availability of spare parts and servicing infrastructure varies by region, impacting equipment uptime. Manufacturers must balance robust design with ease of operation to reduce barriers. Financing options and rental services help address affordability challenges in some markets.

Technological advancements are reshaping the graders market with the introduction of automation and precision control features. GPS-enabled graders allow operators to achieve highly accurate grading with reduced manual intervention, increasing efficiency and minimizing material wastage. Semi-automated and fully automated graders are gaining popularity, especially in large-scale infrastructure and mining projects where consistent performance is critical. These technologies reduce operator fatigue and improve safety by limiting human error. Integration with construction management software supports real-time monitoring and data analytics, optimizing project timelines. As automation technology becomes more accessible, manufacturers investing in smart graders are positioned to capture growing demand and differentiate their offerings.

Emerging economies in Asia Pacific, Latin America, and Africa are witnessing rapid urbanization and industrialization, driving the need for graders in infrastructure and mining projects. Expanding transportation networks, energy projects, and resource extraction activities require efficient earthmoving equipment to maintain progress. Established markets in North America and Europe focus on equipment upgrades and replacement cycles, integrating new technologies for enhanced performance. Government incentives for infrastructure modernization and private sector investments further stimulate demand. Regional supply chain developments and dealer network expansions improve equipment accessibility. Tailoring products to local terrain and regulatory requirements helps manufacturers succeed across diverse markets worldwide.

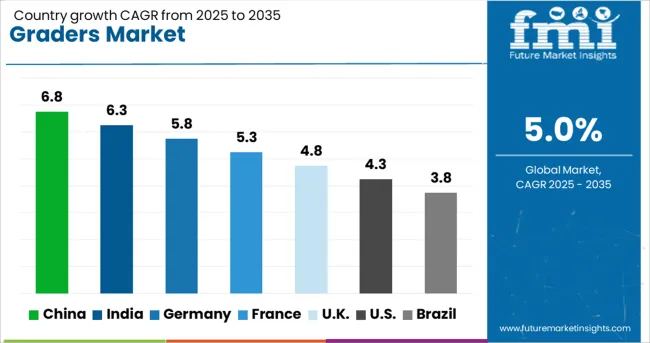

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

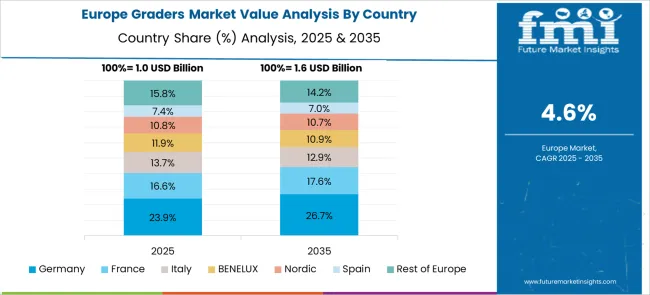

The global graders market is growing steadily at a 5.0% CAGR, with significant growth across major regions. Among BRICS nations, China leads at 6.8%, supported by extensive infrastructure development and strong construction activity. India follows closely with 6.3% growth, driven by increased investments in road construction and urban development. Within the OECD group, Germany reports 5.8% growth, reflecting advanced machinery technology and strict regulatory compliance. The United Kingdom experiences 4.8% growth, fueled by modernization efforts in construction equipment and infrastructure projects. The United States, a mature market, grows at 4.3%, shaped by equipment reliability standards and demand for advanced features. These countries collectively influence market trends through innovations in fuel efficiency, automation, and operator comfort. This report includes insights on 40+ countries; the top countries are shown here for reference.

India’s graders market is growing at a 6.3% CAGR, driven by significant infrastructure development initiatives across tier-1 and tier-2 cities. Government schemes aimed at improving road connectivity and rural infrastructure have boosted demand for graders. The construction sector is expanding rapidly, with both public and private projects requiring efficient earthmoving and grading equipment. Indian manufacturers are enhancing local production capabilities while international companies are strengthening their distribution networks. Leasing and rental services for graders are gaining popularity due to cost-effectiveness for smaller contractors. The market is characterized by a shift toward more technologically advanced models, including those equipped with GPS and automation features, to improve precision and reduce operation time. The focus on road safety and quality is also increasing the demand for reliable grader machines.

India is seeing an 11.1% CAGR in the commercial energy efficient windows market, propelled by smart city projects, infrastructure growth, and energy conservation efforts. Builders and architects are increasingly specifying energy-efficient glass for office complexes, malls, and educational institutions. Rising temperatures and power costs are influencing adoption in tier-1 and tier-2 cities. Indian glass manufacturers are scaling up their production capabilities and partnering with international firms to introduce low-emissivity and double-glazed solutions. The Bureau of Energy Efficiency is actively promoting energy-efficient building standards, encouraging adoption in commercial sectors. Growth in IT parks and business hubs is also a key contributor to rising demand.

Graders market in Germany is growing steadily at a 5.8% CAGR, supported by robust infrastructure maintenance and modernization efforts. The country’s focus on maintaining its extensive road network and upgrading urban infrastructure creates steady demand for graders. Construction companies prefer high-performance graders that offer fuel efficiency and low emissions to comply with strict environmental regulations. Germany has a mature market with a mix of local manufacturers and global brands competing on innovation and quality. Rental services for graders are well-established, catering to both large infrastructure projects and smaller maintenance works. Advances in grader technology, such as telematics and automation, are being adopted to improve operational efficiency. The government’s emphasis on sustainable construction practices encourages the use of eco-friendly equipment in the graders market.

The graders market in the United Kingdom is expanding at a 4.8% CAGR, influenced by ongoing urban redevelopment and transport infrastructure upgrades. Public investments in road maintenance and new construction projects support the demand for grading equipment. UK contractors are increasingly adopting modern graders with advanced control systems that improve precision and reduce labor costs. The market features a competitive landscape with established international suppliers and rental companies offering flexible equipment solutions. Environmental concerns and regulatory compliance push manufacturers to develop low-emission grader models. Additionally, the rental market continues to grow as companies prefer asset-light strategies. The emphasis on safety and quality in construction projects further drives demand for reliable and technologically advanced graders.

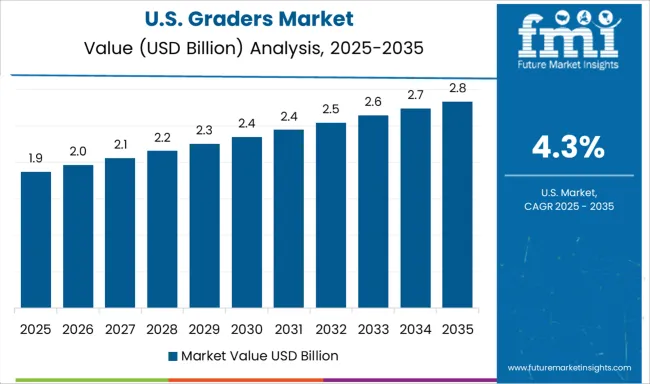

The graders market in the United States is growing at a moderate 4.3% CAGR. Growth is supported by steady investments in infrastructure rehabilitation and expansion, particularly in transportation and urban development. Demand is driven by federal and state funding for road repair, highway construction, and public works projects. USA buyers prefer graders with advanced features like GPS guidance, automation, and fuel efficiency to optimize project timelines and reduce operating costs. The market is highly competitive, with global manufacturers and local suppliers offering a wide range of models. Rental services remain popular, providing flexibility for contractors. Environmental regulations encourage manufacturers to innovate cleaner and more efficient grader designs. The market is also influenced by the increasing adoption of smart construction technologies and digital monitoring systems.

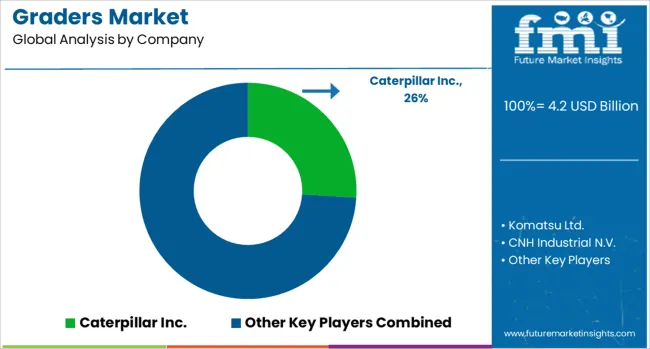

The graders market is primarily driven by the demand for efficient earthmoving and road construction equipment. Key industry leaders such as Caterpillar Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, and SANY Group dominate this sector with their extensive product portfolios.

Caterpillar Inc. stands out by offering technologically advanced graders known for durability, precision, and fuel efficiency, catering to various construction and mining applications. Komatsu Ltd. emphasizes innovation and operator comfort in their grader models, incorporating advanced control systems to enhance grading accuracy and productivity.

CNH Industrial N.V., through its Case and New Holland brands, provides graders designed for versatility and reliability across multiple terrains and project scales. Deere & Company focuses on integrating smart technology and ergonomic design into their graders, enabling better control and lower operator fatigue, which contributes to higher efficiency on-site. SANY Group leverages competitive pricing and robust performance to expand its presence in emerging markets, with machines tailored for heavy-duty grading tasks.

The market growth is fueled by ongoing infrastructure projects and maintenance activities worldwide. Increased investment in road networks, highways, and urban development boosts the demand for graders capable of precise leveling and earthmoving. The integration of automation and telematics in graders improves operational efficiency, reduces downtime, and lowers maintenance costs. The focus on machine versatility and fuel economy aligns with operational cost reduction goals of construction companies. Overall, these key players are continuously evolving their offerings to meet the dynamic requirements of the construction industry while maintaining reliability and performance standards.

Caterpillar’s Bauma 2025 launch of the next-generation Cat 140 Motor Grader introduced advanced operator technology, ergonomic enhancements, and smart controls. In May 2025, the company released a High Performance Circle upgrade for its 140, 150, and 160 JOY models, offering improved torque, durability, and reduced maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Propulsion | ICE and Electric |

| Frame | Articulated and Rigid |

| Blade | Medium motor graders, Large motor graders, and Small motor graders |

| Application | Construction, Mining, Agriculture, Snow removal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, and SANY Group |

| Additional Attributes | Dollar sales vary by grader type, including rigid‑frame and articulated‑frame units; by capacity, such as small, medium, and large power outputs; by application, spanning construction, mining, infrastructure, forestry & agriculture, and oil & gas; and by region, with Asia‑Pacific leading volume, while North America and Europe drive modernization and value. Growth accelerates by infrastructure development, urbanization, and automation adoption. |

The global graders market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the graders market is projected to reach USD 6.8 billion by 2035.

The graders market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in graders market are ice, _construction, _mining, _agriculture, _snow removal, _others, electric, _construction, _mining, _agriculture, _snow removal and _others.

In terms of frame, articulated segment to command 61.0% share in the graders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA