Prominent players like Gillette, Schick, and BIC lead the razor and blade market by delivering precision-engineered, ergonomic, and durable shaving solutions. These Brands consistently innovate with advanced features like pivoting heads, lubricating strips, and reusable handles, catering to diverse consumer preferences.

The market, projected to grow at a CAGR of 3.9% to USD 5,334 million by 2035, benefits from rising demand for premium grooming products and sustainable solutions. Brands introducing subscription models and customizable shaving kits enhance customer retention by offering convenience and affordability. The growth of e-commerce platforms allows companies to reach a broader audience with targeted marketing and product bundling.

| Metric | Value |

|---|---|

| Market Size, 2035 | USD 5,334 million |

| CAGR (2025 to 2035) | 3.9% |

Collaborations with dermatologists and barbers enhance product credibility, while smart razors featuring skin analytics and app connectivity represent the next frontier of innovation. Sustainability remains a critical focus, with Brands adopting plastic-free packaging and recyclable components to appeal to eco-conscious consumers.

In a competitive landscape, companies prioritizing advanced materials, personalization, and sustainability will dominate. As consumer grooming habits evolve, the razor and blade market will continue to expand, driven by innovation and adaptability.

The razor and blade market is growing steadily due to increasing grooming habits and the demand for high-performance, durable shaving solutions. Technological innovations and the emergence of eco-friendly alternatives are reshaping the market, appealing to both traditional and modern consumers.

Global Brand Share & Industry Share (%):

| Category | Industry Share (%) |

|---|---|

| Top 3 (Gillette, Schick, Philips) | 40% |

| Rest of Top 5 (Harry’s, Bic) | 20% |

| Next 5 of Top 10 (Dorco, Feather, others) | 15% |

Type of Player & Industry Share (%):

| Type of Player | Industry Share (%) |

|---|---|

| Top 10 | 75% |

| Top 20 | 20% |

| Rest | 5% |

Year-over-Year Leaders:

Advanced Blade Engineering

Ergonomic and User-Centric Designs

Sustainable Technologies

Eco-Friendly Materials

Carbon-Neutral Production

Refillable Systems

Demand for Customization

Preference for Multi-Functional Tools

Gender-Inclusive Grooming

Invest in Sustainability:

Develop biodegradable razors and refillable systems to appeal to eco-conscious consumers.

Leverage Technology:

Incorporate advanced blade engineering and ergonomic designs to enhance user experience.

Expand Digital Engagement:

Use online platforms to promote subscription services and engage with tech-savvy consumers.

The razor and blade market will continue to grow as brands innovate with sustainable designs, advanced blade technologies, and customizable solutions. Companies investing in regional expansions, targeted marketing, and hybrid product offerings will dominate the market. Emerging trends, such as gender-inclusive grooming tools and IoT-enabled electric razors, will further reshape the industry.

Revenue and Share by Brand

Market leaders like Gillette, Schick, and Philips maintain dominance through innovation, scalability, and strong distribution networks.

Figures/Visuals

| Brand | Gillette |

|---|---|

| Market Contribution (%) | 20% |

| Key Initiatives | Innovated nutraceuticals targeting anti-aging and hydration |

| Brand | Schick |

|---|---|

| Market Contribution (%) | 15% |

| Key Initiatives | Expanded affordable product lines for diverse demographics |

| Brand | Philips |

|---|---|

| Market Contribution (%) | 10% |

| Key Initiatives | Developed waterproof electric razors with multi-functional features |

Scope of Market Definition

The razor and blade market includes disposable razors, cartridge systems, electric razors, and replacement blades designed for personal and professional grooming. This analysis excludes industrial cutting tools and non-grooming blades.

Key Terms and Terminology

The primary research involved a combination of primary interviews, secondary data analysis, and industry-specific modelling. The data was cross-validated with market experts and industry stakeholders to validate the accuracy and relevance of the data.

The global razor and blade market will grow at a CAGR of 3.9% between 2025 and 2035.

The global razor and blade market will reach USD 5,334 million by 2035.

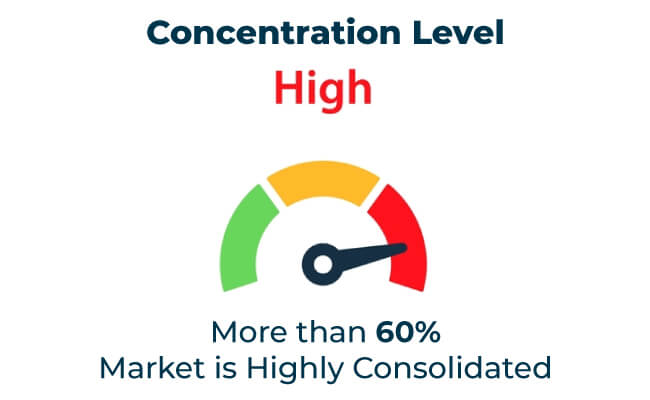

The top 10 players account for over 63% of the global market.

Key manufacturers include Dorco, Feather, Gillette, Schick, and BIC among others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Razor and Blade Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA