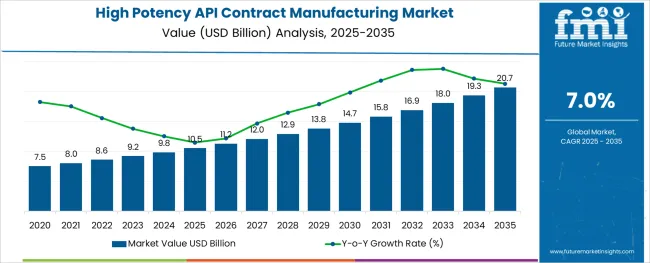

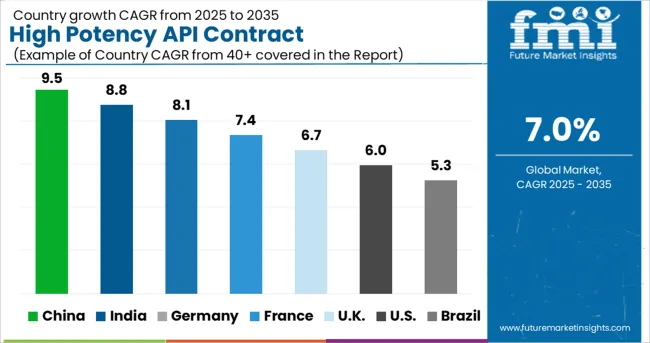

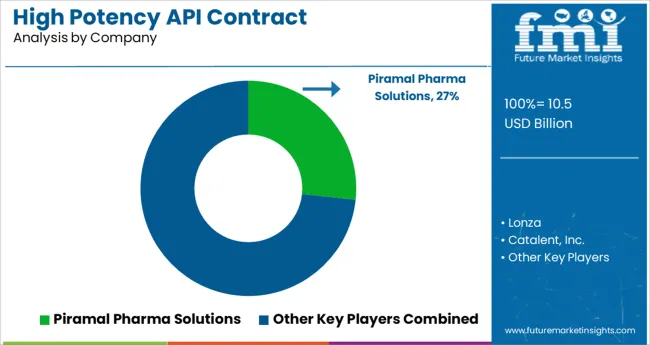

The High Potency API Contract Manufacturing Market is estimated to be valued at USD 10.5 billion in 2025 and is projected to reach USD 20.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The high potency API contract manufacturing market is experiencing strong growth as pharmaceutical companies increasingly outsource the production of complex and highly potent compounds to specialized contract manufacturers. The rising global burden of chronic conditions such as cancer and autoimmune diseases has led to increased demand for targeted therapies, many of which require high potency APIs.

Stringent regulatory requirements and the need for advanced containment infrastructure have encouraged biopharmaceutical companies to partner with contract manufacturers that offer dedicated high containment capabilities, technical expertise, and scalability. Furthermore, the cost advantages of outsourcing and the need for faster time to market have reinforced the role of contract manufacturing organizations in the high potency space.

With the continued focus on personalized medicine and targeted drug development, the market outlook remains positive as contract manufacturers expand capacity, adopt advanced synthesis technologies, and strengthen compliance frameworks.

The market is segmented by Product Type, Synthesis, Application, and Dosage Form and region. By Product Type, the market is divided into Innovative and Generic. In terms of Synthesis, the market is classified into Synthetic and Biotech. Based on Application, the market is segmented into Oncology, Hormonal Disorders, Glaucoma, and Others. By Dosage Form, the market is divided into Injectable, Oral Solids, Creams, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

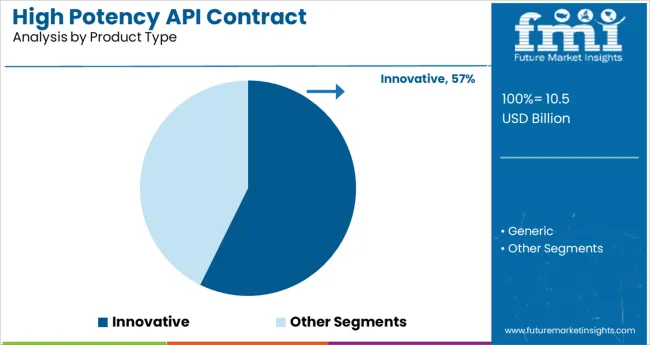

The innovative segment is expected to account for 57.30% of the total market revenue by 2025 within the product type category, making it the dominant segment. This leadership position is driven by the increasing pipeline of novel therapeutics requiring high potency APIs and the industry’s growing focus on targeted and personalized treatments.

Innovative high potency APIs are critical in the development of complex oncology and immunotherapy drugs, many of which demand high levels of purity, potency, and containment. Contract manufacturers with expertise in innovative molecule development have been pivotal in accelerating time to market for pharmaceutical companies through specialized infrastructure and regulatory support.

The rising investment in research and clinical trials for novel therapies further supports the expansion of this segment, positioning innovative products as the cornerstone of high potency API manufacturing.

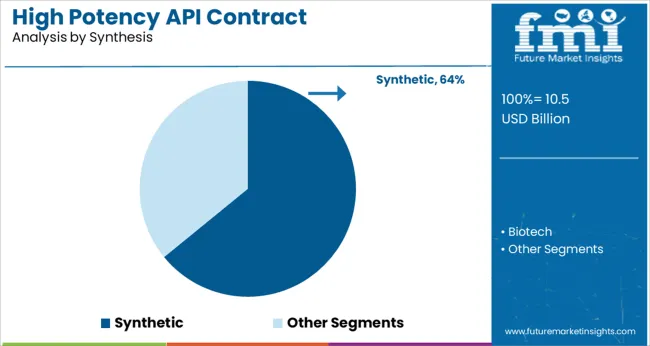

The synthetic segment is projected to represent 64.10% of the total revenue by 2025 in the synthesis category, maintaining its lead in the market. This dominance is attributed to the widespread use of chemical synthesis methods for manufacturing high potency compounds, particularly in oncology and hormone therapies.

Synthetic pathways offer precise control over molecular structure and batch reproducibility, which are essential in producing consistent and compliant high potency APIs. Contract manufacturers specializing in synthetic processes benefit from extensive technical capabilities, process optimization experience, and containment infrastructure that align with global regulatory standards.

The continued demand for chemically synthesized cytotoxic and highly active agents ensures the sustained relevance of this segment in high potency API production.

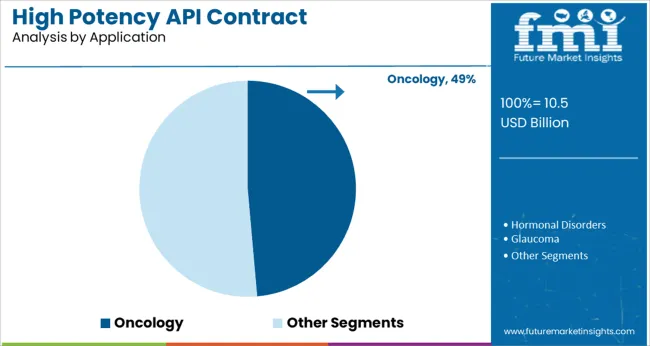

The oncology application segment is expected to contribute 48.60% of the total market revenue by 2025, positioning it as the most significant therapeutic area. This is largely driven by the expanding prevalence of cancer globally and the resulting surge in demand for highly potent anticancer agents.

Oncology drugs often require precise dosing and targeted delivery, making high potency APIs indispensable in their formulation. Contract manufacturers play a crucial role in ensuring safe, compliant, and efficient production of these compounds, given the complexity and containment challenges involved.

The high clinical value and growing regulatory emphasis on quality and safety in oncology drug manufacturing have reinforced the dominance of this segment. As oncology remains a central focus of global pharmaceutical innovation, this application area continues to drive growth and investment across the high potency API contract manufacturing market.

The global demand for high potency API contract manufacturing is projected to increase at a CAGR of 7% during the forecast period between 2025 and 2035, reaching a total of USD 20.7 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 5%.

The increased demand for outsourcing HPAPI manufacture, as well as a robust pipeline of targeted therapeutic medications, is projected to drive the growth of the market. However, the concentration of technological expertise in the hands of a few significant companies, as well as the absence of uniform regulatory regulations and standards, are expected to drive the growth of the market.

Other factors driving market expansion include rising demand for antibody-drug conjugates and cancer treatments. Furthermore, the approval of government regulations for the development and manufacture of innovative medicine is expected to boost market growth throughout the forecast period.

Patent Expiration of Blockbuster Drugs to Open New Growth Frontiers

The expiration of patents and subsequent launch of generic versions is a major boon for pharmaceutical businesses to extend their product portfolios and enter attractive market niches in this technology-driven industry.

Several biosimilars have been authorized in Europe, however, the US FDA has only approved one biosimilar yet. Increased research and development operations, as well as ongoing attempts to replicate branded biological medications, would pave the way for the introduction of cost-effective therapeutic options.

Several blockbuster pharmaceuticals are projected to lose their patent protection in the near future, opening up significant prospects in the biosimilar industry. Some of the key medications that will go off patent in the near future are Avastin (bevacizumab), Herceptin (trastuzumab), Synagis (palivizumab), Erbitux (cetuximab), Humira (adalimumab), Remicade (infliximab), and Rituxan (rituximab).

Growing need for Outsourcing HPAPI Manufacturing, as well as a robust pipeline of Targeted Therapeutic Medications

Pharmaceutical firms were hesitant to outsource the production of high-potency APIs; hence the vast bulk of production remained captive or in-house. The fear of patent violation was a major motivator. However, when pharmaceutical businesses began to grow geographically, they began to run out of HPAPIs.

Furthermore, rising medication development and commercialization costs increased the financial strain. With the evolving regulatory and legal environment, outsourcing has proven to be the best alternative for HPAPI manufacture.

The concentration of Technical Expertise across a handful of Players is causing Market Disruption

Manufacturing high-potency APIs is capital-demanding and needs specialized technical know-how; this has been a key obstacle for new players seeking to enter the lucrative HPAPI business. There are now just a few large companies that have established their own capabilities through mergers, acquisitions, collaborations, and Research and Development (R&D).

A host of Medicines in the Pipeline to bolster prospects for API Contract Manufacturing

The Asia Pacific region is predicted to develop at the quickest rate throughout the projection period. The expanding spectrum of prospects, particularly in Japan, China, and India, can be linked to the expansion.

Factors like as a better regulatory environment, a large potential for cost reductions, enhanced risk management skills, and a healthy medication pipeline are projected to boost the region's growth in the coming years. Furthermore, the availability of qualified labor at cheaper prices than in established nations such as the United States is expected to accelerate regional market growth.

Rising Incidence of Illnesses such as Cancer and Neurological Problems to Accelerate Market Growth

During the projection period, North America is likely to have a large market share, estimated at around 38% by 2025-end. With the incidence of illnesses such as cancer and neurological problems, the United States was the most impacted country in the world. As the incidence of these illnesses rises, so will the region's output of HPAPIs.

HPAPIs are frequently employed in cancer and other major diseases therapeutic, drug development, and other research activities. As a result, the demand for the same will be substantially larger in the North American area, where the patient population is growing faster than in other countries. Because of its growing elderly population and increased prevalence and incidence of infectious illnesses, North America is likely to dominate the high-potency APIs/HPAPI market.

Chronic disorders, such as cancer, are also prevalent in the United States. According to the American Cancer Society journal's 2024 report, there will be an estimated 20.7.8 million new cancer cases diagnosed and 606,520 cancer deaths in 2024.

According to the Parkinson's Foundation's 2024 estimates, around 20.7 million individuals in the United States have Parkinson's disease, which is greater than the total number of persons diagnosed with muscular dystrophy, multiple sclerosis, and Amyotrophic Lateral Sclerosis. By 2035, this figure is predicted to rise to 20.7.2 million.

Oncology to be a promising Field for High Potency API Contract Manufacturing

According to Future Market Insights, major developments are expected to happen in the oncology segment with regard to high-potency API contract manufacturing. The rising number of cancer cases worldwide is the primary driver of this market. For example,

The Cancer Atlas predicts that there will be 7.5 million cancer diagnoses by 2040, up from over 18 million in 2020. Furthermore, unlike traditional, systemic treatments, some new cancer medicines in development are exceedingly precise.

Antibody-drug conjugates, which can have occupational exposure levels, and monoclonal antibodies coupled with small molecule cytotoxic chemicals are examples of such targeted HPAPIs. Because of the fast increase of cancer targets, the fraction of HPAPI applications in the therapeutic pipeline is rapidly growing. As per the report, oncology likely accounts for over 63% of all high-potency API contract manufacturing operations.

Demand for Injectables to witness a Steady Incline in Forthcoming Years

The global industry has been subdivided into Injectables, oral solids, lotions, and others based on dosage forms. In 2024, the injectable dosage form sector led the worldwide industry, comprising over 50% of global revenues.

The category is expected to grow at a stable CAGR, maintaining its dominance throughout the projected years. The speedy delivery of HPAPI to the intended area can be credited to the segment's rise. They can be administered subcutaneously (in the fat layer), intradermally (between the layers of skin), or intramuscularly (in the muscle).

Key players in the High Potency API Contract Manufacturing market are Piramal Pharma Solutions, Lonza, Catalent, Inc., VxP Pharma, Inc., Pfizer CentreOne, Gentec Pharmaceutical Group, AbbVie, Aurigene Pharmaceutical Services Ltd., CordenPharma International, and Curia Global, Inc.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 10.5 billion |

| Market Value in 2035 | USD 20.7 billion |

| Growth Rate | CAGR of 7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Application, Dosage Form, Synthesis, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Malaysia, Singapore, Thailand, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Piramal Pharma Solutions; Lonza; Catalent, Inc.; VxP Pharma, Inc.; Pfizer CentreOne; Gentec Pharmaceutical Group; AbbVie; Aurigene Pharmaceutical Services Ltd.; CordenPharma International; Curia Global, Inc. |

| Customization | Available Upon Request |

The global high potency api contract manufacturing market is estimated to be valued at USD 10.5 billion in 2025.

It is projected to reach USD 20.7 billion by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are innovative and generic.

synthetic segment is expected to dominate with a 64.1% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA