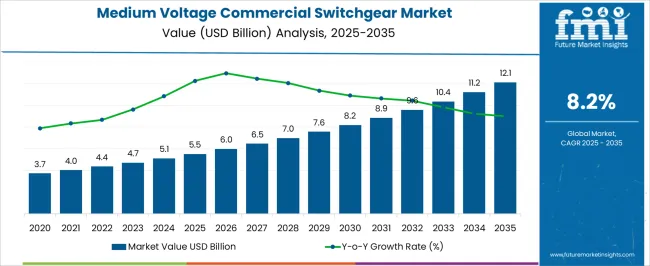

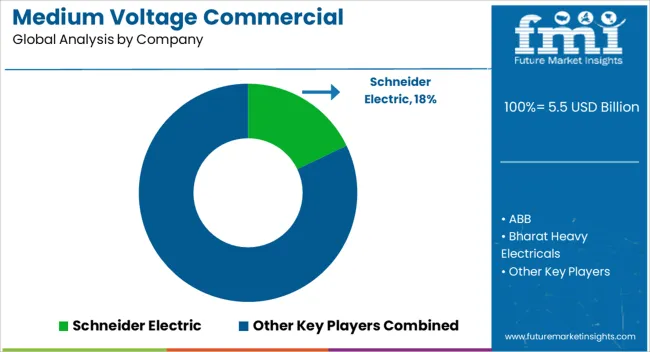

The medium voltage commercial switchgear market is projected at 5.5 USD billion in 2025 and is anticipated to reach 12.1 USD billion by 2035, registering a CAGR of 8.2%. Early growth from 2025 to 2030 is driven by adoption in commercial complexes, industrial plants, and data centers, where reliable electrical distribution and protective equipment are prioritized. Investments during this phase are focused on conventional switchgear solutions offering operational safety, system flexibility, and basic automation.

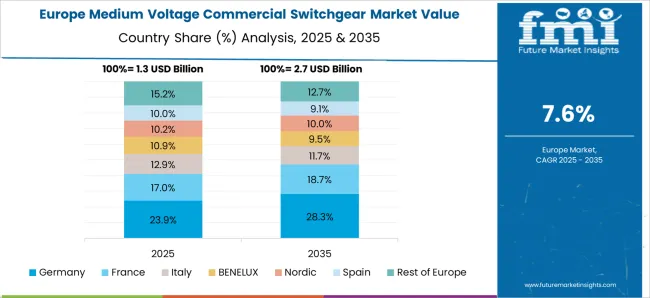

Dollar sales and share are largely influenced by regions with established infrastructure and regulatory requirements, including North America, Europe, and parts of Asia-Pacific.

Late-stage growth from 2030 to 2035 is accelerated as advanced switchgear solutions with smart sensors, digital monitoring, and predictive maintenance are increasingly deployed. Regulatory mandates on energy efficiency, grid stability, and safety standards also support expansion. Manufacturers are observed expanding production capacities, forming strategic partnerships, and offering integrated electrical solutions to meet evolving facility management needs.

Emerging economies contribute to market momentum through industrial electrification and the modernization of commercial electrical networks. Overall, market growth is shaped by a transition from conventional adoption to widespread deployment of technologically enhanced, energy-efficient medium voltage switchgear, creating long-term revenue opportunities globally.

| Metric | Value |

|---|---|

| Medium Voltage Commercial Switchgear Market Estimated Value in (2025 E) | USD 5.5 billion |

| Medium Voltage Commercial Switchgear Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The medium voltage commercial switchgear market is influenced by several interconnected parent markets, each contributing differently to overall demand and growth. The commercial infrastructure and building segment holds the largest share at 40%, as medium voltage switchgear is widely used in office complexes, shopping malls, hospitals, and data centers to ensure safe electrical distribution, system protection, and operational reliability. The industrial and manufacturing sector contributes 25%, driven by demand for electrical distribution solutions in factories, processing plants, and production facilities where equipment safety, fault prevention, and uptime are critical. The energy and utility sector accounts for 15%, with medium voltage switchgear deployed in substations, renewable energy facilities, and grid modernization projects to maintain load management, energy efficiency, and compliance with safety standards. The transportation and logistics market holds 10%, where adoption is seen in airports, rail networks, and ports to manage high-capacity electrical distribution for operations and infrastructure.

The commercial retrofit and modernization segment represents 10%, focusing on upgrading aging electrical systems with advanced switchgear incorporating digital monitoring and predictive maintenance capabilities. Collectively, commercial infrastructure, industrial, and utility applications account for 80% of overall demand, highlighting that facility reliability, operational safety, and energy management remain the primary drivers, while transportation and modernization projects provide consistent, complementary growth opportunities across global markets.

The medium voltage commercial switchgear market is experiencing robust growth, driven by the increasing demand for reliable electrical distribution systems in commercial infrastructure and industrial facilities. The current market environment reflects a strong emphasis on operational safety, system efficiency, and adaptability to evolving power requirements.

The growing integration of smart monitoring systems, along with advancements in fault detection and load management, is enabling switchgear to function as an integral component of modern energy networks. Urbanization, coupled with the expansion of large-scale commercial complexes, has created a sustained requirement for medium voltage solutions that balance high performance with safety compliance.

Future growth is expected to be supported by the transition toward more energy-efficient equipment, the incorporation of intelligent digital controls, and the global focus on reducing downtime through predictive maintenance capabilities. As infrastructure investments rise, the market is poised to maintain strong momentum, supported by technology innovations and the increasing need for resilient power systems.

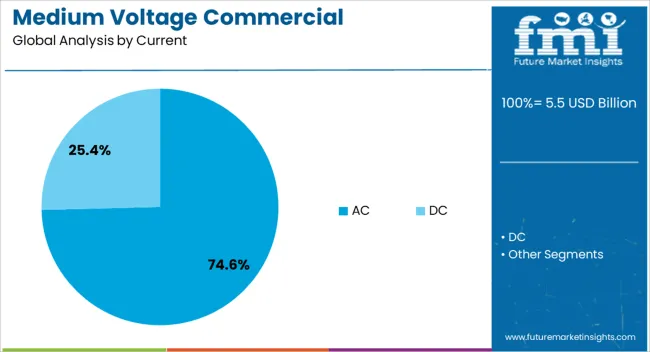

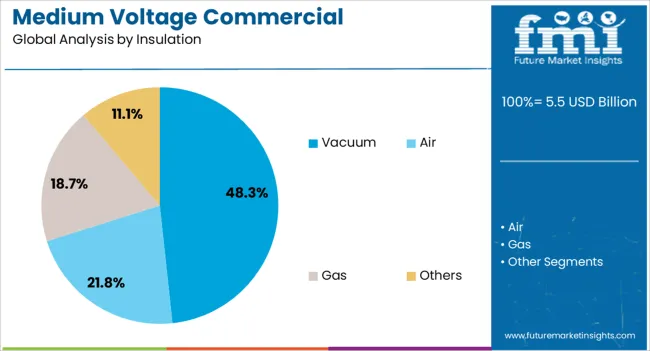

The medium voltage commercial switchgear market is segmented by current, insulation, and geographic regions. By current, medium voltage commercial switchgear market is divided into AC and DC. In terms of insulation, medium voltage commercial switchgear market is classified into Vacuum, Air, Gas, and Others.

Regionally, the medium voltage commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC segment is projected to account for 74.6% of the Medium Voltage Commercial Switchgear market revenue in 2025, making it the dominant current type. This leadership is being attributed to its widespread application in commercial electrical distribution systems, where alternating current remains the standard for delivering power over long distances with minimal loss.

The segment’s growth has been supported by its compatibility with a wide range of commercial loads, ease of voltage transformation, and ability to integrate with backup power and renewable energy sources. The adaptability of AC systems to varied operational needs, along with their established infrastructure in commercial facilities, has contributed to sustained demand.

The preference for AC in medium voltage switchgear is further reinforced by its cost-effectiveness in installation and maintenance, along with the availability of skilled personnel for its operation. As modernization projects continue, the segment is expected to maintain its market leadership due to its proven reliability and operational flexibility.

The Vacuum insulation segment is anticipated to capture 48.3% of the Medium Voltage Commercial Switchgear market revenue in 2025, positioning it as the leading insulation type. This dominance is being driven by the superior arc-quenching capabilities and minimal maintenance requirements associated with vacuum technology.

The ability of vacuum-insulated switchgear to deliver consistent performance in demanding environments has made it a preferred choice for commercial installations where operational safety and equipment longevity are critical. The segment’s growth has been further supported by its compact design, which enables space optimization in commercial buildings, and by its environmentally friendly operation, as it avoids the use of gas-based insulating mediums.

The long service life, combined with reduced risk of fire or explosion, has reinforced the appeal of vacuum insulation. As safety regulations and efficiency standards in commercial infrastructure become more stringent, this segment is expected to retain its leadership due to its proven operational advantages and alignment with sustainable energy practices.

The medium voltage commercial switchgear market growth is primarily driven by commercial infrastructure, industrial applications, energy sectors, and modernization projects. Adoption is shaped by demand for reliable power distribution, operational safety, and load management across regions globally.

The medium voltage commercial switchgear market is influenced by growing adoption in commercial buildings, office complexes, hospitals, and data centers, where reliable electrical distribution and system protection are critical. Dollar sales and share indicate that commercial infrastructure contributes the largest portion of market demand, driven by the need for uninterrupted power supply, safety compliance, and efficient load management. Replacement of aging electrical systems in developed regions is creating incremental growth opportunities, while expanding retail and commercial real estate projects in emerging economies are further supporting adoption. Manufacturers are observed providing scalable switchgear solutions with modular designs to accommodate evolving electrical loads. Early-stage installations emphasize cost-effective protection, while advanced systems are deployed to meet performance and reliability requirements.

Industrial facilities, manufacturing plants, and processing units are contributing significantly to the medium voltage switchgear market, accounting for a considerable portion of dollar sales and share. Switchgear adoption in these sectors ensures operational safety, prevents equipment failure, and supports uninterrupted production cycles. Industries with heavy machinery and high-power demand prioritize switchgear with fault detection, overload protection, and integrated monitoring capabilities. Expansion is influenced by investments in industrial electrification, automation of production lines, and modernization of electrical networks. Companies supplying industrial switchgear focus on customizable configurations, compliance with regional electrical codes, and long-term reliability. Market growth is also supported by industrial retrofit projects aimed at upgrading legacy systems with higher-capacity, energy-efficient solutions.

Medium voltage switchgear adoption is increasingly observed in energy and utility sectors, including power generation plants, substations, and renewable energy installations. This segment contributes a substantial share to overall market revenue, as switchgear ensures load management, fault isolation, and uninterrupted energy transmission. Regional growth patterns indicate strong demand in areas undergoing grid expansion and modernization projects. Manufacturers are providing solutions capable of integrating with smart grid systems, energy storage, and distributed generation. Dollar sales and share are influenced by government mandates, energy efficiency regulations, and incentives for grid stability. Consistent performance under variable load conditions, reliability, and compliance with electrical safety standards are key factors shaping market expansion in energy applications.

A notable portion of medium voltage switchgear demand comes from retrofit and modernization projects in commercial and industrial facilities. Aging electrical infrastructure requires replacement with switchgear offering improved safety, operational efficiency, and integration with digital monitoring tools. Adoption is observed in hospitals, airports, rail networks, and industrial plants where downtime reduction is critical. Dollar sales and share indicate that modernization initiatives are concentrated in developed regions, while emerging markets are increasingly adopting upgraded systems as new construction projects emerge. Manufacturers are focusing on modular designs, compatibility with existing installations, and ease of maintenance. Projected market growth is also driven by increasing awareness of preventive maintenance, predictive monitoring, and operational reliability.

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

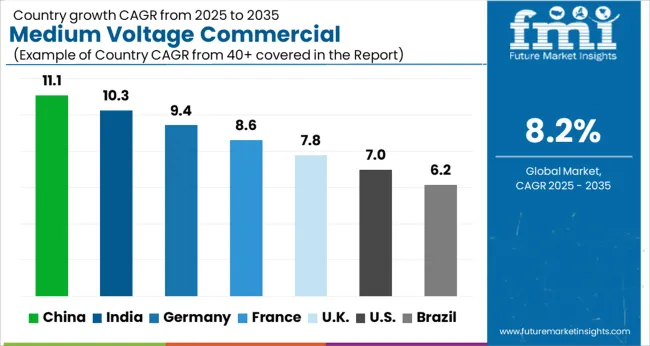

The global medium voltage commercial switchgear market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads at 11.1%, followed by India at 10.3%, France at 8.6%, the UK at 7.8%, and the USA at 7.0%. Growth is driven by rising demand for reliable electrical distribution, system protection, and operational safety across commercial buildings, industrial plants, and energy infrastructure. Asia, particularly China and India, demonstrates rapid expansion due to large-scale commercial construction, industrial electrification, and modernization of electrical networks. Europe emphasizes high-quality, standards-compliant switchgear with digital monitoring and predictive maintenance capabilities, while North America focuses on energy efficiency, smart grid integration, and industrial reliability. Adoption in emerging applications, such as renewable energy facilities, data centers, and retrofit projects, further supports market expansion. The analysis includes over 40+ countries, with the leading markets detailed above.

The medium voltage commercial switchgear market in China is projected to grow at a CAGR of 11.1% from 2025 to 2035, fueled by expanding commercial infrastructure, industrial electrification, and modernization of aging electrical networks. Adoption is concentrated in office complexes, hospitals, manufacturing plants, and data centers, where reliable power distribution and system protection are critical. Manufacturers are supplying modular, scalable, and digitally enabled switchgear to support evolving load demands and predictive maintenance. Government-driven initiatives promoting grid stability, energy efficiency, and smart building integration further accelerate market penetration. Dollar sales and share indicate that both retrofit projects and new construction projects contribute significantly to growth. Strong domestic manufacturing capabilities and partnerships with international suppliers ensure consistent product quality, cost-effective production, and timely delivery.

The medium voltage commercial switchgear market in India is expected to grow at a CAGR of 10.3% from 2025 to 2035, driven by increased commercial construction, industrial electrification, and urban infrastructure development. Key adoption sectors include hospitals, IT parks, industrial units, and shopping complexes, where uninterrupted power supply and operational safety are critical. Dollar sales and share indicate strong demand for modular, scalable, and fault-protective switchgear solutions. Government programs promoting energy efficiency, electrical safety, and modernization of distribution networks further support growth. Manufacturers are providing cost-effective solutions with enhanced protection, digital monitoring, and integration with renewable energy systems. Expansion in tier-2 and tier-3 cities and the replacement of legacy installations are additional growth drivers, while partnerships with local distributors ensure market accessibility.

France’s medium voltage commercial switchgear market is projected to grow at a CAGR of 8.6% from 2025 to 2035. Adoption is concentrated in commercial complexes, industrial facilities, healthcare centers, and data hubs, emphasizing electrical safety, uninterrupted power, and compliance with European standards. Dollar sales and share indicate significant opportunities in industrial retrofitting and new construction projects. Suppliers focus on high-quality, standards-compliant switchgear with digital monitoring, fault detection, and predictive maintenance capabilities. Energy efficiency regulations and grid modernization programs accelerate adoption, while renewable energy integration increases the need for adaptive, reliable switchgear. Domestic and international manufacturers compete through advanced modular designs, service support, and regional distribution networks to ensure consistent availability and reliability for commercial and industrial users.

The UK medium voltage commercial switchgear market is expected to expand at a CAGR of 7.8% from 2025 to 2035, driven by adoption in commercial buildings, industrial sites, data centers, and healthcare facilities. Dollar sales and share indicate growth in retrofit projects and new construction requiring efficient power distribution and fault protection. Suppliers emphasize modular, digital, and predictive monitoring-enabled switchgear to support electrical reliability and operational safety. Adoption is also supported by government programs promoting energy efficiency, electrical safety standards, and smart building initiatives. Distribution networks and partnerships with local contractors facilitate deployment, while manufacturers provide solutions compatible with renewable energy integration and high-density electrical loads, enhancing system reliability across commercial and industrial applications.

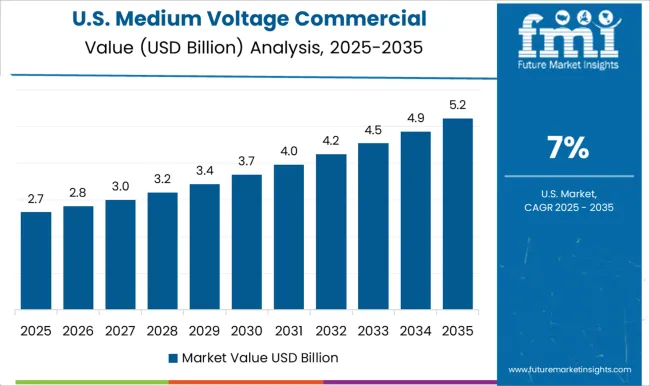

The USA medium voltage commercial switchgear market is projected to grow at a CAGR of 7.0% from 2025 to 2035, with adoption driven by commercial complexes, industrial facilities, healthcare centers, and high-capacity data centers. Dollar sales and share suggest significant investment in retrofitting legacy installations and integrating switchgear in new constructions. Emphasis is on modular, scalable, and digitally monitored switchgear to enhance operational safety, load management, and predictive maintenance. Adoption is reinforced by regulatory standards for energy efficiency, grid modernization, and industrial safety. Suppliers focus on advanced fault protection, reliability, and service support, catering to both industrial and commercial segments. Renewable energy integration and distributed power systems further increase demand for adaptive and reliable switchgear solutions.

Competition in the medium voltage commercial switchgear market is defined by product reliability, safety standards, technological integration, and regional distribution capabilities. Schneider Electric and ABB lead with modular, digitally enabled switchgear, focusing on commercial buildings, industrial facilities, and data centers, emphasizing fault protection, predictive maintenance, and energy efficiency. Bharat Heavy Electricals and CG Power and Industrial Solutions compete through cost-effective, scalable solutions for large-scale industrial and utility projects, targeting retrofit and new construction opportunities. E + I Engineering and Eaton differentiate with customized switchgear offerings, integrating smart monitoring and advanced protection systems suitable for high-load commercial and industrial applications. Fuji Electric, General Electric, and Hitachi focus on high-performance switchgear for commercial and industrial grids, emphasizing reliability, compliance with safety standards, and energy management capabilities. HD Hyundai Electric and Hyosung Heavy Industries provide region-specific solutions with modular designs and enhanced monitoring for maintenance optimization. Lucy Group, Mitsubishi Electric, and Ormazabal target European and Asian markets with standardized, certified switchgear that meets grid modernization and renewable energy integration needs.

Siemens, Skema, and Toshiba emphasize innovation in compact, modular switchgear, supporting digital monitoring, load management, and predictive maintenance. Market strategies across these players include expanding regional distribution networks, establishing partnerships with construction and engineering firms, and offering after-sales service, technical training, and maintenance support. Product portfolios are detailed, covering voltage ratings, fault current capacity, modularity, digital features, and compatibility with industrial and commercial electrical systems. Manufacturers focus on packaging, installation guidelines, and operational manuals to ensure reliable adoption. Dollar sales and share analyses indicate that commercial buildings, industrial units, and utility projects remain primary revenue drivers, while digital monitoring and integration with renewable energy infrastructure enhance incremental growth opportunities. The competitive landscape reflects a market driven by reliability, compliance, and performance consistency, with companies differentiating through technical expertise, regional presence, and product innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.5 Billion |

| Current | AC and DC |

| Insulation | Vacuum, Air, Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales, share, key end-use sectors (commercial buildings, industrial, utilities), competitive landscape, product types, adoption trends, regulatory standards, and digital/IoT integration potential. |

The global medium voltage commercial switchgear market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the medium voltage commercial switchgear market is projected to reach USD 12.1 billion by 2035.

The medium voltage commercial switchgear market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in medium voltage commercial switchgear market are ac and dc.

In terms of insulation, vacuum segment to command 48.3% share in the medium voltage commercial switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium Carbon Steel Market

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA