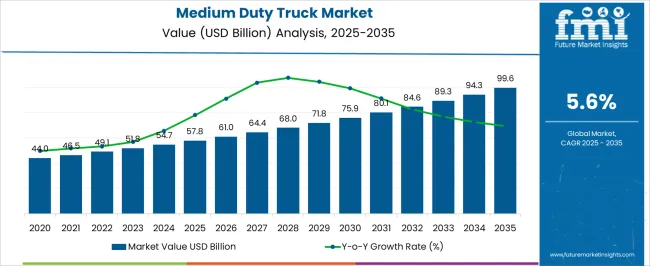

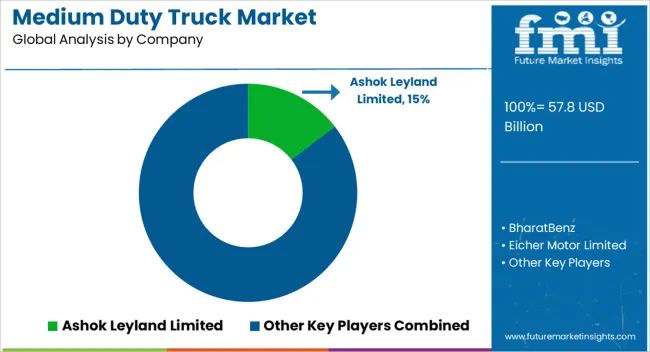

The medium duty truck market is estimated to be valued at USD 57.8 billion in 2025 and is projected to reach USD 99.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The early growth phase sees a gradual acceleration, driven by increased demand for medium-duty trucks in sectors like logistics, construction, and distribution. As eCommerce continues to expand, the need for medium-duty vehicles in last-mile delivery increases, supporting steady growth.

Between 2026 and 2030, the market strengthens further from USD 57.8 billion to USD 75.9 billion, progressing through USD 61.0 billion, 64.4 billion, and 68.0 billion. This phase reflects an accelerated growth pattern, as the adoption of advanced truck technologies, including electric powertrains and telematics, adds momentum to the market. The rise in fuel efficiency and emission regulations also boosts market demand.

From 2031 to 2035, the market expands from USD 75.9 billion to USD 99.6 billion, passing through USD 80.1 billion, 84.6 billion, 89.3 billion, and 94.3 billion. The growth during this period follows a steady deceleration pattern, as the market matures.

| Metric | Value |

|---|---|

| Medium Duty Truck Market Estimated Value in (2025 E) | USD 57.8 billion |

| Medium Duty Truck Market Forecast Value in (2035 F) | USD 99.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The commercial vehicle market is the largest contributor, accounting for approximately 35-40%, as medium-duty trucks are an essential segment within the broader commercial vehicle industry. These trucks are critical for transportation, logistics, and delivery applications. The logistics and supply chain market follows with around 25-30%, as the demand for regional and last-mile deliveries continues to rise, especially with the growth of e-commerce and the need for fast delivery services.

The construction and building materials market contributes about 15-18%, as medium-duty trucks are extensively used in transporting materials like cement, gravel, and sand for construction projects. The growth of global infrastructure and construction projects, particularly in emerging economies, drives demand in this segment. The waste management market accounts for approximately 8-10%, as medium-duty trucks are used for waste collection and disposal, particularly in urban areas. With the increasing focus on efficient waste management solutions, the demand for these trucks rises. The food and beverage market contributes around 10-12%, as medium-duty trucks are essential for the regional transportation of food products, particularly fresh and frozen items.

The medium duty truck market is expanding steadily, driven by increasing demand for regional freight transportation, urban delivery logistics, and vocational applications such as construction and utility services. The segment’s ability to balance payload capacity with maneuverability makes it essential for last-mile and mid-range distribution networks.

The rise of e-commerce, infrastructure development, and growing emphasis on fleet modernization are further catalyzing adoption across both public and private sectors. Diesel-powered models continue to dominate, although gradual electrification is underway, especially in urban operations seeking emission reduction.

Market players are also focusing on enhanced driver comfort, telematics integration, and fuel efficiency improvements to meet evolving regulatory and operational requirements. With increasing investments in smart logistics and urban infrastructure, medium duty trucks are expected to witness consistent demand and technological innovation, positioning the market for continued long-term growth.

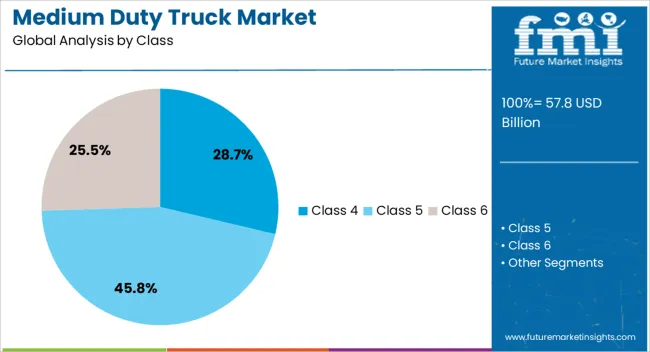

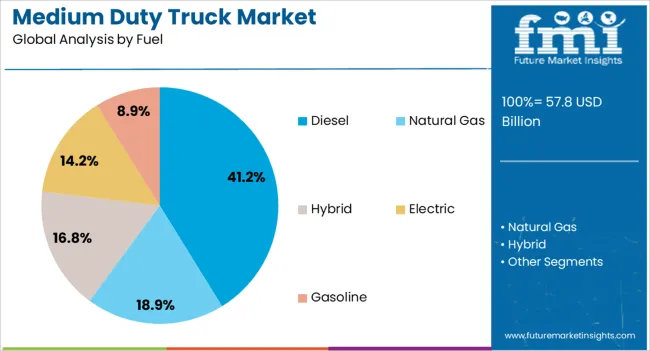

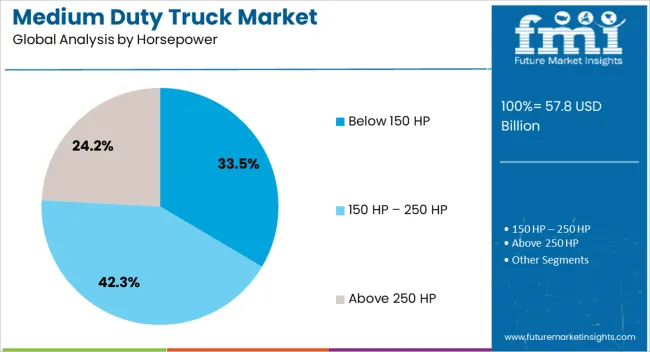

The medium duty truck market is segmented by class, fuel, horsepower, application, and geographic regions. By class, medium duty truck market is divided into Class 4, Class 5, and Class 6. In terms of fuel, medium duty truck market is classified into Diesel, Natural Gas, Hybrid, Electric, and Gasoline. Based on horsepower, medium duty truck market is segmented into Below 150 HP, 150 HP – 250 HP, and Above 250 HP.

By application, medium duty truck market is segmented into Construction & Mining, Freight & Logistics, and Others. Regionally, the medium duty truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Class 4 segment holds a significant 28.7% share in the medium duty truck market, largely due to its suitability for light-duty commercial applications requiring moderate payload capacity and fuel efficiency. This class serves a diverse set of industries including parcel delivery, food distribution, and municipal services where operational flexibility and ease of navigation in urban settings are critical.

The segment has gained traction as fleet operators seek right-sized vehicles that minimize total cost of ownership while meeting payload demands. Manufacturers continue to enhance Class 4 offerings with advanced safety features, ergonomic cabin designs, and connectivity solutions to appeal to logistics operators and owner-operators alike.

Additionally, government incentives and emissions regulations are prompting interest in lower-emission Class 4 models, further reinforcing their relevance in modern fleets. The segment’s versatility and alignment with urban distribution needs are expected to sustain its strong position in the market.

Diesel-powered trucks lead the fuel category with a commanding 41.2% market share, reflecting their long-standing dominance in the medium duty truck segment. Diesel engines are preferred for their high torque output, fuel economy, and durability, making them suitable for demanding applications across long hours and varying terrain.

This segment continues to benefit from technological advancements that have improved emissions performance and compliance with stricter environmental regulations. Fleet managers favor diesel models for their proven reliability, widespread service infrastructure, and resale value, especially in regions where alternative fuel infrastructure remains underdeveloped.

While electric and hybrid variants are gaining attention, the diesel segment remains resilient due to its cost-effectiveness and compatibility with existing fleet operations. Continued enhancements in fuel injection systems and exhaust aftertreatment technologies are expected to sustain diesel’s market relevance in the near to medium term.

The below 150 HP segment comprises 33.5% of the medium duty truck market, representing a preferred choice for urban and light-load operations where high torque and horsepower are not critical. Trucks in this category are often used for deliveries, service jobs, and short-haul tasks that require agility, lower operating costs, and easier licensing requirements.

The segment has attracted attention due to its alignment with emerging low-emission zones and urban traffic restrictions, where smaller, more efficient engines are advantageous. Additionally, fleet operators value these trucks for their affordability, simplified maintenance, and fuel efficiency, particularly in congested metropolitan areas.

OEMs are increasingly offering lightweight, technology-equipped models in this horsepower range to meet evolving regulatory norms and customer expectations. As cities continue to implement green transportation policies and support compact utility vehicles, the below 150 HP segment is well-positioned to maintain its growth within the broader market.

Medium duty trucks, typically ranging from 6,000 to 26,000 pounds in gross vehicle weight, are critical for businesses engaged in local deliveries, construction, and services like utilities. Market growth is being driven by increased e-commerce activity, the need for last-mile delivery solutions, and the recovery of the construction sector. Challenges such as rising fuel prices, regulatory pressures regarding emissions, and fluctuating raw material costs for manufacturing can impact market dynamics. Opportunities lie in the development of electric and fuel-efficient trucks, technological advancements in autonomous driving, and expansion into emerging markets where demand for medium-duty vehicles is growing.

The growing demand for efficient urban logistics and last-mile delivery solutions is a significant driver of the medium duty truck market. With the rise of e-commerce and changing consumer purchasing habits, there is an increasing need for reliable transportation to fulfill local deliveries quickly and efficiently. Medium duty trucks are ideal for navigating city streets, making them the preferred choice for many logistics providers. Additionally, the recovery of the construction industry is boosting demand for these trucks in material transport, further increasing market growth. As cities grow and logistics become more complex, the need for adaptable and efficient medium-duty trucks will continue to rise.

The medium duty truck market faces constraints related to rising fuel costs, raw material prices, and regulatory pressures, especially around emissions standards. Manufacturers must navigate complex regulations related to fuel efficiency and emissions control, particularly as countries tighten standards to meet environmental goals. These regulations can increase manufacturing costs as companies invest in cleaner technologies and compliance efforts. Additionally, fluctuating raw material prices, such as steel and aluminum, can affect the cost of production. On the technical side, the development of more fuel-efficient engines and advanced safety features requires significant investment in research and development. These factors combine to present challenges for manufacturers in maintaining cost competitiveness while complying with regulations.

The medium duty truck market is experiencing significant opportunities in the development of electric vehicles (EVs) and technological advancements. As governments and businesses seek to reduce carbon footprints, electric medium duty trucks are gaining traction. These trucks provide operational cost savings, especially in urban environments where fuel consumption and emissions are a concern. Additionally, technological advancements, such as autonomous driving features and telematics systems for fleet management, are driving market growth. Fleet owners are looking for trucks that offer improved fuel efficiency, better load management, and predictive maintenance capabilities. Companies focusing on these innovations are well-positioned to capture demand in an evolving market where technology plays a crucial role in operational efficiency.

The medium duty truck market is witnessing a shift toward fleet electrification and autonomous driving technology. As governments continue to impose stricter environmental standards and fleet operators look to reduce operational costs, there is a growing trend toward electric trucks for urban deliveries and regional transportation. Additionally, advancements in autonomous driving technologies are starting to impact the medium-duty truck segment. Self-driving vehicles, when combined with telematics and fleet management systems, are expected to enhance operational efficiency, reduce labor costs, and improve safety. As both electric and autonomous vehicles become more commercially viable, the medium duty truck market is set to evolve with a focus on reducing carbon emissions and improving delivery logistics.

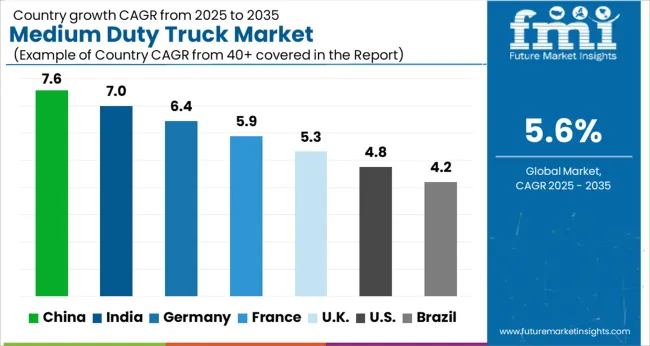

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global medium-duty truck market is growing at a CAGR of 5.6% from 2025 to 2035. China leads the market with a growth rate of 7.6%, followed by India at 7.0% and France at 5.9%. The UK and USA show more moderate growth rates of 5.3% and 4.8%, respectively. The market is largely driven by the booming logistics, retail, and construction sectors, coupled with increasing demand for cleaner, more efficient vehicles. The push for smart transportation infrastructure and regulatory incentives for low-emission trucks further strengthens market growth. The analysis includes over 40+ countries, with the leading markets detailed below.

The medium-duty truck market in China is set to grow at a CAGR of 7.6% from 2025 to 2035. The country’s rapid industrialization, coupled with the ongoing expansion of e-commerce and logistics networks, is driving the demand for medium-duty trucks. China’s bustling construction sector, along with the need for goods transportation across vast urban and rural areas, continues to push the market for these trucks. The rise of online retail and last-mile delivery services also boosts the need for versatile and efficient medium-duty trucks. With the development of smart logistics systems and urban mobility, the medium-duty truck market is expected to see increased adoption. Government policies aimed at enhancing freight efficiency and regulating emissions are also influencing the demand for cleaner, more fuel-efficient trucks.

The medium-duty truck market in India is projected to grow at a CAGR of 7.0% from 2025 to 2035. As the country’s economy continues to grow, the demand for trucks used in industrial, construction, and goods transportation is increasing. India’s rapidly expanding infrastructure projects, such as roads, railways, and airports, are significant drivers of medium-duty truck demand. The growing e-commerce and retail sectors also contribute to the demand for reliable and efficient trucks capable of handling both urban and rural deliveries. Additionally, the increasing adoption of medium-duty trucks in the agriculture and logistics sectors further supports the market growth. Indian businesses are increasingly looking for trucks that offer better fuel efficiency, load-carrying capacity, and durability to meet growing consumer demands. The push for cleaner, greener vehicles is also expected to drive the adoption of electric and hybrid medium-duty trucks in the country.

The medium-duty truck market in France is expected to grow at a CAGR of 5.9% from 2025 to 2035. The market is driven by the growing demand for efficient freight transportation within the country, especially in urban areas. With the rising need for clean and efficient logistics, medium-duty trucks are seen as ideal solutions for city deliveries, as they offer a balance between load capacity and fuel efficiency. Additionally, France’s focus on improving its transportation infrastructure, such as highways and ports, creates a positive environment for medium-duty truck adoption. The country’s logistics sector, which plays a critical role in the movement of goods across Europe, is another major driver of demand. Furthermore, France’s regulatory push for cleaner emissions is encouraging the adoption of electric and hybrid medium-duty trucks.

The UK medium-duty truck market is projected to grow at a CAGR of 5.3% from 2025 to 2035. The demand for medium-duty trucks is primarily driven by the logistics, construction, and retail sectors, where these vehicles play a crucial role in transporting goods. The UK government’s initiatives to improve freight transport efficiency, reduce emissions, and develop smart infrastructure are expected to further stimulate market growth. The rise of e-commerce and the need for faster, more reliable delivery services are pushing the demand for medium-duty trucks that can handle last-mile delivery efficiently. The UK is also seeing a shift towards electric vehicles, and medium-duty trucks are a significant part of this transition.

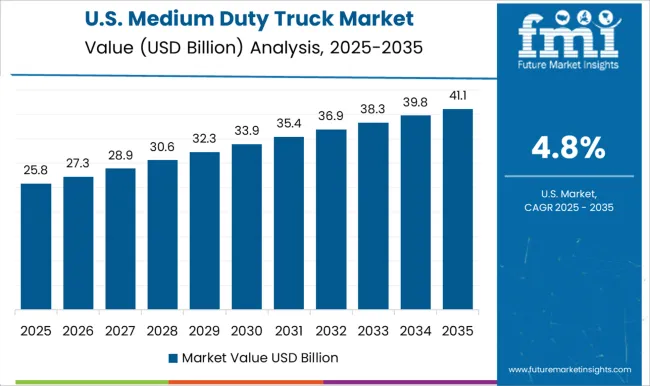

The USA medium-duty truck market is expected to grow at a CAGR of 4.8% from 2025 to 2035. The market is driven by the expansion of the transportation and logistics sectors, particularly in urban and suburban areas. Medium-duty trucks are essential for last-mile deliveries, and as e-commerce continues to grow, these trucks are expected to play an increasingly vital role. The USA also sees a steady rise in construction and infrastructure projects, requiring efficient transportation solutions for materials and equipment. Moreover, rising concerns about emissions and fuel efficiency are driving demand for eco-friendly medium-duty trucks, including electric and hybrid models.

The medium-duty truck market is characterized by intense competition among leading manufacturers who differentiate themselves through innovation, pricing, and market coverage. Ashok Leyland Limited remains a prominent player, leveraging its strong presence in the Indian market with a wide range of medium-duty trucks known for reliability and cost-effectiveness. BharatBenz competes by offering technologically advanced trucks that combine performance with fuel efficiency, catering to both domestic and international markets. Eicher Motor Limited is positioned as a strong player in the mid-range segment, offering trucks that balance performance with affordability, especially suited for emerging markets. Global giants like Ford Motor Company and General Motors target medium-duty truck sales through their robust distribution networks, with a focus on North America and other high-demand regions. Ford’s trucks are known for performance and durability, while General Motors emphasizes fuel-efficient solutions and high-tech features. Hino Motors, Ltd. and ISUZU MOTORS are key competitors in Asia, offering durable trucks designed for logistics, construction, and other heavy-duty applications.

Hino is known for its focus on quality and fuel efficiency, while Isuzu excels with its lightweight, fuel-efficient trucks suitable for urban delivery. Mercedes-Benz Group AG focuses on premium medium-duty trucks that cater to the high-end commercial vehicle market, offering advanced safety features, technology, and luxury interiors. PACCAR Inc., with its brands Kenworth and Peterbilt, is well-known for offering heavy-duty trucks with robust engines and customizable options. Tata Motors Limited leads in India with an extensive range of medium-duty trucks that serve various sectors, from transport to construction. Traton Group, with its Volkswagen and Scania brands, emphasizes innovation, automation, and sustainability, making strides in electric and hybrid vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 57.8 Billion |

| Class | Class 4, Class 5, and Class 6 |

| Fuel | Diesel, Natural Gas, Hybrid, Electric, and Gasoline |

| Horsepower | Below 150 HP, 150 HP – 250 HP, and Above 250 HP |

| Application | Construction & Mining, Freight & Logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashok Leyland Limited, BharatBenz, Eicher Motor Limited, Ford Motor Company, General Motors, Hino Motors, Ltd., ISUZU MOTORS, Mercedes-Benz Group AG, PACCAR Inc, Tata Motors Limited, and Traton Group |

| Additional Attributes | Dollar sales by product type (rigid trucks, tractor trucks, refrigerated trucks), engine capacity (under 6L, 6L-8L, above 8L), and application (logistics, construction, distribution, agricultural). Demand dynamics are influenced by the growing adoption of e-commerce, urbanization, and infrastructure development. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing adoption of electric and fuel-efficient trucks, as well as government incentives for sustainable transport solutions. |

The global medium duty truck market is estimated to be valued at USD 57.8 billion in 2025.

The market size for the medium duty truck market is projected to reach USD 99.6 billion by 2035.

The medium duty truck market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in medium duty truck market are class 4, class 5 and class 6.

In terms of fuel, diesel segment to command 41.2% share in the medium duty truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA