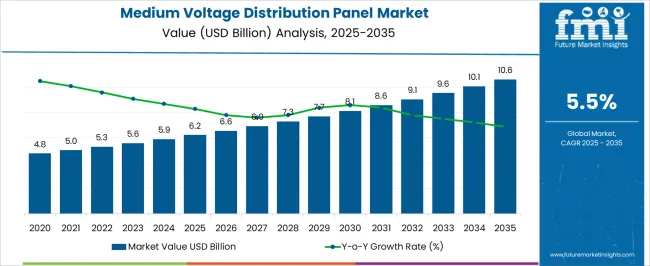

The medium voltage distribution panel market is projected to reach USD 6.2 billion in 2025 and further expand to USD 10.6 billion by 2035, reflecting a steady CAGR of 5.5% over the forecast period. Growth in this market demonstrates an acceleration pattern during the mid-term, where the global demand begins to outpace earlier trends due to rising electrification projects, modernization of utility grids, and industrial automation.

The early years between 2025 and 2029 showcase a modest climb from USD 6.2 billion to around USD 7.3 billion, as emerging economies strengthen infrastructure investments and renewable energy integration picks up. The pace intensifies between 2030 and 2035, where deceleration risks such as cost pressures and raw material constraints appear but are countered by heightened adoption in data centers, manufacturing hubs, and smart city projects.

Anticipated drivers also include the replacement cycle of outdated electrical panels across Europe and North America, alongside robust new installations in the Asia-Pacific region. Government policies on grid stability, coupled with private investment in industrial parks and urban energy systems, sustain a long-term momentum. By 2035, the market is anticipated to demonstrate maturity, though continued adoption in green energy integration and digital monitoring panels will prevent stagnation. The growth trajectory reflects a balanced acceleration phase mid-term with slight deceleration towards maturity.

| Metric | Value |

|---|---|

| Medium Voltage Distribution Panel Market Estimated Value in (2025 E) | USD 6.2 billion |

| Medium Voltage Distribution Panel Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The medium voltage distribution panel market is shaped by multiple interconnected parent industries, each driving adoption and revenue differently. The power generation and utility sector holds the largest share at 38%, as distribution panels are essential in managing load distribution, ensuring grid stability, and integrating renewable power sources such as solar and wind into national grids. The industrial manufacturing market contributes 27%, where rising automation, process optimization, and the expansion of heavy industries such as steel, cement, and chemicals create sustained demand for reliable medium voltage panels. The commercial infrastructure segment accounts for 18%, supported by the growth of smart buildings, office complexes, hospitals, and retail spaces that require advanced power distribution and monitoring systems.

The data center and ICT infrastructure market holds 10%, fueled by rising global digitalization, cloud computing, and 5G rollouts, all of which need uninterrupted and efficient power distribution solutions. Finally, the transportation and public infrastructure market represents 7%, with adoption in airports, metro systems, and large-scale urban projects where reliable electrical panels ensure operational efficiency. Utilities, industrial, and commercial infrastructure account for more than 80% of total demand, reflecting that power stability, manufacturing growth, and modern urban facilities remain the core pillars of market expansion globally.

Increasing investments in power distribution networks, coupled with the integration of automation and monitoring technologies, have enhanced the operational efficiency of these panels, ensuring their relevance in both developed and emerging markets.

Regulatory emphasis on safety standards, energy efficiency, and sustainable operations has influenced product designs and manufacturing practices, prompting vendors to adopt advanced materials and optimized layouts. Supply chain stability and rising construction activities are further reinforcing market momentum.

Industrialization in emerging economies, coupled with the refurbishment of outdated electrical systems in developed regions, is creating a balanced growth trajectory. Over the forecast period, the market is expected to benefit from rising adoption in renewable energy integration projects, infrastructure upgrades, and the shift toward smart grid solutions, thereby ensuring steady revenue expansion and increased technological sophistication.

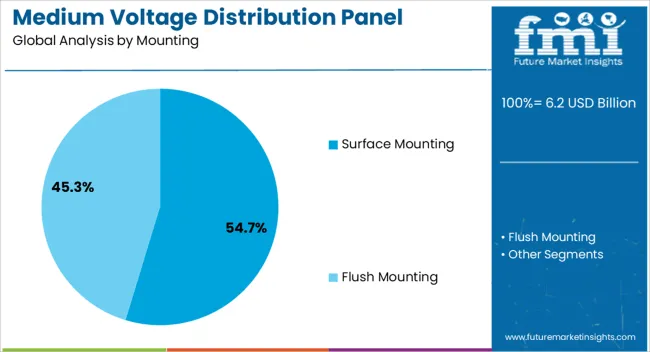

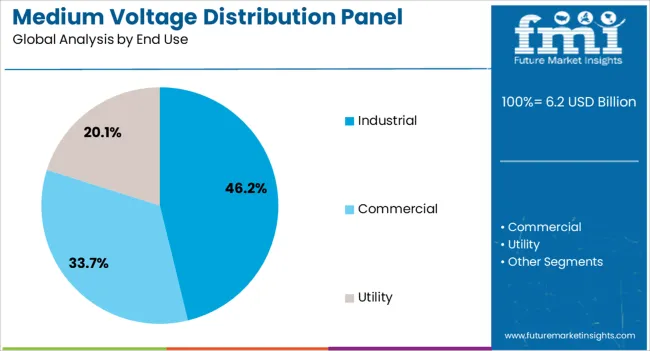

The medium voltage distribution panel market is segmented by mounting, end use, and geographic regions. By mounting, medium voltage distribution panel market is divided into Surface Mounting and Flush Mounting. In terms of end use, medium voltage distribution panel market is classified into Industrial, Commercial, and Utility. Regionally, the medium voltage distribution panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surface mounting segment, accounting for 54.7% of the mounting category, has retained its leading position due to its ease of installation, cost-effectiveness, and suitability for diverse industrial and commercial applications. Its adoption has been favored by simplified assembly processes and reduced installation time, which lowers overall project costs.

Enhanced accessibility for maintenance and upgrades has further increased its preference among contractors and facility managers. Demand stability is also supported by compatibility with a wide range of panel configurations and the ability to integrate additional features without extensive structural modifications.

Technological advancements in enclosure materials and thermal management have improved safety and operational efficiency, reinforcing its competitiveness. The segment’s strong share is expected to be maintained through continued demand from both new installations and retrofitting projects, especially in industrial zones and infrastructure developments where surface mounting offers practical and economical deployment.

The industrial segment, holding 46.2% of the end-use category, continues to dominate owing to the sector’s high reliance on medium voltage panels for uninterrupted power distribution in manufacturing, processing, and heavy-duty operations. This share has been sustained by rapid industrialization, particularly in emerging economies, where large-scale production facilities require robust electrical distribution infrastructure.

Energy-intensive industries such as steel, cement, and chemicals have been key drivers, supported by government-led infrastructure development and foreign direct investment inflows. The segment benefits from established maintenance protocols, ensuring long service life and operational reliability of the panels.

Technological upgrades, including the integration of digital monitoring and fault detection systems, have further improved efficiency and reduced downtime risks. With ongoing expansion in industrial capacity, coupled with the replacement of outdated systems to meet modern safety and efficiency standards, the industrial segment is projected to maintain its leading position throughout the forecast period.

Medium voltage distribution panel demand is strongly driven by infrastructure upgrades, industrial manufacturing, commercial construction, and data center growth. Collectively, these sectors highlight the rising need for reliable, efficient, and future-ready power distribution solutions worldwide.

Growing investments significantly influence the medium voltage distribution panel market in energy infrastructure across developing and developed economies. Governments and private players are upgrading power distribution networks to reduce transmission losses, improve efficiency, and ensure a reliable electricity supply. Rapid industrial growth and urban construction projects are creating consistent demand for modernized panels with higher load-handling capacities. The transition toward renewable energy integration requires advanced distribution systems capable of managing variable power sources. Countries in the Asia-Pacific and the Middle East are leading in large-scale utility expansions, which strongly boost adoption. This trend reflects how energy infrastructure upgrades directly correlate with higher medium voltage distribution panel installations globally.

Industrial manufacturing continues to play a dominant role in shaping the medium voltage distribution panel market, as heavy industries rely heavily on stable electricity flow. Sectors such as steel, chemicals, oil and gas, cement, and automotive demand highly reliable panels to avoid downtime and operational inefficiencies. Manufacturing hubs in the Asia-Pacific, supported by low-cost production and government incentives, are contributing significantly to panel adoption. Increasing automation within industrial processes creates demand for panels with advanced monitoring and control features. As global manufacturing activity expands, particularly in emerging economies, medium voltage distribution panels are positioned as vital equipment to ensure energy reliability, reduce disruptions, and optimize plant operations efficiently.

Commercial spaces such as malls, office complexes, educational institutions, hospitals, and hotels are major contributors to the medium voltage distribution panel market. The rising demand for energy-efficient and uninterrupted power distribution in these facilities drives large-scale adoption of advanced panel solutions. With the ongoing rise in smart building projects, there is a greater requirement for panels that support energy monitoring, safety compliance, and seamless integration with facility management systems. Hospitals and healthcare infrastructure, in particular, demand high-reliability panels due to the critical nature of medical operations. This commercial infrastructure growth, combined with steady investments in institutional development, strengthens long-term opportunities for manufacturers of medium voltage distribution panels.

The increasing penetration of cloud computing, artificial intelligence, and digital services is fueling the construction of large-scale data centers worldwide. These facilities require a continuous, high-quality electricity supply, making medium voltage distribution panels critical for smooth operations. Demand is rising in North America, Europe, and Asia-Pacific, where hyperscale data centers are expanding rapidly. The rollout of 5G networks further accelerates the need for efficient ICT infrastructure supported by advanced electrical panels. With downtime in data centers carrying immense financial implications, reliability and capacity are top priorities. As digital economies grow globally, the data center sector represents one of the most promising demand drivers for the medium voltage distribution panel market.

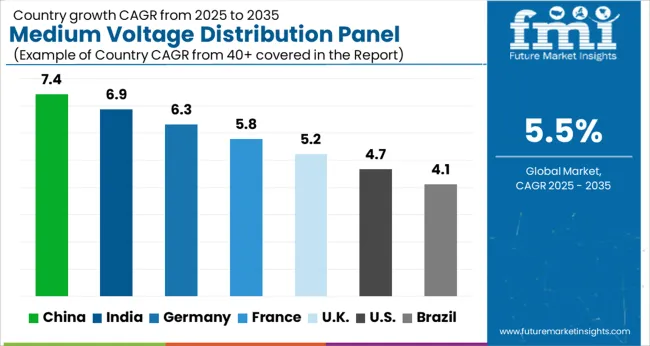

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

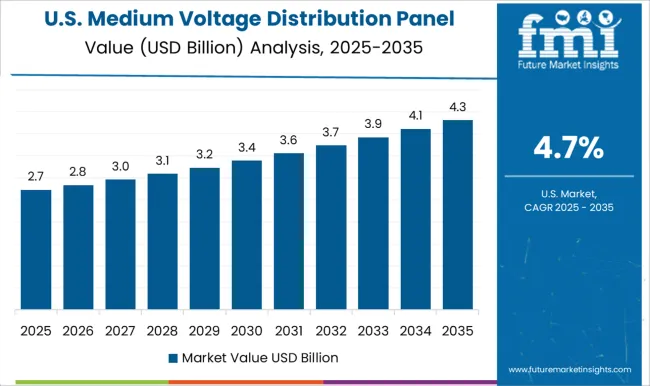

| USA | 4.7% |

| Brazil | 4.1% |

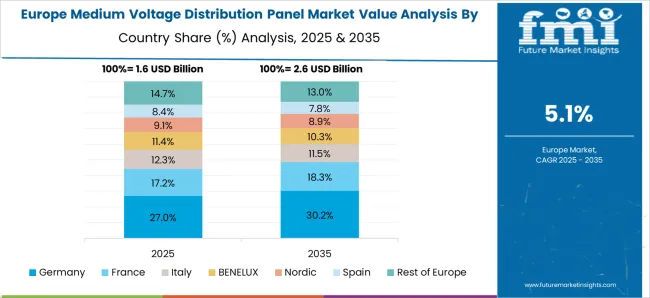

The global medium voltage distribution panel market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads expansion at 7.4%, followed by India at 6.9%, Germany at 6.3%, the UK at 5.2%, and the USA at 4.7%. Growth is fueled by rising electricity demand, industrial manufacturing expansion, and large-scale infrastructure projects requiring efficient and reliable distribution systems. China and India are witnessing rapid adoption due to power sector reforms, renewable energy integration, and urban construction growth. Germany and the UK emphasize modernization of aging grids and compliance with advanced safety standards, while the USA focuses on upgrading panels for data centers, commercial facilities, and industrial automation. The analysis spans over 40+ countries, with the leading markets shown below.

The medium voltage distribution panel market in China is projected to expand at a CAGR of 7.4% from 2025 to 2035, driven by rapid industrialization, large-scale infrastructure projects, and power grid modernization initiatives. Growing investments in renewable energy integration and smart grid development are significantly contributing to adoption. Domestic manufacturers are scaling production capacity and introducing panels with enhanced safety, automation, and modular features. International players are collaborating with local firms to tap into China’s fast-growing industrial base and urban projects. Demand is also strong across manufacturing hubs, data centers, and high-density residential areas, ensuring steady growth momentum.

The medium voltage distribution panel market in India is expected to grow at a CAGR of 6.9% from 2025 to 2035, supported by power sector reforms, industrial manufacturing expansion, and large-scale renewable energy projects. Increasing demand from metro rail networks, airports, and smart cities is enhancing adoption. Domestic players are focusing on cost-effective yet efficient solutions, while global manufacturers target premium segments with advanced safety and monitoring features. Government initiatives such as Make in India and rising FDI inflows in the energy sector are further fueling market penetration. The rapid electrification of rural and semi-urban areas also creates significant growth opportunities across utilities and infrastructure.

The medium voltage distribution panel market in Germany is forecasted to expand at a CAGR of 6.3% between 2025 and 2035, driven by grid modernization, renewable energy integration, and industrial automation. Germany’s energy transition policy is accelerating demand for reliable and efficient distribution systems across utilities and commercial facilities. The automotive and manufacturing sectors are investing in advanced electrical infrastructure to support electrification and automation goals. Manufacturers emphasize safety, compact design, and digital monitoring solutions. Strong regulations and compliance with EU energy efficiency standards ensure steady adoption, while government funding for renewable expansion and energy-efficient grids provides an additional boost.

The medium voltage distribution panel market in the UK is expected to grow at a CAGR of 5.2% from 2025 to 2035, supported by grid upgrades, industrial expansion, and rising energy efficiency initiatives. Investments in data centers, commercial complexes, and modern residential infrastructure are driving demand. The UK’s push toward renewable energy integration, particularly offshore wind projects, further enhances market prospects. Domestic and global manufacturers are aligning with government policies promoting energy efficiency and safety compliance. Adoption is also rising in the transportation sector, with growing demand from electrified rail networks and EV charging infrastructure. Compact, modular, and smart-ready panels are becoming preferred solutions in both commercial and industrial settings.

The medium voltage distribution panel market in the USA is projected to expand at a CAGR of 4.7% from 2025 to 2035, influenced by modernization of aging power infrastructure, rising demand from data centers, and industrial automation. Increasing investments in renewable energy projects, especially solar and wind, are accelerating adoption. Domestic manufacturers focus on innovation in digital monitoring and safety compliance, while global players emphasize premium, large-scale solutions. The expansion of smart grids and the electrification of transportation, including EV infrastructure, provide additional opportunities. Supportive government initiatives and funding for infrastructure resilience further sustain market growth, making the USA a key region for technology-driven panel adoption.

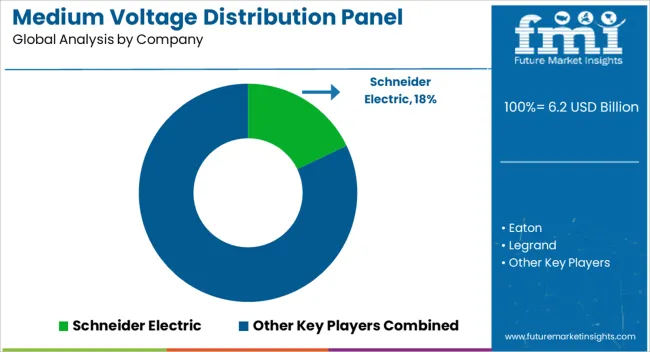

Competition in the medium voltage distribution panel market is defined by safety standards, reliability, and customization capabilities. Schneider Electric maintains leadership with broad product portfolios and strong service networks worldwide. Siemens and ABB compete closely through digital integration, modularity, and efficiency-focused solutions for utilities and industrial sectors. Eaton and Legrand emphasize energy management expertise, durable designs, and customer-focused innovation. General Electric and Larsen & Toubro Limited strengthen competitiveness with large-scale infrastructure deployments and localized manufacturing strengths. Hager Group and Alfanar Group bring region-specific adaptability, focusing on cost-efficiency and compliance with diverse regulatory standards.

Niche players like NHP, INDUSTRIAL ELECTRIC MFG, and ESL POWER SYSTEMS, INC., cater to specialized requirements, reinforcing a highly fragmented competitive structure. Strategies emphasize scalability, advanced monitoring, and lifecycle services. Manufacturers highlight intelligent panels capable of predictive maintenance, remote monitoring, and fault detection to enhance efficiency and uptime. Portfolio expansions target industries such as utilities, oil & gas, and commercial infrastructure, aligning with rising electrification trends.

Partnerships with EPC contractors and governments strengthen long-term projects, while after-sales services and maintenance packages ensure recurring revenue. Marketing focuses on safety certifications, installation ease, and adaptability to smart grid networks. Regional players like Ags, Meba Electric Co., Ltd, and Norelco emphasize affordability and compliance, competing through localized service delivery and customer trust. Product brochures in this segment are highly technical and specification-driven. Key details include rated voltage, current capacity, insulation types, fault tolerance, and compliance with IEC/ANSI standards.

Modular designs, compact footprints, and compatibility with renewable energy systems are highlighted. Manufacturers provide detailed diagrams, installation guides, and lifecycle support instructions. Safety features such as arc fault containment, grounded enclosures, and protective relays are emphasized to instill trust among utility providers and industries. Customization options, retrofitting compatibility, and digital integration tools like SCADA connectivity are presented to differentiate offerings in competitive tenders. The market remains dynamic as global electrification, infrastructure development, and grid modernization projects expand. Competitive strategies are shifting toward digital ecosystems, customer training, and long-term reliability assurances. Key players position themselves by offering both high-end smart solutions and cost-effective standard panels to address different customer segments. The balance between global giants and specialized regional manufacturers ensures a competitive yet collaborative environment. Partnerships, R&D investments, and government tie-ups are crucial to securing major contracts in utilities and industrial applications, making the market highly opportunistic for players across the value chain.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Mounting | Surface Mounting and Flush Mounting |

| End Use | Industrial, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Eaton, Legrand, Siemens, ABB, General Electric, Larsen & Toubro Limited, NHP, INDUSTRIAL ELECTRIC MFG, ESL POWER SYSTEMS, INC., Hager Group, Ags, Meba Electric Co., Ltd, Norelco, EAMFCO, and alfanar Group |

| Additional Attributes | Dollar sales, regional demand patterns, competitor share, regulatory frameworks, pricing benchmarks, growth drivers, and customer preferences shaping adoption trends. |

The global medium voltage distribution panel market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the medium voltage distribution panel market is projected to reach USD 10.6 billion by 2035.

The medium voltage distribution panel market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in medium voltage distribution panel market are surface mounting and flush mounting.

In terms of end use, industrial segment to command 46.2% share in the medium voltage distribution panel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium Carbon Steel Market

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA