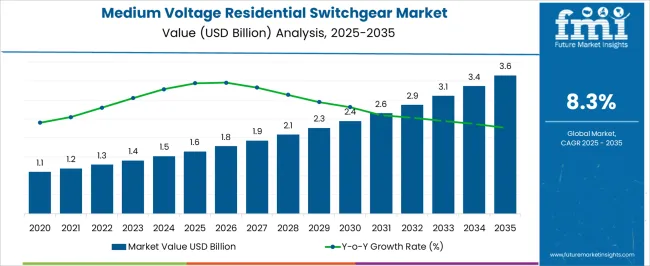

The medium voltage residential switchgear market, valued at USD 1.6 billion in 2025 and projected to reach USD 3.6 billion by 2035 with a CAGR of 8.3%, is shaped by the contribution of multiple technologies that address safety, efficiency, and reliability in residential power systems. Traditional air-insulated switchgear (AIS) continues to play a role due to cost efficiency and established adoption, yet its growth contribution is expected to remain moderate as the market increasingly transitions to advanced solutions.

Gas-insulated switchgear (GIS) contributes significantly to market expansion because of its compact design, higher safety margins, and suitability for dense residential setups. Its rising share in the value chain is driven by the growing need for space optimization and reduced maintenance. Vacuum switchgear is another key contributor, valued for its arc-extinguishing capability and longer lifecycle, which aligns with efficiency-driven residential demand. Hybrid technologies combining gas and vacuum insulation are emerging as complementary solutions, enabling cost balance while ensuring performance and safety.

Digital switchgear technologies are expected to accelerate growth contribution by enabling real-time monitoring, fault detection, and integration with smart grid networks. Their role is forecast to rise considerably within the adoption curve, especially in advanced economies. The GIS and digital switchgear are anticipated to lead the contribution mix toward the forecasted USD 3.6 billion market size by 2035.

| Metric | Value |

|---|---|

| Medium Voltage Residential Switchgear Market Estimated Value in (2025 E) | USD 1.6 billion |

| Medium Voltage Residential Switchgear Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The medium voltage residential switchgear market represents a niche but expanding segment within the electrical equipment and power distribution industry, emphasizing safety, reliability, and efficient energy delivery. Within the overall switchgear market, it accounts for about 3.9%, driven by growing residential demand for stable medium voltage distribution. In the residential electrical equipment sector, it holds nearly 4.5%, reflecting its role in ensuring safe power supply in high-rise housing and gated communities. Across the power distribution and grid infrastructure market, the segment captures 3.2%, supporting integration of renewable energy and distributed generation. Within the smart home and automation-driven energy management category, it represents 2.8%, highlighting digital monitoring and control integration. In the electrical safety and protection equipment sector, it secures 3.4%, emphasizing fault detection, arc prevention, and load management. Recent developments in this market have focused on compact designs, intelligent monitoring, and renewable compatibility. Innovations include modular switchgear with embedded IoT sensors for predictive maintenance and real-time diagnostics. Key players are introducing arc-resistant and eco-efficient gas-insulated designs to enhance safety and environmental compliance. Integration with smart meters and home automation platforms is gaining momentum, allowing energy optimization and improved reliability. The hybrid solutions combining medium voltage switchgear with battery storage and solar integration are being developed for residential microgrids. These trends demonstrate how digitalization, safety, and sustainability are shaping the medium voltage residential switchgear market.

The medium voltage residential switchgear market is expanding steadily, supported by the rising demand for reliable and efficient power distribution systems in modern residential infrastructure. Developments in smart grid integration, renewable energy adoption, and urban housing projects have significantly influenced the uptake of advanced switchgear solutions. Industry reports and utility sector updates have highlighted that safety, operational efficiency, and compact design are key factors driving product innovation.

Government regulations mandating electrical safety compliance and energy efficiency standards have further encouraged residential developers to incorporate medium voltage switchgear in building designs. Additionally, the expansion of urban housing in developing economies, coupled with grid modernization programs in mature markets, is creating new growth opportunities.

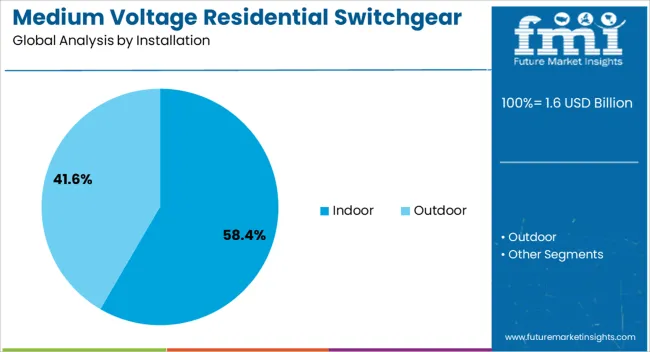

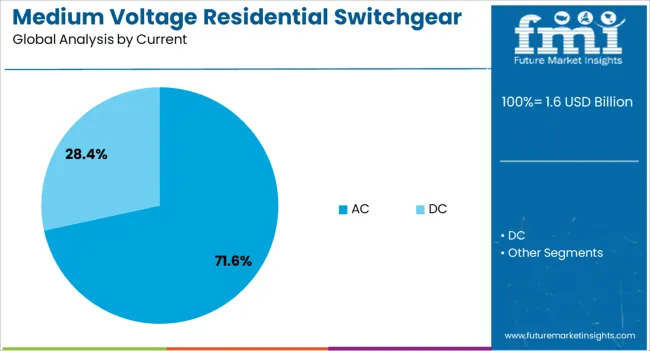

Technological advancements, such as arc-resistant enclosures and IoT-enabled monitoring, are enhancing reliability and performance, making these systems more attractive for residential applications. The market’s momentum is expected to remain strong, with growth concentrated in indoor installations and alternating current configurations due to their practicality, safety, and adaptability in residential settings.

The medium voltage residential switchgear market is segmented by installation, current, and geographic regions. By installation, medium voltage residential switchgear market is divided into Indoor and Outdoor. In terms of current, medium voltage residential switchgear market is classified into AC and DC. Regionally, the medium voltage residential switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The indoor segment is projected to account for 58.4% of the medium voltage residential switchgear market revenue in 2025, maintaining its position as the dominant installation type. This leadership is driven by the suitability of indoor installations for residential environments where space optimization, safety, and protection from environmental conditions are priorities.

Indoor switchgear systems provide a controlled environment that reduces exposure to moisture, dust, and temperature fluctuations, thereby improving operational lifespan and reliability. Residential projects, particularly in urban areas, favor indoor setups due to limited outdoor space and aesthetic considerations.

Additionally, advancements in compact and modular designs have allowed manufacturers to offer indoor systems that are easier to install, maintain, and integrate with smart home energy management systems. As residential developments increasingly focus on high safety standards and system efficiency, the demand for indoor switchgear installations is expected to remain consistently high.

The AC segment is projected to hold 71.6% of the medium voltage residential switchgear market revenue in 2025, reinforcing its dominance in current type selection. The preference for AC systems in residential applications stems from the global standardization of alternating current for power distribution, ensuring compatibility with grid supply and household electrical systems.

AC switchgear solutions are favored for their proven efficiency in transmitting power over varying distances with minimal loss, making them ideal for residential distribution networks. Utility sector analyses have indicated that AC configurations allow for cost-effective integration into existing infrastructure without significant modifications.

Furthermore, technological improvements in AC switchgear, such as enhanced insulation, better arc fault protection, and remote monitoring capabilities, have strengthened their reliability and safety. With residential power demands growing due to increased electrification of appliances and renewable energy integration, AC switchgear is expected to sustain its leadership, supported by both technical advantages and broad infrastructural compatibility.

The market has been gaining momentum as urban housing, smart residential complexes, and energy-efficient infrastructure projects demand advanced electrical distribution systems. These switchgears are essential for managing, protecting, and controlling power flow within medium voltage ranges in residential environments. Rising electricity consumption, integration of renewable energy sources, and the need for enhanced electrical safety are accelerating market adoption. Manufacturers are introducing compact, modular, and digital switchgear solutions that improve reliability and reduce operational risks. Growing emphasis on automation and remote monitoring also strengthens the role of switchgear in modern residential applications.

The market has been positively influenced by the rising demand for energy-efficient housing and modern residential infrastructure. Developers are incorporating medium voltage switchgear into apartment complexes, gated communities, and smart housing projects to ensure safe and reliable electricity distribution. These systems are designed to handle growing loads from household appliances, HVAC units, and electric vehicle charging stations. Energy-efficient housing policies introduced by governments and municipalities have created additional momentum for adoption. Furthermore, the inclusion of smart metering systems and automation technologies within residential switchgear improves monitoring capabilities and enhances consumer control over energy usage. The requirement for long-lasting and low-maintenance electrical distribution systems has positioned medium voltage residential switchgear as a vital element in the transition toward modernized housing projects globally.

Medium voltage residential switchgear plays a central role in enabling the integration of renewable and distributed energy systems. The rise of rooftop solar, community energy storage, and residential microgrids has necessitated advanced switchgear to manage bidirectional power flows. These systems ensure stability, safety, and efficient energy management when distributed generation is combined with the central grid. Smart switchgear allows seamless connection of renewables, reduces downtime during fluctuations, and enhances grid resilience. With the global shift toward clean energy sources, residential areas increasingly require switchgear that supports distributed power integration. The demand is particularly evident in regions with strong renewable adoption targets, where homeowners and developers prioritize solutions that ensure uninterrupted power supply while aligning with evolving grid modernization initiatives.

Technological advancements have fueled the adoption of smart and digital medium voltage switchgear in residential applications. Manufacturers are introducing compact, modular, and digitally enabled solutions that support remote monitoring, predictive maintenance, and enhanced fault detection. Integration with IoT platforms and building management systems allows residents and operators to optimize energy efficiency, reduce downtime, and improve safety. Digital switchgear offers enhanced connectivity features that make it easier to track performance and minimize operational risks. In addition, eco-friendly insulation technologies and arc-flash safety mechanisms are being integrated to meet modern safety standards. These innovations not only improve performance but also reduce lifecycle costs, making advanced switchgear increasingly attractive for residential developers and smart city projects worldwide.

Despite strong technological advancements, cost and awareness barriers continue to challenge the adoption of medium voltage residential switchgear. The high initial cost of installation and maintenance often deters small-scale residential projects, especially in cost-sensitive regions. Builders in emerging markets may opt for low-voltage alternatives, reducing penetration of medium voltage solutions. In addition, limited awareness about the long-term benefits of advanced switchgear, such as improved reliability, energy efficiency, and reduced operational risks, affects decision-making among developers and homeowners. Regulatory complexities and a lack of standardized guidelines in some countries further complicate market expansion. Addressing these barriers through cost optimization, educational initiatives, and region-specific product strategies will be crucial for unlocking the full growth potential of medium voltage residential switchgear globally.

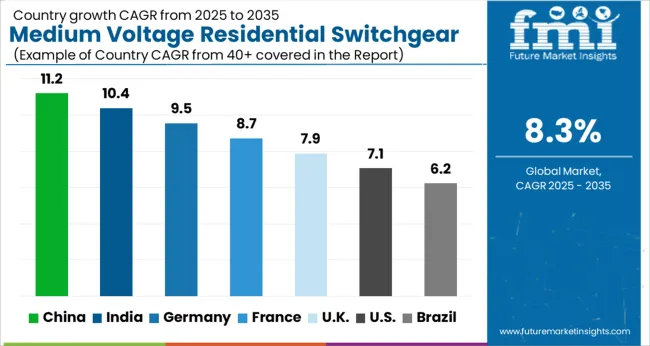

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

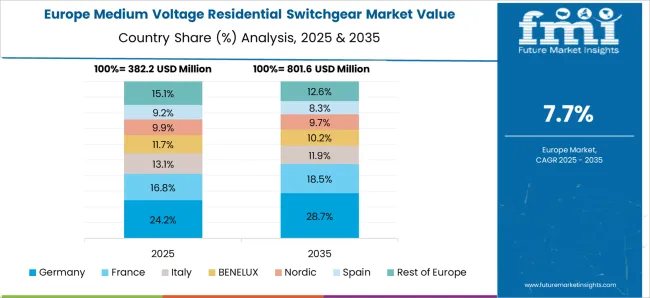

China is projected to post the highest growth of 11.2% in the market, largely influenced by expanding residential developments and rising demand for efficient electrical distribution. India, with 10.4%, benefits from extensive housing projects and government-backed electrification programs that stimulate installations. Germany achieves 9.5%, supported by a well-established electrical infrastructure and focus on integrating modern grid technologies. The United Kingdom, at 7.9%, shows progress through retrofitting activities and emphasis on safer household power systems. The United States, recording 7.1%, demonstrates steady advancement due to modernization of existing residential grids and growing energy requirements. Collectively, these nations highlight the pivotal role of switchgear in ensuring reliable and secure electricity distribution across the residential sector. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 11.2%, driven by large-scale residential development and modernization of electrical distribution systems. Expanding urban areas and government-backed housing projects have fueled steady demand for reliable switchgear solutions. Rising electricity consumption per household has encouraged adoption of advanced medium voltage systems to ensure safety and efficiency. Chinese manufacturers are focusing on cost-effective yet technologically advanced equipment to cater to both domestic and international demand. The integration of digital monitoring features is increasingly being implemented to improve performance and fault detection. With rapid smart home adoption and infrastructure upgrades, demand for switchgear in China is expected to remain robust over the next decade.

India’s market is set to grow at a CAGR of 10.4%, supported by the rapid expansion of residential construction and infrastructure modernization. Increasing household electricity demand has highlighted the need for efficient and reliable distribution systems. Government programs focusing on electrification and affordable housing have further spurred demand for switchgear in rural and semi-urban areas. Domestic manufacturers are developing products tailored to Indian grid conditions, with emphasis on safety, durability, and cost competitiveness. Technological advancements such as automated fault detection and modular designs are also gaining traction. Rising foreign investments in housing projects and urban development initiatives are expected to strengthen the adoption of medium voltage switchgear in the country.

Germany is anticipated to expand at a CAGR of 9.5%, influenced by strict quality standards and high reliance on efficient electrical distribution systems. Residential modernization and energy efficiency initiatives are driving adoption of advanced switchgear solutions. Demand is particularly strong in smart housing projects, where automation and reliability are prioritized. German manufacturers are at the forefront of developing eco-friendly switchgear with reduced energy losses and improved lifespan. The integration of renewable energy sources into residential grids further supports market growth, as homes increasingly rely on decentralized energy systems. Upgrades in existing housing infrastructure and the focus on reducing operational costs are expected to sustain steady growth.

The market in the United Kingdom is expected to register a CAGR of 7.9%, supported by growing investment in modern housing and energy infrastructure upgrades. Rising focus on safe and reliable electricity distribution has driven adoption of medium voltage switchgear in residential complexes and high-density housing projects. The shift toward green building initiatives and compliance with strict energy regulations has accelerated demand for advanced switchgear solutions. British suppliers are increasingly focusing on modular designs and smart monitoring systems that allow efficient control of power distribution. With ongoing urban renewal projects and the adoption of smart residential technologies, the United Kingdom is expected to remain a promising market for advanced switchgear systems.

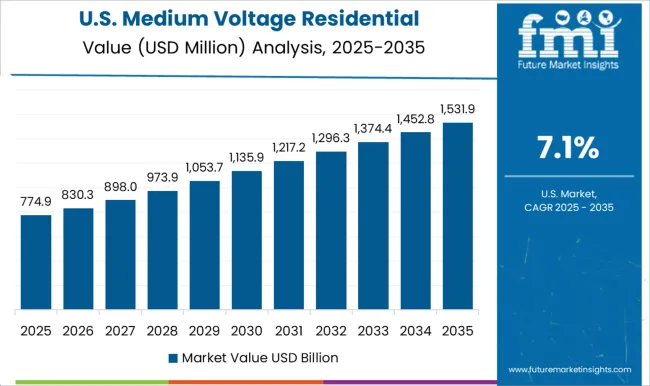

The market in the United States is forecasted to expand at a CAGR of 7.1%, supported by modernization of residential electrical infrastructure and high investment in smart housing. Growing demand for safety, energy efficiency, and digital integration has encouraged adoption of advanced switchgear across urban and suburban housing. Manufacturers are innovating with compact and modular switchgear to meet space constraints while ensuring superior performance. Rising integration of solar energy systems and home automation has further boosted the demand for reliable switchgear solutions. Federal initiatives for grid modernization and energy resilience also support long-term adoption. With a strong push for technologically advanced and sustainable housing, the United States market is expected to maintain steady growth.

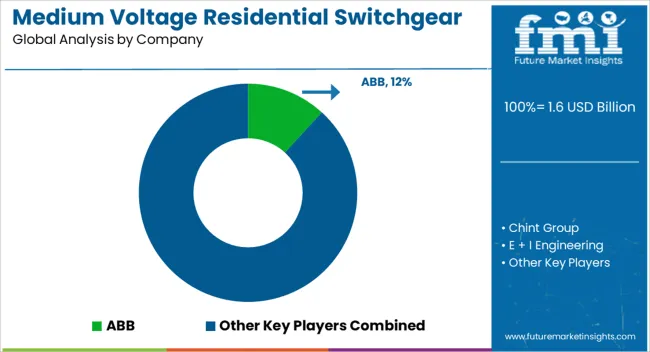

The market is gaining prominence as modern housing projects demand safer, more efficient, and intelligent electrical distribution solutions. ABB, Siemens, and Schneider Electric dominate this space with strong global portfolios, offering switchgear systems that integrate automation, monitoring, and energy efficiency. Eaton Corporation, Mitsubishi Electric, and Fuji Electric Co., Ltd. hold substantial market shares by leveraging advanced technologies for compact and reliable installations suited to residential environments. Hitachi Ltd. and Hyundai Electric & Energy Systems Co., Ltd. extend their expertise in power systems to provide adaptable solutions for urban power distribution needs.

Emerging competitors such as Chint Group and Lucy Group Ltd. are expanding their global footprint by offering cost-competitive and scalable products tailored to residential projects. Hyosung Corporation and Powell Industries strengthen their presence with custom-engineered solutions, while Regal Rexnord Corporation focuses on enhancing distribution reliability through advanced component integration. Skema S.p.A. and E+I Engineering continue to cater to niche demands, particularly in modular switchgear systems that support localized housing projects. Increasing demand for smart homes and sustainable housing has prompted players to prioritize digitalized switchgear with features like remote diagnostics and predictive maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Installation | Indoor and Outdoor |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Chint Group, E + I Engineering, Eaton Corporation, Fuji Electric Co., Ltd., Hitachi Ltd., Hyosung Corporation, Hyundai Electric & Energy Systems Co., Ltd., Lucy Group Ltd., Mitsubishi Electric Corporation, Powell Industries, Regal Rexnord Corporation, Siemens, Schneider Electric, and Skema S.p.A. |

| Additional Attributes | Dollar sales by switchgear type and capacity, demand dynamics across residential complexes, smart homes, and mixed-use developments, regional trends in medium voltage adoption, innovation in safety features, compactness, and digital monitoring, environmental impact of material usage and disposal, and emerging use cases in renewable integration, home energy management, and resilient residential power distribution. |

The global medium voltage residential switchgear market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the medium voltage residential switchgear market is projected to reach USD 3.6 billion by 2035.

The medium voltage residential switchgear market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in medium voltage residential switchgear market are indoor and outdoor.

In terms of current, ac segment to command 71.6% share in the medium voltage residential switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium Carbon Steel Market

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA