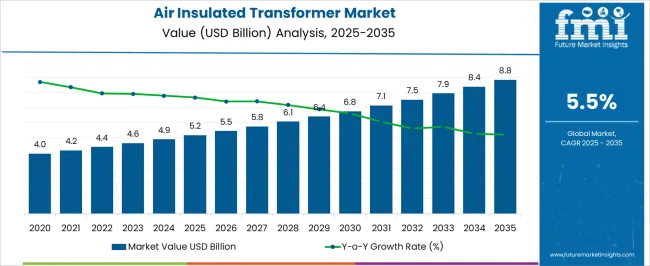

The Air Insulated Transformer Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. A rolling CAGR analysis shows consistent but moderate growth over the forecast period, with steady acceleration followed by a slight deceleration as the market matures. Between 2025 and 2030, the market grows from USD 5.2 billion to USD 7.5 billion, contributing USD 2.3 billion in growth, with a CAGR of 6.3%. This early-phase growth is driven by the increasing demand for reliable and efficient power transmission and distribution systems, particularly in emerging economies and renewable energy infrastructure projects.

Government initiatives and investments in power grid modernization further support market expansion during this phase. From 2030 to 2035, the market continues to grow from USD 7.5 billion to USD 8.8 billion, adding USD 1.3 billion in growth, with a slightly lower CAGR of 3.3%. This deceleration reflects the market reaching maturity in more developed regions, where most infrastructure upgrades and investments in air-insulated transformers have already been implemented. However, demand remains robust in developing regions as infrastructure improvements and the transition to smart grids continue. The rolling CAGR analysis indicates strong early-phase growth, followed by stable and sustained expansion as the market matures.

Insulation system design involves coordinating between primary insulation materials, turn-to-turn barriers, and phase separation requirements that must withstand electrical stress without oil immersion while maintaining thermal stability during load variations. Vacuum pressure impregnation procedures require specialized equipment and environmental controls that ensure complete resin penetration throughout winding structures while preventing voids that could initiate electrical breakdown under service conditions. Temperature rise testing becomes critical when air cooling limitations affect overload capability and require careful thermal design validation during factory acceptance procedures.

Utility distribution applications create specification challenges when air insulated transformers must provide equivalent performance to oil-filled units while accommodating space constraints, noise limitations, and environmental regulations that favor non-liquid dielectric systems. Pad-mounted installations require specialized enclosures that protect internal components from weather exposure, animal intrusion, and vandalism while maintaining accessibility for maintenance and inspection procedures. Load tap changer integration involves mechanical complexity when voltage regulation equipment must operate reliably in air-insulated environments without oil lubrication and arc suppression benefits.

Quality control procedures involve specialized testing for partial discharge activity, temperature rise verification, and insulation resistance measurements that ensure reliable operation without oil-immersed dielectric systems. Burn-in testing requires extended evaluation periods when thermal cycling validates insulation system integrity and identifies manufacturing defects that could cause premature failures. Sound level testing becomes important when air cooling fans or core magnetostriction creates noise that exceeds installation site requirements.

| Metric | Value |

|---|---|

| Air Insulated Transformer Market Estimated Value in (2025 E) | USD 5.2 billion |

| Air Insulated Transformer Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The air-insulated transformer market is gaining steady traction as industries and utilities prioritize safety, environmental sustainability, and cost-effective installation practices. Unlike oil-filled alternatives, air-insulated transformers eliminate the need for flammable insulating fluids, making them suitable for indoor applications and densely populated settings.

Rapid urbanization, particularly in developing economies, and the rising demand for safe and compact power distribution systems are contributing to market growth. Additionally, environmental regulations are driving interest in dry-type transformer solutions that support energy efficiency and low maintenance requirements.

Technological improvements in insulation materials, temperature control, and modular configurations are further enabling their deployment in both grid and non-grid applications. With increasing investments in modernizing residential and commercial power infrastructure, the outlook for air-insulated transformers remains positive.

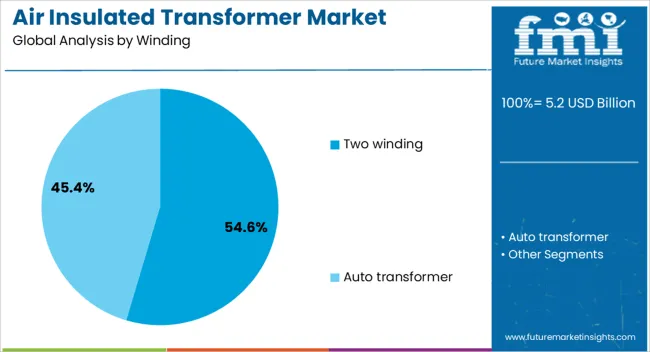

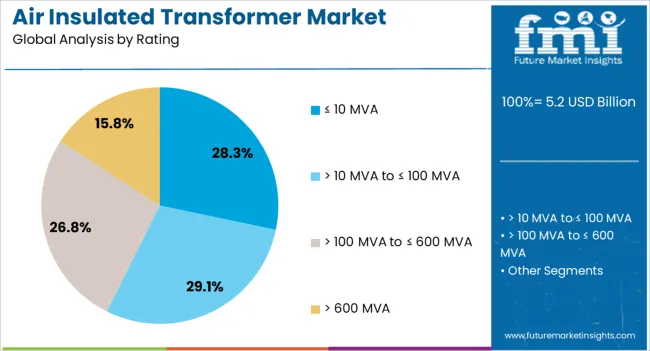

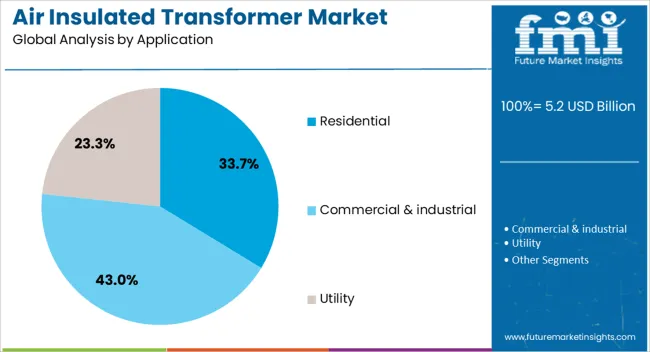

The air insulated transformer market is segmented by winding, rating, application, and geographic regions. By winding, the air insulated transformer market is divided into two-winding and Auto transformers. In terms of rating, the air insulated transformer market is classified into ≤ 10 MVA, > 10 MVA to ≤ 100 MVA, > 100 MVA to ≤ 600 MVA, and > 600 MVA. Based on application, the air insulated transformer market is segmented into Residential, Commercial & industrial, and Utility.

Regionally, the air insulated transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The two winding segment is projected to contribute 54.60% of total market revenue by 2025 within the winding category, positioning it as the leading configuration. This dominance is attributed to its straightforward design, cost efficiency, and suitability for standard voltage transformation requirements.

Two winding transformers are commonly deployed in distribution networks due to their operational simplicity, lower losses, and ease of installation. Their adoption is further reinforced in utility and commercial applications where isolation between primary and secondary windings is essential. The consistent performance and wide applicability of this configuration have made it the preferred choice across multiple end user environments, particularly in medium voltage settings.

In terms of transformer rating, the segment rated at 10 MVA or below is expected to account for 28.30% of total market revenue by 2025. This growth is driven by increasing deployment in small-scale power distribution applications, particularly in urban and residential sectors.

The compact size and low energy demand of such transformers make them ideal for localized power needs and integration within space-constrained infrastructures. Additionally, the lower capital and operational costs associated with these units make them attractive to utility providers and commercial facilities aiming to expand grid access with minimal investment. Their flexibility in indoor and outdoor installations further boosts their market relevance.

The residential application segment is projected to hold 33.70% of total revenue by 2025, making it the most significant application area. This is primarily due to rapid urbanization, rising household electrification rates, and the expansion of smart grid infrastructure.

Air insulated transformers are increasingly used in residential complexes, apartment buildings, and gated communities owing to their safety features, quiet operation, and minimal maintenance requirements. The push for greener building practices and the integration of rooftop solar systems are also contributing to their adoption. As utilities strive to deliver stable and efficient power within densely populated regions, the demand for safe and compact air insulated solutions is expected to remain strong in the residential segment.

The air insulated transformer market is expanding due to the increasing demand for energy-efficient and reliable power distribution systems. Air-insulated transformers, which use air as the insulating medium, are favored for their cost-effectiveness, ease of maintenance, and high reliability in medium to low-voltage applications. As the global power infrastructure undergoes upgrades to meet growing energy demands and improve grid stability, air-insulated transformers are gaining traction. Despite challenges like the limited use in high-voltage applications and competition from gas-insulated transformers, technological advancements continue to drive the market forward.

The growth of the air-insulated transformer market is driven by the increasing need for energy-efficient power distribution systems across residential, commercial, and industrial sectors. With a rising global population and rapid urbanization, the demand for electricity continues to surge, requiring more efficient transmission and distribution infrastructure. Air-insulated transformers offer a cost-effective solution for power distribution systems, especially in medium to low-voltage applications. Their design allows for ease of maintenance and reliable performance, making them suitable for areas with moderate climate conditions. Growing investments in renewable energy projects and the modernization of aging power grids are fueling the demand for reliable and cost-efficient transformer solutions, driving market growth.

One of the key challenges in the air-insulated transformer market is the limited application of these transformers in high-voltage systems. While air-insulated transformers are well-suited for medium to low-voltage applications, they are not ideal for high-voltage transmission due to their larger size and the potential for air-related dielectric breakdown. As a result, air-insulated transformers face competition from gas-insulated transformers (GIS), which can handle higher voltages in a more compact form. Moreover, air-insulated transformers require adequate space for proper ventilation, which can be a limitation in densely populated urban areas or areas with restricted space. Overcoming these limitations while maintaining cost-effectiveness and performance remains a challenge for manufacturers in the air-insulated transformer market.

The air-insulated transformer market presents significant opportunities driven by the expansion of power infrastructure and the growing demand for renewable energy projects. As countries invest in upgrading their electrical grids to meet the rising demand for electricity, especially in emerging markets, there is an increased need for reliable and efficient transformers. The transition towards renewable energy sources, such as wind and solar power, provides additional growth prospects, as these sources require efficient energy conversion and distribution systems. Air-insulated transformers, due to their cost-effectiveness and simplicity, are well-positioned to meet the needs of small to medium-sized renewable energy projects and decentralized power distribution systems. Manufacturers can seize these opportunities by developing innovative transformer solutions for renewable energy applications and distributed energy systems.

A key trend in the air-insulated transformer market is the technological advancements in design and efficiency. Manufacturers are focusing on developing transformers that offer improved performance and energy efficiency while reducing operational costs. Innovations in materials and design are enabling the creation of more compact, lightweight, and reliable air-insulated transformers, with enhanced dielectric properties for better performance. The integration of smart technologies, such as remote monitoring and diagnostics, is another growing trend in the market, allowing for real-time performance tracking and predictive maintenance. These advancements not only help in optimizing transformer performance but also improve their lifecycle, offering customers higher returns on investment. Additionally, the use of eco-friendly materials in manufacturing and a shift toward modular designs for easier installation are shaping the future of air-insulated transformers.

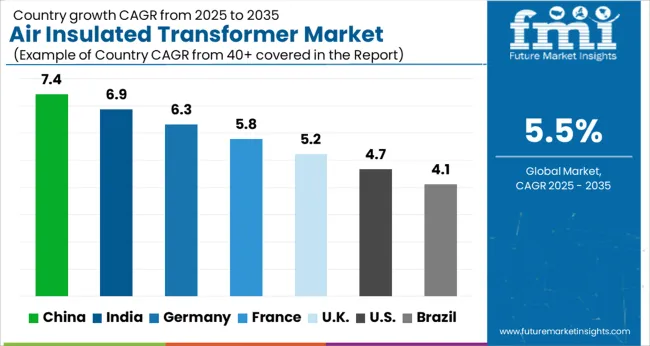

The global air insulated transformer market is projected to grow at a CAGR of 5.5% from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 7.4%, followed by India at 6.9%, and Germany at 6.3%, while the United Kingdom records 5.2% and the United States posts 4.7%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rapid industrialization and infrastructure expansion in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established infrastructure and regulatory frameworks. The analysis includes over 40+ countries, with the leading markets detailed below.

The air insulated transformer market in China is growing at a 7.4% CAGR through 2035. The country’s robust industrialization, urbanization, and rising demand for electricity are driving the adoption of air insulated transformers. China’s increasing investments in renewable energy infrastructure, coupled with the ongoing expansion of smart grids and electrical transmission networks, contribute significantly to the market growth. The government’s push to modernize electrical infrastructure, particularly in remote and rural areas, further accelerates the demand for these transformers. Additionally, the shift towards high-efficiency transformers in various sectors, including manufacturing, construction, and utilities, boosts the market.

Demand for air insulated transformer in India is projected to grow at a 6.9% CAGR through 2035. The demand for air insulated transformers is driven by the country’s expanding power distribution networks and the increasing adoption of renewable energy sources. As India works towards improving its electrical grid and enhancing power access to rural areas, the need for efficient and reliable transformers continues to grow. The rise in industrial projects and the government's focus on smart cities and infrastructure development further accelerate the market demand for air insulated transformers. The growing focus on reducing transmission and distribution losses also supports market growth.

Demand for air insulated transformers in Germany is growing at a 6.3% CAGR through 2035. Germany’s emphasis on energy efficiency and renewable energy integration is contributing to the increasing need for reliable and efficient transformers. The expansion of the electrical grid to support renewable energy sources, especially wind and solar, further drives the demand for air insulated transformers. Germany’s strong industrial base, particularly in automotive and manufacturing sectors, is also contributing to the market growth. The country’s commitment to modernizing its energy infrastructure to support green energy solutions accelerates the adoption of air insulated transformers.

The UK market for air insulated transformers is expected to grow at a 5.2% CAGR through 2035. The increasing demand for reliable energy systems, coupled with the country’s focus on transitioning to renewable energy sources, drives the adoption of air insulated transformers. The UK is heavily investing in electrical grid modernization to accommodate more decentralized renewable energy sources like solar and wind. Additionally, the ongoing expansion of energy-efficient infrastructure in the residential, industrial, and transportation sectors supports the market for air insulated transformers. The country’s regulatory framework and government incentives for green technologies further contribute to market growth.

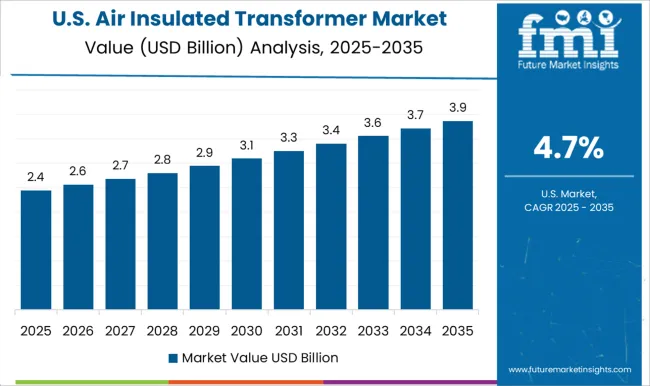

Demand for air insulated transformers in the USA is projected to grow at a 4.7% CAGR through 2035. The USA is focusing on modernizing its electrical grid to improve efficiency, support renewable energy sources, and meet increasing power demand. The growing emphasis on smart grids, energy storage, and sustainable energy solutions is driving the adoption of air insulated transformers in various sectors, including manufacturing, energy distribution, and utilities. Furthermore, the shift towards electric vehicles and the increased focus on industrial energy efficiency are contributing to the growing demand for reliable and high-performance transformers.

The Air Insulated Transformer Market is witnessing notable momentum as electrification projects, renewable integration, and industrial expansion continue to reshape global power infrastructure. Unlike their oil-filled counterparts, air-insulated transformers offer a cleaner and safer alternative, aligning with growing environmental and safety regulations. Their deployment is increasing across commercial complexes, substations, and renewable energy facilities where compact design, operational safety, and minimal fire risk are prioritized.

Hitachi Energy, Siemens Energy, and GE Vernova Grid Solutions lead global supply, leveraging digital diagnostics, AI-enabled monitoring, and modular configurations to enhance reliability and grid flexibility. Schneider Electric and Eaton are responding to smart grid initiatives with connected transformer systems that improve asset visibility and energy management efficiency. Mitsubishi Electric Corporation and Toshiba Energy Systems & Solutions Corporation emphasize low-loss materials and eco-design principles to meet global decarbonization goals.

Regional manufacturers such as Arteche, Celme, CG Power and Industrial Solutions Limited, and Elsewedy Electric are building strong domestic networks across Asia, the Middle East, and Europe. Meanwhile, Hyosung Heavy Industries, DAIHEN Corporation, and PFIFFNER Group are targeting renewable developers and utility clients with tailored high-voltage air-insulated solutions. Trench Group, IMEFY, and Kirloskar Electric Company continue to strengthen their expertise in specialized, project-driven transformer designs.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Winding | Two winding and Auto transformer |

| Rating | ≤ 10 MVA, > 10 MVA to ≤ 100 MVA, > 100 MVA to ≤ 600 MVA, and > 600 MVA |

| Application | Residential, Commercial & industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Energy, Arteche, Celme, CG Power and Industrial Solutions Limited, DAIHEN Corporation, Eaton, Elsewedy Electric, GE Vernova Grid Solutions, Hyosung Heavy Industries, IMEFY Group, Kirloskar Electric Company, Mitsubishi Electric Corporation, PFIFFNER Group, Schneider Electric, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, and Trench Group |

| Additional Attributes | Dollar sales by product type (medium-voltage, high-voltage, low-voltage) and end-use segments (power generation, industrial, commercial, utility). Demand dynamics are driven by increasing demand for energy-efficient transformers in power generation and distribution, growth in renewable energy integration, and rising infrastructure investments in emerging markets. Regional trends show strong growth in Asia-Pacific, driven by industrialization and urbanization, while North America and Europe continue to focus on smart grid integration and renewable energy projects. Innovation trends focus on improving transformer efficiency, reducing carbon emissions, and enhancing digitalization for monitoring and predictive maintenance. |

The global air insulated transformer market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the air insulated transformer market is projected to reach USD 8.8 billion by 2035.

The air insulated transformer market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in air insulated transformer market are two winding and auto transformer.

In terms of rating, ≤ 10 mva segment to command 28.3% share in the air insulated transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Two Winding Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA