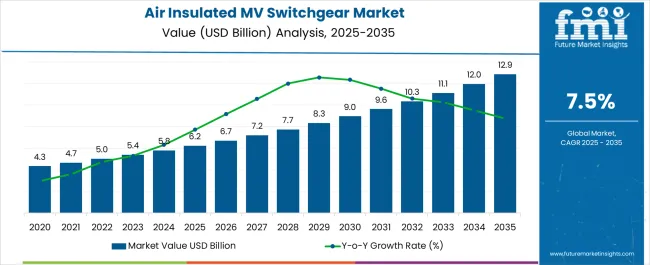

The air insulated medium voltage switchgear market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 12.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The air insulated medium voltage switchgear market is expected to witness notable value growth, expanding from USD 6.2 billion in 2025 to USD 12.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.5%. Market expansion is being driven by the rising demand for reliable electrical distribution systems across industrial, commercial, and utility sectors. Incremental revenue opportunities are being created through modernization of existing infrastructure, replacement of aging switchgear units, and adoption of compact, space-efficient solutions.

Year-on-year projections indicate steady growth, with the market anticipated to reach approximately USD 8.5 billion by 2029, highlighting the consistent pace of adoption. Throughout the forecast period, the air insulated medium voltage switchgear market is being influenced by evolving safety standards, stringent regulatory compliance, and the need for efficient operational performance. Market presence is being reinforced through strategic deployment in urban and industrial power grids, supporting uninterrupted energy transmission and distribution.

Product differentiation through enhanced insulation techniques, modular configurations, and maintenance-friendly designs is being increasingly recognized as a key factor driving demand. By 2035, the market is projected to attain a substantial footprint, with value creation largely shaped by end-user requirements for durability, operational reliability, and integration flexibility across diverse applications in power management systems.

| Metric | Value |

|---|---|

| Air Insulated Medium Voltage Switchgear Market Estimated Value in (2025 E) | USD 6.2 billion |

| Air Insulated Medium Voltage Switchgear Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The air insulated medium voltage switchgear market is estimated to hold a notable proportion within its parent markets, accounting for approximately 18-20% of the medium voltage switchgear market, around 7-8% of the electrical transformers and switchgear market, close to 6-7% of the power distribution equipment market, about 5-6% of the industrial electrical equipment market, and roughly 3-4% of the electrical substation equipment market. Collectively, the cumulative share across these parent segments is observed in the range of 39-45%, reflecting a strong presence of air insulated switchgear solutions across power distribution, industrial, and utility applications.

The market has been influenced by the widespread adoption of reliable, safe, and cost-efficient switchgear systems where operational durability, thermal performance, and ease of maintenance are highly prioritized. Adoption is guided by procurement decisions that emphasize compliance with electrical standards, compatibility with existing infrastructure, and long-term operational stability. Market participants have focused on design robustness, insulation quality, and operational reliability to ensure consistent performance in critical electrical networks. As a result, the air insulated medium voltage switchgear market has not only captured a substantial share within the medium voltage and electrical switchgear segments but has also influenced power distribution, industrial equipment, and substation domains, highlighting its strategic role in strengthening electrical network efficiency, safety, and operational control across multiple sectors.

The air insulated medium voltage switchgear market is witnessing sustained growth due to increasing investments in power infrastructure modernization, grid reliability enhancement, and renewable energy integration. Rising electricity demand across industrial, commercial, and residential sectors is driving the need for efficient medium voltage distribution systems.

Air insulated switchgear offers cost effectiveness, operational safety, and ease of maintenance, making it highly suitable for diverse installation environments. Advancements in arc fault detection, monitoring systems, and eco friendly insulation technologies are further increasing adoption.

Additionally, regulatory mandates for grid stability and energy efficiency are encouraging utilities and industries to replace outdated equipment with modern switchgear solutions. With ongoing urbanization and industrial expansion, the market outlook remains positive, supported by long term infrastructure development and sustainable power distribution initiatives.

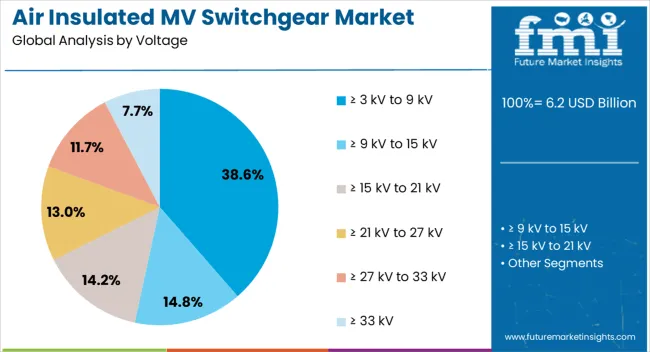

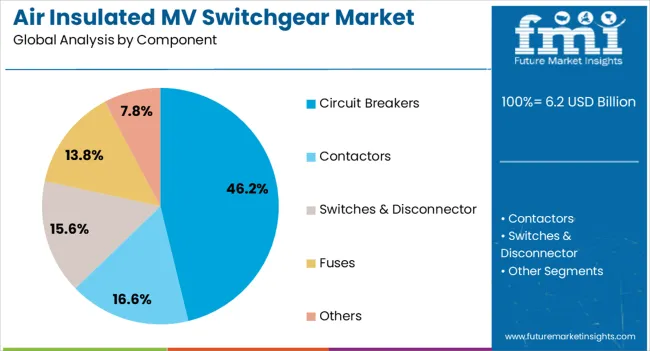

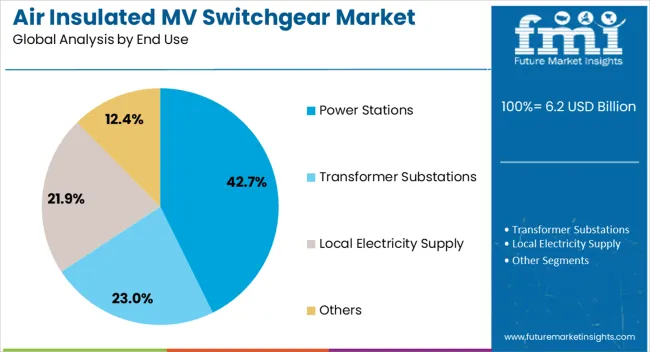

The air insulated medium voltage switchgear market is segmented by voltage, component, end use, application, and geographic regions. By voltage, air insulated medium voltage switchgear market is divided into ≥ 3 kV to 9 kV, ≥ 9 kV to 15 kV, ≥ 15 kV to 21 kV, ≥ 21 kV to 27 kV, ≥ 27 kV to 33 kV, and ≥ 33 kV. In terms of component, air insulated medium voltage switchgear market is classified into circuit breakers, contactors, switches & disconnector, fuses, and others. Based on end use, air insulated medium voltage switchgear market is segmented into power stations, transformer substations, local electricity supply, and others. By application, air insulated medium voltage switchgear market is segmented into residential, commercial, industrial, and utility. Regionally, the air insulated medium voltage switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≥ 3 kV to 9 kV voltage segment is projected to account for 38.6% of total market revenue by 2025 within the voltage category, positioning it as a leading segment. This dominance is supported by its suitability for medium scale power distribution applications in industrial plants, commercial facilities, and municipal grids.

The segment benefits from cost efficient installation and maintenance, as well as compatibility with widely used medium voltage components. Its operational flexibility and adaptability to different network configurations have further strengthened adoption, particularly in markets prioritizing reliability and energy efficiency.

As a result, this voltage range continues to be preferred in both expansion projects and grid modernization programs.

The circuit breakers segment is expected to contribute 46.2% of the total market revenue by 2025 under the component category, making it the most prominent segment. This leadership is attributed to the critical role circuit breakers play in ensuring system protection, operational safety, and fault isolation in medium voltage networks.

Enhanced performance features such as improved arc quenching, real time monitoring, and extended service life have elevated their usage.

The growing demand for reliable switching equipment in both utility and industrial applications has reinforced the position of circuit breakers as an essential component within air insulated switchgear assemblies.

The power stations segment is projected to hold 42.7% of the total market revenue by 2025 in the end use category, establishing it as the leading segment. This is driven by the increasing need for stable and efficient power distribution systems within generation facilities.

Air insulated switchgear in power stations ensures high reliability, safety, and operational efficiency, while accommodating the requirements of both conventional and renewable power plants. Investment in upgrading aging infrastructure, coupled with the expansion of power generation capacity, has further strengthened adoption.

As energy demand continues to rise, power stations remain a key driver of growth in the air insulated medium voltage switchgear market.

The biotin ingredients market is growing due to rising demand from health, beauty, and wellness sectors. Opportunities are driven by functional food and beverage fortification, while trends emphasize premium formulations and enhanced bioavailability. Challenges persist from regulatory compliance, pricing pressures, and formulation complexities. Overall, biotin ingredients are being increasingly integrated into nutraceuticals, functional foods, and personal care products, enabling improved consumer outcomes in hair, skin, and nail health, while creating new avenues for product innovation and market expansion globally.

The demand for biotin ingredients has been propelled by growing consumer focus on hair, skin, and nail health supplements. Nutraceutical manufacturers and cosmetic formulators are increasingly incorporating biotin into multivitamins, protein powders, and beauty supplements to enhance product efficacy. Market participants are leveraging clinical studies that demonstrate biotin’s role in strengthening keratin structures and promoting overall wellness. Retail and online distribution channels have expanded access to biotin-based products, driving consistent sales growth. Consumer preference for high-quality, standardized biotin formulations is prompting suppliers to maintain strict quality controls, optimize bioavailability, and provide transparent labeling, reinforcing confidence in biotin ingredients across nutraceutical and personal care applications worldwide.

Opportunities in the biotin ingredients market are expanding as food and beverage manufacturers integrate biotin into functional and fortified products. Ready-to-drink protein shakes, breakfast cereals, and dairy products are increasingly enriched with biotin to cater to health-conscious consumers. Strategic partnerships between ingredient suppliers and food manufacturers are enabling seamless product formulation while maintaining stability and efficacy. Regulatory approvals for nutrient fortification in key regions are creating avenues for wider product offerings. The growing popularity of functional beverages and fortified snacks is expected to propel demand for biotin ingredients, presenting suppliers with new revenue streams and positioning biotin as a key functional additive in the broader food and beverage sector.

Market trends indicate a shift toward premium biotin formulations, including high-potency capsules, liquid biotin drops, and combination supplements. Advanced encapsulation techniques and carrier systems are being employed to improve bioavailability and stability during processing and storage. Consumer interest in personalized nutrition and hair and beauty supplements is shaping product innovation and marketing strategies. Digital channels and e-commerce platforms are increasingly used to communicate scientific benefits and usage guidelines, influencing purchasing decisions. The emphasis on dosage precision, formulation transparency, and brand credibility is reinforcing adoption trends, positioning biotin ingredients as a core component in wellness-driven product portfolios globally.

Challenges in the biotin ingredients market arise from stringent regulatory frameworks, variable labeling requirements, and pricing pressures. Ingredient suppliers must adhere to diverse regional standards regarding dosage, purity, and allowable claims in nutraceuticals, functional foods, and cosmetics. Cost considerations for high-quality, bioavailable biotin can restrict adoption by small-scale manufacturers and private-label brands. Stability during processing and potential interactions with other supplement ingredients further complicate formulation. Industry players are addressing these hurdles by developing standardized and cost-efficient biotin forms, offering technical support for formulation, and navigating compliance requirements, yet these factors continue to influence the pace and scale of biotin integration across product categories.

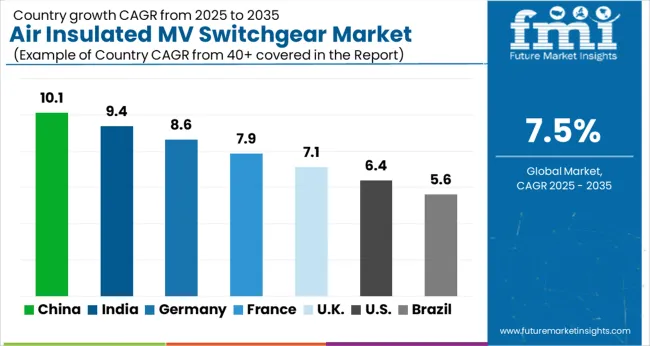

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global air insulated medium voltage switchgear market is projected to grow at a CAGR of 7.5% from 2025 to 2035. China leads with a growth rate of 10.1%, followed by India at 9.4%, and France at 7.9%. The United Kingdom records a growth rate of 7.1%, while the United States shows the slowest growth at 6.4%. Rising demand is driven by increasing industrialization, modernization of power distribution networks, and growing investments in electrical infrastructure. Emerging markets such as China and India benefit from rapid urban electrification and renewable energy integration, while developed markets like the USA, UK, and France focus on retrofitting, digital monitoring, and grid reliability. This report includes insights on 40+ countries; the top markets are highlighted here.

The market has expanded rapidly due to the increasing adoption of electric vehicles and the growing need for smart energy management. These platforms enable seamless monitoring, scheduling, and optimization of charging operations across public and private networks. The integration of real-time analytics, remote control, and IoT connectivity has enhanced user experience while improving grid efficiency. Market growth has been supported by regulatory initiatives promoting clean energy, investment in EV infrastructure, and rising adoption of fleet electrification.

The air insulated medium voltage switchgear market in China is projected to grow at a CAGR of 10.1%. Strong growth is supported by increasing urban electrification, expansion of smart grids, and rising renewable energy integration. Chinese manufacturers are investing in advanced switchgear technologies to enhance grid stability and safety. The government’s focus on infrastructure development, rural electrification programs, and industrial modernization accelerates market adoption. Growing industrial, commercial, and residential electricity demand ensures continued switchgear installation and replacement. The market also benefits from collaborations between domestic and international suppliers, enhancing product quality and technological deployment across the country.

The air insulated medium voltage switchgear market in India is projected to grow at a CAGR of 9.4%. Growth is driven by increasing industrial and commercial electricity demand, modernization of power distribution networks, and rising focus on renewable energy integration. Indian manufacturers are adopting advanced switchgear solutions to improve safety, reliability, and energy efficiency. Government initiatives supporting rural electrification, smart grids, and industrial infrastructure development further stimulate market growth. Expanding urbanization, rising energy consumption, and technological upgrades in transmission and distribution systems create opportunities for the market. Collaborations with global switchgear manufacturers also enhance adoption of high-quality, cost-effective solutions in India.

The air insulated medium voltage switchgear market in France is projected to grow at a CAGR of 7.9%. Adoption is driven by modernization of existing electrical networks, expansion of renewable energy capacity, and industrial infrastructure development. French manufacturers focus on high-reliability solutions, compliance with European standards, and incorporation of monitoring systems for predictive maintenance. Government incentives for grid upgrades, energy efficiency programs, and industrial modernization further support growth. Increasing demand from commercial and industrial sectors ensures consistent switchgear deployment. Partnerships with global suppliers and investment in research and development help maintain product innovation and quality across the French market.

The air insulated medium voltage switchgear market in the United Kingdom is projected to grow at a CAGR of 7.1%. Growth is driven by upgrades to aging electrical infrastructure, increasing renewable energy integration, and industrial electrification. UK manufacturers emphasize compliance with strict safety standards, digital monitoring, and efficient energy management. Government policies promoting grid reliability, renewable energy targets, and smart city initiatives further support market adoption. Rising demand from commercial and industrial sectors ensures continuous switchgear deployment, while investments in predictive maintenance and automation technologies enhance operational efficiency. Strategic collaborations with international suppliers contribute to high-quality solutions across the UK.

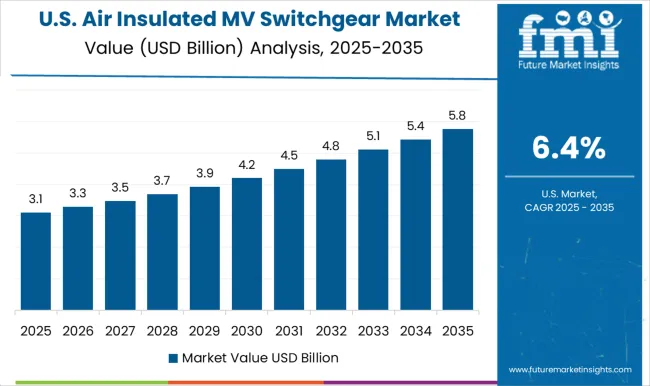

The air insulated medium voltage switchgear market in the United States is projected to grow at a CAGR of 6.4%. Market growth is driven by modernization of distribution networks, industrial electrification, and renewable energy integration. USA manufacturers focus on high-performance switchgear, compliance with safety standards, and digital monitoring for predictive maintenance. Federal and state-level incentives for grid reliability and energy efficiency encourage adoption. Increasing demand from industrial and commercial sectors ensures steady installation and replacement of switchgear. Strategic partnerships with global suppliers and investment in R&D support innovation, reliability, and adoption of next-generation solutions in the USA market.

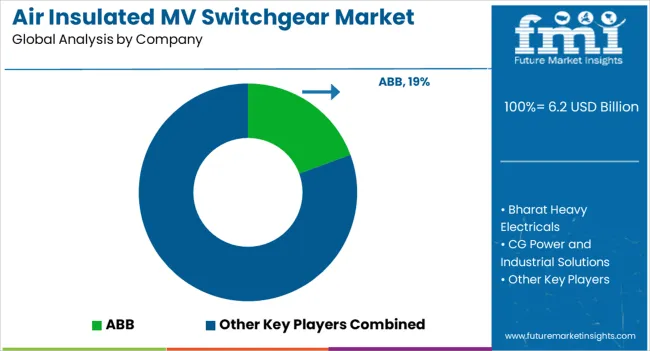

The air insulated medium voltage switchgear market is dominated by multinational electrical and power equipment companies delivering safe, reliable, and scalable solutions for utility, industrial, and commercial applications. Leaders such as ABB, Siemens, Schneider Electric, and General Electric emphasize modular designs, digital integration, and compact footprints to optimize installation and maintenance. Product brochures highlight air-insulated switchgear (AIS) for primary and secondary distribution, with features including fault detection, remote monitoring, and thermal management.

Eaton, Mitsubishi Electric, and Fuji Electric focus on energy efficiency, operational safety, and compliance with international standards. Regional leaders such as Bharat Heavy Electricals, CG Power and Industrial Solutions, and HD Hyundai Electric emphasize cost-effective solutions tailored for local grids and industrial setups. Marketing materials showcase system reliability, extended service life, and compatibility with smart grid applications, positioning AIS as a critical component in modern medium voltage networks.

Emerging and specialized players including E + I Engineering, Hitachi, Hyosung Heavy Industries, Lucy Group, Ormazabal, Skema, and Toshiba compete by providing customized configurations, retrofit solutions, and integration support. Brochures frequently highlight modular panels, protection relays, and intelligent control options designed for enhanced safety and operational flexibility. Market competition is driven by technological differentiation, compliance with IEC and IEEE standards, and after-sales support.

Companies are emphasizing digital monitoring, predictive maintenance, and lifecycle management services to reinforce reliability and reduce downtime. Focus remains on delivering flexible, scalable, and secure AIS solutions that meet diverse customer needs, from urban infrastructure to industrial power distribution, while maintaining performance and safety benchmarks.

| Items | Values |

|---|---|

| Quantitative Units | USD 6.2 billion |

| Voltage | ≥ 3 kV to 9 kV, ≥ 9 kV to 15 kV, ≥ 15 kV to 21 kV, ≥ 21 kV to 27 kV, ≥ 27 kV to 33 kV, and ≥ 33 kV |

| Component | Circuit Breakers, Contactors, Switches & Disconnector, Fuses, and Others |

| End Use | Power Stations, Transformer Substations, Local Electricity Supply, and Others |

| Application | Residential, Commercial, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales by switchgear type (indoor, outdoor) and voltage rating (up to 24kV, 25–36kV, above 36kV) are key metrics. Trends include rising demand for reliable, compact, and cost-effective medium voltage solutions, growth in urban and industrial electricity networks, and adoption in renewable energy integration. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global air insulated medium voltage switchgear market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the air insulated medium voltage switchgear market is projected to reach USD 12.9 billion by 2035.

The air insulated medium voltage switchgear market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in air insulated medium voltage switchgear market are ≥ 3 kv to 9 kv, ≥ 9 kv to 15 kv, ≥ 15 kv to 21 kv, ≥ 21 kv to 27 kv, ≥ 27 kv to 33 kv and ≥ 33 kv.

In terms of component, circuit breakers segment to command 46.2% share in the air insulated medium voltage switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA