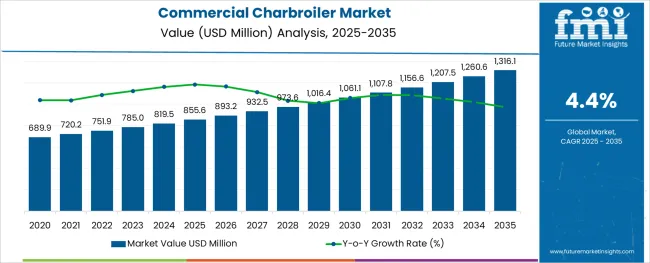

The Commercial Charbroiler Market is estimated to be valued at USD 855.6 million in 2025 and is projected to reach USD 1316.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Power Type, Buyer Type, and Sales Channel and region. By Power Type, the market is divided into Gas, Electric, and Charcoal. In terms of Buyer Type, the market is classified into Commercial and Household. Based on Sales Channel, the market is segmented into Direct Procurement, Distributor Sales, eCommerce Platforms, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

After conducting an in-depth market analysis, FMI specialists discovered that the commercial charbroiler market has experienced exceptional growth in recent years. The relevant market CAGR progressively climbed from 4.4% between 2020 and 2025 to 4.6% between 2025 and 2035.

A charbroiler is an excellent tool for imparting smokey and charred characteristics to steaks, poultry, fish, sandwiches, and vegetables. Most charbroilers are constructed of porcelain, enameled cast iron, or steel. Stainless steel is more durable and less expensive than other materials. This is why it is so popular. To entice customers, charbroiler manufacturers are now giving a variety of benefits.

For example, depending on the material used for the grill, the manufacturer will provide a 1-10 year guarantee. A lifetime burner warranty is prevalent on high-end grills. Vintage, a premium accessory and electric grill company located in the USA, offers a lifetime guarantee on selected accessories and burners.

The advent of the electric charbroiler changed the market and paved the path for new opportunities. If the gas utility line is not accessible to heat the meal, electric charbroilers are a viable alternative. Individuals who do not have access to natural gas or electricity can cook using an alternate fuel source. The expanding number of restaurants and hotels, as well as trekking and camping activities, have contributed to commercial charbroiler's substantial market share.

Furthermore, the growing number of BBQ restaurants in emerging economies such as Japan, India, Mexico, and Brazil is fueling the expansion of the commercial charbroiler industry. Furthermore, as the popularity of backyard gatherings, home-cooked BBQ cuisine, tiny tops, and portable commercial charbroilers grow, homes throughout the world are embracing charbroilers.

Electric - By Power Type

On the basis of power type, the commercial charbroiler market is categorized into electric, gas, and charcoal. Among these categories, the electric segment holds the most significant market share as it is the most preferred product by customers. Currently, the electric category is expected to grow at a moderate rate, with a CAGR of 4.9%. During the base period of 2020 to 2025, the segment accounted for the same historical CAGR. The following factors have contributed to the constant progress of electric commercial charbroil:

Commercial - By Buyer Type

Depending on the buyer type, the commercial charbroiler market is bifurcated into household and commercial.

According to FMI, the commercial category holds the largest market share in the global commercial charbroiler market. This category is now growing at a substantial rate, with a CAGR of 4.6%. Historically, the category accounted for a 4.3% CAGR from 2020 to 2025. The following factors are contributing to the growth of this segment:

With significant demand for commercial charbroilers, North America dominates the industry. The USA continues to dominate the commercial charbroilers market in North America and has registered a market valuation of USD 855.6 million in 2025 which is further expected to reach USD 1316.1 million by 2035. This trend is projected to continue during the projection period.

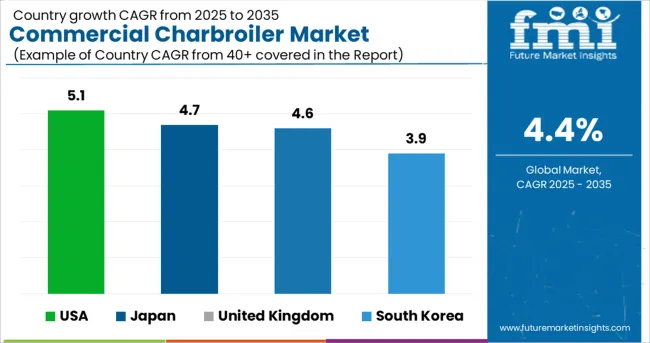

The USA Commercial Charbroiler market recorded a CAGR of 5.0% during the historical and a CAGR of 5.1% during the forecast period respectively. The development of new technology has aided in the development of charbroilers, which are reported to be more efficient and modern than traditional grills used to prepare meals.

According to studies, about 85% of families in the USA own a grill, and the majority of owners utilize it all year. Friends and family congregate around the barbecue for holidays, birthdays, occasions, or for no reason at all. American barbecue is a staple of everyday life, whether for large groups or intimate gatherings of one, with meat, poultry, pork, or vegetables. Cookouts are also popular in the USA around national holidays such as Thanksgiving, Independence Day, Christmas, and New Year's Eve.

Over 50% of customers in this country like barbecue for birthday celebrations, and 25% love it on camping vacations. Businesses are investing in new product development to increase their income in this expanding sector.

Europe has been discovered to have a substantial market share in the commercial charbroiler market. The United Kingdom is now the top country in this area, accounting for a market size of USD 26.70 million in 2025, growing at a moderate-paced CAGR of 4.6%. Earlier, the UK commercial charbroiler market increased at a CAGR of 4.4% throughout the historical period. By 2035, the market valuation is estimated to exceed USD 73.80 million.

BBQ & at-home dining & entertaining has become the UK's No. 1 summer home leisure activity, with three out of every four families having some sort of charbroiler as a result of the Covid-19 lockdown. Despite not being a member of the EU, the United Kingdom overtook Germany as the leading BBQ nation in 2024. It should come as no surprise that gas BBQs are the most popular form of barbecue in the UK. Gas charbroilers grab the top rank due to their efficiency, ease of use, and ability to cook the ideal burger, leaving electric BBQs in last place.

Japan is also predicted to develop rapidly as a result of rising street food consumption and large expenditures by key firms. Furthermore, increased demand for barbecue goods over hot dogs, burgers, and pizza is expected to drive the growth of the Japanese commercial charbroiler market during the forecast period. Japan is expected to grow at a gradual rate, with a CAGR of 4.7% during the projection period, up from 4.4% during the historical period. In 2025, the country has a market worth USD 33.27 million. According to FMI, the worth will exceed USD 89.79 million by the end of 2035.

Yakiniku, or grilled-meat restaurants, are popular in Japan, where customers prepare raw materials including beef shoulder, hog belly, and vegetables at the table. As a result, the requirement for portable commercial charbroilers rises. Furthermore, new restaurants specializing in grilling are sprouting in Japan, increasing the use of commercial charbroilers. With the introduction of Wagyu Yakiniku Ichiro in Japan, a whimsical, trend-setting new 'yakiniku' barbecue grill brand was introduced, replete with distinctive 'Shinkansen bullet train' service to table grills.

The South Korean commercial charbroiler market is expected to grow at a sluggish-paced CAGR of 3.9% over the projected period, up from 3.5% in the preceding season. In 2025, the market is currently valued at USD 12.435 million. FMI researchers forecast a market value of USD 43.05 million by 2035.

Korean barbecue is a menu trend that is here to stay. The delivery of independent and smaller chain restaurants has expanded and continues to develop. K-BBQ, which comes in sweet and sour and sweet and savory flavors and is generally distributed by broad-line distributors to Asian-casual dining and bar & grill restaurants, lends itself to a range of meals such as burgers, jerky, and tacos. These factors contribute to restaurants' increasing adoption of commercial charbroilers.

Furthermore, instead of a massive heavy-duty device on wheels, the grill is normally tabletop in size. As a result, it is an indoor practice, much like in Japan. This, in turn, increases the adoption of portable and electric commercial charbroilers.

Start-up Ecosystem:

New Entrants Give the Commercial Charbroil Market a Competitive Advantage

New players in the rice processing machine market are capitalizing on technological improvements to offer new products and acquire a competitive edge. These companies are always investing in research and development to stay up with changing customer tastes and end-use industry demands. Efforts are being made to boost their position in the forum and help the commercial charbroiler industry flourish.

| Start-up Company | Spark Grills |

|---|---|

| Country | United States of America |

| Description | Spark Grills include a revolutionary wood and charcoal barbeque system, which makes loading and rapid lighting easy, smooth, and mess-free. Spark is a sleek charbroiler that lights up in seconds and features oven-like temperature control, allowing grilling fans and home cooks alike to unleash their culinary prowess. It also sells accessories such as grill covers, temperature sensors, cutting boards, and so forth. The firm also has a social effect by assisting local families and communities with their financial health. |

| Start-up Company | June |

|---|---|

| Country | United States of America |

| Description | June is the first brand to provide smart top ovens on the Internet. Sensors in the oven detect the weight and automatically set the temperature. Its app includes functions such as intelligent notifications, video monitoring, and food planning. Android and iOS users can download the mobile app. |

Endeavors by Key Players to Bring Revolution in Market Dynamics

Prominent competitors in the commercial charbroiler market are focused on evolving the newest technology and implementing new features, such as temperature sensor technology, into their grill products. Major players in the commercial charbroiler market focus on product launch strategies that are driven by ingenuity. The incorporation of various technologies into domestic electric grills is advancing the manufacture of novel culinary goods in response to consumer demand for convenience. Manufacturers are extensively spending on research and development operations in order to create technological breakthroughs in machinery and gain a larger portion of the global market.

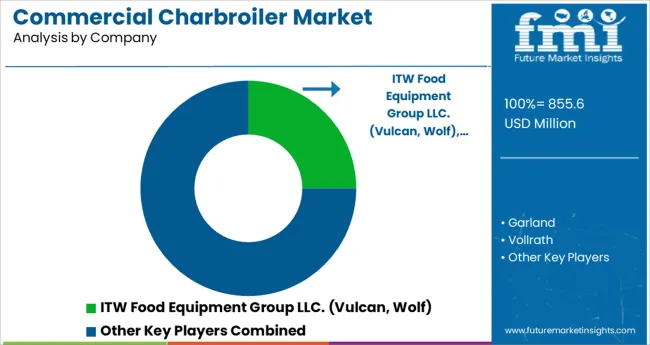

ITW Food Equipment Group LLC. Heats Things Up in the Global Forum

ITW Food Equipment Group LLC. is a prominent player in the total commercial charbroil market and has seized the lead in both the present and future predictions. The goal of this company is to produce food equipment that food service and food retail professionals can rely on to work hard and give quality, consistent results day in and day out, allowing them to focus on what they love most-creating great food for wonderful people.

Garland Expands its Presence by Receiving Several Awards

Garland has spent the last 140 years working directly with our clients, partnering on practical, effective, and long-lasting solutions that assist to bring their passion to the surface every day. The firm worked hard to win their trust, innovating and adapting regularly to keep up with our ever-changing industry. From ranges and clamshell grills to whole island suites, the organization has cooperated on several advances to meet the different demands of our consumers. Nonetheless, they have all been founded on the same underlying goal of practical application, developed from true necessity to address the real issues that an organization faces.

Avantco Equipment Fires up the Market with their Unique Offerings

Avantco commercial charbroilers are ideal for bustling businesses that have limited space. The long-lasting stainless steel design and strong burners let you swiftly produce chicken, burgers, steaks, and veggie meals with the convenience and efficiency that you need. Avantco charbroilers use a radiant heat source for uniform cooking and precision heat distribution.

Recent Developments:

In April 2025, Avantco released the Chef Series CAG-36-RC 36" Gas Countertop Radiant Charbroiler with 90,000 BTU. Because each burner can be adjusted to a different temperature, it is great for cooking burgers, prawns, or veggie skewers. This charbroiler employs radiants to reflect heat onto the cooking surface, guaranteeing speedy recovery and convenient heat retention.

In May 2025, Clark Associates topped Foodservice Equipment & Supplies magazine's list of 2025 Distribution Giants for the second year in a straight, cementing its position as the nation's premier supplier.

In August 2024, Garland introduced additional time-saving features to its Cuisine Series® heavy-duty oven and burner system, which is trusted and market-leading. The Cuisine Series, built on a 36" chassis, has long blended durability and careful design to satisfy the needs of high-performance kitchens. Garland has now implemented a number of new features to give faster results and even greater simplicity of use.

The global commercial charbroiler market is estimated to be valued at USD 855.6 million in 2025.

It is projected to reach USD 1,316.1 million by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are gas, electric and charcoal.

commercial segment is expected to dominate with a 68.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA