The global soy protein isolate market is projected to grow from an estimated USD 3.29 billion in 2025 to around USD 4.40 billion by 2035, reflecting a modest yet steady CAGR of 2.9% over the forecast period. This expansion is driven by rising demand for plant-based protein in both developed and emerging economies.

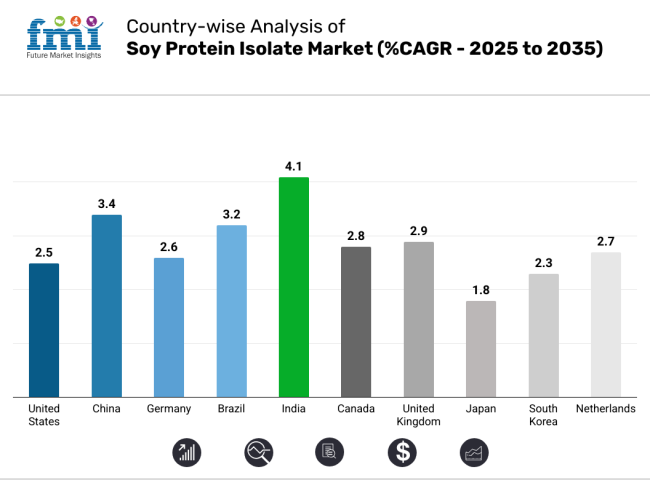

While the United States remains the dominant contributor with a 25.7% market share, emerging markets like India (4.1% CAGR) and China (3.4% CAGR) offer strong untapped growth opportunities. Carbon-neutral sourcing and traceable supply chains are emerging as competitive differentiators for global manufacturers.

The market is heavily skewed toward dry soy protein isolate (SPI), which accounts for over 80% of the total share in 2025. The product’s shelf-stability, ease of storage, and integration into mainstream food manufacturing have kept it the preferred format for processors.

However, liquid SPI, despite representing only ~18% of global revenues in 2025, is forecast to grow faster at a CAGR of 3.9%, supported by its rapid adoption in RTD (ready-to-drink) nutrition beverages and hybrid dairy formulations, especially in North America, Brazil, and India.

Key demand drivers include rising consumer awareness of functional health, affordability of soy relative to animal-based proteins, and the ability of SPI to meet clean-label and high-protein formulation needs. Functional foods using SPI are projected to grow at a 3.7% CAGR, benefiting from increasing consumer interest in heart health, digestive wellness, and high-protein snacking. While bakery and confectionery applications show slower growth due to formulation constraints, SPI’s use in meat analogues, infant nutrition, and sports beverages is showing resilient performance across regions.

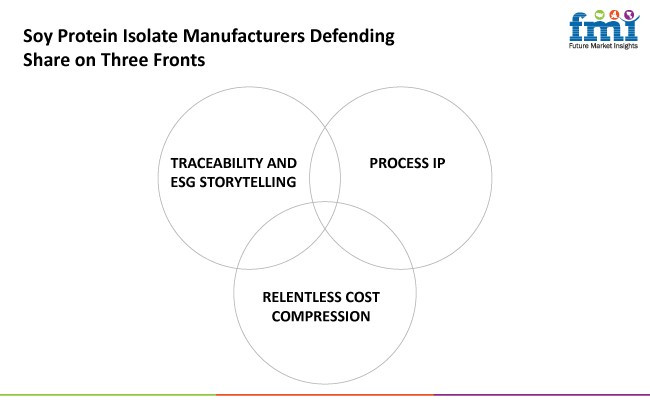

From a production standpoint, leading companies are optimizing proprietary processing technologies to address long-standing taste and solubility issues. ADM, Cargill, and IFF/DuPont are spearheading efforts to develop high-purity isolates with fewer off-notes, while also investing in ESG-linked traceability and cost compression. With mounting competition from pea, fava, and precision-fermented proteins, traditional SPI makers are increasingly targeting high-margin niches rather than volume-based expansion alone.

Looking ahead, innovation in SPI functionality (e.g., film-forming, gelling, emulsification) and increased usage in emerging applications like biodegradable coatings, plant-based sports drinks, and high-protein medical foods are expected to provide a fresh wave of growth. Manufacturers that focus on traceability, specialized formulations, and differentiated applications are better positioned to capture value in a maturing yet diversifying market landscape.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 3.29 billion |

| Projected Market Size (2035) | USD 4.40 billion |

| CAGR (2025 to 2035) | 2.9% |

The soy protein isolate market is segmented based on three primary investment areas: product type, application, and function. By product type, the market includes dry soy protein isolate and liquid soy protein isolate. In terms of application, key segments encompass functional foods, bakery and confectionery, and other applications such as meat analogues, sports nutrition powders, infant formula, and fortified beverages. By function, the market includes nutrients, emulsifiers, fat and water binding agents, restaurant uses, and other specialized functions such as gelling, foaming, and film-forming.

Dry soy protein isolate (SPI) holds the dominant position in the global market, accounting for over 80% of total market share in 2025. This significant share stems from its cost-effectiveness, long shelf life, and high compatibility with mainstream food manufacturing-especially in bakery products, snacks, and restructured meats. Dry SPI is projected to grow at a modest CAGR of 2.8% over the forecast period, maintaining its leadership due to existing infrastructure and well-established distribution channels.

However, liquid SPI, despite contributing just around 18% of revenue in 2025, is poised to grow faster at a CAGR of 3.9%. This growth is driven by its clean-label appeal, instant solubility, and lower dust loss, making it ideal for ready-to-drink nutritional beverages and hybrid dairy alternatives. The tilt in product mix will continue modestly toward liquids by 2035, though dry SPI will still dominate overall.

| Product Type | Share (2025) |

|---|---|

| Dry Soy | 80% |

Functional foods are expected to lead application-based demand with a CAGR of 3.7% between 2025 and 2035. This growth is supported by the rising consumer shift toward wellness-oriented products like heart-health bars, gut-friendly beverages, and high-protein snacks compatible with GLP-1 dietary trends. These applications require clean-label, cost-effective protein, which SPI fulfills efficiently.

The “Other Applications” segment, which includes meat analogues, fortified beverages, sports nutrition powders, and infant formulas, follows closely with a CAGR of 3.3%, benefiting from niche expansion in Asia and cost-conscious dairy alternatives. Bakery and confectionery remain the slowest-growing segment at 2.2% CAGR, as protein fortification in baked goods faces limitations in texture and consumer acceptance.

| Application | CAGR (2025 to 2035) |

|---|---|

| Functional Foods | 3.7% |

The nutrient enrichment function dominates SPI usage due to its high protein content (>90%) and ideal amino acid profile. This sub-segment is forecast to grow at a CAGR of 3.4% through 2035, as brands continue to target “high protein” label claims in bars, beverages, and clinical foods.

Emulsifier functionality, long used in processed meats and sauces, will expand slowly at 2.6% CAGR due to cost-optimization and ingredient blending. Fat and water binding applications, which help retain moisture in meat analogues and nuggets, will grow at just 2.1% CAGR, constrained by the emergence of konjac, methylcellulose, and pea proteins.

The “Other Functions” category, which includes gelling, foaming, and film-forming, will grow at a robust 3.2% CAGR due to innovative uses in aerated sports drinks and eco-friendly coatings. Meanwhile, restaurant and food service adoption of SPI in pre-hydrated and frozen alt-protein formats supports a 3.0% CAGR.

| Function | CAGR (2025 to 2035) |

|---|---|

| Nutrients (Fortification) | 3.4% |

The USA is the world’s most mature and sophisticated SPI market. Dominated by giants like ADM and Cargill, it blends massive processing infrastructure with innovation in clean-label proteins, high-purity isolates, and traceable supply chains. SPI demand here is driven by mainstream food processing and the functional wellness market, though growth is plateauing. With plant-based enthusiasm flattening post-peak hype and margin pressure rising due to pea and precision-fermented proteins, SPI is holding steady mainly through cost efficiencies and IP-led formulations.

| Country | Value(CAGR) |

|---|---|

| USA | 2.5% |

China’s SPI market is entering a transformation phase. Once primarily an importer and low-cost processor, it’s now fueling demand via domestic plant-based meat alternatives and fortified functional foods. Urban middle-class consumers are increasingly prioritizing health, and SPI is gaining traction in supplements and sports nutrition. While the local production base is expanding, traceability and purity issues remain a bottleneck-offering foreign players an edge.

| Country | Value(CAGR) |

|---|---|

| China | 3.4% |

Germany acts as the anchor market for SPI within the European Union. With a strong vegan food culture and well-established food processing industry, demand for SPI is embedded in both B2B ingredients and retail products. Its emphasis on sustainability, labeling, and product purity pushes manufacturers to refine SPI applications for premium niches. Growth is stable, largely mirroring the broader EU market.

| Country | Value(CAGR) |

|---|---|

| Germany | 2.6% |

As one of the largest soybean producers globally, Brazil is a powerhouse in SPI raw material availability. The local SPI industry is slowly moving beyond bulk commodity exports to domestic applications in bakery, processed foods, and sports supplements. Infrastructure gaps in high-purity processing remain a limitation, but policy incentives for agri-value addition are nudging the market forward.

| Country | Value(CAGR) |

|---|---|

| Brazil | 3.2% |

India represents the most under-penetrated yet high-potential SPI market. With a vegetarian-leaning population and rising awareness around fitness and protein intake, SPI is beginning to appear in snacks, ready meals, and nutritional supplements. However, domestic production lags, and most SPI is imported. Cost remains a key sensitivity, but the sheer population base makes it a breakout opportunity.

| Country | Value(CAGR) |

|---|---|

| India | 4.1% |

Canada punches above its weight in plant-based innovation. With strong regulatory oversight, clean-label demand, and access to North American and EU markets, Canadian firms are building a niche in high-purity SPI blends. Growth is tied to export potential, particularly as Asian markets open up to premium protein sources.

| Country | Value(CAGR) |

|---|---|

| Canada | 2.8% |

The UK’s SPI market is largely driven by fast-moving consumer goods (FMCG) innovation in vegan-ready meals and protein-rich snacks. While the post-Brexit trade environment has introduced complexity, the domestic demand for healthy, high-protein, meat-free foods continues to grow steadily. Major food processors rely on SPI for its emulsifying and binding properties.

| Country | Value(CAGR) |

|---|---|

| United Kingdom | 2.9% |

Japan’s SPI use is entrenched in traditional foods and health-focused products, but its overall market is mature. Innovation is focused on elderly nutrition, functional foods, and pharma-food hybrids. However, growth is modest due to a declining population and price sensitivity. SPI producers here compete more on quality and novelty than on volume.

| Country | Value(CAGR) |

|---|---|

| Japan | 1.8% |

South Korea is building SPI demand via fitness culture and beauty-from-within nutraceuticals. SPI is also used in hybrid convenience foods combining traditional Korean elements with Western formulations. Government support for food-tech R&D has enabled startups to explore SPI applications in novel formats. However, market size is still relatively small.

| Country | Value(CAGR) |

|---|---|

| South Korea | 2.3% |

A vital SPI player in the European manufacturing ecosystem, the Netherlands acts more as a processing and export hub than a large consumer base. It excels in private-label manufacturing for global brands, leveraging tight ESG controls and efficient supply chains. Demand is stable, and growth is incremental but essential for Europe’s supply continuity.

| Country | Value(CAGR) |

|---|---|

| Netherlands | 2.7% |

The global soy protein isolate (SPI) market is moderately consolidated, with the top five players collectively accounting for an estimated 50 to 55 percent of total revenues. ADM leads the market with a share of approximately 20 to 22 percent, backed by extensive upstream integration, proprietary processing technologies, and aggressive ESG positioning. It is followed by Cargill, which commands 12 to 14 percent of the market and leverages its vast commodity trading and formulation infrastructure to retain pricing power.

DuPont Nutrition, now a part of IFF, holds between 9 and 11 percent of the market and continues to refine its plant-protein portfolio post-merger. Fuji Oil and Kerry Group round out the top five, with market shares of roughly 7 to 8 percent and 5 to 6 percent, respectively. Meanwhile, innovation-centric firms such as BurconNutraScience, though smaller in scale, are carving out influence through patent-led differentiation and strategic licensing.

Strategically, manufacturers are increasingly competing on traceability, purity, and application versatility. ADM is targeting 100 percent deforestation-free soy by the end of 2025, a move designed to align with rising procurement standards among Western food companies and meet investor expectations on ESG. BurconNutraScience exemplifies this shift.

On December 10, 2025, the company announced it had secured a USA patent for a next-generation soy protein isolate engineered for improved solubility and reduced off-notes in beverage applications-a historically difficult use-case for SPI. CEO Kip Underwood emphasized the importance of protecting competitive edge through intellectual property, particularly as the market shifts toward high-performance plant proteins.

Cargill, while less vocal in the SPI-specific IP race, is investing heavily in application research and regional labs, especially in Singapore and the USA, to develop functional blends that combine soy with other proteins such as pea. Its strategy remains grounded in scale, sourcing efficiency, and versatility in formulation. Fuji Oil is positioning itself as a leader in bakery and emulsifier applications in Asia, particularly in Japan and Southeast Asia, where its partnerships with local food manufacturers and its specialization in texture-modifying SPI forms give it an edge.

DuPont Nutrition, now integrated into IFF, is consolidating its SPI product portfolio to focus on high-margin, functional formulations for bakery, dairy alternatives, and nutraceuticals. The post-merger realignment has allowed it to reduce operational redundancy while increasing focus on targeted plant-protein applications.

Overall, the competitive battleground for SPI is no longer limited to volume production. Companies that combine traceable sourcing, proprietary processing techniques, and downstream innovation-particularly in beverages, supplements, and functional foods-are emerging as the real winners. The next decade will not favor commoditized SPI manufacturers but those who offer precision, performance, and proof.

| Attribute | Details |

|---|---|

| Market Covered | Soy Protein Isolate (SPI) - value (USD million) and volume (metric tons) |

| Base Year | 2025 |

| Historical Coverage | 2019 to 2023 |

| Forecast Horizon | 2025 to 2035 |

| Units & Currency | Revenue in constant 2025 USD; volume in metric tons |

| Segmentation | Product Type: (Dry, Liquid), Application: (Functional Foods; Bakery & Confectionery; Other Applications), Function: (Nutrients; Emulsifiers; Fat & Water (binding); Restaurants; Other Functions) |

| Geographic Coverage | Regional: (North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa), Country-level break-outs for 30+ economies, incl. the (United States, Canada, Mexico, Brazil, Germany, France, the UK, China, Japan, India, Australia, Saudi Arabia, South Africa, and others on request) |

| Key Sections Included | Executive summary, market dynamics (drivers, restraints, opportunities), pricing analysis, value-chain mapping, market size & growth (value & volume), segment-wise and region-wise forecasts, country snapshots (2025), market structure, competitive landscape, assumptions & acronyms, research methodology |

| Companies Profiled | Archer Daniels Midland; Cargill; Fuji Oil Holdings; Farbest ; Kerry Group; Batory Foods; CHS Inc.; Crown Soya Protein Group; The Scoular Company; Food Chem International; Nutra Food Ingredients; Osage Food Products; DuPont de Nemours; plus additional players on request |

| Deliverables | 185-plus page PDF + Excel workbook with data book, interactive dashboard (optional) |

The global soy protein isolate market is expected to reach approximately USD 4.40 billion by 2035, up from USD 3.29 billion in 2025, expanding at a CAGR of 2.9% during the forecast period.

Dry soy protein isolate dominates the market with over 80% share in 2025, driven by its shelf stability, lower transportation costs, and widespread use in baked goods and meat analogues.

The liquid soy protein isolate segment is projected to grow at the fastest CAGR of 3.9% from 2025 to 2035, fueled by rising demand in ready-to-drink nutritional beverages and hybrid dairy alternatives.

The functional foods segment is growing at a CAGR of 3.7%, driven by increasing consumer interest in heart health, digestive wellness, and protein-enriched snack products using clean-label ingredients.

India and China offer the highest growth potential, with CAGR rates of 4.1% and 3.4%, respectively, due to rising health awareness, growing vegetarian populations, and demand for affordable plant-based proteins.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Function, 2019 to 2034

Table 9: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 13: North America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Function, 2019 to 2034

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 21: Latin America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Function, 2019 to 2034

Table 25: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 26: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: Europe Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 29: Europe Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 30: Europe Market Volume (MT) Forecast by Application, 2019 to 2034

Table 31: Europe Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Function, 2019 to 2034

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 34: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 35: East Asia Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 37: East Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 38: East Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 39: East Asia Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 40: East Asia Market Volume (MT) Forecast by Function, 2019 to 2034

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 42: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: South Asia Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 45: South Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 46: South Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 47: South Asia Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 48: South Asia Market Volume (MT) Forecast by Function, 2019 to 2034

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 50: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 51: Oceania Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 53: Oceania Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 54: Oceania Market Volume (MT) Forecast by Application, 2019 to 2034

Table 55: Oceania Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 56: Oceania Market Volume (MT) Forecast by Function, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ million) Forecast by Product Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (MT) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ million) Forecast by Function, 2019 to 2034

Table 64: Middle East and Africa Market Volume (MT) Forecast by Function, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ million) by Function, 2024 to 2034

Figure 4: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Global Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 18: Global Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 21: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Function, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ million) by Product Type, 2024 to 2034

Figure 26: North America Market Value (US$ million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ million) by Function, 2024 to 2034

Figure 28: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 37: North America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 42: North America Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 45: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Function, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ million) by Product Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ million) by Function, 2024 to 2034

Figure 52: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 66: Latin America Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Function, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Europe Market Value (US$ million) by Product Type, 2024 to 2034

Figure 74: Europe Market Value (US$ million) by Application, 2024 to 2034

Figure 75: Europe Market Value (US$ million) by Function, 2024 to 2034

Figure 76: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 78: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Europe Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 85: Europe Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 86: Europe Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Europe Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 90: Europe Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 91: Europe Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 93: Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 94: Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Europe Market Attractiveness by Function, 2024 to 2034

Figure 96: Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ million) by Product Type, 2024 to 2034

Figure 98: East Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 99: East Asia Market Value (US$ million) by Function, 2024 to 2034

Figure 100: East Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: East Asia Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 109: East Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: East Asia Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 114: East Asia Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 117: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 118: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 119: East Asia Market Attractiveness by Function, 2024 to 2034

Figure 120: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia Market Value (US$ million) by Product Type, 2024 to 2034

Figure 122: South Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 123: South Asia Market Value (US$ million) by Function, 2024 to 2034

Figure 124: South Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 133: South Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 138: South Asia Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 141: South Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 142: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia Market Attractiveness by Function, 2024 to 2034

Figure 144: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 145: Oceania Market Value (US$ million) by Product Type, 2024 to 2034

Figure 146: Oceania Market Value (US$ million) by Application, 2024 to 2034

Figure 147: Oceania Market Value (US$ million) by Function, 2024 to 2034

Figure 148: Oceania Market Value (US$ million) by Country, 2024 to 2034

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: Oceania Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 157: Oceania Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: Oceania Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 162: Oceania Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 165: Oceania Market Attractiveness by Product Type, 2024 to 2034

Figure 166: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 167: Oceania Market Attractiveness by Function, 2024 to 2034

Figure 168: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ million) by Product Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ million) by Function, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ million) Analysis by Product Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ million) Analysis by Function, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (MT) Analysis by Function, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Function, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Soy Protein Isolates in EU Size and Share Forecast Outlook 2025 to 2035

Soy-based Chemical Market Size and Share Forecast Outlook 2025 to 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Soy Nuts Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soy-Based Meat Alternative Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy-based Food Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Isoflavones Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soy Food Products Market Analysis by food, beverages, oils and product type Through 2035 food, beverages, oils and product type

Soy Milk Market Analysis by Product Type, Category, Application, Distribution Channel and Region Through 2035

Soy Beverage Market Analysis by Product Type, Flavor, and Distribution Channel Through 2035

Soy Polysaccharides Market

Soy Hydrolysates Market

Soybean Oil Market

Soy Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Soy Protein Concentrate Market Growth - Plant-Based Protein & Industry Expansion 2024 to 2034

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA