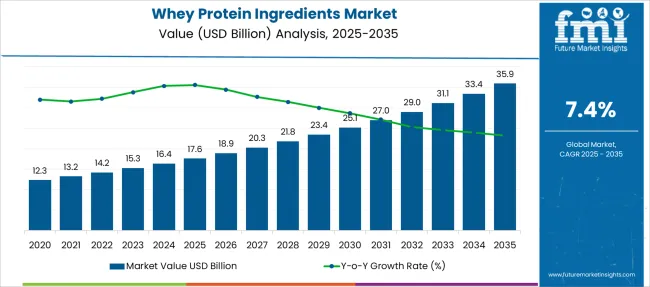

The Whey Protein Ingredients Market is estimated to be valued at USD 17.6 billion in 2025 and is projected to reach USD 35.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Whey Protein Ingredients Market Estimated Value in (2025 E) | USD 17.6 billion |

| Whey Protein Ingredients Market Forecast Value in (2035 F) | USD 35.9 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The whey protein ingredients market is growing steadily, driven by increasing consumer awareness of health and fitness and the rising popularity of sports nutrition products. Nutritional science advancements and fitness trends have elevated the demand for protein supplements that support muscle building and recovery.

Growing adoption of high-protein diets and the expanding number of fitness enthusiasts worldwide are also contributing factors. Manufacturers have responded by innovating with high-quality protein isolates that offer better absorption and purity.

Distribution channels have evolved to accommodate diverse consumer preferences, making whey protein products widely accessible through multiple retail formats. The market is expected to continue its upward trajectory, fueled by increased investment in sports nutrition and the rising trend of functional foods. Segmental growth is anticipated to be led by the sports nutrition type and whey protein isolate as the preferred distribution channel.

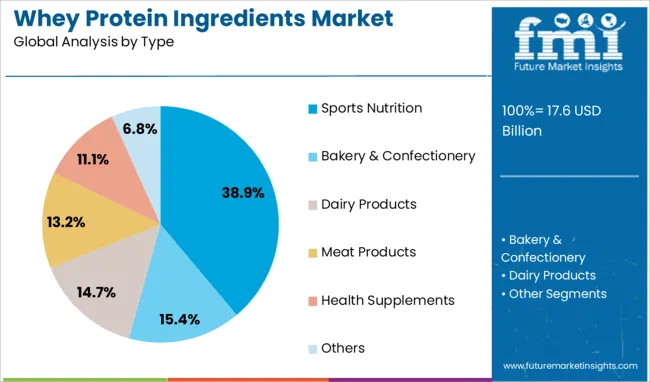

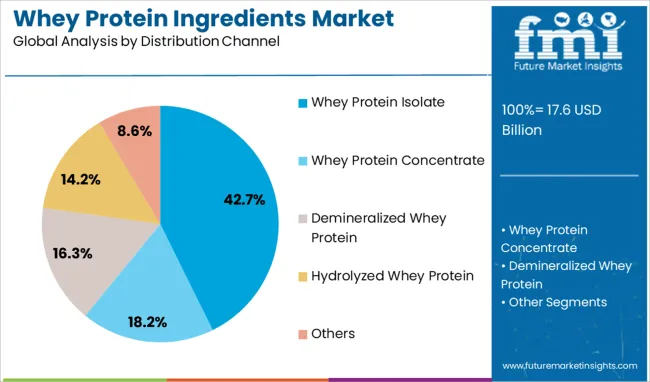

The whey protein ingredients market is segmented by type, distribution channel, and geographic regions. By type, the whey protein ingredients market is divided into Sports Nutrition, Bakery & Confectionery, Dairy Products, Meat Products, Health Supplements, and Others. In terms of distribution channels, the whey protein ingredients market is classified into Whey Protein Isolate, Whey Protein Concentrate, Demineralized Whey Protein, Hydrolyzed Whey Protein, and Others. Regionally, the whey protein ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Sports Nutrition segment is projected to hold 38.9% of the whey protein ingredients market revenue in 2025, maintaining its position as the dominant type. Growth in this segment has been supported by increased participation in physical activities and the desire for products that enhance athletic performance and muscle recovery.

Consumers have shown a preference for specialized protein blends designed to meet their workout and nutritional needs. Additionally, the rise of professional sports and recreational fitness has boosted demand for scientifically formulated supplements.

Marketing efforts by health and fitness influencers have further raised awareness and adoption of whey protein products in this category. As the global fitness culture strengthens, the Sports Nutrition segment is expected to sustain its leadership position.

The Whey Protein Isolate segment is expected to contribute 42.7% of the whey protein ingredients market revenue in 2025, securing its lead as the preferred distribution channel. This segment has gained traction due to the superior protein content and reduced lactose levels in isolate products, making them suitable for a broad range of consumers, including those with lactose intolerance.

Manufacturers have prioritized whey protein isolate formulations for their high purity and effectiveness in muscle synthesis. The segment has been favored in specialty nutrition stores and online platforms that cater to fitness-focused customers. With continued innovation and consumer demand for premium protein sources, the Whey Protein Isolate segment is anticipated to maintain strong growth.

Whey protein ingredients encompass whey concentrate, isolate, and hydrolysate derived from milk in the dairy processing stream. These ingredients are used in nutritional supplements, functional foods, sports nutrition, and beverages. Demand is influenced by growing interest in high-protein diets, muscle support, and health-enhancing formulations. Suppliers delivering consistent amino acid profiles, high purity levels, and minimal lactose content have been well positioned. Product formats that support mixability, taste masking, and clean label claims continue to guide procurement by food manufacturers, supplement producers, and formulation scientists seeking scalable protein bases.

Adoption of whey protein ingredients has been supported by rising consumer interest in protein-rich diets for fitness, recovery, and wellness purposes. Demand has been reinforced by growth in gym culture, active lifestyles, and athletic performance use. Nutritional studies highlighting benefits of whey protein for muscle synthesis and satiety have increased awareness. Food and beverage brands seeking to enhance protein content in products such as snacks, ready-to-drink beverages, and meal replacement powders have integrated whey ingredients. Ingredient performance attributes such as solubility, amino acid completeness, and nutritional labeling transparency have guided selection. Increasing personal care and functional food innovation continues to support whey protein uptake.

Expansion has been limited by fluctuations in raw milk supply and seasonal variations in whey availability, which affect ingredient consistency and cost. Protein specifications such as purity level or lactose content may vary across sourcing regions, complicating formulation. Cost differences between concentrated, isolated, or hydrolyzed forms have influenced producer price sensitivity. Regulatory requirements for food safety, allergen labeling, and clean production audits have imposed compliance demands on manufacturers. Potential presence of minor antibiotic residues or microbial contamination risks has required rigorous quality control testing. Supply chain disruptions in dairy logistics and drying capacity constraints have further introduced volatility in ingredient delivery timelines and formulation planning.

Opportunities are emerging in advanced fractionation and filtration technologies that enable high protein recovery and tailored ingredient forms. Development of protein blends combining whey with plant-based proteins is expanding formulation flexibility. Applications in infant formula, clinical nutrition, and meal supplements offer higher value paths. Private label partnerships with sports nutrition brands and health food manufacturers support ingredient bundling and recurring demand. Expansion into international markets with rising middle class and protein-aware consumers presents growth potential. Development of flavored whey bases, minimally processed formats, and ready-to-mix sachets offers differentiation. Collaboration with ingredient innovators for bioactive peptides or enzyme-enhanced proteins continues to open product development channels.

Ingredient production has shifted toward methods such as microfiltration or membrane processing that preserve protein activity and reduce heat degradation. Enhanced nutritional profiling with labeling of essential amino acid percentages and protein efficiency ratios has become standard. Use of acid whey valorization and upcycling byproducts through fermentation or fractionation is gaining attention. High protein variants with low lactose or fat content are increasingly offered for diet-sensitive consumers. Ingredient traceability systems and batch-level quality certification have gained favor among formulation teams. Development of functional whey apps that track ingredient origin, processing methods, and nutritional specs continues to influence procurement preferences. Focus on clean processing methods and transparency in sourcing remains a defining trend.

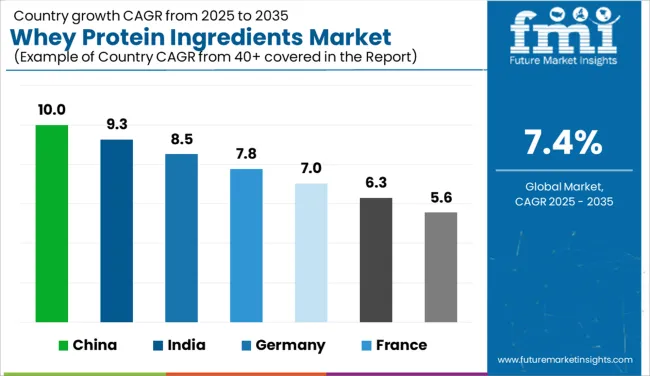

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

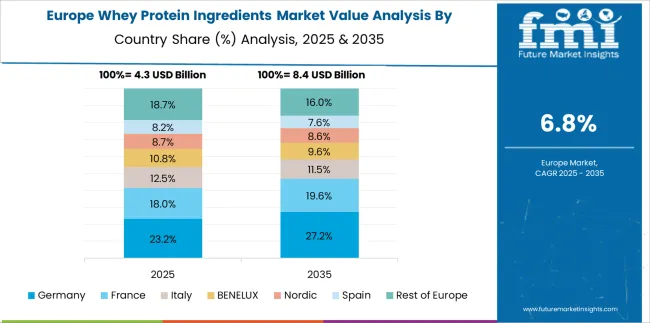

The whey protein ingredients market is projected to grow at a CAGR of 7.4% between 2025 and 2035, driven by rising consumer demand for high-protein diets, functional food innovation, and growth in sports nutrition. China leads at 10.0% CAGR, supported by increased use of whey protein in infant formula and performance nutrition products. India follows at 9.3%, fueled by demand for fortified dairy and nutritional supplements. Among European markets, Germany posts 8.5%, emphasizing clean-label protein powders and medical nutrition applications, while France records 7.8%, supported by functional foods and premium health supplements. The United Kingdom grows at 7.0%, led by ready-to-drink protein beverages and plant-dairy protein blends. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to grow at a 10.0% CAGR, driven by significant demand for whey protein concentrates and isolates in infant formula and high-protein snacks. The sports nutrition segment is experiencing strong growth, supported by the fitness culture among urban consumers. Dairy manufacturers are investing in value-added whey-based beverages targeting young and health-conscious consumers. Online retail platforms are enabling rapid market penetration with premium whey protein supplements from domestic and international brands. Partnerships between dairy cooperatives and global ingredient suppliers are boosting innovation in whey-based functional ingredients for food and beverage applications.

India is expected to post a 9.3% CAGR, supported by strong growth in nutritional supplements and fortified dairy segments. Rising awareness of protein deficiencies is influencing consumer preference for whey protein-based powders and drinks. Quick-service restaurants and fitness cafes are introducing whey-based smoothies and shakes to target health-conscious customers. Indian dairy processors are investing in advanced filtration systems for producing whey isolates with high purity and improved solubility. Collaborations between global ingredient companies and domestic food manufacturers are creating opportunities for new formulations in bakery and confectionery applications.

Germany is forecasted to grow at an 8.5% CAGR, driven by increasing demand for premium whey protein concentrates and isolates in sports nutrition and clinical applications. Functional food and beverage brands are introducing clean-label protein bars and fortified drinks featuring whey as a key ingredient. Manufacturers are investing in lactose-free and flavored whey protein products to cater to dietary preferences and improve palatability. The pharmaceutical and medical nutrition sectors are incorporating whey-based formulas for recovery and elderly nutrition. Digital grocery platforms and specialty health stores are expanding product accessibility across German regions.

France is projected to grow at 7.8% CAGR, supported by innovation in functional dairy and performance nutrition products. Health-focused consumers are driving demand for whey protein-enriched yogurts, ready-to-drink shakes, and meal replacements. Domestic brands are launching low-fat, high-protein dairy beverages positioned as lifestyle products for weight management. The bakery and confectionery industries are incorporating whey protein concentrates for protein enrichment, creating new avenues for application. Collaborations between research institutions and ingredient manufacturers are fostering advancements in protein solubility and flavor optimization for French food brands.

The United Kingdom is forecasted to post 7.0% CAGR, supported by the popularity of ready-to-drink whey protein beverages among fitness and convenience-driven consumers. Retail chains and online platforms are expanding premium whey protein product assortments, including isolates and hydrolysates. Manufacturers are developing plant-blend whey protein products to target flexitarian and health-conscious audiences. Foodservice operators are introducing whey-based smoothies and protein shakes as part of quick meal solutions. Private-label launches and subscription-based delivery services are further contributing to market growth by improving affordability and accessibility for whey protein supplements.

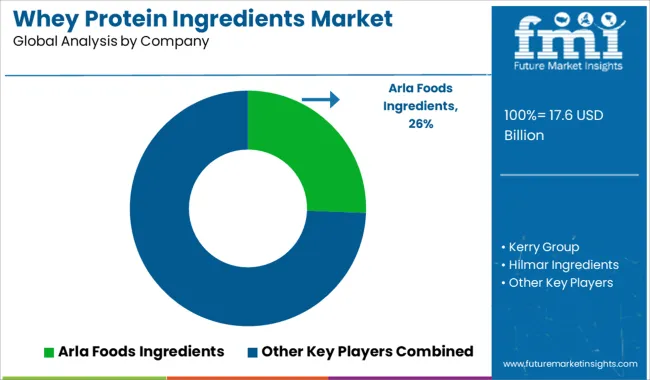

The whey protein ingredients market is dominated by leading dairy and nutritional solution providers such as Arla Foods Ingredients, Kerry Group, Hilmar Ingredients, Lactalis Ingredients, Milk Specialties Global, Carbery Group, Leprino Foods Company, Davisco Foods International, and Agropur. Arla Foods and Lactalis lead with extensive product portfolios covering whey protein concentrates (WPC), isolates (WPI), and hydrolysates tailored for sports nutrition, infant formula, and functional food sectors.

Kerry Group strengthens its position by combining protein solutions with flavor systems and fortification technologies for ready-to-drink and high-protein snacks. Hilmar and Milk Specialties Global specialize in high-purity whey isolates for performance and clinical nutrition markets, while Carbery Group focuses on innovative protein hydrolysates designed for fast absorption in sports and medical applications. Leprino Foods and Agropur leverage vertical integration and strong raw milk supply chains, ensuring consistency and scalability in production for global customers. Competitive dynamics are shaped by increasing demand for clean-label, high-protein formulations and stringent quality standards in infant and medical nutrition.

Key differentiation factors include protein purity, solubility, flavor masking, and functional properties in beverage and bar applications. Strategic initiatives center on capacity expansion, partnerships with nutrition brands, and R&D investments in bioactive peptides and lactose-free protein solutions. Future competitiveness will be influenced by innovations in microfiltration technology, sustainable processing methods, and personalized nutrition solutions. Companies integrating digital platforms for supply chain transparency and developing multifunctional protein blends will hold a strong edge in the evolving global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.6 Billion |

| Type | Sports Nutrition, Bakery & Confectionery, Dairy Products, Meat Products, Health Supplements, and Others |

| Distribution Channel | Whey Protein Isolate, Whey Protein Concentrate, Demineralized Whey Protein, Hydrolyzed Whey Protein, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arla Foods Ingredients, Kerry Group, Hilmar Ingredients, Lactalis Ingredients, Milk Specialties Global, Carbery Group, Leprino Foods Company, Davisco Foods International, and Agropur |

| Additional Attributes | Dollar sales by product type (WPC, WPI, hydrolysates) and end-use application (sports nutrition, infant formula, functional foods, clinical nutrition), with demand driven by rising protein fortification trends and health-focused dietary patterns. Regional dynamics show North America and Europe as mature markets, while Asia-Pacific is the fastest-growing due to expanding sports and infant nutrition sectors. Innovation trends include high-protein ready-to-drink solutions, low-lactose whey formulations, and enzymatically hydrolyzed whey for faster digestion and improved amino acid absorption. |

The global whey protein ingredients market is estimated to be valued at USD 17.6 billion in 2025.

The market size for the whey protein ingredients market is projected to reach USD 35.9 billion by 2035.

The whey protein ingredients market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in whey protein ingredients market are sports nutrition, bakery & confectionery, dairy products, meat products, health supplements and others.

In terms of distribution channel, whey protein isolate segment to command 42.7% share in the whey protein ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Native Whey Protein Ingredients Market

Whey Permeate Market Analysis by End user and Packaging Through 2035

Whey Hydrolysates Market

Whey Protein Market Size and Share Forecast Outlook 2025 to 2035

Whey Protein Isolate Market Growth - Trends & Forecast through 2025 to 2035

Analysis and Growth Projections for Native Whey Protein Market

Condensed Whey Market Size and Share Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Demand for Whey Hydrolysates for Medical Nutrition Drinks in CIS Analysis Size and Share Forecast Outlook 2025 to 2035

Demand for Whey-plus-Prebiotic Stacks for RTD Shakes in CIS Analysis Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Whey Protein Market Analysis by Product Form, Application, Sales Channel and Region through 2035

Concentrated Whey Market

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Demand for RTD Whey Deployments for Shelf-stable Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Microparticulated Whey Protein Market Analysis by Application, Form & Region Through 2035

Demand of Heat Stable Whey for RTD Performance Drinks in EU Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA