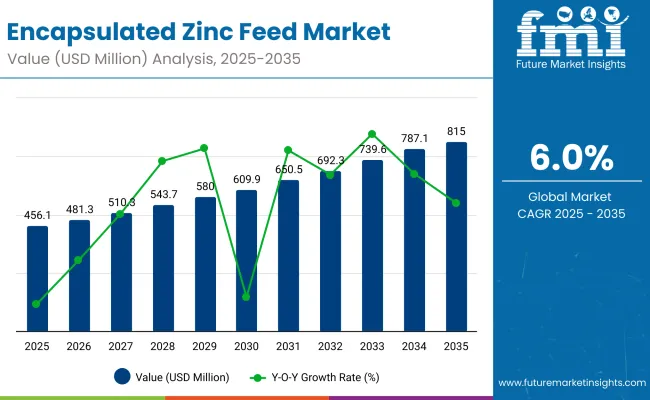

A valuation of USD 456.1 million is estimated for the Encapsulated Zinc Feed Market in 2025, and the industry is forecast to reach USD 815 million by 2035. This expansion equals an incremental gain of USD 357.5 million across the decade, reflecting a compound annual growth rate (CAGR) of 6.0%. The trajectory signals a near doubling of market value as encapsulation shifts from specialized application toward mainstream feed formulation.

Encapsulated Zinc Feed Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 456.1 Million |

| Market Forecast Value in (2035F) | USD 815 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

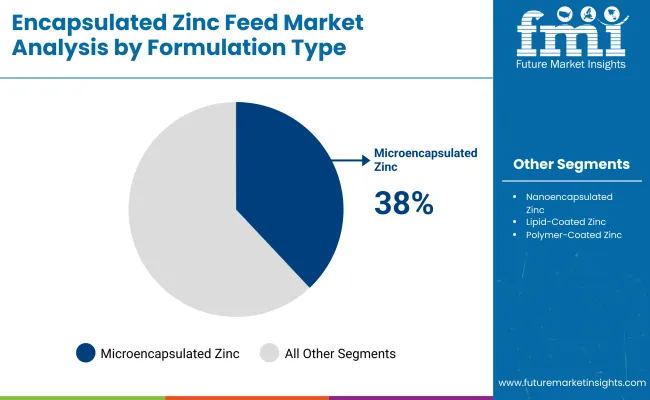

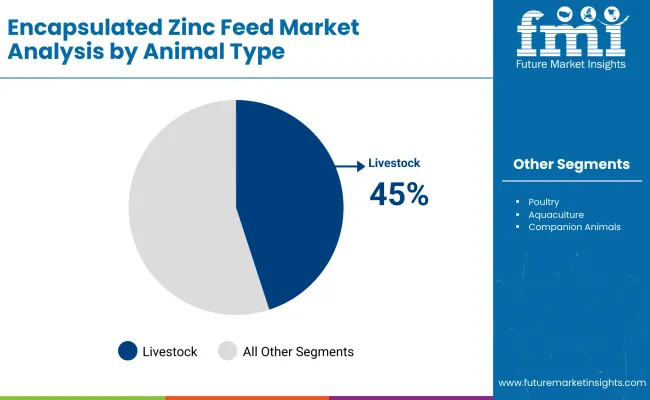

During the initial period from 2025 to 2030, the market is projected to expand from USD 456.1 million to USD 609.9 million, contributing nearly USD 153.8 million and accounting for more than 40% of the total decade growth. This phase is expected to be marked by reformulation in livestock and poultry diets, where encapsulated zinc enables compliance with regulated mineral ceilings while sustaining productivity. Microencapsulated zinc is anticipated to dominate the formulation segment with a 38% share in 2025, while livestock is projected to hold the largest animal type share at 45%.

In the latter half from 2030 to 2035, an additional USD 205.1 million is forecast to be generated, equal to nearly 60% of total growth. This acceleration is expected to be supported by stronger adoption in aquaculture and companion animals, alongside premium demand for organic zinc complexes and nanoencapsulated formats that deliver bioavailability advantages. Regional leadership is projected to remain with North America at 30%, closely followed by Europe at 28%, though Asia-Pacific is expected to contribute the largest incremental gains by the end of the forecast horizon.

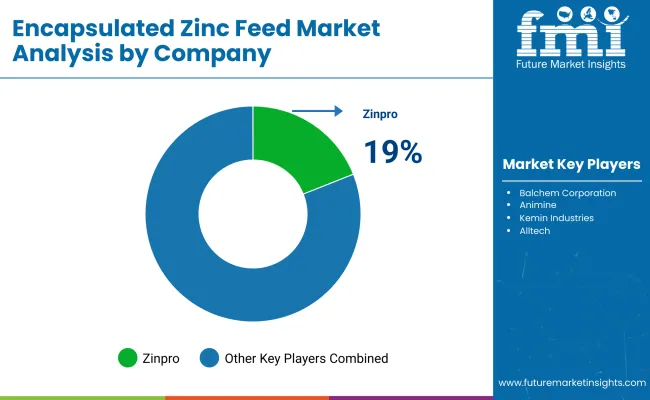

From 2020 to 2024, the Encapsulated Zinc Feed Market advanced from USD 380 million to USD 440 million, supported by compliance-driven adoption in livestock and poultry diets. During this period, the competitive landscape was dominated by multinational feed additive manufacturers controlling nearly 65% of revenue, with leaders such as Zinpro Corporation, Balchem Corporation, Animine, Kemin Industries, and Alltech focusing on microencapsulation and coating innovations to enhance bioavailability and regulatory compliance. Competitive differentiation was determined by coating stability, release control, and validated trial outcomes, while premium chelates and organic complexes were positioned as niche offerings rather than mainstream revenue drivers.

Service-based models, including veterinary consultancy and technical nutrition support, contributed less than 10% of total market value. Demand for encapsulated zinc feed is forecast to expand to USD 456.1 million in 2025, and the revenue mix is expected to shift as nanoencapsulated formats, aquaculture applications, and companion animal nutrition grow to over 35% of incremental market value. Traditional leaders are projected to face intensifying competition from regional innovators and digital-first integrators offering precision-formulation platforms, cloud-based nutrient optimization, and subscription-driven advisory models.

Major incumbents are anticipated to pivot toward hybrid models that combine coating technology with sustainability analytics to retain relevance. Emerging entrants specializing in organic zinc complexes, advanced encapsulation techniques, and species-specific solutions are expected to gain share. The competitive advantage is moving away from volume leadership alone to ecosystem strength, regulatory alignment, and cost-in-use validation across species and regions.

Advances in encapsulation technology have improved nutrient stability and release control, allowing for more efficient zinc utilization across diverse animal species. Microencapsulated formats have gained prominence due to their proven stability in pelleted feeds and ability to support consistent bioavailability. The rise of nanoencapsulation has contributed to enhanced absorption and targeted delivery, strengthening functional outcomes in gut health and immunity. Livestock and poultry industries are driving demand for encapsulated zinc feed solutions that can integrate seamlessly into existing nutritional programs.

Expansion of aquaculture and companion animal nutrition has further fueled market growth. Innovations in lipid- and polymer-coated technologies and the adoption of chelated and organic zinc complexes are expected to open new opportunities across species and regions. Segment growth is anticipated to be led by livestock applications, microencapsulated zinc in formulation types, and organic zinc complexes within source categories due to their premium positioning and compliance-ready profiles.

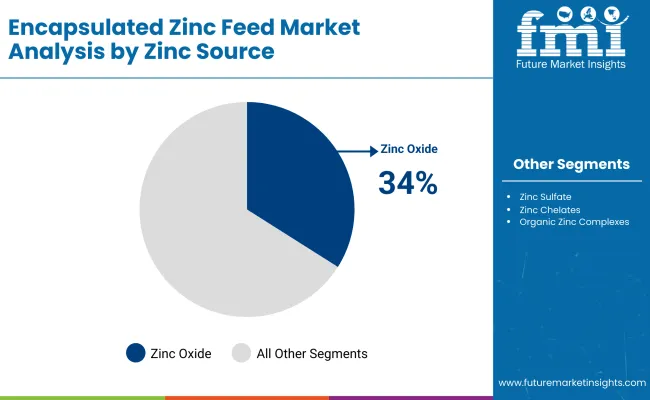

The Encapsulated Zinc Feed Market is segmented by formulation type, zinc source, animal type, functionality, sales channel, and region. Formulation types include microencapsulated, nano encapsulated, lipid-coated, and polymer-coated zinc, designed to optimize nutrient stability and delivery. Zinc sources comprise zinc oxide, zinc sulfate, zinc chelates, and organic complexes, each contributing differently to absorption and compliance objectives. By animal type, the market spans livestock, poultry, aquaculture, and companion animals, highlighting distinct nutritional and regulatory requirements. These segments together reflect the market’s transition from bulk mineral supplementation toward precision nutrition solutions, driven by environmental regulations, bioavailability optimization, and demand for sustainable feed practices.

| Formulation Type | 2025 Share |

|---|---|

| Microencapsulated Zinc | 38% |

| Nano encapsulated Zinc | 26% |

| Lipid-Coated Zinc | 20% |

| Polymer-Coated Zinc | 16% |

The microencapsulated zinc segment is projected to hold 38% of revenue in 2025, sustaining dominance as the preferred formulation type. This leadership is expected to be supported by its ability to stabilize nutrients during feed processing and deliver controlled release in the gut. Nano encapsulated zinc, although smaller in share, is forecast to be the fastest-growing category at a CAGR of 7.4%, driven by rising validation of superior bioavailability. Lipid- and polymer-coated formats are anticipated to remain stable contributors, serving feed applications requiring durability under pelleting and extrusion. Innovation in encapsulation technologies is expected to remain the critical driver for this segment, ensuring efficiency and sustainability in feed formulations.

| Zinc Source | 2025 Share |

|---|---|

| Zinc Oxide | 34% |

| Zinc Sulfate | 28% |

| Zinc Chelates | 22% |

| Organic Zinc Complexes | 16% |

The zinc oxide segment is anticipated to remain the largest contributor with a 34% share in 2025, reinforced by its wide availability and cost-effectiveness. Encapsulation is expected to mitigate environmental concerns, securing its compliance viability under stricter regulations. Zinc sulfate is forecast to retain a 28% share, while chelates are projected to expand steadily at a CAGR of 7.0%. Organic zinc complexes are expected to achieve the strongest momentum at a CAGR of 7.2%, supported by premium positioning and strong absorption claims. Over the forecast period, a gradual shift from bulk oxide and sulfate toward chelates and organic complexes is expected, reflecting sustainability and efficiency priorities in modern animal production.

| Animal Type | 2025 Share |

|---|---|

| Livestock | 45% |

| Poultry | 35% |

| Aquaculture | 12% |

| Companion Animals | 8% |

The livestock segment is forecast to dominate with a 45% share in 2025, supported by high demand across cattle, swine, and small ruminants. Encapsulated zinc is expected to be prioritized for reproductive performance, hoof integrity, and immunity in these species. Poultry is projected to contribute 35%, with broilers expanding fastest at 7.0% CAGR, driven by large-scale production efficiency needs. Aquaculture, while smaller in base, is expected to grow most rapidly at 7.4% CAGR, supported by water quality mandates and the need for targeted mineral delivery in finfish and crustaceans. Companion animals are forecast to account for 8%, with demand supported by premium pet nutrition trends focusing on immunity and skin health. Across species, livestock is expected to anchor demand, while aquaculture and pets contribute the fastest relative growth.

Market expansion is being shaped by regulatory ceilings on mineral inclusion and the shift toward precision nutrition. While encapsulated zinc adoption is gaining traction for bioavailability and sustainability benefits, evolving cost structures and compliance frameworks continue to create both opportunities and constraints.

Regulatory Realignment Favoring Precision Minerals

Stricter restrictions on zinc oxide inclusion have created reformulation imperatives, particularly in Europe and Asia-Pacific. Encapsulation is being positioned as the compliance-ready solution, ensuring delivery efficiency at lower inclusion levels. As nutrient excretion targets are tightened, integrators are expected to increasingly prioritize encapsulated formats to safeguard performance while aligning with sustainability frameworks. Regulatory-driven adoption is anticipated to solidify encapsulated zinc as an essential component of feed formulations, especially in markets where environmental audits and traceability requirements are intensifying.

Volatility in Coating Material and Input Costs

The cost of coating polymers, emulsifiers, and stabilizers used in encapsulation has exhibited volatility, influenced by fluctuations in petrochemical supply chains and rising energy costs. These uncertainties are expected to challenge cost-in-use competitiveness in price-sensitive markets. While demand for sustainable feed additives remains strong, margin pressures may limit adoption among smaller feed mills. To mitigate this restraint, suppliers are expected to focus on process innovations, backward integration, and alternative coating technologies that reduce dependency on volatile raw materials.

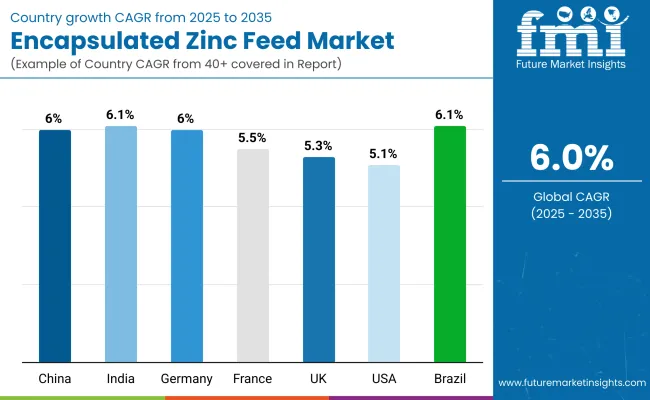

| Countries | CAGR |

|---|---|

| China | 6.05% |

| India | 6.14% |

| Germany | 6.03% |

| France | 5.55% |

| UK | 5.30% |

| USA | 5.10% |

| Brazil | 6.19% |

The Encapsulated Zinc Feed Market demonstrates distinct country-level dynamics, influenced by regulatory actions, livestock production systems, and sustainability agendas. Asia-Pacific is projected to remain a growth anchor, led by India at 6.14% CAGR and China at 6.05% CAGR. India’s trajectory is expected to be supported by rapid poultry expansion, increasing integration of functional feed additives, and the rising role of veterinary consultants in precision formulations. China’s progress is anticipated to be moderated by regulatory controls on mineral inclusion, but aquaculture adoption and large-scale swine production are forecast to sustain momentum.

In Europe, growth remains steady with Germany at 6.03% CAGR, France at 5.55% CAGR, and the UK at 5.30% CAGR. The region is projected to advance through stringent environmental mandates, traceability requirements, and sustainability-linked certifications, making encapsulated zinc an attractive reformulation tool. Germany is expected to maintain its position as the regional anchor due to strong livestock and dairy integration, while France and the UK are forecast to strengthen adoption through poultry and companion animal markets.

North and Latin America also show promising trajectories. The USA at 5.10% CAGR is expected to record the highest momentum among mature markets, driven by integrator consolidation and sustainability-linked procurement, while Brazil at 6.19% CAGR is anticipated to lead regional expansion through poultry and beef exports.

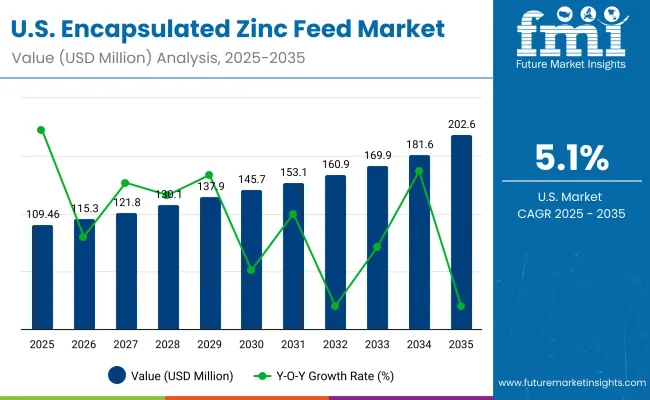

| Year | USA Encapsulated Zinc Feed Market (USD Million) |

|---|---|

| 2025 | 109.46 |

| 2026 | 116.8 |

| 2027 | 124.0 |

| 2028 | 131.8 |

| 2029 | 140.4 |

| 2030 | 149.5 |

| 2031 | 158.7 |

| 2032 | 169.8 |

| 2033 | 180.4 |

| 2034 | 192.0 |

| 2035 | 202.6 |

The Encapsulated Zinc Feed Market in the United States is projected to expand from USD 109.46 million in 2025 to USD 202.6 million by 2035, advancing at a CAGR of 6.3%. Growth is expected to be sustained by feed mill integration of encapsulated formats, sustainability-driven procurement, and the rising need for bioavailable trace minerals in livestock and poultry production. Increasing focus on reducing fecal excretion and maintaining performance under mineral ceilings is anticipated to strengthen adoption.

The Encapsulated Zinc Feed Market in the United Kingdom is projected to expand at a CAGR of 5.30% between 2025 and 2035. Market development is expected to be reinforced by regulatory continuity with European Union nutrient ceilings, pushing integrators toward compliant mineral delivery systems. Premium adoption in poultry and companion animals is anticipated to gain strength as feed efficiency and pet wellness trends converge. Sustainability-linked certifications are expected to accelerate encapsulated zinc adoption across the value chain, with retailers increasingly demanding traceability in feed formulations.

The Encapsulated Zinc Feed Market in India is forecast to grow at a CAGR of 6.14% from 2025 to 2035. Expansion is expected to be anchored by rapid poultry sector growth and rising veterinary guidance for precision trace minerals. Demand is anticipated to be concentrated in poultry and companion animals, while cattle adoption gains traction under productivity-focused dairy programs. As antibiotic restrictions strengthen, gut health modulation and immunity enhancement benefits are expected to support encapsulated zinc penetration.

The Encapsulated Zinc Feed Market in China is expected to grow at a CAGR of 6.05% during 2025–2035. Growth momentum is anticipated to be moderated by cost sensitivity in small-scale feed mills but supported by structural reforms in swine and aquaculture industries. Regulatory scrutiny on mineral inclusion and excretion is expected to act as both a challenge and a catalyst, reinforcing encapsulation as a compliance-ready solution. Companion animal nutrition is projected to emerge as a high-margin growth niche, supported by premiumization of pet diets.

| Countries | 2025 |

|---|---|

| UK | 20.93% |

| Germany | 21.53% |

| Italy | 9.72% |

| France | 13.74% |

| Spain | 9.95% |

| BENELUX | 6.96% |

| Nordic | 5.05% |

| Rest of Europe | 12% |

| Countries | 2035 |

|---|---|

| UK | 20.29% |

| Germany | 20.47% |

| Italy | 9.13% |

| France | 12.11% |

| Spain | 10.45% |

| BENELUX | 5.37% |

| Nordic | 5.59% |

| Rest of Europe | 17% |

The Encapsulated Zinc Feed Market in Germany is projected to advance at a CAGR of 6.03% between 2025 and 2035. Market growth is anticipated to be underpinned by stringent regulatory mandates on trace mineral ceilings and environmental stewardship, which make encapsulation an attractive compliance pathway. Livestock nutrition, particularly in dairy, is expected to dominate demand, while poultry and companion animals contribute incremental growth. Sustainability-linked supply contracts are projected to strengthen adoption among integrated feed producers.

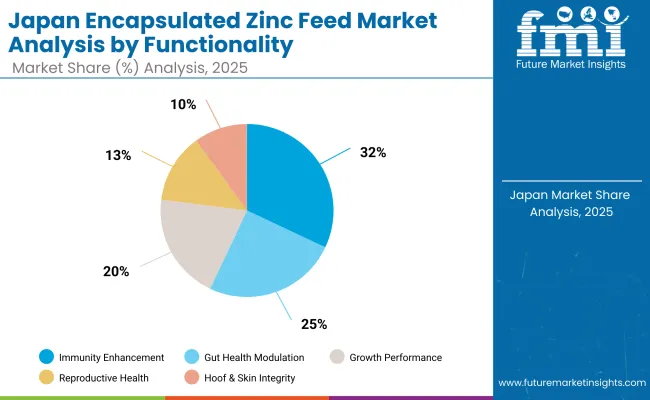

| japan Functionality | 2025 Share |

|---|---|

| Immunity Enhancement | 32% |

| Gut Health Modulation | 25% |

| Growth Performance | 20% |

| Reproductive Health | 13% |

| Hoof & Skin Integrity | 10% |

The Encapsulated Zinc Feed Market in Japan is projected to reflect strong functionality-led adoption in 2025, with immunity enhancement contributing 32% of value and gut health modulation holding 25%. This concentration highlights the role of functional nutrition in Japan’s livestock and poultry production systems, where efficiency and animal welfare are tightly linked to compliance standards. Immunity-focused formulations are expected to dominate, supported by antibiotic reduction mandates and rising preference for preventive health strategies. Gut health modulation is anticipated to remain critical, with encapsulated zinc positioned to provide targeted intestinal delivery and improved nutrient utilization. Growth performance and reproductive health together account for one-third of functional demand, emphasizing the continued importance of productivity and breeding efficiency.

As Japan advances its livestock modernization and food safety agendas, the role of encapsulated trace minerals is projected to strengthen further. Functional outcomes will be prioritized as part of integrated feed strategies, enabling higher efficiency and compliance readiness.

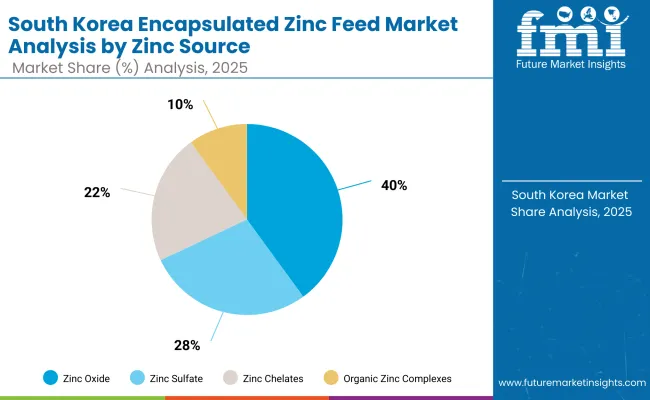

| South Korea Zinc Source | 2025 Share |

|---|---|

| Zinc Oxide | 40% |

| Zinc Sulfate | 28% |

| Zinc Chelates (e.g., Zn-Methionine, Zn- Glycinate) | 22% |

| Organic Zinc Complexes | 10% |

The Encapsulated Zinc Feed Market in South Korea is projected to be anchored by zinc oxide, which holds a 40% share in 2025 due to cost-effectiveness and wide application across livestock and poultry diets. However, environmental concerns linked to bulk mineral use are expected to gradually accelerate a shift toward more efficient alternatives. Zinc sulfate contributes 28%, reflecting its role as a standard source, though it faces substitution pressure from chelated and organic forms. Zinc chelates, including Zn-Methionine and Zn-Glycinate, represent 22% of demand and are anticipated to gain traction as bioavailability data and cost-in-use benefits strengthen. Organic zinc complexes, while smaller at 10%, are projected to capture increasing attention as sustainability-linked certifications gain importance in feed procurement.

South Korea’s focus on intensive livestock systems and export-oriented poultry production is expected to favor adoption of encapsulated sources with proven efficiency and reduced excretion. Strategic emphasis on sustainability and premium nutrition is anticipated to strengthen uptake of chelated and organic sources beyond 2030.

The Encapsulated Zinc Feed Market is moderately consolidated, with global leaders, mid-sized innovators, and regional specialists competing across livestock, poultry, aquaculture, and companion animal applications. Global feed additive leaders such as Zinpro Corporation, Balchem Corporation (Bergafat), Kemin Industries, Alltech, and Animine hold significant market share, supported by advanced encapsulation technologies, validated bioavailability outcomes, and long-standing distribution networks. Their strategies are increasingly emphasizing sustainability credentials, precision nutrient delivery, and performance trials across diverse production environments.

Established mid-sized innovators are focusing on species-specific solutions and hybrid coating systems that balance cost-efficiency with regulatory compliance. These players are accelerating adoption through encapsulated zinc chelates and organic complexes, enabling higher absorption and reduced environmental footprint. Their positioning is being reinforced by strategic partnerships with regional feed mills and veterinary consultants, allowing penetration into emerging Asian and Latin American markets.

Specialist providers are tailoring solutions for niche sectors such as aquaculture and companion animals. Their strength lies in customization, process innovation, and regional adaptability rather than global scale. Competitive differentiation is shifting away from simple formulation types toward integrated value propositions built on sustainability-linked procurement, cost-in-use validation, and digital advisory platforms. Over the next decade, leadership is expected to be defined by ecosystem strength, proof of performance, and alignment with environmental compliance frameworks.

Key Developments in Encapsulated Zinc Feed Market

| Item | Value |

|---|---|

| Quantitative Units | USD 456.1 Million |

| Formulation Type | Microencapsulated Zinc, Nano encapsulated Zinc, Lipid-Coated Zinc, Polymer-Coated Zinc |

| Zinc Source | Zinc Oxide, Zinc Sulfate, Zinc Chelates (Zn-Methionine, Zn- Glycinate), Organic Zinc Complexes |

| Animal Type | Livestock (Cattle, Swine, Sheep & Goats), Poultry (Broilers, Layers, Turkeys), Aquaculture (Finfish, Crustaceans), Companion Animals (Dogs, Cats) |

| Functionality | Immunity Enhancement, Gut Health Modulation, Growth Performance, Reproductive Health, Hoof & Skin Integrity |

| Sales Channels | Feed Mill Direct Sales, Distributors, Online B2B Platforms, Veterinary Clinics & Consultants |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, Brazil, South Korea, Australia, South Africa |

| Key Companies Profiled | Zinpro Corporation, Balchem Corporation (Bergafat), Animine, Kemin Industries, Alltech |

| Additional Attributes | Market shares by formulation and animal type, regulatory-driven adoption in Europe and North America, premium demand for nanoencapsulation and organic complexes, rapid uptake in poultry and aquaculture, sustainability-linked procurement trends, validation through bioavailability trials, regional adoption disparities shaped by cost sensitivity, and functional benefits aligning with antibiotic reduction mandates. |

The global Encapsulated Zinc Feed Market is estimated to be valued at USD 456.1 million in 2025.

The market size for the Encapsulated Zinc Feed Market is projected to reach USD 813.6 million by 2035.

The Encapsulated Zinc Feed Market is expected to grow at a 5.7–6.0% CAGR between 2025 and 2035.

The key product types in the Encapsulated Zinc Feed Market are microencapsulated zinc, nanoencapsulated zinc, lipid-coated zinc, and polymer-coated zinc.

In terms of animal type, the livestock segment is expected to command the largest share at 45% in the Encapsulated Zinc Feed Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Encapsulated Citric Acid Market

Encapsulated Salt Market

Encapsulated Caffeine Market

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Paraffin Phase Change Materials Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Omega-3 Powders Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Fish Oil Market

Micro-Encapsulated Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Encapsulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Market Forecast and Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA