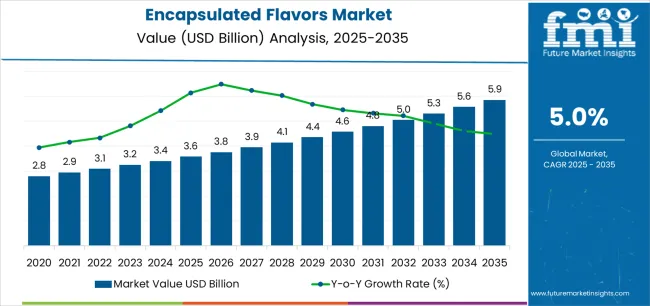

The Encapsulated Flavors Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The Encapsulated Flavors market is expanding steadily as food and beverage manufacturers increasingly adopt advanced encapsulation technologies to preserve flavor stability, extend shelf life, and ensure consistent taste delivery. The growing demand for processed and convenience foods across both developed and developing regions is fueling the adoption of encapsulated flavors, as these solutions help maintain product integrity even under challenging storage and transportation conditions.

Rising health-consciousness has also created opportunities for encapsulated natural flavors, as consumers seek clean label and functional products that offer both taste and nutritional benefits. Innovations in microencapsulation techniques are enabling better control over flavor release, supporting premiumization trends within the food and beverage sector.

Additionally, the increasing use of encapsulated flavors in pharmaceuticals, nutraceuticals, and dietary supplements is further contributing to market expansion As companies continue to focus on product differentiation and sustainable formulations, encapsulated flavors are expected to play a critical role in supporting evolving consumer preferences, ensuring strong growth potential across multiple applications in the coming years.

| Metric | Value |

|---|---|

| Encapsulated Flavors Market Estimated Value in (2025 E) | USD 3.6 billion |

| Encapsulated Flavors Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

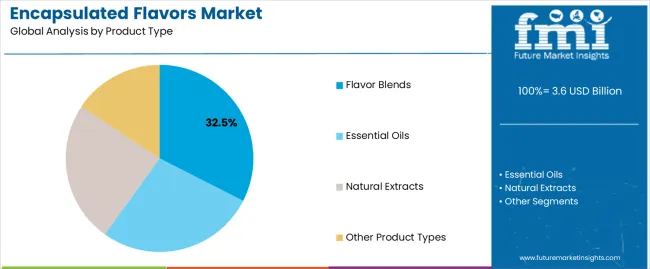

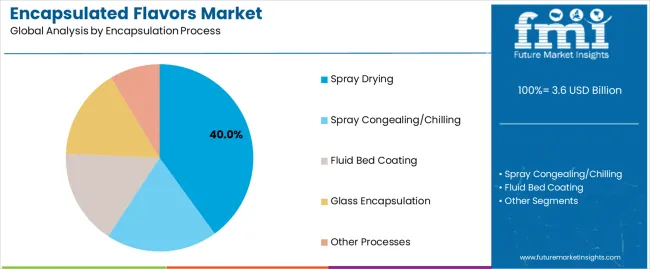

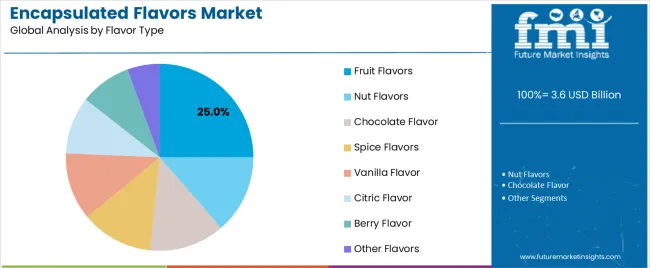

The market is segmented by Product Type, Encapsulation Process, Flavor Type, and End-Use Application and region. By Product Type, the market is divided into Flavor Blends, Essential Oils, Natural Extracts, and Other Product Types. In terms of Encapsulation Process, the market is classified into Spray Drying, Spray Congealing/Chilling, Fluid Bed Coating, Glass Encapsulation, and Other Processes. Based on Flavor Type, the market is segmented into Fruit Flavors, Nut Flavors, Chocolate Flavor, Spice Flavors, Vanilla Flavor, Citric Flavor, Berry Flavor, and Other Flavors. By End-Use Application, the market is divided into Pharmaceutical And Personal Care, Bakery And Confectionary, Cereal And Oatmeal, Snack Food, Frozen Food, Dairy Products, Beverages And Instant Drinks, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flavor blends product type is projected to hold 32.50% of the Encapsulated Flavors market revenue share in 2025, making it the leading product segment. This dominance has been attributed to the ability of flavor blends to provide consistent multi-note taste profiles that are highly demanded in bakery, confectionery, and beverage formulations. Manufacturers have relied on encapsulated flavor blends to improve flavor retention and protect sensitive ingredients from oxidation or degradation during processing and storage.

The increasing demand for convenient packaged foods with unique taste experiences has further strengthened the role of flavor blends. Encapsulation ensures uniform distribution of blended flavors, resulting in enhanced product quality and consumer satisfaction.

Moreover, the segment has benefited from innovations in encapsulation carriers and coating materials that enable improved flavor stability and targeted release With growing consumer preference for diverse taste combinations and the need for reliable flavor delivery systems, the flavor blends segment continues to maintain a dominant position in the market.

The spray drying process is expected to account for 40.00% of the Encapsulated Flavors market revenue share in 2025, positioning it as the leading encapsulation method. This process has been widely adopted due to its cost efficiency, scalability, and ability to preserve flavor compounds effectively under large-scale production. Spray drying provides consistent particle size and stability, making it highly suitable for applications in powdered food and beverage products such as instant drinks, soups, and seasonings.

The method has gained traction as it allows the incorporation of heat-sensitive flavors into formulations while maintaining their sensory characteristics. Additionally, the ability of spray drying to extend product shelf life and reduce flavor volatility has reinforced its widespread adoption.

Manufacturers have also utilized this process to enhance handling, transport, and storage convenience for flavor ingredients As demand for reliable, cost-effective, and industrially scalable encapsulation solutions rises, spray drying remains a dominant technology in the encapsulated flavors market.

The fruit flavors segment is anticipated to capture 25.00% of the Encapsulated Flavors market revenue share in 2025, highlighting its strong role within flavor types. This segment has been driven by the increasing consumer preference for natural and refreshing taste profiles in beverages, dairy products, confectionery, and health supplements.

Encapsulation of fruit flavors has addressed challenges related to flavor degradation, volatility, and instability, ensuring that products maintain consistent sensory appeal throughout their shelf life. The segment’s growth has also been supported by the rising demand for clean label and plant-based products, where fruit flavors are perceived as healthier alternatives to synthetic options.

Furthermore, encapsulated fruit flavors provide enhanced solubility and controlled release, enabling manufacturers to deliver authentic taste experiences in a wide range of product formulations With the global trend toward natural ingredients and functional foods, encapsulated fruit flavors are expected to remain a key growth driver, securing their position as a leading flavor type in the market.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and current year (2025) for global Encapsulated Flavors market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 6.4% (2025 to 2035) |

| H2 | 6.5% (2025 to 2035) |

| H1 | 6.6% (2025 to 2035) |

| H2 | 6.7% (2025 to 2035) |

The above table presents the expected CAGR for the global Encapsulated Flavors demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2025, the business is predicted to surge at a CAGR of 6.4%, followed by a slightly higher growth rate of 6.5% in the second half (H2) of the same year.

In the first half (H1 2025) the market witnessed a decrease of 20 BPS while in the second half (H2 2025), the market witnessed an increase of 35 BPS.

Innovation in Encapsulated Flavors: Customization and Exotic Blends Leading the Way

Consumers are seeking personalized and unique taste experiences, which is encouraging companies to innovate and offer customized flavors. Additionally, there is a rising interest in exotic flavor combinations, as consumers are eager to explore new and distinct taste experiences.

This is especially leading in the premium and artisanal product segments, where unique and exotic flavors help the brand to stand out in a competitive market, and appeal to adventurous and discreet palates looking for something distinct and memorable.

Natural and Refreshing: Citric Flavors in the Spotlight for Beverages and Confectionery

Citric flavors are highly popular in beverages and confectionery due to their refreshing and zesty taste, which appeals to consumers trying to find stimulating and refreshing experiences. These flavors are particularly favored in summer drinks, candies, and desserts for their bright and lively experience. Moreover, there is a growing demand for natural and clean label products, which is driving the preference for naturally derived citric flavors.

With time consumers are gradually avoiding artificial additives, and instead choosing for ingredients seen as healthier and more transparent. This supports the use of citric flavors from natural sources, going with the clean label movement and enhancing product appeal.

Preserving Quality in the Growing Ecosystem of Convenient Meals

Encapsulated flavors play an important role in this market by ensuring that flavors remain stable and vibrant throughout the freezing and reheating processes. These encapsulated flavors preserve the quality and integrity of the taste, and prevents degradation that can occur in extreme conditions.

Due to which, manufacturers can provide high-quality, flavorful meals that meet consumer expectations for convenience without compromising on taste, maintaining the appeal of frozen and ready-to-eat products in this competitive market.

Global Encapsulated Flavors sales increased at a CAGR of 4.1% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on Encapsulated Flavors will rise at 5.3% CAGR

Advancements in encapsulation processes such as spray drying, spray congealing, fluid bed coating, and glass encapsulation are upgrading the flavor industry by enhancing stability, controlled release, and shelf life of encapsulated flavors. Spray drying, known for its efficiency and scalability, ensures uniform encapsulation of flavors suitable for large-scale production.

Spray congealing and fluid bed coating techniques protect flavors from heat and moisture, preserving their integrity and enhancing their stability. Glass encapsulation provides superior protection, especially for delicate flavors, ensuring they withstand harsh processing conditions. These innovations are essential for meeting consumer demand for high-quality, consistent flavors across a wide range of food and beverage applications.

A favorable regulatory environment for natural and encapsulated flavors stimulates innovation and adoption within the industry. By providing guidelines and incentives, regulations encourage companies to consider new techniques and formulations, particularly those using natural ingredients.

This regulatory support encourages the development of safer and more sustainable encapsulation processes. Strict adherence to safety and quality standards ensures that encapsulated flavors meet rigorous criteria, enhancing consumer confidence in product safety and regulatory compliance.

As a result, manufacturers can optimistically trade their products while meeting consumer demand for natural, transparently labelled choices, driving overall growth and reliability in the encapsulated flavors market.

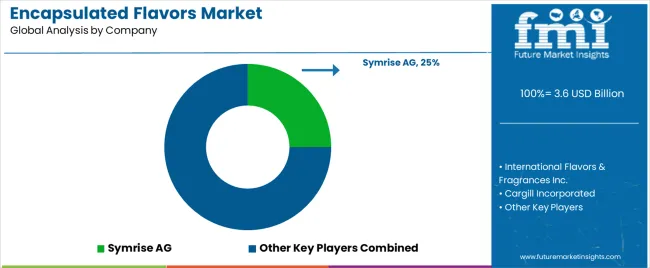

Tier 1 companies comprise market leaders with market revenue of above USD 50 million capturing significant sales domain share of 50% to 60% in the global sphere. These business leaders are characterized by high production capacity and a wide product portfolio.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Firmenich International Flavors & Fragrances Inc., Cargill, Kerry, and Symrise.

Tier 2 companies include mid-size players with revenue of USD 10 to 50 million having presence in specific regions and highly influencing the local retail space. These are characterized by a strong presence overseas and strong consumer base knowledge. These industry players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Instant Foods, FONA International Inc., Clextral, Gold Coast Ingredients, Inc., and Synthite Industries Limited. Tier 3 includes the majority of small-scale having revenue below USD 25 million.

The following table shows the estimated growth rates of the top three sales domains. The United States and Germany are set to exhibit high Encapsulated Flavors consumption, recording CAGRs of 4.9% and 5.2%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.9% |

| Germany | 5.2% |

| China | 4.5% |

| India | 4.2% |

| Australia | 3.2% |

The ecosystem for Encapsulated Flavors in the United States is projected to exhibit a CAGR of 4.9% during the assessment period. By 2035, revenue from the sales of Encapsulated Flavors in the country is expected to reach USD 1.3 billion.

In the United States, advances in encapsulation technologies like spray drying and fluid bed coating have changed the food and beverage industry. These technologies enhance the efficiency and effectiveness of flavor encapsulation, which ensures better flavor stability and controlled release.

Due to which, encapsulated flavors are now utilized in a broader array of products including beverages, snacks, dairy items, and pharmaceuticals. This expansion meets consumer demand for consistent taste experiences and longer shelf life, while it also supports innovation in functional foods and dietary supplements that require precise flavor delivery and enhanced product performance.

Encapsulated Flavors demand in Germany is calculated to rise at a value CAGR of 5.2% during the forecast period (2025 to 2035). By 2035, Germany is expected to account for 17.5% of Encapsulated Flavors sales in Europe.

Favorable regulatory frameworks play a crucial role in supporting the use of encapsulated flavors in Germany by ensuring stringent safety and quality standards are met. These regulations provide clear guidelines for manufacturers to adhere to, promoting transparency and consumer trust in product safety.

Moreover, the supportive regulatory environment promotes continuous innovation in flavor technology. This encourages research and development efforts intended to improve flavor stability, efficacy, and sustainability. Due to which, encapsulated flavors are increasingly utilized across various industries, meeting evolving consumer preferences for high-quality, safe, and innovative food and beverage products.

Consumption of Encapsulated Flavors in China is projected to increase at a value CAGR of 4.5% over the next ten years. By 2035, the segment size is forecasted to reach USD 987.5 million, with China expected to account for a demand space share of 46.5% in East Asia.

As Chinese food manufacturers expand their global reach, the demand for encapsulated flavors rises to meet stringent international standards. These flavors ensure consistent quality, optimal flavor retention, and extended shelf stability to maintain product integrity during export.

By utilizing advanced encapsulation technologies like spray drying and fluid bed coating, manufacturers can achieve these requirements, enhancing the appeal and competitiveness of their products in global markets. This emphasis on quality and consistency supports China's food industry in establishing a strong international presence and meeting the diverse tastes of global consumers effectively.

| Segment | Flavor Blends (Product Type) |

|---|---|

| Value Share (2025) | 32.5% |

Sales of flavor blends are projected to register a CAGR of 4.8% from 2025 to 2035. Flavor blends are mainly favored for their adaptability across diverse industries such as food, beverages, and pharmaceuticals.

Manufacturers benefit from the flexibility to customize blends according to specific application requirements and consumer preferences. This versatility allows for the creation of products with precise flavor combinations that enhance taste experiences and differentiate brands in competitive markets.

Whether adjusting sweetness levels in beverages, enhancing savory notes in snacks, or masking bitterness in pharmaceuticals, customized flavor blends ensure consistency and consumer satisfaction. Their ability to meet varied industry demands highlights their popularity and essential role in product development across multiple industries.

| Segment | Pharmaceutical and Personal Care (End-Use Application) |

|---|---|

| Value Share (2025) | 16.8% |

The pharmaceutical and personal care segment is anticipated to advance at 5.2% CAGR during the projection period.

Encapsulated flavors offer more than just sensory enhancement in personal care products; they contribute functional benefits that goes with current trends favoring multifunctional and natural ingredients. For instance, certain encapsulated flavors can provide antimicrobial properties, helping to maintain product freshness and hygiene.

Furthermore, they offer skin-soothing effects, which makes them ideal for skincare formulations made for sensitive or irritated skin. These functional benefits not only enhances the product efficacy but also appeal to consumers searching for skincare and hygiene solutions that offer both sensory pleasure and tangible health benefits, thus driving their increasing use in the personal care industry.

Manufacturers are also looking to preserve their demand space position by focusing on product quality, innovation, and matching varied customer preferences.

For instance

As per product type, the ecosystem has been categorized into Flavor Blends, Essential Oils, Natural Extracts, and Other Product Types

This segment is further categorized into Spray Drying, Spray Congealing/Chilling, Fluid Bed Coating, Glass Encapsulation, and Other Processes

As per the flavour type, the customer base has been categorized into Fruit Flavors, Nut Flavors, Chocolate Flavor, Spice Flavors, Vanilla Flavor, Citric Flavor, Berry Flavor, and Other Flavors

This segment is further categorized into Bakery and Confectionary, Cereal and Oatmeal, Snack Food, Frozen Food, Dairy Products, Beverages and Instant Drinks, Pharmaceutical and Personal Care, and Other Applications

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global encapsulated flavors market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the encapsulated flavors market is projected to reach USD 5.9 billion by 2035.

The encapsulated flavors market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in encapsulated flavors market are flavor blends, essential oils, natural extracts and other product types.

In terms of encapsulation process, spray drying segment to command 40.0% share in the encapsulated flavors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Demand for Encapsulated Flavors and Fragrances in USA Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Encapsulated Citric Acid Market

Encapsulated Salt Market

Encapsulated Caffeine Market

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Paraffin Phase Change Materials Market Size and Share Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Omega-3 Powders Market Size and Share Forecast Outlook 2025 to 2035

Food Flavors Market Insights – Taste Innovation & Industry Expansion 2025 to 2035

Pork Flavors Market Analysis by Form, Packaging and Distribution Channel Through 2035

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Microencapsulated Fish Oil Market

Micro-Encapsulated Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bacon Flavors Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA