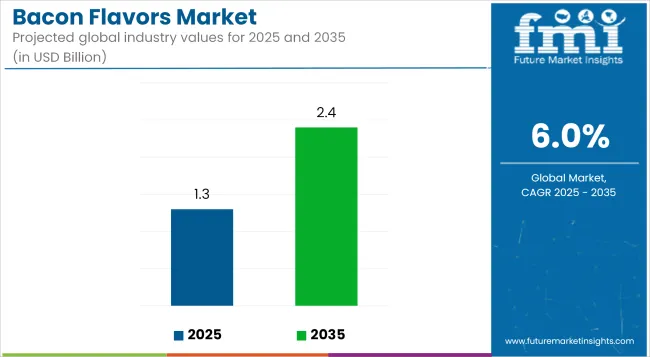

The global market for bacon flavors is expected to grow significantly over the next decade, from an estimated USD 1.3 billion in 2025 to USD 2.4 billion by 2035, with a CAGR of 6.0%. This upward trend is reflective of evolving consumer palettes increasingly favoring bold, smoky, and umami-rich profiles across a variety of product categories. The demand is being driven by innovations in flavor encapsulation, clean-label bacon substitutes, and the shift toward plant-based savory flavor systems replicating traditional pork essence.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.3 Billion |

| Projected Market Size in 2035 | USD 2.4 Billion |

| Global CAGR (2025 to 2035) | 6.0% |

The current momentum in the bacon flavors market is underpinned by the rapid proliferation of bacon-flavored products across snacks, sauces, condiments, and meat alternatives. Growth is being reinforced by the rising popularity of smoky undertones in global cuisines and an uptick in indulgent snacking.

However, regulatory scrutiny over artificial flavoring agents and the growing vegan demographic pose mild restraints. Still, the trend toward vegan-compatible, non-animal-derived bacon flavors is being actively addressed through R&D investments. Market participants are recalibrating offerings to prioritize natural, allergen-free, and label-friendly claims while optimizing shelf-stability and sensory complexity. Cross-category flavor pairing such as maple-bacon, chipotle-bacon, or bourbon-bacon is also gaining strong traction.

Over the next decade, the market is expected to mature into a specialized flavor segment driven by convergence of gourmet product positioning and dietary customization. By 2025, snack applications such as chips, popcorn, and extruded snacks are anticipated to hold the highest share, while plant-based formulations will gain incremental adoption.

By 2035, the market will likely witness diversification into nutraceuticals and ready meals, with flavor systems engineered for low-sodium, keto, and protein-rich foods. Flavor companies with robust formulation capabilities and advanced sensory science platforms are poised to influence premiumization and product innovation across both retail and foodservice channels.

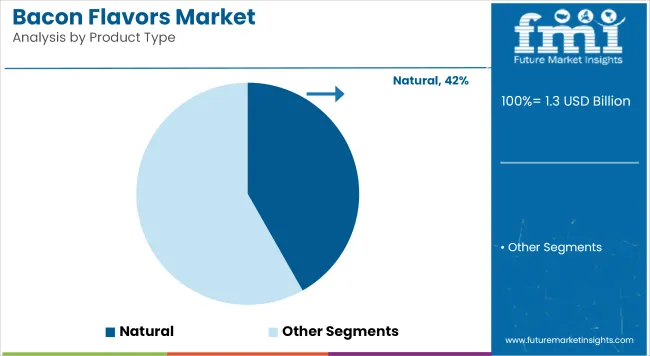

Natural bacon flavors are projected to account for 41.8% of the market in 2025. Meanwhile, plant-based bacon flavor systems are estimated to contribute under 12%, yet are growing over 8% CAGR. As plant-forward eating habits become mainstream in North America and Western Europe, flavor houses are engineering bacon profiles compatible with vegan matrices, including soy, pea, and mung-based carriers.

Regulatory guidance from EFSA and the Flavor and Extract Manufacturers Association (FEMA) has also shaped the development of allergen-free and non-GMO solutions, with FEMA GRAS evaluations increasingly referenced for compliance in clean-label claims. Manufacturers such as Givaudan and Kerry Group are scaling their encapsulated and emulsion-based vegan bacon flavors to support bakery snacks and RTD savory beverages.

These formats require thermal and oxidative stability, making formulation complexity a key entry barrier. The market continues to evolve toward multipurpose flavor bases that can be tailored to fat mimetics, salt reducers, or protein-enhanced products.

Application-specific engineering is observed in keto-friendly bacon flavors for collagen bars and air-fried snacks, indicating a shift from bulk seasoning to precision flavor delivery systems. This convergence of sensory science with functional food formulation is driving premium pricing and niche innovation beyond traditional foodservice channels.

In 2025, foodservice-specific bacon flavor systems are estimated to account for 22.6% of total revenues, with growth driven by quick-service restaurants (QSRs) and hybrid casual dining. Operators increasingly seek modular flavor formats such as concentrated pastes, oil dispersions, and spray-dried powders tailored for menu engineering and seasonal LTOs. Companies such as Sensient Technologies and Mane Group have advanced capabilities in developing thermal-resistant and reconstitution-stable flavor solutions for high-heat and shelf-stable meal kits.

The USA FDA’s guidelines under 21 CFR 101.22 have necessitated explicit labeling of artificial versus natural flavoring agents in institutional kitchens. This has led to higher demand for natural-certified bacon flavor concentrates with minimized carriers like propylene glycol or silicon dioxide.

Regional chains in Europe and East Asia are deploying these bacon flavor systems in vegan ramen bases, fast-casual breakfast sauces, and smoky condiments. Furthermore, flavor modulation using yeast extracts and umami boosters allows chefs to replicate the Maillard reaction typical of pan-fried bacon, without requiring animal-derived ingredients. This segment is expected to benefit from cloud kitchen formats and meal subscription services, which increasingly demand scalable, easy-to-dose, allergen-compliant bacon flavoring systems.

Health Concerns and Regulatory Scrutiny

Bacon tastes market is facing an emerging challenge with the food community turning into increasingly mindful of punitive risks from eating processed meat. Many consumers are leaning toward healthier diets, which has led them to decrease their consumption of artificial flavourings, sodium and other additives commonly found in bacon-flavoured foods. Moreover, regulatory authorities are tightening restrictions on artificial flavouring body parts, preservatives, and label specifications, leading to increased compliance costs for manufacturers.

To tackle these challenges, businesses need to be creative by providing natural and clean-label bacon flavours that satisfy health-conscious consumers. Brands could "reformulate [products] with plant-based or smoke-infused alternatives, and reduce sodium and artificial additives to maintain consumer trust" as companies comply with changing regulatory standards.

Rising Demand for Plant-Based and Alternative Bacon Flavours

As more consumers are following flexitarian, as well as vegetarian and vegan diets, plant-based bacon flavours are in high demand. Food manufacturers are trying novel approaches to recreate the smoky, savoury, umami-rich profile of bacon without animal-derived components. Yeast extracts and plant-based proteins, along with natural smoke flavourings are being added to meat substitutes, snack foods, and seasonings to create bacon-like flavours.

Given that plant-based eating is on the rise, companies see this as a way to create a bacon-sequel taste that will appeal to more than just meat-eaters, many of whom are turning to more ethical, environmental or health-friendly lifestyles. By 2025, the global plant-based food industry is expected to boom as brands that have positioned their products as clean-label, allergen-free, and sustainable will get a competitive edge on this evolving market.

Growing consumer inclination towards smoky and savoury flavoured snacks, fast food, and ready-to-cook meals is paving the way for the growth of the USA bacon flavours market. Growing application of it as plant-based bacon flavouring in vegan and vegetarian food products is also propelling the trend. Food manufacturers are putting money into natural and clean-label ingredients to meet the needs of health-conscious consumers, while fast-food chains keep rolling out bacon-flavoured menu items in response to consumer demand.

| Country | CAGR (2025 to 2035) |

|---|---|

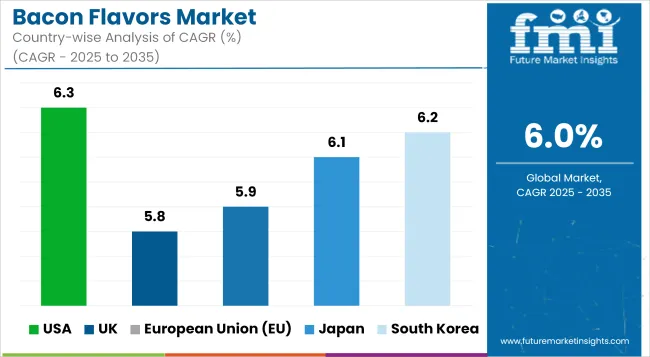

| USA | 6.3% |

The rising demand for these snacking options further accelerates the growth of the market on a global scale, particularly in the United Kingdom bacon flavours marketplace, which includes the UK bacon flavours market as well. The growing demand for meat alternatives has resulted in the creation of artificial and plant-based bacon flavour. Increase in premium and gourmet bacon flavour profiles will also be the dominant trend in product innovation within the foodservice and packaged food side.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

Germany, France, and Italy are the top markets for bacon flavours in the European Union, driven by high demand for processed meats, sauces, and flavoured seasonings. The increasing flexitarian trend has led to the creation of bacon flavours derived from synthetic and yeast sources. At the same time, health-conscious consumers in Europe are increasingly gravitating towards clean-label and organic flavouring trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.9% |

The market for Japanese bacon flavours is growing as demand for more Western-style flavours grow in demand for convenience, instant noodles, and sauces. The food industry is now adding bacon-flavoured umami notes to packaged snacks and seasoning blends. Moreover, the availability of enhanced synthetic flavours of bacon for plant-based items is propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

South Korea’s appetite for bacon flavours is on the rise, as global fast-food chains and domestic snack manufacturers roll out bacon-flavoured foods. Chips, instant meals and sauces are also using more bacon flavours, as Western-style foods become more popular. Additionally, plant-based food makers are pouring resources into bacon replacements that offer genuine smoky and crispy flavour profiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Growing consumer preference for bacon flavours in foods, snacks, plant-based products, etc. is likely to fuel the bacon flavours market. Natural and artificial bacon flavour innovations, clean-label ingredients, and vegan-friendly bacon flavour substitutes are among the key transformation areas. Companies are working to improve product authenticity, sustainability, and compatibility with ready-to-eat meals, seasonings, and sauces.

The Bacon Flavours Market was valued at approximately USD 1.3 billion in 2025.

The market is projected to reach USD 2.4 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.0% from 2025 to 2035.

The demand for Bacon Flavours Market is expected to be driven by the rising use of bacon-inspired flavours in pet treats, increasing consumer preference for meaty taste enhancements in functional nutrition products, and the growing popularity of plant-based bacon flavour alternatives.

The top 5 countries contributing to the Bacon Flavours Market are the United States, Canada, Germany, United Kingdom, and Australia.

The Pet Treats and Functional Nutrition segment is expected to lead the Bacon Flavours market, driven by the growing demand for high-palatable pet food options, rising focus on protein-rich and fortified nutrition, and expanding innovations in bacon-inspired formulations for human and animal consumption.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bacon Slicers Market Growth & Forecast 2025 to 2035

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Nitrate-Free Bacon Market

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Food Flavors Market Insights – Taste Innovation & Industry Expansion 2025 to 2035

Pork Flavors Market Analysis by Form, Packaging and Distribution Channel Through 2035

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Global Umami Flavors Market Insights – Growth, Demand & Forecast 2025–2035

Turkey Flavors Market Trends Size & Forecast 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Liquid Flavors Market Analysis – Demand, Growth & Forecast 2025-2035

Analysis and Growth Projections for Natural Flavors Business

Seafood Flavors Market Growth - Innovations & Industry Demand 2025 to 2035

Chicken Flavors Market

Cat Food Flavors Market

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA