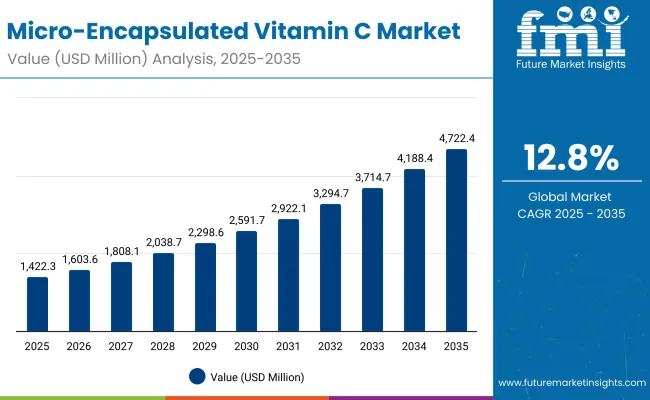

The micro-encapsulated vitamin C market is anticipated to begin at USD 1,422.3 million in 2025 and is forecast to reach USD 4,722.4 million by 2035. This growth of more than USD 3,300 million across the decade reflects a nearly 3.3-fold expansion, translating into a compound annual growth rate of 12.8%. The value progression indicates strong momentum as consumer adoption of stable, slow-release vitamin C solutions continues to rise.

Micro-Encapsulated Vitamin C Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,422.3 million |

| Market Forecast Value in (2035F) | USD 4,722.4 million |

| Forecast CAGR (2025 to 2035) | 12.80% |

During the first half of the period, from 2025 to 2030, the market is projected to advance from USD 1,422.3 million to USD 2,591.7 million, contributing nearly USD 1,170 million to overall growth. This accounts for more than one-third of the decade’s incremental expansion. Growth in this phase is expected to be driven by higher demand for efficacy-led formulations in skin brightening and anti-aging routines, supported by the increasing appeal of dermatologist-tested and clean-label claims. Pharmacies are likely to remain important gateways for early adoption, though digital channels are expected to accelerate penetration.

The second half, from 2030 to 2035, adds approximately USD 2,130 million as the market rises from USD 2,591.7 million to USD 4,722.4 million. This later-stage acceleration highlights a broader consumer shift toward advanced skin health solutions and higher acceptance of encapsulated actives for enhanced stability and performance. Emerging Asian economies, particularly China and India, are projected to outpace global averages, reinforcing the shift in demand centers. Collectively, these trends point toward a high-growth trajectory, with evidence suggesting sustained premiumization, strong functional positioning, and deepening regional diversification.

Between 2020 and 2024, the Micro-Encapsulated Vitamin C Market transitioned from niche innovation toward broader adoption, expanding steadily as encapsulation technology improved stability and shelf life. During this period, premium skincare brands accounted for the majority of revenues, reinforcing the clinical credibility of dermatologist-tested and pharmacy-distributed formulations. Mass-market penetration was limited, with specialist and prestige skincare players holding over 80% share.

By 2025, demand is projected to accelerate, valued at USD 1,422.3 million, with brightening and even-tone solutions leading consumer preference. A shift toward claim stacking vegan, clean-label, and fragrance-free will support broader consumer engagement. Competitive advantage is expected to transition from brand heritage alone to proof-based efficacy, encapsulation patents, and omnichannel trust-building strategies. Emerging players are anticipated to challenge incumbents by leveraging direct-to-consumer models, digital-first marketing, and value-driven innovation. By 2035, revenues are forecast to reach USD 4,722.4 million, supported by Asia-led growth and premiumization across global markets.

Growth in the micro-encapsulated vitamin C market is being propelled by rising consumer preference for stable, effective, and irritation-free skincare solutions. Encapsulation technology is enabling improved bioavailability and controlled release, addressing the limitations of conventional vitamin C products that degrade quickly and lose potency. Strong demand is being observed for brightening and even-tone applications, which remain leading functional claims across global markets.

Dermatologist-tested, vegan, clean-label, and fragrance-free formulations are being prioritized, as safety and transparency emerge as key purchase drivers. Pharmacies are serving as trusted entry points, while e-commerce and specialty beauty stores are expected to expand market reach by delivering education and social proof. Innovation in encapsulation materials and delivery systems is expected to unlock new product formats and widen adoption. Rapid growth in Asia, particularly in China and India, is further fueling expansion, with local demand supported by urbanization, rising disposable income, and heightened awareness of advanced skin health solutions.

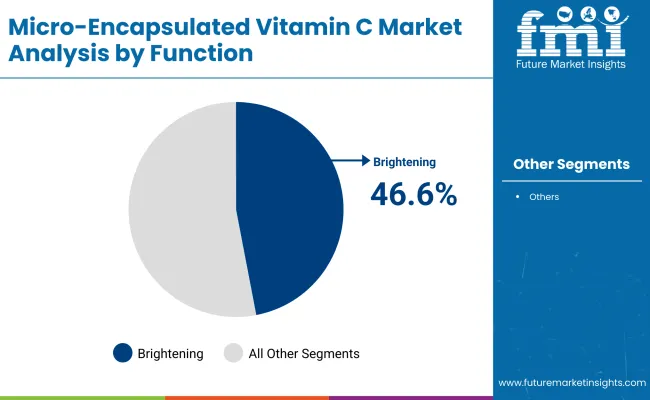

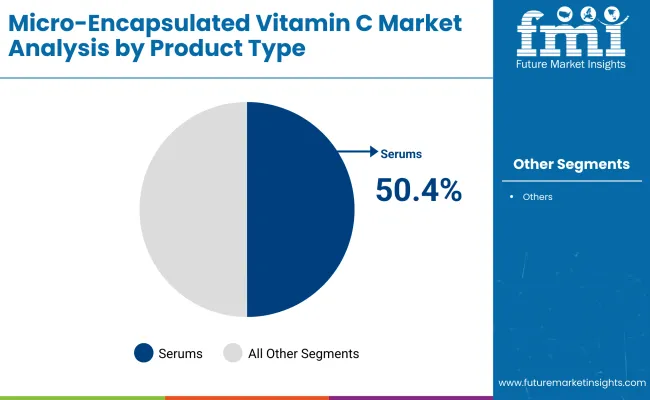

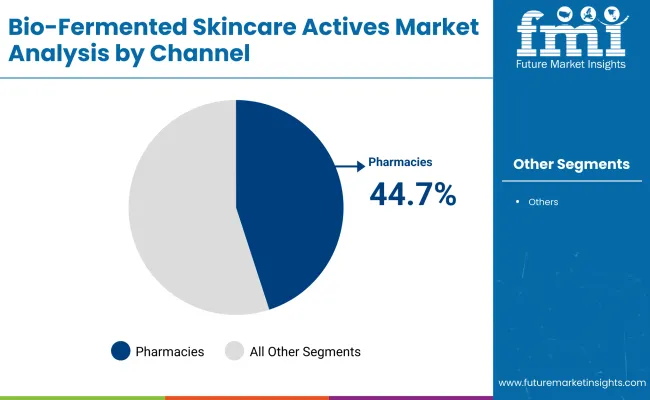

The micro-encapsulated vitamin C market has been segmented across function, product type, and distribution channel, each shaping adoption trends and influencing consumer behavior. Functional segmentation highlights brightening as a major demand driver, supported by the increasing focus on radiance and even skin tone. Product type segmentation reveals serums as a leading category, reflecting their ability to deliver concentrated formulations with improved absorption.

Distribution channels indicate pharmacies as a key point of consumer trust, while online and specialty stores accelerate wider accessibility. These segments collectively underscore how efficacy, format innovation, and retail presence interact to drive growth. Each segment is expected to evolve distinctly, influenced by consumer expectations, regulatory standards, and technological improvements in encapsulation science.

| Segment | Market Value Share, 2025 |

|---|---|

| Brightening | 46.6% |

| Others | 53.4% |

The brightening function is projected to remain a central pillar of the micro-encapsulated vitamin C market, holding 46.6% of value share in 2025. This dominance is attributed to consumer focus on pigmentation correction, even skin tone, and overall radiance. The encapsulation process is enabling higher stability and longer shelf life, ensuring sustained efficacy of brightening claims. Dermatologist-tested and clean-label formulations are expected to reinforce consumer confidence, especially in mature markets such as North America and Europe.

In emerging Asian economies, brightening products are projected to experience stronger adoption due to cultural emphasis on skin luminosity. Although the “Others” segment contributes slightly higher revenue overall, brightening maintains strategic importance by positioning vitamin C as a high-value active in premium skincare routines.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 50.4% |

| Others | 49.6% |

Serums are expected to dominate product type segmentation in 2025, accounting for 50.4% of value share. This leadership is linked to their lightweight texture, high concentration, and ability to deliver encapsulated vitamin C directly to deeper skin layers with improved absorption. Encapsulation technology is mitigating stability challenges, allowing brands to formulate potent vitamin C serums without rapid oxidation.

Consumers are increasingly aligning with serums as essential steps in multi-step routines, boosting daily use cases. Growth is projected to accelerate in e-commerce channels, where serums are strongly marketed through influencer endorsements and efficacy demonstrations. While creams and lotions retain relevance in mass-market categories, serums continue to capture premium positioning, reinforcing their centrality in skincare portfolios.

| Segment | Market Value Share, 2025 |

|---|---|

| Pharmacies | 44.7% |

| Others | 55.3% |

Pharmacies are expected to maintain a key role in distribution, securing 44.7% of market share in 2025. Their dominance is reinforced by consumer trust in pharmacist recommendations and perception of medical credibility associated with pharmacy-sold products. Micro-encapsulated vitamin C formulations benefit from this association, particularly as dermatologist-tested and clinically validated claims gain traction. Pharmacies serve as critical trial channels for premium skincare, where educated staff can guide consumer decision-making.

However, the “Others” category, including e-commerce and specialty beauty retailers, is projected to outpace growth, supported by convenience, wider product ranges, and strong digital marketing. Together, these distribution channels highlight a dual strategy: pharmacies drive trust and initial adoption, while online and specialty formats expand reach and accelerate mainstream acceptance.

The micro-encapsulated vitamin C market is being shaped by multiple dynamics, where technological innovation and shifting consumer preferences fuel expansion, while sustainability challenges and formulation complexities restrain pace. Key industry trends emphasize scientific validation, premiumization, and evolving regional demand structures.

Advancements in Encapsulation Technology

Market growth is being accelerated through innovations in encapsulation methods that extend vitamin C stability, protect against oxidative degradation, and enable controlled release. Micro-encapsulation is allowing higher bioavailability with reduced irritation risk, ensuring consistent efficacy across diverse formulations. Brands are expected to leverage these advances to justify premium positioning and differentiated claims. As formulations become more resilient to environmental stressors, supply chains are projected to unlock longer shelf life and reduced wastage. This not only enhances consumer trust but also enables deeper penetration in e-commerce and pharmacy-driven markets, where repeat purchases depend on demonstrable effectiveness.

Claim Stacking as a Differentiation Strategy

A key trend is the layering of multiple safety and ethical claims such as vegan, dermatologist-tested, clean-label, and fragrance-free onto micro-encapsulated vitamin C products. This approach is being utilized to address sensitivities, expand appeal across demographics, and strengthen credibility. As consumers increasingly scrutinize labels for transparency, companies are expected to integrate encapsulation efficacy with ethical positioning to capture both trust and loyalty. This trend is anticipated to shape marketing narratives and influence regulatory oversight, as claims verification becomes central to brand reputation and competitive advantage.

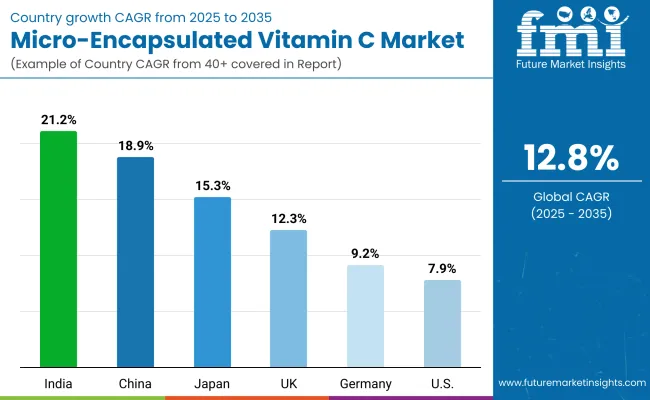

| Countries | CAGR |

|---|---|

| China | 18.9% |

| USA | 7.9% |

| India | 21.2% |

| UK | 12.3% |

| Germany | 9.2% |

| Japan | 15.3% |

The global micro-encapsulated vitamin C market demonstrates varied growth trajectories across key countries, shaped by consumer behavior, innovation intensity, and regional retail ecosystems. Asia is expected to lead the momentum, supported by strong cultural demand for skin-brightening and anti-aging solutions. India is projected to be the fastest-growing market, expanding at a CAGR of 21.2% from 2025 to 2035, driven by rapid urbanization, growing disposable incomes, and increasing penetration of dermatologist-tested formulations. China is also anticipated to post significant gains at 18.9% CAGR, benefiting from advanced R&D pipelines, strong digital commerce integration, and heightened consumer acceptance of premium functional skincare. Japan’s 15.3% CAGR reflects the nation’s established culture of high-performance beauty, with encapsulation science aligning well with consumer preference for safety and efficacy.

In Europe, the UK is expected to expand at 12.3% CAGR, supported by strong pharmacy-based sales and rising adoption of vegan and clean-label formulations. Germany’s market, though moderate at 9.2% CAGR, is projected to grow steadily through innovation in premium formulations and regulatory-driven emphasis on safe active delivery systems. In contrast, the USA is likely to expand at a slower pace of 7.9% CAGR, reflecting market maturity and widespread availability of conventional vitamin C formats. However, growth will be supported by claim-stacking strategies and increasing trust in encapsulated solutions to deliver long-term skin health benefits. Collectively, these differences highlight a shift toward Asia-led market expansion while Europe and North America sustain premium-focused but slower trajectories.

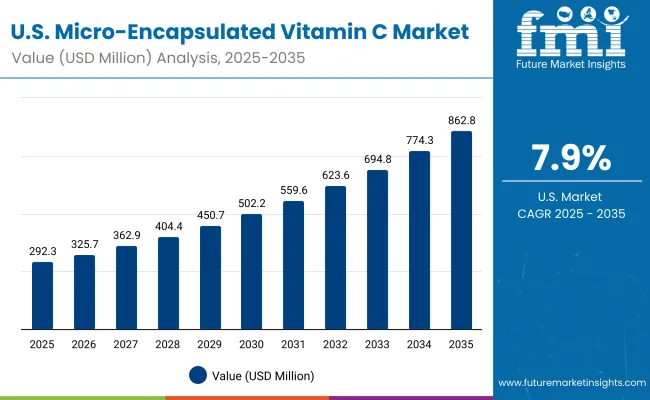

| Year | USA Micro-Encapsulated Vitamin C Market (USD Million) |

|---|---|

| 2025 | 292.34 |

| 2026 | 325.76 |

| 2027 | 362.99 |

| 2028 | 404.48 |

| 2029 | 450.71 |

| 2030 | 502.23 |

| 2031 | 559.63 |

| 2032 | 623.60 |

| 2033 | 694.87 |

| 2034 | 774.30 |

| 2035 | 862.80 |

The micro-encapsulated vitamin C market in the United States is projected to grow at a CAGR of 11.4% from 2025 to 2035, increasing from USD 292.34 million in 2025 to USD 862.80 million by 2035. This nearly threefold expansion highlights the market’s strong resilience and evolving consumer adoption. Growth is expected to be driven by the rising demand for multifunctional skincare benefits, with brightening, anti-aging, and antioxidant protection gaining the highest traction.

Pharmacies are anticipated to remain central to consumer trust, supporting trial and sustained repurchase, while e-commerce platforms are projected to accelerate visibility and access. Brand strategies that integrate dermatologist-tested, vegan, and fragrance-free claims are likely to enhance differentiation. Encapsulation technology that ensures long-lasting stability and potency is expected to further reinforce consumer confidence. Premium-positioned formulations are set to command higher willingness-to-pay, making the USA market a key pillar of innovation-led expansion in the global landscape.

The micro-encapsulated vitamin C market in the United Kingdom is projected to expand at a CAGR of 12.3% between 2025 and 2035, reflecting strong alignment with premium skincare demand. Valuation is expected to rise steadily as consumers increasingly favor clinically validated products offering multifunctional benefits. Pharmacy-led sales are projected to remain a cornerstone, reflecting trust in dermatologist-backed formulations. Simultaneously, clean-label and vegan claims are anticipated to resonate strongly with sustainability-conscious buyers. E-commerce channels are likely to accelerate adoption through digitally driven awareness campaigns and peer-led endorsements. With encapsulation technology ensuring product stability and efficacy, UK consumers are expected to invest more in brightening and anti-aging solutions as part of routine skincare regimens.

The micro-encapsulated vitamin C market in India is forecast to grow at a CAGR of 21.2% from 2025 to 2035, making it the fastest-growing country market globally. Rapid urbanization, rising disposable incomes, and growing awareness of skin health are anticipated to fuel accelerated adoption. Dermatologist-tested and brightening-focused products are expected to resonate most with consumers, reflecting cultural emphasis on radiance and even tone.

Pharmacies are anticipated to maintain influence, but e-commerce platforms are projected to dominate expansion, leveraging influencer marketing and online education. The premiumization of serums and treatment-based skincare formats is expected to accelerate, supported by increasing willingness-to-pay in metros and tier-1 cities. Encapsulation is likely to be positioned as a cutting-edge solution that ensures potency, long shelf life, and reduced irritation, driving consumer loyalty.

The micro-encapsulated vitamin C market in China is projected to register a CAGR of 18.9% between 2025 and 2035, driven by rapid uptake of advanced skincare technologies. Growth is expected to be reinforced by consumer readiness to adopt premium formats promising stability and visible results. Digital-first strategies are anticipated to dominate, with cross-border e-commerce and live commerce shaping demand trajectories. Functional claims related to brightening and antioxidant protection are forecast to be most persuasive, particularly among urban consumers. Regulatory emphasis on product safety and label transparency is projected to favor encapsulated formulations with clinical backing. With local and global brands competing on technology and trust, China is expected to remain a hub for skincare innovation and consumer-driven premiumization.

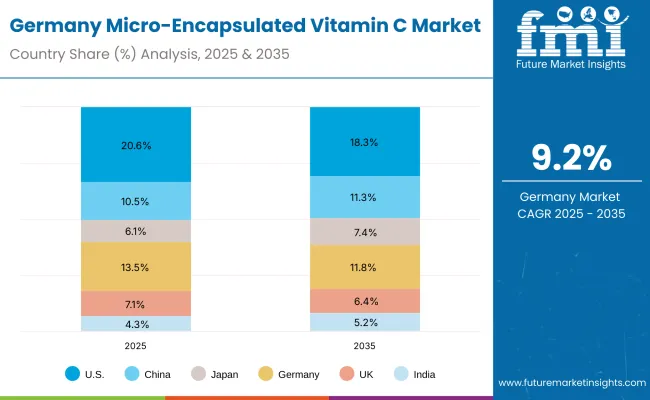

| Countries | 2025 |

|---|---|

| USA | 20.6% |

| China | 10.5% |

| Japan | 6.1% |

| Germany | 13.5% |

| UK | 7.1% |

| India | 4.3% |

| Countries | 2035 |

|---|---|

| USA | 18.3% |

| China | 11.3% |

| Japan | 7.4% |

| Germany | 11.8% |

| UK | 6.4% |

| India | 5.2% |

The micro-encapsulated vitamin C market in Germany is projected to grow at a CAGR of 9.2% during 2025-2035, supported by consistent consumer demand for safe and clinically backed formulations. Market maturity is expected to temper expansion, but steady growth will be anchored by preference for pharmacy-driven retail channels. German consumers are anticipated to prioritize dermatologist-tested, fragrance-free, and clean-label solutions, aligning with regulatory emphasis on safety and sustainability.

Premium serums and lotions fortified with encapsulated actives are expected to gain prominence as functional skincare adoption deepens. Regulatory frameworks in Europe are projected to continue influencing formulation standards, giving encapsulated formats a competitive edge. E-commerce penetration is likely to support broader access, but pharmacy trust will remain central to long-term market sustainability.

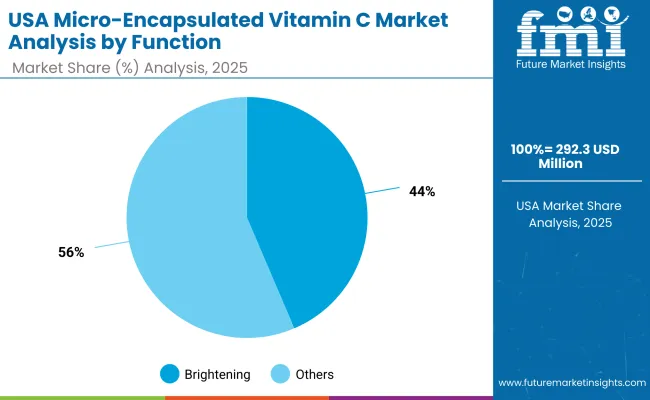

| Segment | Market Value Share, 2025 |

|---|---|

| Brightening | 43.6% |

| Others | 56.4% |

The Micro-Encapsulated Vitamin C Market in the U.S. is projected at USD 292.3 million in 2025, supported by a strong clinical skincare culture and high consumer awareness of antioxidant protection. Brightening applications contribute 43.6% (USD 127.46 million), while other functions collectively hold 56.4% (USD 164.88 million), reflecting a balanced mix of tone-evening, anti-aging, and barrier-supportive formulations. This composition suggests that brightening will remain a critical anchor of value creation, though synergistic multi-benefit offerings are expected to dominate regimen adoption.

This market composition indicates a strategic opportunity for brands to elevate regimen loyalty by coupling brightening serums with antioxidant-rich moisturizers and SPF protection. Clinical positioning, dermatologist endorsements, and evidence-backed claims are expected to accelerate growth, as U.S. consumers continue to migrate toward dermatologist-tested, clean-label, and fragrance-free solutions. Growth is likely to be fueled by DTC brands leveraging digital platforms, with e-commerce and pharmacy channels expected to capture a majority of incremental demand.

As personalized skincare gains traction, micro-encapsulation technology is expected to be leveraged to create tailored release profiles and optimize bioavailability. By 2035, the U.S. market is forecast to nearly triple in size, strengthening its status as a leading hub for innovation and early adoption.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 52.1% |

| Others | 47.9% |

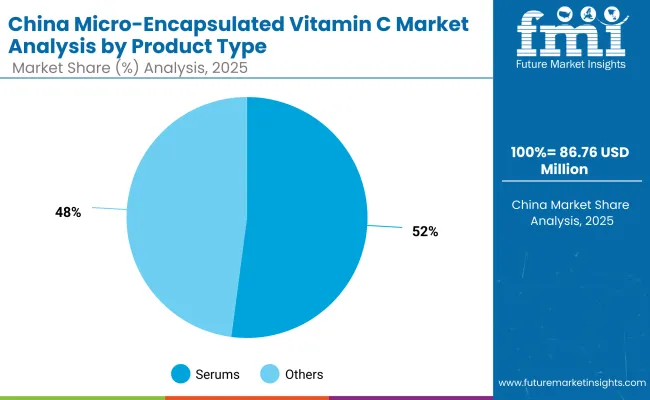

The Micro-Encapsulated Vitamin C Market in China is projected at USD 149.4 million in 2025, driven by an accelerated shift toward premium, clinically backed skincare solutions. Serums are expected to contribute 52.1% (USD 77.85 million), while other product types hold 47.9% (USD 71.57 million), underscoring the growing consumer preference for potent, concentrated delivery systems that deliver visible brightening results. This dominance of serums highlights China’s position as a leader in adopting single-step, high-efficacy routines powered by advanced actives.

Market growth is expected to be propelled by rising skincare literacy, urban pollution concerns, and the influence of livestream commerce channels, where KOLs and dermatologists promote clinical-grade solutions. The stability and penetration benefits of micro-encapsulation technology are expected to resonate with consumers who prioritize consistent performance and minimal irritation, driving repeat purchase behavior.

Regulatory tightening on cosmetic safety and ingredient transparency is expected to further strengthen the appeal of clean-label, vegan, and dermatologist-tested formulations. By 2035, the market is forecast to more than triple in value, as China’s share of the global market rises from 10.5% to 11.3%, supported by an 18.9% CAGR, making it one of the fastest-growing regions worldwide.

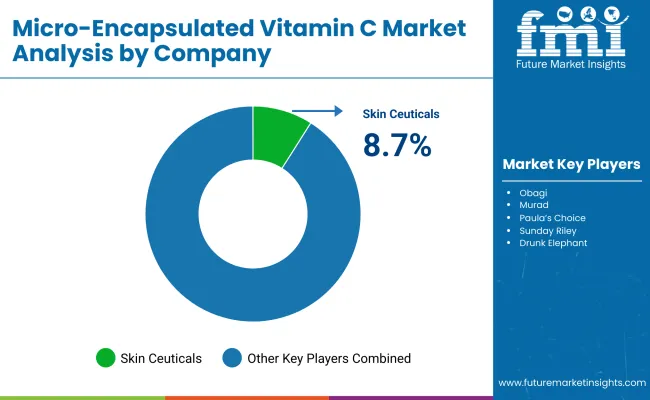

The micro-encapsulated vitamin C market is moderately fragmented, with global dermatology-driven leaders, prestige skincare innovators, and niche-focused clean beauty specialists competing for share. SkinCeuticals is estimated to hold the largest global value share in 2025 at 8.7%, positioning it as the most dominant single player. Its leadership is attributed to clinical validation, dermatologist endorsements, and a strong footprint across pharmacies and dermatology clinics. This positioning is expected to be reinforced by sustained investment in encapsulation R&D and claim-backed formulations.

Other major international brands, including Obagi, Murad, Paula’s Choice, Sunday Riley, Drunk Elephant, Kiehl’s, The Ordinary, CeraVe, and Clinique, are anticipated to capture incremental growth within the collective “Others” category, which accounts for 91.3% of the market in 2025. Their competitive edge lies in differentiated product narratives, ranging from dermatologist-tested credibility to clean-label positioning and affordability-driven mass premium strategies.

Competitive dynamics are projected to shift toward clinical substantiation, multifunctional claim stacking, and omnichannel distribution. Partnerships with dermatologists, emphasis on vegan and fragrance-free labels, and integration with digital beauty education platforms are expected to define growth strategies. The market is not dominated by a hardware or industrial technology base; instead, prestige skincare brands with strong clinical reputation and consumer trust are driving adoption.

Key Developments in Micro-Encapsulated Vitamin C Market

| Item | Value |

|---|---|

| Global market size (2025) | USD 1,422.3 million |

| Global market size (2035) | USD 4,722.4 million |

| Absolute growth (2025-2035) | USD 3,300.1 million |

| CAGR (2025-2035) | 12.80% |

| Function segmentation (2025) | Brightening 46.6% (USD 662.77 million); Others 53.4% (USD 759.53 million) |

| Product type segmentation (2025) | Serums 50.4% (USD 716.87 million); Others 49.6% (USD 705.43 million) |

| Channel segmentation (2025) | Pharmacies 44.7% (USD 635.72 million); Others 55.3% (USD 786.58 million) |

| Competitive concentration (2025) | SkinCeuticals 8.7%; Others 91.3% |

| Regions covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries covered (key) | United States; China; India; United Kingdom; Germany; Japan |

| Key companies profiled | SkinCeuticals; Obagi; Murad; Paula’s Choice; Sunday Riley; Drunk Elephant; Kiehl’s; The Ordinary; CeraVe; Clinique |

| Additional attributes (market scope) | Dermatologist-tested, clean-label, vegan, and fragrance-free claims; pharmacy and e-commerce focus; micro-encapsulation for stability/controlled release; premiumization and Asia-led growth dynamics |

The global Micro-Encapsulated Vitamin C Market is estimated to be valued at USD 1,422.3 million in 2025.

The market size for the Micro-Encapsulated Vitamin C Market is projected to reach USD 4,722.4 million by 2035.

The Micro-Encapsulated Vitamin C Market is expected to grow at a CAGR of 12.8% between 2025 and 2035.

The key product types in the Micro-Encapsulated Vitamin C Market are serums, creams & lotions, ampoules, and masks.

In terms of function, the brightening segment is expected to command a 46.6% share in the Micro-Encapsulated Vitamin C Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin D Deficiency Treatment Market

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA