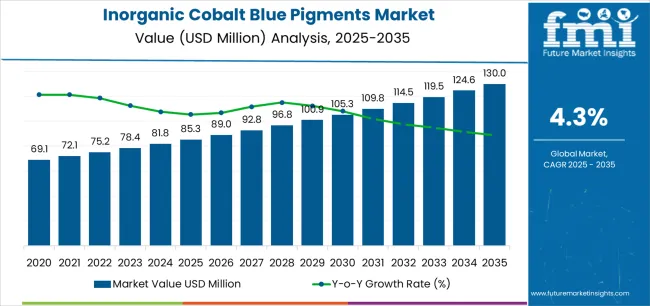

The inorganic cobalt blue pigments market is expected to grow from USD 85.3 million in 2025 to USD 130.0 million by 2035. The inorganic cobalt blue pigments market is set to expand steadily over the next decade, supported by rising demand for high stability, high brightness colorants used in coatings, ceramics, plastics, and specialty material formulations. Cobalt blue pigments are valued for their exceptional resistance to heat, ultraviolet exposure, and chemical degradation, making them suitable for environments where color longevity and performance consistency are critical. Adoption continues to increase in architectural coatings, automotive refinishing products, construction materials, and advanced ceramic glazing applications, where color permanence and aesthetic clarity influence product appeal and lifecycle durability.

In the first half of the forecast period (2025 to 2030), the market is expected to grow from USD 85.3 million to approximately USD 105.3 million, adding USD 20.0 million and accounting for 45 percent of the total projected expansion. This phase will be defined by broader industrial use and standardization of high purity pigment grades to ensure consistent dispersion and coating stability. From 2030 to 2035, continued growth will be supported by increased emphasis on environmentally mindful pigment production processes and the integration of cobalt blue solutions into more advanced material performance frameworks. Suppliers with reliable sourcing, controlled impurity profiles, and strong technical support capabilities will be well positioned for long-term market advantage.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Pigment sales (cobalt aluminate, zinc, magnesium) | 58% | Volume-led, coating-driven purchases |

| Custom color formulations | 22% | Application-specific blends, performance optimization | |

| Technical support services | 12% | Color matching, formulation assistance | |

| Testing and certification | 8% | Quality verification, regulatory compliance | |

| Future (3-5 yrs) | Eco-friendly pigment systems | 52-56% | Low-cobalt formulations, recycled content |

| Custom formulation services | 20-24% | Application-specific colors, performance optimization | |

| Technical consulting | 12-16% | Color development, regulatory support | |

| Certification services | 8-12% | Environmental compliance, quality validation | |

| Digital color matching | 4-6% | Spectral analysis, formulation software | |

| Data services (color performance, durability) | 3-5% | Analytics for coating manufacturers |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 85.3 million |

| Market Forecast (2035) | USD 130.0 million |

| Growth Rate | 4.3% CAGR |

| Leading Technology | Cobalt Aluminate Blue Spinel |

| Primary Application | Coatings Segment |

The market demonstrates strong fundamentals with cobalt aluminate blue spinel capturing a dominant share through advanced color stability features and industrial coating optimization. Coatings applications drive primary demand, supported by increasing durability requirements and performance standards. Geographic expansion remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by local production initiatives and rising quality standards.

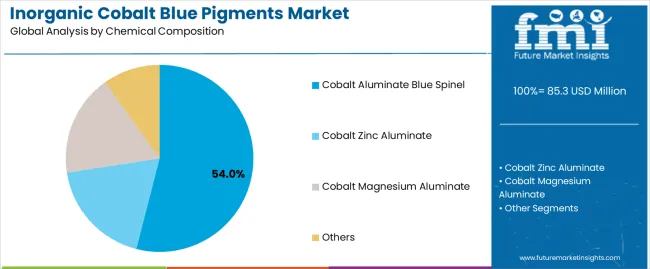

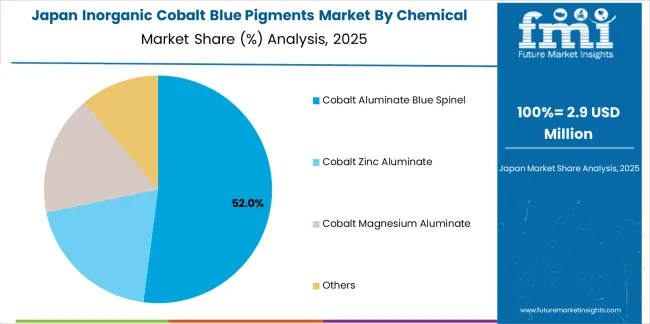

Primary Classification: The market segments by chemical composition into cobalt aluminate blue spinel, cobalt zinc aluminate, cobalt magnesium aluminate, and others, representing the evolution from basic colorant materials to sophisticated pigment solutions for comprehensive industrial color optimization.

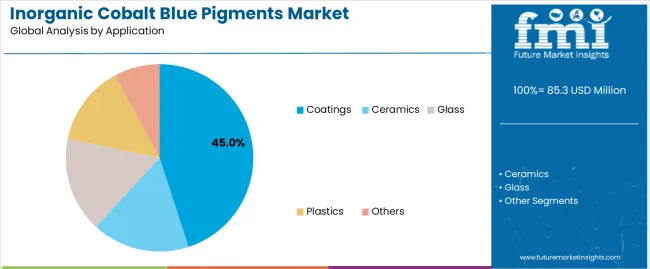

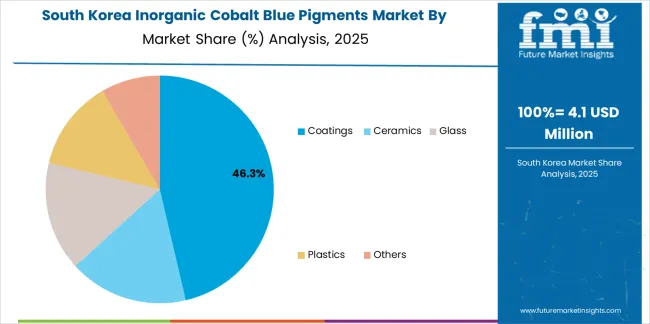

Secondary Classification: Application segmentation divides the market into coatings, ceramics, glass, plastics, and others sectors, reflecting distinct requirements for color performance, environmental resistance, and manufacturing standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by industrial manufacturing expansion programs.

The segmentation structure reveals technology progression from standard pigment materials toward sophisticated color systems with enhanced stability and environmental capabilities, while application diversity spans from industrial coatings to ceramics manufacturing requiring precise color performance solutions.

Market Position: Cobalt Aluminate Blue Spinel commands the leading position in the inorganic cobalt blue pigments market with 54% market share through advanced color features, including superior heat stability, weather resistance, and industrial coating optimization that enable manufacturing facilities to achieve optimal color consistency across diverse coating and ceramics environments.

Value Drivers: The segment benefits from industrial manufacturer preference for reliable pigment systems that provide consistent color performance, excellent light fastness, and operational efficiency optimization without requiring significant formulation modifications. Advanced chemical features enable high-temperature stability, chemical resistance, and integration with existing coating systems, where color performance and environmental durability represent critical application requirements.

Competitive Advantages: Cobalt Aluminate Blue Spinel pigments differentiate through proven color stability, consistent performance characteristics, and integration with industrial coating systems that enhance product effectiveness while maintaining optimal quality standards suitable for diverse coating and ceramics applications.

Key market characteristics:

Cobalt Zinc Aluminate pigments maintain a 28% market position in the inorganic cobalt blue pigments market due to their balanced color properties and cost advantages. These pigments appeal to manufacturers requiring moderate heat resistance with competitive pricing for ceramic and coating applications. Market growth is driven by ceramics expansion, emphasizing reliable color solutions and production efficiency through optimized formulation designs.

Cobalt Magnesium Aluminate pigments capture 12% market share through specialized color requirements in high-temperature ceramics, industrial coatings, and glass applications. These facilities demand superior heat stability pigments capable of handling extreme temperatures while providing effective color performance and operational consistency.

Other cobalt blue compositions account for 6% market share, including specialty formulations, modified structures, and application-specific pigments requiring unique performance characteristics for specialized industrial requirements.

Market Context: Coatings applications exhibit the highest growth rate in the inorganic cobalt blue pigments market, holding a 45% market share. This growth is driven by the widespread adoption of high-performance coating systems and a growing focus on industrial durability, weather resistance, and aesthetic applications goals that maximize product lifespan while maintaining color standard

Appeal Factors: Coating manufacturers prioritize pigment stability, color consistency, and integration with existing formulation infrastructure that enables coordinated production operations across multiple coating types. The segment benefits from substantial industrial investment and infrastructure modernization programs that emphasize the acquisition of stable pigments for durability optimization and performance efficiency applications.

Growth Drivers: Industrial coating programs incorporate cobalt blue pigments as standard materials for color operations, while automotive and architectural coating growth increases demand for weather-resistant capabilities that comply with quality standards and minimize color degradation.

Market Challenges: Varying coating formulations and compatibility complexity may limit pigment standardization across different manufacturers or application scenarios.

Application dynamics include:

Ceramics applications capture a 25% market share, driven by specialized requirements in tile manufacturing, tableware production, and sanitaryware applications. These applications demand high-temperature stable pigments that can withstand firing cycles while providing effective color intensity and consistent operational performance.

Glass applications account for 20% of the market share, including architectural glass, decorative glass, and specialty glass. These applications require stable colorants that ensure optimal thermal processing and optical performance.

Plastics applications demonstrate a 10% market share, including engineering plastics, masterbatch production, and specialty polymers. These applications require heat-stable pigments to ensure color consistency and processing performance.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Infrastructure development and construction growth (emerging markets) | ★★★★★ | Increases coating and ceramics demand requiring stable blue pigments with weather resistance and color consistency across applications. |

| Driver | Automotive production and premium finishes (electric vehicles) | ★★★★★ | Turns high-performance pigments from optional to mandatory; vendors providing automotive-grade stability and certification gain competitive advantage. |

| Driver | Regulatory compliance and environmental standards (heavy metal restrictions) | ★★★★☆ | Manufacturers need compliant colorants; demand for certified pigments meeting environmental regulations expanding addressable market. |

| Restraint | Cobalt price volatility and supply chain concerns | ★★★★★ | Raw material cost fluctuations impact pricing stability; increases manufacturer sensitivity and creates sourcing challenges. |

| Restraint | Competition from organic pigments and alternative blues | ★★★☆☆ | Organic colorants and new blue pigments provide alternatives, limiting market penetration in certain applications. |

| Trend | Eco-friendly formulations and cobalt minimization | ★★★★★ | Lower cobalt pigments, recycled inputs, and alternative chemical processes drive production transformation; environmental responsibility takes center stage as the primary value proposition. |

| Trend | Digital color matching and formulation software | ★★★★☆ | Spectral analysis tools for accurate matching; automated formulation systems and quality control drive competition toward precision solutions. |

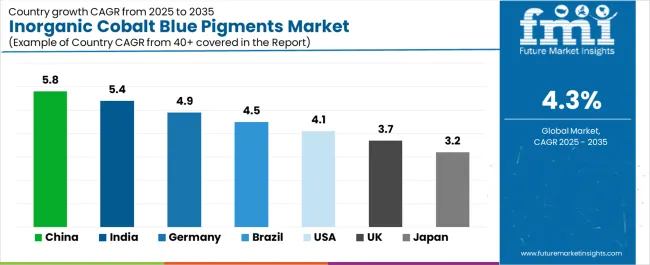

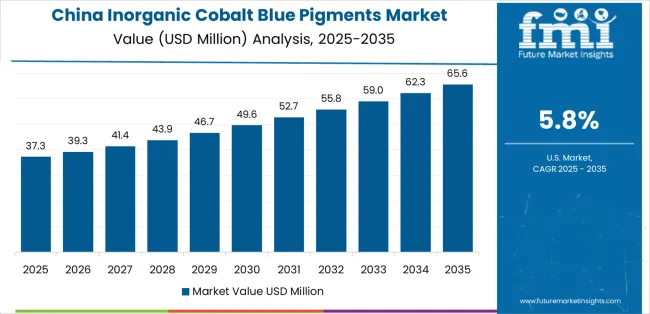

The inorganic cobalt blue pigments market demonstrates varied regional dynamics with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through industrial manufacturing initiatives and production capacity development. Steady Performers encompass Germany (4.9% growth rate), United States (4.1% growth rate), and developed regions, benefiting from established manufacturing industries and advanced coating technology adoption. Emerging Markets feature Brazil (4.5% growth rate) and developing regions, where industrial initiatives and manufacturing modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through industrial expansion and manufacturing development, while North American countries maintain steady expansion supported by coating technology advancement and quality standardization requirements. European markets show moderate growth driven by automotive applications and environmental responsibility trends into manufacturing processes.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.8% | Lead with cost-effective formulations | Environmental regulations; cobalt sourcing |

| India | 5.4% | Focus on infrastructure coatings | Price sensitivity; quality standards |

| Germany | 4.9% | Offer automotive-grade pigments | Environmental standards; accreditation |

| USA | 4.1% | Provide technical support | Regulatory compliance; sourcing concerns |

| Brazil | 4.5% | Value-oriented products | Import duties; economic volatility |

| UK | 3.7% | Push performance pigments | Market consolidation; Brexit impacts |

| Japan | 3.2% | Focus on specialty ceramics | Conservative adoption; high standards |

China establishes fastest market growth through aggressive industrial manufacturing programs and comprehensive coating production development, integrating advanced inorganic cobalt blue pigments as standard materials in automotive coating and ceramics installations. The country's 5.8% growth rate reflects government initiatives promoting manufacturing quality and domestic materials capabilities that mandate the use of stable pigments in coatings and ceramics facilities. Growth concentrates in major manufacturing hubs, including Guangdong, Jiangsu, and Zhejiang, where industrial technology development showcases integrated pigment materials that appeal to manufacturers seeking advanced color capabilities and durability applications.

Chinese manufacturers are developing cost-effective cobalt blue pigment solutions that combine domestic production advantages with advanced color features, including heat stability and weather resistance capabilities. Distribution channels through coating material suppliers and ceramics service distributors expand market access, while government support for industrial production supports adoption across diverse coating and ceramics segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Ahmedabad, coating facilities and ceramics manufacturing plants are implementing advanced inorganic cobalt blue pigments as standard materials for color optimization and quality compliance applications, driven by increasing government infrastructure investment and manufacturing modernization programs that emphasize the importance of durable color capabilities. The market holds a 5.4% growth rate, supported by government industrial initiatives and manufacturing infrastructure development programs that promote advanced pigments for coating and ceramics facilities. Indian operators are adopting cobalt blue pigments that provide consistent color performance and quality compliance features, particularly appealing in urban regions where durability and aesthetic standards represent critical product requirements.

Market expansion benefits from growing coating manufacturing capabilities and international technology partnerships that enable domestic production of advanced pigment systems for industrial applications. Technology adoption follows patterns established in colorant materials, where stability and performance drive procurement decisions and production deployment.

Market Intelligence Brief:

Germany establishes automotive leadership through comprehensive coating programs and advanced manufacturing technology development, integrating inorganic cobalt blue pigments across automotive and industrial applications. The country's 4.9% growth rate reflects established automotive industry relationships and mature coating technology adoption that supports widespread use of high-performance pigments in automotive and architectural facilities. Growth concentrates in major manufacturing centers, including Bavaria, Baden-Wurttemberg, and North Rhine-Westphalia, where coating technology showcases mature pigment deployment that appeals to manufacturers seeking proven color stability capabilities and durability applications.

German pigment providers leverage established distribution networks and comprehensive technical support capabilities, including automotive qualification programs and environmental certification support that create customer relationships and operational advantages. The market benefits from mature automotive standards and environmental requirements that mandate stable pigment use while supporting technology advancement and color optimization.

Market Intelligence Brief:

United States establishes industrial leadership through comprehensive coating programs and advanced manufacturing infrastructure development, integrating inorganic cobalt blue pigments across automotive and architectural applications. The country's 4.1% growth rate reflects established coating industry relationships and mature pigment technology adoption that supports widespread use of stable colorants in industrial and commercial facilities. Growth concentrates in major manufacturing regions, including Ohio, Michigan, and Texas, where coating technology showcases mature pigment deployment that appeals to manufacturers seeking proven color performance capabilities and regulatory compliance applications.

American pigment providers leverage established distribution networks and comprehensive technical support capabilities, including regulatory compliance programs and formulation support that create customer relationships and operational advantages. The market benefits from mature environmental standards and coating requirements that mandate stable pigment use while supporting technology advancement and color optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse industrial demand, including manufacturing development in Sao Paulo and Rio de Janeiro, coating facility upgrades, and government infrastructure programs that increasingly incorporate stable pigments for durability applications. The country maintains a 4.5% growth rate, driven by rising construction activity and increasing recognition of stable pigment technology benefits, including color consistency and enhanced weather resistance.

Market dynamics focus on cost-effective pigment solutions that balance advanced color performance with affordability considerations important to Brazilian coating manufacturers. Growing industrial development creates continued demand for modern pigment systems in new infrastructure projects and manufacturing modernization programs.

Strategic Market Considerations:

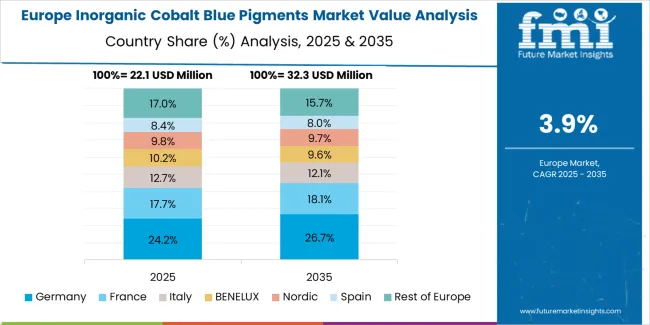

The inorganic cobalt blue pigments market in Europe is projected to grow from USD 30.1 million in 2025 to USD 43.9 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 36.2% market share in 2025, supported by its advanced automotive coating infrastructure and major manufacturing centers.

United Kingdom follows with a 22.4% share in 2025, driven by comprehensive coating programs and industrial manufacturing initiatives. France holds a 18.8% share through specialized automotive applications and architectural coating requirements. Italy commands a 12.6% share, while Spain accounts for 10.0% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.6% to 6.4% by 2035, attributed to increasing pigment adoption in Nordic countries and emerging coating facilities implementing manufacturing modernization programs.

Japan's inorganic cobalt blue pigments market benefits from established ceramics manufacturing excellence and comprehensive quality standards. The country maintains a 3.2% growth rate, supported by government initiatives promoting advanced materials and coating technology advancement. Major manufacturing centers in Aichi, Osaka, and Tokyo showcase advanced pigment deployment for ceramics applications and specialty coatings. Japanese manufacturers prioritize pigment purity and color consistency, creating demand for premium materials with superior thermal stability and environmental resistance. Distribution channels through established colorant material networks enable broad market access across ceramics and coating segments.

South Korea's market expansion reflects advanced automotive manufacturing infrastructure and comprehensive coating programs. The country demonstrates strong adoption of high-performance pigments in coating facilities across Ulsan, Seoul, and Incheon. Growth is driven by automotive production initiatives and increasing focus on coating quality standards. Korean coating facilities emphasize stable pigment solutions with automotive-grade performance and environmental compliance. Market development benefits from government automotive technology investment programs and established pigment manufacturing capabilities supporting domestic production of advanced cobalt blue systems.

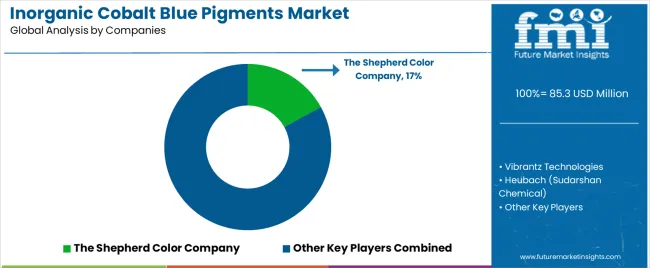

The inorganic cobalt blue pigments market maintains a moderately consolidated structure with 15-18 credible players, where the top 5-6 companies hold approximately 58-64% by revenue. Market leadership is maintained through technical expertise networks, application support capabilities, and formulation innovation encompassing crystal structure optimization, particle size control, and heat stability enhancement. Competition centers on color consistency, thermal stability, and integration with coating workflows including formulation systems and quality verification protocols.

Basic cobalt aluminate formulations and standard blue pigments are commoditizing, shifting competitive advantage toward advanced features such as low-cobalt content, eco-friendly production methods, and comprehensive technical support services. Margin opportunities concentrate in custom color matching, application-specific formulations, and integration into manufacturing workflows with environmental compliance protocols and performance optimization programs. Leading manufacturers differentiate through extensive testing data supporting automotive and architectural applications, comprehensive technical documentation for formulation chemists, and responsive customer support reducing production disruptions.

The competitive landscape features global pigment manufacturers leveraging broad distribution networks and established coating industry relationships, specialized inorganic pigment companies focusing on color innovation and application expertise, regional colorant suppliers providing localized support and competitive pricing, and emerging pigment providers introducing reduced-cobalt formulations and recycled content materials. Strategic partnerships between pigment manufacturers and coating producers are increasing, enabling integrated color solutions and expanding addressable markets beyond traditional coatings applications into ceramics and plastics sectors.

Market dynamics favor participants with proven thermal stability validation, comprehensive technical support networks, and ability to meet automotive-grade quality requirements. Formulation refresh cycles accelerate as environmentally features and environmental compliance become standard expectations, while automotive qualification and environmental certifications create barriers to entry protecting established players. Pricing pressure emerges in commodity coating applications, while premium positioning remains viable for manufacturers offering comprehensive technical solutions with demonstrated performance characteristics and integration capabilities supporting advanced industrial manufacturing initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 85.3 million |

| Chemical Composition | Cobalt Aluminate Blue Spinel, Cobalt Zinc Aluminate, Cobalt Magnesium Aluminate, Others |

| Application | Coatings, Ceramics, Glass, Plastics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, South Korea, Italy, and 20+ additional countries |

| Key Companies Profiled | The Shepherd Color Company, Vibrantz Technologies, Heubach, Sun Chemical, TOMATEC, Oxerra, Asahi Kasei Kogyo, Noelson Chemicals |

| Additional Attributes | Dollar sales by chemical composition and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with pigment manufacturers and coating industry suppliers, manufacturer preferences for color stability and heat resistance, integration with coating formulation platforms and quality control systems, innovations in green formulations and cobalt reduction, and development of high-performance pigment solutions with enhanced thermal stability and environmental optimization capabilities. |

The global inorganic cobalt blue pigments market is estimated to be valued at USD 85.3 million in 2025.

The market size for the inorganic cobalt blue pigments market is projected to reach USD 130.0 million by 2035.

The inorganic cobalt blue pigments market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in inorganic cobalt blue pigments market are cobalt aluminate blue spinel, cobalt zinc aluminate, cobalt magnesium aluminate and others.

In terms of application, coatings segment to command 45.0% share in the inorganic cobalt blue pigments market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inorganic Scintillators Market Size and Share Forecast Outlook 2025 to 2035

Inorganic filler Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Oxides Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Salts Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Zinc Coatings Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Fungicide Market - Growth & Demand 2025 to 2035

Industry Share Analysis for Inorganic Scintillators Companies

Inorganic Flame Retardants Market

Inorganic Ion Exchange Materials Market

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Salt for Tires Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Based Laser Cladding Powder Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Resinate Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Carbonate Market

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Nickel Cobalt Manganese (NCM) Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Nickel Cobalt Aluminium Market Trend Analysis Based on Purity, End Use, and Region 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algal Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA